TIDMCGO

RNS Number : 6505Q

Contango Holdings PLC

29 October 2021

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural

Resources

Contango Holdings Plc ('Contango' or the 'Company')

29 October 2021

Garalo-Ntiela Gold Project Update

Highlights:

-- Airborne magnetics have confirmed that Garalo-Ntiela Project

hosts similar tectonic structures, which support a number of

multi-million ounce deposits in the region

-- Two prominent structures have been confirmed, running NE-SW

and NW-SE, along with a new 'dome' structure in the north-west

corner

-- Drilling to commence on G1 and G3 structures Q4 2021,

targeting NI 43-101 Resource of up to 2Moz

-- Near term production scenario continues to be optimised

Contango Holdings Plc, the London listed natural resource

development company, is pleased to provide an update on recent

activities at the Garalo-Ntiela Gold Project Area ('the Project')

in Southern Mali.

Aeromagnetics and airborne geophysics for the collection of

magnetic and radiometric data has been completed and analysed, with

the objective of informing direct mine planning activities and

supporting the Project's accelerated development into production.

These studies have built on the existing drill data on the Project,

the basis for the March 2021 NI 43-101 Independent Technical

Report, which highlighted the potential for the Garalo licence to

host a 2Moz Resource.

The survey also targeted some untested areas within the Project

area, particularly at Ntiela where exploration work earlier in 2021

yielded very encouraging results. The Company believes the results

of the survey reconfirm the expected extensions of the G1 and G3

deposits, the main targets used to support the potential 2Moz

resource.

The Company will now focus on a short but targeted drilling

campaign on the G1 and G3 deposits to test interpretations to depth

alongside infill drilling, to support a formal enhanced NI 43-101

Resource Report.

The expectation remains that Garalo-Ntiela will merit the

development of a processing hub capable of supporting multiple open

pit operations given the excellent proximal infrastructure,

historical exploration and the orebody's near surface location.

However, the Company is continuing to focus and refine its plans

for a smaller standalone 30,000oz per annum heap leach gold

operation, which is expected to generate significant cashflow for a

modest CAPEX requirement.

Carl Esprey, Chief Executive Officer of Contango Holdings, said:

"The aeromagnetic and airborne geophysics work conducted during

2021 has reinforced our belief in the potential of the

Garalo-Ntiela Gold Project to be developed into a profitable gold

mine. Indeed, the results from the G1 target clearly demonstrate

geological similarities to nearby producing mines.

"This recent programme was devised to provide valuable

geotechnical data to direct our broader mine planning activities,

whilst also providing further information to support a proposed

initial 30,000oz per annum heap leach gold operation. The positive

results have led us to embark on additional exploration with the

objective of defining a 2Moz resource as indicated in the NI 43-101

Independent Technical Report delivered earlier this year. We look

forward to providing further updates in due course as our

activities in Mali increase over the coming weeks and months."

Click on, or paste the following link into your web browser, to

view the associated PDF document with pictures included:

http://www.rns-pdf.londonstockexchange.com/rns/6505Q_1-2021-10-28.pdf

Project Background

The combined Garalo-Ntiela Project covers an area of 161.5km(2)

and is in the department of Bougouni within the Sikasso region in

southern Mali, 200km south-south-east of Bamako and close to the

Guinea border. The Project is surrounded by several

multi-million-ounce gold deposits and the region is home to some of

the world's leading gold miners, which has helped to establish Mali

as the third largest gold producer in Africa.

An NI 43-101 Independent Technical Report delivered in March

2021 highlighted the potential for the Garalo to have up to 2Moz

Resource. The Company believes that there is still room for

improvement over and above this threshold as, in addition to G1 and

G3 targets (the basis for 2Moz), numerous other clusters of

anomalous zones with potential for gold discovery have been

identified in both the Garalo and contiguous Ntiela permit area.

With this background and given the excellent infrastructure in the

vicinity, historical exploration, and the deposit's surface

location, the Company aims to establish a processing hub in the

region, capable of supporting multiple open pit operations

targeting initial production of gold in the near term in

conjunction with an exploration programme including expansion

drilling.

Figure 1: Geophysical interpretations identified two predominant

structural fabrics running NE/SW and NW/SE as well as an

interesting 'dome' structure in the NW corner (which has been

interpreted as an intrusive body around which are metamorphic

aureole zones). An interpretation of a NE shear has also been made

which has reactivated folds in this area.

Figure 2: Re-activated folding associated with metamorphic

aureole and with positive results from termite sampling programme

show in the Ntiela licence. G1 target demonstrates shears similar

to the Morila Gold Mine in Mali, which has produced over 7.5Moz

gold since 2000.

The 2021 aeromagnetics and airborne geophysics campaign was

devised to better define the extents and characteristics of the

orebody, considering the significant increase in resource quantum

that is now contemplated at Garalo. The Company continues to

advance the development of a 30,000oz per annum heap leach

operation from the shallow oxides given the high margins and low

capex for development. Given the dramatic increased resource

potential highlighted in the NI 43-101 Independent Technical Report

released in March 2021, the Company is also likely to undertake a

drilling programme in parallel to help realise and optimise the

asset's full potential, as Contango looks to establish a large

standalone gold mine with multiple open pit operations across both

permit areas.

**ENDS**

For further information, please visit

www.contango-holdings-plc.co.uk or contact:

Contango Holdings plc E: contango@stbridespartners.co.uk

Chief Executive Officer

Carl Esprey

Brandon Hill Capital Limited T: +44 (0)20 3463 5000

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd E: info@stbridespartners.co.uk

Financial PR & Investor Relations

Susie Geliher

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFELESAEFSELS

(END) Dow Jones Newswires

October 29, 2021 02:00 ET (06:00 GMT)

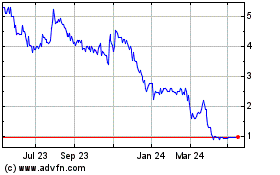

Contango (LSE:CGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

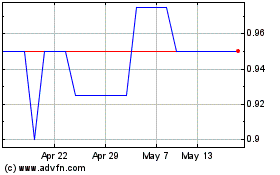

Contango (LSE:CGO)

Historical Stock Chart

From Jul 2023 to Jul 2024