UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of The Securities Exchange Act of 1934

POINT

OF CARE NANO-TECHNOLOGY, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

27-2830681

|

|

(State

or other jurisdiction of incorporation or

|

|

(I.R.S.

Employer Identification No.)

|

|

organization)

|

|

|

109

Ambersweet Way

Davenport, FL

|

|

33897

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (732) 723-7395

With

a copy to:

Louis A. Bevilacqua, Esq.

Bevilacqua, PLLC

1050 Connecticut Ave, NW, Suite 500

Washington, DC 20036

T: (202) 869-0888

F: (202) 203-8665

lou@bevilacquapllc.com

Securities

registered under Section 12(b) of the Act:

|

Title

of each class

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

Securities

registered under Section 12(g) of the Act:

Common

Stock, $0.0001 par value

(Title of class)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o

|

Smaller

reporting company x

|

|

|

Emerging

growth company x

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

TABLE

OF CONTENTS

EXPLANATORY

NOTE

Point

of Care Nano-Technology, Inc. is filing this General Form for Registration of Securities on Form 10 (the “Registration Statement”)

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on a voluntary basis to resume the registration

of our common stock, par value $0.0001 per share (the “Common Stock”), pursuant to Section 12(g) of the Exchange Act and in

order to provide current public information to the investment community. Once this Registration Statement is effective, the Company will

be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated thereunder, which

will require the Company, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports

on Form 8-K, and the Company will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration

statements pursuant to Section 12(g) of the Exchange Act.

FORWARD

LOOKING STATEMENTS

This

Form 10 contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can

identify forward-looking statements by terminology such as “may,” should,”” expect,” “plan,” “anticipate,”

“believe”, “estimate,” “predict,” “potential” or “continue” or the negative of these

terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other

factors, including the risks described in the section entitled “Risk Factors” included herein, that may cause our actual results,

levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or

achievements expressed or implied by these forward-looking statements. Important factors that may cause actual results to differ

from projections include, for example:

|

|

●

|

the

success or failure of management’s efforts to implement the Company’s plan of operation;

|

|

|

●

|

the

ability of the Company to fund its operating expenses;

|

|

|

●

|

the

ability of the Company to compete with other companies that have a similar plan of operation;

|

|

|

●

|

the

effect of changing economic conditions impacting our plan of operation;

|

|

|

●

|

the

ability of the Company to meet the other risks as may be described in future filings with

the SEC.

|

While

these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment

regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions,

projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities

laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbor for forward-looking statements provided in the Private Securities Litigation Reform Act of 1995 does not apply to this

annual report.

Unless

otherwise noted, all references in this Form 10 to “Point of Care Nano-Technology,” “PCNT,” the “Company,”

“we,” “us,” “our” and similar terms and expressions shall mean Point of Care Nano-Technology, Inc., a Nevada

corporation formerly known as Unique Growing Solutions, Inc., and its former subsidiaries.

PART

I

Item

1. Business

Overview

Historical

Development

The

Company was incorporated as “Alternative Energy & Environmental Solutions, Inc.” in the State of Nevada on June 10, 2010,

to develop and license an innovative biotechnology for the environmentally friendly and cost-effective extraction of natural gas (coalbed

methane) from low-producing, depleted and abandoned coal mines in the U.S. The Company was not successful in developing this business

and discontinued its biotechnology related operations.

The

Company changed its name in 2014 to Unique Growing Solutions, Inc. and again in 2015 to Point of Care Nano-Technology, Inc.

On

February 25, 2015, the Company entered into an exclusive worldwide license License Agreement (the “License Agreement”) with

Lamina Equities Corporation (“Lamina”), a private corporation owned by Dr. Raouf Guirguis. The License Agreement related to

intellectual property for diagnosing illness in humans via a saliva test.

In

connection with signing the License Agreement, on February 25, 2015, the Company signed an employment agreement with Dr. Guirguis pursuant

to the terms of which the Company appointed Dr. Guirguis as its Chief Executive Officer and agreed to pay Dr. Guirguis an annual salary

of $350,000. In addition, the Company issued thirty-seven million, five hundred thousand (37,500,000) shares of its common stock, $0.0001

par value per share, to Dr. Guirguis (the “Stock Issuance”) resulting in a change of control of the Company with Dr. Guirguis

becoming the Company’s majority stockholder. Also on February 25, 2015, Dr. Guirguis and Mr. Ayman El-Salhy were appointed

as members of the board of directors of the Company.

During

the past few years, the Company has not had the financial resources to pursue business development relating to the Lamina license.

On

December 31, 2019, Investment Reserves Series Point of Care Nano-Technology, Inc. LLC (“Petitioner”) filed a motion for custodianship

of the Company with the District Court, Clark County, Nevada (the “District Court”). As a custodian, Petitioner applied to

become the court appointed custodian over the Company. At the time, the Company was delinquent and in arrears with its financial obligations

as a corporation under the laws of the State of Nevada, where it is domiciled, and owed fees to its transfer agent. The duty of a court

appointed custodian is to help a company meet its financial obligations and to reconcile past accounts so that the company can return

to active business operations. On February 11, 2020, the District Court granted Petitioner custodianship over the Company having given

proper notice to officers and directors of the Company. As the court appointed custodian for the Company, Petitioner received no consideration

from the court or the Company for its work on behalf of the Company. On March 19, 2020, a certificate of revival for the Company, signed

by the Company’s President, Dr. Guirguis, was filed with the Secretary of State of the State of Nevada. On February 16, 2021, Yosef

Yafe (“Yafe”) filed a motion with the District Court to intervene and replace Petitioner as the custodian for the Company.

Yafe advised the District Court that because of the onset of the COVID-19 pandemic, Petitioner was not able to complete its obligations

as the custodian of the Company. The District Court allowed the intervention and on February 17, 2021, in accordance with a stipulation

between Petitioner and Yafe whereby Petitioner agreed to Yafe’s request, the District Court approved the substitution of Yafe as

custodian of the Company. A copy of each of the stipulation and order of the District Court approving the appointment of Yafe as the

custodian instead of the petitioner is attached as an exhibit to this Form 10 registration statement.

