TIDMGETB

RNS Number : 4138R

GetBusy PLC

01 March 2023

1 March 2023

GetBusy plc

2022 Audited Results

Growth strategy delivering

GetBusy plc ("GetBusy", the "Company" or the "Group") (AIM:

GETB), a leading provider of productivity software for professional

and financial services, announces its audited results for the year

ended 31 December 2022.

2022 2021 Change

GBP'000 GBP'000 Reported currency Constant currency***

------------------

ARR 19,240 15,828 22% 16%

------------------ ---------------------

Recurring revenue 18,281 14,343 27% 21%

-------- -------- ------------------ ---------------------

Total revenue 19,293 15,448 25% 19%

-------- -------- ------------------ ---------------------

Adjusted EBITDA* 692 (510) n/a

-------- -------- -----------------------------------------

Adjusted loss before tax** (746) (1,222) 39%

-------- -------- -----------------------------------------

Loss before tax (543) (2,335) 77%

-------- -------- -----------------------------------------

Cash 2,972 2,670 11%

-------- -------- -----------------------------------------

Financial highlights

-- 27% recurring revenue growth (21% at constant currency)

to GBP18.3m

-- 25% total revenue growth (19% at constant currency) to

GBP19.3m

-- ARR growth of 22% (16% at constant currency) to GBP19.2m

with healthy new business, improving churn and successful

monetisation

-- Recurring revenue comprises 95% of total revenues (2021:

93%)

-- Gross margin remains strong at 89.9% (2021: 91.6%) with

greater volume of cloud revenue

-- First year of positive Adjusted EBITDA at GBP0.7m (2021:

GBP(0.5)m) - with majority of incremental revenue reinvested

for growth in line with strategic roadmap

-- Increased cash of GBP3.0m (2021: GBP2.7m) validates self-funding

model, underpinned by new committed GBP2.0m facility, which

remains entirely undrawn

Operational highlights

-- Over one billion unique documents now stored securely in

our products, with 250million documents and three million

digital signatures handled annually

-- 300,000 trees and 14,000 tonnes of CO(2) cumulatively saved

by customers through our paperless solutions

-- Group ARPU up 13% at constant currency to GBP256 (2021:

GBP216)

-- 2% increase in paying users to 75,058 (2021: 73,352)

-- Strong net revenue retention of 100.2% per month (2021:

99.8%), reflecting successful fair-price monetisation efforts

and value customers ascribe to our solutions

-- Launched major new channel partnership with Right Networks,

targeting SmartVault to its substantial base of over 8,500

accounting firms

-- Strengthened position in insolvency market through integration

and referral partnership with Turnkey IPS

-- Merged Virtual Cabinet and Workiro operations to leverage

our enterprise capabilities and expertise for the ERP market

-- Awarded SuiteCloud International Partner of the Year for

Workiro application

Outlook

-- Targeting sustained double-digit ARR growth

-- Ramping investment in sales and marketing through 2023

-- Strong start to 2023

Daniel Rabie, CEO of GetBusy, comments:

"2022 was another fantastic year with 25% revenue growth,

strong, double-digit ARR growth and our first Adjusted

EBITDA-positive period, leading to a third consecutive year of cash

generation. Against a difficult economic backdrop, our products are

solving real, practical, and universal challenges for our customers

in large, under-penetrated and resilient markets, supported by

enduring the themes of productivity, cyber-security, mobility and

privacy.

"Our strategy of investing for long-term, sustainable growth

from a stable platform with excellent visibility is validated.

"Moving into 2023 we plan to capitalise further on these

valuable market opportunities through sustained investment in

customer acquisition across the Group as we enter the next exciting

phase of our scaling journey."

*Adjusted EBITDA is Adjusted Loss before Tax with capitalised

development costs added back. A full list of our alternative

performance measures, together with a glossary of certain terms,

can be found in note 2.

** Adjusted Loss before Tax is Loss before tax, depreciation and

amortisation on owned assets, long-term incentive costs, net

capitalised development costs, finance costs that are not related

to leases, and non-underlying items.

*** Changes at constant currency are calculated by retranslating

the comparative period at the current period's prevailing rate of

exchange.

A copy of the presentation to investors and the audited annual

report will be available on the Company's website, at

www.getbusyplc.com shortly.

GetBusy plc

investors@getbusy.com

finnCap (Nominated Adviser and Broker)

Matt Goode / Charlie Beeson / Milesh Hindocha

(Corporate Finance) +44 (0)20 7220

Alice Lane / Harriet Ward (ECM) 0500

Alma PR (Financial PR) +44 (0)20 7886

Hilary Buchanan / Andy Bryant / Hannah Campbell 2500

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION (EU) NO 596/2014 AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018

("MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN. THE

PERSON RESPONSIBLE FOR MAKING THIS ANNOUNCEMENT ON BEHALF OF THE

COMPANY IS PAUL HAWORTH.

About GetBusy

GetBusy's specialist productivity software solutions enable

growing businesses to work securely and efficiently with their

customers, suppliers and teams anytime, anywhere. Our solutions can

be delivered flexibly across cloud, mobile, hosted and on-premise

platforms, whilst integrating seamlessly with a wide variety of

other class-leading core business systems.

With over 75,000 paying users and over 3 million collaborators

across multiple market sectors and jurisdictions, GetBusy is an

established and fast-growing SaaS business delivering sustained

double-digit growth in high-quality recurring subscription revenue

over the long term.

Further information on the Group is available at

www.getbusyplc.com

Chairman's Statement

GetBusy is firmly focused on sustainable recurring revenue

growth within a large, well-defined, robust and valuable market

opportunity.

