TIDMELLA

RNS Number : 9110A

Ecclesiastical Insurance Office PLC

27 September 2022

2022 INTERIM RESULTS

Ecclesiastical Insurance Office plc 27 September 2022

Ecclesiastical Insurance Office plc ("Ecclesiastical"), the

specialist financial services group(1) , today announces its 2022

interim results. A copy of the results will be available on the

Company's website at www.ecclesiastical.com

Group overview

-- Within Ecclesiastical, there was excellent growth in Gross

Written Premiums (GWP) to GBP261.9m (H1 2021: GBP226.5m), driven by

new business, and supported by strong retention and rate

strengthening.

-- Underwriting profit increased to GBP16.6m (H1 2021: GBP2.5m).

-- Our capital position remains robust with Solvency II capital

cover increasing to 280% and AM Best and S&P affirming our

excellent and strong ratings. A consequence of our capital strength

is that we are able to hold a large diversified portfolio of

equities, property, infrastructure and other investments on top of

those assets held to meet our insurance and capital requirements.

This is done to enhance our returns over the long term, although it

can lead to short term volatility in our reported results, as it

has in the first half of the year.

-- Overall loss before tax of GBP27.3m (H1 2021: Profit before

tax of GBP46.5m), which includes GBP79.8m of fair value investment

losses (H1 2021: GBP34.3m gains) as a result of adverse market

conditions. Net investment losses were GBP26.6m (H1 2021: GBP58.2m

profit).

-- As part of the Benefact Group of companies, Ecclesiastical

remained focused on its charitable ambition to grow to give. The

Group has now given GBP182m(2) to charity against its target of

donating GBP250m by the end of 2025.

-- This includes a grant of GBP5m to our owner Benefact Trust

Limited in respect of 2021 performance. Alongside this, thanks to a

robust underlying performance of the Group's businesses, we're

announcing a further GBP5m will be granted to our charitable

owner.

-- Our donations are benefiting charities and communities all

over the UK and Ireland, Canada and Australia, and also helping to

tackle current issues such as the war in Ukraine and cost of living

crisis in the UK.

-- Our parent company Benefact Group plc published its climate

commitments in March, setting out a roadmap to achieve net zero

(direct and indirect) by 2040. This includes an ambitious

commitment to achieve net zero for direct emissions by the end of

2023 and to become net negative for direct emissions by the end of

2025.

-- Continued external recognition of the Group as a trusted and

specialist financial services organisation. This included being

named as the UK's most trusted home insurer for the 15th time by

independent ratings agency Fairer Finance, and our Canadian team

was named one of the Top Employers for Young People for the tenth

consecutive year. Ecclesiastical Financial Advisory Services won

the NatWest Intermediary local hero mortgage awards - South West

& Wales, while EdenTree's Responsible & Sustainable Managed

Income Fund was awarded the ESG Clarity Best Multi-Asset ESG

(Environmental, Social and Governance) fund.

Mark Hews, Group Chief Executive Officer of Ecclesiastical,

said:

"Being owned by a charity, we measure our success less in terms

of the profit we make, but more in terms of the amount we give away

to good causes. Together, thanks to outstanding commitment from all

our supporters, the Group have now become the fourth largest

corporate donor to charity in the UK, and with additional donations

made this year, we have now given GBP182m(2) to good causes against

our target of giving GBP250m by the end of 2025.

"In terms of Group profits, whilst we report short term losses

due to investment volatility, I'm pleased to report a resilient

financial performance for the first half of 2022 from our core

businesses. Our business model is focused on delivering long-term

sustainable profits, which allows us to withstand short-term

economic pressures, and we have continued to grow the business

despite the challenging environment. Our GI businesses reported

excellent premium growth, driven by new business wins, and

supported by strong retention and rate strengthening. This led to

an underwriting profit of GBP16.6m, a significant increase on the

previous year.

"While much of the investment industry saw outflows as investor

sentiment fell, EdenTree, our award-winning responsible and

sustainable investment management business, bucked the trend by

growing its fee income and receiving positive net flows. Our broker

businesses also performed well, with SEIB reporting solid results

with a half year profit before tax of GBP1.9m (H1 2021:

GBP1.7m).

"Our capital position remains strong, with AM Best and S&P

recently affirming our excellent and strong credit ratings, and we

continued to invest in our business. In the UK and Ireland, we saw

the release of our new general insurance system, which will

ultimately enable a better, faster service for our customers and

brokers, and we continued to rollout our innovative Smart

Properties proposition to heritage properties, schools and

cathedrals, which provides an early-warning system to prevent fire

and flood. I'm also pleased that Ecclesiastical Financial Advisory

Services (EFAS) have signed an official partnership to provide

independent financial advice to ordained and lay members of the

various Church of England Pension schemes administered by the

Church of England Pension Board.

"The challenging market conditions in the first half adversely

affected our investment performance as equity prices fell sharply

amid concerns around inflation and the on-going uncertainty in

Ukraine. Our results included fair value losses of GBP79.8m (H1

2021: GBP34.3m gains) on our investment portfolio, which

contributed to a net investment loss of GBP26.6m (H1 2021: GBP58.2m

profit) and overall loss before tax of GBP27.3m (H1 2021: GBP46.5m

profit).

"In these difficult times, we remain resolute in our vision to

build a movement for good in society, helping to transform lives

and communities for the better. In June, we celebrated our

achievement of giving GBP100m to good causes with a Service of

Thanksgiving at Westminster Abbey, attended by HRH The Prince of

Wales, now HM King Charles III, politicians, brokers, clients,

colleagues and some of over 10,000 charities that have benefited

from our giving. It was a remarkable and moving occasion. It

demonstrated our combined impact and inspires us to do even

more.

"In the first half of 2022, we have helped hundreds of charities

in the UK through our Movement for Good Awards. Our charitable

owner, Benefact Trust, stepped up its giving to include a GBP1m

funding package to support those affected by the devastating

conflict in Ukraine.

"Earlier this year we granted GBP5m to Benefact Trust in respect

of our excellent 2021 performance and we have announced a further

grant of GBP5m to be paid in October. This will support even more

people and help us achieve our new ambition of becoming Britain's

biggest corporate donor.

"We are conscious of the financial pressures currently facing

many of our customers. In response, we have provided fundraising

resources to help churches and charities raise much-needed funds.

We have also invested significantly in our risk management

services, both face to face and online, to help customers protect

themselves from losses, and if the worst happens, our expert claims

team are always there for our customers when they need us most.

"Our charitable purpose feels even more relevant in these

difficult times. It spurs us on to grow the business, so that we

may give even more to good causes, and help those in society who

need it most. We are actively seeking new opportunities and paths

to growth in all our markets and we have the appetite and capacity

to achieve this goal."

(1) The 'Group' refers to Ecclesiastical Insurance Office plc

together with its subsidiaries. The 'Benefact Group' and 'wider

group' refers to Benefact Group plc, the immediate parent company

of Ecclesiastical Insurance Office plc, together with its

subsidiaries. The 'Benefact Trust' and 'the Trust' refers to

Benefact Trust Limited, the ultimate parent undertaking of

Ecclesiastical Insurance Office plc.

