TIDMDPP

RNS Number : 3658N

DP Poland PLC

24 September 2019

DP Poland plc

("DP Poland" or the "Group")

Interim results for the half year to 30 June 2019

System sales up 10%, like-for-likes returning positive from

March and more sub-franchisees in place

Appointment of General Manager in Poland

Financial highlights:

-- 10% increase in System Sales(1) to 41m PLN H1 2019 (37m PLN H1 2018)

o including the three highest monthly levels of System Sales for

the Group to date

-- -1% like-for-like(2) growth in System Sales H1 2019 on H1

2018, reflecting the strong comparatives driven by TV advertising

in January and February 2018

o Latest like-for-like System Sales: July +1% and August +8%

o System Sales growth continuing in September to date

-- Pre-IFRS 16 Group EBITDA(5) losses increased, impacted as

expected by investment in operations and weaker commissary

performance

-- Net cash of GBP5.1m as at 30 June 2019 (GBP2.0m as at 31 December 2018)

-- Group performance in line with management expectations for 2019

Operational highlights:

-- 80% of delivery sales ordered online H1 2019 (77% H1 2018)

-- 4 new stores opened in H1 2019, 2 further opened since the period end

-- 69 stores open to-date, across 29 towns and cities

-- 2 further leases signed

-- 3 corporate stores acquired by 2 new sub-franchisees across Poland

-- 3 corporate stores taken under management contract by 1 existing sub-franchisee

-- Appointment of Iwona Olbrys as General Manager in Poland

joining from Telepizza Poland; an experienced Food & Beverage

executive

-- Positive interaction with aggregator Pyzszne

Nick Donaldson, non-executive Chairman, said:

"DP Poland delivered continued expansion and growth in System

Sales across both corporate stores and commissary during the first

half of the year, notwithstanding the strong comparatives driven by

TV advertising in January and February 2018. March to June 2019 saw

positive growth in both like-for-like System Sales and

like-for-like order count. Pleasingly, System Sales growth has

continued in July, August and September.

We have expanded the store estate to 69 stores. We intend to

continue to increase the number of stores through corporate and

sub-franchise openings.

We are delighted to announce the appointment of Iwona Olbrys as

our new General Manager in Poland, succeeding Peter Shaw. Iwona,

who is based in Warsaw, has significant experience in the Food

& Beverage sector in Poland, having been the general director

of Telepizza Poland - a business with 93 stores, both company owned

and sub-franchised - since 2011. This appointment is in line with

our strategy, announced in February, to focus our resources in

Poland.

The recent headwinds affecting the Polish food delivery sector,

including food and labour costs, and the impact of the aggregators

on the sector, continue. However we remain confident that,

underpinned by our well-invested infrastructure and world-renowned

service and products, Domino's Pizza in Poland will continue to

grow in this environment. The strong fundamentals in the Polish

economy and continued expansion of the delivery market support the

growing opportunity for the Domino's proposition in Poland."

(1) System Sales - total retail sales including sales from

corporate and sub-franchised stores, unaudited.

(2) Like-for-like growth in PLN, matching trading periods for

the same stores between 1 January and 30 June 2018 and 1 January

and 30 June 2019.

(3) When a store's delivery area is split, by opening a second

store in its original delivery area, a significant portion of the

original store's customer database is allocated to the new store,

resulting in the original store losing sales.

(4) Sales minus variable costs

(5) Excluding non-cash items, non-recurring items and store

pre-opening expenses

(6) Source: PizzaPortal

(7) Non-like-for-like stores that are less than 12 months old,

with no matching trading periods year on year.

(8) Exchange rate average for H1 2019 GBP1: 4.9158

(9) Exchange rate average for H1 2018 GBP1: 4.7988

Enquiries:

DP Poland PLC

Nick Donaldson, non-executive Chairman

www.dppoland.com 020 3393 6954

Peel Hunt LLP

Adrian Trimmings / George Sellar 020 7418 8900

Notes to editors:

DP Poland, through its wholly owned subsidiary DP Polska S.A.,

has the exclusive right to develop, operate and sub-franchise

Domino's Pizza stores in Poland. There are currently 69 Domino's

Pizza stores, 42 corporately managed (4 of which are under

management contract) and 27 sub-franchised.

Non-executive Chairman's Review

Group performance

System Sales increased by 10% in H1 2019. This was driven by

improved like-for-like growth during March-June 2019, following the

strong comparatives driven by our trial TV advertising in January

2018 (+24%) and February 2018 (+18%). Other positive factors

included the incremental growth from stores that are less than 12

months old and the contributions from 4 new corporate stores opened

during the course of H1 2019.