More than ever, GetBusy's products are delivering tangible value

across a growing addressable market. Annually, we handle more than

250 million documents for our customers, who execute over 3 million

digital signatures and share information with over 3 million

collaborators. Our products have saved around 300,000 trees and

14,000 tonnes of CO2 by helping our customers to go paperless.

We are helping professionals to be as productive, efficient, and

secure as possible in the face of rising cost pressures and

operational complexities. Our very high - and improving - customer

retention rates demonstrate how embedded our growing range of

capabilities have become within our clients' technology stacks; a

trend we expect to continue as the tailwinds of digital

transformation, cyber security, privacy legislation and hybrid

working strengthen.

I am delighted with the progress the business has made in 2022.

Together with the headline growth rates generated by our core

businesses, there has been significant progress in our efforts to

underpin longer-term growth, including through our emerging

products. Significant new customer wins, new channel partnerships,

the introduction of new capabilities to our customer base and

prestigious industry awards have all been notable landmarks, but

the foundation of these achievements remains the provision of a

compelling proposition for new and existing customers.

On behalf of the Board, I would like to thank each member of our

teams in Cambridge, Houston and Sydney for their commitment in

2022. Across the business, our people consistently exhibit

ingenuity, tenacity, ambition and humanity; they are our most

valuable asset and the reason for our success.

In 2022, we have re-examined each of our markets and products

and concluded there is substantial long term value to be created by

continuing to invest in the growth of our high quality recurring

subscription revenue. Our industry-leading levels of recurring

revenue endow us with excellent forecasting visibility which,

twinned with our cash-generative underlying SAAS business model -

proven over the five and a half years since GetBusy's inception -

provides a stable platform to continue to invest for growth.

In 2021 we announced our ambition to at least double Annual

Recurring Revenue within five years. I am pleased to report that

ambition remains firmly on track.

CEO's review - a clear focus on growth

Since IPO, GetBusy has achieved over 18% compound annual growth

in ARR. Over 95% of our revenue is recurring in nature - amongst

the highest in the UK market. 2022 was GetBusy's third consecutive

year of cash generation and our first year of positive Adjusted

EBITDA. Our business model has enabled us to achieve growth since

our IPO in a cash neutral fashion - we raised GBP3m in 2017 and, 5

years on, we have GBP3m of cash. Our markets are large and

under-penetrated and we solve real-life, practical problems for our

customers, making our products sticky. Against the current

difficult economic backdrop, never has the relevance of our

products been more apparent as we help customers to be efficient

and secure in the face of rising costs. Our strategy of investing

for long-term, sustainable growth from a stable platform with

excellent visibility is validated.

Growing recurring subscription revenue remains our key

focus.

The reliable and predictable revenue runrate from software

subscriptions provides a solid foundation for mid- to long-term

planning. Our high gross margins, strong customer retention rates

and the favourable working capital profile arising from a high

proportion of customers paying annually in advance, de-risk the

investments we can make to drive future growth. Our business model,

allows us to double down responsibly on growth investment in an

otherwise cautious macro-economic environment, building a highly

valuable base of customer cashflows that have annuity

characteristics.

As we move into 2023, we are setting up the business to

capitalise on the market opportunity with a clear focus on

accelerating our customer acquisition, which ultimately underpins

long term growth. We are making significant investments in our US

sales and marketing operations for SmartVault, to strengthen its

already robust position in a highly attractive market, and in the

UK we are leveraging the substantial enterprise experience from

Virtual Cabinet to penetrate the ERP space with Workiro.

We are excited to begin this next chapter in our growth

story.

27% growth in recurring revenue - predictable, scalable and

valuable

Recurring revenue growth in 2022 was driven by continued

execution against the Group's consistent growth strategy: new

customers and markets, customer retention, monetisation and product

expansion.

ARR grew 16% at constant currency to GBP19.2m (2021: GBP15.8m),

through a combination of new customer acquisition, strong customer

retention rates and improved pricing within our established

products.

Predictable

Users were up 2% to 75,058 with new business contributing

significantly to this growth. Predictability is key to our customer

acquisition model; we have consistently returned more than GBP4 in

customer lifetime value for every GBP1 spent on acquiring a new

customer. Once acquired, our customers tend to be sticky: gross

churn is resilient, averaging 0.9% per month, an improvement on

2021 (1.0%) despite the anticipated increase arising from higher

monetisation.

ARPU was up 13% at constant currency to GBP256. The size of our

customer base enables us to draw valuable insights from users,

informing product development and the retention activities of our

customer success teams. That insight also proves the value of the

productivity benefits delivered to our customers, enabling us to

set fair prices for our new and existing clients with confidence.

These price movements have been the core driver of ARPU in 2022,

contributing GBP2.4m in ARR over the year from both the SmartVault

and Virtual Cabinet products.

Our strong net revenue retention of 100.2% per month (2021:

99.8%) - meaning revenue from our customer base on average grows

each month before the addition of new customers - provides us with

outstanding visibility over near-term growth, built from a very

stable foundation of predictable recurring revenue.

The absence of significant customer concentration contributes to

the reliability of revenue generated from our customer base; no

single client accounts for more than 2% of revenue.

Scalable

The professional and financial services markets that the Group

targets are large and under-penetrated. GetBusy's software

portfolio adds a productivity layer to core business applications,

simplifying workflows, improving productivity, enhancing security

and delighting clients. With the strong and enduring tailwinds of

digital transformation, privacy legislation, mobility and cyber

security, these supportive market dynamics will provide substantial

growth opportunities for the Group for years to come. Many

organisations are still very early on their software automation or

optimisation journeys, and the depth of our expertise within these

markets positions us well to provide an ever-increasing set of

solutions to customers on that journey.

