RNS Number:7045V

First Artist Corporation PLC

30 April 2007

First Artist Corporation plc ("the Group")

Interim Results for the six months ended 28 February 2007

First Artist Corporation plc, the integrated marketing, sport and entertainment

management group, today announces its Interim Results for the six months ended

28 February 2007.

Financial Highlights

* Turnover rose 309% to #18,480,000 (2006: #4,513,000)

* Earnings Before Interest Tax and Amortisation (EBITA)* up 854% to

#687,000 (2006: #72,000)

* Retained profit increased #104,000 to #76,000 from a loss of #28,000 in

the first half of 2006

* Earnings Per Share (EPS) increased 0.95p to 0.64p from a loss per share

of 0.31p in the first half of 2006 (before tax, amortisation of goodwill

and exceptional costs)

* Consolidated assets up 90% to #6,383,000 (2006: #3,356,000)

Operational Highlights

* Successful integration of all acquisitions, transforming the Group's

business portfolio

* Acquisitions in the period include:

- Dewynters - the leader in entertainment and theatre marketing in the

UK.

- Newman Displays - The UK's leading front of house and facia display

manufacturing and design company

* Group now consists of five balanced business areas; Marketing, Sport,

Wealth Management, Events and Entertainment

*Before exceptional items associated with the acquisition programme

Jon Smith, Chief Executive, said:

"The significant improvement in the Group's figures and in the performance of

several of the Group's divisions is a clear illustration of the success of our

stated strategy of developing an integrated marketing and sport, entertainment

management group. This holistic approach is resulting in an increasing number of

cross referrals between the divisions and we look forward to this momentum

continuing throughout the year and beyond."

-ends-

Enquiries

First Artist Management plc

Jon Smith, Chief Executive

Richard Hughes, Group Managing Director Tel: +44(0)208 900 1818

Bell Pottinger Corporate & Financial

Peter Otero / Rosanne Perry Tel: +44(0)207 861 3232

First Artist Corporation Plc ("FAC")

Interim Report for the Six months ended 28 February 2007

CHAIRMAN'S STATEMENT

It gives me great pleasure to introduce our results for the six months ended 28

February 2007. They report an interim profit after tax of #76,000 and an

operating profit (before exceptional administration expenses), of #687,000,

which is in line with our expectations. Exceptional items in the period of

#312,000 reflect costs associated with the acquisition programme.

The Group continues to be second half weighted although to a lesser extent. The

Sport division, due to the football trading windows, essentially only trades for

one complete month during the period and for this year Dewynters was included

for only part of the period.

The significant improvement in the Group's figures and in the performance of

several of the Group's divisions is a clear illustration of the success of our

stated strategy of developing an integrated marketing and sport, entertainment

management group. This holistic approach is resulting in an increasing number of

cross referrals between the divisions and we look forward to this momentum

continuing throughout the year and beyond.

The acquisitions made last summer have now been fully integrated and are

contributing to the strong performance of the Group. In particular the

acquisition of Dewynters and its sister companies Dewynters Advertising Inc. and

Newman Displays has significantly broadened the Group's business base. Dewynters

is an iconic brand in its own right, holding a dominant position in the UK

theatre and entertainment industry. Its US merchandising operation currently

works on three Broadway shows, a number in Las Vegas and additional supporting

touring shows. With at least three new US show agreements soon to be announced

the future of this operation is extremely bright.

The Dewynters acquisition has not only greatly increased the size of the Group,

but also significantly enhanced visibility of earnings and profitability. This

provides a solid platform from which to build on the Group's organic growth, in

addition to developing the acquisition programme based upon strong financial

controls and reporting systems.

The financial highlights of the Group compared with the 6-month period to 30

April 2006:

*Earnings Before Interest Tax and Amortisation (EBITA)* up 854% to

#687,000

*Retained profit increased #104,000 to #76,000

*Turnover rose 309% to #18,480,000 (2006: #4,513,000)

*Group Headcount has increased from 20 to 239 staff within 2 years

*Earnings per Share (EPS) increased 4.97p to 5.77p

(before taxation and exceptional costs)

*Consolidated net assets up 90% to #6,383,000

*Successful integration of all acquisitions

*EBITA is stated before exceptional administrative expenses

OUTLOOK

The Group has grown considerably over the last two years and will continue to do

so following the successful integration of the acquired businesses. This level

of growth has been supported by a significant investment in strong financial and

operating reporting systems, controls and corporate governance.

