FALSE000093993000009399302024-06-122024-06-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 12, 2024

Pyxus International, Inc.

(Exact name of Registrant, as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Virginia | | 000-25734 | | 85-2386250 |

(State or other jurisdiction

of incorporation) | | (Commission file number) | | (I.R.S. Employer

Identification No.) |

|

6001 Hospitality Court, Suite 100

Morrisville, North Carolina 27560-2009

(Address of principal executive offices, including zip code)

(919) 379-4300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Item 5.02 | | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On June 12, 2024, the Board of Directors of Pyxus International, Inc. (the “Company”) adopted the Pyxus International, Inc. Executive Severance Plan (the “Executive Severance Plan”) to provide increased certainty for the covered executive officers and the Company in the event of a severance. The Executive Severance Plan is expected to assist the Company with the retention and recruitment of key executives, provide the Company with important protections, and reduce costs in the event of a dispute. The Executive Severance Plan applies to the Company’s Chief Executive Officer and its other executive officers (the “Covered Officers”). The Executive Severance Plan provides that severance benefits payable to a Covered Officer under the Executive Severance Plan will be in lieu of and not in addition to any severance benefits to which the Covered Officer would otherwise be entitled under any general severance policy or severance plan maintained by the Company or any agreement between the Covered Officer and the Company that provides for severance benefits (unless the policy, plan, or agreement expressly provides for severance benefits to be in addition to those provided under the Executive Severance Plan) and any severance benefits payable to a Covered Officer under the Executive Severance Plan will be reduced by any severance benefits to which the Covered Officer is entitled by operation of a statute or government regulations.

The Executive Severance Plan provides that, in the event the employment of a Covered Officer is terminated by the Company without “Cause” or by a Covered Officer with “Good Reason” (as each such term is defined in the Executive Severance Plan), the Covered Officer would be entitled to receive:

•the sum of one and one-half year’s (two year’s for the Chief Executive Officer) base salary at the Covered Officer’s regular salary rate and the annual bonus that would have been payable to the Covered Officer under the Company’s annual bonus plan for the fiscal year in which such termination of employment occurs based on achievement of financial and other goals at “target” levels (provided that if such termination of employment occurs within 12 months after a “Change in Control” (as defined in the Executive Severance Plan) such amount would be two times such annual bonus for the Chief Executive Officer and one and one-half times such annual bonus for the other Covered Officers), which total amount will be paid in substantially equal installments over one and one-half years (two years for the Chief Executive Officer) following such termination of employment, payable in accordance with the Company’s normal payroll practices, and

•the annual bonus under the Company’s annual bonus plan for the fiscal year in which such termination of employment occurs based on actual achievement of financial and other goals, prorated for the number of days in the fiscal year that the Covered Officer was employed by the Company, which annual bonus amount is to be paid on the date that annual bonuses are paid to the Company’s senior executives generally, but in no event later than the later of two and one-half months following the end of the fiscal year in which such termination of employment occurs or two and one-half months following the end of the calendar year in which such termination of employment occurs.

The Executive Severance Plan provides for the reduction of the foregoing payments in connection with the application of Internal Revenue Code Section 280G if such a reduction would enable the Covered Officer to benefit financially on an after-tax basis.

The receipt by a Covered Officer of any payment or other benefit under the Executive Severance Plan is conditioned upon the Covered Officer executing a severance agreement, including a release of claims in favor of the Company, its affiliates and their respective officers and directors and non-solicitation, non-disparagement, confidentiality and further cooperation provisions, in a form reasonably satisfactory to the Company, and such severance agreement becoming effective and irrevocable within 60 days following the Covered Officer’s termination of employment. The Executive Severance Plan also provides that all benefits of a Covered Officer under the Executive Severance Plan are subject to any policy established by the Company providing for clawback or recovery of amounts paid to such Covered Officer. The Executive Severance Plan

provides that it may be amended, modified or terminated at any time by the Company upon action by its Board of Directors.

The foregoing description of the Executive Severance Plan is qualified in its entirety by reference to the text of the Executive Severance Plan, which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 10.1 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 14, 2024

| | | | | | | | |

| | |

| PYXUS INTERNATIONAL, INC. |

|

| By: | | /s/ William L. O’Quinn, Jr. |

| | |

| | William L. O’Quinn, Jr. |

| | Senior Vice President – Chief Legal |

| | Officer and Secretary |

Pyxus International, Inc.

