TIDMCAD

Cadogan Petroleum plc

Annual Results for year ended 31 December 2019

The Board of Cadogan Petroleum plc, ("Cadogan" or "the Company"), is pleased to

announce the Company's annual results for the year ended 31 December 2019.

Key Financial Highlights of 2019:

* Loss for the year: $2.1 million (2018: profit of $1.2 million)

* Average realized price: 47.2$/boe (2018: 51.3$/boe)

* Gross revenues[1]: $5.9 million (2018: $14.7 million)

* G&A[2]: $5.7 million (2018: $4.8 million)

* Loss per share: 0.9 cents (2018: profit of 0.5 cents)

* Cash at year end: $12.8 million (2018: $35.2 million)

Key Operational Highlights of 2019:

* Production: 104,816 boe (2018: 91,085 boe), a 15% increase year-on-year

* Gas trading loss of $2.0 million (2018: profit of $0.7 million)

* Services business loss of $0.01 million (2018: profit of $0.06 million),

net of services provided to the group[3]

* No LTI/TRIs'[4]

* ISO 14001 and ISO 45001 certifications validated by annual audit

* Conversion of the Monastyretska exploration license into the Blazhiv

20-year production license

* Blazhiv-10 successful drilling and consequent stable commercial production

Other

Cadogan entered into a 2-year loan agreement (euros 13.385 million) with Proger

Management & Partners Srl with an option to convert it into an indirect 24 %

equity interest in Proger Spa.

Group overview

The Group has continued to maintain exploration and production assets, to

conduct gas trading operations and to operate an oil services business in

Ukraine. Cadogan's assets are concentrated in the West of the country, far away

from the zone of military confrontation with Russia. Gas trading includes the

import of gas from Slovakia, Hungary and Poland and local purchase and sales

with physical delivery of natural gas. The oil services business focuses on

workover operations, civil works services and other services provided to

Exploration and Production ("E&P") companies in Ukraine.

Our business model

We aim to increase value through:

* Maintaining a robust balance sheet, monetizing the remaining value of our

Ukrainian assets and supplementing E&P cash flow with revenues from gas

trading and oil services

* Pursuing farm-out to progress investments in Ukrainian licenses

* Sourcing additional assets to diversify Cadogan's portfolio, both

geographically and operationally

Both gas trading and the services business optimize the use of existing

available resources, such as cash as working capital for trading and equipment

and competences for the services business and continue to contribute to the

Group's goal of being cash neutral, while actively searching for value

accretive opportunities.

Ukraine

West Ukraine

The Group continued to produce oil and gas from its licenses in the West

Ukraine. The average net production in 2019 was 288 boepd, a 15% increase over

the production of the previous year. The additional oil production from the

Monastyretska license more than off-set the loss of gas production from

Debeslavetska and Cheremkhivska fields, which Cadogan exited in January 2019.

In January 2019, the Group finalized the transfer of its participatory interest

in Debeslavetske JAA and Cheremkhivsko-Strupkivske JAA to NJSC Nadra as part of

the 2018 trilateral agreement with Eni and NJSC Nadra on the exit of Eni from

the shale gas project.

All regulatory approvals required to file the application for a 20-year

production license, for the Monastyretska license, were received and the

application was filed on 2 July 2019, well ahead of the license expiry date of

18 November 2019. The company was forced to shut-down its operations and

production at the field for 30-days due to the absence of license award by the

licensing authority of Ukraine post expiry date. The new Blazhiv 20-year oil

production license (formerly Monastyretska exploration area) was issued on 19

December 2019. The Blazhiv-1 and Blazhiv-10 wells are currently in production.

The production at Blazhiv-3 and Blazhiv-3 Monasterets is suspended waiting for

the renewal of the rental agreements.

In 2019, the Bitlyanska license has been advertised for a farm-out partnership,

but the preliminary discussions have not been satisfactory and were ended. The

state subsoil controlling authority has confirmed, during the license audit,

that the Company has fully fulfilled its license obligations. All regulatory

approvals required to file the application for a 20-year exploration and

production license were received and the application was filed on 29 August

2019, well ahead of the license expiry date of 23 December 2019. Required

intermediary approvals including the one of Lviv's Regional Council and

Environmental Impact Assessment have been obtained. The company has been

waiting the State Licensing Authority's award of the application. The Licensing

Authority has delayed the grant of the new license beyond the regular timeline

provided by the regulatory laws. Accordingly, Cadogan has launched a claim

before the Administrative Court to challenge the non-granting of the 20-year

production license by the Licensing Authority.

East Ukraine

The Pirkovska exploration license expired in October 2015. The Company filed an

application in due time, but the Licensing Authority returned it 6 times for

different reasons, the legal ground of which appears to be doubtful. Despite

the efforts of Cadogan and its reply in due time to each of the comments, the

license was not awarded, and the 3-year period for conversion, given to the

applicant by law, expired in October 2018. Cadogan launched a litigation before

Administrative Court against the Licensing Authority for non-granting the

production license.

Subsidiary businesses

Given the collapse in the gas price, which through the heating season had

dipped below the level of the previous summer, unsold gas was kept in storage

for the following heating season. The company has purchased 7.5 million m3 of

gas in the declining price environment towards the end of 2019 to be sold

during the upcoming 2020 trading season.

Finally, the Group continued providing oil services through its wholly owned

subsidiary Astroservice LLC. Substantial resources of the company have been

engaged to support Monastyretska license wells' operations.

Italy

The Group owns a 90% interest in Exploenergy s.r.l., an Italian company, which

has filed applications for two exploration licenses (Reno Centese and Corzano),

located in the Po Valley region (Northern Italy). The leads identified on these

licenses have combined unrisked prospective resources estimated to be in excess

of 60 bcf of gas.

Activity through the year was focused on maintaining the liaison with the

central and regional authorities and on updating the Environmental Impact

studies by implementing the suggestions received from the authorities. Attempts

to meet the relevant Minister, in order to understand what else, if anything,

is required to move forward the application, were unsuccessful.

In February 2019, the Italian Parliament approved a moratorium of 18 months in

the award of new licenses and a 25-fold increase of license fees. Exploenergy

has subsequently reduced its activity to the minimum required to fulfil its

statutory obligations. It has also identified areas which can be voluntarily

released in order to mitigate the impact of higher fees, when licenses are

awarded, with a minimum impact on their exploration potential.

In February 2019, the Group entered in a 2-year loan agreement with Proger

Management & Partners Srl with an option to convert it into an indirect 24%

equity interest in Proger Spa. Proger is an Italian engineering company

providing services in Italy and in different international areas.

Strategic Report

The Strategic Report has been prepared in accordance with Section 414A of the

Companies Act 2006 (the "Act") and presented hereunder. Its purpose is to

inform stakeholders and help them assess how the Directors have performed their

legal duty under Section 172 of the Act to promote the success of the Company.

Section 172 Statement

The Company's section 172 statement is presented on page 34 and 35 and forms

part of this strategic report.

Principal activity and status of the Company

The Company is registered as a public limited company (registration number

05718406) in England and Wales. Its principal activity is oil and gas

exploration, development and production; the Company also conducts gas trading

and provides services to other E&P operators.

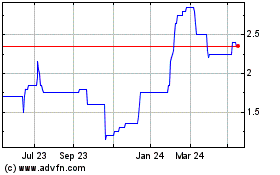

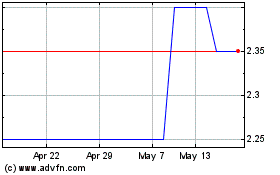

The Company's shares have a standard listing on the Official List of the UK

Listing Authority and are traded on the Main Market of the London Stock

Exchange.

