TIDMJAN

RNS Number : 7578F

Jangada Mines PLC

17 July 2019

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

17 July 2019

Jangada Mines plc ("Jangada" or the "Company")

Proposed Disposal of the Pedra Branca Project and Notice of

General Meeting

Jangada Mines plc, a natural resources company, is pleased to

announce that, further to its announcement of 28 May 2019, it has

now entered into a binding Share Purchase Agreement with ValOre

Metals Corp. ("ValOre") and PBBM Holdings Ltd., a wholly-owned

subsidiary of ValOre, for the sale, subject to satisfaction of a

number of conditions, of 100% of its interest in Pedra Branca do

Brasil Mineração Ltda., the entity that holds the Pedra Branca

Project, to ValOre ('the Disposal'). The maximum consideration

payable for the Disposal is an aggregate of approximately GBP5.64

million based on ValOre's financing price of C$0.25 per common

share pursuant to the VO Equity Raise.

The Disposal is of sufficient size relative to that of the Group

to constitute a disposal resulting in a fundamental change of

business pursuant to Rule 15 of the AIM Rules and Completion is,

therefore, conditional upon the approval of Shareholders.

Accordingly, on 17 July 2019, the Company will be posting a

circular (the "Circular"), along with a Form of Proxy, to

shareholders convening a General Meeting to be held at the offices

of Bird & Bird LLP, 12 New Fetter Lane, London EC4A 1JP at

10.00 a.m. on Friday, 2 August 2019. The Notice convening the

General Meeting and setting out the Resolution to be considered at

it, is set out at the end of the Circular.

The key sections of the Circular have been included in the

announcement below.

Unless the context requires otherwise, definitions used in this

announcement and the Circular are set out at the end of this

announcement.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

For further information, please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20 7317

6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser) Jack Botros

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis Tel: +44 (0)20 7236

Ltd Gaby Jenner 1177

(Financial PR)

LETTER FROM THE CHAIRMAN OF JANGADA MINES PLC

Introduction

Your Board announced on 28 May 2019 that the Company entered

into a binding letter agreement (the "Agreement") with ValOre, for

the sale, subject to satisfaction of a number of conditions (set

out further below), of 100% of Pedra Branca do Brasil Mineração

Ltda. ("Pedra Branca"), the entity that holds the Pedra Branca

Project, to ValOre.

The Company has now entered into a binding Share Purchase

Agreement with ValOre and the Purchaser. The Company is the

registered and beneficial owner of 23,862,321 quotas of Pedra

Branca, which represents 99.99% of all outstanding quotas of Pedra

Branca (the "Purchased Shares"), while FFA Holding & Mineração

Ltda. ("FFA") is the registered and beneficial owner of 1 quota of

Pedra Branca, which represents 0.01% of all outstanding quotas of

Pedra Branca (the "FFA Share"). Under the terms of the Share

Purchase Agreement, Jangada has agreed to sell the Purchased Shares

to the Purchaser and FFA has agreed to transfer the FFA Share to

ValOre.

The Share Purchase Agreement sets out that the following

consideration is payable to Jangada pursuant to the Disposal:

1. the issuance and allotment to Jangada of the:

a. Initial Consideration Shares on the date of closing of the Disposal ("Completion");

b. Post-Closing Consideration Shares in six equal tranches

commencing on the date falling six months after Completion and

ending on the date falling thirty-six months after Completion,

subject to any adjustment as further described in Part 2 of the

Circular; and

2. cash payments to Jangada in the aggregate of C$3,000,000, as follows:

a. C$250,000, which has been received by Jangada;

b. C$750,000 payable on Completion;

c. C$1,000,000 on, or before, 3 months after Completion; and

d. C$1,000,000 on, or before, 6 months after Completion.