(2) Cumulative giving since 2014.

Results summary

H1 2022 H1 2021

Gross written premiums GBP261.9m GBP226.5m

Group underwriting profit(3) GBP16.6m GBP2.5m

Group combined operating ratio(3) 88.8% 98.1%

Fair value (losses)/gains on investments (GBP79.8m) GBP34.3m

Net investment (losses) / return (GBP26.6m) GBP58.2m

(Loss) / profit before tax (GBP27.3m) GBP46.5m

30 June 2022 31 Dec 2021

Net asset value GBP611m GBP632m

Solvency II capital cover (solo) 280% 261%

(3) The Group uses Alternative Performance Measures (APMs) to

help explain performance. More information on APMs is included in

note 17.

Financial highlights

General Insurance - UK and Ireland

UK and Ireland reported strong GWP growth of 16% to GBP166m in

the six months to 30 June 2022 (H1 2021: GBP143m). This has been

driven by new business, particularly in Real Estate, and supported

by strong retention and rate strengthening. The business reported

an underwriting profit of GBP9.3m and a net combined ratio of 89.6%

(H1 2021: GBP15.3m profit, COR 81.5%).

Large weather related losses early in the year were

substantially offset by benign weather conditions in the second

quarter of the year. The overall property result performed only

slightly behind expectations, although lower than the prior period

which was driven by more favourable weather conditions. Claims

volumes in our liability business have continued to be lower than

pre-pandemic levels, whilst also benefiting from favourable prior

year releases.

General Insurance - Canada

The Canadian business delivered premium growth of 16% in local

currency, reporting GWP of GBP39.5m (H1 2021: GBP32.4m), driven by

high retention and rate strengthening. This premium growth,

alongside a reduction in expenses, has resulted in an underwriting

profit of GBP5.2m (H1 2021: GBP0.4m loss) and a COR of 85.6% (H1

2021: 101.5%). A lower than average number of weather events in the

first half of the year has led to strong returns in the property

portfolio, whilst the liability portfolio recorded a small

loss.

General Insurance - Australia

Our Australian business reported GWP of GBP54.2m (H1 2021:

GBP49.6m), with premium growth of 9.4% in local currency,

demonstrating the strength of its renewal portfolio and rate

adequacy. The business reported an underwriting profit of GBP0.8m

(H1 2021: GBP3.9m loss). The property result was again impacted by

weather events including the Queensland and New South Wales Floods,

however the liability book reported a strong result in the period

compared with 2021, which had been adversely impacted by

strengthening of historic liability claims.

General Insurance - Other

The Group made a further underwriting profit of GBP1.4m (2021:

GBP8.5m loss) within its internal reinsurance portfolio, in line

with expectations. The prior period result was impacted by reserves

strengthening in respect of historic PSA claims in Ansvar

Australia.

Investment Returns

Our investment result for the first half of the year was a loss

of GBP26.6m (H1 2021: GBP58.2m profit), which includes fair value

losses of GBP79.8m (H1 2021: GBP34.3m gains). Investment markets

have been impacted by macroeconomic disruptions, exacerbated by the

geopolitical turmoil in Ukraine and the cost of living crisis

shadowing the economic outlook. Higher food and energy prices are

pushing inflation to a 40 year high in the UK and other parts of

the world, as central banks respond with tighter monetary policy in

an effort to bring this under control. The resulting outlook for

higher interest rates and a deteriorating economy has driven down

financial asset prices.

Income from financial assets was GBP14.9m (H1 2021: GBP14.2m),

with signs this will continue to increase as interest rates

rise.

We discount some of our liability claims reserves at a rate that

reflects the yield on long-term investment grade bonds. The

reserves relate to liability policies, written over many decades,

and represent very long-tail risks. The movement in yields from the

year end resulted in a gain of GBP38.7m (2021: GBP7.6m) in the

first six months of the year.

We continue to take a long-term view of risk and our approach to

the management of risks resulting from the Group's exposure to

financial markets is outlined in note 4 to our latest annual

report.

Asset Management - EdenTree

Despite market movements negatively impacting fund values, our

investment management business, EdenTree, grew fee income by 2.6%

to GBP7.0m (H1 2021: GBP6.8m), supported by positive net flows,

largely into the Short Dated Bond Fund . Investor sentiment had

caused outflows in the industry as a whole, which highlights the

strength of EdenTree performance.

Within the funds EdenTree continues to manage at the period end,

net new money totalled GBP129.5m (2021: GBP190.8m). During the

period, EdenTree transferred or delegated (as appropriate)

investment management to a portfolio management business within the

wider Benefact Group as part of a strategic decision to clarify

functions and associated regulatory permissions. Under this model

EdenTree fulfils the role of Authorised Corporate Director for the

OEIC range and is legally responsible for the day to day management

of the funds to ensure they are managed within applicable

regulations, whilst the other business now performs the Investment

Management function.

As expected, our emphasis on the continued investment in the

business and people contributed to a loss of GBP1.2m (H1 2021:

GBP0.2m loss).

Broking and Advisory - SEIB Insurance Brokers

SEIB has continued to report solid results with a half year

profit before tax of GBP1.9m (H1 2021: GBP1.7m). General commission

and fees, excluding profit share commission, has increased by 7.9%

in the first half of the year to GBP6.4m (H1 2021: GBP5.9m)

primarily as a result of continued strong renewal retention and

rate increases.

Life Business

Our life business reopened to business during 2021, launching a

new product providing guarantees for pre-paid funeral planning

products sold by our Funeral Planning business in the wider

Benefact group. The life business reported a profit before tax of

GBP0.8m at the half year (H1 2021: GBP0.7m). Assets and liabilities

within this business are well matched, though we expect small

variances as margins in the insurance liabilities unwind.

Taxation

The Group's taxation charge in the period is a credit of

GBP18.7m (H1 2021: GBP18.1m charge), driven by reduced deferred tax

liabilities which reflect unrealised losses in the period on the

investment portfolio. Deferred tax is based on tax rates and laws

which have been enacted or substantively enacted at the period-end

date.

Balance Sheet and Capital Position

In the first half of the year, total shareholders' equity

decreased by GBP21.8m from GBP632.4m to GBP610.5m. The decrease was

primarily driven by investment losses as a result of fair value

movements the period which were partially offset by underwriting

profits. There were also actuarial gains, net of tax of GBP7.0m, on

retirement benefit plans driven by an increase in discount rate.

The Group made a GBP5m charitable grant in the period in respect of

prior year performance.

Strategic highlights

The Group's purpose to contribute to the greater good of society

underpins its strategic intent: the Group has a long history of

giving and a commitment to make a difference in the world. During

the first half of 2022 there have been several significant

highlights which contribute to the continued progress of the

Group.

Firstly, the Group's charitable ambition and focus is at the

heart of everything the Group does. In March 2022, the immediate

parent was rebranded and renamed Benefact Group, and the ultimate

charitable owner was rebranded and renamed the Benefact Trust. This

reinforces the distinctive positioning - enabling better

understanding that the Trust and its businesses are united and

motivated by a common purpose to give its profits to good

causes.

