TIDMCAPD

RNS Number : 4248Q

Capital Limited

18 October 2023

Capital Limited

("Capital", the "Group" or the "Company")

Q3 2023 Trading Update

Capital (LSE: CAPD), a leading mining services company, today

provides its trading update for the period 1 July to 30 September

2023 (the "Period").

THIRD QUARTER (Q3) 2023 KEY METRICS

Q3 2023 Q3 2022 vs Q2 2023 vs

Q3 2022 Q2 2023

===================================== ========== ========== =========== ========== ==========

Revenue ($m) 79.7 73.1 9.0% 76.5 4.2%

===================================== ========== ========== =========== ========== ==========

Drilling and associated revenue ($m) 51.2 52.3 -2.1% 52.6 -2.7%

------------------------------------- ---------- ---------- ----------- ---------- ----------

Mining revenue ($m) 18.0 13.0 38.5% 14.3 25.9%

===================================== ========== ========== =========== ========== ==========

MSALABS revenue ($m) 10.5 7.7 36.4% 9.6 9.4%

------------------------------------- ---------- ---------- ----------- ---------- ----------

All amounts are in USD unless otherwise stated.

* Unaudited numbers

Financial Highlights

-- Revenue US$79.7 million, a 9.0% increase on Q3 2022 (US$73.1

million) and a 4.2% increase on Q2 2023 (US$76.5 million);

- Drilling and associated revenue for the quarter was $51.2

million, down 2.1% on Q3 2022($52.3 million) and 2.7% on Q2 2023

($52.6 million);

- Mining revenue for the quarter was $18.0 million, up 38.5% on

Q3 2022 ($13.0 million) and 25.9% on Q2 2023 ($14.3 million);

and

- Laboratories (MSALABS) revenue for the quarter was $10.5

million, up 36.4% on Q3 2022 ($7.7 million) and 9.4% on Q2 2023

($9.6 million).

-- Interim dividend of 1.3 cents per share (cps), paid on 3 October 2023, (1.3 cps H1 2022).

Operational Update

-- Safety performance remains world-class with the nine-month

YTD Total Recordable Injury Frequency Rate ("TRIFR") of 1.23 per

1,000,000 hours worked (FY 2022 1.2).

-- Capital Drilling: Continuing geographical expansion:

-- Fleet utilisation for the quarter was 72%, down 6.5% on Q3

2022 and 1.4% on Q2 2023, impacted by seasonal weather conditions

in West Africa as well as softer activity levels in Mali; and

-- Average monthly revenue per operating rig ("ARPOR") was

US$179,000 in Q3 2023, down 1.6% on Q3 2022 ($182,000) and 2.2% on

Q2 2023 (US$183,000) similarly impacted by seasonal weather

conditions.

-- New major multi service drilling contract won:

- Capital has secured a new comprehensive drilling services

contract with Nevada Gold Mines (NGM), USA, extending our drilling

presence into North America. The contract encompasses a wide array

of drilling services including underground reverse circulation and

diamond, both surface and underground. The contract has a term of 3

years and will generate approximately $35 million of revenue per

annum once fully operational from 2025.

-- Other contract wins:

- An extension of the exploration drilling contract with Allied

Gold Corp at its Sadiola project in Mali; and

- An additional grade contract drilling contract with Allied

Gold Corp at its Sadiola project.

-- Ongoing ramp up of material contracts: The two high-quality

contracts at Reko Diq, Pakistan and Ivindo SA, Gabon began to ramp

in the third quarter and will continue towards full operating rates

as we progress through Q4 2023.

-- Meyas Sand Gold Project update:

- Operations at Perseus Mining's Meyas Sand Gold Project had

been temporarily ceased following the escalation of conflict in

Sudan in April 2023. Capital alongside Perseus Mining have been

closely monitoring the situation and are actively engaged in

discussions with the anticipation of resuming operations in

2024.

-- Rig count increased from 125 to 126 through Q3 2023, net of depletion.

Q3 2023 Q3 2022 vs Q2 2023 vs

Q3 2022 Q2 2023

=========================================== ========== ========== ============ ========== ==========

Closing fleet size 126 127 -0.8% 125 0.8%

=========================================== ========== ========== ============ ========== ==========

Average Fleet 125 119 5.0% 124 0.8%

------------------------------------------- ---------- ---------- ------------ ---------- ----------

Fleet utilisation (%) 72 77 -6.5% 73 -1.4%

=========================================== ========== ========== ============ ========== ==========

Average utilised rigs 90 91 -1.1% 90

------------------------------------------- ---------- ---------- ------------ ---------- ----------

ARPOR*($) 179,000 182,000 -1.6% 183,000 -2.2%

=========================================== ========== ========== ============ ========== ==========

Drilling revenue ($m) 48.6 49.8 -2.4% 49.4 -1.6%

------------------------------------------- ---------- ---------- ------------ ---------- ----------

Surveying revenue 0.9 1.1 -18.2% 0.9

=========================================== ========== ========== ============ ========== ==========

Other Associated revenue (1) ($m) 1.8 1.4 28.6% 2.3 -21.7%

------------------------------------------- ---------- ---------- ------------ ---------- ----------

Total Drilling and associated revenue ($m) 51.2 52.3 -2.1% 52.6 -2.7%

------------------------------------------- ---------- ---------- ------------ ---------- ----------

*Average revenue per month per operating rig

*Unaudited numbers

(1) Associated revenue refers to revenue generated from

complementary services tied to our drilling operations.