Separately,

and independent of the actions of Yafe as custodian of the Company, on April 15, 2021, the Company accepted the resignations, effective

as of that date, of Dr. Guirguis, as Chief Executive Officer, President, Treasurer, Secretary and Chairman of the board of directors,

and of Mr. El-Salhy, as director. The Company entered into separate settlement and release of claims agreements with each of Dr. Guirguis

and Mr. El Salhy, dated effective as of April 15, 2021. Also on April 15, 2021, upon the effectiveness of Dr. Guirguis’ resignation

from all of his positions with the Company, the Company appointed Mr. Nicholas DeVito as Chief Executive Officer, Chief Financial Officer,

President, Treasurer, Secretary and sole director. In consideration for the services that Mr. DeVito would be providing to the Company,

the Company issued to Mr. DeVito 1,000 shares of its non-convertible Class A preferred stock that grants him 80% voting rights. These

shares of non-convertible Class A preferred stock vote together with the outstanding shares of our common stock as a single class and

represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of our shareholders or action by written

consent of shareholders. This issuance of the 1,000 shares of Series A non-convertible preferred stock to Mr. Devito constituted a change

of control of the Company giving Mr. Devito control of 80% of the voting power of the Company.

Additionally,

the Company and Dr. Guirguis have entered into an assignment and assumption agreement pursuant to the terms of which the Company has

agreed to form a subsidiary to which it will transfer all the outstanding debts of the Company and the License Agreement. It will then

transfer ownership of this subsidiary to Dr. Guirguis in exchange for the return of 26,000,000 shares of our common stock currently held

by Dr. Guirguis. This transaction has not yet been completed.

As

of the date hereof, Dr. Guirguis controls 26,000,000 shares of our common stock directly and 2,500,000 shares of our common stock indirectly

via his wife’s ownership of those shares.

On

May 9, 2021, Yafe, the court appointed custodian of the Company, and Mr. El Salhy, a former director of the Company, entered into a settlement

agreement (the “Settlement Agreement”) pursuant to which Mr. El Salhy agreed to pay (i) Yafe the sum of $11,500 towards Yafe’s

costs and expenses in bringing the custodian action and (ii) the Company’s transfer agent $13,565 owed to the transfer agent in

order to bring current the Company’s account with the transfer agent. In exchange for these payments, Yafe agreed to file a voluntary

dismissal action with the District Court, which he filed on May 14, 2021 and which was accepted by the District Court on that date. A

copy of each of the Settlement Agreement and the voluntary dismissal of custodian action filed with the District Court is attached as

an exhibit to this Form 10 registration statement. The Company was a party to this Settlement Agreement solely with respect to a mutual

release and discharge between the Company and Yafe.

On

May 25, 2021, the Company filed a Form 15 to terminate its registration and duties to report under Section 12 of the Securities Exchange

Act.

The

Company’s plan of operation over the next 12 months is to seek new business assets in the life sciences industry. The Company cannot

make any guarantee that it will be successful in achieving this objective.

The

Company’s principal executive office location and mailing address is 109 Ambersweet Way, Davenport, FL 33897 and its telephone number

is 732-723-7395.

Current

Business Focus

The

Company currently has no business activities. Management of the Company has determined to direct its efforts and limited resources to

pursue potential new business opportunitiesin the life science sector. The Company does not intend to limit itself to a particular field

within the life sciences sector and has not established any particular criteria upon which it shall consider a business opportunity.

There can be no assurances that the Company will be successful with its new business objective.

The

Company’s common stock is currently quoted on the OTC Markets, Inc. Pink tier under the symbol PCNT. There is currently a limited

trading market in the Company’s shares nor do we believe that any active trading market has existed for approximately the last five

years. There can be no assurance that there will be an active trading market for our securities following the effective date of this

registration statement under the Exchange Act. In the event that an active trading market commences, there can be no assurance as to

the market price of our shares of common stock, whether any trading market will provide liquidity to investors, or whether any trading

market will be sustained.

Management

will have substantial flexibility in identifying and selecting a prospective new business opportunity in the life sciences sector. The

Company is dependent on the judgment of its management in connection with this process. In evaluating a prospective business opportunity,

we would consider, among other factors, the following:

|

|

●

|

costs

associated with pursuing a new business opportunity;

|

|

|

●

|

growth

potential of the new business opportunity;

|

|

|

●

|

experiences,

skills and availability of additional personnel necessary to pursue a potential new business

opportunity;

|

|

|

●

|

necessary

capital requirements;

|

|

|

●

|

the

competitive position of the new business opportunity;

|

|

|

●

|

stage

of business development;

|

|

|

●

|

the

market acceptance of the potential products and services;

|

|

|

●

|

proprietary

features and degree of intellectual property; and

|

|

|

●

|

the

regulatory environment that may be applicable to any prospective business opportunity.

|

The

foregoing criteria are not intended to be exhaustive and there may be other criteria that management may deem relevant. In connection

with an evaluation of a prospective or potential business opportunity, management may be expected to conduct a due diligence review.

The

time and costs required to pursue new business opportunities, which includes negotiating and documenting relevant agreements and preparing

requisite documents for filing pursuant to applicable securities laws, cannot be ascertained with any degree of certainty.

Management

intends to devote such time as it deems necessary to carry out the Company’s affairs. The exact length of time required for the

pursuit of any new potential business opportunities is uncertain. No assurance can be made that we will be successful in our efforts.

We cannot project the amount of time that our management will actually devote to the Company’s plan of operation.

The

Company intends to conduct its activities so as to avoid being classified as an “Investment Company” under the Investment Company

Act of 1940, and therefore avoid application of the costly and restrictive registration and other provisions of the Investment Company

Act of 1940 and the regulations promulgated thereunder.

Item

1A. Risk Factors

An

investment in our common stock involves a high degree of risk. Before making an investment decision, you should give careful consideration

to the following risk factors, in addition to the other information included in this annual report, including our financial statements

and related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the adverse developments

described in the following risk factors could materially and adversely harm our business, financial condition, results of operations

or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We

have a limited operational history.

We

have a limited history upon which an evaluation of our prospects and future performance can be made. Our proposed operations are subject

to all business risks associated with new enterprises. The likelihood of our success must be considered in light of the problems, expenses,

difficulties, complications, and delays frequently encountered in connection with the expansion of a business operation in an emerging

industry, and the continued development of advertising, promotions, and a corresponding customer base. There is a possibility that we

could sustain losses in the future, and there are no assurances that we will ever operate profitably.

