As filed with

the Securities and Exchange Commission on May 1, 2015

Registration No.

UNITED STATES

SECURITIES AND

EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT

OF 1933

POWERSTORM HOLDINGS,

INC.

(Exact name of registrant

in its charter)

| Delaware |

|

4813 |

|

45-3733512 |

| (State or other jurisdiction of incorporation) |

|

(Primary Standard Industrial Classification

Code Number) |

|

(I.R.S. Employer Identification No.) |

31244 Palos Verdes

Dr W, Ste 245

Rancho Palos Verdes,

CA 90275-5370

Tel.: (424) 327-2991

(Address, including

zip code, and telephone number,

including area code,

of registrant’s principal executive offices)

Copies of communications

to:

Gregg E. Jaclin, Esq.

Szaferman Lakind Blumstein

& Blader, P.C.

101 Grovers Mille

Road, Suite 200

Lawrenceville, NJ

08648

Tel. No.: (609) 275-0400

Fax No.: (609)

275-4511

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. ¨

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act.

| Large accelerated filer |

¨ |

|

Accelerated filer |

¨ |

Non-accelerated filer (Do not check if a

smaller reporting company) |

¨ |

|

Smaller reporting company |

x |

CALCULATION OF REGISTRATION FEE

Title of Each Class Of Securities to be

Registered | |

Amount to be

Registered (1) | | |

Proposed

Maximum

Offering

Price per

share (2) | | |

Proposed

Maximum

Aggregate

Offering

Price | | |

Amount of

Registration

Fee | |

| Common Stock, $0.001 par value per share | |

| 1,172,000 | | |

$ | 0.72 | | |

$ | 843,840 | | |

$ | 98.05 | |

| (1) |

Represents an aggregate of (i) 1,172,000 shares of common stock being

registered for resale on behalf of the selling stockholders of such securities and (ii) pursuant to Rule 416 under the Securities

Act, an indeterminate number of shares of common stock that are issuable upon stock splits, stock dividends, recapitalizations

or other similar transactions affecting the shares of the selling stockholder. |

| (2) |

Estimated solely for the purpose of determining the registration fee

pursuant to Rule 457(o) promulgated under the Securities Act of 1933, as amended. Share price determined based

upon the average of the bid and asked price quoted on the OTCQB as of April 30, 2015. |

Powerstorm Holdings, Inc. hereby amends this

registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a

further amendment which specifically states that this registration statement shall thereafter become effective in accordance with

Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed without notice. The selling stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and

Next Fuel, Inc. and the selling stockholders are not soliciting offers to buy these securities, in any state where the offer or

sale of these securities is not permitted.

| Preliminary Prospectus |

Subject to completion, dated ________, 2015 |

POWERSTORM HOLDINGS, INC.

1,172,000 SHARES OF COMMON STOCK

This prospectus relates to 1,172,000 shares

of common stock of Powerstorm Holdings, Inc. which may be offered by the selling stockholders for their own account. We

are paying the expenses incurred in registering the shares, but all selling and other expenses incurred by the selling stockholders

will be borne by the selling stockholders.

The shares of common stock being offered by

the selling shareholders pursuant to this prospectus are “restricted securities” under the Securities Act of 1933,

as amended (the “Securities Act”), before their sale under this prospectus. This prospectus has been prepared for

the purpose of registering these shares of common stock under the Securities Act to allow for a sale by the selling stockholders

to the public without restriction. Each of the selling stockholders and the participating brokers or dealers may be deemed to

be an “underwriter” within the meaning of the Securities Act, in which event any profit on the sale of shares by such

selling stockholder, and any commissions or discounts received by the brokers or dealers, may be deemed to be underwriting compensation

under the Securities Act.

Investing in our common stock involves

a high degree of risk. Please carefully consider the “Risk Factors” beginning on page 7 of this prospectus before

making an investment decision.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved the securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective.

This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any jurisdiction where the offer or sale is not permitted.

Investing in our common stock involves

a high degree of risk. See “Risk Factors” beginning on page [ ] to read about factors you should consider before

buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL

OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

POWERSTORM HOLDINGS, INC.

The Date of This Prospectus is: May 1,

2015

TABLE OF CONTENTS

Please read this prospectus carefully.

It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will

have the information necessary to make an informed investment decision.

You should rely only on information contained

in this prospectus. We have not authorized any other person to provide you with different information. This prospectus is not

an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The

information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed

since that date.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

The information contained

in this prospectus, including in the documents incorporated by reference into this prospectus, includes some statements that are

not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are

not limited to, statements regarding our Company and management’s expectations, hopes, beliefs, intentions or strategies

regarding the future, including our financial condition, results of operations, and the expected impact of the offering on the

Company’s individual and combined financial performance. In addition, any statements that refer to projections, forecasts

or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipates,” “believes,” “continue,” “could,” “estimates,”

“expects,” “intends,” “may,” “might,” “plans,” “possible,”

“potential,” “predicts,” “projects,” “seeks,” “should,” “will,”

“would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the

absence of these words does not mean that a statement is not forward-looking.

The forward-looking

statements contained in this prospectus are based on current expectations and beliefs concerning future developments and the potential

effects on the Company and the transaction. There can be no assurance that future developments actually affecting us will be those

anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s

control) or other assumptions that may cause actual results or performance to be materially different from those expressed or

implied by these forward-looking statements.

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus. This summary does not contain all the information that you should consider

before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements,

before making an investment decision. In this Prospectus, the terms “Powerstorm” “Company,” “we,”

“us” and “our” refer to Powerstorm Holdings, Inc..

Overview

Powerstorm Capital Corp. was formed on October

11, 2011 in the state of Delaware. On February 25, 2015, Powerstorm Capital Corp. filed a Certificate of Amendment to the Certificate

of Incorporation changing its name to Powerstorm Holdings, Inc. (“we”, “Powerstorm” or the “Company”)

d/b/a Powerstorm ESS. The Company is a manufacturer of hybrid energy storage systems that provides reliable off-grid solutions

to: a) service providers such as telecom tower operators, managed network operators (MNOs), data centers, mining companies, hospitals,

b) rural communities and, c) the residential/home use and disaster recovery market.