All amounts are in USD unless otherwise stated

-- Capital Mining: Ramp up of major contract continues

-- Mobilisation at our mining contract with Ivindo SA is

progressing rapidly, with the majority of mining equipment now on

site. The contract has a term of up to 5 years and will generate

approximately $30 million of revenue per annum once fully

operational. The contract involves both earthmoving and crushing

services; and

-- Sukari Gold Mine (Egypt) waste mining contract saw consistent

operations once again through Q3 2023.

-- MSALABS: Building momentum of its multi-year growth strategy:

-- The deployment of Chrysos' PhotonAssay(TM) units remains on

track and continues to advance successfully:

- MSALABS possesses the largest international network of Chrysos

PhotonAssay(TM) technology with ten units currently deployed or

under construction across Africa and Canada; and

- MSALABS relationship with Chrysos remains strong and is making

significant progress towards the deployment of 21 units by

2025.

-- MSALABS continues to make strides with its traditional

geochemical business with the establishment of a mine site fire

assay laboratory at Barrick's Kibali, DRC Phase II project which is

set to become operational imminently.

-- Capital Investments: Allied Gold IPOs during the quarter:

-- The total value of investments (listed and unlisted) was

$47.8 million as at 30 September 2023 ($42.1 million at as 30 June

2023);

-- The portfolio continues to be focused on a select few key

holdings with our holdings in Predictive Discovery, Allied Gold

Corp, WIA Gold and Leo Lithium comprising the majority of our

investments; and

-- Allied Gold Corp listed on the Toronto Stock Exchange during

the quarter with a market capitalisation of C$1.3 billion, Canada's

largest mining IPO since 2010. Capital's holding in Allied Gold was

worth $10 million as at 30th September 2023, at Allied Gold's share

price of C$4.74.

Outlook

-- Revenue guidance for 2023 remains $320 to $340 million;

-- Capital Drilling will see positive momentum into Q4 2023 from

the continued ramp up of operations particularly at Ivindo and Reko

Diq . This momentum will continue further into 2024 as operations

commence with Nevada Gold Mines, USA;

-- Capital Mining is focusing on finalising the mobilisation of

equipment at our mining contract at Ivindo, Gabon. In addition, the

Sukari earth moving contract is expected to perform at steady state

through the remainder of the year;

-- MSALABS is continuing its multi-year laboratory expansion,

with a strong emphasis on the deployment of Chrysos PhotonAssay(TM)

units. Client assay trials continue to grow the reputation of

Chrysos PhotonAssay technology and we remain very confident on the

continued rollout of 21 units over the next 12 months; and

-- Tendering activity remains robust across the Group with a

number of opportunities progressing.

Commenting on the trading update, Peter Stokes, Chief Executive,

said:

"The Group recorded an increase in revenue during the quarter,

despite the typical seasonal impacts, underscoring the high quality

and diverse nature of our services. This growth was bolstered by

the ramp-up in our high-quality contracts at Reko Diq, Pakistan,

and Ivindo, Gabon, across drilling and mining as well as the

continued laboratory rollout in MSALABS.

Furthermore, we are thrilled to continue expand our services

with Barrick at the Nevada Gold Mines complex. This contract

represents a significant milestone for our Group extending our

geographic reach in drilling into North America, adding to our

growing presence in the Americas with MSALABS and building a strong

platform for additional growth as we look towards 2024 and

beyond."

- ENDS -

For further information, please visit Capital's website

www.capdrill.com or contact:

Capital Limited investor@capdrill.com

Peter Stokes, Chief Executive Officer

Rick Robson, Chief Financial Officer

Conor Rowley, Corporate Development & Investor Relations

Tamesis Partners LLP +44 20 3882 2868

Charlie Bendon

Richard Greenfield

Stifel Nicolaus Europe Limited +44 20 7710 7600

Ashton Clanfield

Callum Stewart

Rory Blundell

Buchanan +44 20 7466 5000

Bobby Morse capital@buchanan.uk.com

George Pope

About Capital Limited

Capital Limited is a leading mining services company providing a

complete range of drilling, mining, maintenance and geochemical

laboratory solutions to customers within the global minerals

industry. The Company's services include: exploration, delineation

and production drilling; load and haul services; maintenance; and

geochemical analysis. The Group's corporate headquarters are in the

United Kingdom and it has established operations in Côte d'Ivoire,

Canada, Democratic Republic of Congo, Egypt, Gabon, Ghana,Guinea,

Kenya, Mali, Mauritania, Nigeria, Pakistan, Saudi Arabia and

Tanzania.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZMMGDNRGFZM

(END) Dow Jones Newswires

October 18, 2023 02:00 ET (06:00 GMT)

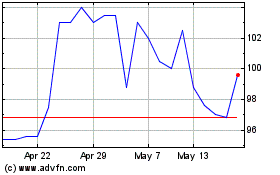

Capital (LSE:CAPD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Capital (LSE:CAPD)

Historical Stock Chart

From Jan 2024 to Jan 2025