As

filed with the Securities and Exchange Commission on March 29, 2017

Registration

No. 333-214045

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

AMENDMENT NO. 1 TO

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

XFIT

BRANDS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

2032

|

|

47-1858485

|

|

(State

or other Jurisdiction

of

Incorporation)

|

|

(Primary

Standard

Classification

Code)

|

|

(IRS

Employer

Identification

No.)

|

25731

Commercentre Drive

Lake

Forest, CA 92630

Tel:

(949) 916-9680

(Address

and Telephone Number of Registrant’s Principal

Executive

Offices and Principal Place of Business)

David

E. Vautrin

Interim

Chief Executive Officer

XFit

Brands, Inc.

25731

Commercentre Drive

Lake

Forest, CA 92630

Tel:

(949) 916-9680

Email:

dave.vautrin@xfitbrands.com

(Name,

Address and Telephone Number of Agent for Service)

Copies

of communications to:

Joseph

P. Galda, Esq.

J.P.

Galda & Co.

Three

Westlakes

1055

Westlakes Drive, Suite 300

Berwyn,

Pennsylvania 19312

Tel

No.: (215) 815-1534

Fax

No.: (610) 727-4001

Email:

jpgalda@jpgaldaco.com

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933,

please check the following box and list the Securities Act Registration Statement number of the earlier effective registration

statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If delivery of the Prospectus is expected to

be made pursuant to Rule 434, please check the following box. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[ ]

|

Smaller

reporting company

|

[X]

|

CALCULATION

OF REGISTRATION FEE

|

Title

of Each Class

of

Securities to

be

Registered

|

|

Amount

to be

Registered (1)

|

|

|

Proposed

Maximum

Offering

Price

Per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount

of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $0.0001 ( 2 )

|

|

|

3,800,000

|

|

|

$

|

0.09

|

(3)

|

|

$

|

342,000

|

(3)

|

|

$

|

39.64

|

(4)

|

|

Common Stock, par value $0.0001 ( 5 )

|

|

|

380,000

|

|

|

$

|

0.09

|

(3)

|

|

$

|

34,200

|

(3)

|

|

$

|

3.96

|

(4)

|

|

Common Stock, par value $0.0001 ( 6 )

|

|

|

4,932,067

|

|

|

$

|

0.09

|

(7)

|

|

$

|

443,886

|

(7)

|

|

$

|

51.45

|

|

|

Common Stock, par value $0.0001 ( 8 )

|

|

|

771,395

|

|

|

$

|

0.09

|

(7)

|

|

$

|

69,426

|

(7)

|

|

$

|

8.05

|

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of

common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends

or similar transactions affecting the shares to be offered by the selling stockholders.

|

|

|

|

|

|

|

(2)

|

The shares of the registrant’s

common stock being registered hereunder are being registered primarily for resale by

GHS Investments, LLC in accordance with the terms of an Investment Agreement between

GHS Investments, LLC and the registrant. The number of shares of common stock registered

upon the initial filing of this registration statement represented the registrant’s

initial good faith estimate of the number of shares of the registrant’s common

stock issuable upon delivery of a “put” notice under the guidance from the

Commission staff for equity lines.

|

|

|

|

|

|

|

(3)

|

The proposed maximum offering

price per share and the proposed maximum aggregate offering price have been estimated

solely for the purpose of calculating the amount of the registration fee in accordance

with Rule 457(c) under the Securities Act of 1933 on the basis of the average of the

high and low prices of the common stock on the OTCQB on September 30, 2016, a date within

five trading days prior to the date of the initial filing of this registration statement.

|

|

|

|

|

|

|

(4)

|

Previously paid.

|

|

|

|

|

|

|

(5)

|

Represents shares of common stock to be offered

by PIMCO Funds: Private Account Portfolio Series: PIMCO High Yield Portfolio which are to be issued upon exercise of a warrant

held by them to purchase up to 10% of the registrant’s outstanding common stock (which gives effect to the initial 3,800,000

shares of common stock being offered by GHS Investments LLC registered hereunder).

|

|

|

|

|

|

|

(6)

|

The shares of the registrant’s

common stock being registered hereunder are being registered primarily for resale by

GHS Investments, LLC in accordance with the terms of an Investment Agreement between

GHS Investments, LLC and the registrant. The number of shares of common stock registered

hereunder represents the registrant’s good faith estimate of the number of additional

shares of the registrant’s common stock issuable upon delivery of a “put”

notice under the Commission staff guidance for equity lines based upon the increase in

the registrant’s public float since the initial filing of this registration statement.

Should the number of shares being registered be an insufficient number of shares to fully

utilize the credit facility, the registrant will not rely upon Rule 416, but will file

a new registration statement to cover the resale of such additional shares should that

become necessary.

|

|

|

|

|

|

|

(7)

|

The proposed maximum offering

price per share and the proposed maximum aggregate offering price have been estimated

solely for the purpose of calculating the amount of the registration fee in accordance

with Rule 457(c) under the Securities Act of 1933 on the basis of the average of the

high and low prices of the common stock on the OTCQB on March 23, 2017, a date

within five trading days prior to the date of the filing of this amendment to the registration

statement.

|

|

|

|

|

|

|

(8)

|

Represents additional shares of common stock to

be offered by PIMCO Funds: Private Account Portfolio Series: PIMCO High Yield Portfolio which are to be issued upon exercise

of a warrant held by them to purchase up to 10% of the registrant’s outstanding common stock (which gives effect to

the additional 4,932,067 shares of common stock being offered by GHS Investments LLC registered hereunder and other

shares of common stock issued by the Company since in the initial filing of the registration statement).

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective

on such date as the Commission, acting pursuant to said section 8(a), may determine.

Pursuant

to Rule 429 under the Securities Act of 1933, as amended, the Prospectus relating to the securities registered under this Registration

Statement also relates to the registrant’s Registration Statement on Form S-1 (Registration Nos. 333-209774) filed with

the Securities and Exchange Commission on February 26, 2016.

The

information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

MARCH 29, 2017

|

13,765,962 Shares of Common Stock

XFIT

BRANDS, INC.