In the first half of 2019 we had the three highest monthly

levels of System Sales to date. These results were achieved despite

the increased cost of ingredients and higher labour rates. We

continue to focus upon controlling and, where possible, reducing

our costs.

Overall, Pre-IFRS 16 Group EBITDA losses increased in the period

by 20% year on year at constant exchange rates(8) . At actual

exchange rates(8,9) , Pre-IFRS 16 Group EBITDA losses increased by

18% year on year.

Group performance remains in line with management expectations

for 2019.

Store performance

System Sales in the period increased 10% year on year on the

back of -1% like-for-like sales growth, growth from

non-like-for-like(7) stores and four new store openings. Compound

like-for-like sales performance H1 2018-19 was 12%. Pre-IFRS 16

corporate store EBITDA decreased 11% year on year.

Sustained robust growth in the Polish economy continues to add

inflationary pressure to labour rates, particularly in Warsaw and

the other major cities. Although staff recruitment and retention

pressures continue, we believe that the fact that we are perceived

to be an attractive employer continues to be helpful to us.

Store roll-out

We currently have 69 stores in 29 towns and cities, having

expanded the store estate by 6 stores since the beginning of the

year.

Stores 1 Jan 2019 Opened 30 June 2019 24 Sept 2019

Corporate 39 4 43 42*

----------- ------- ------------- -------------

Sub-franchised 24 0 24 27

----------- ------- ------------- -------------

Total 63 4 67 69

----------- ------- ------------- -------------

* 4 corporate stores are run by sub-franchisees under management

contract, with the option to acquire and sub-franchise in the

future.

We have two further store leases signed and a pipeline of more

sites under negotiation.

We have satisfied the minimum store opening target under the

Master Franchise Agreement we have with Domino's Pizza, Inc.

Commissary performance

Our two commissaries are both performing efficiently in the

production of dough and the supply of all ingredients and non-food

items to pizza stores. The growing commissary revenue line is an

increasingly important component of the Group's total revenue and

directly reflects growth in System Sales. However, pre-IFRS 16

commissary gross profit(4) in the period decreased 7%, H1 2019 on

H1 2018, principally on account of sales incentives and other

support for sub-franchisees.

Cost pressures on ingredients impacted gross profit margins in

the first half, driven particularly by price inflation in respect

of flour in Q1 2019 and in respect of cheese and meat in Q2 2019.

Assisted by our increasing volume requirements we seek to buy

ingredients and non-food items at the best prices for our business,

sharing these cost reductions with our sub-franchisees.

We expect to see continued inflationary pressures on ingredients

in the second half. I am confident that our buying team will

continue to perform strongly.

Sub-franchising

Two new sub-franchisees acquired three existing corporate

stores. In addition, three corporate stores were taken under

management contract by one existing sub-franchisee. We currently

have 10 sub-franchisees across Poland. As at 30 June, 24 of our 67

stores were sub-franchised and a four further stores were managed

by sub-franchisees under management contract, with the option for

them to sub-franchise those stores in the future.

With 39% of the store estate operated today by sub-franchisees

we are seeing the establishment of successful sub-franchise

businesses. The emerging success stories should attract more

potential sub-franchisees to the brand. We are actively marketing

our sub-franchise proposition and strengthening our resources to

address this increasing interest.

We are in discussions with a number of third parties about

sub-franchising Domino's stores, which we expect complete later

this year and early 2020.

Marketing and product

We continue to invest in improving our digital presence,

including the effectiveness of our existing interfaces and the

creation of new ones. We are currently testing dynamic pricing on

our digital channels.

80% of all delivery orders were ordered online in H1 2019, up

from 77% in H1 2018. We are seeing a growing proportion of online

orders made on small screens (smart phones in particular),

presently accounting for 63% of online orders.

We introduced 2 new pizzas in H1 2019, SzparagoweLove and Lesne

Smaki, both created by Damian Kordas, the Polish MasterChef winner.

These new recipes have been well received by our customers.

Appointment of General Manager in Poland

DP Poland is a very different business from the start-up which

opened its first store in Warsaw in February 2011. DP Poland is now

a business of substance, requiring greater management resource in

Poland, with strong local knowledge.

We are therefore delighted to announce the appointment of Iwona

Olbrys as our new General Manager in Poland, succeeding Peter Shaw.

