TIDMFDBK

RNS Number : 4899Q

Feedback PLC

07 November 2012

7 November 2012

Feedback plc

("Feedback" or "the Company")

Final Results for the year ended 31 May 2012

Chairman's Statement

2012 was a difficult year for everyone at Feedback plc as tough

market conditions further exposed the Group's long-term

weaknesses.

The structure and costs of Feedback were those of a larger

Group. Without sustained growth reversing the more than 40% decline

in revenues over the past few years, the business was not

sustainable.

The Group's strategy, since my appointment, had been for a sales

led turnaround whilst investing in new products and pushing through

measures to improve operational effectiveness, all the time working

within the harsh constraints of the Group's working capital

requirements.

Results

The financial year started well. Half-year results showed what

looked like clear indications of a recovery. Turnover to November

2011 was up 13% with the Group running at breakeven on a

like-for-like basis. The multi-year implementation of an expensive

new ERP system was finally completed and immediately delivered on

its long-anticipated promise of enabling faster order-to-ship times

and real-time management of inventory. Two loss-making product

ranges were eliminated, the operational structure was simplified

somewhat to reduce cost, and we started Feedback Black Box (Black

Box) as a new product incubator with a promising first

customer.

The cost of restructuring the Group, of following through on a

number of long-term investment decisions, the impact of margins

being squeezed from customers and suppliers, and the simple demands

of growth, all created an increased need for working capital that

was forecast to be on-going. Funds were raised from new and

existing shareholders, including every member of the Board, in

October 2011.

Despite the encouraging start, results for the full year,

including for Feedback Instruments Limited and Feedback Inc

(Feedback Instruments) up to its disposal on 23 May 2012 and

allowing for the effects of its sale, are extremely

disappointing.

Turnover of GBP7.0 million was up 11.7% from GBP6.3 million in

the previous year. Reported loss on all activities was GBP1.8

million (2011: loss of GBP831,000) reflecting operating losses of

GBP414,000 (2011: loss of GBP831,000), loss of GBP802,000 (2011:

nil) on the sale of Feedback Instruments, GBP293,000 (2011: nil)

write-off of intercompany debt, and an impairment of GBP274,000

(2011: nil) relating to property. The loss after taxation was

GBP1.82 million (2011: GBP862,000).

Revenue for Feedback Instruments up to the date of its disposal

grew 8% to GBP4.9 million, up from GBP4.5 million in 2011, despite

extremely low order volumes for most of the second half of the

year. This growth was well below management's expectations with

export sales particularly disappointing. Feedback Instruments had

an operating profit of GBP311,000 (2011: GBP466,000 loss) due in

part to the write-back of GBP260,000 (2011: nil) legacy stock

provisions.

The financial challenge facing Feedback Instruments that led to

its disposal was funding the working capital demands of the long

lead-time between receipt of order and receipt of payment and the

overhead needed to maintain the minimum level workforce during the

months of lean trading.

For Feedback Data, revenues of GBP1.9 million represent a 12%

growth on the GBP1.7 million performance in 2011. However, losses

worsened to GBP294,000 (2011: GBP23,000) largely due to the cost of

restructuring the sales team and the increased investment necessary

to finish two product development projects started in prior

years.

The increases in revenue in both operating companies occurred in

the first half of the year.

As we moved into the second half of the year, all parts of the

Group suffered poor levels of sales. Feedback Instruments in

particular experienced several consecutive months of extremely weak

order intake that fell well below management's even short-term

forecasts.

The engine of the Group had long been Feedback Instruments'

export sales. When these dried to a trickle, predominantly due to

the lack of product investment in prior years, the prospect of a

sales led recovery evaporated and the Board then determined that to

turnaround the entire Group would be impossible.

After a thorough review in early 2012 the Board concluded that

given its cash burn, its weakness in terms of the age of its

existing products, and the length of time needed for any new

products to be developed and marketed effectively in the education

sector, returning Feedback Instruments to positive cash flow and

profitability would take more time and cash resources than the

Group possessed or had access to.

Accordingly, and with a heavy heart given its position as the

foundation stone of the Group in 1958 and the presence still on the

Board of one of the founders, the decision was taken to dispose of

Feedback's education business. In a difficult and, due to the lack

of viable offers received, in the end distressed transaction,

Feedback Instruments was sold to a subsidiary of LD Didactic GmbH

for a nominal consideration in respect of the shares and a

repayment of GBP260,000 of the Group's indebtedness.