Key performance indicators

The Group monitors its performance through five key performance indicators

("KPIs"):

* to increase oil, gas and condensate production measured on the number of

barrels of oil equivalent produced per day ("boepd");

* to decrease administrative expenses;

* to increase the Group's basic earnings per share;

* to maintain no lost time incidents; and

* to grow and geographically diversify the portfolio.

The Group's performance in 2019 against these KPI's is set out in the table

below, together with the prior year performance data.

Unit 2019 2018 2019 vs

2018

Average production (working boepd 288 250 38

interest basis) 1

Overhead (G&A) $ million 5.7 4.8 0.9

Basic (loss)/profit per share 2 cents (0.9) 0.5 (1.4)

Lost time incidents 3 incidents 0 0

Geographic diversification new assets 14

1. Average production is calculated as the average daily production during

the year

2. Basic (loss)/profit per ordinary share is calculated by dividing the net

(loss)/profit for the year attributable to equity holders of the parent company

by the weighted average number of ordinary shares during the year

3. Lost time incidents relate to the number of injuries where an employee/

contractor is injured and has time off work (IOGP classification)

4. Loan to Proger Managers & Partners Srl with an option to convert it into

an indirect 24 % equity interest in Proger Spa.

Chairman's Statement

Despite the changes that have occurred, Ukraine is still in the middle of its

journey towards a developed and stable economy. The efforts to reform the

country made limited progress and the key issues of reforms and transparency

continued to be the main concerns of investors and international financial

institutions. The political and economic outlook remains uncertain.

For Cadogan, 2019 has been a mixed year. The successful drilling of Blazhiv-10

has increased the oil production whilst the trading activities have not

delivered the expected results. The Company maintained its operational

activities but failed to build a sustainable business model leading to profits

and positive operating cashflow. Importantly, the decision to commit part of

its cash to a 2-year loan to Proger Managers & Partners Srl has not been

addressing the main issues in developing a successful strategy for the Company.

Given this situation, a majority of the shareholders expressed, at the

Extraordinary Shareholders Meeting in November 2019, their will to change the

governance of the Company by replacing some of the directors with newly

appointed ones.

The current world economic crisis that is resulting from the pandemic corona

virus and the oil & gas market turmoil is severely affecting Ukraine and thus

our activities. These are uncertain times, but we are reassured that Cadogan

has a competent and strong management to weather this storm.

Michel Meeùs

Non-Independent non-executive Chairman

1 May 2020

Chief Executive's Review

2019 was a challenging year for Cadogan during which the Company has not been

able to record a profit. Production grew for the 4th consecutive year with a

positive contribution from the E&P segment of $0.4 million. The Company

recorded $4 million of non-recurring income associated with the sale of LLC

Astroinvest Ukraine and LLC Gazvydobuvannya, which held previously impaired VAT

receivables and tax losses. Among the Company's achievements can be

highlighted:

* E&P operations revenue growth driven by a 15% increase in production;

* effective efforts to recover past receivables as well as the sale of legacy

assets.

Unfortunately, these achievements have not allowed the Company to overcome

negative aspects leading to the recorded losses:

* gas prices collapsing and its negative impact on Cadogan trading business

results and also an impairment on the inventory value in storage;

* oil average realized price decreasing by 13% in 2019, in line with

international markets;

* Blazhiv field production shut down for 30 days due to a delay in the

license award during the year.

2019 also witnessed three important events for Cadogan, namely:

* award of the Blazhiv production license (formerly Monastyretska exploration

license) for a 20-year period;

* successful drilling and completion of the Blazhiv-10 well and start of

commercial production;

* appointment of new Directors to the Board and a new CEO of the Company.

For Ukraine, 2019 was another difficult year, as the Country remained embroiled

in its confrontation with Russia with significant challenges for its economy.

The presidential vote in Ukraine resulted in the election of Volodymyr

Zelenskyy as the new President of Ukraine, with 73% of the valid votes. The

newly elected President dissolved the Verkhovna Rada shortly after his election

and called for parliamentary elections where pro-President's party took the

majority of seats in the Parliament and formed its Cabinet of Ministers. The

new government continued making some progress towards modernization of its oil

& gas legislative framework but has been unable to create a favourable

environment for the significant investments needed to increase the Country's

domestic production. In this uncertain context, Cadogan remained one of the few

truly foreign investors operating in Ukraine's E&P sector.

Against this challenging background, Cadogan's operational activities performed

as following:

* the average production rate through the year increased up to 288 boepd;

* the operational income of E&P business segment in 2019 was 4% higher than

the prior year, outperforming the 13% decrease in the realized average oil

price over the same period.

Highlights of 2019 are:

* a 15% increase in production, from 91,085 boe in 2018 to 104,816 boe in

2019;

* a 20% increase of overhead (G&A), from $4.8 million in 2018 to $5.7 million

in 2019;

* a difficult year for trading which generated a negative margin;

* a robust balance sheet, with $12.8 million of net cash, kept mostly in UK

banks;

* another year without LTIs'; and

* a EUR13.385 million loan to Proger Managers & Partners Srl, with an option to

convert it into an indirect 24 % equity interest in Proger SpA. The

maturity of the loan is February 2021.

Core operations

Cadogan has continued to safely and efficiently produce from its field in the

West of Ukraine. Oil production has increased by 15% over the previous year.

The Company has completed its commitment work programme by drilling Blazhiv-10

well, which confirmed geological understanding of the area and reservoir

potential. Securing of the license for 20 years will allow to build-up

strategic future field development.

For the Bitlyanska license, Cadogan has fully complied with legislative

requirement and submitted application for a 20-year exploration and production

license 5 months before its expiry on 23 December 2019. Decision on the award

was expected to be provided by State Geological Service of Ukraine before 19

January 2020, since all other intermediary approvals have been secured in line

with the applicable legislation requirements. Given the delay in awarding the

new license beyond the regular timeline provided by legislation, Cadogan has

launched a claim before the Administrative Court to challenge the non-granting

of the 20-year production license by the Licensing Authority.

In 2019, Cadogan tried also to identify a partner for the Bitlyanska license to

fund the necessary investments to confirm the upside of the high-pressure gas

condensate deep target. The preliminary discussions have not been satisfactory

and were ended. For the future, the Company intends to adjust its farm-out

strategy to the new context in which it operates.

The rental agreements with Ukrnafta for Blazhiv-3 and Blazhiv-3 Monasterets

wells ended in November 2019 and the operations were stopped. Cadogan fulfilled

all its duties for the renewal of the contracts but due to internal process

within Ukrnafta, these contracts are not signed yet. Cadogan's subsidiary,

Usenco, has been informed that Ukrnafta's Board approved the rental agreements

and that their signature will be shortly executed.

In the past, Cadogan had not been successful in converting the exploration

license of Pirkovska into a new production license. The exploration license

expired in October 2015. The Company filed an application in due time, but the

Licensing Authority returned it 6 times for different reasons, the legal ground

of which appears to be doubtful. Despite the efforts of Cadogan and its reply

in due time to each of the comments, the license was not awarded, and the

3-year period for conversion, given to the applicant by law, expired in October

2018. Historically, Cadogan impaired the value of the asset on its balance

sheet and launched litigation before the Administrative Court against the

Licensing Authority for non-granting of the production license.

The activity in Italy has been limited to routine housekeeping as the

uncertainty before the general election and then the program of the current

government coalition has left no room to progress the applications at present.