This charitable ambition shapes and drives the commitments of

the Group's businesses: each offers distinctive positioning and

support for its customers and communities. The Group's most recent

target to give GBP100m to charity was achieved in 2021.

The Benefact Group has continued to invest in its businesses,

operations and people to drive business benefit and enable

charitable giving to its communities. This investment is

underpinned by the Group's resilience and financial strength. This

is demonstrated by the achievement of key milestones including: the

first go-live of the new policy administration platform;

establishment of the Benefact family across all divisions and

businesses supported by refreshed values, culture and behaviours;

the launch of new investment funds; further acquisitions within the

Broking and Advisory division; and providing financial support to

the people of Ukraine through triple-matching of employee

giving.

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Group and our

approach to managing them are outlined in our latest annual report

and in note 4 to these condensed financial statements. There has

been no change to the principal risks and uncertainties since the

year end.

Group Outlook

Our robust performance in recent years delivering profitable

growth within the insurance business has been underpinned by strong

underwriting discipline and a real focus on supporting customers to

manage their risks. In order to be able to give more, we are

ambitious in our plans to grow the business on the back of our many

years of success. We are focussing on ways in which we can deliver

even better customer value and reach additional customers and

customer groups while retaining our strong underwriting and risk

management disciplines.

The global outlook remains uncertain, with the UK expected to

enter recession and the Bank of England expected to announce

further increase to interest rates to tackle inflation. Despite

these economic pressures and challenges ahead, we remain confident

about our future and are well placed to withstand potential

volatility.

Challenging times serve to remind us just why we do business -

we are motivated to make a real difference in the lives of the

people and the communities we were built to help.

The Group's Next Chapter strategy enables the Group to

significantly increase its impact, with aspirations to build a

Movement for Good that transforms lives and communities. This

strategy focuses on four themes which encompass both the

longer-term ambitions and the short term priorities, while

enhancing its strong competitive position in its markets. It brings

together the Group's ambitions to grow its profitability, diversify

its portfolio within its specialist areas, continue its investments

in technology, people and proposition development, and anticipates

strong business growth - together enabling the Group to give back

even more to society and its communities through its giving. The

Benefact Group has a new ambition to give over GBP250m cumulatively

by the end of 2025, following the successful delivery of its

GBP100m ambition as part of its previous strategic chapter.

By order of the Board

Mark Hews

Group Chief Executive

27 September 2022

CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the 6 months to 30 June 2022

30.06.22 30.06.21 31.12.21

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Revenue

Gross written premiums 261,885 226,529 486,211

Outward reinsurance premiums (114,469) (97,571) (198,601)

Net change in provision for unearned premium 1,048 2,444 (14,620)

Net earned premiums 148,464 131,402 272,990

------------ ------------ ----------

Fee and commission income 41,795 37,275 81,547

Other operating income 2,161 1,000 1,136

Net investment return (26,578) 58,177 101,067

Total revenue 165,842 227,854 456,740

------------ ------------ ----------

Expenses

Claims and change in insurance liabilities (151,734) (151,188) (269,633)

Reinsurance recoveries 77,813 77,711 123,822

Fees, commissions and other acquisition costs (51,761) (45,211) (95,896)

Other operating and administrative expenses (66,605) (61,613) (135,632)

Total operating expenses (192,287) (180,301) (377,339)

------------ ------------ ----------

Operating (loss)/profit (26,445) 47,553 79,401

Finance costs (839) (1,090) (2,364)

(Loss)/profit) before tax (27,284) 46,463 77,037

Tax credit/(expense) 18,695 (18,050) (17,648)

------------ ------------ ----------

(Loss)/profit for the financial period from

continuing operations attributable to equity

holders of the Parent (8,589) 28,413 59,389

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 6 months to 30 June 2022

30.06.22 30.06.21 31.12.21

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit for the period (8,589) 28,413 59,389

------------ ------------ ----------

Other comprehensive (expense)/income

Items that will not be reclassified subsequently

to profit or loss:

Actuarial (losses)/gains on retirement benefit

plans (9,352) 35,510 38,660

Attributable tax 2,338 (7,314) (8,098)

(7,014) 28,196 30,562

Items that may be reclassified subsequently

to profit or loss:

Gains/(losses) on currency translation differences 7,634 (1,491) (2,356)

(Losses)/gains on net investment hedges (6,496) 1,258 1,912

Attributable tax 1,286 (183) (183)

2,424 (416) (627)

------------ ------------ ----------

Net other comprehensive (expense)/income (4,590) 27,780 29,935

------------ ------------ ----------

Total comprehensive (expense)/income attributable

to equity holders of the Parent (13,179) 56,193 89,324

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 6 months to 30 June 2022

Translation

Share Share Revaluation and hedging Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

2022 (Unaudited)

At 1 January 120,477 4,632 268 17,603 489,381 632,361

Loss for the period - - - - (8,589) (8,589)

Other net income/(expense) - - - 2,424 (7,014) (4,590)

--------- -------- ------------ ------------ --------- ----------

Total comprehensive

income/(expense) - - - 2,424 (15,603) (13,179)

Dividends on preference

shares - - - - (4,591) (4,591)

Gross charitable grant - - - - (5,000) (5,000)

Tax relief on charitable

grant - - - - 950 950

Reserve transfers - - (46) - 46 -

At 30 June 120,477 4,632 222 20,027 465,183 610,541

--------- -------- ------------ ------------ --------- ----------

2021 (Unaudited)

At 1 January 120,477 4,632 599 18,230 425,290 569,228

Profit for the period - - - - 28,413 28,413

Other net (expense)/income - - (21) (416) 28,217 27,780

--------- -------- ------------ ------------ --------- ----------

Total comprehensive

(expense)/income - - (21) (416) 56,630 56,193

Dividends on preference

shares - - - - (4,591) (4,591)

Reserve transfers - - (313) - 313 -

At 30 June 120,477 4,632 265 17,814 477,642 620,830

--------- -------- ------------ ------------ --------- ----------

2021 (Audited)

At 1 January 120,477 4,632 599 18,230 425,290 569,228

Profit for the year - - - - 59,389 59,389

Other net (expense)/income - - (18) (627) 30,580 29,935

--------- -------- ------------ ------------ --------- ----------

Total comprehensive

(expense)/income - - (18) (627) 89,969 89,324

Dividends on preference

shares - - - - (9,181) (9,181)

Gross charitable grant - - - - (21,000) (21,000)

Tax relief on charitable

grant - - - - 3,990 3,990

Reserve transfers - - (313) - 313 -

At 31 December 120,477 4,632 268 17,603 489,381 632,361

--------- -------- ------------ ------------ --------- ----------

The revaluation reserve represents cumulative net fair value

gains on owner-occupied property. Further details of the

translation and hedging reserve are included in note 12.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2022