Losses in Feedback Data (Data) also increased in the year under

review; the result of its own ageing product range, postponed

projects, and further restructuring costs.

The Group undertook a series of actions to preserve and maximise

value for shareholders. Data was restructured to reduce headcount;

hardware development, production and certain customer support

functions were outsourced. The Board has determined that the

Group's headquarters in Crowborough, which long-standing

shareholders will remember was sold in 2007 and bought back in

2008, is now surplus to requirements and is in the process of being

sold.

Notwithstanding the challenges of the current economic

environment, shareholders should be aware that the single factor

most responsible for the decline in the Group's long-term

performance is the lack of priority given, over many years, to new

product development.

In the education sector, product development is generally

accepted to be a long-term strategy. The Group's education

customers are reluctant to consider new products until they are

available on the market, and the sales cycle is upwards of two

years due to the necessary time required to incorporate new

equipment into curricular activities. However, even in this

context, Feedback Instruments generating approximately 90% of

revenues from products developed more than 10 years ago shows a

clear picture of a company resting too long on past glories.

The pace of product development in the Group has been, in the

eyes of our customers and when compared with our competitors,

extremely disappointing. Feedback's development teams, working with

the evolving demands of the market place and rapidly changing

technologies, were left behind by the quicker cycle times of larger

and faster manufacturers who have bigger development budgets.

None of this is to say that Feedback products are not excellent

pieces of engineering. They are. Indeed, the Company has built a

strong reputation for designing and building robust products that

continue to provide value even after many years in the field.

Developing new products is always a risk-based activity.

However, for too many years the operating companies failed to make

enough wise choices - leaving decisions in the hands of engineers,

and not listening to end users or feeling the pulse of the market -

which left customers looking elsewhere for the innovation that

would drive their own growth.

Given the time needed to develop new products for our

established markets, Feedback Black Box Company (Black Box) was an

attempt to leverage Feedback's engineering reputation and inject

urgency and revenue into the Group with a completely outsourced

business model. But with start-up revenues of only GBP186,000

(2011: nil) and losses of GBP128,000 (2011: nil), despite much

promise, Black Box was closed as part of the cost cutting programme

immediately after the sale of Feedback Instruments.

People

In October 2011, David Marks left the Company after giving over

30 years' service in all parts of the business. He joined the main

Board in 2009 after spending time as Managing Director of Feedback

Instruments Limited, and more latterly held the role of Group

Operations Director.

We have recently also seen the departure, on health grounds, of

David Barton. David worked tirelessly for the Company from his

appointment as a non-executive director in 2007 until his

withdrawal in October 2012.

I would like to thank the two Davids and all my other colleagues

across the Group's operations for their commitment and hard work

during what continues to be an extremely difficult year.

Outlook

After 54 years in operation, 2012 has been Feedback's annus

horribilis and this has forced a complete re-evaluation of the

business.

With the distressed sale of Feedback Instruments, Feedback is

left with annual revenues of approximately GBP2 million. These

revenues are predominantly derived from low-growth products which

are sold into a competitive market. The cost base of the remaining

business is difficult to bare and the potential for organic growth

is limited. The Group's continued poor performance has resulted in

it relying on its banking and other loan facilities and has meant a

significant amount of management time has been focused on cash

management.

In such a challenging environment the Board continue to consider

all viable strategic opportunities to maximise value for

shareholders, including the potential disposal of the remaining

operating businesses.

In the meantime, the Group is seeking to minimise its cash burn

from on-going operations.