Iwona, who is based in Warsaw, has significant experience in the

Food & Beverage sector in Poland, having been the general

director of Telepizza Poland - a business with 93 stores, both

company owned and sub-franchised - since 2011. This appointment is

in line with our strategy, announced in February, to focus our

resources in Poland.

We are confident that Iwona, working closely with Maciej Jania,

will comprise a strong, experienced management team, focused on

taking DP Poland to its next stage of growth.

Current trading and outlook

We have expanded the store estate by 10% so far this year to 69

stores to date. We intend to continue to increase the number of

stores through corporate and sub-franchise openings.

As our business matures and the DP Poland sub-franchisee

proposition become more attractive, we expect to interest an

increasing number of sub-franchise candidates. We are in

discussions with both existing and potential sub-franchisees to

open stores and expect to see the sub-franchised estate expand in

H2 2019 and thereafter.

Our business has been affected by the rapid growth of new food

and beverage offers and by the growing presence of the aggregators

in Poland, particularly in Warsaw, notably Pyzszne, Pizza Portal

and UberEats. We believe that the aggregators now represent a

continuing feature of the Polish food service market, which can be

particularly helpful to DP Poland in regions where we are less well

known. We remain confident that Domino's will continue to grow

well, underpinned by the strength of our consumer proposition -

food quality, customer service, competitive pricing and the

investments we have made in our expansion.

Poland is arguably the last large high growth market opportunity

in Europe, a substantial and stable country of 38 million people

that is maturing into a sophisticated consumer economy. The food

delivery sector is growing(6) and we remain confident of the

long-term sales and growth prospects for Domino's Pizza in

Poland.

Nick Donaldson

Non-executive Chairman

24 September 2019

Finance Director's Review

In accordance with new accounting requirements, these half year

results are presented in accordance with IFRS 16, the new lease

accounting standard. On 1 January 2019 the Group adopted a new

accounting standard, IFRS 16 'Leases'. The Group has used the

modified retrospective transition approach as permitted by the

standard, which means that comparative figures in the financial

statements have not been restated. The adoption of IFRS 16 has had

a significant impact on the Group's financial statements, including

the important measure of Group EBITDA, which under IFRS 16 excludes

the rental cost of the Group's stores, commissaries and offices.

The Directors believe that a clearer picture of trading performance

compared to prior periods is given by looking at Group EBITDA

excluding the effect of IFRS 16 and therefore the figures for Group

EBITDA shown in the Non-executive Chairman's Statement and the

Finance Director's Review are shown excluding the effect of IFRS 16

('Pre-IFRS 16').

Unaudited Unaudited Unaudited

6 months 6 months

to 6 months to to

30.06.19 30.06.19 30.06.18

Pro-forma

Pre-IFRS 16

GBP GBP GBP

Revenue 6,887,081 6,945,328 6,394,787

Direct costs (5,820,311) (6,490,479) (5,820,464)

Selling, general and administrative

expenses - excluding:

store pre-opening expenses, depreciation,

amortisation and share based payments (1,332,591) (1,417,293) (1,388,409)

GROUP EBITDA - excluding non-cash

items, non-recurring items and store

pre-opening expenses (265,821) (962,444) (814,086)

------------ ------------ ------------

Store pre-opening expenses (30,971) (30,971) (45,852)

Other non-cash and non-recurring

items (220,043) (198,248) 335,960

Finance income 78,071 66,650 70,651

Finance costs (106,420) (10,178) (10,189)

Foreign exchange gains / (losses) (18,446) (18,446) (21,968)

Depreciation, amortisation and impairment (1,214,320) (631,985) (530,025)

Share based payments (72,902) (72,902) (95,573)

Loss before taxation (1,850,852) (1,858,524) (1,111,082)

------------ ------------ ------------

Direct costs

We continue to experience inflation in food costs. We work hard

to control these cost increases as well as possible, and we are

careful to share the benefits of any reduction in food costs with

our sub-franchisees.

Labour cost inflation continues in Poland's robust economy and

represents a challenge, particularly for our younger stores which

have fewer sales to absorb the fixed element of labour. National

Minimum Wage in Poland in 2019 has been increased by 7%

(year-on-year) on top of a 5% (year-on-year) increase in 2017. We

expect a further National Minimum Wage increase in 2020.

Selling, General and Administrative expenses

In H1 2019 Pre-IFRS 16 Selling, General and Administrative

expenses were 17% of System Sales, representing a 1% point

improvement on H1 2018 (H1 2018 18%) (measured using actual average

exchange rates).

Store count

6 stores have been opened in 2019 to-date, taking the total to

69 stores in 29 cities.

