TIDMCRV

RNS Number : 1923R

Craven House Capital PLC

27 February 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

Craven House Capital PLC

("Craven House" or the "Company")

Unaudited Interim Report for the period ended 30 November

2022

CRAVEN HOUSE CAPITAL PLC

CRAVEN HOUSE CAPITAL PLC

INVESTMENT MANAGER'S REPORT FOR THE SIX MONTH PERIODED

30 NOVEMBER 2022

Statement by the Investment Manager

The Company's investment portfolio comprises minority

shareholdings in five Swedish-managed businesses operating in the

eCommerce and pharmaceutical sectors. The valuations of the

respective entities at the end of the period are as follows

Investment Value at 30 Nov Value at 31

2022 May 2022

Shares in Garimon Limited $290,000 $1,600,000

Shares in Stormfjord Limited $1,310,000 -

Shares in Rosedog Limited $1,600,000 $1,600,000

Shares in Honeydog Limited $1,600,000 $1,600,000

Shares in Bio Vitos Medical Limited $1,600,000 $1,600,000

The investee companies have each demonstrated positive progress

during the period however remain at a 'pre-revenue' stage of

business development. As previously disclosed on 15 November 2022,

the onebas.com domain was transferred out of Garimon during the

period into a new entity (Stormfjord Ltd). Stormfjord Ltd

subsequently raised $520,000 of arms-length financing, which valued

the domain at $5,000,000. The proceeds of the financing were used

to upgrade the functionality and capacity of the websites as well

as launch a PR / advertising campaign across key target

markets.

After the end of the period, BioVitos Ltd reported that it had

entered into a conditional agreement (the "Agreement") to undertake

a reverse takeover of Hemcheck Sweden AB, a company listed on the

Nasdaq Stockholm (as announced on 8 February 2023). As part of the

Agreement and subject to approval by Hemcheck's shareholders at an

EGM to be convened at a date still to be confirmed, Hemcheck will

create a new subsidiary ("NewCo") and transfer all current business

and assets of Hemcheck to this new subsidiary. Under the terms of

the Agreement, Bio Vitos has agreed to provide Hemcheck with

SEK1.23 million in cash, within 14 days after the approval of the

transaction by Hemcheck's shareholders.

Bio Vitos will then pay a further SEK4 million in cash, to

Hemcheck, within thirty days following the distribution of shares

in NewCo to Hemcheck shareholders.

In addition Bio Vitos has agreed to provide Hemcheck with its IP

rights (patents or patent applications) in respect of an active

substance Iron Succinate (Succifer and used in a marketed product

Inofer). In exchange, Bio Vitos will receive 259,654,000 shares in

Hemcheck, amounting to circa 88.3% of Hemcheck's share capital.

Desmond Holdings Ltd

Investment Manager to Craven House Capital Plc

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

Six months ended Year Ended

30 Nov 2022 30 Nov 2021 31 May 2022

Note (Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

CONTINUING OPERATIONS

Changes in fair value - - -

Administrative expenses (72) (78) (180)

OPERATING LOSS (72) (78) (180)

Interest expense - - (56)

------------ ------------ ------------

LOSS BEFORE INCOME TAX (72) (78) (236)

Income tax 2 - - -

------------ ------------ ------------

LOSS FOR THE PERIOD (72) (78) (236)

============ ============ ============

Earnings per share expressed

In cents per share:

Basic and diluted 5 (1.86) (2.02) (6.11)

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF FINANCIAL POSITION

AS AT 30 NOVEMBER 2022

Six months ended Year Ended

30 Nov 2022 30 Nov 2021 31 May 2022

(Unaudited) (Unaudited) (Audited)

Note $'000 $'000 $'000

ASSETS

NON-CURRENT ASSETS

Investments at fair value

through

profit or loss 3 6,400 6,400 6,400

--------- -------- --------------

6,400 6,400 6,400

--------- -------- --------------

CURRENT ASSETS

Trade and other receivables 32 16 43

Cash and cash equivalents 1 1 1

--------- -------- --------------

33 17 44

--------- -------- --------------

TOTAL ASSETS 6,433 6,417 6,444

========= ======== ==============

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 4 3,802 3,802 3,802

Share premium 11,153 11,153 11,153

Accumulated deficit (9,896) (9,666) (9,824)

--------- -------- --------------

TOTAL EQUITY 5,059 5,289 5,131

--------- -------- --------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 78 86 76

NON-CURRENT LIABILITIES

Other payables 1,296 1,042 1,237

--------- -------- --------------

TOTAL LIABILITIES 1,374 1,128 1,313

--------- -------- --------------

TOTAL EQUITY AND LIABILITIES 6,433 6,417 6,444

========= ======== ==============

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

Called

up share Share Accumulated

capital premium deficit Total

$'000 $'000 $'000 $'000

Balance at 1 June

2021 3,802 11,153 (9,588) 5,367

Changes in equity

Issue of share capital - - - -

---------- ---------- -------------- --------

Transactions with

owners 3,802 11,153 (9,588) 5,367

---------- ---------- -------------- --------

Loss for the period - - (78) (78)

