Current Report Filing (8-k)

06 May 2023 - 7:04AM

Edgar (US Regulatory)

0001517681

false

--06-30

0001517681

2023-05-05

2023-05-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): May 5, 2023 (May 1, 2023)

PROPANC

BIOPHARMA, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-54878 |

|

33-0662986 |

(State

or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification Number) |

302,

6 Butler Street

Camberwell,

VIC, 3124 Australia

(Address

of registrant’s principal executive office) (Zip code)

+61-03-9882-0780

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.03 Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of this Current Report on Form 8-K (this “Report”), the information contained in Item 5.03 of this Report is incorporated herein

by reference.

Item

5.03 Amendments to Articles of Incorporation or Bylaws.

On

May 1, 2023, Propanc Biopharma, Inc. (the “Company”) filed a certificate of amendment (the “Certificate of

Amendment”) to its certificate of incorporation, as amended (the “Certificate of Incorporation”), to effect a

one-for-one thousand reverse stock split (the “Reverse Stock Split”) of its outstanding shares of common stock, par

value $0.001 per share (the “Common Stock”), effective as of May 1, 2023. In connection with the Reverse Stock

Split, the Company submitted an issuer company-related action notification form to the Financial Industry Regulatory Authority,

Inc. (“FINRA”) notifying FINRA of the Reverse Stock Split. The processing of the effects of the Reverse Stock

Split by FINRA on the reported price of the Common Stock on the Pink® Open Market operated by the OTC Markets Group Inc. will

occur at the time that the Reverse Stock Split is announced by FINRA on its over-the-counter daily list, which has not occurred as of the date of this Report.

As

a result of the Reverse Stock Split, the Common Stock has been assigned a new CUSIP number (74346N602). The Reverse Stock

Split does not affect the total number of shares of capital stock, including the Common Stock, that the Company is authorized to issue,

or the par value of the Common Stock, which shall remain as set forth pursuant to the Certificate of Incorporation. No fractional shares

of Common Stock will be issued in connection with the Reverse Stock Split, all of which were rounded up to the nearest whole number.

The Company’s outstanding warrants and equity awards will be adjusted as a result of the Reverse Stock Split, as required by the

terms of such warrants and equity awards.

Securities

Transfer Corporation, the Company’s transfer agent, will send instructions to stockholders of record who hold stock certificates

regarding the exchange of any Common Stock certificates in connection with the Reverse Stock Split. Stockholders who hold their shares

of Common Stock in book-entry form or in brokerage accounts or “street name” are not required to take any action to effect

the exchange of their shares of Common Stock following the Reverse Stock Split.

The

foregoing summary of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the

full text of the Certificate of Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Forward-Looking

Statements

This

Report contains, and may implicate, forward-looking statements regarding the Company, and include cautionary statements identifying important

factors that could cause actual results to differ materially from those anticipated. Forward-looking statements include, but are not

limited to, statements that express the Company’s intentions, beliefs, expectations, strategies, predictions or any other statements

related to the Company’s future activities, or future events or conditions. These statements are based on current expectations,

estimates and projections about the Company’s business based, in part, on assumptions made by its management. These statements

are not guarantees of future performances and involve risks, uncertainties and assumptions that are difficult to predict. Therefore,

actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking statements due to numerous

factors, including those risks discussed in documents that the Company files from time to time with the SEC. Any forward-looking statements

speak only as of the date on which they are made, and the Company undertakes no obligation to update any forward-looking statement to

reflect events or circumstances after the date of this Report, except as required by law.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits:

*

Filed herewith

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

May 5, 2023 |

PROPANC

BIOPHARMA, INC. |

| |

|

|

| |

By: |

/s/

James Nathanielsz |

| |

Name: |

James

Nathanielsz |

| |

Title: |

Chief

Executive Officer and Chief Financial Officer |

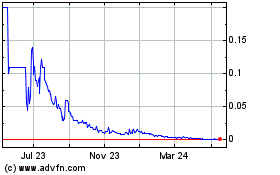

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

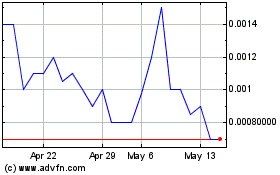

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Jan 2024 to Jan 2025