0001770141false00017701412023-10-052023-10-050001770141us-gaap:CommonStockMember2023-10-052023-10-050001770141uph:RedeemableWarrantsMember2023-10-052023-10-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 5, 2023

Date of Report (date of earliest event reported)

UpHealth, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-38924 (Commission File Number) | 83-3838045 (I.R.S. Employer Identification Number) |

| | | | | | | | |

| 14000 S. Military Trail, Suite 203 | |

| Delray Beach, FL 33484 | |

| (Address of principal executive offices, including zip code) | |

| | |

(888) 424-3646 |

| (Registrant's telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | UPH | | New York Stock Exchange |

| Redeemable Warrants, exercisable for one share of Common Stock at an exercise price of $115.00 per share | | UPH.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Chief Executive Officer

On October 6, 2023, UpHealth, Inc. (the “Company”) notified Samuel J. Meckey that pursuant to a decision made by the Board of Directors (the “Board”) on October 5, 2023, his service as the Chief Executive Officer of the Company was terminated, effective immediately, and that he would cease to be an employee of the Company effect as of October 11, 2023. There are no changes to the severance that Mr. Meckey is entitled to receive upon his termination pursuant to his amended and restated employment agreement (the “Employment Agreement”), as previously disclosed by the Company. On October 5, 2023, the Board appointed Martin Beck, the Company’s Chief Financial Officer, to serve as the Chief Executive Officer of the Company effective upon the termination of Mr. Meckey as Chief Executive Officer. There are no changes to the terms and conditions of Mr. Beck’s employment as previously disclosed by the Company in connection with his role as Chief Executive Officer other than having assumed the position of Chief Executive Officer.

Mr. Beck, age 57, has served as our Chief Financial Officer since the closing of the business combinations that formed the Company in June 2021. Mr. Beck has served as a Managing Director at Sikich Corporate Finance, LLC since October 2018 and as the Founder and President of Rewi Enterprises, LLC, a private investment firm, since 2003. Mr. Beck served as a co-founder and Managing Director of MAT Capital, LLC from October 2009 to January 2016. Mr. Beck was a Director at Macquarie Capital Advisors from January 2007 to August 2009 where he focused on mergers and acquisitions and principal transactions. Before then, beginning in May 2000, Mr. Beck was an Executive Director at J.P. Morgan, where he specialized in mergers and acquisitions in the industrials sectors. Mr. Beck also served as Managing Director of Weichai Power Co. from October 2009 to May 2015, where he led International Corporate Development. Mr. Beck received a Master of Business Administration from New York University, a J.D. from Northwestern University School of Law, and a Bachelor of Arts in Economics from Princeton University.

Board of Directors

On October 9, 2023, Mr. Meckey informed the Board that, in accordance with the terms of his Amended and Restated Employment Agreement, he is resigning from his position as a Class I director of the Company, effective immediately. Mr. Meckey’s resignation from the Board did not result from any disagreements with the Company regarding any matter related to the Company’s operations, policies or practices.

Furthermore, on October 9, 2023, the Board appointed Mr. Beck, the Company’s new Chief Executive Officer, to serve as a Class I director. The appointment of Mr. Beck fills the vacancy created by Mr. Meckey’s resignation as a Class I director. As a Class I director, Mr. Beck’s term will expire at the Company’s annual meeting of stockholders in 2025, or until his successor is duly elected and qualified, or until his earlier resignation, removal or death.

Chief Financial Officer

On October 9, 2023, the Board determined that Mr. Beck would no longer serve as the Company’s Chief Financial Officer and appointed Jay Jennings, the Company’s Chief Accounting Officer (which role did not make Mr. Jennings the principal accounting officer of the Company as Mr. Beck has previously served as both the principal financial officer and the principal accounting officer), to replace Mr. Beck as the Chief Financial Officer of the Company, effective immediately, and assume the position of both the principal financial officer and the principal accounting officer of the Company.

Mr. Jennings, age 56, has served as our Chief Accounting Officer since the closing of the business combinations that formed the Company in June 2021. Mr. Jennings is a seasoned accounting and finance executive who served as an Audit Manager at Ernst & Young LLP from September 1989 until January 1996 and as Corporate Controller for MetaCreations Corporation from January 1996 until July 2000. For more than 17 years beginning in March 2001, Mr. Jennings held various roles with publicly traded eHealth, Inc., a leading health insurance marketplace, most recently serving as its SVP Finance and Principal Accounting Officer. In his role at eHealth, Mr. Jennings built a global finance team from five to 100 employees. He was responsible for accounting operations, revenue operations, SEC reporting, technical accounting, financial planning and analysis, business analytics, income taxes, treasury, and corporate insurance/risk management programs. Mr. Jennings also managed system implementations focused on driving automation, improved analytics, and cost-savings. He is a CPA and earned a BA in Economics/Accounting from Claremont McKenna College in 1989.

