SocGen Posts Second Quarterly Loss in a Row on Soaring Provisions, Impairments -- Update

03 August 2020 - 4:59PM

Dow Jones News

--SocGen posted an unexpected quarterly loss amid soaring

bad-loan provisions and impairments related to its trading

operations

--The French bank swung to a net loss for the period of EUR1.26

billion

--The bank aims to cut costs at its trading operations by

roughly EUR450 million by 2022-23

By Pietro Lombardi

Societe Generale SA vowed to cut costs at its trading business

after the lender swung to an unexpected loss in the second quarter

as it set aside more money for potential loan losses and posted

writedowns related to its trading operations.

SocGen's provisions for soured loans increased more than

fourfold, mirroring a trend seen at other U.S. and European banks

bracing for the economic impact of the coronavirus pandemic.

France's third-largest listed bank by assets stowed away 1.28

billion euros ($1.51 billion) for provisions, up from EUR314

million a year earlier.

Results were also dragged by impairments related to its global

markets and investor services business, which includes fixed-income

and stock trading. The lender posted charges of around EUR1.33

billion, of which EUR684 million was goodwill impairment.

The bank said Monday that it will cut costs at its trading

operations by roughly EUR450 million by 2022-23, but that it wants

to keep a strong position in equity structured products. However,

the restructuring will hit revenue at the business, seen declining

by EUR200 million to EUR250 million.

The move comes after another difficult quarter for stock

trading, with equities revenue down 80%. Companies that canceled

dividend payments because of the coronavirus dealt a EUR200 million

blow at its structured product operations. "These activities saw a

gradual recovery from mid May," it said. The weak performance in

stock trading follows an even tougher first quarter, in which

equities revenue collapsed.

Like other peers, fixed-income revenue rose significantly in the

quarter, posting a 38% increase.

Net loss for the period was EUR1.26 billion compared with a

profit of EUR1.05 billion a year earlier, the French bank said.

Net banking income, the bank's top-line revenue figure, fell

almost 16% to EUR5.30 billion.

Analysts had forecast quarterly profit of EUR139 million on

revenue of EUR5.45 billion, according to a consensus forecast

provided by FactSet.

SocGen said it expects cost of risk for the year to be at the

bottom of its 70 basis points to 100 basis points guidance. Capital

is seen at the top of the 11.5%-12% range. The bank targets

underlying costs of about EUR16.5 billion for this year, down from

EUR17.4 billion last year.

"While April and May were heavily impacted by the reduction in

activity of numerous economies around the world, the rebound in

activities from mid-May is very encouraging," Chief Executive

Frederic Oudea said.

"The group is already working on new initiatives to build its

next strategic stage."

Write to Pietro Lombardi at pietro.lombardi@dowjones.com;

@pietrolombard10

(END) Dow Jones Newswires

August 03, 2020 02:44 ET (06:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

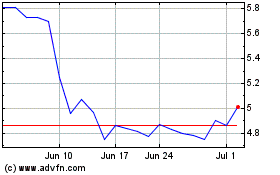

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

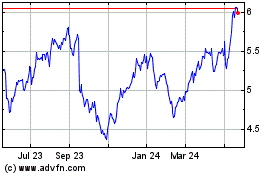

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Feb 2024 to Feb 2025