Executive Severance Plan

1.Purpose. This Pyxus International, Inc. Executive Severance Plan has been established by Pyxus International, Inc. to provide Participants with the opportunity to receive severance benefits in the event of certain terminations of employment. The purpose of the Plan is to attract and retain qualified executives. Capitalized terms used but not otherwise defined herein have the meanings set forth in Section 2.

2.Definitions.

2.1.“Administrator” means the Compensation Committee; provided, however, that with respect to any matter related to participation in the Plan by the Chief Executive Officer of the Company, “Administrator” will mean the Board.

2.2.“Board” means the Board of Directors of the Company.

2.3.“Cause” means the Participant’s (A) material violation of an employment or other agreement between the Participant and the Company; (B) conviction of or entry of a plea of nolo contendere to (1) a felony or (2) a misdemeanor involving moral turpitude; (C) substance abuse that the Company determines in good faith adversely affects the Participant’s ability to perform the Participant’s duties; (D) engagement in conduct that constitutes gross neglect or gross misconduct in carrying out the Participant’s duties, resulting in material harm to the financial condition or reputation of the Company; (E) engagement in any act of dishonesty or theft, fraud, embezzlement, or unauthorized use of the property of the Company; (F) usurpation or diversion of any business opportunity of the Company for the Participant’s personal benefit; (G) refusal to comply with lawful directives of the Company’s Chief Executive Officer, or Board of Directors; (H) violation of the Company’s rules, policies or procedures in any material respect, or other demonstration of unacceptable or disruptive behavior that the Company determines in good faith adversely affects the Participant’s ability to perform the Participant’s duties or results in material harm to the financial condition or reputation of the Company; or (I) failure to perform the Participant’s duties in a satisfactory manner, as determined by the Company in good faith, provided, however, that the Company will first have given the Participant written notice setting forth in reasonable detail the specific conduct that has been determined not to have been performed in a satisfactory manner and a 30 day period for the Participant to substantially correct such conduct, if it can be corrected.

2.4.“Change in Control” means the occurrence of any of the following after the Effective Date:

(a)one person (or more than one person acting as a group) other than (i) Glendon Capital Management LP, a Delaware limited partnership, and on any entities that, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with Glendon Capital Management LP, including funds/entities managed, advised or sub-advised by the same Investment Manager of Glendon Capital Management LP or (ii) Monarch Alternative Capital LP, a Delaware limited partnership, and on any entities that, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with Monarch Alternative Capital LP, including funds/entities managed, advised or sub-advised by the same Investment Manager of Monarch Alternative Capital LP, acquires ownership of interests in the Company that, together with the ownership interests held by such person or group, constitutes more than 50% of the total fair market value or total voting power of the ownership interests of the Company; provided that, a Change in Control will not occur if any person (or more than one

person acting as a group) owns more than 50% of the total fair market value or total voting power of the ownership interests of the Company and acquires additional ownership interests; or

(b)the Company consummates a plan of merger, consolidation or share exchange between the Company and an entity other than a direct or indirect wholly-owned subsidiary of the Company, unless the Company shareholders immediately before the completion of such transaction will continue to hold at least 50% of the aggregate voting power of all classes of voting securities of the surviving or resulting entity;

(c)the Company consummates a sale, lease, exchange or other disposition of all, or substantially all, of the Company’s property, unless the Company shareholders immediately before the completion of such transaction will continue to hold, directly or indirectly, at least 50% of the aggregate voting power of all classes of voting securities of the transferee.

Notwithstanding the foregoing, a Change in Control will not occur unless such transaction constitutes a change in the ownership of the Company, a change in effective control of the Company, or a change in the ownership of a substantial portion of the Company’s assets under Section 409A of the Code.

2.5.“Code” means the Internal Revenue Code of 1986, as amended. Any reference to a section of the Code will be deemed to include a reference to any regulations promulgated thereunder.

2.6.“Company” means Pyxus International, Inc.

2.7.“Compensation Committee” means the Compensation Committee of the Board.

2.8.“Effective Date” means June 12, 2024.

2.9.“Eligible Executive” means any employee of the Company or of any of its subsidiaries who is an executive officer of the Company under the Exchange Act, as designated from time to time by the Board. Eligible Executives will be limited to a select group of management or highly compensated employees within the meaning of Sections 201, 301, and 404 of ERISA.

2.10.“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

2.11.“Exchange Act” means the Securities Exchange Act of 1934, as amended.

2.12.“Fiscal Year” means a fiscal year of the Company, which ends on March 31.