The issue of the Consideration Shares would give Jangada an

interest of approximately 33 per cent. in the current share capital

of ValOre as enlarged by the issue of the Consideration Shares, but

prior to the issue of the new common shares in ValOre pursuant to

the ValOre Equity Raise. On Completion, Jangada will have the right

to nominate two individuals to the ValOre Board with one nominee to

be appointed immediately and one nominee to be appointed as an

observer to the ValOre Board, with the intention that such observer

shall be appointed to the ValOre Board at the next annual general

meeting of ValOre following Completion. The two nominees will also

be nominated for re-election at the annual general meeting of

ValOre in 2020. Subsequently, Jangada's right to nominate up to two

directors may be extended if mutually agreed in writing by ValOre,

Jangada and each of the nominee board members.

Pursuant to the Share Purchase Agreement, Jangada has agreed

that, for so long as it holds 10% or more of the issued and

outstanding common shares of ValOre, in the event Jangada wishes to

sell any of its holding of ValOre shares it will give ValOre the

opportunity to find buyers for such shares on a best price and best

execution basis, with a view to maintaining an orderly market for

the issued and outstanding common shares in ValOre.

The Disposal is of sufficient size relative to that of the Group

to constitute a disposal resulting in a fundamental change of

business pursuant to Rule 15 of the AIM Rules and Completion is,

therefore, conditional upon the approval of Shareholders.

Accordingly, your approval of the Disposal is being sought at a

General Meeting of the Company to be held at the offices of Bird

& Bird LLP, 12 New Fetter Lane, London EC4A 1JP at 10.00 a.m.

on Friday, 2 August 2019. The Notice convening the General Meeting

and setting out the Resolution to be considered at it is set out at

the end of the Circular. A summary of the action you should take is

set out in paragraph 9 of Part 1 of the Circular and on the Form of

Proxy which accompanies the Circular.

Further details of the Disposal and the Share Purchase Agreement

are set out below and in Part 2 of the Circular.

The purpose of the Circular is to give you further details of

the Disposal, including the background to and reasons for it, to

explain why the Directors consider it to be in the best interests

of the Company and its Shareholders as a whole.

Shareholders should be aware that if the Resolution is not

approved at the General Meeting the Disposal will not proceed.

Accordingly, the Board would need to consider alternative

strategies for the Group, including any associated financing for

further development of the Company's projects, of which there is no

guarantee it would be forthcoming on acceptable terms or at

all.

Background to and reasons for the Disposal

As announced on 28 May 2019, whilst the Board continues to

believe very strongly in the Pedra Branca Project and its

prospects, since the Company's IPO in June 2017, the Board has

found there to be limited support in the UK financial markets for

financing a PGM project. In the Board's view, the support that

Jangada has experienced is at odds with both the independent

experts' value of the underlying assets and the level of support

given to projects with similar asset suites on other bourses. The

Board is disappointed that, notwithstanding Jangada's success at

developing its two projects, the UK financial markets have not

responded as expected.

The Board believes that the Pedra Branca Project will continue

to develop strongly as a project, but, in order to continue that

development, the project requires stronger financial market

support, which the Board believes ValOre will experience in Canada.

It is for this reason that Jangada has made the decision to proceed

with the Disposal which will see ValOre raising finance to continue

the development of the Pedra Branca Project and allow the Company

to maintain an interest in a project that will be funded through to

its next stage of development. In addition, Jangada has the right

to appoint two nominees to the ValOre Board. Additionally, the

Disposal provides for the payment of cash consideration at

Completion and in two tranches in the six-months following

Completion. This cash consideration allows Jangada to continue to

progress its remaining assets without the need to seek further

equity financing, thereby alleviating the need for the issuance of

further shares at this time.

Recognising the difficulties of financing PGM projects in the UK

markets, since October 2017, the Board has increasingly focused its

efforts on proving up the vanadium potential of Pitombeiras. To

this end, on 5 February 2019, the Company reported the results of

its vanadium drilling campaign, which confirmed the presence of a

high-grade deposit with the potential for significant resource

delineation.

The Board believes there is strong support for vanadium as an

asset class, primarily driven by its importance as an input to

battery metals, and assuming completion of the Disposal, the Board

considers that it's in the best interests of shareholders to focus

the Company's resources on pursuing the development of Pitombeiras.

