Potash Ridge Reports First Quarter 2014 Financial Results and Provides Update on Its Blawn Mountain Sulphate of Potash Project

09 May 2014 - 7:30AM

Marketwired

Potash Ridge Reports First Quarter 2014 Financial Results and

Provides Update on Its Blawn Mountain Sulphate of Potash Project

TORONTO, ONTARIO--(Marketwired - May 8, 2014) - Potash Ridge

Corporation ("Potash Ridge" or the "Corporation") (TSX:PRK)

(OTCQX:POTRF) today released its first quarter financial

results.

2014 Q1 Financial Results

- The Corporation reported a net loss for the first quarter of

$0.2 million ($0.00 per share) compared with a net loss of $1.0

million ($0.01 per share) for the first quarter of 2013.

- A total of $2.6 million was incurred on Blawn Mountain Project

(the "Project") activities in the first quarter compared with $3.6

million on project activities for the first quarter of 2013.

- The Corporation closed the first quarter of 2014 with cash and

cash equivalents of $5.5 million and had accounts payable and

accrued liabilities of $0.9 million.

The Corporation's first quarter unaudited Financial Statements

and Management's Discussion & Analysis are available at

www.sedar.com.

Key Project Highlights of the Three Months Ended March 31,

2014

- Various studies undertaken by the Corporation's consultants

have established premiums growers are willing to pay for sulphate

of potash ("SOP") over muriate of potash ("MOP") for certain key

crops due to yield benefits, and also the market demand potential

for SOP in various key markets. These studies indicate that growers

are willing to pay significant premiums, and that the demand growth

potential in key markets is robust. During the quarter, the

Corporation initiated discussions with various purchasers and users

of SOP in North America, all of which have indicated a severe

supply shortage. This supply shortage is expected to persist, given

limited growth potential using existing SOP production processes.

The impact of the supply deficit, and the willingness and ability

of growers to pay a significant premium for SOP over MOP is evident

when comparing prices. In North America, average realized SOP

prices were approximately US$670/tonne for the first quarter of

2014 compared with approximately US$690/tonne for the same period

in 2013. By contrast, North American MOP average realized prices

declined to approximately US$250/tonne during the first quarter of

2014 from approximately US$363/tonne during the same period in

2013. The average realized price for SOP is currently approximately

170% over the average realized price for MOP.

- In February 2014, the Corporation filed its groundwater

discharge permit application. The permit is expected in the second

quarter of 2014.

- In March 2014, the U.S. Army Corp of Engineers confirmed the

Corporation's findings that no jurisdictional waters or wetlands

will be impacted by the Project and, accordingly, a "Department of

the Army Permit" is not required for the Project. Following receipt

of this confirmation, no further federal permitting issues are

expected as it pertains to the Project site.

- On March 24, 2014, the Corporation converted its Exploration

Agreement with the Utah State School and Institutional Land Trust

Administration ("SITLA") into a Mining Lease. Concurrent with the

exercise of the Option, the Corporation entered into an agreement

with SITLA, whereby the upfront payment requirement of US$1,020,000

upon conversion was replaced with an initial payment of US$200,000

plus five equal semi-annual installments of US$164,000 commencing

in March 2015. Interest will accrue on unpaid installments at an

annual rate of 5.75%.

- The Corporation has initiated discussions with a number of

independent engineering firms regarding the upcoming feasibility

study for the Project. It is expected that the feasibility study

contract will be awarded by mid-year, subject to receipt of

additional financing by the Corporation.

- The scope of additional metallurgical test work required for

the upcoming feasibility study has been determined and proposals

are being obtained from metallurgical testing firms to carry out

this testing program. The test program will include variability

testing, continuous testing and testing at vendor facilities, with

the objective of obtaining process guarantees.

- The Corporation is advancing discussions towards securing

build, own, operate type arrangements for various infrastructure

aspects of the Project, such as the electricity transmission line,

a natural gas pipeline, short-line rail and load-out facilities,

sulphuric acid plant and water treatment plant.

2014 Outlook

Several initiatives are currently underway that are expected to

result in the achievement of various key milestones during 2014 and

beyond

- The Corporation continues to advance its permitting strategy:

- The water rights application, submitted jointly with SITLA in

late 2012, is currently being reviewed by the Utah Division of

Water Rights. The approval of this application is anticipated

during the second quarter of 2014;

- The Corporation filed an application for a large mining permit

with the Utah Division of Oil, Gas and Mining in late 2013, and it

is anticipated that the approval of the application will be

received in mid-2014; and

- Air monitoring data was collected over a one-year period that

ended in October 2013. Modeling for the air permit application will

continue in parallel with the feasibility study.

- Various commercial discussions currently underway with respect

to infrastructure and marketing initiatives are expected to

conclude with signing of commercial arrangements with third

parties.