30.06.22 30.06.21 31.12.21

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Assets

Goodwill and other intangible assets 54,355 59,277 52,512

Deferred acquisition costs 48,204 42,082 46,027

Deferred tax assets 9,083 3,028 8,480

Pension surplus 16,919 25,241 28,304

Property, plant and equipment 35,187 37,973 35,245

Investment property 169,844 146,266 163,355

Financial investments 823,901 847,561 883,770

Reinsurers' share of contract liabilities 303,975 258,464 254,449

Current tax recoverable 8,873 7,981 5

Other assets 302,842 252,836 240,910

Cash and cash equivalents 110,137 108,148 114,036

Total assets 1,883,320 1,788,857 1,827,093

------------ ------------ -----------

Equity

Share capital 120,477 120,477 120,477

Share premium account 4,632 4,632 4,632

Retained earnings and other reserves 485,432 495,721 507,252

Total shareholders' equity 610,541 620,830 632,361

------------ ------------ -----------

Liabilities

Insurance contract liabilities 988,888 921,131 943,292

Investment contract liabilities 38,649 - 15,519

Lease obligations 21,691 24,319 22,738

Provisions for other liabilities 8,928 9,350 6,373

Retirement benefit obligations 5,462 6,283 7,058

Deferred tax liabilities 31,928 54,641 48,355

Current tax liabilities 788 104 1,232

Deferred income 30,714 26,867 28,385

Subordinated liabilities 25,049 24,981 24,433

Other liabilities 120,682 100,351 97,347

Total liabilities 1,272,779 1,168,027 1,194,732

------------ ------------ -----------

Total shareholders' equity and liabilities 1,883,320 1,788,857 1,827,093

------------ ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the 6 months to 30 June 2022

30.06.22 30.06.21 31.12.21

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit before tax (27,284) 46,463 77,037

Adjustments for:

Depreciation of property, plant and equipment 3,016 3,128 6,155

(Profit)/loss on disposal of property, plant

and equipment (10) 28 24

Amortisation of intangible assets 1,104 413 856

Loss on disposal of intangible assets - - 4,765

Net fair value losses/(gains) on financial

instruments and investment property 79,765 (34,285) (58,340)

Dividend and interest income (10,244) (9,733) (21,802)

Finance costs 839 1,090 2,364

Adjustment for pension funding 416 713 1,646

47,602 7,817 12,705

Changes in operating assets and liabilities:

Net increase in insurance contract liabilities 20,602 58,895 83,952

Net increase in investment contract liabilities 23,131 - 15,519

Net increase in reinsurers' share of contract

liabilities (41,291) (52,761) (49,513)

Net increase in deferred acquisition costs (545) (317) (4,376)

Net increase in other assets (57,661) (37,376) (25,891)

Net increase in operating liabilities 21,147 9,452 8,472

Net increase/(decrease) in other liabilities 2,570 2,778 (234)

Cash generated/(used) by operations 15,555 (11,512) 40,634

Purchases of financial instruments and investment

property (117,263) (60,478) (186,514)

Sale of financial instruments and investment

property 98,910 62,504 157,614

Dividends received 3,889 2,929 7,427

Interest received 6,886 6,689 14,068

Tax paid (2,817) (4,042) (3,142)

Net cash from/(used by) operating activities 5,160 (3,910) 30,087

------------ ------------ ----------

Cash flows from investing activities

Purchases of property, plant and equipment (2,336) (3,380) (3,634)

Proceeds from the sale of property, plant

and equipment 27 27 48

Purchases of intangible assets (2,772) (5,557) (3,914)

Proceeds from the sale of intangible assets - 62 -

Net cash used by investing activities (5,081) (8,848) (7,500)

------------ ------------ ----------

Cash flows from financing activities

Interest paid (839) (1,090) (2,364)

Payment of lease liabilities (1,583) (1,560) (3,209)

Proceeds from issue of subordinate debt, net

of expenses - 25,014 25,014

Dividends paid to Company's shareholders (4,591) (4,591) (9,181)

Charitable grant paid to ultimate parent undertaking - - (21,000)

Net cash (used by)/from financing activities (7,013) 17,773 (10,740)

------------ ------------ ----------

Net (decrease)/increase in cash and cash

equivalents (6,934) 5,015 11,847

Cash and cash equivalents at the beginning

of the period 114,036 104,429 104,429

Exchange gains/(losses) on cash and cash equivalents 3,035 (1,296) (2,240)

Cash and cash equivalents at the end of the

period 110,137 108,148 114,036

------------ ------------ ----------

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

1. General information and basis of preparation

Ecclesiastical Insurance Office plc (hereafter referred to as

the 'Company'), a public limited company incorporated and domiciled

in England, together with its subsidiaries (collectively the

'Group') operates principally as a provider of general insurance

and in addition offers a range of financial services, with offices

in the UK & Ireland, Australia and Canada.

The annual financial statements are prepared in accordance with

UK adopted International Financial Reporting Standards (IFRSs)

applicable at 31 December 2021 issued by the International

Accounting Standards Board (IASB) and the Disclosure Guidance and

Transparency Rules issued by the Financial Conduct Authority. The

condensed set of financial statements included in the 2022 interim

results has been prepared in accordance with UK adopted IAS 34,

Interim Financial Reporting.

The information for the year ended 31 December 2021 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor

reported on those accounts: its report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

These condensed consolidated interim financial statements were

approved by the Board on 27 September 2022 and were reviewed by the

Group's statutory auditor but not audited.

The Directors have assessed the going concern status of the

Group. The Directors have considered the Group's plans and

forecasts, financial resources, investment portfolio and solvency

position. The Group's forecasts and projections, taking into

account plausible scenarios, show that the group will have adequate

resources to continue operating over a period of at least 12 months

from the approval of the condensed consolidated interim financial

statements. Accordingly, the Directors continue to adopt the going

concern basis in preparing the consolidated interim financial

statements.

2. Accounting policies

The same accounting policies and methods of computation are

followed in the consolidated interim financial statements as

applied in the Group's latest audited annual financial

statements.

The following standards were in issue but not yet effective and

have not been applied to these condensed financial statements.

IFRS 17, Insurance Contracts, was issued in May 2017 and is

effective for periods beginning on or after 1 January 2023. The

standard establishes revised principles for the recognition,

measurement, presentation and disclosure of insurance contracts.

The Group's long-term business is expected to be the most affected

by the new standard. The Group's expected accounting policy choices

are disclosed in the 2021 Annual Report and Accounts.

IFRS 9, Financial Instruments, which provides a new model for

the classification and measurement of financial instruments, is

effective for periods beginning on or after 1 January 2018. The

Group has taken the option available to insurers to defer the

application of IFRS 9 until the implementation of IFRS 17 on 1

January 2023.

The Group's implementation of both IFRS 17 and IFRS 9 are in

progress. It is not currently practicable to reliably quantify the

impact on the Group's financial position or performance once these

standards are adopted, however, the Group is on track to be able to

report IFRS 17 results for the first time in its 2023 interim

results. The Group expects to provide further updates in the 2022

Annual Report and Accounts.

Other standards in issue but not yet effective are not expected

to materially impact the Group.

3. Critical accounting estimates and judgements

In preparing these interim financial statements and applying the

Group's accounting policies, the Directors have made judgements and

estimates based on their best knowledge of current circumstances

and expectation of future events. The judgements made in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the 31 December

2021 consolidated financial statements. Estimates and their

underlying assumptions continue to be reviewed on an ongoing basis

with revisions to estimates being recognised prospectively. There

have been no significant changes since 31 December 2021. Management

have considered the current economic environment including the

impact of high inflation in their estimates and judgements.