The Group strongly believes in the investment in development and incentivisation

of its staff. We will continue to follow these principles into the future with

the new Sharesave scheme, which will be launched in the UK soon. We will also

continue to invest in improved IT and communications networks, which will

deliver enhanced quality assurance and client support whilst maintaining

flexibility in our fast moving environment.

We have a committed strategy to grow a broad based group around the five

distinct divisions of Marketing, Sport, Wealth, Events, and Entertainment and we

actively seek appropriate acquisitions and joint venture opportunities within

these sectors, and in particular;

*Event management businesses: to further expand our corporate business and

develop own venues to market and manage.

*Public relations: to enable us to promote our representation and

corporate clients.

*Wealth management: to increase our client base and geographical

positioning either through acquisitions or by joint ventures with other

professional service companies.

*Ancillary support service businesses, such as publishing, which would

work across the full spectrum of Group companies.

The first half of the year has clearly demonstrated the success of our growth

strategy, all acquisitions having been fully integrated within the period. The

Group is trading in line with expectations and the Board remains optimistic

about the Group's continued growth for the remainder of the year and beyond. In

particular, the Sport division should benefit from the knock on effect of the

significantly increased TV rights monies, which commence this summer and the

Events division from the strong recovery of the corporate sector and term

extension to its Public Sector contract.

We will continue with the strategy of strengthening our position in the UK and

Europe through targeted organic and acquisitive growth. This will be firmly

underpinned by a solid business operating strong financial and operational

systems. We look forward to the future with confidence.

Jarvis Astaire

Chairman

30th April 2007

OPERATING AND FINANCIAL REVIEW

This Review covers the activities of First Artist Corporation during the six

months to 28 February 2007. Due to the change in the Group's year-end to 31

August, the first half comparatives are against the six month period ended 30

April 2006.

SUMMARY RESULTS FOR THE PERIOD

Unaudited Unaudited Audited

6 months 6 months 10 months

ended ended ended

28 February 30 April Variance 31 August

2007 2006 2006

(Restated) (Restated)

#'000s #'000s #'000s #'000s

Turnover 18,480 4,513 13,967 9,508

---------------------------------------------------------------

Adjusted Operating

Profit* 687 72 615 1,620

Exceptional items (312) (5) (307) (170)

---------------------------------------------------------------

Operating Profit 375 67 308 1,450

Net interest (422) (54) (368) (283)

---------------------------------------------------------------

(Loss)/profit before

tax (47) 13 (60) 1,167

Taxation 123 (41) 164 (502)

Retained Profit/

(Loss) 76 (28) 104 665

===============================================================

EPS** 0.64 pence (0.31) pence 0.95 pence 7.18 pence

(Basic earnings/(loss)

per share)

Adjusted EPS** 5.77 pence 0.80 pence 4.97 pence 17.48 pence

(Basics earnings per

share before exceptional

items)

*Adjusted Operating Profit is stated before exceptional

administrative expenses

**Earnings per share for comparative periods has been restated to reflect the share

consolidation on 27 December 2006

TURNOVER

Turnover for the period has increased 309% compared to the six month period

ended 30 April 2006, largely due to inclusion of revenue contribution from the

acquisitions of Dewynters Group, First Artist Scandinavia A/S, NCI Management

Limited and Sponsorship Consulting Limited.

ADJUSTED OPERATING PROFIT

The operating profit for the Group, before exceptional administrative expenses,

was #687,000 an increase of #615,000 compared to the six month period ended 30

April 2006.

