RNS Number : 6815J

First Artist Corporation PLC

08 December 2008

Date: 8 December 2008

On behalf of: First Artist Corporation plc ("First Artist" or "the Company" or "the Group")

Embargoed for: 0700hrs

First Artist Corporation plc

Preliminary Results for the year ended 31 August 2008

First Artist Corporation plc (AIM: FAN), the media, events and entertainment management group, today announces its final audited results

for the year ended 31 August 2008.

The Group*s performance in difficult market conditions was slightly ahead of current market expectations with EBITDA* of �3.8m (2007:

�3.9m), demonstrating the consistent performance of the underlying business. The media division provided the backbone to the trading

performance by contributing 55% of EBITDA** (2007: 52%).

Highlights from last 12 month period include:

* Turnover up 11% to �54.1 million (2007: �48.6m)

* EBITDA* of �3.8 million (2007: �3.9m)

* Profit on ordinary activities before tax �607,000 (2007: �1.7m)

* Basic EPS 1.09p (2007: 9.00p)

* Consolidated net assets up 7% to �8.2 million (2007: �7.6m)

*(Earnings before interest, tax, depreciation and amortisation (EBITDA) is stated before exceptional administrative expenses)

**(EBITDA pre Group Central Costs)

Post year activity:

* Completion of acquisition of Spot and Company of Manhattan ("SpotCo"), a leading US-based live entertainment advertising agency,

on 31 October 2008.

* Announcement that the acquisition of SpotCo was funded through a new committed banking facility totalling �16.428 million,

provided by Allied Irish Bank.

Jon Smith, Chief Executive of First Artist Corporation commented:

"In August 2008 we announced that the Company had agreed the acquisition of SpotCo, underlining our commitment to placing the live event

sector at the heart of our business. SpotCo is a leading US-based live entertainment advertising agency and is a natural strategic fit with

Dewynters, the UK entertainment industry's leading full-service agency and the largest operation within the Group. The acquisition gives the

Group a dominant position in live entertainment advertising in the world's two most important markets - London's West End and New York's

Broadway.

"The Group now benefits from nine diverse income streams, spread across our three divisions: Media, Entertainment and Events.

"2008 was a challenging year for the Group and with the scale of the economic crisis we remain in uncertain times. Our response for many

months has been ever closer scrutiny of our cost base and a drive for greater efficiencies, without undermining our operations. Over the

last year we have improved our cash collection, and going forward will continue to ensure that cash is tightly managed. In addition, we

expect all our businesses to be cash generative this year.

"We believe that in the current year, having laid these foundations and having secured new funding from Allied Irish Bank, we are well

placed to weather the current conditions."

First Artist Corporation plc tel: 020 7993 0000

Jon Smith, Chief Executive www.firstartist.com

Julianne Coutts, Company Secretary

Daniel Stewart & Company plc, Nominated Adviser and tel: 020 7776 6550

Broker www.danielstewart.co.uk

Stewart Dick

Redleaf Communications Tel: 020 7822 0200

Emma Kane/Samantha Robbins/Michael Ward firstartist@redleafpr.com

Chairman's Statement

It gives me great pleasure to report the results of the First Artist Group for the financial year ended 31 August 2008.

EBITDA, at �3.8 million, was ahead of the top end of the range given to the market in our trading update of 29 July 2008.

In August 2008 we announced that the Company had agreed the acquisition of Spot and Company of Manhattan, Inc. ("SpotCo"), underlining

our commitment to placing the live event sector at the heart of our business. SpotCo is a leading US-based live entertainment advertising

agency and is a natural strategic fit with Dewynters, the UK entertainment industry's leading full-service agency and the largest operation

within the Group. The acquisition, which was completed at the end of October 2008, gives the Group a dominant position in live entertainment

advertising in the world's two most important markets - London's West End and New York's Broadway - and the opportunity to extend our global

reach as shows go on tour, together with an enlarged pool of creative talent and vision. The benefits and synergies of the enhanced

collaboration between Dewynters and SpotCo are already coming through, for example in the combined campaign for Priscilla: Queen of the

Desert. SpotCo's current campaigns include Avenue Q, Chicago, West Side Story, Shrek the Musical, Young Frankenstein and Billy Elliott, which opened on Broadway last month to huge acclaim.

It has also been a year of consolidation and focus across our three divisions.

The Media division, which accounted for 55% of the Group's EBITDA* for the year (2007: 52%) is made up of the Dewynters Group, ie.

Dewynters (UK), Dewynters Advertising Inc., and Newman Displays, the specialist signage and display company, together with Sponsorship

Consulting Limited and First Rights Limited. Following the acquisition the division also incorporates SpotCo.

Dewynters enjoyed another good year, supporting such productions as Mamma Mia!, Joseph And His Amazing Technicolor Dreamcoat, Wicked,

The Sound of Music, The Lord of the Rings, Avenue Q and Equus. Newman Displays undertook many front of house displays, including signage

for the West End musical Jersey Boys and numerous film events, in particular the BAFTA Film Awards at the Royal Opera House, The Other

Boleyn Girl, and Sweeney Todd, together with Atonement for the London Film Festival and Indiana Jones and the Kingdom of the Crystal Skull

at Cannes. Recent work has included the new James Bond film, Quantum of Solace.