This Prospectus relates to the resale of up

to 8,732,067 shares of the common stock of XFit Brands, Inc., a Nevada corporation, by GHS Investments, LLC, a Nevada limited

liability company (“GHS”), a selling shareholder, pursuant to a Put Notice(s) under an Investment Agreement (the “Investment

Agreement”) that we have entered into with GHS. The Investment Agreement permits us to sell shares of our common stock to

GHS by enabling us to put up to $5 million of common stock to GHS. The registration statement of which this Prospectus is a part

covers the offer and possible sale of approximately $611,200 in common stock by GHS based on our March 16, 2017 lowest sale price

of $0.07 per share. This Prospectus also relates to the resale of up to 3,783,895 shares of our common stock by PIMCO Funds: Private

Account Portfolio Series: PIMCO High Yield Portfolio (“PIMCO”) to be issued upon exercise of a warrant issued to PIMCO

to purchase an amount of shares of our common stock equal to ten percent (10%) of all shares of common stock then outstanding,

at an exercise price of $350,000 for the full 10% of our common stock ($35,000 for each one-percent of common stock purchased),

which expires on June 12, 2024, and 1,250,000 shares of our common stock by Kodiak Capital Group, LLC, a Delaware limited

liability company (“Kodiak”), which we previously put to Kodiak under a prior Equity Purchase Agreement which has

expired. We will not receive any proceeds from the sale of these shares of common stock offered by GHS, Kodiak or PIMCO. However,

we will receive proceeds from the sale of securities pursuant to each Put Notice we send to GHS and we will receive up to $350,000

upon full exercise of the warrant by PIMCO. We will bear all costs associated with this registration.

The total amount of shares of common stock which may be sold to GHS pursuant to this

Prospectus would constitute approximately 30% of our issued and outstanding common stock as of March 17, 2017 , if all of

the shares had been sold by that date. On March 17, 2017 , the lowest trading price of our common stock was $0.07 .

GHS

and Kodiak are “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities

Act”), in connection with the resale of our common stock under their respective agreements with the Company. GHS will pay

us the lower of (a) the lowest sale price of our common stock on the trading day following the date of our notice to GHS of our

election to put shares pursuant to their Investment Agreement (the “Purchase Date”) and (b) the arithmetic average

of the three lowest trading prices during the five trading days following the Purchase Date. The maximum number of shares that

can be put to GHS is two times the average daily trading volume during the ten trading days prior to the Purchase Date. If the

amount of the tranche exceeds the volume limitation, additional tranches will be delivered until the entire purchase amount is

delivered. Each tranche, including the initial tranche, will trigger a new purchase price, and will be priced according to the

purchase price definition.

There

are no underwriting agreements in place.

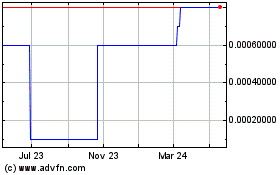

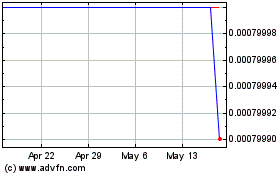

Our shares of common stock are currently quoted

on the OTC Markets Group (OTC.QB Tier) under the symbol “XFTB.” The closing price of our common stock on March

17 , 2017 was $0.0867 .

Investing

in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material

risks of investing in our common stock in “Risk Factors” beginning on page 6 of this Prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of anyone’s

investment in these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is

a criminal offense.

The

Date of This Prospectus Is: _____________, 2017

TABLE

OF CONTENTS

FORWARD-LOOKING

STATEMENTS

Some

of the statements contained in this Registration Statement are forward-looking statements within the meaning of the Securities

Act of 1933 (the

“Securities Act”

) and the Securities Exchange Act of 1934 (the

“Exchange

Act”

). The safe harbor created by the Private Securities Litigation Reform Act of 1995 does not apply to an issuer

of penny stock, such as the Company. We have based these forward-looking statements largely on our expectations and projections

about future events and financial trends affecting the financial condition and/or operating results of our business. Forward-looking

statements involve risks and uncertainties; particularly those risks and related to the development, manufacturing and sale of

alternative fuel vehicles. There are important factors that could cause actual results to be substantially different from the

results expressed or implied by these forward-looking statements.

In

addition, in this Registration Statement, the words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “plan,” “expect,” “potential,”

or “opportunity,” the negative of these words or similar expressions, as they relate to us, our business, future financial

or operating performance or our management, are intended to identify forward-looking statements. Except as required by law, we

do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Past financial or operating performance is not necessarily a reliable indicator of future performance and you should not use our

historical performance to anticipate results or future period trends.

The

terms “XFIT” “our” “we,” and the “Company” as used in this Prospectus, refer to

XFit Brands, Inc. and its predecessors, subsidiaries, and affiliates, collectively, unless the context indicates otherwise.

You

should rely only on the information contained in this Prospectus. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not

making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information appearing in this Prospectus is accurate as of the date on the front cover of this Prospectus only. Our business,

financial condition, results of operations and prospects may have changed since that date.

We

intend to furnish our stockholders with annual reports containing consolidated financial statements audited by an independent

accounting firm.

PROSPECTUS

SUMMARY

This

summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information

that you should consider before investing in the common stock. You should carefully read the entire Prospectus, including “Risk

Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

the Consolidated Financial Statements, before making an investment decision.

General

XFit

Brands, Inc. was incorporated in September 2014 under the laws of the State of Nevada. As used herein, the terms “we,”

“us,” “XFIT,” and the “Company” refer to XFIT Brands, Inc. and its predecessors, subsidiaries,

and affiliates, collectively, unless the context indicates otherwise. Our fiscal year end is June 30. Our principal office address

is 25731 Commercentre Drive, Lake Forest, CA 92630 and our telephone number is (949) 916-9680.

Our principal business activity is the design, development, and worldwide marketing and selling of functional

equipment, training gear, apparel, and accessories for the impact sports market and fitness industry. Our mission is to become

a leading developer and marketer of functional fitness brands and products at retail and fitness outlets worldwide. Our products

span the Impact Sports, Mixed Martial Arts (MMA), High and low impact fitness and Cross Training, and other Action Sports and are

marketed and sold under the Throwdown®, XFit Brands®, and Transformations™ brand names, which along with certain

trade secrets are protected worldwide. Our products are marketed and sold through a range of different channels including gyms,

fitness facilities, and directly to consumers via our internet website and through third party catalogues (which we refer to as

our “Direct to Consumer”) through a mix of independent distributors and licensees throughout the world. All of our

products are manufactured by a network of independent manufacturers, which satisfy our strict quality requirements.