Non E&P operations

Trading had a complicated year due to substantial drop in prices on the EU and

Ukrainian markets driven by a mild winter, subsequent low demand, and excess

gas in storage. This excess gas in the Ukrainian market was prepared, as the

back-up, in case the gas transit contract between the Russian Federation and

Ukraine was not extended for the new period after 31 December 2019. All these

factors created challenging trading conditions. This led to the situation where

Cadogan had to impair its stored gas value to reflect the weak pricing

environment.

The oil services activities were used primarily to serve the Group's wells'

operations.

In February 2019, Cadogan used part of its cash (euros 13.385 million) to enter

into a 2-year loan agreement with Proger Managers & Partners Srl, with an

option to convert it into an indirect 24 % equity interest in Proger Spa.

According to IFRS, the option has to be represented in our balance sheet at

fair value.

The Group's original investment decision involved assessment of Proger Spa

business plans and analysis with professional advisers including valuations

performed using the income method (discounted cash flows) and market approach

using both the precedent transactions and trading multiples methods.

Unfortunately, Proger has refused to provide Cadogan information regarding its

2019 financial performance or updated forecasts to undertake a detailed fair

value assessment using the income method or market approach at 31 December

2019. As a consequence, we have assessed the fair value of the instrument

based on the terms of the agreement, including the pledge over shares, together

with financial information in respect of prior periods and determined that

$15.7 million represented the best estimate of fair value, being equal to

anticipated receipts discounted at a market rate of interest of 5.5% with no

value attributed to the option. However, the absence of information regarding

Proger's 2019 financial performance and prospects represents a significant

limitation on the fair value exercise and, as a result, once received, the fair

value could be materially higher or lower than this value.

After the resignation of Mr Guido Michelotti as director of Proger Ingegneria

Srl and Proger Spa, Cadogan notified, in February 2020, the Proger counterparts

for the replacement of Mr Michelotti on the board of Proger Ingegneria Srl and

Proger Spa. Cadogan is monitoring carefully the effective nominations and will

proceed to further updates and actions when and if necessary.

Outlook

With the pandemic corona virus COVID-19 and its negative effects that are

spreading globally, Ukraine, as with other countries, is facing a severe impact

on its economy as well as to the oil & gas market. In this context, 2020 will

be a very difficult year for our business.

In order to keep safe its personnel, the Company has put in place special

measures such as administrative personnel remote work, strict sanitary and

hygienic procedures and personal protection, rotation of field personnel by

company cars, constant medical supervision during the work shift, regular

sanitation of cars, offices and facilities.

The Company intends to adapt its strategy to the situation and to face the very

challenging market environment. Prices for oil and gas have been shrinking with

an incredible speed. The company, as with many of its peers, is not able to

give any outlook on its performance for 2020.

Gas trading, which had become unprofitable, cannot be a major activity for

Cadogan. The Company will focus on its oil operations and a more value

accretive and comprehensive diversification of its activities.

The Company will also stick to a strict cost discipline and will seek to

recover cash from previously impaired assets. As part of its cost discipline,

the Company will continue to streamline its complex corporate architecture by

liquidating companies which represent a legacy of its past with no benefit.

In respect of the Loan Agreement with Proger, Cadogan will develop all

necessary actions to ensure the proper fulfilment of the counterparts'

obligations under this agreement.

Last but not least, I wish, with the other Board Directors, to thank the women

and men of Cadogan for their efforts and their dedication to the Company.

Fady Khallouf

Chief Executive Officer

1 May 2020

Operations Review

Overview

At 31 December 2019, in the west of Ukraine, the Group held working interests

in one conventional gas, condensate and oil exploration and production license

and was expecting the award of the new license for another one. All these

assets are operated by the Group and are located in the Carpathian basin in

close proximity to the Ukrainian gas distribution infrastructures.

Summary of the Group's licenses (as at 31 December 2019)

Working License Expiry License type(1)

interest (%)

99.8 Blazhiv November 2039 Production

99.8 Bitlyanska(2) December 2019 E&D

(1) E&D = Exploration and Development

(2) The Bitlyanska license expired on December 23, 2019 and its renewal had

not been granted by year end

East Ukraine

The Pirkivska production license expired in 2015. The Company applied for a new

license. After several years and the end of the 3-year period allowed for

conversion of the previous license, the Company initiated court proceedings to

defend its rights and to challenge the Licensing Authority's actions.

West Ukraine

The Bitlyanska license covers an area of 390 square kilometres. Bitlyanska,

Borynya and Vovchenska are three hydrocarbon discoveries in this license area.

The Borynya and Bitlya fields hold 3P reserves, contingent recoverable

resources and prospective resources. Vovchenska field holds contingent

recoverable resources.

Borynya 3 well, was kept on hold, monitored and routinely bled-off for an

eventual re-entry and stimulation.

The Vovche 2 well was successfully drilled and produced water with uncommercial

quantities of oil when tested. The well is being monitored and periodically

lifted as a part of pilot production scheme. The company has fully met its

license commitments and had no breaches throughout the exploration period. This

has been confirmed by the Control Department of the State Geological Services

of Ukraine during the respective license audit.

The company has filed to the State Geological Service an application for a

20-year production license 5 months ahead the license expiry date of 23

December 2019. Through the reporting period, the Company secured approval of

the Environmental Impact Assessment study by the Ministry of Ecology, the

approval of the Reserves Report by the State Commission of Reserves and the

approval of the license award by the Lviv Regional Council. Given the delay to

award the new license beyond the regular timeline provided by legislation,

Cadogan launched a claim before the Administrative Court to challenge the

non-granting of the 20-year production license by the Licensing Authority.

The Monastyretska license continued to produce oil from four wells until 19

November 2019 waiting for the award of the new license. The average production

rate of 284 bpd (2018: 187 bpd) was achieved with a successful incident free

drilling of Blazhiv-10 well and stable production from the three producing

wells notwithstanding 30-days production shut-down.

The Blazhiv-10 well reached TD, at 3394m, with a benchmark drilling time,

notwithstanding severe hole instability issues which were experienced while

drilling. The perforated interval covered the entire Yamna formation, which

proved to be all oil bearing with a net pay of 156 meters. The well was put on

production in natural flow. Further a sucker rod pump was installed to ensure

stable production and mitigate paraffin deposition problems.

Importantly, the Blazhiv 20-year production license (formerly Monastyretska

license) was awarded in December 2019. The Blazhiv-1 and Blazhiv-10 wells are

currently in production. The production of Blazhiv-3 and Blazhiv-3 Monastyrets

is suspended waiting for the renewal of the rental agreements. The

Debeslavetska and the Cheremkhivska production licenses were transferred to WGI

in January 2019 as part of the trilateral agreement with Eni and Nadra Ukrayny

stipulating terms and conditions of Eni's exit from WGI and the shale gas

project.

Gas trading

Volumes of gas trading during 2019 were substantially lower than normal. The

Company only sold a limited volume of gas, given the collapse in the gas price,

which through the heating season had dipped below the level of the previous

summer. Unsold gas was kept in storage for the next season.

Cadogan's gas trading operations continued to take minimum credit risk and

recover its receivables. The company has purchased 7.5 million m3 of gas during

the declining curve price at the end of 2019 to be sold in the upcoming 2020

trading season. Gas prices have further reduced in 2020 and the inventory gas

remains unsold.

Service

The Group continued providing services through its wholly owned subsidiary

Astroservice LLC. The provided services were primarily related to support

drilling of Blazhiv-10 well and serving other intra-group operational needs. A

multi-well contract was secured in the second half of the year and the rig has

remained contracted ever since. The multi-well work-over contract awarded by a

third party in 2018 remained in force till the end of the year and Astroservice

was requested to execute two workovers.