Dewynters Advertising Inc. operates as a merchandising and souvenir programme business in the lucrative US theatre market from its

offices in New York and Las Vegas.

The Entertainment and Sport Management division accounted for 30% of the year's EBITDA* (2007: 39%). First Artist Management, the

celebrity and media personality agency, performed well in a competitive environment, including successfully promoting clients in programmes

such as Natalie Pinkham in ITV's Dancing on Ice and Andrea McLean as the main anchor for ITV's Loose Women. The agency also completed a new

two book deal on behalf of Gillian McKeith and has recently signed a number of new clients, including West End theatre star Ruthie Henshall

and Michael Obiora of Hotel Babylon fame.

First Artist Sport, one of the world's leading player representation agency groups, completed several notable transfers including Pedro

Mendes from Portsmouth to Glasgow Rangers, Andrea Dossena from Udinese to Liverpool and Mikael Forssell from Birmingham to Hannover 96, and

since the year end has raised its profile through the negotiation by Phil Smith of manager Harry Redknapp's move to Tottenham Hotspur.

Optimal Wealth Management, which was directly affected by the turmoil in world markets, nevertheless achieved a creditable performance.

The Finishing Touch, our events business, put in a strong performance with a 53% increase in operating profits, contributing 15% to

Group EBITDA* (2007: 9%). During the year the public sector division delivered over 600 events under its contract with the Training and

Development Agency for Schools. Despite a challenging market, the corporate division enjoyed the benefit of a number of long term

relationships, and had a significant new business win to launch Debenhams' Spring/Summer 2008 collection preview to the fashion press (for

which it achieved a silver medal for Best New Event in recent event industry awards), going on to win the Autumn/Winter 2008 and

Spring/Summer 2009 fashion launches as well. In February 2008 The Finishing Touch also launched its new venue finding service, VenuesFirst,

which was an immediate success.

As we reported in August, the acquisition of SpotCo was funded through a new committed banking facility totalling �16.428 million,

provided by Allied Irish Bank, whose support the Company continues to enjoy.

During the past year we have established a Corporate Responsibility Committee whose remit it is to develop, recommend and implement a

corporate responsibility strategy for the Group, which we have called "Planet First!". Initiatives have included improving recycling and

energy saving practices, various activities for nominated charities, and a corporate responsibility ideas box to which all employees can

contribute. We are delighted that our staff have embraced this initiative so enthusiastically, and we look forward to increasing our efforts

over the coming year.

In the current economic climate we remain firmly focused on cost controls and have introduced additional systems across the Group to

ensure that cost efficiency is maximised. Over the last year we have improved our cash collection, and going forward will continue to ensure

that cash is tightly managed. In addition, we expect all our businesses to be cash generative this year.

This is my last year as Chairman, as I will be standing down from the Board at the next Annual General Meeting. The Group now looks very

different from when I joined it three years ago, and I have every confidence that with its diverse income streams, talented and committed

senior management team and strong internal controls, is well placed to deal with the challenges of the current market. I have greatly

enjoyed my time as Chairman and would like to wish Jon and everyone at First Artist the very best for the future.

Jarvis Astaire

Chairman

(*EBITDA pre Group Central Costs)

Chief Executive's Statement

With the scale of the economic crisis we are in uncertain times. Our response for many months has been ever closer scrutiny of our cost

base and a drive for greater efficiencies, without undermining our operations. We believe that in the current year, having laid these

foundations, we are well placed to weather the current conditions.

I would like to say a few words in particular about our people.

Firstly, I would like to thank the corporate team for their all their hard work in bringing the SpotCo acquisition to fruition. Simon

Bent, the Group Finance Director Designate, who played an integral role in this project, is leaving First Artist at the end of December as

he is emigrating. Simon has been with the Group for over three years and will be greatly missed. However, we are pleased to welcome David

Eglen, who joined us earlier this month, as our new Group FD Designate. David, a Chartered Accountant, was previously Chief Financial

Officer, EMEA region, at FiveTen Recruitment Group. I am sure that you will join me in thanking Simon for his enormous contribution to First

Artist. We wish him and his family all the very best for their new life in Australia.

I would also like to thank all our employees for their contribution over the last year. Their hard work, enthusiasm and commitment to

making a difference is absolutely vital to our success and is greatly appreciated.

Finally, on behalf of all the Directors, I would like to extend our thanks to Jarvis Astaire for serving as our Chairman over the last

three years. As a Board we have benefited from his experience and stewardship over a time of great change; as individuals we have

appreciated and learned from his wise counsel. We wish Jarvis all the very best. We have identified a successor who will be proposed at the

next Annual General Meeting.

Jon Smith

Chief Executive

OPERATING AND FINANCIAL REVIEW

Competitive Performance

31 August 31 August Variance

2008 2007

�'000s �'000s

�'000s

Turnover 54,102 48,607 5,495

EBITDA 3,824 3,949 (125)

Exceptional items (697) (322) (375)

Depreciation (607) (416) (191)

Amortisation (364) (339) (25)

Operating Profit 2,156 2,872 (716)

Net interest (1,549) (1,220) (329)

Profit before tax 607 1,652 (1,045)

Taxation (460) (527) 67

Retained Profit 147 1,125 (978)

EPS 1.09 pence 9.00 pence

(Basic earnings per share)

EPS 15.83 pence 19.93 pence

(Basic earnings per share before exceptionals,

depreciation, amortisation and deemed interest on deferred

consideration)

Outline

The media division provided the backbone to the Group's trading performance, with the entire division accounting for 55% (2007: 52%) of

EBITDA*. The division is dominated by the Dewynters Group which contributed 96% of its EBITDA. Within the Dewynters Group the only

disappointing performance came from Dewynters Inc., which saw a 27% fall in its EBITDA due to a major production ending early. By way of

contrast Dewynters (UK) and Newman Displays both continued to prosper.