Where You Can Find Us

Our principal executive office is located at 31244 Palos Verdes

Drive W., Suite 245, Rancho Palos Verdes CA 90275. Our telephone number is (424) 327-2993. Our website is https://www.powerstormess.com.

Implications of Being an Emerging Growth

Company

We qualify as an emerging growth company as

that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens

that are otherwise applicable generally to public companies. These provisions include:

| |

· |

A requirement to have only two years of audited financial statements

and only two years of related MD&A; |

| |

· |

Exemption from the auditor attestation requirement in the assessment

of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act

of 2002; |

| |

· |

Reduced disclosure about the emerging growth company’s

executive compensation arrangements; and |

| |

· |

No non-binding advisory votes on executive compensation or golden

parachute arrangements. |

We have already taken advantage of these reduced

reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2

of the Exchange Act.

In addition, Section 107 of the JOBS Act also

provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of

the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards.

We have elected to use the extended transition period provided above and therefore our financial statements may not be comparable

to companies that comply with public company effective dates.

We could remain an emerging growth company

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed

$1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act,

which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business

day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible

debt during the preceding three year period.

The Offering

Common stock offered by selling security 1,172,000 shares

of common stock. This number represents 5.42% of our current outstanding common stock (1).

| Common stock outstanding before the offering |

|

21,639,240 |

| |

|

|

| Common stock outstanding after the offering |

|

21,639,240 common shares as of April 30, 2015 |

| |

|

|

| Terms of the Offering |

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus. |

| |

|

|

| Termination of the Offering |

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect. |

| |

|

|

| OTC Trading Symbol |

|

PSTO |

| |

|

|

| Use of proceeds |

|

We are not selling any shares of the common stock covered by this prospectus. As such, we will not receive any of the offering proceeds from the registration of the shares of Common Stock covered by this prospectus. |

| |

|

|

| Risk Factors |

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 7. |

| |

(1) |

Based on 21,639,240 shares

of common stock outstanding as of April 30, 2015 |

RISK FACTORS

The Shares are highly speculative in nature,

involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in our

securities. You should carefully consider the risks described below and the other information in this Memorandum before investing

in our Shares. If any of the following risks actually occurs, our business, financial condition or operating results could be

materially adversely affected. In such case, you may lose all or part of your investment.

Risks Relating to Our Business and Industry

Our ability to continue as a going concern

The Company is an early stage company and has incurred an accumulated

loss of $4,234,511 since inception. The Company has negative working capital of $91,415 as of December 31, 2014 and will

require additional funds to finance its business plan for the next twelve months. Due to the early-stage nature of the Company,

the Company expects to incur additional losses in the immediate future. The Company’s ability to continue as a going concern

is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations

and repay its liabilities arising from normal business operations when they become due. The Company’s Chief Executive

Officer has historically provided funding for operations until the Company raises sufficient capital to provide for the first-year

operating expenses.

We are an early stage company and this

makes it difficult to evaluate our business and future prospects.

For financial accounting purposes, our Company

is in its early-stage so its operations will be subject to all risks inherent in the establishment of a new business. Included

in these risks are our limited capital, corporate infrastructure and marketing arrangements. Our management team is experienced

but new to its intended field and well supported by industry experts and consultants. Our Company’s total service lines

have had no commercial exposure or sales. The likelihood that we will succeed must be considered in light of the problems, expenses,

and delays frequently encountered in connection with the development of new businesses.

We may fail to continue to attract,

develop and retain key management, which could negatively impact our operating results.

We depend on the performance of our executive

officers. The loss of our senior management could negatively impact our operating results and our ability to execute our business

strategy. We do not have “key person” life insurance policies on any of our employees.

Our future success depends on our ability

to attract, retain and motivate highly skilled employees. Competition for employees in the telecommunications equipment industry

is intense. Additionally, we depend on our ability to train and develop skilled sales people and an inability to do so would significantly

harm our growth prospects and operating performance.

Our business may suffer if we are not

successful in our efforts to keep up with a rapidly changing market.

The market for the energy storage solutions

market we sell in is characterized by technological changes, evolving industry standards, changing customer needs and frequent

new equipment and service introductions. Our future success in addressing the needs of our customers will depend, in part, on

our ability to timely and cost-effectively:

| |

o |

respond to emerging

industry standards and other technological changes; |

| |

o |

develop our internal technical

capabilities and expertise; |

| |

o |

broaden our equipment and

service offerings; and |

| |

o |

adapt our services to new

technologies as they emerge. |

Our failure in any of these areas could harm

our business.

We are an ‘emerging growth company”

and any decision on our part to comply only with certain reduced disclosure requirements applicable to ‘emerging growth

companies” could make our common stock less attractive to investors.

We are an “emerging growth company,”

as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take

advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth

companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section

404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports

and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and

shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company”

for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed

$1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act,

which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business

day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible

debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also

provides that an “emerging growth company” can take advantage of the extended transition period provided in Section

7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth

company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have elected to opt in to the extended transition period for complying with the revised accounting standards.

We do not expect our cash or cash equivalents

will be sufficient to fund operations for the next twelve (12) months. We expect we will need to obtain funds from additional

financing or other sources for our business activities. If we do not receive these funds, we would need to reduce, delay or eliminate

some of our expenditures.

We have a history of only nominal revenues, have incurred significant

losses, expect continued losses and may never achieve profitability. If we continue to incur losses, we may have to curtail our

operations, which may prevent us from successfully deploying our electric drive systems, battery systems, renewable energy storage

devices and electric vehicles as well as operating and expanding our business.