Other events

In 2019, the Group sold its subsidiaries LLC Astroinvest Ukraine and LLC

Gazvydobuvannya for the consideration of $4 million. At the date of sale, the

subsidiaries had $1.8 million of VAT recoverable balance which were previously

impaired in the Group's accounts and $136 million accumulated tax losses which

were not recognized due to the lack of sufficient certainty regarding future

profits to utilize the carried losses.

After an inspection conducted by Ukraine's tax authorities in September 2019,

Astroinvest Energy LLC was notified of a tax claim related to the historic

costs for the liquidation of wells on the Zagoryanska license. The tax

authorities notified Astroinvest Energy LLC that they consider recoverable VAT

that has subsequently been used to offset output VAT to be non-deductible and

additionally that the subsidiary's tax losses carry forward should be reduced

(note 28). Astroinvest Energy LLC has launched a claim against the tax

authority's decision on the basis of the current tax legislation and related

court decisions.

Financial Review

Overview

In 2019, the Group increased production and E&P revenues further, while

continuing gas trading activity. The performance of the Group's operating

divisions delivered a loss of $1.7 million (2018: contribution of $1.2 million)

(note 5) and the Group recorded a loss of $2.1 million (2018: profit of $1.2

million) after the positive impact of the sale of non-core and historically

impaired assets totaling $4.3 million (2018: $1.7 million). The Group also

resumed drilling operations after a long pause.

The E&P business positively contributed to the financial results of the Group,

due to the increase in oil production. Average realized oil price decreased by

13% from $54.0 to $47.2 per barrel. The services business focused on providing

drilling and workover services to the subsidiaries of the Group. The trading

business was affected by the rapid decline of gas prices and therefore made a

negative contribution to the Group's performance. These results have been

supplemented by further monetization of the Group's assets as noted above.

Net cash decreased to $12.8 million at 31 December 2019 compared to $35.2

million at 31 December 2018. This was mostly due to a EUR13.4 million loan

provided to Proger Managers & Partners Srl, the capex program for the

Blazhiv-10 well drilling together with an increased inventory of gas at the end

of the year.

Income statement

Revenues from production increased from $4.7 million in 2018 to $4.9 million in

2019, mainly due to increase of the production volume from 91,085 boe in 2018

to 104,816 boe in 2019 but was restrained by decrease in average realized

prices by 13%. E&P costs of sales increased from $3.7 million in 2018 to $3.8

million in 2019. These include production royalties and taxes, fees paid for

the rented wells, depreciations, depletion of producing wells, direct staff

costs and other costs for exploration and development. Overall, in 2019, E&P

made a positive contribution of $1.1 million (2018: $1.0 million) to gross

profit, representing a positive[5] $0.4 million (2018: profit of $0.4 million)

business segment profit.

The oil services business in 2019 focused on internal activities providing its

services, including drilling and workover, to the Group's subsidiaries. In

addition, two external tenders were secured and started delivery during 2019,

which brought a loss of $13 thousand (2018: profit of $63 thousand).

The gas trading business showed losses in 2019. Although revenues decreased

from $9.9 million in 2018 to $0.9 million in 2019, cost of sales also

decreased, from $9.1 million in 2018 to $1.0 million in 2019, resulting in an

overall gross margin loss contribution of $0.1 million (2018: profit $0.7

million). In addition, staff costs (G&A) were reduced, and trading receivables

were recovered together with interest.

Administrative expenses ("G&A") continued to be controlled. Ukrainian G&A

remained flat and the overall G&A increased by 20% from $4.8 million in 2018 to

$5.7 million in 2019 as shown in note 7.

The reversal of impairment of other assets of $0.3 million (2018: reversal of

impairment of $1.8 million) primarily includes the reversal of impairment of

two gas treatment plants to the level of consideration received on the sale of

these assets (2018: VAT refund and offsets of VAT recoverable against trading

margin earned).

Impairment of other assets totalled $2.1 million (2018: $0.7 million) and

included $1.9 million natural gas value impairment due to revaluation to market

price at the year end and $0.2 million of VAT impairment.

The Group recorded a $0.6m increase in the fair value of the Proger loan, which

is held at fair value through profit and loss under IFRS. Refer to note 4(d)

and 27 for details.

Other income of $3.9 million (2018: $2.4 million) included $4.0 million

realized on the disposal of two non-trading entities which held historically

impaired VAT and tax losses. In 2018, the income included $1.7 million realized

from the exit of the WGI joint venture.

Net finance income of $25 thousand (2018: net finance income of $0.6 million)

reflects interest income on cash deposits used for trading of $49 thousand

(2018: $0.3 million); ii) investment revenue of $104 thousand (2018: $0.4

million); iii) interest income on receivables $45 thousand (2018: $nil); less

iv) Unwinding of discount on decommissioning provision of $164 thousand.

Balance sheet

Intangible Exploration and Evaluation ("E&E") assets of $2.9 million (2018:

$2.4 million) represent the carrying value of the Bitlyanska license. The

Property Plant & Equipment (PP&E) balance was $12.3 million at 31 December 2019

(2018: $3.3 million), increased primarily due to the Blazhiv-10 well drilled at

Monastyretska license.

Trade and other receivables of $2.6 million (2018: $2.5 million) includes $2.4

million of recoverable VAT (2018: $1.9 million), which is expected to be

recovered through production, trading and services activities, and $0.2 million

(2018: $0.3 million) of other receivables.

The $1.3 million of trade and other payables as of 31 December 2019 (2018: $1.2

million) consists of $0.6 million (2018: $0.6 million) of accrued expenses and

$0.7 million (2018: $0.5 million) of other creditors.

Provisions include $0.3 million (2018: $0.3 million) of long-term provision for

decommissioning costs which represents the present value of costs that are

expected to be incurred in 2039 for producing assets, when the licenses will

expire.

The cash position of $12.8 million at 31 December 2019 has decreased from $35.2

million at 31 December 2018. This was mostly due to the EUR13.4 million loan

provided to Proger Managers & Partners Srl., realized capex program of

Blazhiv-10 well drilling together with an increased inventory of gas at the end

of the year.

Cash flow statement

The Consolidated Cash Flow Statement on page 78 shows operating cash outflow

before movements in working capital of $4.4 million (2018: outflow of $1.9

million), which represents mostly cash used by the E&P and Trading business

segment net of corporate expenses.

Cash inflows from investing activities represents proceeds from the sale of LLC

Astroinvest Energy and LLC Gazvydobuvannya for the consideration of $4 million

and proceeds from the sale of non-current assets of $0.4 million. Investing

activities outflow represents cash used for drilling of Blazhiv-10 well and

loan provided to Proger Management & Partners Srl.

Related party transactions

Related party transactions are set out in note 29 to the Consolidated Financial

Statements.

Treasury

The Group continually monitors its exposure to currency risk. It maintains a

portfolio of cash and cash equivalent balances mainly in US dollars ("USD")

held primarily in the UK. Production revenues from the sale of hydrocarbons are

received in the local currency in Ukraine, however, the hydrocarbon prices are

linked to the USD denominated gas and oil prices. To date, funds from such

revenues have been used in Ukraine in operations rather than being remitted to

the UK.

Risks and uncertainties

There are several potential risks and uncertainties that could have a material

impact on the Group's long-term performance and could cause the results to

differ materially from expected and historical results. Executive management

review the potential risks and then classify them as having a high impact,

above $5 million, medium impact, above $1 million but below $5 million, and low

impact, below $1 million. They also assess the likelihood of these risks

occurring. Risk mitigation factors are reviewed and documented based on the

level and likelihood of occurrence. The Audit Committee reviews the risk

register and monitors the implementation of risk mitigation procedures via

Executive management, who are carrying out a robust assessment of the principal

risks facing the Group, including those potentially threatening its business

model, future performance, solvency and liquidity.