Balance at 30 November

2021 3,802 11,153 (9,666 5,289

---------- ---------- -------------- --------

Changes in equity

Issue of share capital - - - -

---------- ---------- -------------- --------

Transactions with

owners 3,802 11,153 (9,666) 5,289

---------- ---------- -------------- --------

Loss for the period - - (158) (158)

Balance at 31 May

2022 3,802 11,153 (9,824) 5,131

---------- ---------- -------------- --------

Changes in equity

Issue of share capital - - - -

---------- ---------- -------------- --------

Transactions with

owners 3,802 11,153 (9,824) 5,131

---------- ---------- -------------- --------

Loss for the period - - (72) (72)

Balance at 30 November

2022 3,802 11,153 (9,896) 5,059

---------- ---------- -------------- --------

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

Six months ended Year Ended

30 Nov 30 Nov 31 May 2022

2022 2021

(Unaudited) (Unaudited) (Audited)

$'000 $'000 $'000

Cash flows from operating activities

Loss before income tax (72) (78) (236)

Adjustments for non-cash items

Decrease/(increase) in trade and

other receivables

Increase/(decrease) in trade and

other payables 11 22 (5)

Interest expense 2 (1) (11)

- - 56

------------ ------------ --------------

Net cash used in operating activities (59) (57) (196)

Cash flows from financing activities

Loans received 59 53 192

------------ ------------ --------------

Net cash from financing activities 59 53 192

Net decrease in cash and cash

equivalents - (4) (4)

Cash and cash equivalents at

the beginning

of the period 1 5 5

Cash and cash equivalents at

the end of the period 1 1 1

============ ============ ==============

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL INFORMATION

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

1. ACCOUNTING POLICIES

General Information

Craven House Capital Plc is a company incorporated in the United

Kingdom under the Companies Act 2006. The address of the registered

office is given on the company information page. The Company is

listed on the AIM Market of the London Stock Exchange (ticker:

CRV).

The next annual financial statements of Craven House Capital Plc

will be prepared in accordance with International Financial

Reporting Standards and IFRIC interpretations and with those parts

of the Companies Act 2006 applicable to companies reporting under

UK adopted international standards. Accordingly, the interim

financial information in this report has been prepared using

accounting policies consistent with IFRS. IFRS are subject to

amendment and interpretation by the International Accounting

Standards Board (IASB) and the International Financial Reporting

Interpretations Committee (IFRIC) and there is an on-going process

of review and endorsement by the European Commission. The financial

information has been prepared on the basis of the IFRS that the

directors expect to be applicable as at 31 May 2023.

The financial information has been prepared under the historical

cost convention, except to the extent varied for fair value

adjustments required by accounting standards, and in accordance

with International Financial Reporting Standards and IFRIC

interpretations and with those parts of the Companies Act 2006

applicable to companies reporting under UK adopted international

standards. The principal accounting policies have been applied to

all periods presented.

This financial information is unaudited and does not constitute

statutory financial statements within the meaning of Section 434 of

the Companies Act 2006. The financial statements of the Company for

the year ended 31 May 2022, which were prepared in accordance with

International Financial Reporting Standards and IFRIC

interpretations and with those parts of the Companies Act 2006

applicable to companies reporting under UK adopted international

standards, have been reported on by the Company's auditors and

delivered to the Registrar of Companies. The report of the auditors

was unqualified and did not include any statement under Section 498

of the Companies Act 2006.

This financial information is presented in United States dollar,

rounded to the nearest $'000.

The directors do not propose the issuance of a dividend.

The interim financial information for the six months ended 30

November 2022 was approved by the directors on 24 February

2023.

Going concern

The directors consider that the Company is well placed to manage

its business risks successfully and have a reasonable expectation

that the Company has adequate resources to continue in operational

existence for the foreseeable future. Thus, they continue to adopt

the going concern basis of accounting in preparing the financial

information.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

2. Taxation

No tax charges arose in the period or in comparative periods as

a result of losses incurred.

3. Investments at fair value through profit or loss

Unquoted

equity investments

$'000 Total

$'000

As at 1 June 2022 and 30 November

2022 6,400 6,400

-------------------- --------

The value of Investments represents the Company's acquisitions

during 2020 of interests in the below-named four UK entities. These

are all unquoted investments and have therefore been measured on a

Level 3 basis as no observable market data is available. Further

information on each investment holding is as follows;

Shares in Garimon Limited are valued at $290,000 representing a

29.9% holding. The prior period valuation was used as a starting

point for estimation of fair value and the directors have applied

consideration to current facts and circumstances in reviewing the

November 2022 valuation. Garimon Limited is the owner of

"Magazinos.com", an on-line media magazine and periodical content

provision service

Shares in Stormfjord Limited are valued at $1,310,000

representing a 26.2% holding. The valuation of this shareholding is

supported by arms-length financing which occurred during the period

and represents the best indication of the fair value at the period

end. Stormfjord is the owner of www.onebas.com, an optimised search

engine providing a portal to music content freely circulating

online.