Our strong LTV:CAC ratio of 4:1 (2021: 4:1) allows us to

increase our customer acquisition spend with a high degree of

confidence in the anticipated returns. Typically, more than 65% of

our direct customers elect for contracts that are paid annually in

advance, providing us with structural working capital benefits that

fund additional investment in growth. Our high gross margin of

89.9% (2021: 91.6%) means there are minimal incremental operating

costs from acquiring new customers, which in the long term leads to

substantial operating leverage and cash generation.

The strength of our integrations with core business

applications, such as practice management or tax preparation

software, contributes to our healthy customer retention. Those

integrations also provide channel opportunities for us, enabling us

to leverage a partner's access to well-defined customers, improving

customer acquisition scalability. Major new partners signed in 2022

include Right Networks, which has an installed base of over 8,500

accounting firms, and Turnkey IPS, the leading insolvency practice

management provider. SmartVault's partnership with Right Networks

was launched commercially in December, with the first customers now

onboarded, and we anticipate traction to build in that channel

throughout 2023.

Channels are also a key part of our customer acquisition

strategy for our emerging products Workiro and Certified Vault,

with the former increasing the number of NetSuite value-added

reseller partners to 8 during 2022.

Valuable

GetBusy focuses on the professional and financial services

markets, with over 70% of revenue derived from the accountancy

sector. These markets have remained buoyant during 2022 and

historically have proved relatively resilient in the face of

significant economic uncertainty. The battle to recruit and retain

professional talent, and the well-documented related inflationary

challenges, will drive increased adoption of productivity and

automation tools. The insolvency sector, a key growth area for

GetBusy, is expected to become particularly active as the strain of

three years of extraordinary financial pressures takes its toll on

vulnerable sectors and practitioners increasingly adopt fixed-fee

models, providing a catalyst for efficiency improvements.

The degree to which our products are embedded in our customers'

everyday workflows, and integrated into other mission-critical

applications, contributes to our low churn rates and high levels of

net revenue retention. This leads to a subscription revenue base

that has valuable annuity characteristics; the Group's customer

base at its initial public offering in 2017 generates more ARR

today than it did then as a result of strong retention, increased

penetration, revenue expansion from upsell and price uplifts. Over

time these revenue streams underpin highly profitable businesses,

something we have evidenced with the more mature parts of our

business achieving comfortably over 40% Adjusted Adjusted EBITDA

margins.

This high-quality customer base has considerable strategic

value.Through over 20 years of product and brand development, we

have, through our portfolio of innovative products, built leading

positions in attractive markets with high barriers to entry.

Transaction multiples paid within the broader professional services

software market validate the importance of those customer

relationships and how selling additional products to those

customers can create significant value over the long term. Our

continuing investments in additional capabilities are made with

this in mind. Over the longer term, we expect our emerging

products, including Workiro and Certified Vault, to contribute more

meaningfully to growth as the products mature and brand recognition

is established.

Current trading and outlook

Our balance sheet is strong. Our markets are resilient. Our

products solve relatable, practical problems. Our customer base is

sticky. Our revenue is highly predictable.

This enables us to continue to reinvest incremental revenues

into acquiring new customers and delivering additional value to

existing customers, to sustain double-digit ARR growth over the

long-term.

The strong ARR momentum from 2022 has continued into 2023, with

robust January trading. We have started to scale our investments in

customer acquisition, including in sales and marketing heads, in

both the US and UK and we expect those investments to deliver

meaningful returns over the medium-term.

The Board is tremendously excited about the Group's prospects to

deliver exceptional shareholder value over the long-term and looks

forward to the future with increasing confidence.

Business and financial review

Group 2022 2021 Change

Reported Constant

currency currency

---------- ----------

ARR at 31 December GBP19,240k GBP15,828k 22% 16%

----------- ------------ ---------- ----------

Recurring revenue GBP18,281k GBP14,343k 27% 21%

----------- ------------ ---------- ----------

Total revenue GBP19,293k GBP15,448k 25% 19%

----------- ------------ ---------- ----------

Adjusted EBITDA GBP692k GBP(510)k n/a

----------- ------------ ----------------------

Adjusted loss before

tax GBP(746)k GBP(1,222)k 39%

----------- ------------ ----------------------

Paying users at 31

December 75,058 73,352 2%

----------- ------------ ----------------------

ARPU at 31 December GBP256 GBP216 19% 13%

----------- ------------ ---------- ----------

Net revenue retention 100.2% 99.8% n/a

----------- ------------ ----------------------

Established products

SmartVault and Virtual Cabinet have clear leading positions in

their respective markets.

SmartVault has particular strength within the SME accounting and

tax space in the US, a market which we estimate to exceed $250m in

ARR. SmartVault is the only fully-integrated cloud document

management provider for Intuit's leading Lacerte and ProSeries tax

preparation products; the workflow productivity benefits from this

tight integration lead to outstanding customer retention rates,

typically five times better than for the broader customer base.

SmartVault's product development continued apace during 2022.

Our recently released e-mail capture capability was iterated, and

we introduced custom-branded e-mail messaging, a significantly

updated and refreshed user interface, an overhaul of some of the

features for account administrators and the beta-release of the

form-fill and quoting technology integrations. These developments

help us to retain clients and create distinctive points of value

that allow us to price and package the product effectively,

creating upgrade paths for customers. Feedback from beta customers

on the form-fill and quoting technologies has been positive -

particularly in the case of form-fill- and we have subsequently

moved into general release, with revenue contribution expected to

become impactful in 2024.

Virtual Cabinet further enhanced its position in the insolvency

sector, creating integration partnerships with Turnkey IPS, the

leading practice management provider, and Postworks, the digital

mailroom provider, both of which are key players in the sector.