The Group has analyzed the following categories as key risks:

Risk Mitigation

Operational risks

Health, Safety and Environment

("HSE")

The oil and gas industry by its The Group maintains a HSE management system

nature conducts activities, which in place and demands that management, staff

can cause health, safety and and contractors adhere to it. The system

environmental incidents. Serious ensures that the Group meets Ukrainian

incidents can have not only a legislative standards in full and achieves

financial impact but can also damage international standards to the maximum

the Group's reputation and the extent possible.

opportunity to undertake further Management systems and processes have been

projects. certified as ISO 14001 and ISO 45001

compliant.

Covid-19

The Group's operations are in To manage and where possible mitigate the

Ukraine with a Parent Company risk of personnel infection with the virus

located in the United Kingdom. These for our employees, special measures have

locations are suffering from been applied. These include administrative

increasing levels of Covid-19 personnel remote working, strict sanitary

infection and in due course there and hygienic procedures and personal

may be increasing disruption. This protection, rotation of field personnel by

may include potential impacts company cars, constant medical supervision

through illness amongst our during the work shift, regular sanitation of

workforce, supply chain and sales cars, offices and facilities. We continue to

channel disruption and the wider monitor the situation closely and will

impact of economic disruption on respond accordingly as the position

commodity prices. The national and develops.

local governments in each of our

operating locations are recommending

or implementing increasingly severe

restrictions in order to manage the

situation.

Climate change

Countries may impose moratorium on E A moratorium on domestic production is

&P activities or enact tight limits deemed highly unlikely in Ukraine given the

to emissions level, which may country's need for affordable energy. Such

curtail production. Shareholders may risks exist in Italy, but the Company's

also request that the Company adopt exposure there is limited.

stringent targets in terms of Management strives to reduce emissions in

emissions reduction. everything the Company does and has started

implementing alternatives to offset and/or

mitigate emissions.

Drilling and Work-Over operations

The technical difficulty of drilling The incorporation of detailed sub-surface

or re-entering wells in the Group's analysis into a robustly engineered well

locations and equipment limitations design and work programme, with appropriate

can result in the unsuccessful procurement procedures and competent on-site

completion of the well. management, aims to minimise risk. Only

certified personnel are hired to operate on

the rig floor.

Production and maintenance

There is a risk that production or All plants are operated and maintained at

transportation facilities could fail standards above the Ukrainian minimum legal

due to non-adequate maintenance, requirements. Operative staff are

control or poor performance of the experienced and receive supplemental

Group's suppliers. training to ensure that facilities are

properly operated and maintained. When not

in use the facilities are properly kept

under conservation and routinely monitored.

Service providers are rigorously reviewed at

the tender stage and are monitored during

the contract period.

Sub-surface risks

The success of the business relies All externally provided and historic data is

on accurate and detailed analysis of rigorously examined and discarded when

the sub-surface. This can be appropriate. New data acquisition is

impacted by poor quality data, considered, and appropriate programmes

either historic or recently implemented, but historic data can be

gathered, and limited coverage. reviewed and reprocessed to improve the

Certain information provided by overall knowledge base. Agreements with

external sources may not be qualified local and international

accurate. contractors have been entered into to

supplement and broaden the pool of expertise

available to the Company.

Data can be misinterpreted leading All analytical outcomes are challenged

to the construction of inaccurate internally and peer reviewed. Analysis is

models and subsequent plans. performed using modern geological software.

The area available for drilling Bottom hole locations are always checked for

operations is limited due to their operational feasibility, well

logistics, infrastructures and trajectory, rig type, and verified on

moratorium. This increases the risk updated sub-surface models. They are

for setting optimum well rejected if deemed to be too risky.

coordinates.

The Group may not be successful in The Group performs, on an annual basis, a

proving commercial production from review of its oil and gas assets, impairs if

its Bitlyanska licence and necessary, and considers whether to

consequently the carrying values of commission a review from a third party or a

the Group's oil and gas assets may Competent Person's Report ("CPR") from an

have to be impaired. independent qualified contractor depending

on the circumstances.

Financial risks

The Group is at risk from changes in Revenues in Ukraine are received in UAH and

the economic environment both in expenditure is made in UAH, however the

Ukraine and globally, which can prices for hydrocarbons are implicitly

cause foreign exchange movements, linked to USD prices.

changes in the rate of inflation and

interest rates and lead to credit The Group continues to hold most of its cash

risk in relation to the Group's key reserves in the UK mostly in USD. Cash

counterparties. reserves are placed with leading financial

Cadogan entered into a 2-year loan institutions, which are approved by the

agreement (euros 13.385 million) Audit Committee. The Group is predominantly

with Proger Management & Partners a USD denominated business. Foreign exchange

Srl with an option to convert it risk is considered a normal and acceptable

into an indirect 24 % equity business exposure and the Group does not

interest in Proger Spa which hedge against this risk for its E&P

represented a key transaction and operations.

element of the Group balance sheet.

As security for the reimbursement of the

loan, Cadogan benefits from a pledge over

the shares held by Proger Managers &

Partners Srl in Proger Ingegneria Srl. In

addition to that, details of the steps being

taken by the Group to manage risks

associated with the Proger loan are set out

in the CEO's Statement and financial

statements (note 4(d)).

For trading operations, the Group matches

the revenues and the source of financing.

Refer to note 27 to the Consolidated

Financial Statements for detail on financial

risks.

The Group is at risk that Procedures are in place to scrutinize new

counterparties will default on their counterparties via a Know Your Customer

contractual obligations resulting in ("KYC") process, which covers their

a financial loss to the Group. solvency. In addition, when trading gas, the

Group seeks to reduce the risk of customer

non-performance by limiting the title

transfer to product until the payment is

received, prepaying only to known credible

suppliers.

The Group is at risk that The Group mostly enters back-to-back

fluctuations in gas prices will have transactions where the price is known at the

a negative result for the trading time of committing to purchase and sell the

operations resulting in a financial product. Sometimes the Group takes exposure

loss to the Group. to open inventory positions when justified

by the market conditions in Ukraine, which

is supported by analysis of the specific

transactions, market trends and models of

the gas prices and foreign exchange rate

trends.

Country risks

Legislative changes may bring Compliance procedures, monitoring and

unexpected risk and create delays in appropriate dialogue with the relevant

securing licenses or ultimately authorities are maintained to minimize the

prevent licenses and license risk. In all cases, deployment of capital in

renewals /conversions from being Ukraine is limited and investments are kept

secured. at the level required to fulfil license

obligations.

Ukraine has not progressed as far as The Group minimizes this risk by maintaining

expected towards integration with funds in international banks outside

Europe, the economic challenges in Ukraine, by limiting the deployment of

the country are not yet over and the capital in the Country and by continuously

confrontation with Russia has maintaining a working dialogue with the

remained open. This can impact the regulatory authorities.

political agenda, negatively impacts Commitments are fulfilled and routinely

the creation of a transparent market verified by the relevant Authorities,

and introduces an element of supported by competent and qualified legal

unpredictability in the development contractors.

of the legislative framework. The assets of the Group are located far from

the area of confrontation with Russia.

Other risks

The Group's success depends upon The Group periodically reviews the

skilled management as well as compensation and contract terms of its staff

technical and administrative staff. in order to remain a competitive employer in

The loss of service of critical the markets where it operates.

members from the Group's team could

have an adverse effect on the

business.

