TIDMALBA

RNS Number : 7993M

Alba Mineral Resources PLC

21 July 2014

ALBA MINERAL RESOURCES PLC

HALF-YEARLY UNAUDITED RESULTS

FOR THE SIX MONTHS ENDED 31 MAY 2014

CHAIRMAN'S STATEMENT

Introduction

Alba Mineral Resources plc ("Alba" or the "Company" and

collectively with its subsidiary companies "the Group") holds

mineral properties and projects in Mauritania (uranium) and Ireland

(base-metals).

Results for the Period

The Group made a loss attributable to equity holders of the

parent for the period, after taxation, of GBP64,648. The basic and

diluted loss per share was 0.02 pence.

Review of Activities

Ireland

After the period end, Teck Ireland Limited ("Teck") gave notice

of its withdrawal from the exploration option and joint venture

agreement ("JV") with Alba.

The Board believes there is merit in retaining the licence even

though the JV has been dissolved and at this time the licence is in

good standing.

Mauritania

The Group holds one exploration permit, No 1328, in northern

Mauritania for uranium and radioactive materials. The permit covers

an area of 545 km(2) and lies within the eastern half of a former

permit where we had previously announced several uranium anomalies.

The Board continues to review exploration models on the permit area

and is considering its options with regards to funding the next

stage of exploration.

Fund Raising

On 4 March 2014 the Group successfully completed a fund raising

of GBP230,718 (before expenses) through the subscription of

92,287,300 ordinary shares at a subscription price of 0.25 pence

per share. These funds will be used to provide working capital,

develop the Group's asset portfolio and investigate further

opportunities. The Company also created and issued new warrants to

subscribe for 66,143,650 ordinary shares. The new warrants are

exercisable at a price of 0.3 pence per share at any time between

(i) the date falling 12 months from 27 March 2014 and (ii) the date

falling 7 years after admission of the trading of the shares on

AIM.

On 29 May 2014 Group raised a further GBP60,000 through the

subscription of 24,000,000 new ordinary shares at a price of 0.25

pence per ordinary share. The Company also created and issued new

warrants to subscribe for 12,000,000 ordinary shares. The new

warrants are exercisable at a price of 0.3 pence per share at any

time between (i) the date falling 12 months from 28 May 2014 and

(ii) the date falling 7 years after admission of the trading of the

shares on AIM.

Post Period End

After the period end the Company announced that it has signed a

binding Heads of Agreement with Horse Hill Developments Ltd

("HHDL") for Alba to invest in a UK onshore oil and gas project.

The Horse Hill-1 well, which is scheduled to be completed by the

end of August 2014, is planned to test several conventional stacked

oil and gas targets in the proven productive Portland Sandstone,

Corallian Sandstone and Great Oolite Limestone levels in the

well-defined Horse Hill prospect in the Weald Basin situated in

Surrey, England.

Alba has a binding agreement in place to acquire a 5% interest

in HHDL, a special purpose company, which has the right to acquire

a 65% participating interest and operatorship of Petroleum

Exploration and Development Licence No. 137 ("PEDL 137"). The total

consideration payable by the Company is GBP300,000. An initial

non-refundable deposit of GBP10,000 is payable upon signing, with

completion subject to the execution of definitive documentation

which the parties are in the process of finalising. Upon

completion, Alba will make a further payment of GBP40,000, with the

balance of GBP250,000 payable in line with the cash calls required

for the drilling of the well.

The 99.29 square kilometres (24,535 acre) PEDL 137 licence, held

by a subsidiary of Magellan Petroleum Corporation, is located in

the Weald Basin in Surrey. The Horse Hill prospect lies about 3

kilometres from Gatwick Airport and covers an area of up to 16

square kilometres in the south-west of PEDL 137. The Collendean

Farm-1 well was drilled by Esso in 1964 on the north-eastern edge

of the Horse Hill structure and found good oil shows.

The participants in the Horse Hill-1 well are HHDL as operator

with a 65% farm in interest and Magellan Petroleum Corporation with

a 35% interest. HHDL has the right to earn the 65% participating

interest in PEDL 137 by completing the proposed well at the

property.

Site construction and preparatory operations have now commenced

on the Horse Hill site, in preparation for the drilling of the

proposed 2,594 metre (8,512 feet) Horse Hill-1 well. The well is

targeting a number of conventional stacked oil and gas targets.

Outlook

The fresh injection of capital now gives us the opportunity to

develop and enhance the Group's project portfolio.

George Frangeskides

21 July 2014

Chairman

For further information please visit the Company's website,

www.albamineralresources.com or contact:

Alba Mineral Resources plc George Frangeskides, Chairman Tel: +44 (0) 20 7907 9328

Mike Nott, CEO

Northland Capital Partners Ltd Matthew Johnson Tel: +44 (0) 20 7382 1100

Gavin Burnell

UNAUDITED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2014

Unaudited Unaudited Audited

6 mths ended 6 mths ended Year ended

31 May 2014 31 May 2013 30 Nov 2013

GBP GBP GBP

Revenue - - -

Cost of sales - - -

------------ ------------ -----------

Gross profit - - -

Administrative expenses (65,826) (25,762) (85,023)

Exceptional items - - 592,688

------------------------------------------------- ------------ ------------ -----------

Administrative expenses (65,826) (25,762) 507,665

------------ ------------ -----------

Operating (loss)/profit (65,826) (25,762) 507,665

Finance costs (9) (8,232) (8,232)

------------ ------------ -----------

(Loss)/profit before taxation (65,835) (33,994) 499,433

Taxation (note 3) - - -

------------ ------------ -----------

(Loss)/profit for the period (65,835) (33,994) 499,433

============ ============ ===========

Attributable to:

Equity holders of the parent (64,648) (33,965) 497,680

Minority interest (1,187) (29) 1,753

------------ ------------ -----------

(Loss)/profit for the period (65,835) (33,994) 499,433

============ ============ ===========

(Loss)/earnings per ordinary 0.1p share (note 5)

- basic and diluted (0.02) pence (0.02) pence 0.31 pence

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2014

Unaudited Unaudited Audited

31 May 2014 31 May 2013 30 Nov 2013

GBP GBP GBP

Non-current assets

Intangible assets - deferred exploration costs 611,646 664,412 605,956

611,646 664,412 605,956

----------- ----------- -----------

Current assets

Trade and other receivables 25,650 100,989 21,300

Cash and cash equivalents 220,794 3,942 216

----------- ----------- -----------

246,444 104,931 21,516

----------- ----------- -----------

Total assets 858,090 769,343 627,472

=========== =========== ===========

Current liabilities

Trade and other payables (62,819) (818,477) (61,164)

Borrowings (251,024) (374,259) (233,823)

Total liabilities (313,843) (1,192,736) (294,987)

=========== =========== ===========

Net assets 544,247 (423,393) 332,485

=========== =========== ===========

Equity

Share capital 1,169,255 989,401 1,052,968

Share premium account 1,429,229 1,138,701 1,268,834

Merger reserve 200,000 200,000 200,000

Other reserve 140,400 110,734 139,485

Profit and loss account (2,422,940) (2,889,937) (2,358,292)

----------- ----------- -----------

Equity attributable to equity holders of the parent 515,944 (451,101) 302,995

Minority interest 28,303 27,708 29,490

Total equity 544,247 (423,393) 332,485

=========== =========== ===========

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2014

Unaudited Unaudited Audited

6 mths ended 6 mths ended Year ended

31 May 2014 31 May 2013 30 Nov 2013

GBP GBP GBP

Net cash (used in)/generated from operating activities (81,651) 8,595 (37,828)

Investing activities

Purchase of intangible assets (5,690) (19,447) (7,518)

Net cash used in investing activities (5,690) (19,447) (7,518)

============ ============ ===========

Financing activities

Proceeds from issue of shares 290,718 18,000 22,000

Funds from/(repayment of) borrowings 17,201 (3,768) 23,000

Net cash generated from financing activities 307,919 14,232 45,000

============ ============ ===========

Net increase/(decrease) in cash and cash equivalents 220,578 3,380 (346)

Cash and cash equivalents at the beginning of the period 216 562 562

Cash and cash equivalents at the end of the period 220,794 3,942 216

============ ============ ===========

Operating (loss)/profit (65,826) (25,762) 507,665

Foreign exchange revaluation adjustment 915 (59,679) (32,139)

(Increase)/decrease in trade and other receivables (4,350) 10,305 2,690

(Decrease)/increase in trade and other payables (12,390) 83,731 (516,044)

Net cash (used in)/generated from operating activities (81,651) 8,595 (37,828)

============ ============ ===========

NOTES TO THE HALF-YEARLY FINANCIAL INFORMATION

1. Basis of preparation

The Group consolidates the financial statements of the Company

and its subsidiary undertakings.

The financial information has been prepared under the historical

cost convention in accordance with International Financial

Reporting Standards (IFRSs). The financial information set out in

this half-yearly report does not constitute statutory accounts as

defined in Section 434 of the Companies Act 2006. The same

accounting policies, presentation and methods of computation are

followed in this interim condensed consolidated report as were

applied in the Group's annual financial statements for the year

ended 30 November 2013. The auditor's report on those financial

statements was unqualified and did not contain any statements under

section 498(2) or section 498(3) of the Companies Act 2006. The

auditor's report for the year ended 30 November 2013 did include

emphasis of matter paragraphs relating to the uncertainty as to

whether the Group can raise sufficient funds to continue to develop

the Group's exploration assets.

2. Going Concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to meet its

current committed expenditure and recurring outgoings for the

foreseeable future, although the funding is not sufficient to

continue to develop the Group's exploration assets, the directors

continue to adopt the going concern basis of accounting in

preparing the financial statements

3. Taxation

No charge for corporation tax for the period has been made due

to the expected tax losses available.

4. Continuation of exploration activities

Notwithstanding the Directors' going concern considerations set

out above, to continue to develop the Group's exploration assets,

with a carrying value of GBP611,646 and support the Company's value

of the investment in subsidiaries supported by those assets, with a

carrying value of GBP1,633,863, the Group is dependent on securing

further funds to continue exploration activities.

If it is not possible to raise sufficient funds, the carrying

value of the exploration assets of the Group and the investment of

the Company in its subsidiaries are likely to be impaired.

5. (Loss)/earnings per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP64,648 (May 2013:

GBP33,965; November 2013: GBP497,680 profit) by the weighted

average number of shares of 260,355,087 (May 2013: 150,558,878;

November 2013: 162,876,894) in issue during the period. The diluted

loss per share calculation is identical to that used for basic loss

per share as the exercise of warrants would have the effect of

reducing the loss per ordinary share and therefore is not dilutive

under the terms of Financial Reporting Standard 22 "Earnings Per

Shares".

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFIADAIIFIS

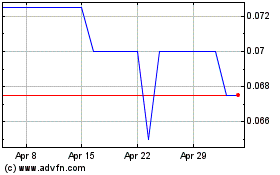

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Jul 2024 to Aug 2024

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Aug 2023 to Aug 2024