CleanTech Lithium PLC Further information re share consolidation

26 November 2024 - 4:35AM

RNS Regulatory News

RNS Number : 5795N

CleanTech Lithium PLC

25 November 2024

25 November

2024

CleanTech Lithium PLC ("CleanTech

Lithium" or the "Company")

Further information re share

consolidation

Further to the Notice of AGM announcement on 30

October 2024 CleanTech Lithium confirms that subject to the passing

of relevant resolutions at the Company's

Annual General Meeting ("AGM") to be held on 26 November 2024

at 11:00AM GMT, every two existing ordinary shares of £0.01 each

will be consolidated into one new ordinary share of £0.02 (the "New

Ordinary Shares").

The ISIN for the New Ordinary Shares will be

JE00BTJ01443 and the SEDOL for the New Ordinary Shares will be

BTJ0144.

The detailed reasons for and background to the

resolutions are set out in a Circular which contains the notice of

AGM available on the Company's website https://ctlithium.com/investors/circulars-documents/.

EXPECTED TIMETABLE OF PRINCIPAL

EVENTS

|

|

2024

|

|

Publication of the Circular and the

Form of Proxy

|

30

October

|

|

Latest time and date for receipt of

Forms of Proxy and CREST voting instructions

|

11.00 a.m.

on 24 November

|

|

Time and date of the Annual General

Meeting

|

11.00 a.m.

on 26 November

|

|

Result of Annual General Meeting

announced

|

26

November

|

|

Record Date in respect of the Share

Consolidation

|

6.00 p.m.

on 26 November

|

|

Admission expected to become

effective and dealings expected to commence in the New Ordinary

Shares on AIM

|

8.00 a.m.

on 27 November

|

|

Where applicable, expected date for

CREST accounts to be credited in respect of New Ordinary Shares in

uncertificated form

|

27

November

|

|

Where applicable, expected date for

despatch of definitive certificates for New Ordinary Shares in

certificated form

|

3

December

|

|

ADMISSION

STATISTICS

|

|

Number of Existing Ordinary

Shares

|

167,889,592

|

|

Consolidation ratio of Existing

Ordinary Shares to New Ordinary Shares

|

2:1

|

|

Nominal value of a New Ordinary

Share following the Share Consolidation

|

£0.02

|

|

Number of Existing Ordinary Shares

in issue as at the Share Consolidation Record Date

|

167,889,592

|

|

Number of New Ordinary Shares in

issue immediately following the Share Consolidation

|

83,944,796

|

|

Current ordinary share

ISIN

|

JE00BPCP3Z37

|

|

New Ordinary Share ISIN

|

JE00BTJ01443

|

|

Current warrant ISIN

|

JE00BLFDJM55

|

|

New warrant ISIN

|

JE00BS0CHP56

|

|

|

|

|

For

further information contact:

|

|

|

|

CleanTech Lithium PLC

|

|

|

|

Steve Kesler/Gordon Stein/Nick

Baxter

|

Jersey office: +44 (0) 1534 668

321

Chile office:

+562-32239222

|

|

|

|

Or via Celicourt

|

|

|

Celicourt Communications

Felicity Winkles/Philip Dennis/Ali

AlQahtani

|

+44 (0) 20 7770 6424

cleantech@celicourt.uk

|

|

|

Beaumont Cornish Limited (Nominated Adviser)

Roland Cornish/Asia

Szusciak

|

+44 (0) 20 7628 3396

|

|

|

Fox-Davies Capital Limited (Joint Broker)

Daniel Fox-Davies

|

+44 (0) 20 3884 8450

daniel@fox-davies.com

|

|

|

Canaccord Genuity (Joint Broker)

James Asensio

|

+44 (0) 20 7523 4680

|

|

|

|

|

| |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish's responsibilities as the Company's Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

Notes

CleanTech Lithium (AIM:CTL,

Frankfurt:T2N, OTCQX:CTLHF) is an exploration and development

company advancing lithium projects in Chile for the clean

energy transition. Committed to net-zero, CleanTech Lithium's

mission is to become a new supplier of battery grade lithium using

Direct Lithium Extraction technology powered by renewable

energy.

CleanTech Lithium has two key

lithium projects in Chile, Laguna Verde and Viento Andino, and

exploration stage projects in Llamara and Arenas Blancas

(Salar de Atacama), located in the lithium triangle, a leading

centre for battery grade lithium production. The two most advanced

projects: Laguna Verde and Viento Andino are situated

within basins controlled by the Company, which affords significant

potential development and operational advantages. All four projects

have good access to existing infrastructure.

CleanTech Lithium is committed to

utilising Direct Lithium Extraction with reinjection of spent brine

resulting in no aquifer depletion. Direct Lithium Extraction is a

transformative technology which removes lithium from brine with

higher recoveries, short development lead times and no extensive

evaporation pond construction. www.ctlithium.com

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

FUREAXFSADALFFA

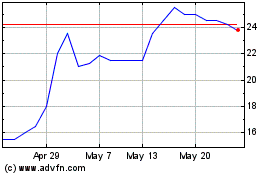

Cleantech Lithium (LSE:CTL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cleantech Lithium (LSE:CTL)

Historical Stock Chart

From Mar 2024 to Mar 2025