Our

auditors have expressed substantial doubt about our ability to continue as a going concern.

As

of July 31, 2021 and July 31, 2020, we had no cash or cash equivalents and an accumulated deficit of $120,212,367 and $120,204,867, respectively.

Our audited financial statements for the years ended July 31, 2021 and 2020 were prepared using the assumption that we will continue

our operations as a going concern. Our independent accountants in their audit report have expressed substantial doubt about our ability

to continue as a going concern. Our operations are dependent on our ability to raise sufficient capital or complete a business combination

as a result of which we become profitable. Our financial statements do not include any adjustments that may result from the outcome of

this uncertainty.

There

is not enough cash on hand to fund our administrative expenses and operating expenses for the next twelve months. Therefore, we may be

unable to continue operations in the future as a going concern. If we cannot continue as a viable entity, our stockholders may lose some

or all of their investment in the Company’s shares of common stock.

Our

operational strategy is changing to be refocused on the Life Sciences space.

We

expect our business growth to be generated through future acquisitions of life sciences assets. No assurances can be made if any additional

acquisitions will be consummated.

If

we do not generate sufficient cash flow from operations in the future, we may not be able to fund our product development efforts and

acquisitions or fulfill our future obligations.

Our

ability to generate sufficient cash flow from operations to fund our operations and business development efforts, including the potential

payment of cash consideration in acquisitions and the payment of our other obligations, depends on a range of economic, competitive and

business factors, many of which are outside of our control. We cannot assure you that our business will ever generate sufficient cash

flow from operations, or that we will be able to raise equity or debt financings when needed or desirable. An inability to fund our operations

would have a material adverse effect on our business, financial condition and results of operations. For further information, please

refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources.”

Acquisitions

present many risks, and we may not realize the financial and strategic goals we anticipate at the time of an acquisition.

Our

growth is dependent upon our ability to acquire new assets and to introduce new products and services on a timely basis. Acquisitions,

including those of high-technology companies, are inherently risky. We cannot provide any assurance that any future acquisitions, if

completed, will be successful in helping us reach our financial and strategic goals. The risks we commonly encounter in undertaking,

managing and integrating acquisitions are:

|

|

●

|

an

uncertain revenue and earnings stream from the acquired company;

|

|

|

●

|

difficulties

and delays integrating the personnel, operations, technologies, products and systems of the

acquired companies;

|

|

|

●

|

the

need to implement controls, procedures and policies appropriate for a public company at companies

that prior to acquisition had lacked such controls, procedures and policies;

|

|

|

●

|

difficulties

managing or integrating an acquired company’s technologies or lines of business;

|

|

|

●

|

potential

difficulties in completing projects associated with purchased in-process research and development;

|

|

|

●

|

entry

into markets in which we have no or limited direct prior experience and where competitors

have stronger market positions and which are highly competitive;

|

|

|

●

|

the

potential loss of key employees of the acquired company;

|

|

|

●

|

potential

difficulties integrating acquired products and services into our operational framework;

|

|

|

●

|

assuming

pre-existing contractual relationships of an acquired company that we would not have otherwise

entered into, the termination or modification of which may be costly or disruptive to our

business;

|

|

|

●

|

being

subject to unfavorable revenue recognition or other accounting treatment as a result of an

acquired company’s practices; and

|

|

|

●

|

intellectual

property claims or disputes.

|

Our

failure to manage growth effectively and successfully integrate acquired assets or companies due to these or other factors could have

a material adverse effect on our future business, results of operations and financial condition. In addition, we may not have the opportunity

to make suitable acquisitions on favorable terms, which could negatively impact the growth of our business. We expect that other companies

in our industry will compete with us to acquire compatible assets or businesses. This competition could increase prices for businesses

and technologies that we would likely pursue, and our competitors may have greater resources than we do to complete these acquisitions.

We

will require substantial funding which may not be available to us on acceptable terms, or at all. If we fail to raise the necessary capital,

we may be unable to successfully implement our business plans.

We

intend to acquire assets in the life sciences sector. We will require capital for any such acquisitions and for operating expenses and

capital expenditures.

We

cannot be certain that funding will be available on acceptable terms, or at all. If we are unable to raise capital in sufficient amounts

or on terms acceptable to us we may have to significantly delay, scale back or discontinue the development or our business, The inability

to raise the required funds would significantly harm our business, financial condition and prospects.

The

life-sciences industry is highly competitive and subject to rapid technological changes. As a result, we may be unable to compete successfully,

which would harm our business.

The

life-sciences industry is highly competitive and characterized by rapid technological change. We expect to face intense competition from

other companies which have resources substantially greater than ours. This competitive disadvantage may make it extremely difficult for

us to acquire commercially viable life science assets.

Covid-19

Coronavirus Risk.

We

are now operating under a constant threat from COVID-19, the novel coronavirus which has infected millions of people globally and is

responsible for the deaths of nearly one million five hundred thousand people as of this filing on Form 10. We will face uncertainty

operating under the conditions of COVID-19. Given the severity of COVID-19, we will have limited to no control over our affairs if our

management team becomes infected or if we are under lockdown or quarantine orders where we may have limited opportunity to review asset

acquisition targets. To the extent that we can work from home such accommodations may not be in the best interest of the Company and

thus may impair the value of our management’s services. There are also risks additional beyond our control, for example; if we identify

an asset target for acquisition and if key owners or managers of that target are infected by COVID-19, it could significantly impair

our strategy and would force us to reconsider our options if it could not be remedied with an alternate plan. If we encounter a prolonged

lockdown or quarantine, we would likely encounter opportunity risks such as being unable to execute our plans, evaluate target businesses,

and loss of potential business connections.

General

Economic Risks

The

Company’s current and future business objectives and plan of operation are likely dependent, in large part, on the state of the

general economy. Adverse changes in economic conditions may adversely affect the Company’s business objective and plan of operation.

These conditions and other factors beyond the Company’s control include also, but are not limited to regulatory changes.

Risks

Related to Our common stock

The

Company’s shares of common stock are traded from time to time on the OTC Markets, Inc. Pink Tier.