DIVISIONAL RESULTS

Unaudited Unaudited Audited

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Restated) (Restated)

#'000s #'000s #'000s

Marketing 12,556 - 49

Sport 1,471 949 4,162

Wealth 1,164 1,060 1,873

Events 2,902 2,362 3,093

Entertainment 387 142 331

-------------------------------------------------

Turnover 18,480 4,513 9,508

=================================================

Marketing 836 - -

Sport (415) (303) 1,092

Wealth 289 452 801

Events 339 176 218

Entertainment 73 63 132

Group Costs (435) (316) (623)

-------------------------------------------------

Adjusted Operating Profit* 687 72 1,620

=================================================

*Adjusted Operating Profit is stated before exceptional

administrative expenses

N.B. A more detailed composition of the results by division can be seen in the

business reviews.

EXCEPTIONALS

Exceptional costs in the period resulted from various acquisition costs, as well

as closure costs associated with FIMO Sport Promotion AG and First Artist

international Limited.

First Artist International has been dissolved. FIMO is due to be dissolved

before the financial year-end.

INTEREST PAYABLE, FUNDING AND LIQUIDITY

At 28 February 2007 the cash balance of the Group was #2,471,000, up #1,780,000

compared to the six months ended 30 April 2006.

Net interest payable was #422,000, of which #135,000 relates directly to the

unwinding of the discounted deferred consideration, in accordance with FRS7,

'Fair value in acquisition accounting'. This FRS7 charge is a non-cash

adjustment and relates to the provision of a net present valuation on deferred

consideration required under this standard.

During the period the Group secured a new seven-year loan facility of

#11,000,000 and a new two-year mezzanine banking loan facility of #2,785,000,

both with Allied Irish Bank. These were used to provide working capital and to

primarily facilitate the acquisition of Dewynters. All previous loans, also with

Allied Irish Bank, were paid off on the acquisition of Dewynters.

The Board believes that the resultant level of net gearing, at around 177% as at

28 February, will be acceptable given the cash generative nature of the

significantly enlarged Group. Interest cover, at 28 February was 6.88 times and

the Board envisages that the current Group borrowing requirement will steadily

reduce whilst retaining sufficient financial flexibility for the continued

investment in the Group.

Net debt of #11.14 million (2006: #3.80 million) at the period end was comprised

of

28 February 30 April 31st August

2007 2006 2006

#millions #millions #millions

Two year mezzanine bank loan (2.78) - -

Seven year bank loan (10.76) - -

Other bank loans - (1.41) (3.78)

Other group net debts (0.07) (0.36) (0.90)

Cash in hand and bank

overdrafts 2.47 0.29 0.88

--------------------------------------------

Group net debt (11.14) (1.48) (3.80)

--------------------------------------------

TAXATION

The tax credit of #123,000 includes a #50,000 rebate in the Wealth Division from

a previous tax year.

EARNINGS PER SHARE*

Earnings per share before exceptional items increased from a profit of 0.80p to

5.77p. This is directly due to the increased profitability of the enlarged Group

and the earnings enhancing means of financing the acquisitions. Basic earnings

per share on a like for like basis increased from a loss of (0.31)p to a profit

of 0.64p.

*Earnings per share for comparative periods has been restated to reflect the

share consolidation on 27 December 2006

SHAREHOLDERS' FUNDS

Shareholders funds increased from #5.09 million to #6.38 million over the last 6

months, resulting in a movement in basic net assets per share from 54.9p

(restated) to 53.6p.

ACQUISITIONS

On 30 November the Group acquired, Dewynters Limited, an established UK

Entertainment Management company for a total maximum consideration payable of

#15.5 million. Initial consideration of #9 million cash and 1 million shares was

paid. Dewynters Limited has two wholly owned subsidiaries; Dewynters Advertising

Inc. and Newman Displays Limited.

Richard Hughes

Group Managing Director

30 April 2007

BUSINESS REVIEWS

MARKETING

We are very pleased to announce that the newly created Marketing division,

formed through the acquisitions of Sponsorship Consulting and Dewynters and its

sister business Newman Displays, has been successfully integrated into the

Group. All the businesses are performing in line with expectations and are

already demonstrating the significant opportunities available through cross

referral of business within the Group.