In October 2016 we expanded our product line

to include sports surfaces and construction of athletic training centers through the acquisition of substantially all of the assets

of Environmental Turf Surfaces, LLC. Management believes the Company can not only provide the resources for EnviroTurf ® to

expand across all sports and at all levels from professional to the collegiate ranks and high schools, but will also augment the

supply chain, sourcing, production and execution capabilities of EnviroTurf to facilitate their growth. Notwithstanding this belief,

funding EnviroTurf ® has presented a challenge to management and the Company has begun a comprehensive evaluation of

the EnviroTurf ® strategy. Xfit Brands is a turnkey supplier to thousands of major gym outlets worldwide and does everything

from design, to production, to installation for the outlets. Having surface capabilities now in its portfolio complements its

broad line of functional fitness equipment, impact sports equipment, and accessories and furthers its one-stop-shop strategy.

We

are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging

growth company, we will not be required to comply with the requirements that are applicable to other public companies that are

not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation

requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in

our periodic reports and proxy statements, and the exemptions from the requirements of holding a nonbinding advisory vote on executive

compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of

these reporting exemptions until we are no longer an emerging growth company.

Following

this offering, we will continue to be an emerging growth company until the earliest to occur of (1) the last day of the fiscal

year during which we had total annual gross revenues of at least $1 billion (as indexed for inflation), (2) the last day of the

fiscal year following the fifth anniversary of the date of our initial public offering (February 11, 2015), (3) the date on which

we have, during the previous three-year period, issued more than $1 billion in non-convertible debt and (4) the date on which

we are deemed to be a “large accelerated filer,” as defined under the Securities Exchange Act of 1934, as amended

(which we refer to as the “Exchange Act”).

We

also qualify as a “smaller reporting company” under Rule 12b-2 of the Exchange Act, which is defined as a company

with a public equity float of less than $75 million. To the extent that we remain a smaller reporting company at such time as

we are no longer an emerging growth company, we will still have reduced disclosure requirements for our public filings, some of

which are similar to those of an emerging growth company, including not being required to comply with the auditor attestation

requirements of Section 404 of the Sarbanes-Oxley Act and the reduced disclosure obligations regarding executive compensation

in our periodic reports and proxy statements.

Under

U.S. federal securities legislation, our common stock could be “penny stock.” Penny stock is any equity security that

has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving penny stock, unless

exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks,

and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity

of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker

or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination

that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial

matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, before

any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which,

in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing

to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors

to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the

risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both

the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies available

to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price

information for the penny stock held in the account and information on the limited market in penny stocks.

Background

Our company was founded in 2003 under the

Throwdown name. Our initial focus was for development and sale of ramps for Action sports (Skate, Moto, other) and training and

competition cages for the Mixed Martial Arts (“MMA”) industry and thereafter expanded into development and sales of

training and protective gear for the MMA industry. In the past year, we have begun commercializing a significantly broader portfolio

of cross training, fitness and other products capitalizing on the growth of the fitness, training, and exercise industry that

has significantly expanded our business. In September 2014, we formed XFit Brands, Inc. as a wholly-owned subsidiary of TD Legacy,

LLC to act as a holding company for our Throwdown operations. TD Legacy distributed the shares of XFit Brands held by it to its

members on February 13, 2015 and then dissolved TD Legacy on September 22, 2015.

Corporate

History

The

business was founded in 2003 under the Throwdown name, and was originally incorporated in 2007 as Throwdown Industries, Inc.,

a California corporation.

As

part of a restructuring plan, Throwdown Industries, LLC, a Delaware limited liability company, was formed on January 11, 2012

and TD Legacy, LLC, a Florida limited liability company, was formed on January 26, 2012.

On

January 26, 2012, all stockholders of Throwdown Industries, Inc. contributed their shares, totaling 136,013 of Throwdown Industries,

Inc., to TD Legacy, LLC in exchange for a corresponding 136,013 units of membership interests in TD Legacy, LLC, making TD Legacy,

LLC the sole shareholder of Throwdown Industries, Inc. Throwdown Industries, Inc. then redeemed 69,367 of its shares from TD Legacy,

LLC. TD Legacy, LLC sold the remaining 66,646 shares of Throwdown Industries, Inc. to Throwdown Industries, LLC in exchange for

49% ownership of Throwdown Industries, LLC. Affliction Holdings, LLC, a California limited liability company, contributed know-how,

marketing, distribution, and resources to Throwdown Industries, LLC as consideration for 51% ownership of Throwdown Industries,

LLC.

On

August 23, 2012, Windsor Court Holdings, LLC, a Delaware limited liability company, purchased all of Affliction Holdings, LLC’s

ownership interest in Throwdown Industries, LLC. On September 13, 2012, Throwdown Industries Holdings, LLC, a Delaware limited

liability company was formed. As part of a new restructuring plan, Windsor Court Holdings, LLC contributed all of its ownership

of Throwdown Industries, LLC in exchange for 25% ownership interest in Throwdown Industries Holdings, LLC, and TD Legacy, LLC

contributed all of its ownership of Throwdown Industries, LLC in exchange for 75% ownership interest in Throwdown Industries Holdings,

LLC.

On

April 24, 2014, Windsor Court Holdings, LLC transferred all of its ownership interest of Throwdown Industries Holdings, LLC to

TD Legacy, LLC. TD Legacy, LLC was the sole owner of 100% of the ownership interests in Throwdown Industries Holdings, LLC on

such date.

On

September 26, 2014, TD Legacy, LLC contributed 100% of the equity of Throwdown Industries Holdings, LLC to XFit Brands, Inc. in

exchange for 4,000,000 shares of XFit Brands, Inc. common stock. TD Legacy, LLC owns 100% of XFit Brands, Inc., which in turn

owns 100% of Throwdown Industries Holdings, LLC, which in turn owns 100% of Throwdown Industries, LLC, which in turn owns 100%

of Throwdown Industries, Inc.

On November 26, 2014, we filed a registration statement for the distribution of 4,000,000 shares of our common

stock then held by TD Legacy, LLC, our parent company on such date, to TD Legacy members as a liquidating distribution (the “Distribution”).

The registration statement was declared effective by the Securities and Exchange Commission on February 9, 2015 and the Distribution

occurred on February 13, 2015. TD Legacy, LLC was dissolved on September 22, 2015.