We have a history of only nominal revenues, have not been profitable

and expect continued losses. Historically, we have relied upon cash from the company’s Chief Executive Officer to fund substantially

all of the cash requirements of our activities and have incurred significant losses and experienced negative cash flow. As of

December 31, 2014, we had an accumulated deficit of $4,234,511 and a net loss of $4,003,062 for the year then ended. We cannot

predict when we will become profitable or if we ever will become profitable. We may continue to incur losses for an indeterminate

period of time and may never achieve or sustain profitability. An extended period of losses and negative cash flow may prevent

us from successfully producing and selling our MESS and zeroXess solutions.

Our significant losses have resulted principally from costs incurred

in connection with the development of our products and from costs associated with our administrative activities. We expect our

operating expenses to dramatically increase as a result of our planned production and sale of our energy storage systems the MESS

and zeroXess. Since we have no significant operating history, we cannot assure you that our business will ever become profitable

or that we will ever generate sufficient revenues to meet our expenses and support our planned activities. Even if we are able

to achieve profitability, we may be unable to sustain or increase our profitability on a quarterly or annual basis.

Without substantial additional financing, we may be unable to achieve

the objectives of our current business strategy, which could force us to delay, curtail or eliminate our product and service development

programs thereby adversely affecting our operations and the price of our common stock.

We have been, and currently are, working toward identifying and

obtaining new sources of financing. No assurances can be given that we will be successful in obtaining additional financing in

the future. Any future financing that we may obtain may cause significant dilution to existing stockholders. Any debt financing

or other financing of securities senior to common stock that we are able to obtain will likely include financial and other covenants

that will restrict our flexibility. At a minimum, we expect these covenants to include restrictions on our ability to pay dividends

on our common stock. Any failure to comply with these covenants would have a material adverse effect on our business, prospects,

financial condition, results of operations and cash flows. In addition, our senior secured convertible debentures contain covenants

that include restrictions on our ability to pay dividends on our common stock.

If adequate funds are not available, we may be required to delay,

scale back or eliminate portions of our operations and product and service development efforts or to obtain funds through arrangements

with strategic partners or others that may require us to relinquish rights to certain of our technologies or potential products

or other assets. Accordingly, the inability to obtain such financing could result in a significant loss of ownership and/or control

of our proprietary technology and other important assets and could also adversely affect our ability to fund our continued operations

and our product and service development efforts and adversely affect the price of our common stock.

We have very limited operating experience; therefore, regardless

of the viability or market acceptance of our products, we may be unable to achieve profitability or realize our other business

goals.

The company has not begun the production of our products. We have

been engaged primarily in research and development of the MESS and zeroXess. Our success will depend in large part on our ability

to address problems, expenses and delays frequently associated with bringing a new product to market. We may not be able to successfully

sell our products even if our products prove to be a viable solution and achieve market acceptance. Consequently, we may be unable

to achieve profitability or realize our other business goals.

The current global financial crisis and uncertainty in global

economic conditions could prevent us from accurately forecasting demand for our products which could adversely affect our operating

results or market share.

Market instability, including the instability of the financial

condition of the International Markets, United States and the State of California, makes it increasingly difficult for us, our

customers and our suppliers to accurately forecast future product demand trends. Due to the forecasting difficulty caused by the

unstable economic conditions, we may be unable to satisfy demand for our products which may in turn result in a loss of market

share.

We are targeting a new and evolving market and we cannot

be certain that our business strategy will be successful.

The market for energy storage systems is relatively rapidly evolving.

We cannot accurately predict the size of this market or its potential growth. Our products represent only one of the possible

solutions for energy storage systems. Use of. The new and evolving nature of the market that we intend to target makes an accurate

evaluation of our business prospects and the formulation of a viable business strategy very difficult. Thus, our business strategy

may be faulty or even obsolete and as a result, we may not properly plan for or address many obstacles to success, including the

following:

| |

· |

the timing and necessity of substantial expenditures for the development, production and

sale of our products; |

| |

· |

the emergence of newer, more competitive technologies and products; · the future

cost of the components used in our systems; |

| |

· |

applicable regulatory requirements; |

| |

· |

the reluctance of potential customers to consider new technologies; |

| |

· |

the failure to strategically position ourselves in relation to joint venture or strategic

partners, and potential and actual competitors; |

| |

· |

the failure of our products to satisfy the needs of the markets that we intend to target

and the resulting lack of widespread or adequate acceptance of our products; and |

| |

· |

the difficulties in managing rapid growth of operations and personnel. |

The industry within which we compete is highly competitive.

Many of our competitors have greater financial and other resources and greater name recognition than we do and one or more of

these competitors could use their greater financial and other resources or greater name recognition to gain market share at our

expense.

The industry within which we compete is highly competitive. New

developments in technology may negatively affect the development or sale of some or all of our products or make our products uncompetitive

or obsolete. Competition for our products may come from current battery technologies, improvements to system technologies and

new system technologies. Our target market is currently serviced by existing manufacturers with existing customers and suppliers

using proven and widely accepted lead acid powered systems or solutions. As a result, our competitors may be able to compete more

aggressively and sustain that competition over a larger period of time than we could. Each of these competitors has the potential

to capture market share in various markets, which could have a material adverse effect on our position in the industry and our

financial results.

Products within the industry in which we operate are subject

to rapid technological changes. If we fail to accurately anticipate and adapt to these changes, the products we sell will become

obsolete, causing a decline in our sales and profitability.

The industry within which we compete is subject to rapid technological

change and frequent new product introductions and enhancements which often cause product obsolescence. We believe that our future

success depends on our ability to continue to enhance our existing products and technologies, and to develop and manufacture in

a timely manner new products with improved technologies. We may incur substantial unanticipated costs to ensure product functionality

and reliability early in its products’ life cycles. If we are not successful in the introduction and manufacture of new

products or in the development and introduction, in a timely manner, of new products or enhancements to our existing products

and technologies that satisfy customer needs and achieve market acceptance, our sales and profitability will decline.