We are also pleased to report the launch of First Rights, which will act on

behalf of sponsorship rights owners. This is a major area for potential growth

and one that will benefit greatly from being part of the enlarged and expanding

group.

Turnover

6 6 10

months ended months ended months ended

28 February 2007 30 April 2006 31 August 2006

#000's #000's #000's

UK 11,162 - 49

USA 1,394 - -

-----------------------------------------------

12,556 - 49

-----------------------------------------------

Operating Profit* 836 - -

-----------------------------------------------

*Prior to intergroup management fees

Overview

Dewynters has defined entertainment and theatre industry marketing in the UK

with iconic campaigns for productions ranging from Cats and The Phantom of the

Opera to Les Miserables and The Royal Opera House. Recent West End successes

include Equus, staring Daniel Radcliffe, The Lord of the Rings, which is due to

open in June and The Sound of Music. Its US merchandising operation currently

works on three Broadway shows, on others in Las Vegas and supporting touring

shows, with at least three new US show agreements soon to be announced.

Newman Displays, the leading front of house and fascia display manufacturing and

design company, produces displays for all major theatre productions, which have

recently included Spamalot and Mamma Mia as well as working with the leading

West End cinemas on films such as The Queen, Casino Royale, Dreamgirls and the

Spartan blockbuster 300.

Sponsorship Consulting is one of the UK's most respected sponsorship strategy

and corporate responsibility consultancies, advising clients such as Unilever,

Siemens, Corus, and Shell on their sponsorship activity and implementation,

particularly in the spectra of sports, arts, community, environment and

education. Siemens' sponsorship, in conjunction with The Science Museum,

recently won the Corporate Sponsorship category at the Hollis awards.

Opportunities

General trading continues to be in line with expectations, benefiting in

particular from a buoyant West End market. Real benefits however will be derived

from the significant opportunities available through cross referral of business

within the Group and by the expansion of these businesses into other areas,

where their core skills can be used to best effect. The launch of First Rights

will offer sponsors opportunities across the broad spectrum of sport,

entertainment and theatre, which would not otherwise be so readily available

outside of such a broad based group.

SPORT

Following last year's successful acquisition of our Scandinavian football

agency, First Artist Sport is now a truly pan-European business. We are based in

all the major football trading regions and work closely with our associates in

Europe, US and the rest of the World.

Turnover

6 months 6 months 10 months

ended ended ended

28 February 2007 30 April 2006 31 August 2006

#000's #000's #000's

UK 475 557 2,073

Europe 996 392 2,089

----------------------------------------------

1,471 949 4,162

----------------------------------------------

Operating (Loss) / Profit* (415) (303) 1,092

----------------------------------------------

*Prior to intergroup management fees

Overview

The January 2007 transfer window proved undoubtedly our most successful to date

with the division being involved in over 30 transfer deals with activity spread

evenly across our offices in London, Milan, Portugal and Copenhagen. This strong

performance included the UK window's largest football transfer of the window,

Ashley Young, who moved from Watford to Aston Villa for #9.65m and the

appointment of Alan Curbishley as West Ham manager and resulted in a 55%

increase in turnover over the corresponding trading period.

Due to the football trading windows, the division essentially only traded for

one complete month during the period, whilst operating expenses reflect the

enlarged operation including our Scandinavian agency acquired last summer.

Recruitment of new players together with communication and systems enhancements

between Group offices is all contributing to the strong development of the

division under the stewardship of Vincenzo Morabito in his new role as Head of

Football,. The contracted income pipeline is now growing rapidly and generating

increased forward visibility of earnings.

First Artist is a strong believer in advancement through regulation and is

working closely with the newly formed Agents Association and respective

authorities and associations to ensure that the correct framework is developed

to afford increased transparency and adherence to regulation within the market

whilst allowing freedom of trade.

Opportunities

The increased UK Premier League TV rights deal comes into effect this summer and

we are confident this will have a positive impact on the transfer market. In

addition, now that the Italian market has settled, following last year's Italian

match-fixing scandal, we also anticipate this region will recover. Our position

as a respected truly global agency and our strong relationships with all leading

clubs and associations puts us firmly at the heart of this strengthening market.

