First Day of Dealings

12 October 2010 - 5:00PM

UK Regulatory

TIDMCEL

RNS Number : 2197U

Caparo Energy Ltd

12 October 2010

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN

+---------------------------------+---------------------------------+

| Press Release | 12 October 2010 |

+---------------------------------+---------------------------------+

Caparo Energy Limited

("Caparo Energy" or the "Company")

First Day Dealings

The board of directors of Caparo Energy, a Guernsey company that is the holding

company for subsidiaries (together, the "Group") that seek to generate wind

power in India, is pleased to announce its admission to the AIM market of the

London Stock Exchange ("Admission") and the commencement of dealings in its

ordinary shares under ticker symbol CEL.

The Company has raised GBP50.2 million in a placing of 43,636,000 new Ordinary

Shares (the "Placing"), representing 26.7 per cent. of the enlarged ordinary

share capital of the Company. The approximate market capitalisation of the

Company following Admission is GBP188.2 million.

Strand Hanson Limited is acting as nominated adviser in relation to the

Admission and Mirabaud Securities LLP is acting as broker.

Overview

Caparo Energy is focused on becoming one of the leading independent power

producers in India and is seeking to generate predictable and long-term cash

flows by building up a portfolio of wind power generating assets in the Indian

wind energy market. The Group intends, in due course, to acquire and develop a

portfolio of wind farms with a target total annual installed capacity of up to

5,000 MW, which it intends to develop in two concurrent phases: Phase I

consisting of 3,000 MW with a target completion date of 2016; and Phase II

consisting of 2,000 MW with a target completion date of 2017.

For Phase I, the Company, through its subsidiary Caparo Energy (India) Limited

("Caparo Energy India"), has entered into a business partnership agreement with

Suzlon Energy Limited ("Suzlon"), one of the world's leading wind turbine

generator manufacturers, to acquire up to 3,000 MW of wind power generation

farms.

For Phase II, Caparo Energy India is in advanced discussions to acquire land and

turbines from international vendors in connection with wind power farm

development in wind-rich states in India, including Karnataka, Maharashtra,

Tamil Nadu and Andhra Pradesh.

The Company believes this should provide both geographic and customer-base

diversification to the Group's portfolio and that these sites will, if and when

acquired, be suitable for installing an additional 2,000 MW of capacity by 2017.

Key investment opportunity

The Company believes the following Group attributes and factors will be

attractive to potential investors:

· the Government of India is seeking to double the country's installed power

capacity to 342 GW and more than treble its clean energy capacity to 54 GW by

2017;

· the Group plans to accumulate a substantial portfolio of wind power

generating assets in India's relatively well established, but fragmented wind

energy market (i.e., not disproportionately dominated by other producers), which

should have considerable growth prospects in the near and medium term;

· Caparo Energy India has an agreement in place with Suzlon, one of the

leading global wind turbine generator manufacturers, and the largest in India,

for up to 3,000 MW of operating capacity and grid connected wind farms;

· the Company believes that ongoing negotiations with infrastructure

companies and wind turbine manufacturers should enable the Group to acquire and

develop suitable sites for up to 2,000 MW of operating capacity and grid

connected Phase II wind power generation farms by 2017; and

· the Company has arranged debt financing which, together with the proceeds

from the Placing, should enable the roll-out of initial projects.

Ravi Kailas, the Company's Chief Executive Officer, said:

"We are delighted that the AIM flotation of the Company has been completed

successfully and we now look forward to working with our new institutional

shareholders.

"The widening energy supply gap in India presents the Company with an extremely

exciting opportunity. Through our business partnership agreement with Suzlon,

India's largest and only fully-integrated wind turbine producer, we plan to

accumulate a substantial portfolio of wind power generating assets. While

India's renewable energy market is relatively established, it also has

considerable growth prospects in the near to medium term, as the government

creates incentives for private operators to help fill the country's energy gap.

Caparo Energy looks forward to capitalising on this urgent market need, and

unlocking continued economic and social development in one of the world's most

significant markets, with a view to becoming one of India's leading energy

businesses and a premier owner and operator of wind farms across the country."

Further information on the Company can be found at www.caparoenergy.com.

- Ends -

For further information please contact:

+----------------------------------------+-------------------------+

| Caparo Energy Limited | |

+----------------------------------------+-------------------------+

| Ravi Kailas, Chief Executive Officer | +44 (0) 20 7398 7702 |

+----------------------------------------+-------------------------+

| | |

+----------------------------------------+-------------------------+

| Strand Hanson Limited | |

+----------------------------------------+-------------------------+

| Angela Peace / Paul Cocker / James | +44 (0) 20 7409 3494 |

| Harris | |

+----------------------------------------+-------------------------+

| | |

+----------------------------------------+-------------------------+

| Mirabaud Securities LLP | |

+----------------------------------------+-------------------------+

| Peter Krens / Rory Scott | +44 (0) 20 7878 3360 |

+----------------------------------------+-------------------------+

| | |

+----------------------------------------+-------------------------+

| Abchurch Communications | |

+----------------------------------------+-------------------------+

| Henry Harrison-Topham | +44 (0) 20 7398 7702 |

+----------------------------------------+-------------------------+

| Heather Salmond | +44 (0) 20 7398 7704 |

+----------------------------------------+-------------------------+

| henry.ht@abchurch-group.com | www.abchurch-group.com |

+----------------------------------------+-------------------------+

NOTE TO EDITORS:

Executive Directors

Ravi Kailas, Chief Executive Officer, age 44

Mr. Kailas has 20 years of entrepreneurial experience in telecoms, software and

real estate. He was the founder of a number of start-up companies, including Zip

Global Network, a telecom services company, which was subsequently sold to Tata

Teleservices; Xius Technologies, a telecom software company which launched the

world's first inter-operator prepaid roaming service and which was merged with a

leading SEI CMM Level 4 software company; and Altius, a real estate investment

company which was later sold to The Chatterjee Group. He has a Bachelors degree

in Electronics and Communications Engineering from Osmania University and a

Masters degree from The Graduate School of Business, Stanford University.

Vikram Kailas, Chief Financial Officer, age 30

Before joining the Group, Mr. Kailas worked in the power and utilities

investment banking group at Credit Suisse in New York, where he was involved in

a number of renewable energy transactions, including a US$6 billion exit

financing for Calpine, a US$300 million loan for First Energy, a US$1 billion

capital raise for First Solar and the sale of Airtricity's US operations to E.On

and the European assets to Scottish & Southern Energy. Prior to joining Credit

Suisse, Mr. Kailas worked for Deloitte Consulting in Hyderabad, India. He has a

B.Tech in Mechanical Engineering from the Indian Institute of Technology,

Madras, and an

MBA from the Yale School of Management. He is a nephew of Ravi Kailas.

Alastair Cade, Director, age 38

Mr. Cade was one of the founders of Daniel Stewart Securities plc, a London

based institutional stock broking and corporate finance firm and was appointed

Managing Director in 2003. Subsequently, Mr. Cade set up a private investment

vehicle concentrating on agriculture and renewable energy. He has a Masters

degree in Economics from St. Andrews University.

Non-Executive Directors

Hon. Angad Paul, Non-Executive Chairman, age 40

Mr. Paul is the Chief Executive of the Caparo Group and has overseen the

acquisition by the Caparo Group of a number of companies since 2007 and the

Caparo Group's entry into Dubai and China. Mr. Paul attended the Massachusetts

Institute of Technology in Boston, USA, where he received BAs in Economics and

Media Arts and Sciences.

Rohit Kumar Phansalkar, Non-Executive Director, age 65

Mr. Phansalkar is the Chairman and CEO of RKP Capital, Inc., a US based merchant

banking boutique. He was previously the Chairman and CEO of Osicom Technologies,

an optical networking company. He was the co-founder, Vice Chairman and CEO of

Newbridge Capital, a private equity firm investing in India, and formerly the

Head of Energy Finance Group at Oppenheimer & Co. Mr. Phansalkar was co-head of

the Energy Finance Group at Shearson American Express, Managing Director of Bear

Stearns and Managing Director at Oppenheimer & Co. Mr. Phansalkar was the

Founding Chairman of The India Fund. Mr. Phansalkar received an MBA from the

Harvard Graduate School of Business.

Charles Wilkinson, Non-Executive Director, age 67

Mr. Wilkinson is a solicitor who retired from Lawrence Graham LLP in March 2005.

While at Lawrence Graham, he specialised in corporate finance and commercial

law, latterly concentrating on investment trust and fund work. He is currently

chairman of both Asset Management Investment Company PLC, an investment trust,

and Premier Renewable Energy Fund Limited, a listed investment company, and is a

director of Landore Resources Ltd, a Guernsey based mining exploration company.

Philip Swatman, Non-Executive Director, age 60

Mr. Swatman was appointed Chairman of Merlin Corporate Reputation Management, a

public relations advisory firm based in London, in March 2009, where he focuses

particularly on matters of business development. Prior to this, Mr. Swatman was

Vice-Chairman of Investment Banking at NM Rothschild from 2001 until his

retirement in September 2008, having originally joined NM Rothschild in 1979 as

a corporate financier, becoming a Director in 1986. He subsequently became a

Managing Director and later Co-Head of Investment Banking. Mr. Swatman qualified

as a Chartered Accountant with KPMG after graduating from Christ Church, Oxford

and is a Fellow of the Institute of Chartered Accountants. Mr. Swatman is a

nonexecutive director at New England Seafood International Limited and Investec

Structured Products Calculus VCT PLC.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGGUUUUPUPGG

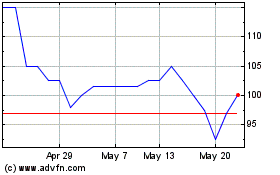

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jul 2023 to Jul 2024