On

March 28, 2016, the Board of Directors approved a 1-for-5 forward split of its outstanding shares of common stock (and proportional

increase of its authorized common stock from 250 million shares to 1.25 billion shares) with a record date of April 14, 2016 and

an effective date of April 15, 2016. Prior to the split, the Company had 4,118,500 shares issued and outstanding and after the

split, the Company had 20,592,500 shares issued and outstanding. All references in this Prospectus to numbers of shares, and share

amounts have been retroactively restated to reflect the 1-for-5 forward split, unless explicitly stated otherwise.

On October 14, 2016 but effective as of

October 10, 2016, the Company acquired the assets of Environmental Turf Services, LLC (“EnviroTurf”) pursuant to a

definitive Asset Purchase Agreement dated October 10, 2016 (the “Purchase Agreement”) between the Company and EnviroTurf.

The acquired assets consisted of inventory, accounts receivable, equipment and vehicles, the registered trademark “ENVIROTURF”

and the associated goodwill. The acquisition was completed on October 14, 2016 upon delivery and acceptance of the schedules to

the Purchase Agreement (the “Acquisition”).

At the closing of the Acquisition, the Company paid and issued to EnviroTurf a total

purchase price of $346,000 as follows: (i) assumption of $200,000 of EnviroTurf’s accounts payable and (ii) 2,000,000 restricted

shares of XFit Common Stock (the “Purchase Price Shares”), which were valued at the closing price on the date of XFit’s

Common Stock on the date of the Acquisition. The Company will fund the non-share purchase price and the costs and expenses of

the Acquisition through a combination of cash on hand and internally-generated working capital.

As

of the date of this registration statement, we have three direct and indirect subsidiaries: our wholly-owned subsidiary, Throwdown

Industries Holdings, LLC, its wholly-owned subsidiary, Throwdown Industries LLC and its wholly-owned subsidiary, Throwdown Industries,

Inc.

Growth

Strategy

Our

growth strategy includes the following:

|

|

●

|

Expand

our presence in the exercise and fitness training community;

|

|

|

|

|

|

|

●

|

Leverage

our MMA core credibility and heritage;

|

|

|

|

|

|

|

●

|

Apply our scale and reach

in the fitness community to expand the opportunities for our newly-acquired sports surfaces

division;

|

|

|

|

|

|

|

●

|

Develop

strategic alliances; and

|

|

|

|

|

|

|

●

|

Acquiring

other fitness related products to leverage our asset base, manufacturing infrastructure, market presence, and experienced

personnel.

|

Our

ability to continue as a going concern is dependent on our ability to raise additional capital and ultimately to achieve profitable

operations. In order to implement our strategy we will require $720,000 in additional capital.

GHS

Investment Agreement

This Prospectus relates to the resale of up

to 8,732,067 shares of our common stock by GHS pursuant to a Put Notice(s) under the Investment Agreement. GHS will obtain

our common stock pursuant to the Investment Agreement entered into by GHS and us, dated August 12, 2016.

Although we are not mandated to sell

shares under the Investment Agreement, the Investment Agreement gives us the option to sell to GHS, up to $5,000,000 worth of

our common stock, par value $0.0001 per share (“Shares”), over the period following effectiveness of the

registration of which this Prospectus forms a part (the “Effective Date”) and ending thirty-six (36) months after

the Effective Date. Under the terms of the Investment Agreement, we have the right to deliver from time to time a Put Notice

to GHS stating the dollar amount of Put Shares (up to $500,000 under any individual Put Notice)(the “Put Amount”)

that we intend to sell to GHS with the price per share based on the following formula: the lesser of (a) the lowest sale

price for the Common Stock on the date of the Put Notice (the “Put Notice Date”); or (b) the arithmetic average

of the three (3) lowest trading prices for the Company’s Common Stock during the five trading days following the Put

Notice Date. The maximum number of shares that can be put to GHS is two times the average daily trading volume during the ten

trading days prior to the closing of a put (the “Closing Date”). The minimum amount of by Put is $5,000.

If the amount of the tranche of our outstanding shares exceeds the volume limitation, additional tranches will be delivered

until the entire Purchase Amount is delivered. Each tranche, including the initial tranche, will trigger a new purchase

price, and will be priced according to the purchase price definition. At the date of filing, we may not obtain the full

$5,000,000 in funding based on the 8,732,067 shares being registered under this Registration Statement if the price of

our common stock does not increase (and stay above) to $0.57 , an increase of approximately 814% from the $0.07

market price on March 17 , 2017. The $5,000,000 was stated as the total amount of available funding in the Investment

Agreement because this was the maximum amount that GHS agreed to offer us in funding. There is no assurance that the market

price of our common stock will increase in the future. Based on our stock price as of March 17 , 2017, the registration

statement covers the offer and possible sale under put notices of approximately $611,200 worth of our shares at a low

sale price of $0.07 .

In

addition, there is an ownership limit for GHS of 9.99% of our outstanding shares.

On

any Closing Date, we shall deliver to GHS the number of shares of the Common Stock registered in the name of GHS as specified

in the Put Notice. In addition, we must deliver the other required documents, instruments and writings required. GHS is not required

to purchase the shares unless:

|

|

●

|

Our

Registration Statement with respect to the resale of the shares of Common Stock delivered in connection with the applicable

Put shall have been declared effective.

|

|

|

|

|

|

|

●

|

at

all times during the period beginning on the date of the Put Notice and ending on the date of the related closing, our common

stock has been listed on the Principal Market as defined in the Investment Agreement (which includes, among others, the OTC

Market: QB Tier) and shall not have been suspended from trading thereon.

|

|

|

|

|

|

|

●

|

we

have complied with its obligations and is otherwise not in breach of or in default under the Investment Agreement, the Registration

Rights Agreement or any other agreement executed in connection therewith;

|

|

|

|

|

|

|

●

|

no

injunction has been issued and remains in force, and no action has been commenced by a governmental authority which has not

been stayed or abandoned, prohibiting the purchase or the issuance of the Put Shares; and

|

|

|

|

|

|

|

●

|

the

issuance of the Put Shares will not violate any shareholder approval requirements of the market or exchange on which our common

stock is principally listed.

|

GHS will not engage in any “short-sale” (as defined in Rule 200 of Regulation SHO) of our common

stock at any time during this Agreement. Pursuant to the Investment Agreement with GHS, we agreed to pay a fee equaling $250,000

or 5% of the Commitment Amount (the “Commitment Fee”) which shall be paid in installments of Fifty Thousand ($50,000)

beginning on the earlier of (i) the Effective Date of this Registration Statement and (ii) February 1, 2017 and, the first Trading

Day of each January, April, July and October thereafter until fully paid. Each installment of the Commitment Fee shall be paid

either in cash or, at the election of the Company, in shares of Common Stock, which shall be deemed a put under the Investment

Agreement. On August 12 2016, we entered into a Registration Rights Agreement with GHS requiring, among other things that we prepare

and file with the SEC a Registration Statement on Form S-1 covering the resale of the shares issuable to GHS under the Investment

Agreement. As per the Investment Agreement, GHS’ obligations are not assignable.