The Group is at risk of The Group applies rigorous screening

underestimating the risk and criteria in order to evaluate potential

complexity associated with the entry investment opportunities. It also seeks

into new countries. input from independent and qualified experts

when deemed necessary. Additionally, the

required rate of return is adjusted to the

perceived level of risk.

Local communities and stakeholders The Group maintains a transparent and open

may cause delays to the project dialogue with authorities and stakeholders

execution and postpone activities. (i) to identify their needs and propose

solutions which address them as well as (ii)

to illustrate the activities which it

intends to conduct and the measures to

mitigate their impact. Local needs and

protection of the environment are always

taken into consideration when designing

mitigation measures, which may go beyond the

legislative minimum requirement.

The Group devotes the highest level of

attention and engage qualified consultants

to prepare the Environmental Impact

Assessment studies and to attend public

hearings, both of them introduced in Ukraine

in the course of 2019.

Statement of Reserves and Resources

In 2019, the company successfully drilled Blazhiv-10 well and conducted routine

rig-less production support activities at the Blazhiv-1, Blazhiv-3 and

Blazhiv-3 Monastyrets to maintain sustainable production.

Summary of Reserves1

at 31 December 2019

Mmboe

Proved, Probable and Possible Reserves at 1 January 2019 7.59

Production 0,1

Revisions (sale of Debeslavetska and 0

Cheremkhivsko-Strupkhivska licences)

Proved, Probable and Possible Reserves at 31 December 7.49

2019

1 The study was conducted in 2016 by Brend Vik and since then Cadogan has

entered into a Technical Service Agreement with them.

Reserves are assigned to the Bitlyanska and Blazhiv fields.

In addition to the tabled reserves, Cadogan has 15.4 million boe of contingent

resources associated with the Bitlyanska and Blazhiv licences.

Corporate Responsibility

Under Section 414C of the Companies Act 2006 (the "Act"), the Board is required

to disclose information about environmental matters, employees, human rights

and community issues, including information about any policies it has in

relation to these matters and the effectiveness of these policies.

Being sustainable in our activities means conducting our business with respect

for the environment and for the communities hosting us, with the aim of

increasing the benefit and value to our stakeholders. We recognize that this is

a key element to be competitive and to maintain our license to operate.

The Board recognizes that the protection of the health and safety of its

employees, communities and the environment in which it operates is not just an

obligation but is part of the personal ethics and beliefs of management and

staff. These are the key drivers for a sustainable development of the Company's

activity. Cadogan Petroleum, its management and employees are committed to

continuously improve Health, Safety and Environment (HSE) performance; follow

our Code of Ethics and apply, in conducting our operations, internationally

recognized best practices and standards.

Our activities are carried out in accordance with a policy manual, endorsed by

the Board, which has been disseminated to all staff. The manual includes a

Working with Integrity policy and policies on business conduct and ethics,

anti-bribery, the acceptance of gifts and hospitality and whistleblowing.

In August 2018, Cadogan Ukraine LLC obtained ISO 14001 and ISO 45001

certifications for the following scope: "Supervision, coordination, management

support, control in the field of oil and gas on-shore exploration and

production." This provides formal recognition of the process embedded in the

Company and demonstrates the commitment and efforts delivered by our employees

and management. It is considered a baseline to continue with the efforts to

improve the way we conduct the business.

The Board believes that health and safety procedures and training across the

Group should be in line with best practice in the oil and gas sector.

Accordingly, it has set up a Committee to review and agree on the health and

safety initiatives for the Company and to report back to the Board on the

progress of these initiatives. Management regularly reports to the Board on HSE

and key safety and environmental issues, which are discussed at the Executive

Management level. The report of the Health, Safety and Environment Committee

can be found on page 39 to 40.

The former Chief Operating Officer was the Chairman of the HSE Committee until

15 November 2019 and is supported in his role by Cadogan Ukraine's HSE Manager.

In accordance with the ISO 14001 and ISO 45001, his role is to ensure that the

Group continuously develops suitable procedures, that operational management

and their teams incorporate them into daily operations and that the HSE

management has the necessary level of autonomy and authority to discharge their

duties effectively and efficiently.

Health, safety and environment

The Group has implemented an integrated HSE management system in accordance

with the ISO requirements. The system aims to ensure that a safe and

environmentally friendly/protection culture is embedded in the organization

with a focus on the local community involvement. The HSE management system

ensures that both Ukrainian and international standards are met, with the

Ukrainian HSE legislation requirements taken as an absolute minimum. All the

Group's local operating companies actively participate in the process.

A proactive approach based on a detailed induction process and near miss

reporting has been in place throughout 2019 to prevent incidents. Staff

training on HSE matters and discussions on near miss reporting are recognized

as the key factors to continuously improve. In-house training is provided to

help staff meet international standards and follow best practice. The process

enacted by the certification, enhances attention to training on risk

assessments, emergency response, incident prevention, reporting and

investigation, as well as emergency drills regularly run on operations' sites

and offices. This process is essential to ensure that international best

practices and standards are maintained to comply with, or exceed, those

required by Ukrainian legislation, and to promote continuous improvement.

The Board monitors the main Key Performance Indicators (lost time incidents,

mileage driven, training received, CO2 emissions) as business parameters. The

Board has benchmarked safety performance against the HSE performance index

measured and published annually by the International Association of Oil and Gas

Producers. In 2019, the Group recorded over 279,980 man-hours worked with no

incidents and close to 1,098,027 hours have been worked since the last injury

in February 2016.

During 2019 the Group continued to monitor its greenhouse gas emissions and

collect statistical data relating to the consumption of electricity, industrial

water and fuel consumption by cars, plants and other work sites, recording a

continuous improvement in the efficient use of resources.

Employees

Wellness and professional development are part of the Company's sustainable

development policy and wherever possible, local staff are recruited. The

Group's activity in Ukraine is entirely managed by local staff. Qualified local

contractors are engaged to supplement the required expertise when and to the

extent it is necessary.

Procedures are in place to ensure that recruitment is undertaken on an open,

transparent and fair basis with no discrimination against applicants. Each

operating company has its own Human Resources function to ensure that the

Group's employment policies are properly implemented and followed. The Group's

Human Resources policy covers key areas such as equal opportunities, wages,

overtime and non-discrimination. As required by Ukrainian legislation,

Collective Agreements are in place with the Group's Ukrainian subsidiary

companies, which outline agreed level of staff benefits and other safeguards

for employees.

All staff are aware of the Group's grievance procedures. All employees have

access to health insurance provided by the Group to ensure that all employees

have access to adequate medical facilities.

Each employee's training needs are assessed on an individual basis to ensure

that their skills are adequate to support the Group's operations, and to help

them to develop.

Diversity

The Board recognizes the benefits and importance of diversity (gender, ethnic,

age, sex, disability, educational and professional backgrounds, etc.) and

strives to apply diversity values across the business. We endeavour to employ

a skilled workforce that reflects the demographic of the jurisdictions in which

we operate. The board will review the existing policies and intends to develop

a diversity.

Gender diversity

The Board of Directors of the Company comprised five Directors as of 31

December 2019. The appointment of any new Director is made based on merit. See

pages 22 and 23 for more information on the composition of the Board.

As at 31 December 2019, the Company comprised a total of 80 persons, as

follows:

Male Female

Non-executive directors 3 1

Executive directors 1 -

Management, other than Executive directors 7 2

Other employees 45 21

Total 56 24

Human rights

Cadogan's commitment to the fundamental principles of human rights is embedded

in our HSE policies and throughout our business processes. We promote the core

principles of human rights pronounced in the UN Universal Declaration of Human

Rights and our support for these principles is embedded throughout our Code of

Conduct, our employment practices and our relationships with suppliers and

partners wherever we do business.