We obtain some of the components and subassemblies included

in our products from a limited group of suppliers, the partial or complete loss of which could have an adverse effect on our sales

and profitability.

We obtain some of the components and subassemblies for our products

from a limited group of suppliers. Although we seek to qualify additional suppliers, the partial or complete loss of these sources

could adversely affect our sales and profitability and damage customer relationships by impeding our ability to fulfill our current

customers’ orders. Further, a significant increase in the price of one or more of these components or subassemblies could

adversely affect our profit margins and profitability if no lower-priced alternative source is approved.

Fluctuation in the price, availability and quality of materials

could increase our cost of goods and decrease our profitability

We purchase materials directly from various suppliers. The prices

we charge for our products are dependent in part on the cost of materials used to produce them. The price, availability and quality

of our materials may fluctuate substantially, depending on a variety of factors, including demand, supply conditions, transportation

costs, government regulation, economic climates and other unpredictable factors. Any material price increases could increase our

cost of goods and decrease our profitability unless we are able to pass higher prices on to our customers. We do not have any

long-term written agreements with any of these suppliers.

Our limited production, commercial launch activities and

continued field tests could encounter problems.

We are currently conducting, and plan to continue to conduct, limited

production and field tests on a number of our products as part of our product development cycle and we are working on scaling

up our production capabilities. These production readiness activities and additional field tests may encounter problems and delays

for a number of reasons, including the failure of our technology, the failure of the technology of others, the failure to combine

these technologies properly and the failure to maintain and service the test prototypes properly. Some of these potential problems

and delays are beyond our control. Any problem or perceived problem with our limited production and field tests could damage our

reputation and the reputation of our products and delay their commercial launch.

Significant changes in government regulation may hinder our

sales.

The production, distribution and sale in the United States of our

products are subject to various federal, state, and local and international statutes and regulations. New statutes and regulations

may also be instituted in the future. If a regulatory authority finds that a current or future product is not in compliance with

any of these regulations, we may be fined, or our product may have to be recalled, thus adversely affecting our financial condition

and operations.

If we do not properly manage foreign sales and operations,

our business could suffer.

We expect that a significant portion of our future revenues will

be derived from sales outside of the United States, and we may operate in jurisdictions where we may lack sufficient expertise,

local knowledge or contacts. Establishment of an international market for our products may take longer and cost more to develop

than we anticipate, and is subject to inherent risks, including unexpected changes in government policies, trade barriers, significant

regulation, difficulty in staffing and managing foreign operations, longer payment cycles, and foreign exchange controls that

restrict or prohibit repatriation of funds. As a result, if we do not properly manage foreign sales and operations, our business

could suffer.

Our failure to manage our growth effectively could prevent

us from achieving our goals.

Our strategy envisions a period of growth that may impose a significant

burden on our administrative, financial and operational resources. The growth of our business will require significant investments

of capital and management’s close attention. Our ability to effectively manage our growth will require us to substantially

expand the capabilities of our administrative and operational resources and to attract, train, manage and retain qualified management,

engineers and other personnel. We may be unable to do so. In addition, our failure to successfully manage our growth could result

in our sales not increasing commensurately with our capital investments. If we are unable to successfully manage our growth, we

may be unable to achieve our goals.

Compliance with regulations governing

public company corporate governance and reporting is uncertain and expensive. Recent changes in our business are likely to increase

our compliance costs and the amount of management time required.

As a public company, we are required to file

with the SEC annual and quarterly information and other reports that are specified in Section 13 of the Securities Exchange Act

of 1934, as amended, ("the Exchange Act"). We have incurred and will continue to incur significant legal, accounting,

and other expenses that private companies do not incur. We incur costs associated with our public company reporting requirements

and with corporate governance and disclosure requirements, including requirements under the Sarbanes-Oxley Act of 2002 (or Sarbanes-Oxley)

and rules implemented by the SEC and the Financial Industry Regulatory Authority. We expect these rules and regulations to increase

our legal and financial compliance costs and to make some activities more time consuming and costly.

As a result of being a public company,

we are obligated to develop and maintain proper and effective internal control over financial reporting and are subject to other

requirements that will be burdensome and costly. We may not timely complete our analysis of our internal control over financial

reporting, or these internal controls may not be determined to be effective, which could adversely affect investor confidence

in our company and, as a result, the value of our Common Stock.

We are required to file with the SEC annual

and quarterly reports and other information that are specified in Section 13 of the Exchange Act. We will also be required to

ensure that we have the ability to prepare financial statements that are fully compliant with all SEC reporting requirements on

a timely basis. In addition, we are subject to other reporting and corporate governance requirements, including the requirements

of listing on the OTCQB, and if listed for continuing to remain listed on the OTCQB, and certain provisions of the Sarbanes-Oxley

Act of 2002 and the regulations promulgated there under, which impose significant compliance obligations upon us. As a public

company, we will be required to:

| |

● |

Prepare and distribute periodic public reports and other stockholder communications in compliance

with our obligations under the federal securities laws and OTCQB rules; |

| |

● |

create or expand the roles and duties of our board of directors and committees of the board; |

| |

● |

maintain a more comprehensive financial reporting and disclosure compliance functions; |

| |

● |

maintain an accounting and financial reporting department, including personnel with expertise

in accounting and reporting for a public company; |

| |

● |

enhance and formalize closing procedures at the end of our accounting periods; |

| |

● |

maintain an internal audit function; |

| |

● |

enhance our investor relations function; |

| |

● |

establish and maintain new internal policies, including those relating to disclosure controls

and procedures; and |

| |

● |

involve and retain to a greater degree outside counsel and accountants in the activities

listed above. |

These requirements entail a significant commitment

of additional resources. We may not be successful in implementing these requirements and implementing them could adversely affect

our business or results of operations. In addition, if we fail to implement the requirements with respect to our internal accounting

and audit functions, our ability to report our results of operations on a timely and accurate basis could be impaired.