PIMCO

Warrant

On

June 12, 2014, Throwdown Industries Holdings, LLC issued a warrant to purchase 10% of its equity at an exercise price of $1.5

million to PIMCO in consideration of the issuance of the delayed draw note payable to PIMCO in June 2014. The issuance was exempt

under Section 4(a)(2) and/or Rule 506 of the Securities Act of 1933, as amended. We assumed all obligations under this warrant

on November 26, 2014 and on November 26, 2014, we issued PIMCO a new warrant to purchase 10% of our equity at an exercise price

of $1.5 million in exchange for the warrant originally issued by Throwdown Industries Holdings, LLC, which warrant was cancelled.

Standard piggyback registration rights were provided under the warrant.

On December 16, 2016

we entered into an Amended and Restated Note Purchase Agreement (the “PIMCO Amendment”) with PIMCO Funds: Private Account

Portfolio Series: PIMCO High Yield Portfolio (“PIMCO”) pursuant to which we issued a $3.5 million 9% Senior Secured

Fixed Rate Note due July 12, 2020 (the “Note”). The Note refinanced our prior 14% Senior Secured Note in the principal

amount of $2.5 million (the “Prior Note”), providing us with an additional $1 million in working capital. As with the

Prior Note, the Note is secured by a lien on substantially all of our assets (other than those sold pursuant to our factoring agreement

with Crown Financial).

In connection with the PIMCO Amendment, (i)

PIMCO converted $278,689 in accrued and unpaid interest into 1,990,639 shares of our common stock. In addition we had previously

issued PIMCO a warrant to purchase ten percent of our equity at an exercise price of $1.5 million. We amended the terms of the

common stock purchase warrant previously issued to PIMCO to reduce the exercise price thereof to $350,000 to reflect the market

capitalization of the Company as of the date of the Amendment.

This

Prospectus relates to the resale of up to 3,783,895 shares of our common stock by PIMCO upon exercise of the warrant held

by them described above (which takes into account the shares of common stock issuable to GHS under their Investment Agreement

being registered hereunder).

Kodiak

Equity Purchase Agreement

This Prospectus relates to the resale of 1,250,000

shares of our common stock by Kodiak that were pursuant to a Put Notice(s) under an Equity Purchase Agreement (the “Kodiak

Agreement”) entered into by Kodiak and us, dated December 17, 2014.

Summary

of Financial Information

The

following summary of financial information for the periods stated summarizes certain information from our financial statements

included elsewhere in this Prospectus. You should read this information in conjunction with Management’s Discussion and

Analysis and Results of Operations, the financial statements and the related notes thereto included elsewhere in this Prospectus.

|

|

|

Years

Ended

June 30,

|

|

|

Six

Month Ended

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2016

|

|

|

2015

|

|

|

Revenues

|

|

$

|

2,357,760

|

|

|

$

|

2,039,239

|

|

|

$

|

1,394,192

|

|

|

$

|

1,147,931

|

|

|

Cost of Revenues

|

|

$

|

1,326,036

|

|

|

$

|

1,418,495

|

|

|

$

|

854,937

|

|

|

$

|

645,331

|

|

|

Operating Expenses

|

|

$

|

2,245,253

|

|

|

$

|

1,847,320

|

|

|

$

|

1,063,220

|

|

|

$

|

1,021,701

|

|

|

Other Income (Expenses)

|

|

$

|

(569,237

|

)

|

|

$

|

(367,219

|

)

|

|

$

|

(528,723

|

)

|

|

$

|

(258,556

|

)

|

|

Net Income (Loss)

|

|

$

|

(1,782,766

|

)

|

|

$

|

(1,593,795

|

)

|

|

$

|

(1,052,688

|

)

|

|

$

|

(777,657

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

663,492

|

|

|

$

|

843,739

|

|

|

$

|

1,260,132

|

|

|

|

|

|

|

Total Liabilities

|

|

$

|

3,742,385

|

|

|

$

|

2,534,749

|

|

|

$

|

4,508,425

|

|

|

|

|

|

|

Accumulated deficit

|

|

$

|

(7,793,257

|

)

|

|

$

|

(6,010,491

|

)

|

|

$

|

(8,845,945

|

)

|

|

|

|

|

|

Stockholders' Deficit

|

|

$

|

(3,078,893

|

)

|

|

$

|

(1,691,010

|

)

|

|

$

|

(3,248,293

|

)

|

|

|

|

|

RISK

FACTORS

The

following is a summary of the risk factors that we believe are most relevant to our business. You should understand that it is

not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion

of all potential risks or uncertainties. We undertake no obligation to publicly update forward-looking statements, whether as

a result of new information, future events, or otherwise.

RISK

FACTORS RELATED TO THE OFFERING

Existing

stockholders may experience significant dilution from the sale of our common stock pursuant to the GHS Investment Agreement.

The

sale of our common stock to GHS in accordance with the Investment Agreement may have a dilutive impact on our stockholders. As

a result, our net income per share could decrease in future periods and the market price of our common stock could decline. In

addition, the lower our stock price is at the time we exercise our put options, the more shares of our common stock we will have

to issue to GHS in order to exercise a put under the Investment Agreement. If our stock price decreases, then our existing stockholders

would experience greater dilution for any given dollar amount raised through the Offering.

The

perceived risk of dilution may cause our stockholders to sell their shares, which may cause a decline in the price of our common

stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors

to engage in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling

could further contribute to progressive price declines in our common stock.

The

issuance of shares pursuant to the GHS Investment Agreement may have a significant dilutive effect.

Depending

on the number of shares we issue pursuant to the Investment Agreement, it could have a significant dilutive effect upon our existing

stockholders. Although the number of shares that we may issue pursuant to the Investment Agreement will vary based on our stock

price (the higher our stock price, the less shares we have to issue) the information set out below indicates the potential dilutive

effect to our stockholders, based on different potential future stock prices, if the full amount of the Purchase Agreement is

realized.

