TIDMJAN

RNS Number : 6034K

Jangada Mines PLC

17 December 2018

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

17 December 2018

Jangada Mines plc ('Jangada' or the 'Company')

Nickel Sulphide Discovery

Maiden Nickel JORC Compliant Resource

Jangada Mines plc, a natural resources company developing the

advanced Pedra Branca project ('the Project') in Brazil, is pleased

to announce a significant increase to its project economics through

the addition of a JORC (2012) compliant nickel and copper sulphide

resource.

To view this announcement with illustrative images, please use

the following link:

http://www.rns-pdf.londonstockexchange.com/rns/6034K_1-2018-12-16.pdf

Highlights

-- Current mine plan provides for an open pit operation

processing PGM+Au and associated by-product metals including

nickel, chrome, copper and cobalt as outlined in the recent

Preliminary Economic Assessment ('PEA')

-- High-grade economic nickel and copper sulphide mineralisation

identified immediately below the existing PGM resource, potentially

extending the scale and life of the open pit operation

-- The new resource adds 8 million tonnes of mineral at 0.22%

nickel; 0.04% copper; 135 g/t cobalt; 0.21 g/t of PGM+Au at a

nickel equivalent grade of 0.39%

-- The new resource could add circa US$110 million, at today's

spot price, to current estimated project revenue - a 10% increase

in revenue

-- Strong potential to increase resource as it remains open at depth and along strike

-- Minimal additional capex expected to facilitate processing of nickel and copper

-- The new nickel and copper resource will be included in the

Bankable Feasibility Study ('BFS'), anticipated to be delivered in

H1 2019, and is expected to substantially improve already

favourable economics

Brian McMaster, Chairman of Jangada, said: "Our ongoing work has

enabled us to further understand the dynamics, scale and potential

of the ore-body; the Project's main economic drivers are palladium,

platinum and nickel and the associated by-products are essentially

cream on the top.

"The planned processing route allows us to process and recover

all metals in one concentrate from the one plant, meaning that the

economics of Pedra Branca have improved substantially. We expect to

demonstrate this in the upcoming BFS. Clearly, the current NPV of

US$192 million against the Company's current circa GBP6 million

market cap demonstrates a disparity between asset and valuation; we

expect this gap to close substantially as we continue to de-risk

the Project."

Background

The Pedra Branca Project is an advanced palladium, platinum and

nickel project in the northeast of Brazil, holding three mining

licenses and 42 exploration licenses over an area of 48,000

hectares. Significant work has been undertaken at the Project,

resulting in the release of a PEA in June 2018, which confirmed its

potential to become a robust, low CAPEX and OPEX, shallow, open pit

operation demonstrating an NPV of US$192 million, an IRR of 67% and

1.6-year payback. Since the release of the PEA, the Company has

announced a significant reduction in CAPEX associated with

development of the Project.

Nickel Sulphide Discovery

The Company recently commissioned a JORC (2012) compliant

resource estimate resulting in additional Inferred resources of 8.3

million tonnes of ore at 0.22% nickel, 0.04% copper, 135 g/t cobalt

and 0.21 g/t PGM+Au. Co-products contribute to a nickel equivalent

grade of 0.39%.

Pedra Branca Deposit - Mineral Resource Update - Nickel intersections

Effective Date: 21st November 2018. Block Model: 20m 10m X 2m

(5m X 2.5m X 0.5m)

Inferred Resource

----------------------------------------------------------------------------------------------------------

Target Classification Tones Ni (%) PGM Pd Pt Au Cu Cr2O3 Co (ppm)

(kt) (g/t) (g/t) (g/t) (g/t) (%) (%)

---------------- ------ ------- ------- ------- ------- ------- ----- ------ ---------

Cedro Inferred 1,886 0.260 0.18 0.10 0.07 0.005 0.04 0.28 150

---------------- ------ ------- ------- ------- ------- ------- ----- ------ ---------

Curiu Inferred 191 0.240 1.00 0.63 0.32 0.057 0.05 0.51 134

---------------- ------ ------- ------- ------- ------- ------- ----- ------ ---------

Esbarro Inferred 5,770 0.200 0.18 0.10 0.08 0.003 0.03 0.13 130

---------------- ------ ------- ------- ------- ------- ------- ----- ------ ---------

Trapia Inferred 421 0.220 0.40 0.26 0.11 0.036 0.08 0.20 135

---------------- ------ ------- ------- ------- ------- ------- ----- ------ ---------

Grand Total 8,268 0.216 0.21 0.12 0.08 0.007 0.04 0.18 135

------ ------- ------- ------- ------- ------- ----- ------ ---------

Geological Setting

The nickel and copper anomalies identified at the Project to

date, are located in the region of the Cedro, Esbarro and Curiu

deposits. The resource is hosted by a tabular-shaped ultramafic

body known as the Troia Unit. The nickel is hosted by the same

geological unit as the PGM resource. Most of the world's high-grade

nickel deposits occur in this geological context. Our exploration

work demonstrates that the high-grade nickel intersections indicate

sulphide ore targets, all of which are associated with geophysical

magnetic anomalies.

Figure 2: This cross-section through the Esbarro target shows

the nickel grades in boreholes and the location of the new nickel

sulphide ore (green) immediately beneath the PGM resource

(black).

Economic Impact

As illustrated in figure 2 above, the nickel resource sits

immediately below the current planned open pit PGM mine. Occurring

in the same geological unit, with similar mineralogical and

chemical compositon as the PGM-Ni-Cu resource, the processing

routes outlined in the PEA released in June 2018, indicate that the

new nickel resource can be processed and recovered using the same

plant as the PGMs. This means that there will be minimal additional

CAPEX required and, as such, the addition of the new nickel

resource is expected to substantially improve the already robust

economics.

The Company has modelled the potential economic impact of

including the nickel resource assuming metallurgical recovery rates

as outlined in the PEA, it is expected the addition of the new

nickel resource will enhance the Project's revenue by circa US$110

million at today's spot price. This represents an increase of

overall expected revenue from the Project of 10%.

The geological modelling and resource estimate relies on data

collected from the 30,000m of diamond core drilling completed at

Pedra Branca.

Competent Person Statement

The technical information in this statement is based on

information compiled by Mr. Bernardo Horta Cerqueira Viana who is a

geologist and full-time director and owner of GE21 and is

registered as a Competent Person with the MAIG. Mr Viana has

sufficient relevant experience to the style of mineralisation to

qualify as a Competent Person as defined in the JORC Code (2012).

Mr Viana also meets the requirements of a qualified person under

the AIM Note for Mining, Oil and Gas Companies.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

ENDS

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20 7317

6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser) Jack Botros

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis Tel: +44 (0)20 7236

Ltd Gaby Jenner 1177

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDLLFETFTLRLIT

(END) Dow Jones Newswires

December 17, 2018 02:00 ET (07:00 GMT)

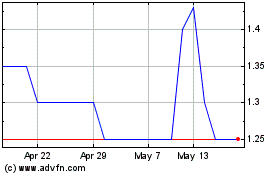

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jul 2023 to Jul 2024