The events division, The Finishing Touch, continued to make good progress and experienced a 35% increase in EBITDA, which was largely

attributable to revenue generated from both the corporate and public sectors. The events division contributed 15% of Group EBITDA*, up from

10% last year.

The entertainment and sports management division showed a fall in profitability compared to the previous year with EBITDA down by 25%.

In difficult trading conditions all three businesses in this division were down on the previous year. Our wealth management business,

Optimal, produced a credible performance in a challenging market. Overall the division contributed 30% of total EBITDA*, which is down from

39% in 2007.

Group costs were flat as compared to 2007. This was achieved despite the Group taking on additional West End office space in September

2007. Group EBITDA as a percentage of gross profit fell from 20% to 18% but the management team are committed to improving margins above

current levels and in particular to bringing administrative expenses in line with gross profit.

*EBITDA pre Group Central Costs

Turnover

Group turnover for the year has increased 11% compared to the prior year. This figure includes a full 12 months trading from all

Companies around the Group.

EBITDA

The EBITDA for the Group, before depreciation, amortisation and exceptional costs, decreased 3% to �3.8 million.

Gross profit increased by 10% to �21.7 million as compared to the previous year; whilst administrative expenses, excluding amortisation,

depreciation and exceptional charges, increased by 14% to �17.9 million.

Group earnings were weighted towards the second half of the year because of the summer transfer window in football.

Foreign Exchange

Foreign exchange gains amounted to �0.32 million (2007: losses of �0.08 million), mainly due to the devaluation of sterling against the

US dollar and the Euro.

Key Performance Indicators (KPI's)

A number of percentage-based KPI's are used for internal reporting purposes, relating to gross profit, operating profit and personnel

costs. KPI's are also calculated on staff numbers to give gross profit, operating profit and gross profit per head.

Amortisation and exceptionals

Other intangibles were amortised in accordance with International Financial Reporting Standards (IFRS). The charge increased by �0.02

million to �0.36 million for the year, the amortisation charge being in respect of customer relationships and also a non-cash adjustment.

Exceptional costs incurred during the year resulted largely from acquisition related payments plus one significant bad debt of �0.24

million.

Interest payable, funding and liquidity

Net interest payable was �1.61 million (2007: �1.28 million). A total of �0.32 million (2007: �0.29 million) relates directly to the

unwinding of the discounted deferred consideration. This charge is a non-cash adjustment and relates to the provision of a net present

valuation on deferred consideration required under this standard.

New banking facilities were agreed with Allied Irish Bank (GB) in the post balance sheet period, details of which can be found in note

29 to the Financial Statements.

Taxation

The tax charge of �0.46 million (2007: �0.52 million) fully utilises the Company's taxable losses for the year across the whole Group.

The effective tax rate for the year of 76% (2007: 32%) is particularly high due to the unwinding of discounts on deferred consideration of

�0.32 million.

Earnings per share

Basic earnings per share was 1.09p (2007: 9.00p); whilst earnings per share before exceptional administrative items, deemed interest on

deferred consideration, depreciation and amortisation was 15.83p (2007: 19.93p).

Divisional Key Performance Indicators (KPI)

The media division showed favourable operating profit per head and gross profit per head, indicating the productivity of individuals has

improved. The gross profit margin was in accordance with the KPI target. However, the operating profit to gross profit margin was short of

target, arising due to recruitment of additional staff in the new media division at Dewynters Limited. The aforementioned costs were

necessary to secure future business in this division with our current and new clients.

The events division showed operational efficiency, with the operating profit to gross profit margin exceeding the KPI target. Operating

profit and gross profit per head were also ahead of target, highlighting the excellent results of the division.

The entertainment and sports management division reported a higher than target gross profit margin, due to reduced third party costs

across the football business. However, the operating profit to gross profit margin was short of the targeted KPI, due to higher than

anticipated costs in the football businesses. This has now been addressed. Operating profit and gross profit per head were below KPI

expectations, emphasising the lower than expected results of this division.

Review of Operations

Balance Sheet

Shareholders' funds

Shareholders' funds increased by 8% �8.23 million.

Cash Flow

During the year the Group repaid �1.57m of the seven-year banking loan facility of �11.00 million via quarterly instalments. A payment

of �1.50m in relation to the new five-year banking loan facility from Allied Irish Bank (GB) was advanced to the Group during the year. This

was used to provide working capital and facilitate the acquisition costs for the Group. The table below indicates the split of net debt over

three periods.

The Board believes that the level of gearing, at 159% (2007: 128%), which has resulted from the acquisition strategy adopted over the

last few years is acceptable given the cash generative nature of the enlarged Group. Interest cover has fallen to 3.3 times (2007: 3.6

times), although this is expected to increase above the 2007 figure during the coming year.