The table below sets out our current store estate.

Stores 1 Jan 2019 Opened Sold to Closed 30 June 24 Sept 2019

franchisees 2019

Corporate 39 4 0 0 43 42*

----------- ------- ------------- ------- -------- -------------

Sub-franchised 24 0 0 0 24 27

----------- ------- ------------- ------- -------- -------------

Total 63 4 0 0 67 69

----------- ------- ------------- ------- -------- -------------

*4 corporate stores are run by sub-franchises under the

management contract; with the option to acquire and sub-franchise

in the future.

Sales Key Performance Indicators

In H1 2019 we saw 10% growth in System Sales, on the back of -1%

like-for-like sales growth, growth from non-like-for-like(7) stores

and 4 new store openings in the period.

Delivery online sales continue to grow, a more cost-efficient

means of making sales, however newly opened stores need time to

build online customers. Mobile orders represented 63% of online

sales.

H1 2019 H1 2018 Change %

000 000

System Sales PLN 41,029 37,159 +10%

-------- -------- ---------

System Sales GBP * 8,346 7,559 +10%

-------- -------- ---------

L-F-L system sales PLN -1% +13%

-------- -------- ---------

Delivery system sales ordered

online +80% +77%

-------- -------- ---------

*Constant exchange rate of PLN 4.92:GBP1

Like-for-likes in July and August 2019 were: +1% and +8%

respectively; pre-split(3) : +1% and +9% post-split.

Group performance

11% growth of Pre-IFRS 16 Group Revenue in PLN is derivative of

10% growth of System Sales.

Group Revenue & EBITDA* H1 2019 H1 2018 Change %

(Pre IFRS 16)

------------------------- ---------

Revenue PLN 000 34,142 30,687 +11%

-------- -------- ---------

Revenue GBP000 * 6,945 6,243 +11%

-------- -------- ---------

Group EBITDA GBP000 (962) (800) -20%

-------- -------- ---------

*Constant exchange rate of PLN 4.92:GBP1

Group Revenue & EBITDA* H1 2019 H1 2018 Change

(Pre IFRS 16) %

------------------------- -------

Revenue PLN 000 34,142 30,687 +11%

-------- -------- -------

Revenue GBP000 * 6,945 6 395 +9%

-------- -------- -------

Group EBITDA GBP000 (962) (814) -18%

-------- -------- -------

*Actual exchange rates for H1 2019 and H1 2018

Group loss for the period

Pre-IFRS 16 Group EBITDA loss (at actual exchange rates)

increased by 18% against the comparative period in 2018, whereas

the Pre-IFRS 16 Group loss before tax (at actual exchange rates)

increased by 67%. The 49% difference between the increase in Group

EBITDA loss and Group loss before tax was due in part to higher

depreciation and amortization charges and an increase of Other

non-cash and non-recurring items. Higher depreciation and

amortization was triggered by the opening of new stores. The

increase of Other non-cash and non-recurring items resulted

principally from redundancy payments to the Group's former CEO and

the fact that, in H1 2018, DP Polska S.A. received a one-off VAT

repayment relating to prior years.

Group Loss for the period* H1 2019 H1 2018 Change %

(Pre IFRS 16) 000 000

Group loss for the period (1,859) (1,111) -67%

-------- -------- ---------

* Actual exchange rates for H1 2019 and H1 2018

Exchange rates

PLN : GBP1 H1 2019 H1 2018 Change %

Profit & Loss Account 4.9158 4.7988 +2.4%

-------- -------- ---------

Balance Sheet 4.7461 4.9443 -4.0%

-------- -------- ---------

Financial Statements for our Polish subsidiary DP Polska S.A.

are denominated in zloties (PLN) and translated to Sterling (GBP).

Under IFRS the Profit and Loss Account for the Group has been

converted from PLN at the average half-a-year exchange rate

applicable to PLN against GBP. The balance sheet has been converted

from PLN to GBP at the 30 June 2019 exchange rate applicable to PLN

against GBP.

Cash position

On 28 February 2019 the Group completed a placing of 96,666,666

new ordinary shares at the price of 6 pence per share, raising a

net total (after expenses) of c. GBP5.5m.

Cash of GBP2.7m was deployed in H1 2019 to cover Group losses,

store CAPEX, working capital and fundraising expenses.

