Europe's Meat Retailers, Processors, Swallow Added Meat-Testing Costs

05 March 2013 - 6:22AM

Dow Jones News

Europe's food industry is adopting tougher measures to trace

meat throughout its complex supply chain, with retailers and

processors swallowing the extra costs of verification and testing

to woo back consumers angered by the presence of horsemeat in

products labeled as beef.

However, if the food industry manages to reduce the number of

links between farmer and consumer by cutting out processors that

can't give a clear account of their supply chain, that could create

more value for some producers, processors and retailers, said

agriculture-industry experts and academics.

Large U.K. supermarket chains learned in January that beef

burgers they were selling contained traces of horse and pig DNA.

Since then, shopping habits have changed throughout Europe. Sales

of frozen burgers in the U.K. plunged 43% on the year during the

four weeks ending Feb. 17, according to market researcher Kantar

Worldpanel.

"We expect in the long term a simplification of the food supply

chain, with retailers stepping up investment in procurement

divisions that deal directly with suppliers and reduce the number

of intermediaries involved," said Francisco Redruello, senior

research analyst at Euromonitor International.

Introducing product traceability and an assurance system

throughout the food chain could add around 5% to a product's cost,

said Justin Sherrard, a global strategist at Rabobank. However, the

additional costs, including of DNA testing, will fall more on food

processors and retailers than on final consumers.

Retailer Tesco PLC's (TSCO.LN, TSCDY) Chief Executive Philip

Clarke said the company will source more of its meat "closer to

home."

"Where changes are needed, we'll make sure they are made," Mr.

Clarke said. But he added, "Let me be clear that this doesn't mean

more expensive food."

Tesco is building a new website, to enable customers to see

progress being made in the company's DNA-testing program, and

showing which products have been tested, Mr. Clarke said.

Nestle SA (NESN.VX, NSRGY), which manufactures food products,

has also suspended deliveries of some finished products made using

beef.

"Despite our own strict controls, despite receiving certificates

and repeated guarantees from our suppliers, DNA tests have showed

that we have been supplied with beef that is mixed with horsemeat,"

said Nestle's corporate spokesperson Meike Schmidt. "There is no

food safety issue, but the mislabeling of products means they fail

to meet the very high standards consumers expect from us."

Nestle has carried out hundreds of analyses in an enhanced

testing program, which by late February had covered about 70% of

the company's beef or veal products manufactured in Europe, Ms.

Schmidt said.

The cost of improving the meat supply chain will be diluted for

large retailers such as Tesco or manufacturers such as Nestle

because meat products make up only a fraction of their brands,

Fitch Ratings said.

Meanwhile, a company with more integrated operations, for

instance Wm. Morrison Supermarkets PLC (MRW.LN, MRWSY), has been

unscathed by the scandal as the company has its own meat-processing

and manufacturing facilities in the U.K., Fitch said.

Morrisons said it is confident about its own supply chain for

fresh meat, most of which comes from U.K.-bred cattle slaughtered

by its own abattoirs, but added it has to rely on other suppliers

for products, such as ready meals. "We can't be complacent;

whenever you outsource, that builds a level of risk that we try and

mitigate," spokesman Julian Bailey said.

Write to Michael Haddon at michael.haddon@dowjones.com and Neena

Rai at neena.rai@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

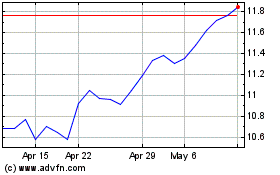

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Jun 2024 to Jul 2024

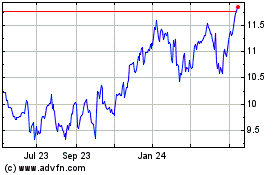

Tesco (PK) (USOTC:TSCDY)

Historical Stock Chart

From Jul 2023 to Jul 2024