UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| ☐ |

Preliminary Information Statement |

| |

|

| ☐ |

Confidential, for use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☒ |

Definitive Information Statement |

ORGANICELL REGENERATIVE MEDICINE, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

(4) |

Proposed maximum aggregate value of transaction: |

| ☐ |

Fee paid previously with Preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing fee for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No. |

ORGANICELL REGENERATIVE MEDICINE, INC.

3321 College Avenue, Suite 246

Davie FL 33314

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

Dear Stockholders:

The purpose of this letter

is to inform you that the holders of a majority of the voting rights of Organicell Regenerative Medicine, Inc., a Nevada corporation

(“we,” “us,” “our” or the “Company”), represented by the

Company’s issued and outstanding shares of Series C Non-Convertible Preferred Stock (the “Majority Voting Stockholders”),

pursuant to a written consent in lieu of a meeting of stockholders in accordance with the Nevada General Corporation Law (“NGCL”):

|

● |

approved and authorized an amendment to the Company’s Articles of Incorporation to effectuate a reverse stock split of the Company’s issued and outstanding shares of common stock in a ratio of up to one-for 300, with the final ratio to be determined by the Company’s board of directors (the “Board”); and |

|

● |

approved an increase in the number of shares of the Company’s common stock reserved for issuance under the Company’s 2021 Equity Incentive Plan (the “Plan”) from 250,000,000 shares to 500,000,000 shares (on a pre-reverse stock split basis). |

The reverse stock split will become effective upon the filing of an amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada in the form annexed as Exhibit A to the Information Statement accompanying Information Statement, which will not be less than twenty (20) days after the mailing of this Notice and the accompanying Information Statement to stockholders.

The approval in the increase of the number of shares of common stock reserved for issuance under the Plan will become effective without further action, twenty (20) days after the mailing of this Notice and the accompanying Information Statement to stockholders.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The accompanying Information Statement, which describes the above corporate actions in more detail, is being furnished to our stockholders for informational purposes only pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder and notice of the action by written consent in lieu of a meeting of the Majority Voting Stockholders pursuant to the NGCL. Pursuant to Rule 14c-2 under the Exchange Act, these corporate actions will not be effective until at least twenty (20) calendar days after the mailing of the Information Statement to our stockholders.

I encourage you to read the enclosed Information Statement, which is being provided to all of our stockholders. It describes the corporate actions taken in detail.

| |

Sincerely, |

| |

|

| |

/s/ Harry Leider, M.D. |

| |

Harry Leider, M.D.

Chief Executive Officer |

Dated: August 14, 2023

This Information Statement is dated August 14, 2023 and is first being mailed to stockholders of record of Organicell Regenerative Medicine, Inc. on or about August 17, 2023.

ORGANICELL REGENERATIVE MEDICINE, INC.

3321 College Avenue, Suite 246

Davie FL 33314

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

NO VOTE OR ACTION OF THE COMPANY’S STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

We are distributing this

Information Statement to stockholders of Organicell Regenerative Medicine, Inc. (“we,” “us,” “our,”

or the “Company”) in full satisfaction of any notice requirements we may have under the Securities and Exchange Act

of 1934, as amended (the “Exchange Act”) and the Nevada General Corporation Law (“NGCL”). No additional

action will be undertaken by us with respect to the receipt of written consents, and no dissenters’ or appraisal rights under the

NGCL are afforded to our stockholders as a result of the corporate actions described in this Information Statement. The record date for

determining the stockholders entitled to receive this Information Statement has been established as of the close of business on July 31,

2023 (the “Record Date”).

OUTSTANDING COMMON STOCK

As of the Record Date, we had issued and outstanding 1,456,696,392 shares of common stock, par value $0.001 per share, such shares constituting all of the Company’s issued and outstanding common stock.

