PetroShale Announces First Quarter 2014 Results

CALGARY, ALBERTA--(Marketwired - May 29, 2014) - PetroShale Inc.

("PetroShale" or the "Company") (TSX-VENTURE:PSH)(OTCQX:PSHIF) is

pleased to announce its financial and operating results for the

quarter ended March 31, 2014. The Company's unaudited consolidated

financial statements and corresponding Management's Discussion and

Analysis (MD&A) for the three month period ended March 31,

2014, will be available on SEDAR at www.sedar.com, on the OTCQX

website at www.otcqx.com, and on PetroShale's website at

www.petroshaleinc.com. Copies of the materials can also be obtained

upon request without charge by contacting the Company directly.

Operating Highlights:

- Reported production for the quarter of 166 boe/d (Company

interest, gross of royalty - 127 boe/d net of royalty interest),

weighted 95% to light crude oil and liquids, a 34% increase over

the same period in 2013.

- Including incremental production volumes from four (gross) new

wells that came on-stream in February 2014 in the Company's

Stockyard Creek asset, confirmed run-rate production through early

May of approximately 300 boe/d (gross of royalty);

- In addition to the four (0.2 net) new wells brought onto

production during the quarter, the Company drilled and is in

various stages of completing an additional four (0.4 net) wells

subsequent to the end of the quarter;

- Realized strong operating netbacks of $54.22 per boe (Company

interest, gross of royalty, and excluding the impact of hedging -

$71.14 per boe net of royalty interest and excluding hedging),

which reflects the Company's high quality production, combined with

a strong pricing environment and low operating expenses; and

- Continued to successfully execute on its aggressive acquisition

strategy in North Dakota, closing three separate transactions

during the period. These include an 18.75% Working Interest ("WI")

in a proposed drilling unit in McKenzie County, an approximate 19%

WI in a drilling unit in Williams County, as well as the

acquisition of additional undeveloped land in Mountrail County

through a Federal land sale. Subsequent to the end of the quarter,

the Company closed on the acquisition of an additional 9.5%

interest in two of its existing wells in Stockyard Creek, and

acquired two additional acreage parcels in McKenzie County.

Financial Highlights:

- Generated $1.1 million in revenue net of royalties during the

period, an increase of 47% over the same period in 2013, reflecting

the substantial growth in the Company's assets;

- Enhanced ongoing financial flexibility to fund further

acquisitions and capital programs by securing a subordinated loan

facility provided by the Company's two largest shareholders. The

facility was recently increased from $20 million to $30 million in

capacity; and

- Subsequent to the end of the period, announced a private

placement of up to 5 million common voting shares at a price of

$1.30 per share, for total gross proceeds of up to $6.5 million.

Proceeds will be used initially to repay outstanding debt.

Completion of the private placement is subject to the approval of

the TSX Venture Exchange.

Results of Oil and Gas Activities

| For the three months ended |

|

March 31, 2014 |

|

|

March 31, 2013 |

|

|

|

|

|

|

|

|

| Sales volumes |

|

|

|

|

|

|

|

Oil

and natural gas liquids (Bbl/d) |

|

159 |

|

|

117 |

|

|

Natural gas (Mcf/d) |

|

41 |

|

|

41 |

|

| Barrel of oil equivalent (Boe/d) |

|

166 |

|

|

124 |

|

|

|

|

|

|

|

|

| Barrel of oil equivalent, net of royalty (Boe/d) |

|

127 |

|

|

96 |

|

|

|

|

|

|

|

|

| Operating Netbacks ($/Boe) |

|

|

|

|

|

|

|

Revenue |

$ |

92.57 |

|

$ |

82.38 |

|

|

Royalties |

|

(22.02 |

) |

|

(18.50 |

) |

|

Realized hedge loss |

|

(0.54 |

) |

|

- |

|

|

Operating costs |

|

(10.84 |

) |

|

(18.50 |

) |

|

Production taxes |

|

(5.49 |

) |

|

(2.23 |

) |

| Operating netback |

$ |

53.68 |

|

$ |

43.15 |

|

| Operating netback prior to hedging |

$ |

54.22 |

|

$ |

43.15 |

|

| Operating netback prior to hedging, on a net of royalty

basis |

$ |

71.14 |

|

$ |

55.65 |

|

Earnings before interest, taxes, depreciation and amortization

(EBITDA) was $204,000 for the three month period ended March 31,

2014 compared to $141,000 for the quarter ended March 31, 2013. For

the first quarter ended March 31, 2014 the Company reported a net

loss of $554,000 ($0.02 per share), compared to a loss of $17.4

million ($0.60 per share) for the three month period ended March

31, 2013 (primarily due to an impairment charge taken in the prior

period).

Letter to shareholders:

The first three months of calendar 2014 coincide with

PetroShale's first quarterly reporting period since changing our

year end to December 31.

Through the first quarter, we continued to execute on our

strategy of acquiring and consolidating working interests ("WI") in

the most prolific and proven areas of the Williston Basin. In

January 2014, we successfully acquired an 18.75% WI in a proposed

drilling unit within the highly productive McKenzie County. This

drilling unit has been spaced for 8 wells and will be operated by

EOG Resources, Inc., a leading and technically skilled operator in

the North Dakota Bakken.

In February 2014, we followed up on that transaction with the

purchase of acreage in Williams County, consisting of an

approximately 19% WI in a drilling unit. Finally, through our

participation in a Federal land sale, we successfully acquired

additional prospective but undeveloped land in Mountrail County for

US$1.8 million. Subsequent to the end of the quarter, we purchased

an additional working interest of approximately 9.5% in two of our

existing wells in Stockyard Creek, and also acquired an interest in

two additional acreage parcels in McKenzie County.