Our

common stock rarely trades on the OTC Pink Sheet Market. There can be no assurance that there will be a liquid trading market for the

Company’s common stock following a business combination. In the event that a liquid trading market commences, there can be no assurance

as to the market price of the Company’s shares of common stock, whether any trading market will provide liquidity to investors,

or whether any trading market will be sustained.

The

application of the “penny stock” rules could adversely affect the market price of our common stock and increase your transaction

costs to sell those shares.

The

Securities and Exchange Commission adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that

has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. If

the trading price of our common stock falls below $5.00 per share, the open-market trading of our common stock is subject to the

penny stock rules, which imposes additional sales practice requirements on broker-dealers who sell to persons other than established

customers and “accredited investors”. The term accredited investor” refers generally to institutions with assets

in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly

with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt

from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny

stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with

current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and

monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations,

and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting

the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition,

the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer

must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s

written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity

in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may

affect the ability of broker-dealers to trade our securities. We believe the penny stock rules discourage investor interest

in and limit the marketability of our common stock.

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and sell our common stock.

In

addition to the “penny stock” rules described above, FINRA adopted rules that require that in recommending an investment to

a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior

to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer’s financial status, tax status, investment objectives and other information. Under

interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable

for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers

buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

Stockholders

should have no expectation of any dividends.

The

holders of our common stock are entitled to receive dividends when, as and if declared by the Board of Directors out of funds legally

available therefore. To date, we have not declared or paid any cash dividends. The Board of Directors does not

intend to declare any dividends in the foreseeable future, but instead intends to retain all earnings, if any, for use in our business

operations.

Our

President and CEO has a no common stock equity interest and a 100% preferred stock equity interest in the Company and thus is in a position

to control all actions requiring stockholder vote.

Management

has no present intention to call for an annual meeting of stockholders to elect new directors prior to the consummation of an asset acquisition.

As a result, our current sole officer and director will continue in office for the indefinite future. If there is an annual meeting of

stockholders for any reason, the Company’s management has broad discretion regarding proposals submitted to a vote by shareholders

as a consequence of management’s controlling equity interest. Accordingly, the Company’s management will continue to exert

control indefinitely.

Management

has broad discretion in decision making.

Any

person who invests in the Company’s common stock will do so without an opportunity to evaluate the specific merits or risks of any

prospective asset acquisition or business combination. As a result, investors will be entirely dependent on the broad discretion and

judgment of management in connection with the selection of a prospective business opportunity. There can be no assurance that determinations

made by the Company’s management will permit us to achieve the Company’s business objectives.

Certain

provisions in our certificate of incorporation and by-laws, and of Nevada law, may prevent or delay an acquisition of our company, which

could decrease the trading price of our common stock.

Our

certificate of incorporation, by-laws and Nevada law contain provisions that are intended to deter coercive takeover practices and inadequate

takeover bids by making such practices or bids unacceptably expensive to the raider and to encourage prospective acquirers to negotiate

with our board of directors rather than to attempt a hostile takeover. These provisions include, among others:

|

|

●

|

the

inability of our stockholders to call a special meeting;

|

|

|

●

|

rules regarding

how stockholders may present proposals or nominate directors for election at stockholder

meetings;

|

|

|

●

|

the

right of our board to issue preferred stock without stockholder approval;

|

|

|

●

|

the

ability of our directors, and not stockholders, to fill vacancies on our board of directors.

|

Future

sales and issuances of our common stock or could result in additional dilution of the percentage ownership of our stockholders and could

cause our share price to fall.

We

expect that significant additional capital will be needed in the future to continue our planned operations. To the extent we raise capital

by issuing equity securities, our stockholders may experience substantial dilution. We may sell common stock, convertible securities

or other equity securities in one or more transactions at prices and in a manner we determine from time to time. If we sell common stock,

convertible securities or other equity securities in more than one transaction, investors may be materially diluted by subsequent sales.

Such sales may also result in material dilution to our existing stockholders, and new investors could gain rights superior to our existing

stockholders.

We

are an “emerging growth company” and as a result of our reduced disclosure requirements applicable to emerging growth companies,

our common stock may be less attractive to investors.

We

are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we intend

to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not

“emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements

of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports

and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder

approval of any golden parachute payments not previously approved. We could remain an “emerging growth company” until the earlier

of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering

in February 2014, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are

deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million

as of the prior December 31st, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt

during the prior three-year period. We cannot predict whether investors will find our common stock less attractive because we will rely

on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for

our common stock and our stock price may be more volatile.

Under

the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply

to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards,

and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth

companies.

We

may be at risk of securities class action litigation.

We

may be at risk of securities class action litigation. In the past, life sciences, biotechnology and pharmaceutical companies have experienced

significant stock price volatility, particularly when associated with binary events such as clinical trials and product approvals. If

we face such litigation, it could result in substantial costs and a diversion of management’s attention and resources, which could

harm our business and results in a decline in the market price of our common stock.

Item

2. Financial Information

Our

financial statements, together with the report of independent registered public accounting firm, appear at Item 15 of this Form 10 for

the year ended July 31, 2021.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

The

following discussion and analysis should be read in conjunction with our audited financial statements and the notes to those financial

statements that are included elsewhere in this Form 10. Our discussion includes forward-looking statements based upon current expectations

that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events

could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those

set forth under the “Risk Factors”, “Cautionary Notice Regarding Forward-Looking Statements” and “Description

of Business” sections and elsewhere in this annual report. We use words such as “anticipate,” “estimate,”

“plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,”

“intend,” “may,” “will,” “should,” “could,” “predict,” and similar

expressions to identify forward-looking statements. Although we believe the expectations expressed in these forward-looking statements

are based on reasonable assumptions within the bound of our knowledge of our business, our actual results could differ materially from

those discussed in these statements. Factors that could contribute to such differences include, but are not limited to, those discussed

in the Risk Factors” section of this annual report. We undertake no obligation to update publicly any forward-looking statements

for any reason even if new information becomes available or other events occur in the future. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements

to actual results. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this annual

report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results

of operations, and prospects.

Overview

The

Company was incorporated as “Alternative Energy & Environmental Solutions, Inc.” in the State of Nevada on June 10, 2010,

to develop and license an innovative biotechnology for the environmentally friendly and cost-effective extraction of natural gas (coalbed

methane) from low-producing, depleted and abandoned coal mines in the U.S. The Company was not successful in developing this business

and discontinued its biotechnology related operations. The Company changed its name in 2014 to Unique Growing Solutions, Inc. and again

in 2015 to Point of Care Nano-Technology, Inc.