On June 6, 2023, the Company’s Board of Directors (the “Board”), at a duly convened meeting, unanimously approved and authorized the corporate actions described in this Information Statement. In addition, on such date, as permitted under the NGCL, the holders (the “Majority Voting Stockholders”) of our Series C Non-Convertible Preferred Stock (the “Series C Preferred Stock”), approved and authorized the corporate actions described in this Information Statement by written consent in lieu of a meeting of stockholders. The Series C Preferred Stock entitles the holders thereof to 51.0% of the voting rights of the Company on all matters presented to stockholders for a vote, including the matters set forth herein, regardless of the number of shares of common stock or other voting securities issued and outstanding.

CORPORATE ACTIONS

The corporate actions described in this Information Statement will not afford stockholders the opportunity to dissent from the action described herein or to receive an agreed or judicially appraised value for their shares.

The Board, at a duly convened meeting and the Majority Voting Stockholders, by written consent in lieu of a meeting of stockholders:

|

● |

approved and authorized an amendment to the Company’s Articles of Incorporation to effectuate a reverse stock split of the Company’s issued and outstanding shares of common stock in a ratio of up to one-for 300, with the final ratio to be determined by the Board; and |

|

● |

approved an increase in the number of shares of the Company’s common stock reserved for issuance under the Company’s 2021 Equity Incentive Plan (the “Plan”) from 250,000,000 shares to 500,000,000 shares (on a pre-reverse stock split basis). |

We will pay the expenses of furnishing this Information Statement to our stockholders, including the cost of preparing, assembling and mailing this Information Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

To the Company’s knowledge, the following table sets forth information with respect to beneficial ownership of outstanding common stock as of the Record Date, by:

| |

● |

each person known by the Company to beneficially own more than 5% of the outstanding shares of the Company’s common stock; |

| |

● |

each of the Company’s executive officers; |

| |

● |

each of Company’s directors; and |

| |

● |

all of the Company’s executive officers and directors as a group. |

Beneficial ownership is determined in accordance with Securities and Exchange Commission (“SEC”) rules and includes voting or investment power with respect to the securities as well as securities which the individual or group has the right to acquire within sixty (60) days of the original filing of this Information Statement. Unless otherwise indicated, the address for those listed below is c/o Organicell Regenerative Medicine, Inc., 3321 College Avenue, Suite 246, Davie FL 33314. Except as indicated by footnote, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The number of shares of the common stock outstanding used in calculating the percentage for each listed person includes the shares of common stock underlying options or convertible securities held by such persons that are exercisable within 60 days of the Record Date, but excludes shares of common stock underlying options or other convertible securities held by any other person. The number of shares of common stock outstanding as of the Record Date was 1,456,696,392. Except as noted otherwise, the amounts reflected below are based upon information provided to the Company and filings with the SEC.

| Officers and Directors |

|

Title |

|

Shares |

|

|

% of

Class(1) |

|

|

% of

Voting Power(2) |

|

| Harry Leider, M.D.(3) |

|

Chief Executive Officer and Director |

|

|

6,298,630 |

|

|

|

* |

|

|

|

* |

|

| Ian Bothwell(4) |

|

Chief Financial Officer and Director |

|

|

170,518,726 |

|

|

|

11.81 |

% |

|

|

5.79 |

% |

| Dr. George Shapiro(5) |

|

Chief Medical Officer and Director |

|

|

78,754,187 |

|

|

|

5.59 |

% |

|

|

2.74 |

% |

| Howard L. Golub, M.D.(6) |

|

Executive Vice President and Chief Science Officer |

|

|

16,575,342 |

|

|

|

1.16 |

% |

|

|

* |

|

| Chuck Bretz(7) |

|

Director – Chairman of the Board |

|

|

1,000,000 |

|

|

|

* |

|

|

|

* |

|

| Jerry Glauser(8) |

|

Director |

|

|

27,666,666 |

|

|

|

1.97 |

% |

|

|

* |

|

| Leathem Stearn(9) |

|

Director |

|

|

14,166,667 |

|

|

|

1.001 |

% |

|

|

* |

|

| Gurvinder Pal Singh(10) |

|

Director |

|

|

1,000,000 |

|

|

|

* |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All officers and directors as a group (8 persons) |