Mr. Jennings is not party to any employment agreement with the Company. Set forth below is a description of Mr. Jennings’ current compensation arrangement. There are no changes to the compensation which Mr. Jennings has been receiving as an employee of the

Company while serving as the Company’s Chief Accounting Officer in connection with his new role as Chief Financial Officer, unless and until the Board determines otherwise.

Mr. Jennings receives a base salary at an annual rate of $312,057, subject to increase from time to time as determined by the Board or the Compensation Committee, and will be eligible to receive an annual bonus of 35% of his base salary based on the Board’s determination, in good faith, as to whether applicable performance milestones have been achieved. The terms of Mr. Jennings’ employment provide for at will employment and the employment relationship may be terminated by either Mr. Jennings or the Company at any time and for any reason or no reason. Mr. Jennings will, in accordance with Company policy and the terms of the applicable plan documents, be eligible to participate in benefits under any executive benefit plan or arrangement which may be in effect from time to time and made available to the Company’s executives or key management employees, including unlimited paid time off subject to the terms and conditions of the Company’s PTO Policy.

The terms of Mr. Jennings’ employment with the Company provide that he is eligible to receive awards of restricted stock units (“RSUs”), pursuant to and subject to the terms of the Company’s 2021 Equity Incentive Plan (the “Plan”). In connection with Mr. Jennings’ employment with the Company, the Board previously approved, upon the recommendation of the Compensation Committee of the Board, the grant of RSUs to Mr. Jennings, pursuant to and subject to the terms of the Plan, in the total amount of 28,952 RSUs (as adjusted for the Company’s reverse stock split effected December 8, 2022), consisting of: (i) 25,452 RSUs awarded during the fiscal years 2021 and 2022 which are eligible to vest subject to Mr. Jennings’s continued provision of services to the Company (the “Time-Based RSUs”), and (ii) 3,500 RSUs awarded during the fiscal year 2022 which are eligible to vest subject to the attainment of certain performance-based metrics established by the Compensation Committee and Mr. Jennings’ continued services as specified by the Compensation Committee and set forth the applicable restricted stock unit agreement for the award (the “Performance-Based RSUs”).

Mr. Jennings will be eligible to earn performance bonuses in the aggregate target amount of $125,000 based on the Company’s performance during the 2023, 2024 and 2025 fiscal years (together, such fiscal years are the “Performance Period”). Mr. Jennings is eligible to earn a performance bonus with respect to each fiscal year in the Performance Period (each a “Revenue Bonus”). His target Revenue Bonus amount applicable to each fiscal year within the Performance Period is $41,666.67. The amount of Revenue Bonus eligible to be earned by Mr. Jennings for each fiscal year during the Performance Period will be determined based on the applicable level of revenue received by the Company during such fiscal year. The applicable percentage of his Revenue Bonus that is eligible to be earned for each fiscal year within the Performance Period will be determined by reference to the Company’s level of revenue received for the applicable fiscal year as measured against the target revenue performance levels for such fiscal year as determined by the Board; with 100% of the target Revenue Bonus for a fiscal year being paid in the event that the targeted level of revenue is achieved by the Company. There are additional target levels at which 85% of the target Revenue Bonus for a fiscal year will be paid in the event that a specified targeted level of revenue is achieved by the Company (the “threshold targeted level”), and up to 125% of the target Revenue Bonus for a fiscal year will be paid in the event that another specified targeted level of revenue is achieved by the Company (the “stretch targeted level”), and linear interpolation between these designated performance levels.

The threshold and stretch targeted levels of revenue for each fiscal year within the Performance Period are independent for each fiscal year (i.e., if the threshold targeted levels of revenue for a fiscal year is attained for such fiscal year and the interpolated targeted level of revenue for another fiscal year at the 110% of target Revenue Bonus level is attained for such other fiscal year, with respect to those fiscal years, the Revenue Bonus amounts eligible to be earned are $35,416.67 and $45,833.33, respectively). If the Company does not meet the targeted threshold level goal of revenue for an applicable fiscal year, Mr. Jennings is not eligible to earn or receive any Revenue Bonus with respect to such fiscal year. If the Company exceeds the stretch targeted level goal of revenue for an applicable fiscal year, the Revenue Bonus that Mr. Jennings is eligible to earn and receive for such fiscal year is 125% of the Revenue Bonus for such fiscal year (i.e., $52,083.33). Whether and to what extent the applicable targeted level of revenue for a fiscal year was attained for such fiscal year will be determined by the Board in a manner consistent with the amounts reported on the Company’s annual audited financial statements, and its determination will be final and binding on Mr. Jennings.

