Other Comprehensive Loss For The

Period - - (13,919) - (13,919)

--------------- -------- ------------ ------------ ---------- ----------

Total Comprehensive Loss for the

Period - (616,135) (17,671) - (633,573)

--------------- -------- ------------ ------------ ---------- ----------

Issue of

Shares 39,767 - - - 39,767

--------------- -------- ------------ ------------ ---------- ----------

Share Issue

expenses - - - (122,705) (122,705)

--------------- -------- ------------ ------------ ---------- ----------

Balance As at 30 September

2010 40,000 (616,135) (17,671) (122,705) (716,511)

--------------- -------- ------------ ------------ ---------- ----------

CAPARO ENERGY LIMITED CONDENSED INTERIM CONSOLIDATED STATEMENT OF

CASH FLOW FOR THE PERIOD FROM 1 APRIL 2010 TO 30 SEPTEMBER 2010 (UNAUDITED)

For The Period From 1 April 2010 To 30 September Note 2010 (Unaudited)

-------------------- ------ ------------------ (US$)

-------------------- ------ ------------------ Cash Flows From Operating

Activities -------------------- ------ ------------------

Loss For The Period (441,073)

---------------------------- ------------------

Depreciation C 5,899

-------------------- ------ ------------------ Operating Cash Flows Before

Working Capital Changes (435,174)

---------------------------- ------------------ Decrease in

Deposits D 3,496

-------------------- ------ ------------------

Increase in Other Assets (12,773)

---------------------------- ------------------ Increase in Trade and Other

Payables F 389.535

-------------------- ------ ------------------ Net Cash Generated From

Operating Activities (54,916)

---------------------------- ------------------ Cash Flows From Investing

Activities -------------------- ------ ------------------

Purchase Of Property, Plant And Equipment (1,809)

---------------------------- ------------------ Cash Used In Investing

Activities (1,809)

---------------------------- ------------------ Cash Flows From Financing

Activities -------------------- ------ ------------------

Proceeds From The Issue Of Ordinary Share Capital 39,767

---------------------------- ------------------ Cash Generated From

Financing Activities 39,767

---------------------------- ------------------ Net Increase In Cash And

Cash Equivalents (16,957)

---------------------------- ------------------ Cash And Cash Equivalents

At Beginning Of The Period 230,667

---------------------------- ------------------ Net effect of foreign

currency translation to presentation currency (1,273)

---------------------------- ------------------ Cash And Cash

Equivalents At End Of The Period E 212,437

-------------------- ------ ------------------

CAPARO ENERGY LIMITED

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL INFORMATION

FOR THE PERIOD FROM 1 APRIL 2010 TO 30 SEPTEMBER 2010

General Information

Caparo Energy Limited ("CEL" or the 'Company') is a company

domiciled is Guernsey and was incorporated on 13 August 2010 and

was admitted to the AIM of London Stock Exchange on 12th October

2010. The Company raised approximately US$ 80 million (GBP50.18

million) at the time of listing (before admission expenses). A

share issue expense of US$122,705 has been accrued in the books as

for 30 September 2010 in relation to the said issue.

The principal activity of the Company is to operate wind energy

farms as a leading independent power producer, and to engage in the

sale of energy to the Indian market through its Indian subsidiary

viz., Caparo Energy (India) Limited (CEIL).

The functional currencies of the respective Group companies

are:

Caparo Energy Limited Great British Pound

(GBP)

-------------------------------------------- --------------------

Caparo Energy Investments Limited-Mauritius US Dollar (US$)

-------------------------------------------- --------------------

Caparo Energy (India) Limited Indian Rupee (INR)

-------------------------------------------- --------------------

NOTE A - PRINCIPAL ACCOUNTING POLICIES

3.1 BASIS OF PREPARATION

The condensed set of financial statements have been prepared

using accounting policies consistent with International Financial

Reporting Standards as adopted by the European Union (IFRSs). The

same accounting policies, presentation and methods of computation

are followed in the condensed set of financial statements as are

expected to be applied in the Company's year-end financial

statements. While the financial figures included in this

half-yearly report have been computed in accordance with IFRSs

applicable to interim periods, this half-yearly report does not

contain sufficient information to constitute an interim financial

report as that term is defined in IAS 34.