Dilution based upon common stock put to GHS

and the stock price discounted to GHS purchase price equal to the lower of the (a) lowest trading price on the date of the Put

Notice and (ii) the average of the three lowest trades during the five days following the Put Notice. The example below illustrates

dilution based upon a $0.07 market price (on March 17 , 2017 and other increased/decreased prices (without regard

to GHS’ 9.99% ownership limit):

$5,000,000

Put

|

Stock Price

|

|

|

Shares Issued

|

|

|

Percentage

of Outstanding

Shares (1)

|

|

|

$

|

0.1225+75

|

%

|

|

|

40,816,327

|

|

|

|

58.4

|

%

|

|

$

|

0.105+50

|

%

|

|

|

47,619,048

|

|

|

|

62.1

|

%

|

|

$

|

0.0875+25

|

%

|

|

|

57,142,857

|

|

|

|

66.3

|

%

|

|

$

|

0.07

|

|

|

|

71,428,571

|

|

|

|

71.0

|

%

|

|

$

|

0.0525-25

|

%

|

|

|

95,238,095

|

|

|

|

62.5

|

%

|

|

$

|

0.035-50

|

%

|

|

|

142,857,143

|

|

|

|

83.1

|

%

|

|

$

|

0.0175-75

|

%

|

|

|

285,714,286

|

|

|

|

90.8

|

%

|

|

|

(1)

|

Based on 29,106,890 shares

outstanding as of March 17 , 2017.

|

GHS

has entered into similar agreements with other public companies and may not have sufficient capital to meet our put notices.

GHS

has entered into similar investment agreements with other public companies, and some of those companies have filed registration

statements with the intent of registering shares to be sold to GHS pursuant to such investment agreements. We do not know if management

at any of the companies who have or will have effective registration statements intend to raise funds now or in the future, what

the size or frequency of each put request would be, if floors will be used to restrict the number of shares sold, or if the investment

agreement will ultimately be cancelled or expire before the entire number of shares are put to GHS. Since we do not have any control

over the requests of these other companies, if GHS receives significant requests, it may not have the financial ability to meet

our requests. If so, the amount of available funds may be significantly less than we anticipate.

We are registering an aggregate of 8,732,067

shares of common stock to be issued under the GHS Investment Agreement. The sale of such shares could depress the market price

of our common stock.

We are registering an aggregate of 8,732,067

shares of common stock under the registration statement of which this Prospectus forms a part for issuance pursuant to the

GHS Investment Agreement. The sale of these shares into the public market by GHS could depress the market price of our common

stock.

We

May Not Have Access to the Full Amount under the Investment Agreement.

The lowest trading price of our common stock

was $0.07 on March 17 , 2017. There is no assurance that the market price of our common stock will increase from

its current level (and stay above) $0.57 , which is the price required for us to obtain the full $5 million under our agreement

with GHS based on the 8,732,067 shares being registered. The entire commitment under the Investment Agreement is for $5,000,000.

Therefore, we may not have access to the remaining commitment under the Investment Agreement under this Registration Statement

if the share price of our common stock does not increase by approximately 814% from the lowest sale price on March

17 , 2017.

Since

our common stock is thinly traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell

your shares at or above the price paid.

Since

our common stock is thinly traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations

in response to various factors, many of which are beyond our control, including (but not necessarily limited to):

|

|

●

|

the

trading volume of our shares;

|

|

|

|

|

|

|

●

|

the

number of securities analysts, market-makers and brokers following our common stock;

|

|

|

|

|

|

|

●

|

changes

in, or failure to achieve, financial estimates by securities analysts;

|

|

|

|

|

|

|

●

|

new

products or services introduced or announced by us or our competitors;

|

|

|

|

|

|

|

●

|

actual

or anticipated variations in quarterly operating results;

|

|

|

|

|

|

|

●

|

conditions

or trends in our business industries;

|

|

|

|

|

|

|

●

|

announcements

by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

|

|

|

|

●

|

additions

or departures of key personnel;

|

|

|

|

|

|

|

●

|

sales

of our common stock and

|

|

|

|

|

|

|

●

|

general

stock market price and volume fluctuations of publicly-traded, and particularly microcap, companies.

|

Investors

may have difficulty reselling shares of our common stock, either at or above the price they paid for our stock, or even at fair

market value. The stock markets often experience significant price and volume changes that are not related to the operating performance

of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad

market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition,

there is a history of securities class action litigation following periods of volatility in the market price of a company’s

securities. Although there is no such litigation currently pending or threatened against the Company, such a suit against us could

result in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and

resources from our business. Moreover, and as noted below, our shares are currently quoted on the OTC Link (OTC.QB tier) and,

further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to

manipulation by market-makers, short-sellers and option traders.

RISKS

RELATED TO OUR BUSINESS

Expanding

our brand into new categories or territories may be difficult and expensive, and if we are unable to successfully expand into

these categories or territories as expected, our brand may be adversely affected, and we may not achieve our planned sales growth.

Our

growth strategy includes the expansion of our brand into new categories or territories, including the fitness, training, and exercise

industry. Products that we or our licensees introduce in these new markets may not be successful with the consumers we target.

Our brand may also fall out of favor with our current customer base as we expand our products into new markets. In addition, if

we, or our licensees, are unable to anticipate, identify or react appropriately to evolving consumer preferences, our sporting

goods equipment sales and license revenues may not grow as fast as we plan or may decline and our brand image may suffer.

Achieving

market acceptance for new products will likely require us to exert substantial product development and marketing efforts, which

could result in a material increase in selling, general and administrative expenses, both in absolute dollars and as a percentage

of revenue. There can be no assurance that we will have the resources necessary to undertake these efforts or that these efforts

will sufficiently increase our sporting goods equipment sales and license revenues. Material increases in our selling, general

and administrative expenses could adversely impact our results of operations.

Our

products face intense competition.

XFIT is a fitness products and sports surfaces

company and the relative popularity of various sports and fitness activities and changing design trends affect the demand for

our products. The fitness and sports surfaces industries are highly competitive in the United States and on a worldwide basis.