31 August 31 August 31 August

2008 2007 2006

�m �m �m

One year bank loan - - (1.00)

Two year mezzanine bank loan (2.79) (2.79) -

Five year bank loans (1.50) - (2.78)

Seven year bank loan (8.45) (9.98) -

Other group net debts (0.72) (0.48) (0.90)

Cash in hand and bank overdrafts 0.46 3.55 0.88

(13.00) (9.70) (3.80)

International Financial Reporting Standards

These are the Group's first annual results to be reported under International Financial Reporting Standards ("IFRS") which became

mandatory for all companies listed on the AIM market for accounting periods commencing on or after 1 January 2007. Comparative figures for

the year ended 31 August 2007 have been restated in accordance with IFRS. The principal effects of adopting IFRS were published in the

Company's "Restatement of Financial Information under International Financial Reporting Standards" release issued on 28 January 2008. The

Group has adopted the material exemption, as permitted by IFRS, not to restate historical business combinations that took place before 1

September 2006, that being the date of IFRS transition.

Risks associated with the Group

The Group is subject to a number of macro economic factors, as with other businesses, such as interest rate and foreign exchange rate

fluctuations, which are outside the Group's control.

On a more specific basis the Group's bank borrowings are subject to various financial covenants based upon EBITDA-based interest cover,

the ratio between total borrowings and EBITDA and the ratio between cash flow and total borrowings. These covenants are typical of those

applied to businesses within the Group's sector and they are not expected to have a material impact on our ability to finance our business.

In the year ended 31 August 2008, the net finance costs were covered 3.28 times by EBITDA and the ratio of total borrowings to EBITDA was

2.65, both comfortably satisfying the covenants. The proposed covenants under the terms of the new �16.428 million banking facility (see

note 9) are expected to be satisfied in the year ended 31 August 2009.

The Group is not currently subject to any material legal or economic restrictions on the ability of its subsidiaries to transfer funds

to the Company in the form of dividends, loans or other advances.

On a regulatory basis, the environments in football and wealth management continue to change, impacting on risk. However, certainly in

football, the Group is well positioned for any changes due to its involvement with the Agents Association.

The loss of key personnel can also be considered a risk, although the retention post earn-out of the key figures in Optimal and The

Finishing Touch suggests that this risk is being managed effectively.

On a competitive basis, although Dewynters dominates its market it could be argued that the business is reliant on the success of the

West End Productions and the general economic climate. In fact, Dewynters benefits two-fold in the majority of cases as new productions have

higher spends and hence profits, whilst lower seat numbers often lead to higher marketing spends by the production house.

Finally, the football market is saturated and dependent upon the agents securing transfer contracts during the trading windows, often

involving large sums of money. Hence period to period comparisons can be difficult. However, the pipeline income generated in this area has

grown considerably year on year, which helps to remove the uncertainty over income generation.

Jon Smith

Chief Executive

8 December 2008

Consolidated Income Statement for the year ended 31 August 2008

Continuing operations

Notes 31 August 31 August

2008 2007

�000 �000

REVENUE 2 54,102 48,607

Cost of sales (32,411) (28,913)

GROSS PROFIT 21,691 19,694

Administrative expenses (19,535) (16,822)

EBITDA 3,824 3,949

Exceptional administrative expenses 3 (697) (322)

Depreciation (607) (416)

Amortisation of intangibles (364) (339)

OPERATING PROFIT 2,156 2,872

Finance income 59 61

Finance costs (1,608) (1,281)

PROFIT ON ORDINARY ACTIVITIES BEFORE TAXATION 607 1,652

Taxation 5 (460) (527)

PROFIT FOR THE YEAR 147 1,125

EARNINGS PER SHARE

Basic 6 1.09p 9.00p

Diluted 6 1.07p 8.26p

Consolidated Balance Sheet as at 31 August 2008

Notes 31 August 31 August

2008 2007

�000 �000

NON-CURRENT ASSETS

Goodwill and intangible assets 23,294 23,224

Property, plant and equipment 1,961 2,157

Available-for-sale investments 142 118

Trade and other receivables 602 632

25,999 26,131

CURRENT ASSETS

Inventories 534 570

Trade and other receivables 11,639 11,704

Cash and cash equivalents 1,212 3,914

13,385 16,188

CURRENT LIABILITIES

Trade and other payables (9,854) (11,307)

Current taxation liabilities (1,242) (970)

Obligations under finance leases (7) (39)

Borrowings 7 (5,787) (2,331)

Provisions (2,205) (3,397)

(19,095) (18,044)

NET CURRENT LIABILITIES (5,710) (1,856)

NON-CURRENT LIABILITIES

Trade and other payables (81) (245)

Deferred taxation liabilities (974) (1,000)

Obligations under finance leases - (11)

Borrowings 7 (8,417) (11,238)

Provisions (2,646) (4,175)

(12,118) (16,669)

TOTAL LIABILITIES (31,213) (34,713)

NET ASSETS 8,171 7,606

EQUITY

Called up share capital 347 328

Share premium 6,598 10,011

Capital redemption reserve 15 15

Share option reserve 285 210

Retained earnings 1,086 (3,048)

Interest in own shares (259) -

Foreign exchange reserve 99 90

TOTAL EQUITY ATTRIBUTABLE TO EQUITY SHAREHOLDERS

OF THE PARENT 8,171 7,606

Consolidated Cash Flow Statement for the year ended 31 August 2008

Notes Year ended Year ended

31 August 31 August

2008 2007

�000 �000

Net cash inflow from operating 8 1,535 2,859

activities

Investing activities

Finance income 59 61

Purchases of property, plant and (461) (823)

equipment

Acquisition of subsidiaries (2,030) (7,566)