Nick Shepheard

Chairman

Consolidated Statement of Comprehensive Income

for the year ended 31 May 2012

Notes 2012 2012 2012 2011

GBP000 GBP000 GBP000 GBP000

Continuing Discontinued Total

REVENUE 3 2,111 4,935 7,046 6,308

Cost of sales (1,290) (3,308) (4,598) (3,969)

----------- ------------- -------- --------

GROSS PROFIT 821 1,627 2,448 2,339

Other operating expenses 4 (1,522) (1,340) (2,862) (3,170)

----------- ------------- -------- --------

OPERATING LOSS (701) 287 (414) (831)

Losses on disposal of discontinued

operations - (1,369) (1,369) -

Net finance expense (13) - (13) (9)

----------- ------------- -------- --------

Loss on ordinary activities

before taxation (714) (1,082) (1,796) (840)

Tax charge (29) 6 (23) (22)

----------- ------------- -------- --------

Loss for the year attributable

to the equity shareholders of

the Company (743) (1,076) (1,819) (862)

----------- ------------- --------

Other comprehensive income/(expense)

Translation differences on overseas

operations 10 (36)

----------- ------------- -------- --------

Total comprehensive expense

for the year (1,809) (898)

=========== ============= ======== ========

LOSS PER SHARE (pence)

Basic and diluted 5 (0.60) (0.87) (1.47) (0.79)

=========== ============= ======== ========

Consolidated Statement of Changes in Equity

for the year ended 31 May 2012

Share Share Capital Retained Translation

Capital Premium Reserve Earnings Reserve Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 June 2010 273 633 300 2,519 (178) 3,547

Total comprehensive expense

for the year - - - (862) (36) (898)

-------- -------- -------- --------- ------------ --------

At 31 May 2011 273 633 300 1,657 (214) 2,649

New shares issued 54 218 - - - 272

Total comprehensive expense

for the year - - - (1,819) 10 (1,809)

-------- -------- -------- --------- ------------ --------

At 31 May 2012 327 851 300 (162) (204) 1,112

======== ======== ======== ========= ============ ========

Consolidated Balance Sheet

at 31 May 2012

2012 2011

Notes GBP000 GBP000 GBP000 GBP000

ASSETS

Non-current assets

Held for sale 1,050 -

Property, plant and equipment 6 73 1,505

Intangible assets 7 330 732

Deferred tax asset - 134

------- ------- ------- -------

1,453 2,371

Current assets

Inventories 8 316 1,030

Trade receivables 343 930

Other receivables 160 233

Cash and cash equivalents - 9

------- ------- ------- -------

819 2,202

------- ------- ------- -------

Total assets 2,272 4,573

------- ------- ------- -------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 86 198

Current liabilities

Trade payables 228 909

Other payables 9 688 817

Bank borrowings 158 -

------- ------- ------- -------

1,074 1,726

------- ------- ------- -------

Total liabilities 1,160 1,924

------- ------- ------- -------

TOTAL NET ASSETS 1,112 2,649

======= ======= ======= =======

EQUITY

Capital and reserves attributable

to the Company's equity

shareholders

Called up share capital 327 273

Share premium account 851 633

Capital reserve 300 300

Retained earnings (366) 1,443

------- ------- ------- -------

TOTAL EQUITY 1,112 2,649

======= ======= ======= =======

Consolidated Cash Flow Statement

for the year ended 31 May 2012

2012 2011

GBP000 GBP000 GBP000 GBP000

Cash flows from operating activities

Loss before tax (1,796) (818)

Adjustments for:

Loss on disposal of subsidiary 802 -

Impairment provision against property 274 -

Net finance expenditure 13 -

Depreciation and amortisation 508 565

Foreign exchange difference (10) (36)

Decrease in inventories (310) 270

Decrease in trade receivables 212 956

Decrease/(increase) in other receivables 42 (8)

Decrease in trade payables (286) (357)

Decrease in other payables 434 (111)

------- -------- ------- -------

1,679 1,279

------- -------- ------- -------

Net cash generated in operating

activities (117) 461

Cash flows from investing activities

Purchase of tangible fixed assets (51) (98)

Purchase of intangible assets (258) (370)

------- -------- ------- -------

Net cash used in investing activities (309) (468)

Cash flows from financing activities

Interest paid (13) (9)

Proceeds of share issue 272 -

------- -------- ------- -------

Net cash used from financing activities 259 (9)

------- -------- ------- -------

Net decrease in cash and cash

equivalents (167) (16)

Cash and cash equivalents at beginning

of year 9 25

------- -------- ------- -------

Cash and cash equivalents at end

of year (158) 9

======= ======== ======= =======

1. ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with

those IFRS standards and IFRIC interpretations issued and effective

or issued and early adopted as at the time of preparing these

statements (October 2012). The accounting policies have been

consistently applied to all the years presented.