1 January 2019 Cash movement 30 June 2019

GBP000 GBP000 GBP000

Cash in bank* 1,958 3,100 5,058

--------------- -------------- -------------

*Actual exchange rates as at 31 Dec 2018 and 30 June 2019

A note on like-for-like metrics

For this and future sets of results we will present

like-for-like sales growth pre-split, as we account for an

increasing number of splits across our store estate. When a store's

delivery area is split - by opening a second store in its original

delivery area - a significant portion of the original store's

customer database is allocated to the new store. It is expected

that the original store will recover its sales after 2-3 years, but

in the meantime its sales will have been reduced. The rationale for

splitting is that the combined sales of the two stores will in time

typically outstrip the original store's sales, as customers are

better served by faster delivery times. Pre-split like-for like

measure the sales growth by like-for-like delivery areas, up until

the first anniversary of the split, when we can revert to

like-for-like store measures. This is a standard approach adopted

by many Domino's Pizza master franchisees.

Maciej Jania

Finance Director

24 September 2019

Group Income Statement

for the six months ended 30

June 2019

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

Notes GBP GBP GBP

Revenue 2 6,887,081 6,394,787 12,369,815

Direct costs (5,820,311) (5,820,464) (11,426,271)

Selling, general and administrative expenses

- excluding:

store pre-opening expenses, depreciation,

amortisation and share based payments (1,332,591) (1,388,409) (2,863,992)

GROUP EBITDA - excluding non-cash items, non-recurring

items and store pre-opening expenses* (265,821) (814,086) (1,920,448)

------------ ------------

Store pre-opening expenses (30,971) (45,852) (72,900)

Other non-cash and non-recurring

items (220,043) 335,960 131,054

Finance income 78,071 70,651 129,315

Finance costs (106,420) (10,189) (21,254)

Foreign exchange gains

/ (losses) (18,446) (21,968) (6,513)

Depreciation, amortisation

and impairment (1,214,320) (530,025) (1,793,258)

Share based payments (72,902) (95,573) (239,268)

Loss before taxation (1,850,852) (1,111,082) (3,793,272)

-------- ------------ ------------ -------------

Taxation 3 - - -

Loss for the

period (1,850,852) (1,111,082) (3,793,272)

-------- ------------ ------------ -------------

(0.86 (0.74 (2.53

Loss per share Basic 4 p) p) p)

(0.86 (0.74 (2.53

Diluted 4 p) p) p)

* The Group has adopted IFRS 16 'Leases' on 1 January 2019 and applied

the modified retrospective method on adoption. Comparatives for 2018

have not been restated and therefore Group EBITDA for the comparative

periods includes the cash cost of rent on stores, commissaries and

head office, whereas under IFRS 16 the current period does not. The

Group EBITDA loss for the six months to 30 June 2019, excluding the

effect of IFRS 16, was GBP962,444.

Group Statement

of comprehensive income

for the six months ended 30

June 2019

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

GBP GBP GBP

--------------------------------------------- ------------ ------------ ------------

Loss for the

period (1,850,852) (1,111,082) (3,793,272)

Currency translation

differences 159,294 (518,905) (253,668)

----------------------------------------------

Other comprehensive expense for the period,

net of tax to be reclassified to profit or

loss in subsequent periods 159,294 (518,905) (253,668)

------------------------------------------------- ------------ ------------

Total comprehensive income

for the period (1,691,558) (1,629,987) (4,046,940)

----------------------------------------------- ------------ ------------ ------------

Group Balance Sheet

at 30 June 2019

Unaudited Unaudited Audited

30.06.19 30.06.18 31.12.18

GBP GBP GBP

----------------------------- ------------- ------------- -------------

Non-current assets

Intangible assets 568,938 547,240 604,392

Property, plant and

equipment 6,459,661 6,492,012 6,437,717

Leases - right of use 3,300,098 - -

assets

Trade and other receivables 1,853,389 1,683,556 1,730,633

------------------------------ ------------- ------------- -------------

12,182,086 8,722,808 8,772,742

Current assets

Inventories 404,860 467,158 464,102

Trade and other receivables 2,443,035 1,840,189 1,931,434

Cash and cash

equivalents 5,057,831 3,807,953 1,957,916

--------------------------------- ------------- ------------- -------------

7,905,726 6,115,300 4,353,452

Total assets 20,087,812 14,838,108 13,126,194

--------------------------------- ------------- ------------- -------------

Current liabilities

Trade and other

payables (1,689,412) (1,551,344) (2,132,199)

Borrowings (123,394) (118,965) (143,820)

Lease liabilities (1,433,843) - -

Provisions (22,666) (31,039) (27,296)

--------------------------------- ------------- ------------- -------------

(3,269,315) (1,701,348) (2,303,315)

