CHINA NONFERROUS GOLD: Gold Dore Sale Agreement

17 February 2022 - 4:17AM

UK Regulatory

TIDMCNG

China Nonferrous Gold Limited

("CNG" or the "Company")

Gold Dore Sale Agreement

China Nonferrous Gold Limited (AIM: CNG), the mineral

exploration and mining company currently mining the Pakrut gold

project in the Republic of Tajikistan, is pleased to announce that

the Company has authorized its subsidiary, LLC Pakrut, to enter

into a Gold Doré sale agreement with Daye Nonferrous Metals Company

Limited ("Daye Nonferrous" or the "Buyer"), for the sale of up to

600kg of Gold Doré ("Sale Agreement").

The Sale Agreement supplements the agreements with the

Tajikistan Government which collectively covers the majority of

gold anticipated to be produced at Pakrut for the calendar year. In

2021 the Company produced a total of 1,249kg of gold bullion,

1,199kg of which was sold to the Tajikistan government on similar

terms, and 50kg was sold to Daye Nonferrous (see announcement dated

07 September 2021).

The terms of this new Sale Agreement remain in force until 30

December 2022, after which the contract may be renewed. The Gold

Doré to be sold under this agreement is to be produced at the

Company's Parkrut gold mine in Tajikistan and gold purity is to be

at, or above, 99.95% with each bar weighing approximately

400oz.

The London Bullion Market Association's Precious Metal's Gold

Price in USD (as published in the London Metal Bulletin on the

business day prior to the collection date of the Buyer's nominated

carrier) is to be used to set the settlement price. At today's

price of US$1,850 per ounce the total contract, if fulfilled in its

entirety, would represent a total consideration of approximately

US$35m; however as the contract is dependent upon the gold being

produced there can be no guarantee this amount will be received.

The Company will receive a provisional payment of up to 95% of the

contained gold, after the Gold Doré has been collected by the

Buyer's nominated carrier.

Related Party Transaction

Daye Nonferrous is subsidiary of China Nonferrous Metals Mining

(Group) Co., Ltd ("CNMC Group") which is also the parent company of

China Nonferrous Metals Int'l Mining Co., Ltd ("CNMIM"), the

substantial shareholder of the Company. Accordingly, the Gold Dore

Sales Agreement is deemed to be related party transaction pursuant

to AIM Rule 13 of the AIM Rules for Companies. The Company's board

of directors (excluding Yu Lixian, Zhang Hui and Wang Xiaohua, who

are connected to CNMIM) consider, having consulted with CNG's

Nominated Adviser, WH Ireland Limited, that the terms of the Sale

Agreement are fair and reasonable insofar as the shareholders of

CNG are concerned.

For further information please visit the Company's website

(www.cnfgold.com) or contact:

China Nonferrous Gold Limited

Zhang Hui, Managing Director

Tel: +86 10 8442 6662

WH Ireland Limited (NOMAD & Broker)

Katy Mitchell, James Sinclair-Ford

Tel: +44 (0)207 220 1666

Blytheweigh (PR)

Tim Blythe

Tel: +44 (0)20 7138 3224

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

View source version on businesswire.com:

https://www.businesswire.com/news/home/20220216006035/en/

CONTACT:

China Nonferrous Gold Limited

SOURCE: China Nonferrous Gold Limited

Copyright Business Wire 2022

(END) Dow Jones Newswires

February 16, 2022 12:17 ET (17:17 GMT)

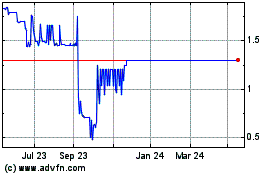

China Nonferrous Gold (LSE:CNG)

Historical Stock Chart

From Dec 2024 to Jan 2025

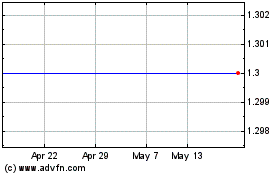

China Nonferrous Gold (LSE:CNG)

Historical Stock Chart

From Jan 2024 to Jan 2025