|

|

|

|

315,980,218 |

|

|

|

21.43 |

% |

|

|

10.50 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other 5% or Greater Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Skycrest Holdings LLC(11) |

|

|

|

|

201,720,710 |

|

|

|

12.96 |

% |

|

|

31.85 |

% |

| Greyt Ventures LLC(12) |

|

|

|

|

200,000,000 |

|

|

|

12.85 |

% |

|

|

31.80 |

% |

| Dr. Bhupendra Kumar Modi(13) |

|

|

|

|

100,000,000 |

|

|

|

7.11 |

% |

|

|

3.48 |

% |

| Albert Mitrani(14) |

|

|

|

|

253,497,990 |

|

|

|

18.02 |

% |

|

|

8.83 |

% |

| Dr. Mari Ines Mitrani(14) |

|

|

|

|

253,497,990 |

|

|

|

18.02 |

% |

|

|

8.83 |

% |

| (1) |

Based on 1,406,696,392 shares of vested common stock outstanding as of the Record Date. |

| (2) |

Based on 1,406,696,392 shares of vested common stock and 100 Series C Preferred Shares outstanding as of the Record Date. The shares of common stock and the Series C Preferred Shares vote together as a single class on all matters presented to stockholders, except as required by Nevada law. Each Series C Preferred Share entitles the holder to 51.0% of the combined voting power of the Company’s capital stock and an aggregate of 51.0% for all 100 Series C Preferred Shares outstanding, notwithstanding the number of shares of common stock outstanding. |

| (3) |

Includes vested warrants to purchase 3,175,342 shares of common stock of the Company under the Plan and warrants to purchase 3,123,288 shares of common stock of the Company under the Plan that vest within sixty (60) days of the date of this Information Statement. |

| (4) |

Includes warrants to purchase 37,500,000 shares of common stock of the Company. Does not include 15,000,000 shares of common stock issued to Mr. Bothwell which vest on December 31, 2023. |

| (5) |

Includes warrants to purchase 3,150,000 shares of common stock of the Company. Does not include 5,000,000 shares of common stock issued to Dr. Shapiro which vest on December 31, 2023. |

| (6) |

Includes vested warrants to purchase 8,356,164 shares of common stock of the Company under the Plan and warrants to purchase 8,219,178 shares of common stock of the Company under the Plan that vest within sixty (60) days of the date of this Information Statement. |

| (7) |

Includes vested warrants to purchase 854,795 shares of common stock of the Company and warrants to purchase 145,205 shares of common stock of the Company that vest within sixty (60) days of the date of this Information Statement. |

| (8) |

Includes vested warrants to purchase 854,795 shares of common stock of the Company and warrants to purchase 145,205 shares of common stock of the Company that vest within sixty (60) days of the date of this Information Statement. |

| (9) |

Includes 12,500,000 shares of common stock held of record by Stearn Enterprises LLC, of which Mr. Stearn is the sole beneficial owner. Includes vested warrants to purchase 854,795 shares of common stock of the Company and warrants to purchase 145,205 shares of common stock of the Company that vest within sixty (60) days of the date of this Information Statement. |

| (10) |

Includes vested warrants to purchase 854,795 shares of common stock of the Company and warrants to purchase 145,205 shares of common stock of the Company that vest within sixty (60) days of the date of this Information Statement. |

| (11) |

812 Meridian Lane, Hollywood FL 33020. Represents 51,720,710 shares of common stock, warrants to purchase 150,000,000 shares of common stock and 50 Series C Preferred Shares held of record by Skycrest Holdings, LLC, of which Louis Birdman is the managing member. |

|

(12) |

20533 Biscayne Blvd., Suite 648, Aventura, FL 33180. Represents 50,000,000 shares of common stock, warrants to purchase 150,000,000 shares of common stock and 50 Series C Preferred Shares held of record by Greyt Ventures LLC, of which Ms. Wendy Grey is the sole member and manager. |

| (13) |

6 Marina Boulevard # 63-18, Singapore 018985. Represents 50,000,000 shares of common stock held of record by Beyond 100 FZE and 50,000,000 shares of common stock held of record by Smart Co. Holding Pte. Ltd., each of which Dr. Modi is the sole beneficial owner. |

| (14) |

Albert Mitrani and Dr. Maria Ines Mitrani are husband and wife. Includes 151,790,190 shares of common stock held by Mr. Mitrani and 101,707,800 shares of common stock held by Dr. Mitrani. |