On

February 25, 2015, the Company entered into the License Agreement with Lamina relating to intellectual property for diagnosing illness

in humans via a saliva test. During the past few years, the Company has not had the financial resources to pursue business development

relating to the Lamina license.

The

Company’s plan of operation over the next 12 months is to split off the Lamina intellectual property and related liabilities generating

in pursuing development of this technology and to seek new business assets in the life sciences industry. The Company cannot make any

guarantee that it will be successful in achieving this objective.

Change

in Financial Condition

Results

of Operations

Fiscal

Year ended July 31, 2021 compared to the Fiscal Year ended June 30, 2020

Revenues

For

the years ended July 31, 2021 and July 31, 2020. the Company did not generate any revenue from product licenses, maintenance, services

and other revenue.

Cost

of Goods Sold

For

the years ended July 31, 2021 and July 31, 2020. the Company did not incur any cost of goods sold expenses from product licenses, maintenance,

services and other expenses.

Operating

Expenses

For

the years ended July 31, 2021 and July 31, 2020. the Company did not incur any operating expenses from product licenses, maintenance,

services and other expenses. The Company incurred administrative expenses of $7,500 for the year ended July 31, 2021 and $12,167 for

the year ended July 31, 2020.

Net

Other Income (Expense)

For

the years ended July 31, 2021 and July 31, 2020. the Company did not receive any income or incur any expense from other sources.

Liquidity

& Capital Resources

At

July 31, 2021, we had $0 in cash, compared to $0 at July 31, 2020. At July 31, 2021, our accumulated stockholders’ deficit was $120,810,608

compared to $120,810,608 at July 31, 2020 There is substantial doubt as to our ability to continue as a going concern.

The

Company has had no cash flow for the two years ended July 31, 2021 and 2020. In the future, the Company’s cash flow will depend

on the timely and successful market entry of the Company’s expected strategic offerings.

Especially

for strategic offerings for paradigm shifting technologies, the management’s budget plan is based on a series of assumptions regarding

regulatory approval, market acceptance, readiness and pricing. While management’s assumptions are based on market research, assumptions

bear the risk of being incorrect and may result in a delay in projects, delays in regulatory approvals and consequently a delay or a

reduction in the related strategic offerings. In case these delays have an impact on the Company’s liquidity and therefore its ability

to support its operations with the necessary cash flow, the Company depends on its ability to generate cash flow from other resources,

such as debt financing from related or independent resources or as equity financing from existing stockholders or through the stock market.

There

were no equity transactions in 2020 and 2021.

Plan

of Operations

During

the remainder of our fiscal year ending July 31, 2022, the Company will seek to acquire strategic assets in the life sciences space.

The Company will need to seek external sources for financing future projects. These sources may also provide the necessary funds to support

the working capital needs of the Company. There can be no assurances, however, that the Company will be able to obtain additional funds

or that such funds will be sufficient to permit the Company to implement its intended business strategy. In the event the Company is

not able to raise additional funds, management will have to postpone the acquisition or any new assets until the financing will be sufficient.

Additionally, management believes the Company will need to raise money to support its standard operations for the remainder of the current

fiscal year ending July 31, 2022.

Our

cash balance as reported in our financial statements is not sufficient to fund our growth plan for any period of time. In order to fully

implement our plan of operations for the next 12-month period, we will need to raise a significant amount of capital through future offerings.

After the next 12-month period, we most likely will need to raise additional financing as well. The discussion below is based on the

assumption that we will be able to raise significant capital in the remainder of our fiscal year ending July 31, 2022. We do not currently

have any arrangements for any such financing and there can be no assurances that we will be able to raise the required capital on acceptable

terms, if at all.

We

have generated no revenues to date and, although we expect to raise significant capital in the future, there can be no assurances that

we will be successful in these endeavors. We believe that the actions presently being taken to further implement our business plan and

generate revenues will provide the opportunity for us to develop into a successful business operation.

We

can provide no assurances, however, that we will be able to successfully acquire additional assets or raise sufficient funds in the next

six months or longer to begin to execute these plans, to reach or to develop, offer and generate revenues from any of our designated

business activities and development actions. Also, we cannot assure you that we will be able to raise additional capital or debt as and

when needed on acceptable terms if at all.

Additional

Cash Requirements

We

expect to incur additional administrative expenses during the next 12 months. We estimate that we will need the following amounts during

the next 12 months to cover the indicated administrative expenses:

|

Category

|

Estimated

Amount

|

|

Legal

|

50,000

|

|

Accounting

|

50,000

|

|

OTC

Listing Fees

|

10,000

|

|

Travel

|

5,000

|

|

Miscellaneous

|

5,000

|

|

TOTAL

|

$120,000

|

This

capital will be used to build out our corporate infrastructure, to provide for the payment of advisory and accounting services, legal,

and anticipated up-listing fees for the OTC Markets, Inc. QB tier. However, there can be no assurance that we will qualify for uplisting

to the OTC QB tier or that our application to the OTC QB will be approved. The table above does not include a line item for funds required

to acquire life science assets. Any such funds will be in amounts in addition to those listed in the table.

Required

funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership

of our shares. There is no assurance that we will be able to generate operations at a level sufficient for an investor to obtain a return

on their investment in our common stock, or that we will be able to raise sufficient capital required to implement our business plan

on acceptable terms, if at all. Even if we are successful in raising sufficient capital to implement our business plan, we may continue

to be unprofitable.

CRITICAL

ACCOUNTING POLICIES AND ESTIMATES

The

financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States

of America, the more significant of which are as follows:

Critical

Accounting Policies and Estimates

The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent

assets and liabilities at the date of financial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates.

We

have identified the policies outlined below as critical to our business operations and an understanding of our results of operations.

The list is not intended to be a comprehensive list of all of our accounting policies. In many cases, the accounting treatment of a particular

transaction is specifically dictated by accounting principles generally accepted in the United States, with no need for management’s

judgment in their application.

