UPDATE: Vivendi Confirms 2011 Targets Despite Economic Troubles

31 August 2011 - 5:34PM

Dow Jones News

French telecom-to-entertainment group Vivendi SA (VIV.FR)

Wednesday confirmed its full-year guidance as strong second-quarter

growth at its video games and Brazilian telecoms units continued to

offset weakness in the company's French telecoms business.

"Despite the turbulent economic and financial environment, our

operational indicators are increasing. We confirm our full year

outlook for adjusted net income above EUR3 billion, and for an

increase in the dividend," Chief Executive Jean-Bernard Levy said

in a statement.

The CEO urged caution amid heightened concerns over the global

economy but said that so far he has seen no signs of a slowdown in

business. Still, the company will not decide on the level of its

dividend increase until the end of the year, the CEO added.

Vivendi said net profit rose 23% to EUR824 million in the second

quarter while adjusted profit rose 12% to EUR884 million, driven by

the settlement of a legal dispute in Poland as well as a tax

advantage linked to Vivendi acquiring full control of telecoms

group SFR.

Adjusted earnings before interest and taxes, a closely watched

figure that excludes non-recurring items, rose 0.3% to EUR1.66

billion in the quarter, beating analysts' forecast, as a surge in

profit at video-games maker Activision Blizzard Inc. (ATVI) and

Brazilian telecoms unit GVT offset weakness at SFR and Maroc

Telecom (IAM.CL), in which Vivendi owns a majority stake.

Revenue rose 0.2% to EUR7.07 billion, in line with analysts'

forecasts.

Vivendi earlier this year acquired the 44% stake SFR it didn't

already own from Vodafone Group PLC (VOD) for EUR7.95 billion.

However, SFR is struggling amid heightened competition in the

French telecoms market ahead of the launch of Iliad SA's (ILD.FR)

Free brand. SFR's adjusted EBIT dropped 8% in the second

quarter.

Levy declined to comment on recent press reports that the group

may be interested in acquiring all or part of Polish broadcaster

TVN SA. "We never comment on any particular rumor," Levy said, but

added that the company is "very attentive" to what is happening in

Poland as it already has operations there.

The CEO also said Vivendi has had no contact with Lagardere SCA

(MMB.FR) over the past few quarters regarding its stake in French

pay TV company Canal Plus France. Vivendi has long been interested

in buying the 20% it doesn't already own in the company but

Lagardere was planning to launch an initial public offering for the

stake, before it postponed the plans in the spring amid worsening

market conditions.

Vivendi shares closed Tuesday at EUR16.18.

-By Ruth Bender, Dow Jones Newswires; +33 1 40 17 17 54;

ruth.bender@dowjones.com

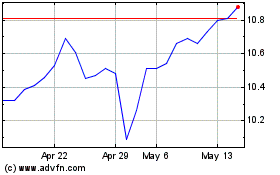

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

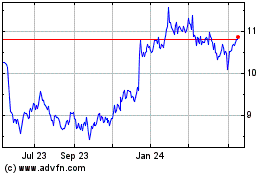

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024