We expect to incur substantially greater expenses

and diversion of management’s time and attention from the daily operations of the business, which is likely to increase

our operating expenses and impair our ability to achieve profitability.

To comply with these requirements, we have

evaluated and tested and intend to continue to evaluate and test our internal controls. Where necessary, we have taken and will

continue taking remedial actions, to allow management to report on (and when and as required, our independent auditors to attest

to), our internal control over financial reporting.

As our business continues to change, our principal

executive officer and principal financial officer will continue to reassess our internal control over financial reporting and

make additional changes to allow management to report on our internal control over financial reporting.

Any issuance of shares of our Common

Stock or senior securities in the future could have a dilutive effect on the value of our existing stockholders’ shares.

If we raise additional funds through the issuance

of equity securities or debt convertible into equity securities, the percentage of stock ownership by our existing stockholders

would be reduced. In addition, such securities could have rights, preferences, and privileges senior to those of our current stockholders,

which could substantially decrease the value of our securities owned by them. Depending on the share price we are able to obtain,

we may have to sell a significant number of shares in order to raise the necessary amount of capital. Our stockholders may experience

dilution in the value of their shares as a result.

Future sales of restricted shares could

decrease the price a willing buyer would pay for shares of our Common Stock and impair our ability to raise capital.

Our stock historically has been very thinly

traded. Future sales of substantial amounts of our shares in the public market, or the appearance that a large number of our shares

are available for sale, could adversely affect market prices prevailing from time to time and could impair our ability to raise

capital through the sale of our securities.

State securities laws may limit secondary

trading, which may restrict the states in which and conditions under which you can sell your shares.

Secondary trading in Common Stock registered

for re-sale will not be possible in any state until the Common Stock is qualified for sale under the applicable securities laws

of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available

for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading

of, the Common Stock in any particular state, the Common Stock could not be offered or sold to, or purchased by, a resident of

that state. In the event that a significant number of states refuse to permit secondary trading in our Common Stock, the liquidity

for the Common Stock could be significantly impacted thus causing you to realize a loss on your investment.

Our Common Stock is a “penny stock,”

and compliance with requirements for dealing in penny stocks may make it difficult for holders of our Common Stock to resell their

shares.

The SEC has adopted rules that regulate broker-dealer

practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than

$5.00 per share (other than securities registered on certain national securities exchanges or quotation systems).

Penny stocks are also stocks which are issued

by companies with: net tangible assets of less than $2.0 million (if the issuer has been in continuous operation for at least

three years); or $5.0 million (if in continuous operation for less than three years); or average revenue of less than $6.0 million

for the last three years.

Currently and at least for the foreseeable

future, our Common Stock will be deemed to be a “penny stock” as that term is defined in Rule 3a51-1 under the Exchange

Act. Rule 15g-2 under the Exchange Act requires a broker-dealer, prior to a transaction in a penny stock not otherwise exempt

from those rules, to deliver a standardized risk disclosure document prescribed by the SEC and certain other information related

to the penny stock, the broker-dealer’s compensation in the transaction, and the other penny stocks in the customer’s

account.

In addition, the penny stock rules require

that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written

determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment

of the receipt of a risk disclosure statement, a written agreement related to transactions involving penny stocks, and a signed

and dated copy of a written suitability statement. These disclosure requirements could have the effect of reducing the trading

activity in the secondary market for our stock, because it will be subject to these penny stock rules. Therefore, stockholders

may have difficulty selling their securities.

Compliance with these requirements may make

it more difficult for holders of our Common Stock to resell their shares to third Parties or otherwise, which could have a material

adverse effect on the liquidity and market price of our Common Stock.

If the estimates that we make, or the

assumptions upon which we rely, in preparing our financial statements prove inaccurate, our future financial results may vary

from expectations. Failure to meet expectations may decrease the market price of our securities

Our financial statements have been prepared

in accordance with accounting principles generally accepted in the United States. The preparation of our financial statements

requires us to make estimates and judgments that affect the reported amounts of our assets, liabilities, stockholders’ equity,

revenues and expenses, the amounts of charges accrued by us and related disclosure of contingent assets and liabilities. We base

our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances.

Actual performance may be higher or lower than our estimates for a variety of reasons, including unanticipated competition, regulatory

actions or changes in one or more of our contractual relationships. We cannot assure you, therefore, that any of our estimates,

or the assumptions underlying them, will be correct.

If significant business or product announcements

by us or our competitors cause fluctuations in our stock price, an investment in our stock may suffer a decline in value.

The market price of our Common Stock may be

subject to substantial volatility as a result of announcements by us or other companies in our industry, including our collaborators

and competitors. Announcements that may subject the price of our Common Stock to substantial volatility include announcements

regarding:

| |

● |

our operating results, including the amount and timing of revenue generation; |

| |

● |

significant acquisitions, strategic partnerships, joint ventures or capital commitments

by us or our competitors. |

As a result, we believe that period-to-period

comparisons of our results of operations are not meaningful and should not be relied upon as any indication of future performance.

Due to all of the foregoing factors, it may be that in some future year or quarter our operating results will be below the expectations

of public market analysts and investors. In that event, the price of our Common Stock would likely be materially adversely affected.

There is a low trading volume of our

Common Stock in the public market for our shares and we cannot assure you that an active trading market or a specific share price

will be established or maintained.