FORWARD-LOOKING STATEMENTS MAY PROVE INACCURATE

This Information Statement contains forward-looking statements that involve risks and uncertainties. Such statements are based on current expectations, assumptions, estimates and projections about the Company and its industry. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance, achievements and prospects to be materially different from those expressed or implied by such forward-looking statements. The Company undertakes no obligation to update publicly any forward-looking statements for any reason even if new information becomes available or other events occur in the future. The Company believes that such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

Actual outcomes are dependent upon many factors. Words such as “anticipates,” “believes,” “estimates,” “expects,” “hopes” “targets” or similar expressions are intended to identify forward-looking statements, which speak only as of the date of this Information Statement, and in the case of documents incorporated by reference, as of the date of those documents. The Company undertakes no obligation to update or release any revisions to any forward-looking statements or to report any events or circumstances after the date of this Information Statement or to reflect the occurrence of unanticipated events, except as required by law.

DESCRIPTION OF CORPORATE ACTIONS

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO EFFECTUATE A REVERSE STOCK SPLIT

The Board and the Majority Stockholders approved and authorized an amendment to the Company’s Articles of Incorporation to effectuate a reverse stock split of the Company’s issued and outstanding shares of common stock in a ratio of up to one-for 300, with the final ratio to be determined by the Board.

The Company believes that implementation of the reverse stock split is desirable because it could improve the marketability and liquidity of our common stock, and assist us in attracting future investment capital. The timing of implementation and exact ratio (up to a ratio of one for 300) will be determined by the Board.

Marketability

The Company believes that the increased market price of our common stock expected as a result of implementing the reverse stock split could improve the marketability and liquidity of our common stock and will encourage interest and trading in our common stock. Theoretically, the number of shares outstanding and the per share price should not, by themselves, affect the marketability of our common stock, the type of investor who acquires them, or our reputation in the financial community. However, in practice, this is not necessarily the case, as many investors look upon low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment in such securities. Our Board is aware of the reluctance of many leading brokerage firms to recommend low-priced stocks to their clients. Further, a variety of brokerage house policies and practices tend to discourage individual brokers within those firms from dealing in low-priced stocks. The structure of trading commissions tends to have an adverse impact upon holders of low-priced stocks because the brokerage commission on a sale of such securities generally represents a higher percentage of the sales price than the commission on a relatively higher-priced issue.

The reverse stock split is intended, in part, to result in a price level for our common stock that will increase investor interest and eliminate the resistance of brokerage firms. No assurances can be given that the market price for our common stock will increase in the same proportion as the reverse split or, if increased, that such price will be maintained. In addition, no assurances can be given that the reverse stock split will increase the price of our common stock to a level that is attractive to brokerage houses and institutional investors.

Effects of the Reverse Stock Split

Once the reverse stock split is implemented, the principal effect will be to proportionately decrease the number of outstanding shares of our common stock based on the reverse stock split ratio. The reverse stock split will not affect the listing of our common stock on the OTCQB tier of the over-the-counter market maintained by OTC Markets Group, Inc.

Proportionate voting rights and other rights and preferences of the holders of our common stock will not be affected by the reverse stock split (except to the extent that the reverse stock split results in any of our stockholders owning a fractional share, in which case such fractional share will be rounded up to the next whole share). For example, a holder of 2% of the voting power of the outstanding shares of our common stock immediately prior to the effectiveness of the reverse stock split will generally continue to hold 2% of the voting power of the outstanding shares of our common stock immediately after the reverse stock split. Moreover, the number of stockholders of record will not be affected by the reverse stock split.