We compete with a significant number of other product, equipment, surfaces and apparel suppliers to the fitness industry, many

of whom have:

|

|

●

|

significantly

greater financial resources than us;

|

|

|

|

|

|

|

●

|

more

comprehensive product lines;

|

|

|

|

|

|

|

●

|

longer-standing

relationships with suppliers, manufacturers and retailers;

|

|

|

|

|

|

|

●

|

broader

distribution capabilities;

|

|

|

|

|

|

|

●

|

stronger

brand recognition and loyalty than we have, and

|

|

|

|

|

|

|

●

|

the

ability to invest substantially more on product advertising and sales.

|

Our

competitors’ greater capabilities in the above areas may enable them to better differentiate their products from ours, gain

stronger brand loyalty, withstand periodic downturns in the apparel and fitness equipment and product industries, compete more

effectively on the basis of price and production, and more quickly develop new products.

Failure

to maintain our reputation and brand image could negatively impact our business.

Our

brand has international recognition, and our success depends on our ability to maintain and enhance our brand image and reputation.

We could be adversely impacted if our brand is tarnished or receives negative publicity. In addition, adverse publicity about

regulatory or legal action against us could damage our reputation and brand image, undermine consumer confidence in us, and reduce

long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

In

addition, our success in maintaining, extending, and expanding our brand image depends on our ability to adapt to a rapidly changing

media environment, including our increasing reliance on social media and online dissemination of advertising campaigns. Negative

posts or comments about us on social networking websites could seriously damage our reputation and brand image. If we do not maintain,

extend, and expand our brand image, then our product sales, financial condition, or results of operations could be materially

and adversely affected.

Failure

to obtain high quality endorsers of our products could harm our business.

We

establish relationships with professional athletes and sports leagues and associations to develop, evaluate, and promote our products,

as well as establish product authenticity with consumers. If certain endorsers were to stop using our products, our business could

be adversely affected. In addition, actions taken by either the athletes or the sports leagues and associations associated with

our products that harm the reputations of those athletes, could also seriously harm our brand image with consumers and, as a result,

could have an adverse effect on our sales and financial condition. In addition, poor performance by our endorsers, a failure to

continue to correctly identify promising athletes or sports leagues and associations to use and endorse our products, or a failure

to enter into cost-effective endorsement arrangements with prominent athletes could adversely affect our brand, sales, and profitability.

Failure

of our licensing partners to preserve the value of our licenses could have a material adverse effect on our business.

The

risks associated with our own products also apply to our licensed products in addition to any number of possible risks specific

to a licensing partner’s business, including, for example, risks associated with a particular licensing partner’s

ability to do the following:

|

|

●

|

obtain

capital;

|

|

|

|

|

|

|

●

|

manage

its labor relations;

|

|

|

|

|

|

|

●

|

maintain

relationships with its suppliers;

|

|

|

|

|

|

|

●

|

maintain

the quality and marketability of products bearing our trademarks;

|

|

|

|

|

|

|

●

|

manage

its credit risk effectively;

|

|

|

|

|

|

|

●

|

meet

its financial obligations to us; and

|

|

|

|

|

|

|

●

|

maintain

relationships with its customers.

|

The

failure of our licensing partners to successfully operate their businesses or to perform in a manner consistent with our desired

business practices could result in a decrease in our revenues generated from sales of our licensed products and the loss of goodwill

which could impact our financial results and cause a material adverse effect on our business.

Third

parties may claim that we are infringing their intellectual property rights, and these claims may be costly to defend, may require

us to pay licensing fees, damages, or other amounts, and may prevent, or otherwise impose limitations on the manufacture, distribution

or sale of our products.

From

time to time, third parties may claim that we are infringing on their intellectual property rights, and we may be found to infringe

those intellectual property rights. While we do not believe that any of our products infringe the valid intellectual property

rights of third parties, we may be unaware of the intellectual property rights of others that may cover some of our current or

planned new products. If we are forced to defend against third party claims, whether or not the claims are resolved in our favor,

we could encounter expensive and time consuming litigation which could divert our management and key personnel from business operations.

If we are found to be infringing on the intellectual property rights of others, we may be required to pay damages or ongoing royalty

payments, or comply with other unfavorable terms. Additionally, if we are found to be infringing on the intellectual property

rights of others, we may not be able to obtain license agreements on terms acceptable to us, and this may prevent us from manufacturing,

marketing or selling our products. Thus, these third party claims may significantly reduce the sales of our products or increase

our cost of goods sold. Any reductions in sales or cost increases could be significant, and could have a material and adverse

effect on our business.

Our

business is affected by seasonality, which could result in fluctuations in our operating results.

We

experience moderate fluctuations in aggregate sales volume during the year. Historically, revenues in the first and fourth calendar

quarters have slightly exceeded those in the second and third calendar quarters. However, the mix of product sales may vary considerably

from time to time as a result of changes in seasonal and geographic demand for particular types of apparel and equipment. In addition,

our customers may cancel orders, change delivery schedules, or change the mix of products ordered with minimal notice. As a result,

we may not be able to accurately predict our quarterly sales. Accordingly, our results of operations are likely to fluctuate significantly

from period to period. This seasonality, along with other factors that are beyond our control, including general economic conditions,

changes in consumer preferences, weather conditions, availability of import quotas, and currency exchange rate fluctuations, could

adversely affect our business and cause our results of operations to fluctuate. Our operating margins are also sensitive to a

number of additional factors that are beyond our control, including manufacturing and transportation costs, shifts in product

sales mix, and geographic sales trends, all of which we expect to continue. Results of operations in any period should not be

considered indicative of the results to be expected for any future period.

Failure

to adequately protect or enforce our intellectual property rights could adversely affect our business.

We

utilize trademarks on nearly all of our products and believe that having distinctive marks that are readily identifiable is an

important factor in creating a market for our goods, in identifying us, and in distinguishing our goods from the goods of others.

We consider our XFit Brands

®

, Throwdown

®

, and Transformations™ trademarks to be among our

most valuable intangible assets. Throwdown

®

, for example is registered in thirty-nine (39) countries.

We

believe that our trademarks, trade secrets, and other intellectual property rights are important to our brand, our success, and

our competitive position. In the future, we may encounter counterfeit reproductions of our products or that otherwise infringe

on our intellectual property rights. If we are unsuccessful in challenging a party’s products on the basis of trade secret

misappropriation or trademark, or other intellectual property infringement, continued sales of these products could adversely

affect our sales and our brand and result in the shift of consumer preference away from our products.