2.13.“Good Reason” means (i) the Participant resigns because (A) the Company substantially changes the Participant’s responsibilities and duties; (B) the Company relocates the Participant’s principal office to a location that is more than 50 miles from the Participant’s existing principal office; (C) the Company has failed to perform any material obligation under, or has breached any material provision of, an employment or other agreement between the Participant and the Company; or (D) the Company materially reduces the Participant’s compensation, unless the reduction is part of an across-the-board compensation reduction for the Company’s senior management; and (ii) the Participant provides written notice of resignation to the Company within 30 days after such circumstances arise. Resignation from employment by the Participant for Good Reason will be effective only after 30 days advance written notice to the Copmany setting forth in reasonable detail the specific conduct of the Company that the Participant asserts constitutes Good Reason and the actual termination of employment occurs no later than 90 days after the initial existence of the conduct that the Participant asserts constitutes Good Reason. Further, a termination of employment by the Participant for Good Reason will not be effective or deemed to be for Good Reason if the

Company substantially corrects the circumstance(s) identified in the written notice within 30 days after receipt of the notice. A Participant will not have Good Reason to terminate the Participant’s employment with the Company should the Participant be offered substantially equivalent continued employment with any successor entity, subsidiary, affiliated company, or other entity that agrees to assume the Company’s obligations under this Plan.

2.14.“Participant” has the meaning set forth in Section 3.

2.15.“Participation Agreement” means the latest participation agreement delivered by the Company to a Participant informing the Eligible Executive of the Eligible Executive’s participation in the Plan.

2.16.“Plan” means this Pyxus International, Inc. Executive Severance Plan, as it may be amended and/or restated from time to time.

2.17.“Pro-Rata Bonus” means the amount determined for a Participant under Section 4.1(b).

2.18.“Qualifying Termination” means the termination of a Participant’s employment either (a) by the Company without Cause; or (b) by the Participant for Good Reason; in each case, other than a termination of employment for which the Participant is entitled to receive severance benefits under the Participant’s Executive Change in Control Severance Agreement (if any).

2.19.“Severance” means the amount determined for a Participant under Section 4.1(a).

2.20.“Severance Agreement” has the meaning set forth in Section 5.3.

2.21.“Severance Multiplier” means:

(a) two for a Participant who is the Chief Executive Officer of the Company; and

(b) one and one-half for any Participant who is not the Chief Executive Officer of the Company.

2.22.“Specified Employee Payment Date” has the meaning set forth in Section 9.13(b).

3.Participation. Each Eligible Executive of the Company who (a) is chosen by the Administrator to participate in the Plan; (b) receives a Participation Agreement from the Company; and (c) executes and returns such Participation Agreement to the Company in accordance with the terms of the Participation Agreement will be a “Participant” in the Plan.

4.Severance.

4.1.Severance. If a Participant experiences a Qualifying Termination, then, subject to Section 5, the Company will provide the Participant with the following:

(a)Severance in an amount equal to the sum of:

(i)the Participant’s annual base salary rate in effect immediately prior to the date of the Qualifying Termination times the Participant’s Severance Multiplier, and

(ii)the Participant’s target annual cash bonus for the Fiscal Year in which the Qualifying Termination occurs, or if the Participant’s Qualifying Termination occurs within 12 months following a Change of Control, the Participant’s target annual cash bonus for the Fiscal Year in which the Qualifying Termination occurs times the Participant’s Severance Multiplier.

Subject to Section 8.12, Severance will be paid in substantially equal installments over a period of time following the Qualifying Termination equal to the Participant’s Severance Multiplier times one year, payable in accordance with the Company’s normal payroll practices, but no less frequently than monthly, which payments in the aggregate are equal to the Severance and which will begin on the 61st day following the Qualifying Termination.

(b)A prorated annual bonus equal to the product of (i) the annual bonus, if any, that the Participant would have earned for the full Fiscal Year in which the Qualifying Termination occurs based on the level of achievement of the applicable performance goals for such Fiscal Year; and (ii) a fraction, the numerator of which is the number of days the Participant was employed by the Company during the Fiscal Year in which the Qualifying Termination occurs and the denominator of which is the number of days in such Fiscal Year.

Subject to Section 8.12, a Participant’s Pro-Rata Bonus will be paid on the date that annual bonuses are paid to the Company’s senior executives, but in no event later than the later of: (i) 2 ½ months following the end of the Fiscal Year in which the Qualifying Termination occurs, or (ii) 2 ½ months following the end of the calendar year in which the Qualifying Termination occurs.