This position is strengthened through Virtual Cabinet's integration

with Workiro, providing a clear path for customers embarking on

their cloud journey whilst retaining the class-leading capabilities

of Virtual Cabinet and its deep integrations into a wide range of

core professional applications.

As well as a refreshed user interface and branding for Virtual

Cabinet, next-generation search capabilities were developed and

launched together with user analytics, improved OneDrive

integration and improved document retention capabilities.

The Workiro technology is also proving to be an attractive cloud

pathway for many Virtual Cabinet customers, with substantial

overlap between the requirements of the ERP market and Virtual

Cabinet's established and target customer base.

Emerging products

Our emerging products provide further growth potential for the

Group. Each addresses a validated productivity need within a

clearly identified and large market that shares the favourable

characteristics and helpful tailwinds of our core professional

services markets.

Workiro provides intuitive document management, task,

communication and approval capability, targeted at users of ERP

systems, with an initial focus on Oracle's NetSuite application,

into which Workiro is deeply integrated. NetSuite's installed base

of over 33,000 enterprise customers provides a considerable market

opportunity for Workiro, with the broader cloud ERP market being

significantly larger.

Workiro established a presence within the NetSuite ERP space

during 2022, signing 8 reseller partners and winning SuiteCloud

International Partner of the Year at the key SuiteWorld event. We

expect our channel partners to contribute significantly to a

scalable customer acquisition model over the long term,

complementing our direct strategy. Given the typical size of many

ERP-using businesses, moving into 2023 we have consolidated our

customer acquisition efforts for Workiro and Virtual Cabinet,

leveraging the latter's substantial enterprise experience and

generating operational efficiencies as Workiro starts to scale.

Certified Vault was introduced into the asset finance market in

the US in 2021, providing secure custody of electronic chattel

paper on behalf of secured lending institutions. Following an

encouraging start towards the end of 2021, we tempered customer

acquisition during 2022 while we further develop and prepare the

product, and the surrounding operational infrastructure, for the

rigorous security and compliance demands of the larger financial

services market. This essential work, which will create a very

solid and sustainable foundation for Certified Vault in what is a

large, highly attractive and under-served market, is progressing

well. We expect to complete the first of our major security

certifications for the market by early H2 2023, with the second,

more robust certification by the end of the year. Ultimately this

work should allow us to develop sales channels through asset

finance providers, providing a high degree of scalability to the

model. In the meantime, acquisition of smaller end customers in the

space is allowing us to refine the product and our operational

processes.

Income statement

Recurring revenue grew 27% (21% at constant currency) to

GBP18.3m (2021: GBP14.3m), reflecting the strong ARR momentum

carried forward at the start of the year and the subsequent ARR

growth, in particular from the fair-price monetisation efforts in

the UK and US.

US recurring revenue growth was strongest in the year, up 55%

(35% at constant currency) to GBP9.5m (2021: GBP6.1m), entirely

driven by SmartVault, in which solid customer acquisition was

supported by excellent monetisation and improved churn. Growth in

the UK was 7% to GBP6.7m (2021: GBP6.3m); the introduction of

Virtual Cabinet Unlimited, our "all-in" pricing plan, and the

migration of a large proportion of customers to that plan.

Australia and New Zealand, in which our products are

well-penetrated, was up 5% at GBP2.0m (2021: GBP2.0m), and the

region remains strongly profitable for the Group.

Non-recurring revenue of GBP1.0m was, as expected, down a little

compared to 2021 following the effective completion of the process

to convert older Virtual Cabinet customers onto pure SaaS models.

Total revenue was up 25% (19% at constant currency) to GBP19.3m

(2021: GBP15.4m).

Gross margin of 89.9% (2021: 91.6%) reflects the greater

proportion of revenue from our cloud products, most notably

SmartVault, as opposed to on-premise products for which there is

very little cost of sale.

SG&A costs of GBP13.5m (2021: GBP11.6m) reflect a number of

investments across the business to underpin future growth and

improve the infrastructure of the Group to support additional

scale. This includes investments in customer acquisition teams

across the Group, customer success teams, which drive customer

retention and expansion revenue campaigns, and a

professionalisation of our cyber security and operations

capabilities. We continued to build out our product development

functions to support capability improvements across the Group, and

developer costs of GBP4.6m were 20% higher (2021: GBP3.8m), partly

due to currency but with additional investment mostly in the

US.

GBP1.4m of development costs were capitalised (2021: GBP0.7m),

including a variety of capability enhancements across Virtual

Cabinet and SmartVault and elements of the core application builds

for Certified Vault and Workiro. The increase compared to 2021 is a

result of Workiro, for which no costs were capitalised prior to

2022, and which met the criteria for capitalisation under IAS38

Intangible Assets during the year.

Adjusted EBITDA was GBP0.7m (2021: GBP(0.5)m), whilst Adjusted

Loss, which is stated before development capitalisation, was

GBP(0.7)m (2021: GBP(1.2)m).

The reduction in depreciation and amortisation to GBP0.6m was

principally a result of a change to the useful economic life of

capitalised development costs to 5 years (previously 3 years),

following a management review; the longer life better reflects the

software development and commercial lifecycles of the Group.

Share option costs were a little lower at GBP0.3m (2021:

GBP0.4m) following the conclusion of the vesting period of some of

the options during the year, with no new grants made. The credit

for employment taxes due on the exercise of options of GBP0.1m

(2021: charge of GBP0.3m)is ultimately is linked to the Company's

share price, which is used in the calculation of the provision.