Upon the completion of the reverse stock split, the Company will have additional shares of common stock available for issuance. Although the Company may use the additional authorized shares of common stock in the future to raise additional capital, it has no specific plans, arrangements, or understandings to do so beyond making shares available for issuance pursuant to the conversion of outstanding convertible debt and the exercise of outstanding options and warrants, if applicable.

On the effective date of the reverse stock split, shares of common stock issued and outstanding immediately prior thereto will be combined and converted, automatically and without any action on the part of the stockholders, into new shares of common stock in accordance with the reverse split ratio.

Fractional Shares

No fractional shares of common stock will be issued as a result of the reverse stock split. Instead, the Company will issue one whole share of the post-reverse stock split common stock to any stockholder who otherwise would have received a fractional share as a result of the reverse stock split. The number of authorized common stock shall remain unaffected and the par value shall remain at $0.001 per share.

Other Effects

If approved, the reverse split will result in some stockholders owning “odd-lots” of fewer than 100 shares of common stock. Brokerage commissions and other costs of transactions in odd-lots are generally somewhat higher than the costs of transactions in “round-lots” of even multiples of 100 shares.

Exchange of Stock Certificates

There is not a requirement that stockholders obtain new or replacement share certificates. Each of the holders of record of shares of the Company’s common stock that is outstanding on the effective date of the reverse stock split may contact the Company’s transfer agent to exchange the certificates for new certificates representing the number of whole shares of post-reverse stock split common stock into which the existing shares of common stock have been converted as a result of the reverse stock split.

Tax Consequences

Stockholders should consult their own tax advisors as to the effect of the reverse split under applicable tax laws.

AMENDMENT TO THE 2021 EQUITY INCENTIVE PLAN

The Board and the Majority Stockholders have approved an increase in the number of shares of the Company’s common stock reserved for issuance under the Company’s 2021 Equity Incentive Plan (the “Plan”) from 250,000,000 shares to 500,000,000 shares (on a pre-reverse stock split basis).

The Plan was originally adopted by the Board and our then majority voting stockholders on September 21, 2021. The Plan permits the grant of Incentive Stock Options, Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Units and Performance Shares (each, an “Award”) to any person who is an employee (including an officer) or director of, or consultant to the Company. The Company believes that adopting the plan is advantageous with respect to the Company’s current business objectives and assists the company in obtaining and retaining individuals who may bring value to the Company.

The Plan originally authorized that the maximum aggregate number of shares of our common stock issuable pursuant to all Awards was 250,000,000 shares. As of the Record Date, Awards granted for a total of 176,500,000 shares of our common stock are currently outstanding under the Plan. As attracting qualified employees, officers, directors and consultants is a key factor to the Company’s future growth, it was determined to be in the best interests of the Company to increase the number of shares of common stock available for Award under the Plan from 250,000,000 to 500,000,000 shares.

AVAILABLE INFORMATION

We are subject to the information and reporting requirements of the Exchange Act and in accordance with the Exchange Act we file periodic reports, documents and other information with the SEC. Such reports. documents and other information may be viewed at the SEC’s website at www.sec.gov.

STOCKHOLDERS SHARING AN ADDRESS

The Company will deliver only one Information Statement to multiple stockholders sharing an address unless the Company has received contrary instructions from one or more of the stockholders. The Company undertakes to deliver promptly, upon written or oral request, a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement is delivered. A stockholder can notify the Company that the stockholder wishes to receive a separate copy of the Information Statement by contacting the Company at the telephone number or address set forth above.

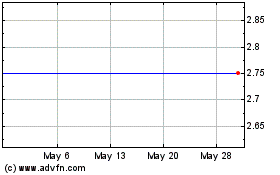

Organicell Regenerative ... (QB) (USOTC:OCEL)

Historical Stock Chart

From Apr 2024 to May 2024

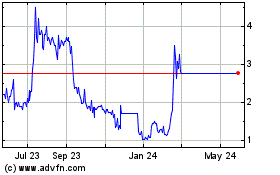

Organicell Regenerative ... (QB) (USOTC:OCEL)

Historical Stock Chart

From May 2023 to May 2024