5.Conditions. A Participant’s entitlement to any severance benefits under Section 4 will be subject to:

5.1.the Participant executing and delivering to the Company their Participation Agreement in accordance with the terms thereof;

5.2.the Participant experiencing a Qualifying Termination; and

5.3.the Participant executing a severance agreement (the “Severance Agreement”) to the reasonable satisfaction of the Company and such Severance Agreement becoming effective and irrevocable within 60 days following the Participant’s Qualifying Termination. Any such Severance Agreement will include, without limitation, (i) a release of claims in favor of the Company, its affiliates and their respective officers and directors; and (ii) non-solicitation, non-disparagement, confidentiality and further cooperation provisions.

6.Claims Procedure.

6.1.Initial Claims. A Participant who believes that they are entitled to a payment under the Plan that has not been received may submit a written claim for benefits to the Plan within 60 days after the Participant’s Qualifying Termination. Claims should be addressed and sent to:

Pyxus International, Inc.

c/o Chief Human Resources Officer

re: Claims – Executive Severance Plan

6001 Hospitality Court, Suite 100

Morrisville, NC 27560

If the Participant’s claim is denied, in whole or in part, the Participant will be furnished with written notice of the denial within 90 days after the Administrator’s receipt of the Participant’s written claim, unless special circumstances require an extension of time for processing the claim, in which case a period not to exceed 180 days will apply. If such an extension of time is required, written notice of the extension will be furnished to the Participant before the termination of the initial 90-day period and will describe the special circumstances requiring the extension, and the date on which a decision is expected to be rendered. Written notice of the denial of the Participant’s claim will contain the specific reason or reasons for the denial of the Participant’s claim; references to the specific Plan provisions on which the denial of the Participant’s claim was

based; a description of any additional information or material required by the Administrator to reconsider the Participant’s claim (to the extent applicable) and an explanation of why such material or information is necessary; and a description of the Plan’s review procedures and time limits applicable to such procedures, including a statement of the Participant’s right to bring a civil action under Section 502(a) of ERISA following a benefit claim denial on review.

6.2.Appeal of Denied Claims. If the Participant’s claim is denied and they wish to submit a request for a review of the denied claim, the Participant or their authorized representative must follow the procedures described below:

(a)Upon receipt of the denied claim, the Participant (or their authorized representative) may file a request for review of the claim in writing with the Administrator. This request for review must be filed no later than 60 days after the Participant has received written notification of the denial.

(b)The Participant has the right to submit in writing to the Administrator any comments, documents, records or other information relating to their claim for benefits.

(c)The Participant has the right to be provided with, upon request and free of charge, reasonable access to and copies of all pertinent documents, records and other information that is relevant to their claim for benefits.

(d)The review of the denied claim will take into account all comments, documents, records and other information that the Participant submitted relating to their claim, without regard to whether such information was submitted or considered in the initial denial of their claim.

6.3.Administrator’s Response to Appeal. The Administrator will provide the Participant with written notice of its decision within 60 days after the Administrator’s receipt of the Participant’s written claim for review. There may be special circumstances which require an extension of this 60-day period. In any such case, the Administrator will notify the Participant in writing within the 60-day period and the final decision will be made no later than 120 days after the Administrator’s receipt of the Participant’s written claim for review. The Administrator’s decision on the Participant’s claim for review will be communicated to the Participant in writing and will clearly state the specific reason or reasons for the denial of the Participant’s claim; reference to the specific Plan provisions on which the denial of the Participant’s claim is based; a statement that the Participant is entitled to receive, upon request and free of charge, reasonable access to, and copies of, the Plan and all documents, records, and other information relevant to their claim for benefits; and a statement describing the Participant’s right to bring an action under Section 502(a) of ERISA.

6.4.Exhaustion of Administrative Remedies. The exhaustion of these claims procedures is mandatory for resolving every claim and dispute arising under the Plan. As to such claims and disputes, no claimant will be permitted to commence any legal action to recover benefits or to enforce or clarify rights under the Plan under Section 502 or Section 510 of ERISA or under any other provision of law, whether or not statutory, until these claims procedures have been exhausted in their entirety; and in any such legal action, all explicit and implicit determinations by the Administrator (including, but not limited to, determinations as to whether the claim, or a request for a review of a denied claim, was timely filed) will be afforded the maximum deference permitted by law.

7.Administration, Amendment, and Termination.