Non-underlying costs of GBP0.4m (2021: GBP0.4m) comprise

corporate restructuring costs of GBP0.2m together with a GBP0.2m

increase in the provision for potential historic sales tax

liabilities in certain jurisdictions in the US. The restructuring

will be completed in H1 2023 and creates separate intermediate

holding company structures and trading companies for each of the

Group's businesses and management support functions. The Group's

registrations for sales tax in the relevant US jurisdictions are

now largely complete and settlements are expected to be made in H1

2023. No further material costs are expected in 2023.

Non-lease finance costs relate solely to the Group's debt

facility with Silicon Valley Bank and include an accelerated

amortisation of residual capitalised facility fees as a result of

the cancellation of the facility on 28 February 2023 and subsequent

replacement with a GBP2million unsecured facility from a

director.

The loss before tax was GBP0.5m (2021: GBP2.3m). The tax credit

of GBP0.6m (2021: credit of GBP0.8m) reflects the expected UK

research and development tax credit offset by overseas tax payable

in Australia and New Zealand.

Cashflow and working capital

2022 was the third straight year of net cash inflows, achieved

despite the Adjusted Loss before Tax of GBP(0.7)m. Key cash

movements in 2022 included:

-- Deferred revenue increased by GBP1.2m as a result of the

continued ARR growth and the large proportion of our new business

that is paid annually in advance;

-- Trade and other payables increased by GBP0.4m, due to a combination of smaller factors;

-- Net tax receipts were GBP0.7m, with UK research and

development credits offset by tax payments in Australia and New

Zealand; and

-- Capital expenditure (excluding capitalised internal

development costs) was GBP0.5m (2021: GBP0.3m), with the increase

due mostly to additions to purchased software, mostly from

enhancements to the DocDown and Quoters technologies commissioned

from the vendors of those assets.

Cash at 31 December 2022 was GBP3.0m, an increase of GBP0.3m

from 31 December 2021.

Loan facility

The GBP2m secured revolving credit facility with Silicon Valley

Bank remained entirely undrawn during the year. On 28 February

2023, this facility was cancelled as certain covenants contained

within it were no longer considered to be appropriate for the

Group's growth strategy. In its place, the Group entered into a

4-year GBP2m unsecured credit facility (the "New Facility") with

Clive Rabie, a non-executive director. Under the facility, interest

is charged on drawings at a margin of 6.0% above the Bank of

England base rate. An availability fee of 75% of the margin is

payable on undrawn amounts. The New Facility contains covenants

related to the Group's ARR, which must remain above GBP18.0m and

grow at no less than 5.0% annually.

The new facility remains undrawn at the date of this report.

Balance sheet

The GBP1.4m increase in intangible assets in 2022 to GBP2.5m is

a result of both higher capitalised development costs, as a result

of Workiro development meeting the capitalisation criteria for the

first time, and lower amortisation following a change to the useful

economic life of the Group's development costs from 3 years to 5

years. Purchased software, mostly associated with the technology

acquisitions of DocDown and Quoters and the implementation of a new

billing system for SmartVault, also contributed to the

increase.

Lease assets decreased in the year to GBP1.2m, mostly as a

result of the continued use of the Group's existing office

facilities.

Trade and other receivables increased by GBP0.2m to GBP2.1m as a

result of an increase in prepayments and the impact of a stronger

USD. The current tax receivable of GBP1.1m relates to the UK

research and development tax credit due for the 2022 financial

year, with GBP0.5m of tax payable or refundable in the UK,

Australia and New Zealand, which is recorded within current

liabilities.

The GBP0.4m increase in trade and other payables is chiefly the

result of higher accruals, including for historic US sales taxes.

Additionally, trade payables were GBP0.3m higher due to the timing

of invoicing from suppliers.

Deferred revenue, which is mostly derived from annual

subscriptions paid in advance has increased by GBP1.2m to GBP6.7m,

driven mostly by the increase in recurring revenue.

The lease liability of GBP1.5m relates to our Cambridge and

Houston office premises.

Over the course of 2022, 98,412 new shares were issued as a

result of the exercise of share options.

Future developments

On a constant currency basis, the Group expects to deliver

sustained double-digit growth in recurring revenue. Non-recurring

revenue is expected to comprise an ever decreasing proportion of

total revenue as the focus remains firmly on subscription revenue

streams.

Over 50% of the Group's recurring revenue is denominated in USD.

Material fluctuations in prevailing exchange rates can have a

material impact on reported revenue growth, although the Group has

no material transactional currency exposure.

Gross margins will continue to trend slightly downwards,

reflecting product mix, with the Group's high-margin Virtual

Cabinet product becoming a smaller part of the overall mix. The

additional investments in sales and marketing across the Group are

expected to have a c. GBP1m impact on the cost base during

2023.

Two factors will likely influence the cashflow profile of the

Group in the medium term.

-- The UK is reforming its regime for research and development

tax credits, making the scheme less favourable for smaller

companies. This is likely to reduce the typical tax credit

available to the Group by around 50% from 2024 onwards.

-- Whilst around 75% of new customers pay annually in advance

for their subscription, certain new channel partnerships have been

negotiated on the basis of monthly payments, to reflect the

partners' model with end users. This may reduce the cashflow

benefit typically obtained through deferred revenue, although it is

still expected that the Group's direct customers will retain the

favourable cashflow profile.

Related Party Transactions

Incentive Plans

On 28 February 2023 the Company introduced the 2023 GetBusy Cash

Distribution Plan to incentivise and reward significant realised

value creation for shareholders ("CDP"). Daniel Rabie and Paul

Haworth are participants in the CDP.

In designing and implementing the CDP, the Committee took advice

from PwC, a remuneration consultant, as well as consulting with the

majority of the Company's larger institutional shareholders, who

all supported its implementation.