WEALTH

Optimal Wealth Management is an FSA regulated, independent financial services

business, offering in-depth, personally tailored consultancy for high-net worth

individuals with backgrounds in music, entertainment, media, sports and other

industries. The business recently established a joint venture with leading

financial services and audit group H.W.Fishers.

Turnover

6 months 6 months 10 months

ended ended ended

28 30 31

February 2007 April 2006 August 2006

#000's #000's #000's

New Investments 867 864 1,533

Renewals 297 196 340

-----------------------------------------

1,164 1,060 1,873

-----------------------------------------

Operating Profit* 289 452 801

-----------------------------------------

*Prior to intergroup management fees

Overview

Optimal continues to trade strongly and in line with expectations. Despite the

positive, but inflationary, effects of the 'A' Day pension rules amendments

increasing 2006 figures, the division's strong year on year profit performance

continued with turnover increasing 10% over the previous period's first six

months. In particular, the businesses strategy to invest in long-term

relationships has resulted in significant year on year growth in renewal/trail

income and bodes well for the future.

During the period the business has invested in the management team in order to

continue the expansion of the core business, whilst putting in place a team to

develop the H.W.Fisher joint venture, Fisher Family Office LLP. We expect

the fruits of this investment to come through over the next twelve months and

beyond.

The business continues to expand its client portfolio across the Group and along

with the Sport division is now working closely with the enlarged entertainment

business.

Opportunities

The continued growth of the Group, underpinned by our investment in the

management and support team will enable the business to further expand its

client base, whilst allowing us to seek further joint ventures and/or

acquisition opportunities.

EVENTS

The Finishing Touch is a full-service events management business, organising

conferences, Christmas and Summer parties, family fun and corporate days, team

building programmes and other specialist and bespoke events for the private,

corporate and public sectors.

Turnover

6 months 6 months 10 months

ended ended ended

28 30 31

February 2007 April 2006 August 2006

#000's #000's #000's

Corporate 1,878 1,210 1,700

Public Sector 1,024 1,152 1,393

-------------------------------------------

2,902 2,362 3,093

-------------------------------------------

Operating Profit* 339 176 218

-------------------------------------------

*Prior to intergroup management fees

Overview

The strong growth in the corporate sector was underlined by yet another record

Christmas period. There is a robust future bookings pipeline and cross referral

opportunities within the Group are developing with Events likely to be one of

the main beneficiaries from the enlarged group.

As previously reported the company has been involved in a tender process with

Public Sector bodies regarding an extension and expansion to their current

contract. This process has yet to be finalised, however, current projects are

continuing as planned.

The business has developed and installed new finance and operational management

software to significantly enhance its internal reporting systems and client

quality control procedures. We are also investing resources to expand our event

management and business development teams to manage the increasing number of

client projects being handled and new business generated.

Opportunities

The business is currently pursuing options to create joint ventures to

exclusively market and manage individual venues, which would allow Finishing

Touch to develop its own product tailored to specific client requirements,

helping to improve margins and further raise quality thresholds.

ENTERTAINMENT

First Artist Entertainment is a 'total management' celebrity and media agency

representing various well-known actors, actresses, sport and TV presenters and

other media personalities for TV, film and media, with a particularly strong

track record of talent development.

Turnover

6 months 6 months 10 months

ended ended ended

28 30 31

February 2006 April 2006 August 2006

#000's #000's #'000's

Entertainment 387 142 331

-------------------------------------------

Operating Profit* 73 63 132

-------------------------------------------

*Prior to intergroup management fees

Overview

Following the acquisition of NCI Management in July 2006 and subsequent

integration into First Artist's own entertainment business, we have renamed the

enlarged company First Artist Entertainment.

To name but a few clients, Ruud Gullit, Lisa Scott Lee, Suzanne Shaw, Gillian

McKeith, Amanda Lamb, Andy Townsend and Peter Schmiechel have had an active

first half of the year with a significant number of further opportunities due to

crystallise in the second half.

The corporate speaking division performed well with several events resulting

from the cross referral of business, particularly from the events division.

