Current Report Filing (8-k)

17 September 2013 - 4:09AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of report

(Date of earliest event reported): September 12, 2013

UMAX GROUP CORP.

--------------------------------------------------------------

(Exact name of

Registrant as specified in its charter)

Nevada

---------------------------------

(State or other

jurisdiction of incorporation)

333-174334

-------------------------------

(Commission File

Number)

99-0364796

-------------------------------------

(IRS Employer

Identification No.)

3923

West 6th Street Ste. 312

Los

Angeles, CA 90020

--------------------------------------------------

(Address of

principal executive offices)

(213) 381-6627

-----------------------------------------------------------------

(Registrant's

Telephone Number, Including Area Code)

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 3 - Securities and Trading

Markets

Item 3.02 Unregistered Sales of Equity Securities.

On or about, September 10, 2013, we sold a total of

100,000 shares of our restricted common stock pursuant to an exemption from

registration under Rule 506 and Rule 144, promulgated under Section 5 of the

Securities Act of 1933, as amended. The shares are “restricted securities” as

defined by Rule 144 of the Act, and cannot be negotiated in the market for a

period of one year after the Company is no longer defined as a “shell” under

Rule 12b-2 of the Securities Exchange Act of 1934, as amended. The offering

was made at a per share price of $2.00 per restricted share, representing an

investment into the Company of $200,000.00 by two non-affiliate accredited

investors. The share offering will not increase the issued and outstanding

shares of the Company as the offering is being offset by the return to treasury

of a like number of shares from a prior control person, thus, the offering will

not result in any additional free trading shares being introduced into the

float and no new shares will be added to our issued and outstanding share

total. We may extend our offering to an additional $800,000.00 under the same

terms and conditions as the present offering (400,000 restricted shares at

$2.00 per share). We undertook this offering as a direct private placement of

securities by the Company and we did not engage a placement agent and no

commissions or other fees are being paid in connection with the offering.

Thus, we will retain all of the proceeds of the offering for use in general

corporate purposes and in implementing our plan of operations.

Section 5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

On September 13, 2013, we entered into a term sheet

agreement for the engagement of a new Chief Executive Officer (CEO). The Board

of Directors has appointed Gerald Edick, of Corona Del Mar, California for a period

of six months, renewable for an additional six months, after which the plan is

to engage Mr. Edick permanently. The two terms are intended to provide review

periods for performance based terms and incentives in the Agreement. The

Agreement calls for monthly compensation along with equity and cash performance

incentives based upon attaining certain gross sales thresholds for our

products. We believe that this agreement gives the Company a very favorable

opportunity to utilize the skills and contacts of Mr. Edick, who has agreed to

incentive compensation hurdles as a major component of his employment

compensation. This agreement tells us Mr. Edick is serious about reaching

significant sales and revenues goals and that he is confident in his abilities

– because he has set in place review periods and performance triggers which

will prove his skills. Mr. Edick will take over the reigns as UMAX CEO on

September 15, 2013, when he will add his marketing and entrepreneurial

experience, along with his extensive business contacts, to our new UMAX plan of

operations.

Mr. Edick will be responsible for implementing UMAX’s marketing and

advertising campaigns, which include radio and internet based marketing

programs and will bring new celebrity product endorsements and promotional

campaigns to UMAX, as well as negotiate our rollout of new procurement and

distribution plans for the growing UMAX product line of nutritional and

enhancement supplements. In his career, Mr.

Edick has focused on product and brand development. Mr. Edick brings over Twenty

Five years’ experience in senior management, finance and brand development and

we are confident his experience with utilizing print, radio, infomercial, and

internet advertising and marketing will be a great benefit to UMAX. Mr. Edick

is the original creator of Genius products, and Baby Genius’ product line, a

household name for

new and expectant mothers, and we believe his prior experience in public company management and operations will be an invaluable addition to the Company. Mr. Edick is the added ingredient necessary for a powerful management and operations team, and we are proud to bring him onboard.

Our current executive and Director, Michelle Mercier, remains in her prior executive positions of Treasurer, President and Chief Financial Officer of Umax Group, Corp., and she remains our sole director until Mr. Edick is appointed to a directorship position.

Section 8 - Other Events

Item 8.01 Other Events.

As of September 13, 2013, under the auspices of new management, UMAX Group Corp., has successfully relocated its operations to the Los Angeles metropolitan area in southern California, for the purpose of implementing our nutritional supplement and enhancement products business. The relocation of the business required entering into a new lease agreement which was negotiated under standard terms and in the normal course of business.

We are currently negotiating to acquire certain business assets and trademarks, along with proprietary formulas, which we intend to utilize in our new operations. The Company does not intend to engage in or to undertake a reverse merger transaction and does not intend to acquire a going concern business. Rather, we have successfully changed our focus to our new business plan and have already commenced operations and received revenues therefrom.

Concurrent with our most recent quarterly periodic filing with the SEC for the fiscal period ending July 31, 2013, we have filed a change of address with the Securities and Exchange Commission which updated our corporate address and contact information and we have changed our Standard Industrial Classification Code (“SIC”) to reflect our nutritional supplement business operations. Our SEC file number has not changed and we will continue to operate under the name of UMAX Group, Corp., and we currently operate under the trade name (d/b/a) of UMAX Nutrition.

Our corporate website can be viewed at: www.umaxnutrition.com.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UMAX GROUP CORP.

By: /s/ Michelle Mercier

Name: Michelle Mercier

Title: President and Chief Financial Officer, Sole Director

Date: September 15, 2013

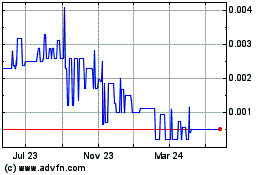

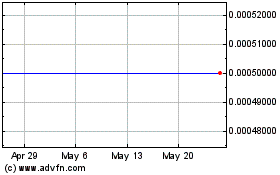

Umax (CE) (USOTC:UMAX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Umax (CE) (USOTC:UMAX)

Historical Stock Chart

From Feb 2024 to Feb 2025