The

actions we take to establish and protect trademarks, and other intellectual property rights may not be adequate to prevent imitation

of our products by others or to prevent others from seeking to block sales of our products as violations of proprietary rights.

We

take various actions to prevent confidential information from unauthorized use and/or disclosure. Such actions include contractual

measures such as entering into non-disclosure agreements. Our controls and efforts to prevent unauthorized use and/or disclosure

of confidential information might not always be effective.

In

addition, the laws of certain foreign countries may not protect or allow enforcement of intellectual property rights to the same

extent as the laws of the United States. We may face significant expenses and liability in connection with the protection of our

intellectual property rights outside the United States, and if we are unable to successfully protect our rights or resolve intellectual

property conflicts with others, our business or financial condition may be adversely affected.

Potential

liability exposure in our equipment business may have a material adverse effect on the consumer demand for our products.

Our

equipment is exposed to an inherent risk of potential product liability claims as MMA, boxing, and fitness training are high-risk

activities that involves physical contact. A judgment against us due to an alleged failure or defects of our equipment could lead

to substantial damage awards. We currently maintain product liability and excess liability insurance with maximum coverage of

one million dollars ($1,000,000) and one million dollars ($1,000,000), respectively, for each occurrence. If a successful claim

is brought against us in excess of, or outside of, our insurance coverage, it could have a material adverse effect on our business,

results of operations, or financial condition. Although we invest resources in research and development and every attempt is made

to ensure the safety of our products, claims against us may arise and, regardless of their merit or eventual outcome, these claims

may have a material adverse effect on the consumer demand for our products.

Our

Success Depends on Attracting and Retaining Qualified Personnel and subcontractors in a Competitive Environment.

The

success of our business is dependent on our ability to attract, develop and retain qualified personnel advisors and subcontractors.

Changes in general or local economic conditions and the resulting impact on the labor market may make it difficult to attract

or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation

packages, high-quality training programs and attractive work environments or to establish and maintain successful partnerships,

our ability to profitably execute our work could be adversely impacted.

Accounting

for Our Revenues and Costs Involves Significant Estimates.

Accounting

for our contract-related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates

and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions

and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could

result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial

position and results of operations.

Our

Contract Backlog is Subject to Unexpected Adjustments and Cancellations and Could be an Uncertain Indicator of Our Future Earnings.

We

cannot guarantee that the revenues projected in our sports surfaces contract backlog will be realized or, if realized, will be

profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions

or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects.

The

Company’s Business May Be Subject to the Effects of Adverse Publicity and Negative Public Perception Related to Synthetic

Turf Products.

Negative

public perception regarding our industry resulting from, among other things, concerns raised by advocacy groups or the public

in general about synthetic turf fields and the potential impact on human health related to certain chemical compounds found in

the infill of such fields may negatively impact the sales of synthetic turf products. Despite not using any toxic or known harmful

materials in our products, there can be no assurance that the Company will not be subject to adverse publicity or negative public

perception surrounding the impact on human health of synthetic turf and related products in the future or that such negative public

perception would not have an adverse or material negative impact on its financial position, results of operations or cash flows.

If

We Are Unable to Obtain Raw Materials in a Timely Manner or if the Price of Raw Materials Increases Significantly, Production

Time and Product Costs Could Increase, Which May Adversely Affect Our Business.

Synthetic

turf made to our specifications can be purchased from a variety of manufacturers, there are several sources of all of our infill

products and two manufacturers from which we can purchase expanded polypropylene shock and drainage pads. We do not anticipate

any supply issues due to the fact that the raw materials to develop these products are readily available and currently not scarce.

We do not have any exclusive supplier contracts for our products. We buy our pad, infill components and turf from manufacturers

at the best price we can negotiate based on volume discounts but if the prices of the raw materials necessary to make these products,

including the yarn, backing and infill in our products, rise significantly, we may be unable to pass on the increased cost to

our customers. Our results of operations could be adversely affected if we are unable to obtain adequate supplies of raw materials

in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet

our specifications, resulting in potential delays or declines in output. Furthermore, problems with our raw materials may give

rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty

claims. Errors or defects may arise from raw materials supplied by third parties that are beyond our detection or control, which

could lead to additional customer returns or product warranty claims that may adversely affect our business and results of operations.

Failure

to Maintain Safe Work Sites Could Result in Significant Losses.

Construction

and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized

equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible

for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we

implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation.

Our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and

could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

An

Inability to Obtain Bonding Could Have a Negative Impact on Our Operations and Results.

We

may be required to provide surety bonds securing our performance for some of our public and private sector contracts. Our inability

to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which

could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

Failure

of Our Subcontractors to Perform as Anticipated Could Have a Negative Impact on Our Results.

We

subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful

completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining

those bonds or guarantees from our higher-risk subcontractors. In this case we may be responsible for the failures on the part

of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In

addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for

that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity.

We

are subject to data security and privacy risks that could negatively affect our results, operations or reputation.

Hackers

and data thieves are increasingly sophisticated and operate large-scale and complex automated attacks. Any breach of our network

may result in the loss of valuable business data, misappropriation of our consumers’ or employees’ personal information,

or a disruption of our business, which could give rise to unwanted media attention, materially damage our customer relationships

and reputation, and result in lost sales, fines, or lawsuits.

Failure

of our contractors or our licensees’ contractors to comply with local laws, and other standards could harm our business.

We

work with third party contractors to manufacture our products, and we also have license agreements that permit unaffiliated parties

to manufacture or contract for the manufacture of products using our intellectual property. From time to time, the contractors

that manufacture our products and our licensees that make products using our intellectual property may not comply with applicable

environmental, health, or safety standards for the benefit of workers, or other applicable local laws, or our licensees may fail

to enforce such standards or applicable local law on their contractors. Significant or continuing noncompliance with such standards

and laws by one or more contractors could harm our reputation or result in a product recall and, as a result, could have an adverse

effect on our sales and financial condition.

We

rely on third party contract manufacturers.

Our

equipment and apparel are supplied by approximately nine (9) factories located in three (3) countries. We do not own or operate

any of our own manufacturing facilities and depend upon independent contract manufacturers to manufacture all of the products

we sell. Our ability to meet our customers’ needs depends on our ability to maintain a steady supply of products from our

independent contract manufacturers. If one or more of our suppliers were to close or sever their relationship with us or significantly

alter the terms of our relationship, we may not be able to obtain replacement products in a timely manner, which could have a