Lego CEO Sees Potential for Brand in Digital Products

08 December 2016 - 10:00PM

Dow Jones News

Lego A/S's top boss says he is eager to hear more business

proposals when taking on a new assignment in January. He warns,

however: his job will also be to say no.

After a 12-year tenure as chief executive of the Danish toy

brick-maker, Jø rgen Vig Knudstorp has been appointed chairman of a

new umbrella-entity, the Lego Brand Group, where he will be the

chief custodian of the four-letter brand, from merchandising to

charity.

His new role, he says, will be to expand Lego into uncharted

business territory, while also avoiding putting the brand name in

the wrong places.

"I'm going to do brand protection and development, in parallel,"

he said in an interview. "Our history is fraught with mistakes, and

we don't plan to repeat them."

Mr. Knudstorp has firsthand experience of how botched

diversification can hurt a company and its brand.

When he took office as Lego CEO in 2004, the family-owned

company was in pieces, with dwindling sales and swelling losses. In

a bid to generate new revenue streams, Lego had ventured into

running theme parks, launching clothing lines, dolls, baby toys and

numerous other products with little commercial success.

Many companies are grappling with how to harness a brand without

harming it.

At the turn of the decade, Finnish mobile-game maker Rovio

Entertainment Ltd. entered others activities like films, theme

parks and various merchandises, hoping that its 'Angry Birds' game

would help it become a Walt Disney Co.-style business. It worked

for a while: In 2013, nongame activities brought in half of Rovio's

revenue. But as interest in 'Angry Birds' games diminished, the

brand lost some of its appeal, forcing Rovio to slash jobs.

German sporting goods firm Puma SE only recently recovered from

years of terrible sales and uncontrolled diversification that

tarnished its image. In the early 2000s, aiming to harvest the

fruits of a well-recognized brand, Puma began putting its name on

anything from bikes to perfumes and sunglasses. Not until it

returned to its core, sportswear, have numbers again turned

black.

During Mr. Knudstorp's time as CEO, Lego got rid of all noncore

assets and took a cautious approach to investments. Films,

videogames and theme parks are now largely handled by third-party

companies.

"There may be a limit to how much Lego can really do outside of

construction toys," said Matthew Hudak, an analyst at the

Euromonitor consultancy, adding, "It may be that consumers interest

in the Lego brand does not extend too far outside of the

construction toy category."

Mr. Knudstorp has some ideas. The biggest untapped growth

potential for Lego lies in the digital world, he says, adding

that potential partners keep knocking on his door.

Lego has been approached to develop games similar to Sweden's

Minecraft, now owned by Microsoft Corp., that would allow children

to manipulate bricks to learn computer coding. Other proposals

include different ways of combining phone scanning technology with

children's bricks play.

"There is an endless range of opportunities," Mr. Knudstorp

said.

While focusing on the brand, Mr. Knudstorp said he intends to

retain some down-to-earth duties. These include meeting partners in

countries like China to guide them in local business decisions and

spending more time with retail and media associates like Toys-R-Us,

Inc. and Walt Disney Co.

Lego Chief Operating Officer Bali Padda, who will take over as

CEO from Jan. 1, said he wasn't worried about him and Mr. Knudstorp

stepping on each other's toes.

"It's the brick-based business that I'm really wanting to

drive," he said. "The other things, he can do."

Write to Ellen Emmerentze Jervell at ellen.jervell@wsj.com

(END) Dow Jones Newswires

December 08, 2016 05:45 ET (10:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

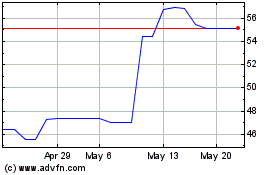

Puma Ag Rudolf Dassl (PK) (USOTC:PMMAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Puma Ag Rudolf Dassl (PK) (USOTC:PMMAF)

Historical Stock Chart

From Jan 2024 to Jan 2025