Banks Slashed 700 Frontline Jobs Last Year -- Financial News

05 March 2021 - 8:11PM

Dow Jones News

By Paul Clarke

Of Financial News

The world's largest investment banks cut 700 frontline jobs last

year, even as revenues in the industry surged to a 10-year high on

the back of a Covid-19 fuelled trading bonanza.

Equities trading units were again at the sharp end of job cuts

last year, according to research provider Coalition, as European

banks pushed ahead with strategic cuts despite the boost from the

coronavirus crisis.

Structured equity derivatives were the target of job cuts last

year, as French banks including Societe Generale SA and Natixis

posted deep losses in the first half of 2020 on the back of

companies shelving dividend payments in the early days of the

pandemic.

Equities is a low-margin business, and banks have continued to

question the viability of their business lines. Both SocGen and

Natixis cut equities jobs last year, while Deutsche Bank AG

shuttered its stock trading unit as part of a broader strategic

review. In 2021, HSBC Holdings PLC has also cut jobs within its

European equities business.

In total, 600 jobs were lost from the top 13 investment banks'

equities units last year.

Investment bank revenues were up by nearly 30% to $194.2

billion, the numbers show, the best performance in over a decade

for the industry, led by a surge in fixed-income, currencies and

commodities trading.

Fixed-income revenues reached $98.3 billion in 2020, driven by

sharp gains in commodities and rates trading. However, after a

record first half for the business unit that has been subject to

deep job cuts since the financial crisis, revenues slowed in the

final six months of the year, and were up by 41% for 2020.

While bank executives have played down a repeat of 2020 for

their trading divisions this year, some have said that 2021 has got

off to a flying start. JPMorgan chief financial officer, Jennifer

Piepszak, told a conference in February that its markets business

has had a "very strong start" and was up "meaningfully." Morgan

Stanley CFO Jonathan Pruzan, speaking at the same conference, said

that "the first six weeks of the year feel more like 2020 than they

do 2019".

Year on year, commodities units of investment banks were the

star performers in 2020, with revenues surging by 98%. Rates

trading units increased by 87%, according to Coalition, which

didn't give revenue numbers for the two divisions.

Traditional investment banking units were spared from any cuts

in 2020, with a reduction in M&A bankers offset by recruitment

within equity capital markets, Coalition said. Revenues in the

division were $49.4 billion, a 29% increase on 2019.

Website: www.fnlondon.com

(END) Dow Jones Newswires

March 05, 2021 03:56 ET (08:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

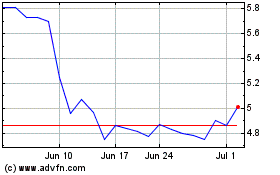

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

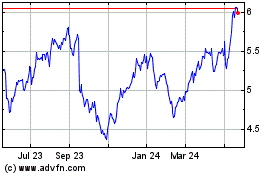

Societe Generale (PK) (USOTC:SCGLY)

Historical Stock Chart

From Feb 2024 to Feb 2025