4. Risk management

The principal risks and uncertainties, together with details of

the financial risk management objectives and policies of the Group,

have not changed significantly during the first half of the year.

These risks are disclosed in the latest annual report.

5. Segment information

The Group segments its business activities on the basis of

differences in the products and services offered and, for general

insurance, the underwriting territory. Expenses relating to Group

management activities are included within 'Corporate costs'. This

reflects the management and internal Group reporting structure.

The activities of each operating segment are described

below.

- General business

United Kingdom and Ireland

The Group's principal general insurance business operation is in the UK, where it operates

under the Ecclesiastical and Ansvar brands. The Group also operates an Ecclesiastical branch

in the Republic of Ireland underwriting general business across the whole of Ireland.

Australia

The Group has a wholly-owned subsidiary in Australia underwriting general insurance business

under the Ansvar brand.

Canada

The Group operates a general insurance Ecclesiastical branch in Canada.

Other insurance operations

This includes the Group's internal reinsurance function, adverse development cover and operations

that are in run-off or not separately reportable due to their immateriality.

- Investment management

The Group provides investment management services both internally and to third parties through

EdenTree Investment Management Limited.

- Broking and Advisory

The Group provides insurance broking through SEIB Insurance Brokers Limited and financial

advisory services through Ecclesiastical Financial Advisory Services Limited.

- Life business

Ecclesiastical Life Limited provides long-term policies to support funeral planning products.

The business reopened to new investment business in 2021 but it is closed to new insurance

business.

- Corporate costs

This includes costs associated with Group management activities.

Inter-segment and inter-territory transfers or transactions are

entered into under normal commercial terms and conditions that

would also be available to unrelated third parties.

Segment revenue

The Group uses gross written premiums as the measure for

turnover of the general and life insurance business segments.

Turnover of the non-insurance segments comprises fees and

commissions earned in relation to services provided by the Group to

third parties. Segment revenues do not include net investment

return or general business fee and commission income, which are

reported within revenue in the consolidated statement of profit or

loss.

Revenue is attributed to the geographical region in which the

customer is based.

6 months ended 6 months ended

30.06.22 30.06.21

Gross Non- Gross Non-

written insurance written insurance

premiums services Total premiums services Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 165,501 - 165,501 142,751 - 142,751

Australia 54,201 - 54,201 49,594 - 49,594

Canada 39,547 - 39,547 32,399 - 32,399

Other insurance operations 2,644 - 2,644 1,784 - 1,784

Total 261,893 - 261,893 226,528 - 226,528

Life business (8) - (8) 1 - 1

Investment management - 7,024 7,024 - 6,848 6,848

Broking and Advisory - 5,906 5,906 - 5,624 5,624

--------- ---------- --------- --------- ---------- ---------

Group revenue 261,885 12,930 274,815 226,529 12,472 239,001

--------- ---------- --------- --------- ---------- ---------

12 months ended

31.12.21

Gross Non-

written insurance

premiums services Total

GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 297,235 - 297,235

Australia 93,365 - 93,365

Canada 91,610 - 91,610

Other insurance operations 4,010 - 4,010

Total 486,220 - 486,220

Life business (9) - (9)

Investment management - 14,908 14,908

Broking and Advisory - 11,346 11,346

--------- ---------- ---------

Group revenue 486,211 26,254 512,465

--------- ---------- ---------

Segment result

General business segment results comprise the insurance

underwriting profit or loss, investment activities and other

expenses of each underwriting territory. The Group uses the

industry standard net combined operating ratio (COR) as a measure

of underwriting efficiency. The COR expresses the total of net

claims costs, commission and underwriting expenses as a percentage

of net earned premiums. Further details on the underwriting profit

or loss and COR, which are alternative performance measures that

are not defined under IFRS, are detailed in note 17.

The life business segment result comprises the profit or loss on

insurance contracts (including return on assets backing liabilities

in the long-term fund), investment return comprising profit or loss

on funeral plan investment business and shareholder investment

return, and other expenses.

All other segment results consist of the profit or loss before

tax measured in accordance with IFRS.

6 months ended Combined

30 June 2022 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 89.6% 9,266 (25,618) (681) (17,033)

Australia 96.0% 801 825 (49) 1,577

Canada 85.6% 5,183 (1,254) (74) 3,855

Other insurance operations 1,380 106 - 1,486

---------- ------------ --------- ---------

88.8% 16,630 (25,941) (804) (10,115)

Life business 799 (7,280) - (6,481)

Investment management - - (1,188) (1,188)

Broking and Advisory - - 1,830 1,830

Corporate costs - - (11,330) (11,330)

Profit/(loss) before tax 17,429 (33,221) (11,492) (27,284)

---------- ------------ --------- ---------

6 months ended Combined

30 June 2021 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 81.5% 15,349 51,179 (952) 65,576

Australia 180.5% (3,929) 104 (19) (3,844)

Canada 101.5% (446) 349 (80) (177)

Other insurance operations (8,466) - - (8,466)

---------- ------------ --------- ---------

98.1% 2,508 51,632 (1,051) 53,089

Life business 719 3,108 - 3,827

Investment management - - (1,249) (1,249)

Broking and Advisory - - 1,681 1,681

Corporate costs - - (10,885) (10,885)

Profit/(loss) before tax 3,227 54,740 (11,504) 46,463

---------- ------------ --------- ---------

12 months ended Combined

31 December 2021 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 85.3% 24,952 87,106 (2,098) 109,960

Australia 156.9% (13,306) 1,924 (34) (11,416)

Canada 88.6% 7,065 246 (156) 7,155

Other insurance operations (9,952) (133) - (10,085)

---------- ------------ --------- ---------

96.8% 8,759 89,143 (2,288) 95,614

Life business 1,117 3,981 - 5,098

Investment management - - (2,525) (2,525)

Broking and Advisory - - 2,984 2,984

Corporate costs - - (24,134) (24,134)

Profit/(loss) before tax 9,876 93,124 (25,963) 77,037

---------- ------------ --------- ---------

6. Net investment return

30.06.22 30.06.21 31.12.21

GBP000 GBP000 GBP000

Investment income 14,921 14,189 30,863

Fair value movements on financial instruments

at fair value through profit or loss (87,557) 31,135 38,102

Fair value movements on investment property 7,792 3,150 20,238

Impact of discount rate change on insurance

contract liabilities 38,266 9,703 11,864

--------- ---------

Net investment (loss)/return (26,578) 58,177 101,067

--------- --------- ---------

7. Tax

Income tax for the six month period is calculated at rates

representing the best estimate of the average annual effective

income tax rate expected for the full year, applied to the pre-tax

result of the six month period.

Deferred tax is provided in full on temporary differences

between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for tax purposes.

Deferred tax is measured using tax rates expected to apply when the

related deferred tax asset is realised, or the deferred tax

liability is settled, based on tax rates and laws which have been

enacted or substantively enacted at the period-end date.