The

Company accounts for income taxes under FASB ASC Topic 740, Income Taxes (“ASC Topic 740”). Under ASC Topic 740, deferred tax

assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying

amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered

or settled. Under ASC 740-10-25, the effect on deferred tax assets and liabilities of a change in tax rates is recognized

in income in the period that includes the enactment date.

Comprehensive

Income (Loss)

The

Company adopted FASB Codification topic (“ASC”) 220, Reporting Comprehensive Income, which establishes standards for the reporting

and display of comprehensive income and its components in the financial statements. Comprehensive income consists of net income and other

gains and losses affecting stockholder’s equity that are excluded from net income, such as unrealized gains and losses on investments

available for sale, foreign currency translation gains and losses and minimum pension liability. Since inception, the Company has not

had any comprehensive income / loss.

Net

Income (Loss) per Common Share

FASB

Codification topic (“ASC”) 260, Earnings per share, requires dual presentation of basic and diluted earnings per share (EPS)

with a reconciliation of the numerator and denominator of the EPS computations. Basic earnings per share amounts are based on the weighted

average shares of common stock outstanding. If applicable, diluted earnings per share would assume the conversion, exercise or issuance

of all potential common stock instruments such as options, warrants and convertible securities, unless the effect is to reduce a loss

or increase earnings per share. Diluted net income (loss) per share on the potential exercise of the equity-based financial instruments

is not presented where anti-dilutive. Accordingly, although the diluted weighted average number of common stock outstanding is disclosed

on the statements of operation, the calculated net loss per share is the same for bother basic and diluted as both are based on the basic

weighted average of common stock outstanding. There were no adjustments required to net income for the period presented in the computation

of diluted earnings per share.

Financial

Instruments

Financial

instruments consist of accounts payable and accrued liabilities. As of the financial statement date, the Company does not

hold any derivate financial instruments. Financial assets and liabilities are measured upon first recognition and reviewed at the financial

statement date. Changes in fair value are recognized through profit and loss. Unless otherwise noted, it is management’s

opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments.

Fair

Value Measurements

The

Company follows FASB Codification topic (ASC”) 820, Fair Value Measurements and Disclosures, for all financial instruments and non-financial

instruments accounted for at fair value on a recurring basis. This new accounting standard establishes a single definition of fair value

and a framework for measuring fair value, sets out a fair value hierarchy to be used to classify the source of information used in fair

value measurement and expands disclosures about fair value measurements required under other accounting pronouncements. It does not change

existing guidance as to whether or not an instrument is carried at fair value. The Company defines fair value as the price that would

be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date. When determining the fair value measurements for assets and liabilities, which are required to be recorded at fair value, the Company

considers the principal or most advantageous market in which the Company would transact and the market-based risk measurements or assumptions

that market participants would use in pricing the asset or liability, such as inherent risk, transfer restrictions and credit risk.

The

Company has adopted (ASC”) 825, Financial Instruments, which allows companies to choose to measure eligible financial instruments

and certain other items at fair value that are not required to be measured at fair value. The Company has not elected the fair value

option for any eligible financial instruments.

An

asset or liability’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the

fair value measurement. Availability of observable inputs can vary and is affected by a variety of factors. The Company uses judgment

in determining fair value of assets and liabilities, and Level 3 assets and liabilities involve greater judgment than Level 1 and Level

2 assets or liabilities.

Segment

Reporting

FASB

ASC 820, “Segments Reporting,” establishes standards for reporting information about operating segments on a basis consistent

with the Company’s internal organization structure as well as information about geographical areas, business segments and major

customers in financial statements. The Company currently operates in one principal business segment.

Related

Parties

The

Company adopted FASB ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Recent

Accounting Pronouncements

The

Company adopts new pronouncements relating to generally accepted accounting principles applicable to the Company as they are issued,

which may be in advance of their effective date. The Company does not expect the adoption of recently issued accounting pronouncements

to have a significant impact on the Company’s results of operations, financial position, or cash flow.

OFF-BALANCE

SHEET ARRANGEMENTS

None.

Item

3. Properties.

The

Company does not own or rent any properties. Our principal address is located at 109 Ambersweet Way, Davenport, FL 33897 and our telephone

number is (732) 723-7395.

Item

4. Security Ownership of Certain Beneficial Owners and Management.

The

following table sets forth certain information regarding our common stock beneficially owned as of October 15, 2021, for (i) each stockholder

known to be the beneficial owner of 5% or more of our outstanding Common Stock, (ii) each executive officer and director, and (iii) all

executive officers and directors as a group. In general, a person is deemed to be a beneficial owner of a security if that person has

or shares the power to vote or direct the voting of such security, or the power to dispose or to direct the disposition of such security.

A person is also deemed to be a beneficial owner of any securities of which the person has the right to acquire beneficial ownership

within 60 days. Shares of common stock subject to options, warrants or convertible securities exercisable or convertible within

60 days are deemed outstanding for computing the percentage of the person or entity holding such options, warrants or convertible securities

but are not deemed outstanding for computing the percentage of any other person. Percentages are determined based on 46,981,059 shares

of common stock of the Company issued and outstanding as of October 15, 2021. To the best of our knowledge, subject to community and

marital property laws, all persons named have sole voting and investment power with respect to such shares, except as otherwise noted.

|

Name

and Address of Beneficial Owner (1)

|

Common

Stock

|

Series

A Non-Convertible Preferred Stock

|

Amount

and Nature

of Beneficial

Ownership

|

Percent

of Class

Beneficially Owned

(2)

|

Amount

and Nature

of Beneficial

Ownership

|

Percent

of Class

Beneficially Owned

(3)

|

|

Officers

and Directors

|

|

|

|

|

|

Nicholas

DeVito

-Chief

Executive Officer, Chief Financial Officer, President, Treasurer and Secretary

|

0

|

0%

|

1,000

|

100%

|

|

All

Officers and Directors as a group (1 persons)

|

0

|

0%

|

1,000

|

100%

|

|

|

|

|

|

|

|

5%

Stockholders

|

|

|

|

|

|

Dr.