The financial performance of the business was slightly lower than anticipated,

although the second half of the year should see the business fall back in line

as several major contracts, delayed from the first half, are confirmed.

Opportunities

First Artist Entertainment continues to expand organically, with new clients

consistently being added to its roster. Opportunities to develop own format and

content programming are being developed which will lead to longer-term income

streams. The launch of First Rights will enable the Group to further develop

programming concepts.

Consolidated Profit and Loss Account

For the six months ended 28 February 2007

Notes Continuing

operations Acquisitions Total

6 months 6 months 6 months 6 months 10 months

ended ended ended ended ended

28 February 28 February 28 February 30 April 31 August

2007 2007 2007 2006 2006

(Unaudited) (Audited)

(Unaudited) (Unaudited) (Unaudited) (Restated) (Restated)

#000's #000's #000's #000's #000's

TURNOVER 6,259 12,221 18,480 4,513 9,508

Cost of sales (2,807) (8,545) (11,352) (2,039) (3,168)

--------------------------------------------------------------

GROSS PROFIT 3,452 3,676 7,128 2,474 6,340

Administrative expenses (3,428) (3,325) (6,753) (2,407) (4,890)

EBITA before

exceptional

administrative expenses 336 351 687 72 1,620

Exceptional

administrative expenses 2 (312) - (312) (5) (170)

--------------------------------------------------------------

OPERATING PROFIT 24 351 375 67 1,450

==========================

Interest receivable 66 19 21

Interest payable and

similar charges (488) (73) (304)

-------------------------------

(LOSS) / PROFIT ON

ORDINARY ACTIVITIES

BEFORE TAXATION (47) 13 1,167

Taxation 3 123 (41) (502)

-------------------------------

RETAINED PROFIT /

(LOSS) FOR THE PERIOD 76 (28) 665

===============================

EARNINGS / (LOSS) PER

SHARE 4

Basic earnings / (loss)

per share (pence) 0.64 (0.31) 7.18

===============================

Fully diluted earnings

/ (loss) per share

(pence) 0.52 (0.31) 5.74

===============================

Consolidated Balance Sheet

As at 28 February 2007

As at As at As at

28 February 30 April 31 August

Notes 2007 2006 2006

(Unaudited) (Unaudited) (Audited)

(Restated) (Restated)

#000's #000's #000's

FIXED ASSETS

Intangible assets 22,143 5,952 9,517

Tangible assets 2,012 739 835

Investments 123 100 118

---------------------------------------------

24,278 6,791 10,470

---------------------------------------------

CURRENT ASSETS

Stock 1,133 - -

Debtors 9,659 4,003 6,895

Cash at bank and in hand 2,471 691 1,108

---------------------------------------------

13,263 4,694 8,003

CREDITORS: Amounts falling

due within one year (11,293) (3,705) (7,709)

----------------------------------------------

NET CURRENT ASSETS 1,970 989 294

----------------------------------------------

TOTAL ASSETS LESS CURRENT

LIABILITIES 26,248 7,780 10,764

CREDITORS: Amounts falling

due after more than one year (11,984) (1,172) (2,252)

PROVISIONS for liabilities 5 (7,881) (3,252) (3,423)

---------------------------------------------

NET ASSETS 6,383 3,356 5,089

=============================================

SHARE CAPITAL AND RESERVES

Called up share capital 326 224 270

Share premium account 9,945 7,902 8,849

Capital redemption reserve 15 15 15

Shares to be issued - - 5

Share option reserve 175 87 133

Profit and loss account (4,078) (4,872) (4,183)

---------------------------------------------

TOTAL SHAREHOLDERS' FUNDS 9 6,383 3,356 5,089

=============================================

Consolidated Statement of Total Recognised Gains and Losses

For the six months ended 28 February 2007

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

(Restated) (Restated)

#000's #000's #000's

Profit / (loss) for the financial

period 76 (28) 665

Currency translation differences on

net foreign currency investments 28 10 6

------------------------------------------

Total recognised gains and losses

relating to the period 104 (18) 671

===========================

Prior year adjustment (note 11) (133)

