Bidstack Group PLC Comment on Azerion Statement (5802R)

02 March 2023 - 4:28AM

UK Regulatory

TIDMBIDS

RNS Number : 5802R

Bidstack Group PLC

01 March 2023

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

1 March 2023

Bidstack Group Plc

("Bidstack" or the "Company" or the "Group")

Comment on Azerion Statement

Bidstack Group Plc (AIM:BIDS), the native in-game activation

platform, notes that Azerion Group N.V. ("Azerion") has recently

published a statement entitled "Response to recent communications

on Bidstack litigation".

Bidstack disagrees with Azerion's interpretation of the

litigation between them in the Dutch courts.

Bidstack believes that Azerion's allegation that "the Court of

Amsterdam ruled broadly in Azerion's favour during a preliminary

hearing" is substantially misleading.

Following the preliminary hearing brought by Azerion in an

attempt to lift an attachment (freezing order) over Azerion's bank

accounts granted to Bidstack by the Dutch courts, the Court held

that Bidstack had claims to which such an attachment could be made

for a net amount of over EUR1.6m relating to invoices issued to

Azerion to the end of October 2022. In accordance with Dutch law

attachments must be lifted where adequate alternative security for

not less than that amount is provided to the party obtaining the

attachments. Azerion subsequently provided such security to

Bidstack in the form of a bank guarantee for that amount and the

attachment has consequently been lifted.

In addition the Court refused Azerion's request to prohibit

Bidstack from making further applications to obtain pre-judgment

attachments over Azerion's bank accounts in respect of Bidstack's

additional claims although, in that event, Bidstack may have to

provide counter-security for costs.

The Court further ruled that each side bear its own costs in

relation to the preliminary hearing.

As stated in the Company's announcement on 13 February 2023, in

the Group's audited accounts for the year ended 31 December 2022,

revenue, gross margin and consequent profit or loss are likely to

be subject to a provision based on the Board's assessment of the

outcome of the Company's case against Azerion.

Bidstack has previously commented on this matter in

announcements on 3 January 2023 and 13 February 2023 and will

publish further updates when appropriate.

-ENDS-

Contacts:

Bidstack Group Plc via SPARK

James Draper, CEO

SPARK Advisory Partners Limited (Nomad)

Mark Brady / Neil Baldwin / James Keeshan +44 (0) 203 368 3550

Stifel Nicolaus Europe Limited (Broker)

Fred Walsh / Tom Marsh +44 (0) 20 7710 7600

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRBRGDXUDGDGXB

(END) Dow Jones Newswires

March 01, 2023 12:28 ET (17:28 GMT)

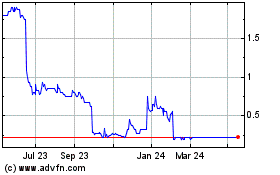

Bidstack (LSE:BIDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

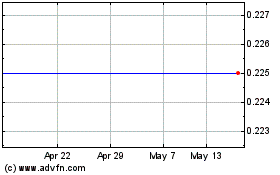

Bidstack (LSE:BIDS)

Historical Stock Chart

From Jan 2024 to Jan 2025