Additions to available-for-sale (24) -

investments

Net cash used in investing (2,456) (8,328)

activities

Financing activities

Repayments of borrowings (1,571) (786)

Repayments of obligations under (45) -

finance leases

New bank loans raised 1,500 13,785

Directors' loans - (33)

Other loans and loan notes (445) (4,441)

Purchase of own shares (259) -

Net cash proceeds from issue of - 812

shares

Interest paid (1,355) (1,228)

Net cash (used) / generated by (2,175) 8,109

financing activities

Net (decrease) / increase in cash (3,096) 2,640

and cash equivalents

Cash and cash equivalents at the 3,551 877

beginning of the year

Effect of foreign exchange rate 9 34

changes

Cash and cash equivalents at the end 464 3,551

of the year

Statement of Changes in Equity

Capital Redemption Share

Share Share to be Issued Reserve Share Option

Capital �000 �000 Premium Reserve

�000 �000 �000

ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT

At 1 September 2006 270 5 15 8,849 133

Deferred taxation on share - - - - -

options

Currency translation - - - - -

differences

Income recognised directly in - - - - -

equity

Retained profit for the year - - - - -

Total recognised income for - - - - -

the year

Shares issued 58 (5) - 1,429 -

Issue costs - - - (267) -

Share-based payment charge - - - - 77

Total change in equity 58 (5) - 1,162 77

At 1 September 2007 328 - 15 10,011 210

Deferred taxation on share - - - - -

options

Currency translation - - - - -

differences

Income recognised directly in - - - - -

equity

Retained profit for the year - - - - -

Total recognised income for - - - - -

the year

Transfer from share premium to - - - (4,047) -

retained earnings

Payment to acquire own shares - - - - -

Shares issued to vendors as 19 - - 634 -

deferred consideration

Share-based payment charge - - - - 75

Total change in equity 19 - - (3,413) 75

At 31 August 2008 347 - 15 6,598 285

Statement of Changes in Equity (continued)

Foreign Exchange Interest in Own

Retained Earnings Reserve Shares Total

�000 �000 �000 Equity

�000

ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT

At 1 September 2006 (4,233) 56 - 5,095

Deferred taxation on share 60 - - 60

options

Currency translation - 34 - 34

differences

Income recognised directly in 60 34 - 94

equity

Retained profit for the year 1,125 - - 1,125

Total recognised income for 1,185 34 - 1,219

the year

Shares issued - - - 1,482

Issue costs - - - (267)

Share-based payment charge - - - 77

Total change in equity - - - 1,292

At 1 September 2007 (3,048) 90 - 7,606

Deferred taxation on share (60) - - (60)

options

Currency translation - 9 - 9

differences

Income recognised directly in (60) 9 - (51)

equity

Retained profit for the year 147 - - 147

Total recognised income for 87 9 - 96

the year

Transfer from share premium to 4,047 - - -

retained earnings

Payment to acquire own shares - - (259) (259)

Shares issued to vendors as - - - 653

deferred consideration

Share-based payment charge - - - 75

Total change in equity 4,047 - (259) 469

At 31 August 2008 1,086 99 (259) 8,171

Notes to the Accounts

1. BASIS OF PREPARATION

The financial information set out above has been prepared in accordance with International Financial Reporting Standards (IFRS) as

adopted by the EU and those parts of the Companies Act 1985 that remain applicable to companies reporting under IFRS and does not constitute

statutory accounts within the meaning of Section 240 of the Companies Act 1985. For details of the impact of the transition to IFRS see the

IFRS Re-statement, released to the AIM Market on 28 January 2008.

Statutory accounts for the year ended 31 August 2008 will be delivered to the Registrar of Companies and sent to Shareholders shortly.

The Company's auditors have indicated that they intend to issue an unqualified auditor's report, which will contain any statement under

Section 237(2) or (3) of the Companies Act 1985, on the statutory financial statements for the year ended 31 August 2008. Statutory accounts

for the year ended 31 August 2007, which were prepared under UK Generally Accepted Accounting Principles, have been filed with the Registrar

of Companies. The auditors report on those accounts was unqualified and did not contain a statement under section 237A of the Companies Act

1985.

BASIS OF ACCOUNTING

The financial statements have been prepared under the historic cost convention on a going concern basis and in accordance with

International Financial Reporting Standards ("IFRS") as adopted by the European Union and IFRC Interpretations for the first time. In 2007

the financial statements were prepared in accordance with UK GAAP. The comparatives have been restated under IFRS.

Conversion to IFRS affects the Group's reporting particularly in the areas of accounting for goodwill, other intangible assets, deferred

consideration, foreign exchange reserves and deferred taxation. This said, the adoption of IFRS represents an accounting change only and

does not change the cash flows of the group or its operations. There is also no impact on the Group's reportable segments from those

reported under UK GAAP.