Awards under the CDP vest if the Company makes a gross cash

distribution to shareholders in excess of GBP70 million and up to

GBP150 million within a 7 year period from the implementation date

of the plan. An adjustment is made to the value of any award under

the CDP to take account of any vested share options that have

previously been exercised by the participants, thereby preventing

participants benefiting from both the CDP and a distribution in

respect of any exercised share options.

At a gross cash distribution of GBP70m (the "Entry Point"), the

award paid to Daniel Rabie under the CDP, the VCP and the EMI Chare

Option Plan would be GBP5.0m and the award paid to Paul Haworth

would be GBP1.75m. These amounts are based on the approximate

values that, absent the CDP, would otherwise be paid on the

participants' fully vested and exercised share options.

Above the Entry Point to a gross cash distribution of GBP120m

(the "Target Point"), the participants earn a linearly increasing

share of the incremental distribution above the Entry Point. Daniel

Rabie's share increases from 7.0% at the Entry Point to 15.0% at

the Target Point. Paul Haworth's share increases from 2.5% at the

Entry Point to 10.0% at the Target Point. Above the Target Point,

the share of the incremental gross cash distribution earned remains

at 15.0% for Daniel Rabie and 10.0% for Paul Haworth up to a

maximum award payable at a gross cash distribution of GBP150m (the

"Stretch Point").

Given the potential size of the cash awards, entry into the CDP

constitutes a related party transaction as a result of the

operation of AIM Rule 13 of the AIM Rules.

Daniel Rabie and Paul Haworth, by virtue of being directors of

the Company, are each considered to be a related party of the

Company and given the potential size of the cash awards, entry into

the CDP constitutes a related party transaction for the purposes of

Rule 13 of the AIM Rules for Companies. GetBusy's independent

directors for this purpose (being Miles Jakeman, Nigel Payne and

Paul Huberman) consider, having consulted with the Company's

nominated adviser, finnCap Ltd ("finnCap"), that the terms of the

CDP and the participation in the new CDP are fair and reasonable

insofar as the Company's shareholders are concerned.

Loan facility

Clive Rabie, by virtue of being a director of the Company, is

considered to be a related party of the Company. The Company's

entry into the New Facility with Clive Rabie constitutes a related

party transaction for the purposes of Rule 13 of the AIM Rules for

Companies. GetBusy's independent directors for this purpose (being

Paul Haworth, Miles Jakeman, Nigel Payne and Paul Huberman)

consider, having consulted with the Company's nominated adviser,

finnCap Ltd ("finnCap"), that the terms of the New Facility are

fair and reasonable insofar as the Company's shareholders are

concerned.

CONSOLIDATED INCOME STATEMENT

2022 2021

Note GBP'000 GBP'000

Revenue 3 19,293 15,448

Cost of sales (1,952) (1,295)

Gross profit 17,341 14,153

Operating costs (17,754) (16,355)

Net finance costs (130) (133)

Loss before tax (543) (2,335)

Loss before tax (543) (2,335)

Depreciation and amortisation on owned

assets 563 706

Long-term incentive costs 329 400

Social security costs on long-term incentives (120) 267

Non-underlying costs 389 400

Finance costs not related to leases 74 52

--------- ---------

Adjusted EBITDA 692 (510)

Capitalised development costs (1,438) (712)

--------- ---------

Adjusted loss before tax (746) (1,222)

----------------------------------------------- ----- --------- ---------

Tax 571 771

--------- ---------

Profit / (loss) for the year attributable

to owners of the Company 28 (1,564)

========= =========

Earnings / (loss) per share (pence)

Basic 4 0.06p (3.16)p

Diluted 4 0.05p (3.16)p

========= =========

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2022 2021

GBP'000 GBP'000

Profit/(loss) for the year 28 (1,564)

-------- --------

Other comprehensive income - items

that may be subsequently reclassified

to profit or loss

Exchange differences on translation

of foreign operations (380) (17)

Other comprehensive income net of tax (380) (17)

-------- --------

Total comprehensive income for the

year (352) (1,581)

======== ========

CONSOLIDATED BALANCE SHEET

2022 2021

GBP'000 GBP'000

Non-current assets

Intangible assets 2,486 1,110

Right of use assets - leases 1,184 1,544

Property, plant and equipment 382 426

4,052 3,080

--------- -----------

Current assets

Trade and other receivables 2,104 1,907

Current tax receivable 1,064 1,021

Cash and bank balances 2,972 2,670

--------- -----------

6,140 5,598

--------- -----------

Total assets 10,192 8,678

--------- -----------

Current liabilities

Trade and other payables (4,473) (3,917)

Deferred revenue (6,659) (5,469)

Lease liabilities (371) (333)

Current tax payable (536) (378)

(12,039) (10,097)

--------- -----------

Non-current liabilities

Deferred revenue - (4)

Lease liabilities (1,131) (1,533)

(1,131) (1,537)

--------- -----------

Total liabilities (13,170) (11,634)

--------- -----------

Net assets (2,978) (2,956)

========= ===========

Equity

Share capital 75 74

Share premium account 3,018 3,018

Demerger reserve (3,085) (3,085)

Retained earnings (2,986) (2,963)

--------- -----------

Equity attributable to shareholders

of the parent (2,978) (2,956)

========= ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022

Share

Share premium Demerger Retained

capital account Reserve earnings Total

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 74 3,018 (3,085) (2,963) (2,956)

Profit for the year - - - 28 28

Exchange differences on translation

of foreign operations, net

of tax - - - (380) (380)

Total comprehensive income

for the year - - - (352) (352)

Issue of ordinary shares 1 - - - 1

Long-term incentive costs - - - 329 329

Total transactions with owners

of the Company 1 - - 329 330

At 31 December 2022 75 3,018 (3,085) (2,986) (2,978)