Shares in Honeydog Limited are valued at $1,600,000 representing

a 29.9% holding, unchanged from the prior period. The prior period

valuation was used as a starting point for estimation of fair value

and the directors have applied consideration to current facts and

circumstances in reviewing the November 2022 valuation. Honeydog

Limited is the 25% owner of the entity which owns the licence to

manufacture and distribute the chemotherapy drug, Temodex, which is

used in the treatment of brain tumours.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIODED 30 NOVEMBER 2022

3. Investments at fair value through profit or loss (continued)

Shares in Rosedog Limited are valued at $1,600,000 representing

a 29.9% holding, unchanged from the prior period. The prior period

valuation was used as a starting point for estimation of fair value

and the directors have applied consideration to current facts and

circumstances in reviewing the November 2022 valuation. Rosedog

Limited is the owner of TV Zinos (www.tvzinos.com), a website which

offers a number of free-to-view television channels

Shares in Bio Vitos Medical Limited are valued at $1,600,000 representing

a 24.5% holding, unchanged from the prior period. The prior period

valuation was used as a starting point for estimation of fair value

and the directors have applied consideration to current facts and

circumstances in reviewing the November 2022 valuation. Bio Vitos

has a portfolio of over 40 different Omega-3 supplements in addition

to its range of collagen products marketed under the "Ocean Skin

Lab" brand. During the prior period, Bio Vitos acquired the licence

to market a patented heart drug 'Succifer' (also marketed as 'Inofer'),

from Double Bond Pharmaceutical AB. The drug has been demonstrated

to improve iron uptake in patients with chronic heart conditions.

The businesses of all of the above portfolio investments are presently

loss-making although their cost bases are low and there is minimal

committed future expenditure, meaning that the extent and timing

of the Company's further investment in the businesses are highly

controllable. The Company and the incumbent management teams of

the investee companies will continue to work together with the aim

that these businesses become financially self-sustaining and generating

surpluses within the short- to medium-term and to crystallise additional

capital value for shareholders through strategic, third-party partnerships

.

4. Called up share capital

Authorised, issued and fully paid share capital as at 30 November

2022 is as follows:

Number Class: Nominal 30 Nov 31 May

Value 2022 2022

(Unaudited) (Audited)

$'000 $'000

3,863,590 Ordinary $1.00 3,802 3,802

3,802 3,802

------------ ------------

The aggregate nominal values of the ordinary shares include exchange

differences arising from the translation of shares at historic rates

and the translation at the rate prevailing at the date of the change

in functional currency.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL INFORMATION - continued

FOR THE SIX MONTH PERIOD ENDED 30 NOVEMBER 2022

5. Earnings per share

The calculation of basic earnings per share is based on the loss

attributable to the equity holders of $72,000 divided by the

weighted average number of shares in issue during the period of

3,863,590 (six months ended 30 November 2021: loss of $78,000 and

3,863,590 shares; year ended 31 May 2022: loss of $236,000 and

3,863,590 shares).

6. Related party disclosures

Craven Industrial Holdings Plc

During the period, Craven Industrial Holdings Plc paid costs on

behalf of and advanced loans to the Company. At the period end, the

outstanding balance due to Craven Industrial Holdings Plc was

$1,296,335. Despite the common director in Mr M J Pajak, the board

of Craven House Capital Plc do not believe that Craven House

Capital Plc or Craven Industrial Holdings Plc are able to exert

control or influence over each other and neither are accustomed to

act in accordance with instructions from the other.

7. Events after the reporting period

On the 8(th) February 2023, the Company announced that its

subsidiary, BioVitos Ltd, had entered into a conditional agreement

to undertake an RTO of Hemcheck Sweden AB, a company listed on the

Nasdaq Stockholm. Under the terms of this agreement, BioVitos has

agreed to provide cash to Hemcheck in addition to IP rights

relating to an active substance Iron Succinate (Succifer and used

in a marketed product Inofer). In exchange, Bio Vitos will receive

259,654,000 shares in Hemcheck, amounting to circa 88.3% of

Hemcheck's share capital. This agreement remains subject to

approval at a meeting of Hemcheck's shareholders in the coming

weeks.

For further information please

contact: Tel: 0203 286 8130

Craven House Capital Plc

Mark Pajak

www.Cravenhousecapital.com

SI Capital Tel: 01483 413500

Broker

Nick Emerson

www.sicapital.co.uk

SPARK Advisory Partners Limited Tel: 0203 368 3550

Nominated Adviser

Matt Davis/James Keeshan

www.Sparkadvisorypartners.com

About Craven House Capital:

The Company's Investing Policy is primarily to invest in or

acquire a portfolio of companies, partnerships, joint ventures,

businesses or other assets participating in the e-Commerce

sector.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDDIDDDGXR

(END) Dow Jones Newswires

February 27, 2023 10:30 ET (15:30 GMT)

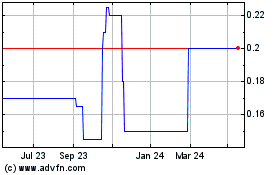

Craven House Capital (LSE:CRV)

Historical Stock Chart

From Apr 2024 to May 2024

Craven House Capital (LSE:CRV)

Historical Stock Chart

From May 2023 to May 2024