8. Preference shares

Interim dividends paid on the 8.625% Non-Cumulative Irredeemable

Preference shares amounted to GBP4.6m (H1 2021: GBP4.6m). At the

point these dividends were paid, consideration was given to the

distributable reserves and capital position.

9. Financial investments

Financial investments summarised by measurement category are as

follows:

30.06.22 30.06.21 31.12.21

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Financial investments at fair value through

profit or loss

Equity securities

- listed 244,973 280,270 281,682

- unlisted 61,612 68,499 68,620

Debt securities

- government bonds 199,092 165,705 204,071

- listed 284,022 330,016 313,294

- unlisted 34 551 34

Structured notes 33,232 - 14,649

Derivative financial instruments

- options 365 790 334

- forwards - 628 2

823,330 846,459 882,686

Financial investments at fair value through

other comprehensive income

Derivative financial instruments

- forwards - 475 414

Total financial investments at fair value 823,330 846,934 883,100

Loans and receivables

Other loans 571 627 670

Total financial investments 823,901 847,561 883,770

------------ ------------ ----------

10. Financial instruments held at fair value disclosures

IAS 34 requires that interim financial statements include

certain disclosures about the fair value of financial instruments

set out in IFRS 13, Fair Value Measurement and IFRS 7, Financial

Instruments Disclosures.

The fair value measurement basis used to value those financial

assets and financial liabilities held at fair value is categorised

into a fair value hierarchy as follows:

Level 1: fair values measured using quoted prices (unadjusted)

in active markets for identical assets or liabilities. This

category includes listed equities in active markets, listed debt

securities in active markets and exchange-traded derivatives.

Level 2: fair values measured using inputs other than quoted

prices included within level 1 that are observable for the asset or

liability, either directly (as prices) or indirectly (derived from

prices). This category includes listed debt or equity securities in

a market that is not active and derivatives that are not

exchange-traded.

Level 3: fair values measured using inputs for the asset or

liability that are not based on observable market data

(unobservable inputs). This category includes unlisted debt and

equities, including investments in venture capital, and suspended

securities. Where a look-through valuation approach is applied,

underlying net asset values are sourced from the investee,

translated into the Group's functional currency and adjusted to

reflect illiquidity where appropriate, with the fair values

disclosed being directly sensitive to this input.

There have been no transfers between investment categories in

the current period or prior period.

Fair value measurement

at the

end of the reporting

period based on

-----------------------------

Level Level Level Total

1 2 3

30 June 2022 GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 244,441 206 61,939 306,586

Debt securities 481,776 1,337 34 483,147

Structured notes - 33,232 - 33,232

Derivative financial instruments - 365 - 365

--------- -------- -------- ---------

Total financial assets at fair value 726,217 35,140 61,973 823,330

--------- -------- -------- ---------

Financial liabilities at fair value

through profit or loss

Other liabilities

Derivative financial instruments - 1,493 - 1,493

Investment contract liabilities - 38,649 - 38,649

--------- -------- -------- ---------

- 40,142 - 40,142

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative financial instruments - 835 - 835

--------- -------- -------- ---------

Total financial liabilities at fair

value - 40,977 - 40,977

--------- -------- -------- ---------

30 June 2021

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 279,688 183 68,898 348,769

Debt securities 494,253 1,467 551 496,271

Derivative financial instruments - 1,418 - 1,418

--------- -------- -------- ---------

773,941 3,068 69,449 846,458

Financial assets at fair value through

other comprehensive income

Financial investments

Derivative financial instruments - 475 - 475

Total financial assets at fair value 773,941 3,543 69,449 846,933

--------- -------- -------- ---------

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative financial instruments - 757 - 757

--------- -------- -------- ---------

Total financial liabilities at fair

value - 757 - 757

--------- -------- -------- ---------

31 December 2021

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 281,169 186 68,947 350,302

Debt securities 515,953 1,412 34 517,399

Structured notes - 14,649 - 14,649

Derivative financial instruments - 336 - 336

797,122 16,583 68,981 882,686

Financial assets at fair value through

other comprehensive income

Financial assets

Derivative financial instruments - 414 - 414

--------- -------- -------- ---------

Total financial assets at fair value 797,122 16,997 68,981 883,100

--------- -------- -------- ---------

Financial liabilities at fair value

through profit or loss

Other liabilities

Derivative financial instruments - 331 - 331

Investment contract liabilities - 15,519 - 15,519

--------- -------- -------- ---------

Total financial liabilities at fair

value - 15,850 - 15,850

--------- -------- -------- ---------

Fair value measurements in level 3 consist of financial assets,

analysed as follows:

Financial assets at fair

value

through profit or loss

----------------------------------

Equity Debt

securities securities Total

GBP000 GBP000 GBP000

2022

At 1 January 68,947 34 68,981

Total losses recognised in profit or loss (7,009) - (7,009)

At 30 June 61,938 34 61,972

----------- ----------- --------

Total losses for the period included in profit

or loss for assets held at the end of the

reporting period (7,009) - (7,009)

----------- ----------- --------

2021

At 1 January 59,688 551 60,239

Total gains recognised in profit or loss 9,210 - 9,210

At 30 June 68,898 551 69,449

----------- ----------- --------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 9,210 - 9,210

----------- ----------- --------

2021

At 1 January 59,688 551 60,239

Total gains/(losses) recognised in profit

or loss 9,259 (517) 8,742

At 31 December 68,947 34 68,981

----------- ----------- --------

Total gains/(losses) for the period included

in profit or loss for assets held at the end

of the reporting period 9,259 (517) 8,742

----------- ----------- --------

All the above gains or losses included in profit or loss for the

period are presented in net investment return within the statement

of profit or loss.

The valuation techniques used for instruments categorised in

Levels 2 and 3 are described below.

Listed debt and equity securities not in active market (Level

2)

These financial assets are valued using third party pricing

information that is regularly reviewed and internally calibrated

based on management's knowledge of the markets.

Non exchange-traded derivative contracts (Level 2)

The Group's derivative contracts are not traded in active

markets. Foreign currency forward contracts are valued using

observable forward exchange rates corresponding to the maturity of

the contract and the contract forward rate. Over-the-counter equity

or index options and futures are valued by reference to observable

index prices.

Structured notes (Level 2)

These financial assets are not traded on active markets. Their

fair value is linked to an index that reflects the performance of

an underlying basket of observable securities, including

derivatives, provided by an independent calculation agent.

Investment contract liabilities (Level 2)

These financial liabilities are not traded on active markets.

Their fair value is obtained directly from the value of structured

notes which are linked to an index that reflects the performance of

an underlying basket of observable securities, including

derivatives, provided by an independent calculation agent. The fair

value is also subject to a minimum guarantee.

Unlisted equity securities (Level 3)

These financial assets are valued using observable net asset

data, adjusted for unobservable inputs including comparable

price-to-book ratios based on similar listed companies, and

management's consideration of constituents as to what exit price

might be obtainable.

The valuation is sensitive to the level of underlying net

assets, the Euro exchange rate, the price-to-tangible book ratio,

an illiquidity discount and a credit rating discount applied to the

valuation to account for the risks associated with holding the

asset. If the illiquidity discount or credit rating discount

applied changes by +/-10%, the value of unlisted equity securities

could move by +/-GBP7m (H1 2021: +/-GBP8m).