========== ========= =========== =========== ==========

Share

Share premium Demerger Retained

capital account Reserve earnings Total

2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2021 74 3,018 (3,085) (1,782) (1,775)

---------- --------- ----------- ----------- ----------

Loss for the year - - - (1,564) (1,564)

Exchange differences on translation

of foreign operations, net

of tax - - - (17) (17)

---------- --------- ----------- ----------- ----------

Total comprehensive income

for the year - - - (1,581) (1,581)

Long-term incentive costs - - - 400 400

---------- --------- ----------- ----------- ----------

Total transactions with owners

of the Company - - - 400 400

At 31 December 2021 74 3,018 (3,085) (2,963) (2,956)

========== ========= =========== =========== ==========

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2022

2021

2022 (restated)

GBP'000 GBP'000

Profit / (loss) for the year 28 (1,564)

Finance costs 130 133

Income tax credit (571) (771)

Depreciation of right of use asset 277 316

Depreciation of property, plant and

equipment 163 133

Amortisation of intangible assets 400 573

Long-term incentive cost 329 400

Increase in receivables (197) (92)

Increase in payables 428 1,360

Increase in deferred income 1,187 806

Cash generated from operations 2,174 1,294

Interest paid (74) (52)

Income taxes received 675 623

Net cash generated from operating

activities 2,775 1,865

-------- -------------

Purchases of property, plant and equipment (118) (181)

Purchases of intangible assets (339) (163)

Capitalised internal development costs (1,438) (712)

-------- -------------

Net cash used in investing activities (1,895) (1,056)

-------- -------------

Principal portion of lease payments (306) (261)

Interest on lease liabilities (56) (81)

Proceeds on issue of shares 1 -

Net cash used in financing activities (361) (342)

-------- -------------

Net increase in cash 519 467

Cash and bank balances at beginning

of year 2,670 2,283

Effects of foreign exchange rates (217) (80)

-------- -------------

Cash and bank balances at end of year 2,972 2,670

======== =============

The presentation of the reconciliation of profit to cash

generated from operations has been amended in the current year. The

starting point of profit/loss for the year rather than adjusted

loss before tax is considered to be a more appropriate presentation

as profit/(loss) for the year is a statutory IFRS measure. For

comparability purposes, the prior year presentation has been

amended.

Notes to the financial information

1. GENERAL INFORMATION

GetBusy plc is a public limited company ("Company") and is

incorporated in England under the Companies Act 2006. The company's

shares are traded on the Alternative Investment Market ("AIM"). The

Company's registered office is Suite 8, The Works, Unity Campus,

Pampisford, Cambridge, CB22 3FT. The Company is a holding company

for a group of companies ("Group") providing productivity software

for professional and financial services.

These financial statements are presented in pounds sterling

(rounded to the nearest thousand) because that is the currency of

the primary economic environment in which the group operates.

In accordance with Section 435 of the Companies Act 2006, the

Group confirms that the financial information for the years ended

31 December 2022 and 2021 are derived from the Group's audited

financial statements and that these are not statutory accounts and,

as such, do not contain all information required to be disclosed in

the financial statements prepared in accordance with UK-adopted

International Accounting Standards. The statutory accounts for the

year ended 31 December 2021 have been delivered to the Registrar of

Companies. The statutory accounts for the year ended 31 December

2022 have been audited and approved but have not yet been filed.

The Group's audited financial statements for the year ended 31

December 2022 received an unqualified audit opinion and the

auditor's report contained no statement under section 498(2) or

498(3) of the Companies Act 2006. The financial information

contained within this full year results statement was approved and

authorised for issue by the Board on 28 February 2023.

2. ALTERNATIVE PERFORMANCE MEASURES AND GLOSSARY OF TERMS

The Group uses a series of non-IFRS alternative performance

measures ("APMs") in its narrative and financial reporting. These

measures are used because we believe they provide additional

insight into the performance of the Group and are complementary to

our IFRS performance measures. This belief is supported by the

discussions that we have on a regular basis with a wide variety of

stakeholders, including shareholders, staff and advisers.

The APMs used by the Group, their definition and the reasons for

using them, are provided below:

Recurring revenue . This includes revenue from software

subscriptions and support contracts. A key part of our strategy is

to grow our high-quality recurring revenue base. Reporting

recurring revenue allows shareholders to assess our progress in

executing our strategy.

Adjusted Loss before Tax . This is calculated as loss before tax

and before certain items, which are listed below along with an

explanation as to why they are excluded:

Depreciation and amortisation of owned assets. These non-cash

charges to the income statement are subject judgement. Excluding

them from this measure removes the impact of that judgement and

provides a measure of profit or loss that is more closely aligned

with operating cashflow. Only depreciation on owned assets is

excluded; depreciation on leased assets remains a component of

Adjusted Loss because, combined with interest expense on lease

liabilities, it is a proxy for the cash cost of the leases.

Long-term incentive costs . Judgement is applied in calculating

the fair value of long-term incentives, including share options,

and the subsequent charge to the income statement, which may differ

significantly to the cash impact in quantum and timing. The impact

of potentially dilutive share options is also considered in diluted

earnings per share. Therefore, excluding long-term incentive costs

from Adjusted Loss before Tax removes the impact of that judgement

and provides a measure of profit that is more closely aligned with

cashflow.

Capitalised development costs . There is a very broad range of

approaches across companies in applying IAS38 Intangible assets in

their financial statements. For transparency, we exclude the impact

of capitalising development costs from Adjusted Loss before Tax in

order that shareholders can more easily determine the performance

of the business before the application of that significant

judgement. The impact of development cost capitalisation is

recorded within operating costs.

Non -underlying costs. Occasionally, we incur costs that are not

representative of the underlying performance of the business. In

such instances, those costs may be excluded from Adjusted Loss

before Tax and recorded separately. In all cases, a full

description of their nature is provided. .

