3i Infrastructure PLC Sale of UK projects portfolio (0500W)

06 December 2019 - 9:30PM

UK Regulatory

TIDM3IN

RNS Number : 0500W

3i Infrastructure PLC

06 December 2019

3i Infrastructure plc agrees to sell its UK projects

portfolio

6 DECEMBER 2019

Following a strategic review of its projects portfolio, 3i

Infrastructure plc ("3i Infrastructure" or the "Company") announces

that it has agreed to sell the UK assets in the portfolio (the "UK

Projects") to various buyers including funds managed by Dalmore,

Semperian and Innisfree. Proceeds to 3i Infrastructure will be c.

GBP194m. Completion is expected to take place before the end of the

financial year.

The strategic review followed the completion of the construction

phase for all projects in the portfolio. The UK Projects being sold

comprise stakes in Ayrshire College, Elgin (a vehicle holding 16

project investments), Mersey Gateway Bridge, Octagon Hospital, the

West of Duddon Sands offshore transmission owner project, as well

as an interest in the Dalmore Capital Fund. Separately, the Company

is also exploring the potential sale of the European assets in its

projects portfolio. The remainder of the Company's portfolio would

then consist entirely of investments in economic infrastructure

businesses.

Richard Laing, Chair of 3i Infrastructure, commented: "Our

review of the role of operational projects in our portfolio

concluded that it was in the best interests of shareholders to sell

these assets and realise the value uplift now that they have all

entered stable operations. We consider that the prices achieved are

attractive."

Phil White, Managing Partner and Head of Infrastructure, 3i

Investments plc, Investment Manager of the Company, added: "Holding

these assets at the sales price achieved would be dilutive to the

Company's returns and although the UK Projects provide good income,

strong growth in income from our economic infrastructure portfolio

underpins confidence that we will continue to deliver our

progressive dividend objective."

-ENDS-

For further information, contact:

Thomas Fodor

Investor enquiries Tel: +44 207 975 3469

Email: thomas.fodor@3i.com

Kathryn van der Kroft

Media enquiries Tel: +44 20 7975 3021

Email: kathryn.vanderkroft@3i.com

Notes to editors:

3i Infrastructure plc

3i Infrastructure plc is a Jersey-incorporated, closed-ended

investment company, an approved UK Investment Trust, listed on the

London Stock Exchange and regulated by the Jersey Financial

Services Commission. The Company's purpose is to deliver a

long-term sustainable return to shareholders from investing in

infrastructure.

3i Investments plc, a wholly-owned subsidiary of 3i Group plc,

is authorised and regulated in the UK by the Financial Conduct

Authority and acts as Investment Manager to 3i Infrastructure

plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBGBDDLDGBGCL

(END) Dow Jones Newswires

December 06, 2019 05:30 ET (10:30 GMT)

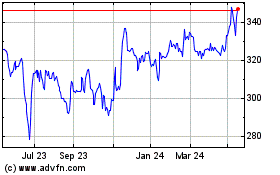

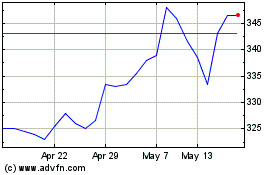

3i Infrastructure (LSE:3IN)

Historical Stock Chart

From Apr 2024 to May 2024

3i Infrastructure (LSE:3IN)

Historical Stock Chart

From May 2023 to May 2024