Raouf Guirguis (4)

10202

Sherman Heights Place

Columbia,

MD 21044-5416

|

28,500,000

|

60.7%

|

-

|

-

|

|

|

(1)

|

Unless

otherwise indicated, the address of the named beneficial owner is c/o Point of Care Nano-Technology,

Inc. 109 Ambersweet Way, Davenport, FL 33897.

|

|

|

(2)

|

Based

on 46,981,059 shares of Common Stock outstanding as of October 15, 2021.

|

|

|

(3)

|

On

April 15, 2021, the Company agreed to issue Nicholas DeVito 1,000 shares of Series A Preferred

Stock. These shares were issued to Mr. DeVito on August 2, 2021.

|

|

|

(4)

|

Dr.

Guirguis controls 26,000,000 shares of Common Stock directly and 2,500,000 shares of Common

Stock indirectly via his wife’s ownership of those shares.

|

Item

5. Directors and Executive Officers

The

table below sets forth the names, title and ages of our current directors and executive officers. Directors hold office until the next

annual meeting of the stockholders or until their successors have been elected and qualified. Executive officers serve at the pleasure

of the Board and may be removed with or without cause at any time, subject to contractual obligations between the executive officer and

the Company, if any.

|

Name

|

Age

|

Position

and Offices Held

|

Director

Since

|

|

Nicholas

DeVito

|

58

|

Chief

Executive Officer, Chief Financial Officer, President, Treasurer, Secretary and Director

|

April

15, 2021

|

Business

Experience:

Nicholas

P. DeVito. Mr. DeVito has 35 years of experience in finance, engineering and operations in a variety of industries including

oil & gas, telecommunications, alternative energy, manufacturing and consumer products. Most recently he served as Sr. Director of

Accounts at Synchronoss Technologies, Chief Operating Officer for Xtreme Oil & Gas (OTCBB:XTOG) successfully reorganizing the company

and completing the filings to begin public trading. Mr. DeVito has served as VP of Business Development and as CEO of several subsidiaries

in Tellium (NASDAQ:ZHNE), a highly successful telecommunications equipment manufacturer that sold optical switching products and completed

an IPO. He consulted to several public and private companies acting to improve operations and grow sales. Finally, he spent 14 years

at AT&T and Bell Laboratories. He has a BSEE and MSEE from Columbia University and an MBA in Management from New York University.

Key

Attributes, Experience and Skills: Mr. DeVito brings his financial, operational and acquisition experience to the Board along with

his leadership and investor relations skills. He has the ability to establish the vision and managing the execution of business plans,

growth goals, creating value for stockholders, and achieving a successful exit.

Family

Relationships

There

are no family relationships between or among any of our current directors, executive officers or persons nominated or charged by the

Company to become directors or executive officers. There are no family relationships among our executive officers and directors and the

executive officers and directors of our direct and indirect subsidiaries.

Involvement

in Certain Legal Proceedings

None

of the directors or executive officers has, during the past ten years:

|

|

(a)

|

Had

any bankruptcy petition filed by or against any business of which such person was a general

partner or executive officer either at the time of the bankruptcy or within two years prior

to that time;

|

|

|

(b)

|

Been

convicted in a criminal proceeding or subject to a pending criminal proceeding;

|

|

|

(c)

|

Been

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated,

of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending

or otherwise limiting his involvement in any type of business, securities, futures, commodities

or banking activities; or

|

|

|

(d)

|

Been

found by a court of competent jurisdiction (in a civil action), the Securities and Exchange

Commission or the Commodity Futures Trading Commission to have violated a federal or state

securities or commodities law, and the judgment has not been reversed, suspended, or vacated.

|

Item

6. Executive Compensation

The

following table sets forth all plan and non-plan compensation for the last two completed fiscal years paid to all individuals who

served as the Company’s principal executive officer or acting in similar capacity during the last completed fiscal year, regardless

of compensation level, and other individuals as required by Item 402(m)(2) of Regulation S-K. We refer to all of these individuals

collectively as our “named executive officers.”

SUMMARY

COMPENSATION TABLE

|

|

Year

Ended

|

Salary

and Fees

|

Bonus

|

Total

|

|

Name

and Principal Position

|

July

31,

|

($)

|

($)

|

($)

|

|

Dr.

Raouf Guirguis

|

|

|

|

|

|

--Former

Chairman and CEO

|

2021

|

-

|

-

|

-

|

|

|

2020

|

-

|

-

|

-

|

|

Nicholas

P. DeVito

--Chairman

and CEO (1)

|

2021

|

-

|

-

|

-

|

|

|

(1)

|

Appointed

as of April 15, 2021.

|

Outstanding

Equity Awards at Fiscal Year-End

As

of October 15, 2021, no stock, stock options, or other equity securities were awarded to our named executive officers.

Employment

Agreements, Termination of Employment and Change-in-Control Arrangements with our Executive Officers

Our

sole executive officer, Nicholas DeVito, does not have a compensation agreement with us as of October 15, 2021.

Long-Term

Incentive Plans

We

do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Compensation

of Directors

None

of our directors was compensated for services in 2020 or 2021.

Term

of Office

Our

directors are elected to hold office for a one-year term until the next annual stockholders’ meeting or until his successor is elected

and qualified.

Item

7. Certain Relationships and Related Transactions, and Director Independence

Certain

Relationships and Related Transactions

None,

during the fiscal years ended July 31, 2020, and 2021.

Independent

Directors

None

Item

8. Legal Proceedings.

We

know of no material, active or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding

or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial

stockholder, is an adverse party or has a material interest adverse to our interest.

Item

9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters.

Market

Information

Our

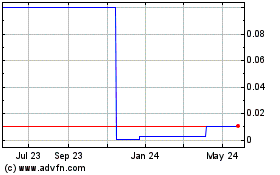

Common Stock is quoted on the OTC Markets’ Pink Sheets under the symbol “PCNT”. Any over-the-counter market quotations

on the OTC’s Pink tier reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent

actual transactions.

Transfer

Agent

Our

transfer agent is Vstock Transfer, LLC, located at 18 Lafayette Pl, Woodmere, NY 11598, telephone: (212) 828-8436.

Holders

As

of October 15, 2021, we had 37 record holders of our common stock (not including beneficial owners who hold shares at broker/dealers

in “street name”).

Dividend

Policy

While

there are no restrictions that limit our ability to pay dividends, we have not paid, and do not currently intend to pay cash dividends

on our common stock in the foreseeable future. Our policy is to retain all earnings, if any, to provide funds for the operation and expansion

of our business. The declaration of dividends, if any, will be subject to the discretion of our Board of Directors, which may consider

such factors as our results of operations, financial condition, capital needs and acquisition strategy, among others.