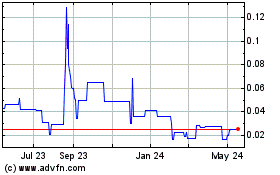

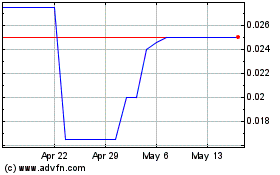

Our Common Stock trades on the OTCQB trading

system. The OTCQB tends to be highly illiquid, in part because there is no national quotation system by which potential investors

can track the market price of shares except through information received or generated by a limited number of broker-dealers that

make markets in particular stocks. There is a greater chance of market volatility for securities that trade on the OTCQB as opposed

to a national exchange or quotation system. This volatility may be caused by a variety of factors including:

| |

● |

the lack of readily available price quotations; |

| |

● |

the absence of consistent administrative supervision of “bid” and “ask”

quotations; |

| |

● |

lower trading volume; and |

In addition, the value of our Common Stock

could be affected by:

| |

● |

actual or anticipated variations in our operating results; |

| |

● |

changes in the market valuations of other oil and gas companies; |

| |

● |

announcements by us or our competitors of significant acquisitions, strategic partnerships,

joint ventures or capital commitments; |

| |

● |

adoption of new accounting standards affecting our industry; |

| |

● |

additions or departures of key personnel; |

| |

● |

sales of our Common Stock or other securities in the open market; |

| |

● |

changes in financial estimates by securities analysts; |

| |

● |

conditions or trends in the market in which we operate; |

| |

● |

changes in earnings estimates and recommendations by financial analysts; |

| |

● |

our failure to meet financial analysts’ performance expectations; and |

| |

● |

other events or factors, many of which are beyond our control. |

In a volatile market, you may experience wide

fluctuations in the market price of our securities. These fluctuations may have an extremely negative effect on the market price

of our securities and may prevent you from obtaining a market price equal to your purchase price when you attempt to sell our

securities in the open market. In these situations, you may be required either to sell our securities at a market price which

is lower than your purchase price, or to hold our securities for a longer period of time than you planned. An inactive market

may also impair our ability to raise capital by selling shares of capital stock and may impair our ability to acquire other companies

by using common stock as consideration.

Securities analysts may not initiate

coverage of our shares or may issue negative reports, which may adversely affect the trading price of the shares.

We cannot assure you that securities analysts

will cover our company. If securities analysts do not cover our company, this lack of coverage may adversely affect the trading

price of our shares. The trading market for our shares will rely in part on the research and reports that securities analysts

publish about us and our business. If one or more of the analysts who cover our company downgrades our shares, the trading price

of our shares may decline. If one or more of these analysts ceases to cover our company, we could lose visibility in the market,

which, in turn, could also cause the trading price of our shares to decline. Further, because of our small market capitalization,

it may be difficult for us to attract securities analysts to cover our company, which could significantly and adversely affect

the trading price of our shares.

Because our stock is thinly traded and

our market capitalization is low, we may not be able to attract the attention of major brokerage firms or institutional investors.

Additional risks to our investors may exist

because security analysts of major brokerage firms generally do not provide coverage for thinly traded securities or companies

that have low market caps. Likewise, institutional investors generally do not invest in companies with low market capitalization.

In addition, because of past abuses and fraud concerns stemming primarily from a lack of public information about new public businesses,

there are many people in the securities industry and business in general who view companies that have been public shells with

suspicion. Without brokerage firm and analyst coverage and institutional investor interest, there may be fewer people aware of

our stock and our business, resulting in fewer potential buyers of our securities, less liquidity, and depressed stock prices

for our investors.

Because we do not anticipate paying

any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

We have not declared or paid cash dividends

on our capital stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development

of our business. In addition, the terms of any future debt agreements may preclude us from paying dividends. As a result, capital

appreciation, if any, of our Common Stock will be your sole source of gain for the foreseeable future.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

The information contained in this report,

including in the documents incorporated by reference into this report, includes some statement that are not purely historical

and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements

regarding our and their management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including

our financial condition, results of operations. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,”

“believes,” “continue,” “could,” “estimates,” “expects,” “intends,”

“may,” “might,” “plans,” “possible,” “potential,” “predicts,”

“projects,” “seeks,” “should,” “would” and similar expressions, or the negatives

of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in

this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties

and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking

statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond

the parties’ control) or other assumptions.

USE OF PROCEEDS

We will not receive any proceeds from the

sale of common stock by the selling security holders. All of the net proceeds from the sale of our common stock will go to the

selling security holders as described below in the sections entitled “Selling Security Holders” and “Plan of

Distribution”. We have agreed to bear the expenses relating to the registration of the common stock for the selling security

holders.

DETERMINATION OF OFFERING

PRICE

The prices at which the shares or common stock covered by this

prospectus may actually be sold will be determined by the prevailing public market price for shares of common stock, by negotiations

between the selling security holders and buyers of our common stock in private transactions or as otherwise described in “Plan

of Distribution.”

DILUTION

The common stock to be sold by the selling

shareholders as provided in the “Selling Security Holders” section is common stock that is currently issued.

Accordingly, there will be no dilution to our existing shareholders.

SELLING SECURITY HOLDERS

The common shares being offered for resale

by the selling security holders consist of 1,172,000 shares of our common stock held by 47 shareholders.

The following table sets forth the names of

the selling security holders, the number of shares of common stock beneficially owned by each of the selling stockholders as of April

30, 2015 and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are

being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale

from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are

the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with

respect to share ownership has been furnished by the selling stockholders.

| Name of Selling Stockholder | |

Shares Beneficially

Owned Prior To

Offering | | |

Shares to

be Offered | | |

Amount

Beneficially

Owned After

Offering | | |

Percent

Beneficially

Owned after

Offering

(19) | |

| Andrew Karigan (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Catherine Girard (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Christy Albeck (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Dorian Bilak (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Frances Bilak (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| T. Hale Boggs (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| John Cobb (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Yukyon Choi (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Stefan Pruteanu (1), (2) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Livia Pruteanu (1), (2) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Patrick Del Duca (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Stefanie Magidson (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Susan Blair (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| The Yuka I. & Daniel R. Kimbell Trust (1), (7) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Thomas Mercurio (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Rich Sootkoos (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Soke Yin Foong (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Richard Clemmer (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Anslow & Jaclin, LLP (4) | |

| 21,000 | | |

| 21,000 | | |

| 0 | | |

| 0 | % |

| Donna Bonfiglio (4) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Eric Stein (4) | |