- The Corporation is targeting to raise approximately US$25

million for the feasibility study phase and near term working

capital requirements. The Corporation currently expects that this

additional funding will bring the development of the Project to the

beginning of the execution phase and the commencement of detailed

engineering, assuming receipt of a positive feasibility study. A

number of strategies to raise this additional capital are currently

being pursued.

About Potash Ridge

Potash Ridge is a Canadian based exploration and development

company focused on developing a surface alunite deposit in southern

Utah called the Blawn Mountain Project. It is expected to produce a

premium fertilizer called sulphate of potash and a possible alumina

rich by-product.

Located in Utah, a mining friendly jurisdiction with established

infrastructure nearby, the Project is expected to produce an

average of 645,000 tons of SOP per annum over a 40 year mine life.

A NI 43-101 compliant Prefeasibility Study completed in November

2013 by Norwest Corporation demonstrated that the Project is both

technically and economically viable. The Prefeasibility Study,

entitled "NI 43-101 Technical Report Resources and Reserves of the

Blawn Mountain Project, Beaver County, Utah" dated effective

November 6, 2013 is available on SEDAR.

Potash Ridge has a highly qualified and proven management team

with significant financial, project management and operational

experience and the proven ability to take projects into

production.

Forward-Looking Statements

This press release contains forward-looking statements,

which reflect the Corporation's expectations regarding future

growth, results of operations, performance and business prospects.

These forward-looking statements may include statements that are

predictive in nature, or that depend upon or refer to future events

or conditions, and can generally be identified by words such as

"may", "will", "expects", "anticipates", "intends", "plans",

"believes", "estimates", "guidance" or similar expressions. In

addition, any statements that refer to expectations, projections or

other characterizations of future events or circumstances are

forward-looking statements. These statements are not historical

facts but instead represent the Corporation's expectations,

estimates and projections regarding future events. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Corporation,

are inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements. Such factors include,

but are not limited to: the future financial or operating

performance of the Corporation and its subsidiaries and its mineral

projects; the anticipated results of exploration activities; the

estimation of mineral resources; the realization of mineral

resource estimates; capital, development, operating and exploration

expenditures; costs and timing of the development of the

Corporation's mineral projects; timing of future exploration;

requirements for additional capital; climate conditions; government

regulation of mining operations; anticipated results of economic

and technical studies; environmental matters; receipt of the

necessary permits, approvals and licenses in connection with

exploration and development activities; appropriation of the

necessary water rights and water sources; changes in commodity

prices; recruiting and retaining key employees; construction

delays; litigation; competition in the mining industry; reclamation

expenses; reliability of historical exploration work; reliance on

historical information acquired by the Corporation; optimization of

technology to be employed by the Corporation; title disputes or

claims and other similar matters.

If any of the assumptions or estimates made by management

prove to be incorrect, actual results and developments are likely

to differ, and may differ materially, from those expressed or

implied by the forward-looking statements contained herein. Such

assumptions include, but are not limited to, the following: that

general business, economic, competitive, political and social

uncertainties remain favorable; that agriculture fertilizers are

expected to be a major driver in increasing yields to address

demand for premium produce, such as fruits and vegetables, as well

as diversified protein rich diets necessitating grains and other

animal feed; that actual results of exploration activities justify

further studies and development of the Corporation's mineral

projects; that the future prices of minerals remain at levels that

justify the exploration and future development and operation of the

Corporation's mineral projects; that there is no failure of plant,

equipment or processes to operate as anticipated; that accidents,

labour disputes and other risks of the mining industry do not

occur; that there are no unanticipated delays in obtaining

governmental approvals or financing or in the completion of future

studies, development or construction activities; that the actual

costs of exploration and studies remain within budgeted amounts;

that regulatory and legal requirements required for exploration or

development activities do not change in any adverse manner; that

input cost assumptions do not change in any adverse manner, as well

as those factors discussed in the section entitled "Risk Factors"

in the Corporation's Annual Information Form (AIF) for the

year-ended December 31, 2013 available at sedar.com. The

Corporation disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

applicable law.

Potash Ridge CorporationLaura SandilandsManager of Investor

Relations416.362.8640 ext. 101info@potashridge.com

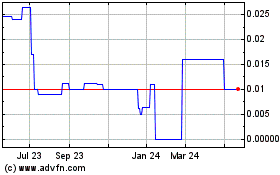

Soperior Fertilizer (CE) (USOTC:POTRF)

Historical Stock Chart

From Nov 2024 to Dec 2024

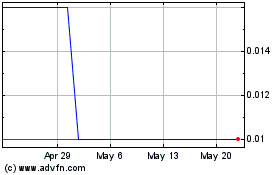

Soperior Fertilizer (CE) (USOTC:POTRF)

Historical Stock Chart

From Dec 2023 to Dec 2024