In all cases, Mr. Jennings’s eligibility to earn a Revenue Bonus for a fiscal year is subject to Mr. Jennings’s continued employment with the Company through the applicable date of payment of such Revenue Bonus. If a Revenue Bonus is eligible to be earned by Mr. Jennings for a fiscal year based on performance for such fiscal year, the applicable Revenue Bonus for such fiscal year will be paid to Mr. Jennings in the calendar year immediately following the fiscal year with respect to which the targeted levels of revenue were attained and no later than March 15 of the calendar year immediately following the fiscal year with respect to which the targeted level of revenue was attained.

Mr. Jennings will not be eligible to earn any Revenue Bonus with respect to any fiscal year that commences following a change in control transaction. In the event there is a change in control of the Company (as defined below) which occurs prior to the end of the Performance Period, and subject to Mr. Jennings’s continued employment with the Company through the date of such change in control, the targeted level of revenue for the remainder of the Performance Period (commencing with the fiscal year in which the change in control occurs) will be deemed to have been attained at the target level upon such change in control so that Mr. Jennings will instead be entitled to receive the target amount of Revenue Bonus for the remainder of the Performance Period, which will be paid in cash to Mr. Jennings no later than fifteen days following such change in control. For example, if a change in control transaction occurs on June 1, 2024 and Mr. Jennings

remains employed by the Company on such date, then Mr. Jennings will receive a total Revenue Bonus equal to $41,666.67 for the 2024 fiscal year, regardless of the Company’s actual level of attainment of the targeted level of revenue for the 2024 fiscal year; however, Mr. Jennings will not be eligible to receive any Revenue Bonus with respect to the 2025 fiscal year.

The Company may, in its sole discretion, settle its obligation to pay the Revenue Bonus in cash or in vested shares of the Company’s common stock, to be issued pursuant to the terms of the Company’s 2021 Equity Incentive Plan, with a then current fair market value equal to the amount of the cash payment, with such Company share value determined by reference to the closing price of the Company’s stock on the last trading day immediately preceding the date of issuance of such shares, or in any combination of cash or issued Company shares.

Item 8.01 Other Events.

On October 11, 2023, the Company issued a press release announcing the departure of Mr. Meckey as the Chief Executive Officer and a member of the Board of the Company, the appointment of Mr. Beck to serve as the Chief Executive Officer and a Class I director of the Company and the appointment of Mr. Jennings to serve as the Chief Financial Officer of the Company, as well as the elimination of 20 positions at the corporate level of the Company. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | | | | | | |

| | | | | |

Exhibit No. | | | | Description | |

99.1 | | | |

104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 11, 2023

| | | | | |

By: | /s/ Martin S.A. Beck |

Name: | Martin S.A. Beck |

Title: | Chief Executive Officer |

UpHealth Announces CEO Transition and Organizational Changes

Martin Beck Appointed CEO; Replacing Samuel Meckey

Announces the Elimination of 20 Corporate Roles

DELRAY BEACH, Fla., Oct. 11, 2023 (GLOBE NEWSWIRE) – UpHealth, Inc. (“UpHealth,” the “Company”) (NYSE: UPH), a global digital health company delivering technology platforms, infrastructure, and services to modernize care delivery and health management, today announced the October 5, 2023 appointment by the Board of Directors of the Company of Martin Beck to serve as the Company’s next Chief Executive Officer, replacing Samuel Meckey, effective October 6, 2023, and Mr. Beck being named as a member of the Board of Directors effective October 9, 2023. Mr. Beck has been UpHealth’s Chief Financial Officer since February 2020. Jay Jennings, currently the Company’s Chief Accounting Officer, will assume the role of Chief Financial Officer.

The Company also announced today the reduction of an additional 20 corporate roles. These organizational changes do not impact the Company’s business units. This action was taken to mitigate the financial impact of the September 14, 2023 decision by a trial court in New York to grant summary judgment in favor of Needham & Company LLC (“Needham”) (“the Needham decision”). The Company continues to seek a fair resolution through an appeals process of the judgment.