These consolidated financial statements have been prepared under

the historical cost convention.

During the period the Group disposed of its Feedback Instruments

Limited and Feedback Inc subsidiaries and is in negotiations to

dispose of its property (held by Brickshield Limited). For these

reasons the results of these subsidiaries have been disclosed as

discontinued.

The financial information set out above does not comprise the

Company's statutory accounts for the periods ended 31 May 2012 or

31 May 2011. Statutory accounts for 31 May 2011 have been delivered

to the Registrar of Companies and those for 31 May 2012 will be

delivered following the Company's Annual General Meeting. The

auditors have reported on those accounts; their report was

unqualified and did not contain statements under section 498(2) or

(3) of the Companies Act 2006 in respect of the accounts for 2012

or for 2011.

2. GOING CONCERN

As highlighted in the Chairman's statement, the cost base of the

Group's remaining business is difficult to bare and the potential

for organic growth is limited. The Group is reliant on its banking

and other loan facilities and a significant amount of management

time is focused on cash management. The Board continue to consider

all viable strategic opportunities to maximise value for

shareholders including the disposal of the remaining operating

businesses. In the meantime, the Group is seeking to minimise its

cash burn from on-going operations.

The current situation and outlook cast significant doubt on the

Group's ability to continue as a going concern. Based on current

plans however, the Directors consider that the Group is a going

concern and have prepared the Group financial statements on a going

concern basis. The financial statements therefore do not include

any adjustments that would result if the Group was unable to

continue as a going concern. In the event the Group ceased to be a

going concern, the adjustments would include writing down the

carrying value of assets, including intangible assets and

inventories, to their recoverable amount and providing for any

further liabilities that might arise.

3. SEGMENTAL REPORTING

The directors have determined the operating segments based on

the management reports that are used to make strategic decisions.

The Group's business is analysed below between the Feedback

Instruments segment and the Data segment. The Feedback Instruments

segment primarily relates to the former subsidiary companies

Feedback Instruments Limited and Feedback Incorporated which were

disposed of in the year. The Data segment relates to the subsidiary

company Feedback Data Limited. Details of these companies are

included in the Directors' Report.

On 23 May 2012 the Group disposed of its Feedback Instruments

business. For this reason the results shown below disclose the

results of the Feedback Instruments business for the period to 23

May 2012.

Year ended 31 May 2012

Feedback Feedback Other Total

Instruments Data

GBP000 GBP000 GBP000 GBP000

Revenue

External 4,935 1,925 186 7,046

------------- --------- -------- --------

Finance expense - - (13) (13)

------------- --------- -------- --------

Loss before tax 311 (286) (1,821) (1,796)

============= ========= ======== ========

Balance sheet

Assets - 781 2,524 3,305

Liabilities - (602) (2,138) (2,740)

------------- --------- -------- --------

- 179 386 565

============= ========= ======== ========

Capital expenditure - 6 33 39

============= ========= ======== ========

Year ended 31 May 2011

Feedback Feedback Other Total

Instruments Data

GBP000 GBP000 GBP000 GBP000

Revenue

External 4,558 1,750 - 6,308

------------- --------- -------- --------

Finance expense - - 9 9

------------- --------- -------- --------

Loss before tax (466) (23) (351) (840)

============= ========= ======== ========

Balance sheet

Assets 1,359 975 3,329 5,663

Liabilities (1,096) (985) (1,635) (3,716)

------------- --------- -------- --------

263 (10) 1,694 1,947

============= ========= ======== ========

Capital expenditure 6 37 53 96

============= ========= ======== ========

Reported segments' assets are reconciled to total assets as

follows:

2012 2011

GBP000 GBP000

Segment assets for reportable

segments 3,305 5,663

Unallocated:

Inter-company receivables

adjustment (1,223) (1,541)

Intangible assets 330 732

Investments (140) (281)

-------- --------

Total assets per the balance

sheet 2,272 4,573

======== ========

Reported segments' assets are reconciled to total assets as

follows:

2012 2011

GBP000 GBP000

Segment liabilities for reportable segments 2,740 3,716

Inter-company payables adjustment (1,666) (1,990)