Issuer

Purchases of Equity Securities

None

Item

10. Recent Sales of Unregistered Securities

On

August 2, 2021, we issued 1,000 restricted shares of our Series A non-convertible preferred stock to Nicholas P. DeVito in exchange for

services being rendered to the Company by Mr. DeVito.

Item

11. Description of Registrant’s Securities to be Registered

The

following statements relating to the capital stock set forth the material terms of the Company’s securities; however, reference

is made to the more detailed provisions of our Articles of Incorporation, as amended to date, and by-laws, copies of which are filed

herewith or incorporated herein by reference.

Description

of our Common Stock

We

are authorized to issue 100,000,000 shares, par value $0.0001 per share, of common stock, of which 46,981,059 shares were issued and

outstanding as of October 15, 2021. Holders of our common stock are entitled to one vote per share on each matter submitted to a vote

at any meeting of stockholders. Shares of our common stock do not carry cumulative voting rights. Our Board of Directors has authority,

without action by the stockholders, to issue all or any portion of the authorized but unissued shares of common stock, which would reduce

the percentage ownership of the stockholders and which may dilute the book value of the common stock. Stockholders have no pre-emptive

rights to acquire additional shares of common stock. The common stock is not subject to redemption and carries no subscription or conversion

rights. In the event of liquidation, the shares of common stock are entitled to share equally in corporate assets after satisfaction

of all liabilities. The shares of common stock, when issued, will be fully paid and non-assessable.

Holders

of common stock are entitled to receive dividends as the board of directors may from time to time declare out of funds legally available

for the payment of dividends. We have not paid dividends on common stock and do not anticipate that we will pay dividends in the foreseeable

future.

All

shares of common stock now outstanding are duly authorized, fully paid and non-assessable.

Description

of our Preferred Stock

Our

Certificate of Incorporation authorize the issuance of 10,000,000 shares of preferred stock, par value $0.0001, and vest in the Company’s

board of directors the authority to establish series of unissued preferred shares by the designations, preferences, limitations and relative

rights, including voting rights, of the preferred shares of any series so established to the same extent that such designations, preferences,

limitations, and relative rights could have been fully stated in the Articles of Incorporation, and in order to establish a series, the

board of directors shall adopt a resolution setting forth the designation of the series and fixing and determining the designations,

preferences, limitations and relative rights, including voting rights, thereof or so much thereof as shall not be fixed and determined

by the Articles of Incorporation as amended.

The

board of directors may authorize the issuance of preferred shares without further action by our shareholders and any preferred shares

would have priority over the common stock with respect to dividend or liquidation rights. Any issuance of preferred shares may have the

effect of delaying, deferring or preventing a change in control of the Company and may contain voting and other rights superior to common

stock. As a result, the issuance of preferred shares may adversely affect the relative rights of the holders of common stock.

On

July 9, 2021, the Company filed a Certificate of Designation with the Secretary of State of the State of Nevada creating a class of Series

A non-convertible preferred stock consisting of 1,000 shares.

The

following is a description of the material rights of our Series A non-convertible preferred stock:

Voting

The

outstanding shares of Series A non-convertible preferred stock vote together with the outstanding shares of our common stock as a single

class and represent eighty percent (80%) of all votes entitled to be voted at any annual or special meeting of our shareholders or action

by written consent of shareholders. Each outstanding share of the Series A non-convertible preferred stock represents a proportionate

share of the 80% voting rights held by all of the outstanding shares of Series A non-convertible preferred stock.

Dividends

The

Series A non-convertible preferred stock is not entitled to receive any dividends in any amount during which such shares are outstanding.

No

Convertibility; No Redemption

The

Series A non-convertible preferred stock is not entitled to be converted into shares of our common stock or to be redeemed.

Liquidation

Preference

In

the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of shares of our Series

A non-convertible preferred stock then outstanding will be entitled to be paid, out of the assets of the Company available for distribution

to its stockholders, an amount equal to the stated value per share, or $0.0001.

Protective

Provisions.

So

long as any shares of Series A non-convertible preferred stock are outstanding, the Company will not, without first obtaining the approval

(by vote or written consent, as provided by the Nevada Business Corporation Act) of the Holders of at least a majority of the then outstanding

shares of Series A non-convertible preferred stock:

|

|

(a)

|

alter

or change the rights, preferences or privileges of the Series A non-convertible preferred stock;

|

|

|

(b)

|

alter

or change the rights, preferences or privileges of any capital stock of the Company so as to affect adversely the Series A non-convertible

preferred stock;

|

|

|

(c)

|

create

any new class or series of capital stock having a preference over the Series A non-convertible preferred stock as to distribution of

assets upon liquidation, dissolution or winding up of the Company (“Senior Securities”);

|

|

|

(d)

|

create

any new class or series of capital stock ranking pari passu with the Series A non-convertible preferred stock as to distribution of assets

upon liquidation, dissolution or winding up of the Company;

|

|

|

(e)

|

increase

the authorized number of shares of Series A non-convertible preferred stock;

|

|

|

(f)

|

issue

any additional shares of Series A non-convertible preferred stock non-convertible preferred stock;

|

|

|

(g)

|

issue

any additional shares of Senior Securities; or

|

|

|

(h)

|

redeem,

or declare or pay any cash dividend or distribution on, any junior securities.

|

Item

12. Indemnification of Directors and Officers

Section

78.138 of the NRS provides that a director or officer will not be individually liable unless it is proven that (i) the directors or officer’s

acts or omissions constituted a breach of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud or

a knowing violation of the law.

Section

78.7502 of NRS permits a company to indemnify its directors and officers against expenses, judgments, fines and amounts paid in settlement

actually and reasonably incurred in connection with a threatened, pending or completed action, suit or proceeding if the officer or director

(i) is not liable pursuant to NRS 78.138 or (ii) acted in good faith and in a manner the officer or director reasonably believed to be

in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe

the conduct of the officer or director was unlawful.

Section

78.751 of NRS permits a Nevada company to indemnify its officers and directors against expenses incurred by them in defending a civil

or criminal action, suit or proceeding as they are incurred and in advance of final disposition thereof, upon receipt of an undertaking

by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that