---------

Total recognised gains and losses

since last financial statements (29)

=========

Consolidated Cash Flow Statement

For the six months ended 28 February 2007

Notes 6 months 6 months 10 months

ended ended ended to

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

(Restated) (Restated)

#000's #000's #000's

Cash inflow / (outflow) from

operating activities 6 219 (340) 80

Returns on investments and

servicing of finance (195) (54) (102)

Taxation (247) (261) (450)

Capital expenditure and

financial investment (438) (42) (241)

Acquisitions and disposals 7 (8,298) (129) (2,749)

---------------------------------------------

Cash outflow before

financing (8,959) (826) (3,462)

---------------------------------------------

FINANCING:

Issue of share capital 1,000 14 1,013

Costs of issue of shares (263) - (120)

New bank loans 13,541 - 2,500

Repayment of bank loans (3,631) (131) (260)

Directors' loans (35) - 34

Other loans (50) (28) (85)

Capital element of finance

lease rental payments (9) (5) (11)

---------------------------------------------

10,553 (150) 3,071

---------------------------------------------

Increase / (decrease) in

cash in the period 1,594 (976) (391)

=============================================

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

Increase / (decrease) in

cash in the period 1,594 (976) (391)

Cash flow from (increase) /

decrease debt financing (8,750) 164 (2,173)

New finance leases (1) (15) 34

Other non cash changes (178) - (623)

--------------------------------------------

(7,335) (827) (3,153)

Net debt at the beginning of

the period 8 (3,801) (648) (648)

--------------------------------------------

Net debt at the end of the

period 8 (11,136) (1,475) (3,801)

============================================

Notes to the Interim Accounts:

For the six months ended 28 February 2007

1. Basis of preparation

The financial information contained within this interim report does not

constitute statutory accounts within the meaning of Section 240 of the Companies

Act 1985. The interim financial information has been prepared on the basis of

the accounting policies set out in the Group's statutory accounts for the period

ended 31 August 2006.

The figures for the six months ended 28 February 2007 and 30 April 2006 are

unaudited. The figures for the period ended 31 August 2006 have been extracted

from the statutory accounts which have been filed with the Registrar of

Companies and did not contain a statement under Section 237 (2) or (3) of the

Companies Act 1985.

2. Exceptional administrative expenses

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Acquisition related costs 297 - 141

Redundancies and other restructuring

costs 15 5 29

-------------------------------------------

312 5 170

===========================================

3. Tax (credit) / charge

The tax (credit) / charge for the period as set out below:

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

UK corporation tax charge 286 70 351

Adjustments in respect of prior

periods (50) - 175

Foreign taxes (142) 51 (24)

-----------------------------------------

Current tax charge for the period 94 121 502

Deferred Taxation:

Origination and reversal of timing

differences (217) (80) -

-----------------------------------------

Tax (credit) / charge on ordinary

activities (123) 41 502

=========================================

4. Earnings / (loss) per share

The calculations of earnings / (loss) per share are based on the following

profits / (losses) and numbers of shares.

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

(Restated) (Restated)

Weighted average number of 2.5 pence

ordinary shares in issue during the

period

For basic earnings / (loss) per

share 11,898,661 8,952,373 9,266,472

Exercise of share options 2,626,273 2,319,611 2,320,735

---------------------------------------------

For diluted earnings / (loss) per

share 14,524,934 11,271,984 11,587,207

#000's #000's #000's

Profit / (loss) on ordinary

activities after taxation 76 (28) 665

=============================================

5. Provisions for liabilities

The provisions for liabilities relate to deferred consideration.

Deferred consideration represents the estimated amounts payable, although the

final amounts payable are dependent upon the results of the acquired businesses.

