Veolia Shares Fall On Fears Of Management Change

21 February 2012 - 5:39AM

Dow Jones News

Shares in Veolia Environnement SA (VE) slumped Monday after it

emerged that the group's Chairman and Chief Executive Antoine

Frerot could be forced out by some members of the company's board

just as the world's largest waste and water utility has embarked

upon a major restructuring plan.

According to people familiar with the matter, Mr. Frerot's

strategy at the helm of the French company has been called into

question by several board members, among them his predecessor Henri

Proglio, the chairman and CEO of state-controlled power giant

Electricite de France SA (EDF.FR).

"Henri Proglio will demand (Frerot's) dismissal during the board

meeting session of Feb.29," said one of the people, who spoke on

condition of anonymity. "Proglio has been very disappointed by

Frerot's strategy, which has called his legacy into question," the

other person said.

In remarks released to the press, Mr. Proglio said: "Veolia's

board is sovereign and the future of the company deserves better

than this flow of political rumors."

French newspaper Liberation first reported the news on Sunday of

the potential ouster of the Veolia chief executive. It was

subsequently widely covered in the French media on Monday.

Liberation and others newspapers reported that former

environment minister Jean-Louis Borloo would likely replace Mr.

Frerot. Other names have also been circulated. The reports also

said French President Nicolas Sarkozy supported the Veolia

management change, suggestions that Mr. Sarkozy dismissed on Monday

as "absurd."

In a letter Monday to Veolia employees, a copy of which was seen

by Dow Jones Newswires, Mr. Frerot wrote that "the turnaround of

Veolia Environnement is underway." Referring to the press reports,

he wrote: "Together we must face this destabilization attempt."

Veolia shares ended down 3.1% in Paris trading on Monday, having

fallen over 4% earlier in the day. By contrast, the blue chip

CAC-40 index ended up 1%.

Analysts said the prospect of a management reshuffle at the helm

of Veolia is coming at precisely the wrong time.

Last fall, Veolia issued a profit warning and unveiled a

cost-cutting program designed to shrink its operations after

incurring significant operational losses at its southern European

and northern African businesses. The company booked a bit more than

EUR800 million in writedowns in its first-half results in 2011. At

the time, Veolia also disclosed an accounting fraud that took place

in the company's U.S. Marine services business and amounted to

EUR90 million in total over 2007-2010 due to results that had been

inflated. The Marine Services unit offers offshore oil and gas and

inland marine maintenance and was badly hit after BP PLC's oil

spill in the Gulf of Mexico in 2010. The employees involved in the

fraud left Veolia last May and Veolia said it was notifying the

Securities and Exchange Commission.

"We would view a management change scenario as negative as it

would raise questions regarding the group's ability to undergo a

much-needed structural change," said Cheuvreux analyst Arnaud

Joan.

The strategy laid out by Mr. Frerot to tackle the group's

underperformance issues and unsustainable debt "seems to have been

validated by the market," said Oddo Securities' analyst Stephane

Lacaze.

It was unclear whether a CEO change would materialize. "There

doesn't seem to be a clear majority within Veolia's board," said a

person familiar with the matter.

-By Geraldine Amiel, Dow Jones Newswires; +33 1 40171767;

geraldine.amiel@dowjones.com

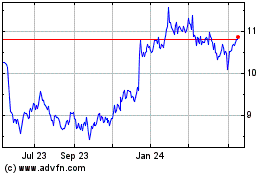

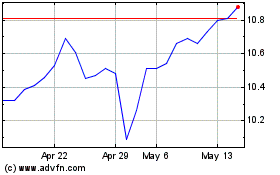

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024