Telecom Italia to Invest Billions in Turnaround Effort

17 February 2016 - 5:15AM

Dow Jones News

By Manuela Mesco

MILAN--Italian telecom giant Telecom Italia SpA will spend

billions over the next three years in new investment aimed at

reversing a decline that saw a sharp fall in profit and revenue

last year and that has made the company vulnerable to a

takeover.

After years of no revenue growth, the firm's management is now

under pressure to deliver results, as its largest shareholder

Vivendi SA pushes for a more effective strategy and speculation

swirls that the Italian group could be a takeover target.

Telecom Italia has struggled to outline a fruitful strategy to

deal with the twin challenges of a protracted economic downturn in

Italy and fierce competition that has sent prices spiraling

downward in its domestic market, which makes up the lion's share of

its business.

The high debt of the company has limited its ability to invest

in the country's infrastructure and new technology for years,

leaving it lagging behind many peers developing broadband services

and content that could lure new customers and help raise prices,

analysts say.

But Telecom Italia announced Tuesday it will sink EUR12 billion

in investments in Italy over the next three year--higher than its

previous target of EUR10 billion planned in its 2015-2017 strategy

plan. It also said it will push harder on new content such as

music, video and gaming.

"We are not increasing [investment]," said Chief Executive Marco

Patuano speaking to analysts on Tuesday. "We are accelerating

it."

Mr. Patuano also said that, while multimedia and content such as

video and music streaming are not "incredible revenue drivers,"

they help retain customers and reduce subscription losses.

According to some analysts, the plan is partially the fruit of

pressure from Vivendi influence. In December, Vivendi--which now

holds a 21% stake in Telecom Italia--won four seats in Telecom

Italia's board after a harsh battle with minority shareholders. It

has repeatedly said that it plans to play an active role in Telecom

Italia's future and that it wants to give the company a better

direction.

Telecom Italia's business plan was for Vivendi "the first step

to see if everyone's rowing in the same direction," says Kepler

Cheuvreux's analyst Javier Borrachero.

But a revival of Telecom Italia will be an uphill battle.

Earlier Tuesday, it said 2015 preliminary Ebitda fell 20% compared

with the previous year, to EUR7 billion, while revenue dropped 8.6%

to EUR19.7 billion.

Net debt rose again last year, reaching EUR27 billion, raising

concerns among analysts about how the company will pay for the

investment plan.

Telecom Italia emphasized that its Italian revenues are now

falling less sharply than before. It also expects Ebitda to

stabilize this year and grow in 2017 and 2018.

But domestic revenues, accounting for over two-thirds of the

total, fell 2.3% last year and Ebitda dropped 20% compared with the

previous year.

"We have made significant improvement in Italy," said Mr.

Patuano on Tuesday. "Investments have started to pay off."

However, the poor results pushed down Telecom Italia's stock,

which has been battered in recent weeks, falling 30% since the end

of last year. On Tuesday, Telecom Italia's stock price closed 6.4%

down in Milan's stock exchange, at EUR0.82.

Nick Kostov contributed to this article

Write to Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

February 16, 2016 13:00 ET (18:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

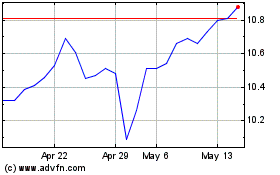

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

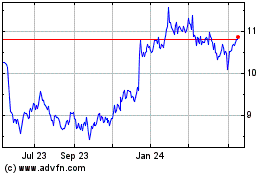

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024