At the date of authorisation of these financial statements, the following Standards and Interpretations relevant to the group operations

that have been applied in these financial statements were in issue but not yet effective or endorsed (unless otherwise stated):

IFRS 2 Share based Payment - Amendments relating to vesting conditions and cancellations

IFRS 3 Business Combinations - Amendments

IFRS 7 Financial Instruments: Disclosures - Consequential amendments arising from amendments to IAS 32

IFRS 8 Operating Segments (endorsed)

IAS 1 Presentation of Financial Statements - Revised

IAS 1 Presentation of Financial Statements - Amendments relating to Puttable Financial Instruments and

obligations arising on liquidation

IAS 23 Borrowing Costs - Amendment

IAS 27 Consolidated and separate Financial Statements - Consequential amendments arising from Amendments from

IFRS 3

IAS 28 Investments in Associate - Consequential amendments arising from amendments to IFRS 3

IAS 31 Interest in Joint Ventures - Consequential amendments arising from amendments to IFRS 3

IAS 32 Financial Instruments Presentation - Amendments relating to Puttable Financial Instruments and obligations arising

on liquidation

IAS 39 Financial Instruments: Recognition and Measurement - Consequential amendments arising from amendments to

IAS 32

IFRIC 11 IFRS 2 - Group and Treasury Share Transactions (endorsed)

IFRIC 12 Service Concession Arrangements

IFRIC 13 Customer Loyalty Programmes

IFRIC 14 IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their interaction

Annual Improvements Project

The directors anticipate that the adoption of these Standards and Interpretations as appropriate in future periods will have no material

impact on the financial statements of the Group, except for additional segment disclosures when IFRS 8 comes into effect for periods

commencing on or after 1 January 2009.

BASIS OF CONSOLIDATION

The consolidated financial statements incorporate the financial statements of First Artist Corporation Plc and its subsidiaries. The

financial statements of the subsidiaries are prepared for the same reporting periods as the parent company, using consistent accounting

policies.

The excess of cost of acquisition over the fair values of the Group's share of identifiable net assets acquired is recognised as

goodwill. Any deficiency of the cost of acquisition below the fair value of identifiable net assets acquired (i.e. discount on acquisition)

is recognised directly in the income statement.

The purchase method of accounting is used to account for the acquisition of subsidiaries by the Group. The costs of an acquisition are

measured as the fair value of the assets given equity instruments issued and liabilities incurred or assumed at the date of exchange, plus

costs directly attributable to the acquisition. Identifiable assets acquired and liabilities and contingent liabilities assumed in a

business combination are initially measured at fair value at acquisition date irrespective of the extent of any minority interest.

The results of subsidiaries acquired or disposed of during the year are included in the consolidated income statement from the effective

date of acquisition or up to the effective date of disposal, as appropriate.

Where necessary, adjustments are made to the financial statements of subsidiaries to bring the accounting policies used into line with

those used by other members of the Group.

All intra-group transactions, balances, and unrealised gains on transactions between group companies are eliminated on consolidation.

Unrealised losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred.

2. BUSINESS AND GEOGRAPHICAL SEGMENTS

Business segments

For management purposes, the Group is currently organised into three operating divisions - Media, Events and Entertainment/Sport. These

divisions are the basis on which the Group reports its primary segment information.

Principal activities are as follows:

Media - marketing, design, advertising, promotions, digital media services, publishing and merchandising, sponsorship and sponsorship

rights consulting.

Events - full event planning and management services, venue finding.

Entertainment/Sport - entertainment, sport and wealth management services.

Segment information about these businesses is presented below.

Segment information for the year ended 31 August 2008 is presented below:

Media Events

Entertainment Group

/Sport

�000

�000 �000

�000

Revenue

External sales 38,568 6,679

8,870 54,117

Inter-segment sales - -

(15) (15)

Total revenue 38,568 6,679

8,855 54,102

Result

Operating EBITDA 2,875 775

1,550 5,200

One-off costs (19) (164)

(291) (474)

Depreciation (412) (6)

(72) (490)

Amortisation (364) -

- (364)

Segment result 2,080 605

1,187 3,872

Unallocated corporate expenses

Group costs

(1,376)

Depreciation

(117)

One off costs

(223)

Operating profit

2,156

Finance income

59

Finance costs

(1,608)

Profit before tax

607

Tax

(460)

Profit after tax

147

Unallocated corporate expenses above include all Head Office costs (such as directors remuneration, wages and salaries, office rentals and

other administrative overheads).

Media Events Entertainment Unallocated Group

/Sport

�000

�000 �000 �000 �000

Other information

Capital additions 201 1 77 182 461

Assets

Segment assets 22,098 4,017 11,121 2,148 39,384

Total assets 22,098 4,017 11,121 2,148 39,384

Liabilities

Segment liabilities 6,583 465 3,149 20,956 31,153

Total liabilities 6,583 465 3,149 20,956 31,153

Segment information for the year ended 31 August 2007 is presented below:

Media Events

Entertainment Group

/Sport

�000

�000 �000

�000

Revenue

External sales 33,612 5,157

9,898 48,667

Inter-segment sales - -

(60) (60)

Total revenue 33,612 5,157

9,838 48,607

Result

Operating EBITDA 2,748 505

2,052 5,305

Depreciation (320) (8)

(70) (398)

Amortisation (339) -

- (339)

Segment result 2,089 497

1,982 4,568

Unallocated corporate expenses

Group income

(1,356)

Depreciation

(18)

One off costs

(322)

Operating profit

2,872

Finance income

61

Finance costs

(1,281)

Profit before tax

1,652

Tax

(527)

Profit after tax

1,125

Unallocated corporate expenses above include all Head Office costs (such as directors remuneration, wages and salaries, office rentals and

other administrative

overheads).

