UK House Prices Rise At Highest Monthly Rate For Almost 10 Yrs-Rightmove

20 February 2012 - 11:30AM

Dow Jones News

Asking prices for property in the U.K. rose at the sharpest pace

for almost 10 years in February, boosted by a pickup in confidence

and an increase in demand from first-time buyers seeking to take

advantage of the government's sales-tax holiday which ends next

month, a survey by Rightmove showed Monday.

According to Rightmove's latest index, which measures the price

at which a property is advertised for sale and not the achieved

price, house prices in mid-February rose 4.1% on the month and were

1.4% higher than a year earlier.

The monthly increase was the biggest rise since April 2002 and

compares with a 0.8% monthly decline and a 0.4% annual gain in

January.

"The biggest jump in new sellers' asking prices for nearly ten

years indicates there is pricing power if you are selling the right

type of property in the right place," said Rightmove director Miles

Shipside.

"There are also indications that those who are able to buy but

had previously lacked the confidence to take the plunge are of a

more positive mindset this year."

Rightmove also noted that the government's stamp-duty sales tax

holiday for first-time buyers purchasing a home costing less than

GBP250,000 comes to an end March 24, and there is an increasing

number of buyers seeking to take advantage of the tax break.

From March 25, first-time buyers will have to pay the government

1% of the cost of any property they purchase priced up to

GBP250,000.

House prices are expected to remain stable over the course of

this year, but monthly changes are often volatile, suggesting this

month's big rise isn't indicative of any sustainable house-price

increase.

While consumer confidence is showing signs of improvement, it

likely reflects the slower pace of inflation and cheaper energy

costs rather than any real expectations for a strong economic

performance this year.

The survey also shows that mortgage financing advertising has

increased in recent weeks, as has the availability of products

requiring only a 10% deposit--something which has been in scarce

supply since the beginning of the global credit crunch in 2007.

The details of the survey show that activity is increasing. The

length of time to sell a property fell to around 91 days by

mid-February from 100 in December.

Prices rose in all regions covered by the survey, the largest

was a 6.9% rise in south-east England, followed by a 5.6% increase

in northern England over the same period.

Rightmove measured 122,030 asking prices of properties put on

sale by estate agents between Jan. 8 and Feb. 11, which Rightmove

estimates represents approximately 90% of the total number of

residential property advertised for sale over that period.

Website: http://www.rightmove.co.uk

-By Ilona Billington, Dow Jones Newswires; +44 7 842 9452;

ilona.billington@dowjones.com

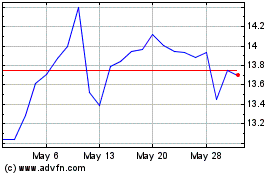

Rightmove (PK) (USOTC:RTMVY)

Historical Stock Chart

From Jan 2025 to Feb 2025

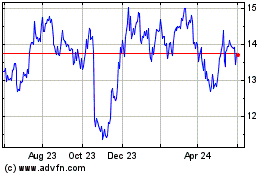

Rightmove (PK) (USOTC:RTMVY)

Historical Stock Chart

From Feb 2024 to Feb 2025