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Deferred consideration due within

one year 3,037 1,231 1,903

Deferred consideration due after

one year 4,844 2,021 1,520

------------------------------------------

Total deferred consideration 7,881 3,252 3,423

==========================================

6. Reconciliation of operating profit to net operating cash flow

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

(Restated) (Restated)

#000's #000's #000's

Operating profit 375 67 1,450

Depreciation 166 40 73

Profit on disposal of fixed assets - (2) (9)

Share options charge 25 54 100

(Increase) in stock (232) - -

Decrease / (increase) in debtors 2,422 743 (1,389)

Decrease in creditors (2,565) (1,252) (151)

Foreign exchange 28 10 6

--------------------------------------------

Net cash inflow / (outflow) from

operating activities 219 (340) 80

============================================

7. Acquisitions and disposals

6 months 6 months 10 months

ended ended ended

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Unaudited) (Audited)

#000's #000's #000's

Consideration on acquisition of

subsidiary undertakings and other

investments (10,424) (107) (3,398)

Cash held by acquired subsidiary

undertakings 3,255 - 671

Payment of deferred consideration (1,129) (22) (22)

--------------------------------------------

Net cash outflow (8,298) (129) (2,749)

============================================

8. Analysis of changes in net debt

At 1 At 28

September Non-Cash February

2006 Cash flow changes 2007

#'000s #'000s #'000s #'000s

Cash at bank and in hand 1,108 1,363 - 2,471

Bank overdrafts (231) 231 - -

----------------------------------------------------

877 1,594 - 2,471

----------------------------------------------------

Finance leases (48) 9 (1) (40)

Debt due within one year (2,411) 992 (178) (1,597)

Debt due after more than

one year (2,219) (9,751) - (11,970)

----------------------------------------------------

(4,678) (8,750) (179) (13,607)

----------------------------------------------------

Total (3,801) (7,156) (179) (11,136)

====================================================

9. Reconciliation of movement in shareholders' funds

28 February 30 April 31 August

2007 2006 2006

(Unaudited) (Audited)

(Unaudited) (Restated) (Restated)

#000's #000's #000's

Profit / (loss) for the financial

period 76 (28) 665

Shares issued to acquire subsidiary

undertakings 411 - 1,112

Shares issued 1,000 14 15

Share options charge 42 54 100

Shares yet to be issued - - 5

Issue costs (263) - (120)

Foreign exchange adjustment 28 10 6

-----------------------------------------

Increase/(decrease) in

shareholders' funds 1,294 50 1,783

Opening shareholders' funds 5,089 3,306 3,306

-----------------------------------------

Closing shareholders' funds 6,383 3,356 5,089

=========================================

Shareholders' funds are entirely attributable to equity interests.

10. Net cash flow effect of acquisitions

The cash flow statement of the Group includes the following cash flow in respect

of subsidiary undertakings acquired during the period:

#000's

Net cash outflow from operating activities (1,214)

Returns on investments and servicing of finance 55

Taxation (7)

Capital expenditure and financial investment (327)

---------

Net cash outflow (1,493)

=========

11. Restatement of prior period figures

The prior period figures have been adjusted for share based payments in

accordance with Financial Reporting Standard 20 (FRS 20). The effects on the

retained profit and share option reserve are as follows:

30 April 2006 31 August

(Unaudited) 2006

(Audited)

#000's #000's

Retained profit as previously stated 26 765

Prior year adjustment (54) (100)

---------------------------

Retained profit as restated (28) 665

===========================

31 October 30 April 31 August

2005 2006 2006

(Audited) (Unaudited) (Audited)

#000's #000's #000's

Share option reserve as previously

stated - - -

Prior year adjustment 33 87 133

-----------------------------------------

Share option reserve as restated 33 87 133

=========================================

The impact on the Profit and Loss Reserves has been to reduce the balance by an

amount equal to the value of the Share Option Reserve.

12. Interim Report

Copies of this interim report are being sent to all shareholders and are

available to the public at the Company's registered office, First Artist House,

87 Wembley Hill Road, Wembley, Middlesex HA9 8BU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR OKOKKOBKDFQB

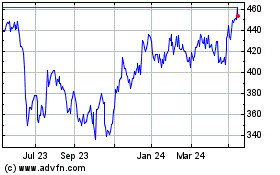

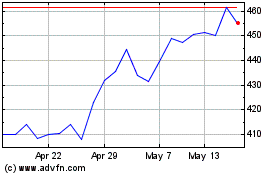

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024