7.1.Administration. The Administrator has the exclusive right, power and authority, in its sole and absolute discretion, to administer and interpret the Plan. The Administrator has all powers reasonably necessary to carry out its responsibilities under the Plan including (but not limited to)

the sole and absolute discretionary authority to: administer the Plan according to its terms and to interpret Plan provisions; resolve and clarify inconsistencies, ambiguities, and omissions in the Plan and among and between the Plan and other related documents; take all actions and make all decisions regarding questions of eligibility and entitlement to benefits, and benefit amounts; make, amend, interpret, and enforce all appropriate rules and regulations for the administration of the Plan; process and approve or deny all claims for benefits; and decide or resolve any and all questions, including benefit entitlement determinations and interpretations of the Plan, as may arise in connection with the Plan.

The decision of the Administrator on any disputes arising under the Plan, including (but not limited to) questions of construction, interpretation and administration will be final, conclusive and binding on all persons having an interest in or under the Plan. Any determination made by the Administrator will be given deference in the event the determination is subject to judicial review and will be overturned by a court of law only if it is arbitrary and capricious.

7.2.Amendment and Termination. Except as set forth in this Section 7.2, the Company, through its Board of Directors, reserves the right, in its sole and absolute discretion, to amend, modify, or terminate the Plan, in whole or in part, at any time or for any reason. Notwithstanding the foregoing, if a Change in Control occurs (i) no amendment or termination may, during the 12-month period following the Change in Control, adversely affect any benefits payable or otherwise made available under the Plan to an individual who is a Participant on the date of the Change in Control; and (ii) no amendment or termination during the 12-month period preceding the Change in Control may adversely affect any benefits payable or otherwise made available under the Plan to a Participant who incurs a Qualifying Termination after such amendment or termination and prior to the Change in Control; in each case, unless the affected Participant provides written consent.

8.Miscellaneous.

8.1.At-Will Employment. The Plan does not alter the status of each Participant as an at-will employee of the Company. Nothing contained herein will be deemed to give any Participant the right to remain employed by the Company or to interfere with the rights of the Company to terminate the employment of any Participant at any time, with or without Cause.

8.2.Effect on Other Plans, Agreements, and Benefits.

(a)Any severance benefits payable to a Participant under the Plan will be: (i) in lieu of and not in addition to any severance benefits to which the Participant would otherwise be entitled under any general severance policy or severance plan maintained by the Company or any agreement between the Participant and the Company that provides for severance benefits (unless the policy, plan, or agreement expressly provides for severance benefits to be in addition to those provided under the Plan); and (ii) any severance benefits payable to a Participant under the Plan will be reduced by any severance benefits to which the Participant is entitled by operation of a statute or government regulations.

(b)Any severance benefits payable to a Participant under the Plan will not be counted as compensation for purposes of determining benefits under any other benefit policies or plans of the Company, except to the extent expressly provided therein.

8.3.Mitigation and Offset. If a Participant obtains other employment after a Qualifying Termination, such other employment will not affect the Participant’s rights or the Company’s obligations under the Plan. The Company may reduce the amount of any severance benefits otherwise payable to or on behalf of a Participant by the amount of any obligation of the Participant to the Company, and the Participant will be deemed to have consented to such reduction.

8.4.Severability. The invalidity or unenforceability of any provision of the Plan will not affect the validity or enforceability of any other provision of the Plan. If any provision of the Plan is held by a court of competent jurisdiction to be illegal, invalid, void or unenforceable, such provision will be deemed modified, amended and narrowed to the extent necessary to render such provision legal, valid, and enforceable, and the other remaining provisions of the Plan will not be affected but will remain in full force and effect.

8.5.Unfunded Obligations. The amounts to be paid to Participants under the Plan are unfunded obligations of the Company. The Company is not required to segregate any monies or other assets from its general funds with respect to these obligations. Participants will not have any preference or security interest in any assets of the Company other than as a general unsecured creditor.

8.6.Successors. The Plan will be binding upon any successor to the Company, its assets, its businesses or its interest, in the same manner and to the same extent that the Company would be obligated under the Plan if no succession had taken place. In the case of any transaction in which a successor would not by the foregoing provision or by operation of law be bound by the Plan, the Company will require any successor to the Company to expressly and unconditionally assume the Plan in writing and honor the obligations of the Company hereunder, in the same manner and to the same extent that the Company would be required to perform if no succession had taken place. All payments and benefits that become due to a Participant under the Plan will inure to the benefit of his or her heirs, assigns, designees, or legal representatives.