Finance costs not related to leases . These are finance costs

and income such as interest on bank balances. It excludes the

interest expense on lease liabilities under IFRS16 because,

combined with depreciation on leased assets, it is a proxy for the

cash cost of the leases.

Adjusted EBITDA . This is calculated as Adjusted Loss before Tax

with capitalised development costs added back.

Constant currency measures . As a Group that operates in

different territories, we also measure our revenue performance

before the impact of changes in exchange rates. This is achieved by

re-stating the comparative figure at the exchange rate used in the

current period.

Glossary of terms

The following terms are used within these financial

statements:

MRR. Monthly recurring revenue. That is, the monthly value of

subscription and support revenue, both of which are classified as

recurring revenue.

ARR . Annualised MRR. For a given month, the MRR multiplied by

12.

CAC . Customer acquisition cost. This is the average cost to

acquire a customer account, including the costs of marketing staff,

content, advertising and other campaign costs, sales staff and

commissions.

LTV. Lifetime value, calculated as the average revenue per

account multiplied by the average gross margin and divided by gross

MRR churn.

MRR churn . The average percentage of MRR lost in a month due to

customers leaving our platforms.

Net revenue retention . The average percentage retained after a

month due to the combined impact of customers leaving our

platforms, customers upgrading or downgrading their accounts and

price increases or reductions.

ARPU . Annualised MRR per paid user at a point in time.

3. Revenue and operating segments

The Group's chief operating decision maker is considered to be

the Board of Directors. Performance of the business and the

deployment of capital is monitored on a group basis and so the

Group has a single reportable segment. Additional revenue analysis

is presented by territory.

2022

UK USA Aus/NZ Total

GBP'000 GBP'000 GBP'000 GBP'000

Recurring revenue 6,739 9,498 2,044 18,281

Non-recurring revenue 511 419 82 1,012

------------ ---------- ---------- -------------

Revenue from contracts

with customers 7,250 9,917 2,126 19,293

Cost of sales (1,952)

-------------

Gross profit 17,341

Sales, general and admin

costs (13,526)

Development costs (4,561)

-------------

Adjusted loss before

tax (746)

Capitalisation of development

costs 1,438

-------------

Adjusted EBITDA 692

Depreciation and amortisation

on owned assets (563)

Long-term incentive

costs (329)

Social security on long-term

incentives 120

Non-underlying costs (389)

Other finance costs (74)

-------------

Loss before tax (543)

=============

2021

UK USA Aus/NZ Total

GBP'000 GBP'000 GBP'000 GBP'000

Recurring revenue 6,280 6,119 1,944 14,343

Non-recurring revenue 661 365 79 1,105

------------ ---------- ---------- -------------

Revenue from contracts

with customers 6,941 6,484 2,023 15,448

Cost of sales (1,295)

-------------

Gross profit 14,153

Sales, general and admin

costs (11,588)

Development costs (3,787)

-------------

Adjusted loss before

tax (1,222)

Capitalisation of development

costs 712

-------------

Adjusted EBITDA (510)

Depreciation and amortisation

on owned assets (706)

Long-term incentive

costs (400)

Social security on long-term

incentives (267)

Non-underlying costs (400)

Other finance costs (52)

-------------

Loss before tax (2,335)

=============

Recurring revenue is defined as revenue from subscription and

support contracts. Non-recurring revenue is defined as all other

revenue. No customer represented more than 10% of revenue in either

year.

4. Earnings / (loss) per share

The calculation of earnings per share is based on the profit for

the year of GBP28k (2021: loss of GBP1,564k).

Weighted number of shares calculation 2022 2021

'000 '000

Weighted average number of ordinary

shares 49,621 49,516

Effect of potentially dilutive 7,341 -

share options in issue

------------------ -------

Weighted average number of ordinary

shares (diluted) 56,962 49,516

================== =======

Earnings per share 2022 2021

Pence pence

Basic 0.06 (3.16)

======= =======

Diluted 0.05 (3.16)

======= =======

At 31 December 2022, there were 7,169,236 share options (2021:

7,527,629). As required by IAS33 (Earnings per Share), the impact

of potentially dilutive options was disregarded for the purposes of

calculating diluted loss per share in the prior year as the Group

was loss making.

5. Reconciliation of Alternative Performance Measures - constant currency

A number of our key performance indicators are provided at

"constant currency". The percentage change in a KPI is shown

assuming the current year exchange rate is used to translate both

the current year and prior year figures. The table below reconciles

the constant currency figures to those reported.

Performance 2022 2021 Constant 2021 Change Change

measure as originally currency at constant at reported at constant

reported adjustment exchange exchange exchange

rates rates rates

-------------------- ----------- --------------- ------------ ------------- ------------ ------------

Group recurring

revenue GBP18,281k GBP14,343k GBP746k GBP15,089k 27% 21%

Group total revenue GBP19,293k GBP15,448k GBP787k GBP16,235k 25% 19%

Group Annualised

Recurring Revenue GBP19,240k GBP15,828k GBP788k GBP16,616k 22% 16%

-------------------- ----------- --------------- ------------ ------------- ------------ ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UWRKROOUUUAR

(END) Dow Jones Newswires

March 01, 2023 02:00 ET (07:00 GMT)

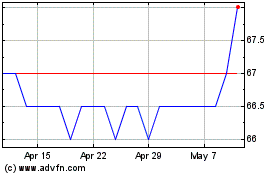

Getbusy (LSE:GETB)

Historical Stock Chart

From Apr 2024 to May 2024

Getbusy (LSE:GETB)

Historical Stock Chart

From May 2023 to May 2024