Unlisted debt (Level 3)

Unlisted debt is valued using an adjusted net asset method

whereby management uses a look-through approach to the underlying

assets supporting the loan, discounted using observable market

interest rates of similar loans with similar risk, and allowing for

unobservable future transaction costs.

The valuation is most sensitive to the level of underlying net

assets, but it is also sensitive to the interest rate used for

discounting and the projected date of disposal of the asset, with

the exit costs sensitive to an expected return on capital of any

purchaser and estimated transaction costs. Reasonably likely

changes in unobservable inputs used in the valuation would not have

a significant impact on shareholders' equity or the net result.

11. Changes in estimates

The estimation of the ultimate liability arising from claims

made under general insurance business contracts is a critical

accounting estimate. There are various sources of uncertainty as to

how much the Group will ultimately pay with respect to such

contracts. There is uncertainty as to the total number of claims

made on each class of business, the amounts that such claims will

be settled for and the timing of any payments.

During the six month period, changes to claims reserve estimates

made in prior years as a result of reserve development resulted in

a net decrease in reserves of GBP48.8m (H1 2021: GBP20.0m increase)

in addition to a GBP27.1m decrease (H1 2021: partially offset by a

GBP7.6m decrease) in reserves due to discount rate movements.

The estimation of the ultimate liability arising from claims

made under life insurance business contracts is also a critical

accounting estimate. Estimates are made as to the expected number

of deaths in each future year until claims have been paid on all

policies, as well as expected future real investment returns from

assets backing life insurance contracts. During the six month

period there was a GBP11.2m decrease (H1 2021: GBP2.1m decrease) in

reserves due to discount rate movements.

12. Translation and hedging reserve

Translation Hedging

reserve reserve Total

GBP000 GBP000 GBP000

2022

At 1 January 13,196 4,407 17,603

Gains on currency translation differences 7,634 - 7,634

Losses on net investment hedges - (6,496) (6,496)

Attributable tax - 1,286 1,286

At 30 June 20,830 (803) 20,027

------------ -------- --------

2021

At 1 January 15,552 2,678 18,230

Losses on currency translation differences (1,491) - (1,491)

Gains on net investment hedges - 1,258 1,258

Attributable tax - (183) (183)

At 30 June 14,061 3,753 17,814

------------ -------- --------

2021

At 1 January 15,552 2,678 18,230

Losses on currency translation differences (2,356) - (2,356)

Gains on net investment hedges - 1,912 1,912

Attributable tax - (183) (183)

At 31 December 13,196 4,407 17,603

------------ -------- --------

The translation reserve arises on consolidation of the Group's

foreign operations. The hedging reserve represents the cumulative

amount of gains and losses on hedging instruments in respect of net

investments in foreign operations.

13. Insurance contract liabilities and reinsurers' share of

contract liabilities

30.06.22 30.06.21 31.12.21

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Gross

Claims outstanding 656,913 614,960 616,225

Unearned premiums 268,285 233,808 253,158

Life business provision 63,690 72,363 73,909

Total gross insurance liabilities 988,888 921,131 943,292

------------ ------------ ----------

Recoverable from reinsurers

Claims outstanding 205,177 173,042 166,360

Unearned premiums 98,798 85,422 88,089

Total reinsurers' share of insurance liabilities 303,975 258,464 254,449

------------ ------------ ----------

Net

Claims outstanding 451,736 441,918 449,865

Unearned premiums 169,487 148,386 165,069

Life business provision 63,690 72,363 73,909

Total net insurance liabilities 684,913 662,667 688,843

------------ ------------ ----------

14. Subordinated debt

30.06.22 30.06.21 31.12.21

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

6.3144% EUR 30m subordinated debt 25,049 24,981 24,433

25,049 24,981 24,433

------------ ------------ ----------

Subordinated debt consists of a privately-placed issue of

20-year subordinated bonds, maturing in February 2041 and callable

after February 2031. The Group's subordinated debt ranks below its

senior debt and ahead of its preference shares and ordinary share

capital.

Subordinated debt is stated at amortised cost.

15. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Charitable grants to the ultimate parent company are disclosed

in the condensed consolidated statement of changes in equity.

There have been no material related party transactions in the

period or changes thereto since the latest annual report which

require disclosure.

16. Ultimate parent company and controlling party

The Company is a wholly-owned subsidiary of Benefact Group plc.

Its ultimate parent and controlling company is Benefact Trust

Limited. Both companies are incorporated in England and Wales and

copies of their financial statements are available from the

registered office. The parent companies of the smallest and largest

groups for which group financial statements are drawn up are

Ecclesiastical Insurance Office plc and Benefact Trust Limited,

respectively.

17. Reconciliation of Alternative Performance Measures

The Group uses alternative performance measures (APM) in

addition to the figures which are prepared in accordance with IFRS.

The financial measures in our key financial performance data

include the combined operating ratio (COR). This measure is

commonly used in the industries we operate in and we believe it

provides useful information and enhances the understanding of our

results.

Users of the accounts should be aware that similarly titled APM

reported by other companies may be calculated differently. For that

reason, the comparability of APM across companies might be

limited.

The table below provides a reconciliation of the combined

operating ratio to its most directly reconcilable line item in the

financial statements.

30.06.22

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

--------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 261,893 (8) - - - - 261,885

Outward reinsurance premiums (114,469) - - - - - (114,469)

Net change in provision

for unearned premiums 1,048 - - - - - 1,048

Net earned premiums [1] 148,472 (8) - - - - 148,464

---------- -------- --------- -------- --------- ---------- ----------

Fee and commission income 28,864 - - 7,025 5,906 - 41,795

Other operating income 2,161 - - - - - 2,161

Net investment return - 4,606 (31,585) (3) 404 - (26,578)

Total revenue 179,497 4,598 (31,585) 7,022 6,310 - 165,842

---------- -------- --------- -------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (148,199) (3,535) - - - - (151,734)

Reinsurance recoveries 77,813 - - - - - 77,813

Fees, commissions and other

acquisition costs (51,654) (33) - (442) 368 - (51,761)

Other operating and administrative

expenses (40,827) (231) (1,636) (7,768) (4,813) (11,330) (66,605)

Total operating expenses (162,867) (3,799) (1,636) (8,210) (4,445) (11,330) (192,287)

---------- -------- --------- -------- --------- ---------- ----------

Operating profit/(loss) [2] 16,630 799 (33,221) (1,188) 1,865 (11,330) (26,445)

Finance costs (804) - - - (35) - (839)

---------- -------- --------- -------- --------- ---------- ----------

Profit/(loss) before tax 15,826 799 (33,221) (1,188) 1,830 (11,330) (27,284)

---------- -------- --------- -------- --------- ---------- ----------

Underwriting profit [2] 16,630

Combined operating ratio

= ( [1] - [2] ) / [1] 88.8%

The underwriting profit of the Group is defined as the operating

profit of the general insurance business.