8.7.Transfer and Assignment. Neither a Participant nor any other person will have any right to sell, assign, transfer, pledge, anticipate or otherwise encumber, transfer, hypothecate or convey any amounts payable under the Plan prior to the date that such amounts are paid, except that, in the case of a Participant’s death, such amounts will be paid to the Participant’s beneficiaries.

8.8.Waiver. Any party’s failure to enforce any provision or provisions of the Plan will not in any way be construed as a waiver of any such provision or provisions, nor prevent any party from thereafter enforcing each and every other provision of the Plan.

8.9.Governing Law. To the extent not pre-empted by federal law, the Plan will be construed in accordance with and governed by the laws of the State of North Carolina without regard to conflicts of law principles. Any action or proceeding to enforce the provisions of the Plan will be brought only in a state or federal court located in the state of North Carolina, and each party consents to the venue and jurisdiction of such court. The parties hereby irrevocably submit to the exclusive jurisdiction of such courts and waive the defense of inconvenient forum to the maintenance of any such action or proceeding in such venue.

8.10.Clawback. Any amounts payable under the Plan are subject to any policy (whether in existence as of the Effective Date or later adopted) established by the Company providing for clawback or recovery of amounts that were paid to the Participant. The Company will make any determination for clawback or recovery in its sole discretion and in accordance with any applicable law or regulation.

8.11.Withholding. The Company will have the right to withhold from any amount payable hereunder any Federal, state, and local taxes in order for the Company to satisfy any withholding tax obligation it may have under any applicable law or regulation.

8.12.Section 409A.

(a)The Plan is intended to comply with or be exempt from Section 409A of the Code (“Section 409A”) and will be construed and administered accordingly. Any payments under the Plan that may be excluded from Section 409A will be so excluded to the maximum extent possible. Each installment payment provided under the Plan will be treated as a separate

payment. Any payments to be made under the Plan upon a termination of employment will only be made upon a “separation from service” under Section 409A. Notwithstanding the foregoing, the Company makes no representation that payments under the Plan comply with Section 409A and in no event will the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by a Participant on account of non-compliance with Section 409A.

(b)If any payment to a Participant under the Plan is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and the Participant is determined to be a “specified employee” under Section 409A, then such payment will not be paid until the first payroll date to occur following the six-month anniversary of the Qualifying Termination or, if earlier, on the Participant’s death (the “Specified Employee Payment Date”). The aggregate of any payments that would otherwise have been paid before the Specified Employee Payment Date will be paid to the Participant in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments will be paid without delay in accordance with their original schedule.

8.13.Section 280G. If any of the payments received or to be received by a Participant (including, without limitation, any payment or benefits received in connection with a change in control or the Participant’s termination of employment, whether pursuant to the terms of this Plan or any other plan, arrangement or agreement, or otherwise) (all such payments collectively referred to herein as the “280G Payments”) constitute “parachute payments” within the meaning of Section 280G of the Code and would, but for this Section 8.13 be subject to the excise tax imposed under Section 4999 of the Code (the “Excise Tax”), then prior to making the 280G Payments, a calculation will be made comparing (i) the Net Benefit (as defined below) to the Participant of the 280G Payments after payment of the Excise Tax to (ii) the Net Benefit to the Participant if the 280G Payments are limited to the extent necessary to avoid being subject to the Excise Tax. Only if the amount calculated under (i) above is less than the amount under (ii) above will the 280G Payments be reduced to the minimum extent necessary to ensure that no portion of the 280G Payments is subject to the Excise Tax. “Net Benefit” means the present value of the 280G Payments net of all federal, state, local, foreign income, employment, and excise taxes. Any reduction made pursuant to this Section 8.13 will be made in a manner determined by the Company that is consistent with the requirements of Section 409A.

IN WITNESS WHEREOF, the Company has executed this Plan as of the 12th day of June, 2024.

Pyxus International, Inc.

By: _/s/ Fernanda Goncalves________________

Printed Name: __ Fernanda Goncalves___________________

Title: _Senior Vice President, Chief Human Resources Officer

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

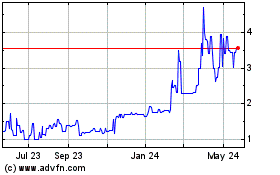

Pyxus (PK) (USOTC:PYYX)

Historical Stock Chart

From May 2024 to Jun 2024

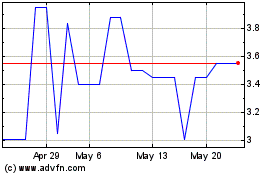

Pyxus (PK) (USOTC:PYYX)

Historical Stock Chart

From Jun 2023 to Jun 2024