| 3,000 | | |

| 3,000 | | |

| 0 | | |

| 0 | % |

| Jennifer Zammit (4) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Bella Zaslavsky (4) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Gajalt Rutte (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| Steven Fryer (1) | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| American Capital Ventures (8), (9) | |

| 250,000 | | |

| 250,000 | | |

| 0 | | |

| 0 | % |

| Anamaria Pruteanu (5) | |

| 7,500,000 | | |

| 135,250 | | |

| 7,364,750 | | |

| 34.03 | % |

| Camille Moigne (3) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Carmilla Lau (17) | |

| 250,000 | | |

| 250,000 | | |

| 0 | | |

| 0 | % |

| Cristian Grecu (3) | |

| 3,500 | | |

| 3,500 | | |

| 0 | | |

| 0 | % |

| Cristiana Dutca (3) | |

| 3,500 | | |

| 3,500 | | |

| 0 | | |

| 0 | % |

| Evgeniya Tkacheva (3) | |

| 3,500 | | |

| 3,500 | | |

| 0 | | |

| 0 | % |

| Gjalt Van Rutten Beheer | |

| 5,000 | | |

| 5,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| KeyMedia Management (LTD) (5), (6) | |

| 5,681,156 | | |

| 135,250 | | |

| 5,545.906 | | |

| 25.63 | % |

| Kirstin Gooldy (5) | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | % |

| Lucia Cioclu (3) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Madalina Neamtu (3) | |

| 3,500 | | |

| 3,500 | | |

| 0 | | |

| 0 | % |

| RZ Consulting (10), (11) | |

| 1,000 | | |

| 1,000 | | |

| 0 | | |

| 0 | % |

| Shailesh Upreti (5) | |

| 50,000 | | |

| 50,000 | | |

| 0 | | |

| 0 | % |

| Sherrilee Li (18) | |

| 15,000 | | |

| 15,000 | | |

| 0 | | |

| 0 | % |

| Simina Macarie (3) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Smash Street Media, LLC (12), (13) | |

| 25,000 | | |

| 25,000 | | |

| 0 | | |

| 0 | % |

| Stefani Trif (3) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| The Brewer Group (14), (15) | |

| 100,000 | | |

| 100,000 | | |

| 0 | | |

| 0 | % |

| Veronica Urjan (3) | |

| 2,000 | | |

| 2,000 | | |

| 0 | | |

| 0 | % |

| Victoria Burlacu (16) | |

| 31,000 | | |

| 31,000 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| — | |

| TOTAL | |

| 14,082,656 | | |

| 1,172,000 | | |

| 12,892,6560 | | |

| 59.66 | % |

(1)

On June 30, 2012, the Company sold through Regulation D Rule 506 offering a total of 100,000 shares of common stock to 20 investors,

at a price per share of $0.10 for an aggregate offering price of $10,000.

(2)

Stefan Pruteanu and Livia Pruteanu are the mother and father of Anamaria Pruteanu, our President.

(3) shares issued to consultants for in exchange for

data research in December, 2013.

(4) shares issued pursuant to an agreement for legal

services in connection with this offering between the Company and Anslow & Jaclin, LLP, dated October 28, 2011

(5) Affiliate shares

(6) Michel Freni, our Chief Executive Officer, is the

owner of KeyMedia Management and has sole voting and investment control with respect to the shares offered.

(7) Daniel R. Kimbell has sole voting and investment

control with respect to the shares offered by The Yuka I. & Daniel R. Kimbell Trust.

(8) shares issued to consultant in exchange for investor

relations in October 2014.

(9) Howard Gostfrand has sole voting and investment

control with respect to the shares offered by American Capital Ventures.

(10) shares issued in exchange for consulting services

in September 2014.

(11) Rimma Ziskine has sole voting and investment control

with respect to the shares offered by RZ Consulting.

(12) shares issued to consultant in exchange for public

relations services.

(13) Mary Chung has sole voting and investment control

with respect to the shares offered by Smash Street Media, LLC.

(14) shares issued to consultant in exchange for business

development and marketing services in April 2015.

(15) Jack Brewer has sole voting and investment control

with respect to the shares offered by The Brewer Group.

(16) In March and July 2013, the Company sold in reliance

through an exemption under Section 4(2) of the Securities Act, 250,000 shares of common stock at a price per share of $0.10 for

an aggregate offering price of $25,000.

(17) shares issued to consultant in exchange for marketing

and sales advisory services in March and June, 2012.

(18) served as a member of the Board of Directors within

the past three years.

(19) Based upon the total outstanding shares of 21,639,240

as of April 30, 2015. For purposes of computing the percentage of outstanding shares of our common stock held by each group of

persons named above, any shares that such person or persons has the right to require within 60 days is deemed to be outstanding

but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

Except as otherwise defined above, none of the selling shareholders

or their beneficial owners:

| - |

has had a material relationship with us other than as a shareholder at any time within the

past three years; or |

| - |

has ever been one of our officers or directors or an officer or director of our predecessors

or affiliates. |

| - |

are broker-dealers or affiliated with broker-dealers. |

There are no agreements between the Company and any selling shareholder

pursuant to which the shares subject to this registration statement were issued.

PLAN

OF DISTRIBUTION

Each selling stockholder of the shares and any of their pledgees,

assignees and successors-in-interest may, from time to time, sell any or all of their shares covered hereby on the OTC or any

other stock exchange, market or trading facility on which our common stock is traded or in private transactions. These sales may

be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling shares:

| |

· |

ordinary brokerage transactions and

transactions in which the broker-dealer solicits purchasers; |

| |

· |

block trades in which the broker-dealer will attempt

to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

· |

purchases by a broker-dealer as principal and

resale by the broker-dealer for its account; |

| |

· |

an exchange distribution in accordance with the

rules of the applicable exchange; |

| |

· |

privately negotiated transactions; |

| |

· |

settlement of short sales entered into after the

effective date of the registration statement of which this prospectus is a part; |

| |

· |

in transactions through broker-dealers that agree

with the selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| |

· |

through the writing or settlement of options or other hedging transactions,

whether through an options exchange or otherwise; |

| |

· |

a combination of any such methods of sale; or |

| |

· |

any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares

under Rule 144 under the Securities Act of 1933, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated,

but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance

with FINRA IM-2440.