BUSINESS AND GEOGRAPHICAL SEGMENTS (continued)

Media Events Entertainment Unallocated Group

/Sport

�000

�000 �000 �000 �000

Other information

Capital additions 497 36 79 216 828

Balance sheet

Assets

Segment assets 24,429 4,367 11,790 1,733 42,319

Total assets 24,429 4,367 11,790 1,733 42,319

Liabilities

Segment liabilities 6,690 1,118 3,927 22,978 34,713

Total liabilities 6,690 1,118 3,927 22,978 34,713

Geographical segments

The Group's operations are located in the UK, Europe and the USA.

The following table provides an analysis of the Group's sales by geographic market:

Revenue by geographical market

Year ended 31 August 2008 Year ended 31 August 2007

�000 �000

United Kingdom 45,232 40,719

Rest of Europe 3,677 3,490

USA 5,193 4,398

54,102 48,607

The following is an analysis of the carrying amount of segment net assets, and additions to property, plant and equipment and

intangible assets analysed by the geographical area in which the assets are located:

Carrying amount of segment net assets Capital additions

Year ended 31 August Year ended 31 August Year ended 31 August Year ended 31 August 2007

2008 2007 2008 �000

�000 �000 �000

United Kingdom 7,697 6,956 366 799

Rest of Europe 439 664 55 -

USA 95 (14) 40 29

8,231 7,606 461 828

3. EXCEPTIONAL ADMINISTRATIVE EXPENSES

Year ended Year ended 31 August

31 August 2007

2008 �000

�000

Acquisition related costs 273 322

Bad debt written off 241 -

Redundancy costs 147 -

Relocation costs 36 -

697 322

Included within redundancy costs are �120,000 payable as compensation for loss of office.

4. PROFIT ON ORDINARY ACTIVITIES

Year ended Year ended

31 August 31 August

2008 2007

�000 �000

Operating profit is stated after

charging/(crediting):

Depreciation of property, plant and 607 416

equipment

Loss on disposal of property, plant and 21 -

equipment

Amortisation of other intangibles 364 339

Operating lease rentals

* plant and machinery 55 159

* land and buildings 839 621

(Gain)/loss on foreign exchange (318) 80

All of the above costs are recognised within 'Administrative expenses' in the income statement. In addition,

administrative expenses consist primarily of salaries, premises, insurances, professional fees and travel

costs.

5. TAXATION

Year Year

ended 31 ended 31

August 2008 August 2007

�000 �000

Current tax:

UK corporation tax on profits of year 382 630

Under/(over) provision in previous years - 7

Overseas tax on profits of year 164 46

Total current tax 546 683

Deferred tax:

Deferred tax credit for year (86) (156)

Total deferred tax (86) (156)

Tax on profit of ordinary activities 460 527

Factors affecting the tax Year Year

charge for the year: ended 31 August 2008 ended 31 August 2007

�000 �000

The tax assessed for the year

is higher than the standard

average rate of corporation tax

in the UK (29.17%). The

differences are explained

below:

Profit on ordinary activities 607 1,652

before tax

Profit on ordinary activities

multiplied by standard average 177 496

rate of corporation tax in the

UK 29.17% (2007: 30%)

Effects of:

Expenses not deductible for tax 81 59

purposes

Depreciation on non-qualifying 36 12

assets

Interest on deferred 92 87

consideration

Losses utilised (16) -

Difference in tax rates in 71 35

overseas earnings

Share-based payments 20 (15)

Prior year charges - 1

Other movements (1) (148)

Total tax charge for the year 460 527

Taxation is calculated at the rates prevailing in the respective jurisdictions. The standard tax rates in each jurisdiction are 37.5% in

the United States, 29.17% in the United Kingdom, 28% in Denmark and 35% in Italy.

6. EARNINGS PER SHARE

The calculations of earnings per share are based on the following profits and number of shares:

Earnings Year Year

ended ended

31 August 2008 31 August 2007

�000 �000

For basic and diluted profit per

share 147 1,125

Profit for the financial year

Number of shares Year Year

ended ended

31 August 2008 31 August 2007

Number Number

Weighted average number of ordinary

shares for the purposes of basic 13,454,959 12,506,588

earnings per share

Dilutive effect of share options 327,329 1,109,621

Weighted average number of ordinary

shares for the purposes of diluted 13,782,288 13,616,209

earnings per share

Year Year

ended ended

31 August 2008 31 August 2007

Basic 1.09p 9.00p

Diluted 1.07p 8.26p

7. BORROWINGS

31 August 2008 31 August 2007

�000 �000

Current:

Bank overdrafts 748 363

Term loans 719 432

Bank loans 4,320 1,536

5,787 2,331

Non-current:

Bank loans 8,417 11,238

Analysis of due dates for borrowings:

On demand or within one year

Bank overdrafts 748 363

Term loans 719 432

Bank loan - senior variable rate loan 1,535 1,536

Mezzanine loan 2,785 -

5,787 2,331

In the second year

Bank loan - senior variable rate loan 215 1,536

Bank loan - senior fixed rate loan 1,321 -

Mezzanine loan - 2,785

1,536 4,321

In the third to fifth years inclusive

Bank loan - senior variable rate loan - 215

Bank loan - senior fixed rate loan 4,607 4,392

Bank loan - senior term loan B 1,500 -

6,107 4,607

After five years

Bank loan - senior fixed rate loan 774 2,310

Amounts due for settlement 14,204 13,569

Less amounts due within one year (5,787) (2,331)