Community

The Group's activities are carried out in rural areas of Ukraine and the Board

is aware of its responsibilities to the local communities in which it operates

and from which some of the employees are recruited. In our operational sites,

management works with the local councils to ensure that the impact of

operations is as low as practicable by putting in place measures to mitigate

their effect. Projects undertaken include improvement of the road

infrastructure in the area, which provides easier access to the operational

sites while at the same time minimizing inconvenience for the local population

and allowing improved road communications in the local communities, especially

during winter season or harsh weather conditions. Specific community activities

are undertaken for the direct benefit of local communities. All activities are

followed and supervised by managers who are given specific responsibility for

such tasks.

The Group's companies in the Ukraine see themselves as part of the community

and are involved and offer practical help and support. All these activities are

run in accordance with our Working with Integrity policy and procedures. The

recruitment of local staff generates additional income for areas that otherwise

are predominantly dependent on the agricultural sector.

The enactment in 2018 of new legislation which introduces Environmental Impact

Assessment studies and public hearings as part of the license's award/renewal

processes was anticipated effectively by the Group. The Group is complying with

these requirements, building on the recognized competence of its people and

advisors as well as on the good communication and relations established with

local communities.

Approval

The Strategic Report was approved by the Board of Directors on 1 May 2020 and

signed by order of the Board by:

Ben Harber

Company Secretary

1 May 2020

Board of Directors

Current directors

Michel Meeùs, 67, Belgian

Non-Independent non-executive Chairman

Mr Meeùs was appointed as a Non-executive Director on 23 June 2014. Mr. Meeùs

was former Chairman of the Board of Directors of Theolia, an independent

international developer and operator of wind energy projects. Since 2007, he

has been a director within the Alcogroup SA Company (which gathers the ethanol

production units of the Group), as well as within some of its subsidiaries.

Before joining Alcogroup, Mr Meeùs carved out a career in the financial sector,

at Chase Manhattan Bank in Brussels and London, then at Security Pacific Bank

in London, then finally at Electra Kingsway Private Equity in London.

Mr Meeus is currently Chairman of the Remuneration and Nomination Committees.

Fady Khallouf, 59, French

Chief Executive Officer

Fady Khallouf was appointed as Director and CEO on 15 November 2019. He has a

35-year experience in the energy, the environment, the engineering and the

infrastructure sectors.

He has previously held the position of CEO and CFO of FUTUREN (Renewable

Energy, listed on Euronext Paris) where he achieved the restructuring and the

turnaround of the group.

Prior to that, he was the CEO of Tecnimont group (Petrochemicals and Oil &

Gas), the Vice-President Strategy and Development of EDISON group (Electricity

and Gas, E&P), the Head of M&A of EDF group (Energy). Fady Khallouf had

beforehand held various management positions at ENGIE (Energy), Suez

(Environmental Services), and DUMEZ (Construction and Infrastructures).

Lilia Jolibois, 55, American

Independent non-Executive Director

Lilia Jolibois was appointed as Director on 15 November 2019. She is currently

a member of four Boards: Futuren S.A., INSEAD, CARA (UK and Wales), and Aster

Fab. Her career spans Merrill Lynch Investment Banking, Sara Lee, and Lafarge

in the USA and Europe. At Lafarge Group, Ms. Jolibois served in numerous

positions in finance, strategy, business development, CEO and Chair of the

Board for Lafarge Cement and Gypsum in Ukraine, and SVP and Chief

Marketing-Sales-Supply Chain Officer for Lafarge Aggregates, Asphalt & Paving.

Lilia is currently Chairman of the Company's Audit Committee and a member of

the Remuneration and Nomination Committees.

Jacques Mahaux, 68, Belgian

Non-Executive Director

Jacques Mahaux was appointed as Director on 15 November 2019. He has held

various executive and directorship positions in Group Crédit Agricole in

Luxembourg, CA Indosuez, Indosuez Bank and various Luxembourg and Swiss Holding

companies active in industrial sectors. Previously he acted as an Attorney at

Law at the Brussels Bar. He is currently a Supervisory Board member of ETAM

SCA.

Mr Mahaux is currently a member of the Audit, Remuneration and Nomination

Committees.

Gilbert Lehmann, 74, French

Senior Independent Non-Executive Director

Mr Lehmann was appointed to the Board on 18 November 2011. He was an adviser to

the Executive Board of Areva, the French nuclear energy business, having

previously been its Deputy Chief Executive Officer responsible for finance. He

is also a former Chief Financial Officer and deputy CEO of Framatone, the

predecessor to Areva, and was CFO of Sogee, part of the Rothschild Group. Mr

Lehmann is also Deputy Chairman and Chairman of the Audit Committee of Eramet,

the French minerals and alloy business. He is Deputy Chairman and Audit

Committee Chairman of Assystem SA, the French engineering and innovation

consultancy. He was Chairman of ST Microelectronics NV, one of the world's

largest semiconductor companies, from 2007 to 2009, and stepped down as Vice

Chairman in 2011.

Mr Lehmann is currently a member of the Remuneration and Nomination Committees.

Directors during part of the period but not at the date of this report

Zev Furst, 71, American

Non-Executive Chairman until 15 November 2019

Appointed to the Board on 2 August 2011.

Mr Furst was Chairman of the Company's Nomination Committee and a member of the

Remuneration Committee until 15 November 2019

Guido Michelotti, 65, Swiss

Chief Executive Officer until 15 November 2019

Mr Michelotti was appointed to the Board of Directors as Chief Executive

Officer on 25 June 2015.

Adelmo Schenato, 67, Italian

Non-Executive Director until 15 November 2019

Mr Schenato was appointed to the Board as Chief Operating Officer on 25 January

2012.

In January 2017, Mr Schenato stepped down as Chief Operating Officer to take up

the role of Advisor to the CEO and Chairman and CEO of Exploenergy Srl, the

Italian company which is 90% owned by the Group.

Mr Schenato was the Chairman of the Health, Safety and Environment Committee.

Enrico Testa, 67, Italian

Independent Non-Executive Director until 15 November 2019

Appointed to the Board on 1 October 2011

Mr Testa was Chairman of the Company's Remuneration Committee and a member of

the Audit and Nomination Committees until 15 November 2019.

Report of the Directors

Directors

Following a general meeting on 15 November 2019 requisitioned by Mr Michel

Meeus (who is also a current Director of the Company) and SPF Devola SA, a

number of resolutions were put forward and subsequently passed changing the

composition of the Board and resulted in the appointment of a new CEO. The

resolutions put to the requisitioned general meeting resulted in the removal of

Messrs Schenato and Testa as Directors of the Company and the appointment of

three new Board members: Messers Mahaux, Jolibois and Khallouf as Directors of

the Company.

Prior to the requisitioned general meeting in November 2019, the Board

requested that the incumbent CEO Guido Michelotti extend his term to November

2019 to facilitate the orderly succession with the new CEO. Following the

general meeting, Mr Khallouf succeeded Guido Michelotti as CEO of the Company

and Michel Meeus, a non-executive Director of the Company was appointed as

Chairman of the Company with immediate effect. Mr Michelotti resigned from the

Company on 15 November 2019 whilst Zev Furst tendered his resignation as a

Director of the Company with effect from 13th December 2019.