In connection with the sale of the shares

or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the shares in the course of hedging the positions they assume. The selling stockholders

may also sell shares short and deliver these shares to close out their short positions, or loan or pledge the shares to broker-dealers

that in turn may sell these shares. The selling stockholders may also enter into option or other transactions with broker-dealers

or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or

other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

DESCRIPTION OF SECURITIES

Authorized Capital Stock

Our authorized share capital consists of 300,000,000

shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.01 per share. As of

April 30, 2015, an aggregate of 21,639,240 shares of common stock and no shares of preferred stock were issued and outstanding.

Common Stock

All outstanding shares of common stock are

of the same class and have equal rights and attributes. The holders of common stock are entitled to one vote per share on all

matters submitted to a vote of stockholders of the Company. All stockholders are entitled to share equally in dividends, if any,

as may be declared from time to time by the Board of Directors out of funds legally available. In the event of liquidation, the

holders of common stock are entitled to share ratably in all assets remaining after payment of all liabilities. The stockholders

do not have cumulative or preemptive rights.

Preferred Stock

Our Articles of Incorporation authorizes the

issuance of up to 5,000,000 shares of blank check preferred stock with designations, rights and preferences determined from time

to time by its Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue preferred

stock with dividend, liquidation, conversion, voting, or other rights which could adversely affect the voting power or other rights

of the holders of the common stock. In the event of issuance, the preferred stock could be utilized, under certain circumstances,

as a method of discouraging, delaying or preventing a change in control of the Company.

Dividends

We have not paid any cash dividends to our

shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our

earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions.

It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any,

in our business operations.

Warrants

There are no outstanding warrants to purchase

our securities

Options

On October 15, 2013, the Board of Directors

and majority of the shareholders of the Company approved an equity incentive plan (the “2013 Plan”) covering 7,500,000

shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”). The purpose of the 2013

Plan is to enable Powerstorm to offer to its employees, officers, directors and consultants, whose past, present and/or potential

contributions to the Company have been, are or will be important to our success, an opportunity to acquire a proprietary interest

in the Company. As of December 31, 2014, 1,690,616 options had been issued under this plan.

Transfer Agent and Registrar

We have engaged with VStock Transfer, LLC as our transfer agent.

INTERESTS OF NAMED EXPERTS

AND COUNSEL

No expert or counsel named in this prospectus

as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being

registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency

basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant

or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries

as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Szaferman Lakind Blumstein & Blader P.C.

located at 101 Grover Mill Road, Suite 200, Lawrenceville, NJ 08648 will pass on the validity of the common stock being offered

pursuant to this registration statement.

The financial statements for the years ended

December 31, 2014 and 2013 included in this prospectus and the Registration Statement have been audited by GBH CPAs, PC, an independent

registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and

in the Registration Statement, and are included in reliance upon such report given upon the authority of said firm as experts

in auditing and accounting.

DISCRIPTION OF BUSINESS

Corporate History and Background

Powerstorm Capital Corp. was formed on October

11, 2011 in the state of Delaware. On February 25, 2015, Powerstorm Capital Corp. filed a Certificate of Amendment to the Certificate

of Incorporation changing its name to Powerstorm Holdings, Inc. (“we”, “Powerstorm” or the “Company”)

d/b/a Powerstorm ESS. The Company is a manufacturer of hybrid energy storage systems that provides reliable off-grid solutions

to: a) service providers such as telecom tower operators, managed network operators (MNOs), data centers, mining companies, hospitals,

b) rural communities and, c) the residential/home use and disaster recovery market.

Powerstorm is a fairly new company, and to

date, our growth efforts have been focused primarily on refinement of our business model, finalizing the design and development

of two initial energy storage products, filing patents, preparing for a full market launch, hiring key personnel, and preparing

to raise expansion capital. The management team has identified its target markets and its target customers, however the Company

does not currently have any written or oral commitments to provide products or services to customers. In addition, our sources

of cash are not adequate for the next 12 months of operations. If we are unable to raise additional cash, we may either have to

suspend or cease our expansion plans.

Our Business

Powerstorm intends to serve the strong, growing

demand for off-grid, Micro Grid energy storage systems worldwide, and in particular in emerging markets, while helping bring power

to the 1.3 billion people living in energy poverty with virtually no connection to the rest of the world. We are focused on developing

and delivering innovative, power agnostic, best-in-class, green, turnkey power management and energy storage solutions such as

our Modular Energy Storage Solution (“MESS”), and our residential solution, “zeroXess.”

MESS is a containerized and optimized hybrid

energy solution that can provide renewable and reliable off-grid power. The MESS container has a diesel generator/alternator combined

with our Lithium Ion battery-based system and powered by Solar and/or Wind Turbines. The MESS unit is equipped with our patent

pending remote monitoring system, the “digital brain” that incorporates and covers the BMS, TMS and NMS. The MESS

is plug-and-play and can be operational within a single day when set up and tested by technicians.

The MESS is designed to support rural communities

and service providers such as telecom tower operators, data centers, mines and hospitals, each serving as anchor points for our

entrance into the surrounding communities. Our customers will experience reduced dependence on increasingly expensive diesel fuel,

reduced OPEX and CAPEX, reduced energy cost, longer system life, ease of expansion, upgrade and scalability, and overall stable

and reliable energy flow.

A single MESS unit is capable of powering

an entire rural community with green alternative energy, allowing for comprehensive ancillary augmentations that will expand into

clean water, healthcare, Internet access, and other benefits. Given that our MESS units are plug and play and operational within