----------------------------- ------------- ------------- -------------

Non-current liabilities

Lease liabilities (2,457,005) - -

Borrowings (180,056) (172,837) (131,963)

--------------------------------- ------------- ------------- -------------

(2,637,061) (172,837) (131,963)

Total liabilities (5,906,376) (1,874,185) (2,435,278)

--------------------------------- ------------- ------------- -------------

Net assets 14,181,436 12,963,923 10,690,916

--------------------------------- ------------- ------------- -------------

Equity

Called up share

capital 1,247,444 763,860 764,111

Share premium

account 36,838,450 31,829,463 31,829,463

Capital reserve - own

shares (48,163) (48,163) (48,163)

Retained earnings (24,214,926) (19,515,337) (22,053,832)

Currency translation

reserve 358,631 (65,900) 199,337

------------------------------ ------------- ------------- -------------

Total equity 14,181,436 12,963,923 10,690,916

--------------------------------- ------------- ------------- -------------

Group Statement of Cash Flows

for the six months ended

30 June 2019

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

GBP GBP GBP

------------------------------------------ ------------ ------------ ------------

Cash flows from operating

activities

Loss before taxation

for the period (1,850,852) (1,111,082) (3,793,272)

Adjustments for:

Finance income (78,071) (70,651) (129,315)

Finance costs 106,420 10,189 21,254

Depreciation and amortisation

and impairment 1,214,320 530,025 1,793,258

Share based payments

expense 72,902 95,573 239,268

------------------------------------------- ------------ ------------ ------------

Operating cash flows before movement

in working capital (535,281) (545,946) (1,868,807)

Change in inventories 61,539 35,039 142,777

Change in trade and

other receivables (612,654) 723,051 313,459

Change in trade and other payables

and provisions (457,019) 143,041 556,875

--------------------------------------------

Cash (used in) / provided by

operations (1,543,415) 355,185 (855,696)

Taxation paid - - -

Net cash from operating

activities (1,543,415) 355,185 (855,696)

Cash flows from investing

activities

Payments to acquire

software (1,852) (25,131) (109,307)

Payments to acquire property, plant

and equipment (491,597) (1,044,815) (1,534,529)

Payments to acquire intangible

fixed assets (11,451) (34,477) (93,468)

Net movement in loans to sub-franchisees 53,389 139,352 239,949

Interest received 15,350 6,776 20,544

---------------------------------------------- ------------ ------------ ------------

Net cash used in investing

activities (436,161) (958,295) (1,476,097)

Cash flows from financing

activities

Net proceeds from issue of

ordinary share capital 5,492,320 1,106 1,357

Repayment of borrowings and

lease liabilities (323,563) - (126,425)

Interest paid (124,866) (9,981) (18,805)

---------------------------------------------- ------------ ------------ ------------

Net cash from financing

activities 5,043,891 (8,875) (143,873)

Change in cash and cash

equivalents 3,064,315 (611,985) (2,475,666)

Exchange differences on cash

balances 35,600 (85,973) (72,329)

Cash and cash equivalents at

beginning of period 1,957,916 4,505,911 4,505,911

Cash and cash equivalents at

end of period 5,057,831 3,807,953 1,957,916

-------------------------------------------- ------------ ------------ ------------

Group Statement of Changes

in Equity

for the six months ended

30 June 2019

Share Currency Capital

Share premium Retained translation reserve

-

capital account earnings reserve own shares Total

GBP GBP GBP GBP GBP GBP

------------------------ ---------- ----------- ------------- ------------ ----------- ------------

At 31 December

2017 762,754 31,829,463 (18,499,828) 453,005 (48,163) 14,497,231

Shares issued 1,106 - - - - 1,106

Share based payments - - 95,573 - - 95,573

Translation difference - - - (518,905) - (518,905)

Loss for the

period - - (1,111,082) - - (1,111,082)

------------------------ ---------- ----------- ------------- ------------ ----------- ------------

At 30 June 2018 763,860 31,829,463 (19,515,337) (65,900) (48,163) 12,963,923

Shares issued 251 - - - - 251

Share based payments - - 143,695 - - 143,695

Translation difference - - - 265,237 - 265,237

Loss for the

period - - (2,682,190) - - (2,682,190)

------------------------ ---------- ----------- ------------- ------------ ----------- ------------

At 31 December

2018 764,111 31,829,463 (22,053,832) 199,337 (48,163) 10,690,916

Adjustment to reserves on

adoption of IFRS 16 (383,144) (383,144)