The Directors in office during the year and to the date of this report are as

shown below:

Non-Executive Directors Executive Director

Michel Meeùs (Chairman) (appointed 15 November Fady Khallouf (appointed 15

2019) November 2019)

Zev Furst (Chairman) (resigned 13 December Guido Michelotti (resigned 15

2019) November 2019)

Gilbert Lehmann

Lilia Jolibois (appointed 15 November 2019)

Jacques Mahaux (appointed 15 November 2019)

Enrico Testa (resigned 15 November 2019)

Adelmo Schenato (resigned 15 November 2019)

Directors' re-election

Following the General Meeting of the Company held on 15 November 2019 which

resulted in the appointment of new Directors and changes to the composition of

the Board, the Board has agreed that the Directors will not be seeking annual

re-election at this year's annual general meeting as the members of the Board

were appointed by the shareholders of the Company less than one year ago. Going

forward, all Directors will be subject to annual election by shareholders.

The biographies of the Directors in office at the date of this report are shown

on pages 23 and 24.

Appointment and replacement of Directors

The Company's Articles of Association allow the Board to appoint any individual

willing to act as a Director either to fill a vacancy or act as an additional

Director. The appointee may hold office only until the next annual general

meeting of the Company whereupon his or her election will be proposed to the

shareholders.

The Company's Articles of Association prescribe that there shall be no fewer

than three Directors and no more than fifteen.

Directors' interests in shares

The beneficial interests of the Directors in office as at 31 December 2019 and

their connected persons in the Ordinary shares of the Company at 31 December

2019 are set out below.

Director Number of

Shares

Michel Meeùs 26,000,000

Fady Khallouf -

Gilbert Lehmann -

Lilia Jolibois -

Jacques Mahaux -

Conflicts of Interest

The Company has procedures in place for managing conflicts of interest. Should

a director become aware that they, or any of their connected parties, have an

interest in an existing or proposed transaction with the Company, its

subsidiaries or any matters to be discussed at meetings, they are required to

formally notify the Board in writing or at the next Board meeting. In

accordance with the Companies Act 2006 and the Company's Articles of

Association, the Board may authorize any potential or actual conflict of

interest that may otherwise involve any of the directors breaching his or her

duty to avoid conflicts of interest. All potential and actual conflicts

approved by the Board are recorded in register of conflicts, which is reviewed

by the Board at each Board meeting.

Directors' indemnities and insurance

The Company's Articles of Association provide that, subject to the provisions

of the Companies Act 2006, all Directors of the Company are indemnified by the

Company in respect of any liability incurred in connection with their duties,

powers or office. Save for such indemnity provisions, there are no qualifying

third-party indemnity provisions. In addition, the Company continues to

maintain Directors' and Officers' Liability Insurance for all Directors who

served during the year.

Powers of Directors

The Directors are responsible for the management of the business and may

exercise all powers of the Company subject to UK legislation and the Company's

Articles of Association, which includes powers to issue or buy back the

Company's shares given by special resolution. The authorities to issue and buy

back shares, granted at the 2019 Annual General Meeting, remains unused.

Dividends

The Directors do not recommend payment of a dividend for the year ended 31

December 2019 (2018: nil).

Principal activity and status

The Company is registered as a public limited company (registration number

05718406) in England and Wales. The principal activity and business of the

Company is oil and gas exploration, development and production.

Subsequent events

Refer to note 30 in the financial statements.

Structure of share capital

The authorized share capital of the Company is currently GBP30,000,000 divided

into 1,000,000,000 Ordinary shares of 3 pence each. The number of shares in

issue as at 31 December 2019 was 235,729,322 Ordinary shares (each with one

vote) with a nominal value of GBP7,071,880. The total number of voting rights in

the Company is 235,729,256. The Companies (Acquisition of Own Shares) (Treasury

Shares) Regulations 2003 allow companies to hold shares in treasury rather than

cancel them. Following the consolidation of the issued capital of the Company

on 10 June 2008, there were 66 residual Ordinary shares, which were transferred

to treasury. No dividends may be paid on shares whilst held in treasury and no

voting rights attached to shares held in treasury.

Rights and obligations of Ordinary shares

In accordance with applicable laws and the Company's Articles of Association,

holders of Ordinary shares are entitled to:

* receive shareholder documentation including the notice of any general

meeting;

* attend, speak and exercise voting rights at general meetings, either in

person or by proxy; and

* a dividend where declared and paid out of profits available for such

purposes. On a return of capital on a winding up, holders of Ordinary

shares are entitled to participate in such a return.

Exercise of rights of shares in employee share schemes

None of the share awards under the Company's incentive arrangements are held in

trust on behalf of the beneficiaries.

Agreements between shareholders

The Board is unaware of any agreements between shareholders, which may restrict

the transfer of securities or voting rights.

Restrictions on voting deadlines

The notice of any general meeting of the Company shall specify the deadline for

exercising voting rights and appointing a proxy or proxies to vote at a general

meeting. In order to accurately reflect the views of shareholders, where

applicable it is the Company's policy at present to take all resolutions at any

general meeting on a poll. Following the meeting, the results of the poll

released to the market via a regulatory news service and be published on the

Company's website.

Substantial shareholdings

As at 31 December 2019 and 17 April 2020, being the last practicable date, the

Company had been notified of the following interests in voting rights attached

to the Company's shares:

31 December 2019 17 April 2020

Major shareholder Number of % of total Number of % of

shares held voting shares total

rights held voting

rights

SPQR Capital Holdings SA 67,298,498 28.55 67,298,498 28.55

Mr Michel Meeùs 26,000,000 11.03 26,000,000 11.03

Ms Veronique Salik 17,959,000 7.62 17,959,000 7.62

Ms Jessica Friedender 17,409,000 7.39 17,409,000 7.39

Kellet Overseas Inc. 14,002,696 5.94 14,002,696 5.94

Credit Agricole Luxembourg 8,676,336 3.68 - -

Mr Pierre Salik 7,950,000 3.37 7,950,000 3.37

Cynderella International Luxembourg 7,657,886 3.25 7,657,886 3.25

Julius Baer 7,270,000 3.08 7,270,000 3.08

CA Indosuez Wealth Mgt Luxembourg 6,000,000 2.55 14,676,336 6.23

Amendment of the Company's Articles of Association

The Company's Articles of Association may only be amended by way of a special

resolution of shareholders.

Disclosure of information to auditor

As required by section 418 of the Companies Act 2006, each of the Directors as

at 1 May 2020 confirms that:

(a) so far as the Director is aware, there is no relevant audit information of

which the Company's auditor is unaware; and

(b) the Director has taken all the steps that he ought to have taken as a

Director in order to make himself aware of any relevant audit information and

to establish that the Company's auditor is aware of that information.

Going concern

The Group's business activities, together with the factors likely to affect its

future development, performance and position, are set out on pages 15 to 18.

Having considered the Company's financial position and its principal risks and

uncertainties, including the assessment of potential risks associated with

Covid-19 including a) restrictions applied by governments, illness amongst our

workforce and disruption to supply chain and sales channels; and b) market

volatility in respect of commodity prices associated with Covid-19 in addition

to geopolitical factors, the Directors have a reasonable expectation that the

Company and the Group have adequate resources to continue in operational

existence for the foreseeable future. Accordingly, they continue to adopt the

going concern basis in preparing the Consolidated and Company Financial

Statements. For further detail please refer to the detailed discussion of the

assumptions outlined in note 3 (b) to the Consolidated Financial Statements.

Reporting year

The reporting year coincides with the Company's fiscal year, which is 1 January

2019 to 31 December 2019.

Financial risk management objectives and policies

The Company's financial risk management objectives and policies including its

policy for managing its exposure of the Company to price risk, credit risk,

liquidity risk and cash flow risk are described on page 106 to 107 in note 27

to the Consolidated Financial Statements.

Outlook