In the near term, this would involve further drilling and

metallurgical work, the results of which would then dictate the

path forward for development. A NI 43-101 compliant CPR is already

underway, which is expected to be completed by the Company during

Q3 2019. The Disposal includes a cash consideration component

allowing Jangada to substantially progress the development of

Pitombeiras.

Further details of the Disposal and the Share Purchase Agreement

are set out below and in Part 2 of the Circular.

Reorganisation

As announced on 17 June 2019, in anticipation of undertaking the

Disposal, the Company has transferred its vanadium, titanium and

iron rights, including the Pitombeiras Project, to a separate 99%

owned subsidiary, VTF Mineração Ltda. ("VTF"). FFA, which holds 1%

of the issued quotas in VTF, is in agreement with the Company's

development plan for Pitombeiras. FFA is owned and controlled by

Luis Azevedo, a Non-Executive Director the Company, and holds the

shares in VTF for the benefit of the Company and in compliance with

Brazilian laws which require two quota holders for limited

liability companies.

Information on ValOre

ValOre Metals Corp. (TSX-V: VO) is a Vancouver based company

with a portfolio of high-quality uranium and precious metal

exploration projects in Canada. In addition to the Baffin Gold

Property, ValOre holds Canada's highest-grade uranium resource

outside of Saskatchewan. ValOre's 89,852-hectare Angilak Property

in Nunavut Territory hosts the Lac 50 Trend with a NI 43-101

Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totalling

43.3 million pounds U3O8. ValOre's comprehensive exploration

programs have demonstrated the "District Scale" potential of the

Angilak Property.

In Saskatchewan, ValOre holds a 100% interest in the

13,711-hectare Hatchet Lake Property and a 50% interest in the

131,412-hectare Genesis Property, both located northeast of the

north-eastern margin of the uranium-producing Athabasca Basin.

ValOre's team has forged strong relationships with sophisticated

resource sector investors and partner Nunavut Tunngavik Inc. (NTI)

on both the Angilak and Baffin Gold Properties. ValOre was the

first company to sign a comprehensive agreement to explore for

uranium on Inuit Owned Lands in Nunavut Territory, Canada and is

committed to building shareholder value while adhering to high

levels of environmental and safety standards and proactive local

community engagement.

Principal terms of the Disposal

Pursuant to the terms of the Share Purchase Agreement, the

Company has conditionally agreed to sell 99.9% of Pedra Branca, the

entity that holds the Pedra Branca Project, to PBBM Holdings Ltd.,

a wholly-owned subsidiary of ValOre, and to procure the transfer of

0.01% of Pedra Branca which is held by FFA to ValOre, further

details of which are described in Part 2 of the Circular. The

Pitombeiras Project remains 100% owned by Jangada and its

representatives.

The maximum consideration payable for the Disposal is an

aggregate of approximately GBP5.64 million based on ValOre's

financing price of C$0.25 per common share pursuant to the VO

Equity Raise. Completion is conditional, inter alia, upon the

approval of the Disposal by Shareholders.

Further details of the Share Purchase Agreement are set out in

Part 2 of the Circular.

Financial effects of the Disposal, use of the proceeds and

future strategy of the Group

Assuming the Resolution is passed, on completion of the

Disposal, Jangada will have cash resources of approximately

GBP350,000, with a further GBP1.2 million to be received from

ValOre, in tranches, in the six-month period following Completion.

Jangada will also have an interest in 25 million ValOre common

shares (subject to any adjustment as described in Part 2 of the

Circular), which whilst it has no intention to dispose of in the

short term, may choose to dispose of in the medium to long term in

order to generate further cash liquidity for the Company.

Jangada intends to use the majority of the net proceeds of the

Disposal for the further development of the Pitombeiras Project,

which in the near term, would involve further drilling and

metallurgical work. A NI 43-101 compliant CPR is already underway,

which is expected to be completed by the Company during Q3

2019.

Jangada estimates that the time required to complete the next

stage of development of the Pitombeiras Project will be six-months

from Completion, at which time, further, informed decisions can be

made as to the correct way forward.