“Martin has the financial acumen and operational expertise to guide our Company forward. He is the ideal leader to navigate UpHealth through the current financial landscape,” said Dr. Avi Katz, Chair of the Company’s Board of Directors. “I am confident that with the work we have done to restructure our financials and with Martin at the helm, UpHealth will continue to serve our customers to their full satisfaction by delivering on our mission to enable high quality, affordable and accessible healthcare for all and to focus on maximizing long-term stakeholder value creation.”

Dr. Katz continued, “I would like to thank Sam for his contributions to the Company. Sam successfully delivered against operational goals and helped accelerate UpHealth’s transformation and growth. We are continuing to focus on serving customers, partners and patients, and we thank all our team members, including those affected by today’s reduction in force, for delivering on our promises to our stakeholders without interruption.”

Mr. Beck said, “I am eager to take on the role of CEO and lead our team at this pivotal juncture for the Company. The aggressive cost reduction actions taken by our new management team represent a first step in the execution of our plan to preserve and enhance stakeholder value.”

About UpHealth

UpHealth is a global digital health company that delivers digital-first technology, infrastructure, and services to dramatically improve how healthcare is delivered and managed. The UpHealth platform creates digitally enabled “care communities” that improve access and achieve better patient outcomes at lower cost, through digital health solutions and interoperability tools that serve patients wherever they are, in their native language. UpHealth’s clients include health plans, healthcare providers and community-based organizations. For more information, please visit https://uphealthinc.com and follow at UpHealth Inc on LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. federal securities laws. Such forward-looking statements include, but are not limited to, the Ch. 11 bankruptcy process and the operations of UpHealth and its subsidiaries with UpHealth Holdings under the protection of the Bankruptcy Court, the prospects for an appeal of the summary judgment issued in favor of Needham, the projected operation and financial performance of UpHealth, its product offerings and developments and reception of its product by customers, and UpHealth’s expectations, hopes, beliefs, intentions, plans, prospects or strategies regarding the future revenue and the business plans of UpHealth’s management team. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this press release are based on certain assumptions and analyses made by the management of UpHealth considering their respective experience and perception of historical trends, current conditions, and expected future developments and their potential effects on UpHealth as well as other factors they believe are appropriate in the circumstances. There can be no assurance that future developments affecting UpHealth will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the parties), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the ability of UpHealth to service or otherwise pay its debt obligations, the mix of services utilized by UpHealth’s customers and such customers’ needs for these services, market acceptance of new service offerings, the ability of UpHealth to expand what it does for existing customers as well as to add new customers, uncertainty with respect to how the ICA or the Indian courts shall decide various matters that are before them or that the Glocal Board will act in compliance with their fiduciary duties to their shareholders, that UpHealth will have sufficient capital to operate as anticipated, and the impact that the novel coronavirus and the illness, COVID-19, that it causes, as well as government responses to deal with the spread of this illness and the reopening of economies that have been closed as part of these responses, may have on UpHealth’s operations, the demand for UpHealth’s products, global supply chains and economic activity in general. Should one or more of these risks or uncertainties materialize or should any of the assumptions being made prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. UpHealth undertakes no obligation to update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except as may be required under applicable securities laws.

Contacts:

Investors Relations:

Shannon Devine (MZ North America)

Managing Director

203-741-8811

UPH@mzgroup.us

v3.23.3

Cover

|

Oct. 05, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 05, 2023

|

| Entity Registrant Name |

UpHealth, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38924

|

| Entity Tax Identification Number |

83-3838045

|

| Entity Address, Address Line One |

14000 S. Military Trail

|

| Entity Address, Address Line Two |

Suite 203

|

| Entity Address, City or Town |

Delray Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33484

|

| City Area Code |

888

|

| Local Phone Number |

424-3646

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Document Information [Line Items] |

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001770141

|

| Amendment Flag |

false

|

| Common Stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

UPH

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants, exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable Warrants, exercisable for one share of Common Stock at an exercise price of $115.00 per share

|

| Trading Symbol |

UPH.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=uph_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

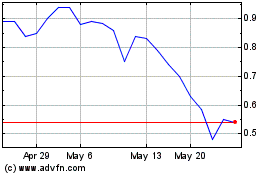

UpHealth (PK) (USOTC:UPHL)

Historical Stock Chart

From May 2024 to Jun 2024

UpHealth (PK) (USOTC:UPHL)

Historical Stock Chart

From Jun 2023 to Jun 2024