Current Report Filing (8-k)

31 December 2016 - 8:46AM

Edgar (US Regulatory)

U.S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 29, 2016

ONCOLOGIX

TECH, INC.

(Name

of Small Business Issuer as Specified in Its Charter)

|

Nevada

|

|

0-15482

|

|

86-1006416

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification No.)

|

1604

W. Pinhook Rd. #200

Lafayette,

LA 70508

(Address

of principal executive offices)

(616)

977-9933

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The

Registrant’s Form 10-K, any Form 10-Q or any Form 8-K of the Registrant or any other written or oral statements made by

or on behalf of the Registrant may contain forward-looking statements that are based on management’s beliefs, assumptions,

current expectations, estimates and projections about the medical device business, and the Company itself. Statements, including

without limitation, those related to: future revenue, earnings, margins, growth, cash flows, operating measurements, tax rates

and tax benefits; expected economic returns; projected operating results, future strength of the Company; future brand positioning;

achievement of the Company vision; future marketing investments; the introduction of new lines or categories of products; future

growth or success in specific countries, categories or market sectors; capital resources and market risk are forward-looking statements.

In addition, words such as “anticipates,” “believes,” “estimates,” “expects,”

“forecasts,” “intends,” “is likely,” “plans,” “predicts,” “projects,”

“should,” “will,” variations of such words and similar expressions are intended to identify forward-looking

statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions

(“Risk Factors”) that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence.

Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking

statements.

Readers

are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Registrant’s views

as of the date the statement was made. The Registrant undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

ITEM

1.01 – Entry into a Material Definitive Agreement

ITEM

5.01 – Changes in Control of Registrant

Update

to Series B Convertible Stock Purchase Agreement (SPA) and Amendment # 1.

On November 16, 2016, Oncologix Tech, Inc. ( the

“Company”) and DIMEVC executed Amendment #1 to the Series B Convertible Stock Purchase Agreement that outlines the

new funding/investment schedule by Diversified Innovative Marketing Enterprises, Ltd. (“DIMEVC”). The amendment calls

for monthly investments of $200,000 beginning December 20, 2016 and continuing for five (5) months thereafter. Following those

initial tranches, a $4,000,000 investment is expected to be delivered to Company on May 19, 2017 with the final tranche of $5,000,000

to be delivered on June 23, 2017. Should any tranche not be met, the Agreement terminates “For Cause” and the Company

reserves the right to seek legal remedy for potential Damages.

On

December 20, 2016 DIMEVC failed to provide the initial tranche of funding in the amount of $200,000. On that day officers of the

Company had discussions with DIMEVC and both parties verbally agreed to extend the amendment provided that DIMEVC provide a partial

investment $50,000 on December 23, 2016 with the balance of the initial tranche to be submitted within 2 weeks. It was also agreed

that no partial shares of the Series B Convertible Preferred Stock would be issued until the full tranche of $200,000 was delivered.

On December 23, 2016, DIMEVC again failed to deliver the $50,000.00 as agreed and DIMEVC could not provide a date when the first

tranche would be delivered. . Therefore, Amendment # 1 to the SPA, and any verbal agreements between the Company and DIMEVC is

hereby terminated “For Cause” and the Company retains all legal rights at law to seek remedy for financial Damages.

ITEM

9.01 – Financial Statements and Exhibits

|

|

99.1

|

Termination

for Cause Letter dated December 29, 2016

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

Dated:

December 30, 2016

|

|

ONCOLOGIX

TECH, INC.

|

|

|

|

|

|

|

By:

|

/s/

Michael A. Kramarz

|

|

|

|

Michael

A. Kramarz, Chief Executive Officer,

Chief Financial Officer

|

|

|

|

|

|

|

By:

|

/s/

Harold Halman

|

|

|

|

Harold

Halman, Chief Operating Officer,

|

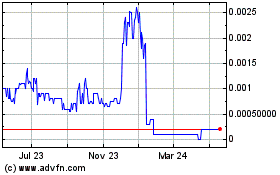

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Oncologix Tech (CE) (USOTC:OCLG)

Historical Stock Chart

From Dec 2023 to Dec 2024