The financial information for the interim period ended 30

September 2010 is unaudited and does not constitute the Company's

statutory financial statements for those periods.

The Company was incorporated with the sole purpose of acquiring

a controlling interest in its directly held, wholly owned,

subsidiary Caparo Energy Investments Limited ("CEILM"), which was

acquired by the Company in September 2010. CEILM itself had

acquired a controlling interest in its directly held, wholly owned,

subsidiary Caparo Energy (India) Ltd ("CEIL") in September 2010.

These transactions are considered to be under common control, as

defined in IFRS 3 Business Combinations, as the companies were

controlled by the same shareholders. The Directors note that

transactions under common control are outside the scope of IFRS 3

Business Combinations and that there is no guidance elsewhere in

IFRS covering such transactions.

The company has chosen to apply merger accounting, such that the

financial statements of the company incorporate the combined

companies' results and cash flows as if the companies have always

been combined with the assets and liabilities of the purchased

business incorporated at the consolidated book value and the

difference between the purchase consideration and the book value of

the assets and liabilities recorded in equity as a common control

reserve. The comparative figures would have been re-presented, but

the date of incorporation of the company and its subsidiaries means

that there are no comparative figures for the corresponding period

in the preceding financial year.

As at 30 September 2010 the following companies formed part of

the Group:

Country of

Company Immediate Parent Incorporation % of Interest

--------------------- --------------------- ---------------- --------------

Caparo Energy

Caparo Energy Investments

(India) Limited Limited India 100

--------------------- --------------------- ---------------- --------------

Caparo Energy

Investments Caparo Energy

Limited Limited Mauritius 100

--------------------- --------------------- ---------------- --------------

The financial information is prepared on the historical cost

basis. Historical cost is generally based on the fair value of the

consideration given in exchange for the assets. The expenses are

analysed by function in the Statement of Comprehensive Income. The

condensed consolidated financial information of the Company for the

six months to 30 September 2010 comprises the financial information

of the Company, its subsidiaries (together referred to as the

"Group").

3. 2 Standards and interpretations in issue not yet adopted

The following new Standards and Interpretations, which are yet

to become mandatory, have not been applied in the Company's

Financial Information.

Standard Or Interpretation Effective For Reporting Periods

Starting On Or After

------------------------------------------- ---------------------------------

IFRS - 9 Financial Instruments Annual periods beginning on or

after 1 January 2013

IFRS-7 Financial Instruments Annual periods beginning on or

disclosure-Amendments resulting after 1 January 2011

from May 2010 annual

improvements to IFRS

IAS 24 Related Party Disclosures - Annual periods beginning on or

Revised Definition Of Related after 1 January 2011

Parties

IAS 34 Interim Financial Reporting- Annual periods beginning on or

Amendments resulting from May after 1 January 2011

2010 annual improvements to

IFRS

Based on the Company's current business model and accounting

policies, management does not expect any material impact to the

Company's financial information as result of the above standards or

interpretations becoming effective.

The Company does not intend to apply any of these pronouncements

early.

3.3 Other Key Policies

Financial assets and liabilities

All financial assets are recognised and derecognised on trade

date where the purchase or sale of a financial asset is under a

contract whose terms require delivery of the financial asset within

the timeframe established by the market concerned, and are

initially measured at fair value, plus transaction costs.

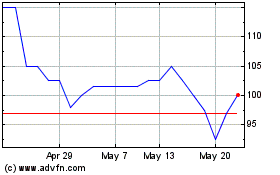

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Celadon Pharmaceuticals (LSE:CEL)

Historical Stock Chart

From Jul 2023 to Jul 2024