United

States

Securities and Exchange Commission

Washington, D.C. 20549

____________________________________________________

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 22, 2015

MIND SOLUTIONS, INC.

(Exact name of Registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

333-166884

(Commission File Number) |

52-2130901

(IRS Employer Identification No.) |

3525 Del Mar Heights Road, Suite 802

San Diego, California

(principal executive offices) |

92130

(Zip Code) |

(888) 461-3932

(Registrant’s telephone number, including area code)

_____________________________________________________________________________________________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant

to Rule 425 under the Securities Act

[ ] Soliciting material pursuant to

Rule 14a-12 under the Exchange Act

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act

EXPLANATORY NOTE

On April 29, 2015, we filed with the

Securities and Exchange Commission our Current Report on Form 8-K with respect to various events described therein. At the time

of the filing of our Current Report on Form 8-K on April 29, 2015, we were unaware of the Commission’s impending order against

Terry L. Johnson, CPA discussed below. On October 2, 2015, we filed Amendment No. 1 to our Current Report on Form 8-K to provide

additional information with respect to the resignation of Terry L. Johnson, CPA as the auditor of the registrant on April 22, 2015,

and to announce our decision to have our financial statements for the years 2013, and 2014, re-audited by our current auditor,

Patrick D. Heyn, CPA, P.A. who was engaged by the registrant on August 12, 2015.

On October 31, 2015, we

were advised by our auditor, after the re-audits of our financial statements for the years 2013, and 2014, that our

financial statements for the years 2013, and 2014, should no longer be relied upon because of an error in such financial

statements as addressed in FASB ASC Topic 250, Accounting Changes and Error Corrections. Consequently, we are

filing this Form 8-K/A, Amendment No. 2, to make a prompt announcement of non-reliance on Form 8-K as required by the rules

of the Commission.

The filing of this Form 8-K/A, Amendment

No. 2, is not an admission that our Form 8-K filed on April 29, 2015, or our Form 8-K/A, Amendment No. 1, filed on October 2, 2015,

when filed, knowingly included any untrue statement of a material fact or omitted to state a material fact necessary to make the

statements made therein not misleading.

Except as described herein, no other

changes have been made to our Current Report on Form 8-K filed on April 29, 2015, or our Form 8-K/A, Amendment No. 1, filed on

October 2, 2015. We have not updated the disclosures in this Form 8-K/A, Amendment No. 2, to speak as of a later date or to reflect

events which occurred at a later date, except as noted.

Item 4.02 Non-Reliance on Previously Issued Financial

Statements or a Related Audit Report or Completed Interim Review.

On September 17, 2015, the Securities

and Exchange Commission issued an order instituting a public administrative and cease-and-desist order against Terry L. Johnson,

CPA, the previous auditor for the registrant who resigned as the registrant’s auditor on April 22, 2015. On July 7, 2015,

the PCAOB withdrew the registration of Terry L. Johnson, CPA. As a result of the Commission’s order, Terry L. Johnson, CPA

was denied the privilege of appearing or practicing before the Commission for failing to comply with PCAOB auditing standards.

Terry L. Johnson, CPA was also cited for the issuance of audit reports that falsely stated that Terry L. Johnson, CPA conducted

its audits in accordance with the standards of PCAOB.

On September 29, 2015, the registrant

was made aware of the Commission’s order dated September 17, 2015, against Terry L. Johnson, CPA. Due to the Commission’s

order, the registrant can no longer include the audit reports of Terry L. Johnson, CPA in the registrant's filings with the Commission.

The registrant made the decision to

have its financial statements for the years 2013, and 2014, re-audited by its current auditor, Patrick D. Heyn, CPA, P.A. who was

engaged by the registrant on August 12, 2015. In its Form 8-K/A, Amendment No. 1, filed on October 2, 2015, the registrant stated

that if it should conclude, after the re-audits of its financial statements for the years 2013, and 2014, that its financial statements

for the years 2013, and 2014, should no longer be relied upon because of an error in such financial statements as addressed in

FASB ASC Topic 250, Accounting Changes and Error Corrections, the registrant will make a prompt announcement on Form 8-K

as required by the rules of the Commission.

On October 31, 2015, the registrant

was advised by its current auditor, Patrick D. Heyn, CPA, P.A., that the registrant’s financial statements for the years

2013, and 2014 should no longer be relied upon because of an error in such financial statements as addressed in FASB ASC Topic

250, Accounting Changes and Error Corrections. Patrick D. Heyn, CPA, P.A. provided the following reasons for the non-reliance:

The registrant incorrectly accounted for certain embedded derivatives related to convertible debt and the valuation of Series A

preferred stock issued for services.

The registrant’s board of directors

in the absence of an audit committee discussed with Patrick D. Heyn, CPA, P.A. the matters disclosed in this filing pursuant to

Item 4.02(b) of Form 8-K.

Pursuant to Item 4.02(b) of Form 8-K,

the registrant has provided Patrick D. Heyn, CPA, P.A. with a copy of the disclosures it is making in response to Item 4.02 of

Form 8-K which Patrick D. Heyn, CPA, P.A. has already received. In addition, Patrick D. Heyn, CPA, P.A. was requested to furnish

to the registrant a letter addressed to the Commission stating whether Patrick D. Heyn, CPA, P.A. agrees with the statements made

by the registrant in response to this Item 4.02 and, if not, stating the respects in which it does not agree. A copy of the response

by Patrick D. Heyn, CPA, P.A. is attached as an exhibit to this Form 8-K/A, Amendment No. 2.

Item 9.01. Financial Statements

and Exhibits.

(a) Financial

Statements of Business Acquired. Not applicable.

(b) Pro forma

financial information. Not applicable.

(c) Shell company

transaction. Not applicable.

(d) Exhibits.

| |

Exhibit No. |

Identification of Exhibit |

| |

15.1* |

Letter from Patrick D. Heyn, CPA, P.A. dated November 2, 2015, as required by Item 4.02(b) of Form 8-K. |

____________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: November 2, 2015. |

MIND SOLUTIONS, INC. |

| |

|

| |

|

| |

By /s/ Kerry Driscoll |

| |

Kerry Driscoll, Chief Executive Officer |

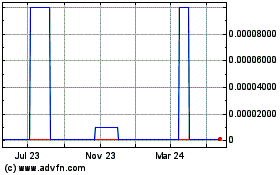

Mind Solutions (CE) (USOTC:VOIS)

Historical Stock Chart

From Dec 2024 to Jan 2025

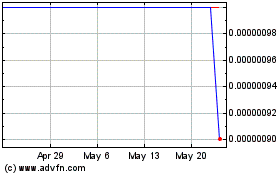

Mind Solutions (CE) (USOTC:VOIS)

Historical Stock Chart

From Jan 2024 to Jan 2025