In May, 2014, we announced a private placement of up to 5

million common voting shares at a price of $1.30 per share, to

generate gross proceeds of up to $6.5 million. Upon closing, which

is anticipated in early June 2014, net proceeds will be used to

repay a portion of outstanding debt. This, along with the extension

of our subordinated loan facility, will provide PetroShale with

enhanced financial flexibility as we continue to pursue

acquisitions that add to our growing asset base in the North Dakota

Bakken.

With our financial strength coupled with our business alliance

with premier operator, Slawson Exploration Company Inc., we are

well positioned to continue seeking strategic asset acquisitions in

the Williston Basin that offer us the ability to grow organically

through a high quality asset base. As drilling activity continues

across our asset base through the balance of 2014, we expect to

benefit from resulting increases in production, cash flow and

booked reserves.

Thank you again for your interest in PetroShale, and we look

forward to keeping our shareholders updated on our ongoing growth

and expansion.

M. Bruce Chernoff

Executive Chairman and CEO

About PetroShale

PetroShale is a growing oil company engaged in the acquisition

and consolidation of interests in the most prolific and proven

areas of the Williston Basin in North Dakota and Montana.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Note Regarding Forward-Looking Statements and Other

Advisories

Company interest means, in relation to the Company's interest in

production and reserves, the Company's working interest (operating

and non-operating) before the deduction of royalties payable and

including such entity's royalty interest in production and

reserves. Where volumes of reserves and production have been

presented, they have been presented as company working interest,

gross of royalties, except where otherwise noted. All operating

netbacks referenced in this press release are Company working

interest, except where otherwise noted. All dollar figures included

herein are presented in Canadian dollars, unless otherwise

noted.

Within this press release, references are made to terms commonly

used in the oil and natural gas industry. The terms "netback",

"operating netback" or "EBITDA" in this press release are not

recognized measures under generally accepted accounting principles

in Canada. PetroShale uses "netback" as a key performance indicator

and it is used by the Company to evaluate the operating performance

of its petroleum and natural gas assets and is determined by

deducting royalties and production and operating expenses from

petroleum and natural gas revenue. EBITDA means earnings before

interest, taxes, depletion and depreciation, impairments, finance

expense, foreign exchange gain or loss, share-based compensation

and other non-cash charges to income. Management believes that in

addition to net income (loss), operating netback and EBITDA are

useful supplemental measures as they assist in the determination of

the Company's operating performance, leverage and liquidity.

Readers are cautioned, however, that these measures should not be

construed as an alternative to net income (loss) or cash flow from

(used in) operating activities determined in accordance with IFRS

as an indication of our performance.

This press release contains forward-looking statements and

forward-looking information (collectively "forward-looking

information") within the meaning of applicable securities laws

relating to aspects of management focus, objectives, strategies and

business opportunities. Forward-looking information typically uses

words such as "anticipate", "believe", "project", "expect", "goal",

"plan", "intend" or similar words suggesting future outcomes,

statements that actions, events or conditions "may", "would",

"could" or "will" be taken or occur in the future. The

forward-looking information is based on certain key expectations

and assumptions made by the Company's management, including

expectations and assumptions concerning prevailing commodity

prices, exchange rates, interest rates, applicable royalty rates

and tax laws; future production rates and estimates of operating

costs; performance of existing and future wells; reserve and

resource volumes; anticipated timing and results of capital

expenditures; anticipated timing of the closing and the size of the

private placement, and the use of proceeds therefrom; the success

obtained in drilling new wells; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the timing,

location and extent of future drilling operations; the state of the

economy and the exploration and production business; results of

operations; performance; business prospects and opportunities; the

availability and cost of financing, labor and services; the impact

of increasing competition; ability to market oil and natural gas

successfully; the Company's ability to access capital, and

obtaining the necessary regulatory approvals, including the

approval of the TSX Venture Exchange.

Although the Company believes that the expectations and

assumptions on which such forward-looking information is based are

reasonable, undue reliance should not be placed on the

forward-looking information because the Company can give no

assurance that they will prove to be correct. Since forward-looking

information addresses future events and conditions, by its very

nature they involve inherent risks and uncertainties. The Company's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, the forward-looking

information and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking information will

transpire or occur, or if any of them do so, what benefits that the

Company will derive therefrom. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

security holders with a more complete perspective on the Company's

future operations and such information may not be appropriate for

other purposes.

Readers are cautioned that the foregoing lists of factors are

not exhaustive. Additional information on these and other factors

that could affect our operations or financial results are included

in reports on file with applicable securities regulatory

authorities and may be accessed through the SEDAR website

(www.sedar.com). These forward-looking statements are made as of

the date of this press release and the Company disclaims any intent

or obligation to update publicly any forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Where amounts are expressed on a barrel of oil equivalent

("boe") basis, natural gas volumes have been converted to boe using

a ratio of 6,000 cubic feet of natural gas to one barrel of oil (6

Mcf: 1 Bbl). This boe conversion ratio is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1 Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

PetroShale Inc.Attention: Executive Chairman and CEOEmail:

Info@PetroShaleInc.comPhone:

+1.303.297.1407www.petroshaleinc.comCindy Gray5 Quarters Investor

Relations, Inc.403.828.0146cgray@5qir.com

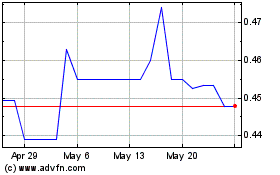

Lucero Energy (QB) (USOTC:PSHIF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lucero Energy (QB) (USOTC:PSHIF)

Historical Stock Chart

From Feb 2024 to Feb 2025