Deferred tax 86 198

-------- --------

Total liabilities per the balance sheet 1,160 1,924

======== ========

External revenue Total assets Capital expenditure

by location of by location of by location of

customer assets assets

2012 2011 2012 2011 2012 2011

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

United Kingdom 3,070 2,820 2,258 4,312 51 95

Rest of Europe 644 879 14 14 - -

United States of

America 445 734 - 247 - 1

Other Americas 498 148 - - - -

Asia 1,040 792 - - - -

Africa 384 192 - - - -

Middle East 965 743 - - - -

--------- -------- -------- -------- ---------- ----------

Total 7,046 6,308 2,272 4,573 51 96

========= ======== ======== ======== ========== ==========

4. OTHER OPERATING EXPENSES

2012 2011

GBP000 GBP000

Distribution costs 1,821 1,352

Administrative costs:

Research and development 619 526

Other 422 1,292

------- -------

2,862 3,170

======= =======

5. LOSS PER SHARE

Basic earnings per share is calculated by reference to the loss

on ordinary activities after taxation of GBP1,819,000 (2011:

GBP862,000) and on the weighted average of 123,679,889 (2011:

109,146,746) shares in issue.

6. PROPERTY, PLANT AND EQUIPMENT

Land and Plant and Motor

buildings equipment vehicles Total

GBP000 GBP000 GBP000 GBP000

Cost of valuation

At 31 May 2010 1,441 757 19 2,217

Additions - 96 - 96

Exchange adjustments - 2 - 2

---------- ---------- --------- --------

At 31 May 2011 1,441 855 19 2,315

Additions - 51 - 51

Disposal (504) (5) (509)

Reclassification (1,441) - - (1,441)

---------- ---------- --------- --------

At 31 May 2012 - 402 14 416

---------- ---------- --------- --------

Depreciation

At 31 May 2010 71 528 15 614

Charge for the year 23 170 1 194

Exchange adjustments - 2 - 2

---------- ---------- --------- --------

At 31 May 2011 94 700 16 810

Charge for the year 24 121 1 146

Disposal - (492) (3) (495)

Reclassification (118) - - (118)

---------- ---------- --------- --------

At 31 May 2012 - 329 14 343

---------- ---------- --------- --------

Net book value

At 31 May 2012 - 73 - 73

========== ========== ========= ========

At 31 May 2011 1,347 155 3 1,505

========== ========== ========= ========

7. INTANGIBLE ASSETS

Development

expenditure

GBP000

Cost

At 31 May 2010 3,725

Additions 370

-------------

At 31 May 2011 4,095

Additions 258

Disposed on sale of subsidiary (2,236)

-------------

At 31 May 2012 2,117

-------------

Amortisation

At 31 May 2010 2,992

Charge for the year 371

-------------

At 31 May 2011 3,363

Charge for the year 362

Disposed on sale of subsidiary (1,938)

-------------

At 31 May 2012 1,787

-------------

Net book value

At 31 May 2012 330

=============

At 31 May 2011 732

=============

8. INVENTORIES

2012 2011

GBP000 GBP000

Raw materials and consumables 308 432

Work in progress 8 11

Finished goods - 587

------- -------

316 1,030

======= =======

9. OTHER PAYABLES

2012 2011

GBP000 GBP000

Amounts falling due within one year

Other payables 124 260

Other taxes and social security 44 102

Accruals and deferred income 520 455

------- -------

688 817

======= =======

10. PUBLICATION OF ANNOUNCEMENT AND REPORT AND ACCOUNTS

A copy of this announcement will be available at the Company's

registered office (Park Road, Crowborough, East Sussex TN6 2QR) and

on its website - www.fbk.com.

This announcement is not being sent to shareholders. The Annual

Report will be posted to shareholders shortly and will be made

available on the website.

For further information contact:

Feedback plc Tel: 0845 3379

155

Nick Shepheard

Merchant Securities Limited

Simon Clements/Lindsay Mair Tel: 020 7628

2200

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DQLFBLFFXFBE

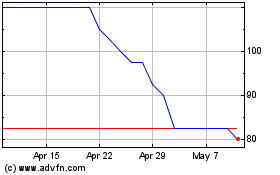

Feedback (LSE:FDBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Feedback (LSE:FDBK)

Historical Stock Chart

From Jul 2023 to Jul 2024