Amounts due for settlement after one year 8,417 11,238

Analysis of borrowings by currency

Sterling Euros Total

�000 �000 �000

2008

Bank overdrafts 679 69 748

Term loans 719 - 719

Bank loans 12,737 - 12,737

14,135 69 14,204

2007

Bank overdrafts 250 113 363

Term loans 432 - 432

Bank loans 12,774 - 12,774

13,456 113 13,569

The bank overdraft in sterling relates to the Company, with the Euro balance attributable to the Italian subsidiary, Promosport srl.

The term loans are unsecured and relate to loan notes payable to the principals of The Finishing Touch (Corporate Events) Limited. Loan

notes of �400,000 (2007: �432,000) bear interest at the rate of the UK bank base rate. Loan notes of �319,000 (2007: �Nil) bear no

interest.

The bank loans are secured against the assets of the Group. The floating rate elements of the loan bear interest at the UK bank LIBOR

rate plus a margin of either 2.25 per cent or 7.00 per cent. The fixed rate element of the loan bears interest at the rate of 8.07 per

cent.

The senior term loan on the existing banking arrangements is split via a variable interest rate and fixed interest rate portion. The

repayments of �393,000 (2007: �393,000) per quarter are netted off against the variable rate loan initially, and when this is paid off the

repayments will net off against the fixed rate portion of the loan. The senior term loan is due to be repaid by 20 December 2014, subject to

the post balance sheet event, whereby new loan facilities were introduced (see note 9).

The mezzanine loan facility on the existing banking arrangements is due for repayment, by way of a bullet payment, on 20 December 2008,

subject to the post balance sheet event, whereby new loan facilities were introduced (see note 9).

An advance drawdown under Term Loan B on the new banking arrangements (see note 9 for full details) of �1,500,000 (�1,771,062 less

�271,062 arrangement fee) was credited into the Company's banking facilities on 29 August 2008.

For further analysis of the new banking facilities provided by Allied Irish Bank (GB) refer to note 9.

8. CASHFLOWS

Year Year

ended ended

31 August 31 August

2008 2007

�000 �000

Reconciliation of net cash flows from

operating activities

Profit before taxation 607 1,652

Adjustments:

Finance costs 1,608 1,281

Finance income (59) (61)

Depreciation 607 416

Amortisation of intangibles 364 339

Loss on disposals of property, plant and 21 -

equipment

Share options charge 75 77

Operating cash flows before movements in 3,223 3,704

working capital

Decrease in inventories 36 396

(Decrease)/increase in trade and other 95 (281)

receivables

Decrease in trade and other payables (1,631) (425)

Cash generated from operating activities 1,723 3,394

Income taxes paid (188) (535)

Net cash from operating activities 1,535 2,859

9. POST BALANCE SHEET EVENTS

Acquisition of Spot and Company of Manhattan, Inc

The Group announced at the end of October that it has completed, through its wholly owned subsidiary First Artist Corporation, Inc. the

transaction to acquire Spot and Company of Manhattan, Inc. ("SpotCo") for a maximum consideration of $18.86 million.

SpotCo is a leading US-based live entertainment advertising agency and is a natural strategic fit with Dewynters Limited, the Group's

full-service media agency.

The fair value of the assets acquired will be determined as per the terms of the Sale and Purchase Agreement, and since this process is

on-going it is not currently possible to derive an accurate assessment of the fair value of the net assets acquired.

New Banking Facilities

The following banking facility agreement dated 28 August 2008 between the Company (as borrower) and Allied Irish Bank ("AIB"), was made

available to the Company following the successful completion of the SpotCo acquisition:

Loan Type Repayment details Interest Margin Loan Value

�

Senior Term Loan A In full within 5 LIBOR + 2.25% 7,200,000

years*

Senior Term Loan B Bullet payment after LIBOR + 2.75% 5,000,000

5 years

Mezzanine Facility Bullet payment after LIBOR + 10.00%** 3,728,000

2 years

Short Term Mezzanine Loan Bullet payment after LIBOR + 10.00%** 500,000

1 year

16,428,000

*The repayment profile for the Senior Term Loan A is to be as follows:

Year Amount (�)

1 -

2 750,000

3 1,000,000

4 1,200,000

5 1,450,000

5 2,800,000

7,200,000

**A total of 4% per annum of the margin is payable quarterly and 6% per annum of the margin is capitalised

at the end of each consecutive period of 3 months and added to the principal amount of the Loans.

A working capital facility in the sum of �1,000,000 was made available as part of the new banking facility

agreement, with an interest rate of 2.50% above AIB's base rate being applied. This facility is due for

review each year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TRBLTMMMMBIP

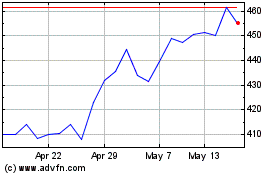

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

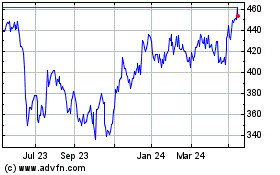

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024