The Group uses the industry standard net combined operating

ratio as a measure of underwriting efficiency. The COR expresses

the total of net claims costs, commission and underwriting expenses

as a percentage of net earned premiums. It is calculated as

( [1] - [2] ) / [1].

30.06.21

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 226,528 1 - - - - 226,529

Outward reinsurance premiums (97,571) - - - - - (97,571)

Net change in provision

for unearned premiums 2,444 - - - - - 2,444

Net earned premiums [1] 131,401 1 - - - - 131,402

---------- ------- -------- -------- ------------- --------- -----------

Fee and commission income 24,803 - - 6,848 5,624 - 37,275

Other operating income 1,000 - - - - - 1,000

Net investment return - 1,528 56,276 (5) 378 - 58,177

Total revenue 157,204 1,529 56,276 6,843 6,002 - 227,854

---------- ------- -------- -------- ------------- --------- -----------

Expenses

Claims and change in

insurance

liabilities (150,545) (643) - - - - (151,188)

Reinsurance recoveries 77,711 - - - - - 77,711

Fees, commissions and other

acquisition costs (45,027) - - (481) 297 - (45,211)

Other operating and

administrative

expenses (36,835) (167) (1,536) (7,611) (4,579) (10,885) (61,613)

Total operating expenses (154,696) (810) (1,536) (8,092) (4,282) (10,885) (180,301)

---------- ------- -------- -------- ------------- --------- -----------

Operating

profit/(loss) [2] 2,508 719 54,740 (1,249) 1,720 (10,885) 47,553

Finance costs (1,051) - - - (39) - (1,090)

---------- ------- -------- -------- ------------- --------- -----------

Profit/(loss) before tax 1,457 719 54,740 (1,249) 1,681 (10,885) 46,463

---------- ------- -------- -------- ------------- --------- -----------

Underwriting profit [2] 2,508

Combined operating ratio

= ( [1] - [2] ) / [1] 98.1%

31.12.21

Broking

Invt. Invt. and Corporate

Insurance return mngt Advisory costs Total

---------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 486,220 (9) - - - - 486,211

Outward reinsurance premiums (198,601) - - - - - (198,601)

Net change in provision

for unearned premiums (14,620) - - - - - (14,620)

Net earned premiums [1] 272,999 (9) - - - - 272,990

----------- -------- -------- --------- --------- ---------- ----------

Fee and commission income 55,417 - - 14,908 11,222 - 81,547

Other operating income 1,136 - - - - - 1,136

Net investment return - 3,939 96,358 6 764 - 101,067

Total revenue 329,552 3,930 96,358 14,914 11,986 - 456,740

----------- -------- -------- --------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (267,291) (2,342) - - - - (269,633)

Reinsurance recoveries 123,822 - - - - - 123,822

Fees, commissions and other

acquisition costs (95,628) (21) - (979) 732 - (95,896)

Other operating and administrative

expenses (81,696) (450) (3,234) (16,460) (9,658) (24,134) (135,632)

Total operating expenses (320,793) (2,813) (3,234) (17,439) (8,926) (24,134) (377,339)

----------- -------- -------- --------- --------- ---------- ----------

Operating profit/(loss) [2] 8,759 1,117 93,124 (2,525) 3,060 (24,134) 79,401

Finance costs (2,288) - - - (76) - (2,364)

----------- -------- -------- --------- --------- ---------- ----------

Profit/(loss) before tax 6,471 1,117 93,124 (2,525) 2,984 (24,134) 77,037

----------- -------- -------- --------- --------- ---------- ----------

Underwriting profit [2] 8,759

Combined operating ratio

= ( [1] - [2] ) / [1] 96.8%

RESPONSIBILITY STATEMENT

Each of the directors, whose names and functions are listed in

the Board of Directors section of the Company's latest Annual

Report and Accounts, confirm that, to the best of their

knowledge:

(a) the consolidated interim financial statements have been

prepared in accordance with UK adopted International Accounting

Standard 34, 'Interim Financial Reporting' and gives a true and

fair view of the assets, liabilities, financial position and

performance of the Company;

(b) the interim management report includes a fair review of the

information required by:

- DTR 4.2.7R being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

- DTR 4.2.8R being material related party transactions in the

first six months of the financial year and any material changes in

the related party transactions described in the last Annual Report

and Accounts.

By order of the Board

Mark Hews

Group Chief Executive

27 September 2022

DISCLAIMER

Certain statements in this document are forward-looking with

respect to plans, goals and expectations relating to the future

financial position, business performance and results of the Group

and wider group. The statements are based on the current

expectations of management of the Group. Management believe that

the expectations reflected in these forward-looking statements are

reasonable, however, can give no assurance that these expectations

will prove to be an accurate reflection of actual results. By their

nature, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are

beyond the Group's ability to control or estimate precisely

including, amongst other things, UK domestic and global economic

and business conditions, market-related risks, inflation, the

impact of competition, changes in customer preferences, risks

relating to sustainability and climate change, the policies and

actions of regulatory authorities, the impact of tax or other

legislation and other regulations in the jurisdictions in which the

Group operates.

INDEPENDENT REVIEW REPORT TO ECCLESIASTICAL INSURANCE OFFICE

PLC

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed Ecclesiastical Insurance Office Public Limited

Company's condensed consolidated interim financial statements (the

"interim financial statements") in the 2022 interim results of

Ecclesiastical Insurance Office Public Limited Company for the 6

month period ended 30 June 2022 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority.

The interim financial statements comprise:

-- the Condensed Consolidated Statement of Financial Position as at 30 June 2022;

-- the Condensed Consolidated Statement of Profit or Loss and

Condensed Consolidated Statement of Comprehensive Income for the

period then ended;

-- the Condensed Consolidated Statement of Cash Flows for the period then ended;

-- the Condensed Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the 2022 interim

results of Ecclesiastical Insurance Office Public Limited Company

have been prepared in accordance with UK adopted International

Accounting Standard 34, 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority.

Basis for conclusion

W e conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the 2022 interim

results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed. This conclusion is based on

the review procedures performed in accordance with this ISRE.

However, future events or conditions may cause the group to cease

to continue as a going concern.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The 2022 interim results, including the interim financial

statements, is the responsibility of, and has been approved by the

directors. The directors are responsible for preparing the 2022

interim results in accordance with the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority. In preparing the 2022 interim results, including

the interim financial statements, the directors are responsible for

assessing the group's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern and

using the going concern basis of accounting unless the directors

either intend to liquidate the group or to cease operations, or

have no realistic alternative but to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the 2022 interim results based on our

review. Our conclusion, including our Conclusions relating to going

concern, is based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report. This report, including the conclusion, has been

prepared for and only for the company for the purpose of complying

with the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority and for no other

purpose. We do not, in giving this conclusion, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

Bristol

27 September 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VDLFLLKLZBBZ

(END) Dow Jones Newswires

September 28, 2022 02:00 ET (06:00 GMT)

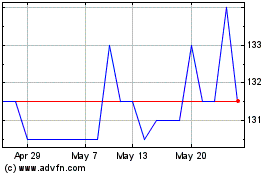

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From May 2024 to Jun 2024

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From Jun 2023 to Jun 2024