------------- ------------ -----------

Shares issued 483,333 5,316,667 - - - 5,800,000

Expenses of share

issue - (307,680) - - - (307,680)

Share based payments - - 72,902 - - 72,902

Translation difference - - - 159,294 - 159,294

Loss for the

period - - (1,850,852) - - (1,850,852)

At 30 June 2019 1,247,444 36,838,450 (24,214,926) 358,631 (48,163) 14,181,436

------------------------ ---------- ----------- ------------- ------------ ----------- ------------

Notes to the Interim Financial Statements

for the six months ended

30 June 2019

1 (a) Basis of

preparation

These condensed interim financial statements are unaudited and do

not constitute statutory accounts within the meaning of the Companies

Act 2006. These condensed interim financial statements have been prepared

in accordance with IAS 34 'Interim Financial Reporting' and were approved

on behalf of the Board by the Non-executive Chairman Nicholas Donaldson.

The accounting policies and methods of computation applied in these

condensed interim financial statements are consistent with those applied

in the Group's most recent annual financial statements for the year

ended 31 December 2018 apart from the new accounting standard; IFRS

16 'Leases', which was adopted by the Group on 1 January 2019. Further

information on the impact of IFRS 16 'Leases' is set out in note 1(b)

below.

The financial statements for the year ended 31 December 2018, which

were prepared in accordance with International Financial Reporting

Standards, as endorsed by the European Union ('IFRS'), and with those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS, have been delivered to the Registrar of Companies. The

auditors' opinion on those financial statements was unqualified and

did not contain a statement made under s498(2) or (3) of the Companies

Act 2006.

Copies of these condensed interim financial statements and the Group's

most recent annual financial statements are available on request by

writing to the Company Secretary at our registered office DP Poland

plc, Elder House, St Georges Business Park, 207 Brooklands Road, Weybridge,

Surrey KT13 0TS, or from our website www.dppoland.com.

1 (b) Change of accounting policy -

IFRS 16 'Leases'

The Group has adopted IFRS 16 'Leases' at 1 January 2019 and applied

the modified retrospective approach. Comparatives for 2018 have not

been restated and the cumulative impact of adoption has been recognised

as a decrease to net assets with a corresponding decrease in retained

earnings at 1 January 2019 as follows:

01 January 2019

-------------------------------------------------- ----------- ------------------------

Non-current assets

Property, plant and equipment (right-of-use

assets) 2,526,723

Trade and other receivables (sub-lease

receivables) 963,334

Current assets

Trade and other receivables (sub-lease

receivables) 286,332

Non-current liabilities

Financial liabilities

- lease liabilities (2,768,254)

Current liabilities

Financial liabilities

- lease liabilities (1,391,279)

Total decrease in retained earnings

at 1 January 2019 (383,144)

----------------------------------------------------- ----------- ---------- ------------

The Group's lease portfolio consists of approximately 70 property

leases together with a number of vehicle and equipment leases. The

lease liability has been measured at the present value of the remaining

lease payments, discounted using the incremental borrowing rate at

transition. The right-of-use asset has been measured at the carrying

amount as if the standard had been applied since the commencement

of the lease, discounted using the incremental borrowing rate at transition.

Where data was not available to enable this measurement to be made,

the right-of-use asset has been measured at an amount equal to the

lease liability. On transition the Group elected not to reassess whether

a contract is, or contains, a lease, instead relying on the assessment

already made applying IAS 17 'Leases' and IFRIC 4 'Determining whether

an Arrangement contains a Lease'. In addition, the Group applied the

available practical expedients as follows:

-- Relied on its assessment of whether leases are onerous immediately

prior to the date of initial application.

-- Applied the short-term leases exemptions to leases with a lease

term ending within 12 months at the date of the initial application.

-- Excluded the initial direct costs from the measurement of the right-of-use

asset at the date of initial application.

-- Used hindsight in determining the lease term where the contract

contains options to extend or terminate the lease.

The Group operates as an intermediate lessor for a proportion of its

leases, resulting in subleases to sub-franchisees. The Group has evaluated

and classified these subleases as either operating leases or finance

leases as required under IFRS 16. Where the sublease transfers substantially

all of the risks and rewards arising from right-of-use asset from

the head lease, the right-of-use asset from head lease has been derecognised

and a lease receivable equal to the net investment in the sublease

has been recognised. Where the sublease does not transfer substantially

all of the risks and rewards arising from right-of-use asset from

the head lease, these are classified as operating leases as required

under IFRS 16 and the accounting treatment has not changed.

