Elliott Raises Stake in Telecom Italia to 8.8% -- Update

10 April 2018 - 1:07AM

Dow Jones News

By Marc Navarro Gonzalez and Alberto Delclaux

Activist investor Elliott Management Corp. has raised its stake

in Telecom Italia SpA (TIT.MI) to 8.8%, according to a regulatory

filing on Monday, as it released a series of proposals to deliver

additional value to shareholders.

Elliott said in a presentation to investors that the separation

of Telecom Italia's fixed-access network into a separate legal

entity, or NetCo--which would be 100% controlled by the Italian

operator--could draw new investors and unlock as much as 7 billion

euros ($8.59 billion) in "hidden value."

Through the creation of the NetCo and the disposal of subsea

cable unit Sparkle, Telecom Italia would be positioned to

reintroduce a dividend, Elliott said. It added that the company

would be able to distribute EUR1.2 billion of dividend in 2019.

The activist fund said that an independent board could deliver

actions which may double the stock price over the next two

years.

The news comes as Elliott pressures Vivendi SA (VIV.FR), holder

of a 24% Telecom Italia stake, for changes at the telecoms company.

The power struggle between the two recently triggered the

resignation of eight Vivendi-affiliated board members, forcing a

complete reshuffle of the board.

Telecom Italia's board of directors is scheduled to meet Monday

to discuss potential action after company auditors requested adding

an Elliott-proposed motion to replace six Vivendi-affiliated board

members to the agenda of its shareholders meeting on April 24.

Read more about the Telecom Italia tug-of-war at:

https://on.wsj.com/2GKAIUX

Write to Marc Navarro Gonzalez at marc.navarro@dowjones.com and

Alberto Delclaux at alberto.delclaux@dowjones.com

-0-

(END) Dow Jones Newswires

April 09, 2018 10:52 ET (14:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

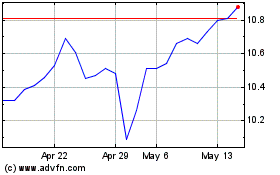

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

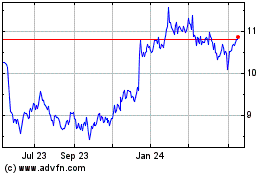

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Jul 2023 to Jul 2024