Adoption of the new standard has a material impact on the Group. The

lease liability brought onto the balance sheet at transition was GBP4,159,533

with the corresponding right-of-use asset valued at GBP3,776,389.

The net impact on the balance sheet is a reduction of net assets of

GBP383,144.

There is no overall impact on the Group's cash and cash equivalents

although there is a change to the classification of cash flows in

the cash flow statement with lease payments and finance lease receipts

previously categorised as net cash used in operations now being split

between the principal element (categorised in financing activities

for payments and investing activities for receipts) and the interest

element (categorised as interest paid in operating activities or interest

received in investing activities).

From 1 January 2019, the Group's lease policy

is summarised as follows:

The Group recognises a right-of-use asset and a lease liability at

the lease commencement date. The right-of-use asset is initially measured

at cost, comprising the initial amount of the lease liability plus

any initial direct costs incurred and an estimate of costs to restore

the underlying asset, less any lease incentives received. The right-of-use

asset is subsequently depreciated using the straight-line method from

the commencement date to the earlier of the end of the useful life

of the asset or the end of the lease term. The lease liability is

initially measured at the present value of the lease payments that

are not paid at the commencement date, discounted using the incremental

borrowing rate. The lease liability is measured at amortised cost

using the effective interest method. It is remeasured when there is

a change in future lease payments arising from a change in an index

or a rate or a change in the Group's assessment of whether it will

exercise an extension or termination option. When the lease liability

is remeasured, a corresponding adjustment is made to the right-of-use

asset.

Where the Group acts as an intermediate lessor, the Group evaluates

and classifies these subleases as either operating leases or finance

leases. Where the sublease transfers substantially all of the risks

and rewards arising from right-of-use asset from the head lease, the

right-of-use asset from head lease is derecognised and a lease receivable

equal to the net investment in the sublease is recognised. Where the

sublease does not transfer substantially all of the risks and rewards

arising from right-of-use asset from the head lease, the sublease

is classified as an operating lease and rent received is recognised

in the income statement on a straight line basis over the lease term.

Copies of these condensed interim financial statements and the Group's

most recent annual financial statements are available on request by

writing to the Company Secretary at our registered office DP Poland

plc, Elder House, St Georges Business Park, 207 Brooklands Road, Weybridge,

Surrey KT13 0TS, or from our website www.dppoland.com.

2 Revenue

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

GBP GBP GBP

================================================== =========== ========== ============

Core revenue 6,887,081 6,349,950 12,325,147

Other revenue - 44,837 44,668

6,887,081 6,394,787 12,369,815

-------------------------------------------------- ----------- ---------- ------------

Core revenues are ongoing revenues including sales to the public from

corporate stores, sales of materials and services to sub-franchisees,

royalties received from sub-franchisees and rents received from sub-franchisees.

Other revenues are non-recurring transactions such as the sale of

stores, fittings and equipment to sub-franchisees.

3 Taxation

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

GBP GBP GBP

======================================== ============= ============ ============

Current tax - - -

Deferred tax charge relating to the

origination and reversal

of temporary - - -

differences

----------------------------------------

Total tax charge in - - -

income statement

----------------------------------------- ------------- ------------ ------------

4 Earnings per ordinary

share

The loss per ordinary share has been

calculated as follows:

Unaudited Unaudited Audited

6 months 6 months Year to

to to

30.06.19 30.06.18 31.12.18

---------------------------------------- ------------- ------------ ------------

Profit / (loss)

after tax (GBP) (1,850,852) (1,111,082) (3,793,272)

Weighted average number of

shares in issue 215,867,842 150,106,962 150,185,274

Basic and diluted earnings (0.86 (0.74 (2.53

per share (pence) p) p) p)

------------------------------------------ ------------- ------------ ------------

The weighted average number of shares for the period excludes those

shares in the Company held by the employee benefit trust. At 30 June

2019 the basic and diluted loss per share is the same, because the

vesting of share awards would reduce the loss per share and is, therefore,

anti-dilutive.

5 Principal risks and

uncertainties

The principal risks and uncertainties facing the Group are disclosed

in the Group's financial statements for the year ended 31 December

2018, available from www.dppoland.com and remain unchanged.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKNDQABKDFCB

(END) Dow Jones Newswires

September 24, 2019 02:00 ET (06:00 GMT)

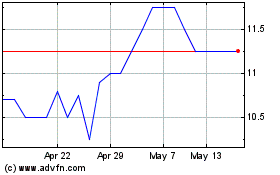

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jul 2023 to Jul 2024