Irrevocable undertakings

Mr Brian McMaster and Mr Luis Azevedo as directors of the

Company have entered into irrevocable undertakings to vote their

aggregate beneficial holdings of 94,511,134 Ordinary Shares in

favour of the Resolution. The Company has also received an

irrevocable undertaking from Mr Matthew Wood, who beneficially

holds 47,844,467 Ordinary Shares, to vote in favour of the

Resolution. Therefore, the Company has received irrevocable

undertakings to vote in favour of the Resolution from Shareholders

holding, in aggregate, 142,355,601 Ordinary Shares, representing

59.99 per cent. of the Company's existing issued share capital. The

necessary threshold to approve the Resolution (which is being

proposed as an ordinary resolution) is more than 50 per cent. of

the votes validly cast being in favour of the Resolution;

accordingly, it is expected that the Resolution will be approved at

the General Meeting.

The General Meeting

Set out at the end of the Circular is a notice convening the

General Meeting to be held on Friday, 2 August 2019 at the offices

of Bird & Bird LLP, 12 New Fetter Lane, London EC4A 1JP at

10.00 a.m.

The Resolution, which will be proposed as an ordinary

resolution, is to approve the Disposal and to authorise the

Directors to take all steps necessary or desirable to complete the

Disposal.

The implementation of the Disposal is conditional, inter alia,

upon the passing of the Resolution set out in the Notice.

The full text of the Resolution is set out in the Notice at the

end of the Circular.

Action to be taken

A Form of Proxy for use at the General Meeting accompanies the

Circular. The Form of Proxy should be completed and signed in

accordance with the instructions thereon and returned to the

Company's registrars, Computershare Investor Services plc, The

Pavilions, Bridgwater Road, Bristol BS13 8AE, as soon as possible,

but in any event so as to be received by no later than 10.00 a.m.

on 31 July 2019 (or, if the General Meeting is adjourned, 48 hours

(excluding any part of a day that is not a working day) before the

time fixed for the adjourned meeting).

If you hold your Ordinary Shares in uncertificated form in

CREST, you may vote using the CREST Proxy Voting Service in

accordance with the procedures set out in the CREST Manual. Further

details are also set out in the notes accompanying the Notice of

General Meeting at the end of the Circular. Proxies submitted via

CREST must be received by Computershare Investor Services plc (ID

3RA50) by no later than 10.00 a.m. on 31 July 2019 (or, if the

General Meeting is adjourned, 48 hours (excluding any part of a day

that is not a working day) before the time fixed for the adjourned

meeting).

The Completion and return of a Form of Proxy or the use of the

CREST Proxy Voting Service will not preclude Shareholders from

attending the General Meeting and voting in person should they so

wish.

Working capital and importance of the vote

The Board is of the opinion that, taking into account the net

cash proceeds of the Disposal received to date and expected to be

received on Completion and in the six months following Completion,

the Group has sufficient working capital for its present

requirements, that is for at least 12 months from the date of the

Circular.

As set out below, the Directors unanimously recommend that

Shareholders vote in favour of the Resolution to be proposed at the

General Meeting. In deciding how to vote, Shareholders should be

aware that if the Resolution is not approved at the General Meeting

the Disposal will not proceed. Accordingly, the Board would need to

consider alternative strategies for the Group, including any

associated financing for further development of the Company's

projects, of which there is no guarantee it would be forthcoming on

acceptable terms or at all.

Accordingly, it is important that Shareholders vote in favour of

the Resolution in order that the Disposal can proceed.

Recommendation

The Directors consider the Disposal to be in the best interests

of the Company and its Shareholders as a whole and accordingly

unanimously recommend Shareholders to vote in favour of the

Resolution to be proposed at the General Meeting.

Mr Brian McMaster and Mr Luis Azevedo as directors of the

Company have entered into irrevocable undertakings to vote their

aggregate beneficial holdings of 94,511,134 Ordinary Shares in

favour of the Resolution. The Company has also received an

irrevocable undertaking from Mr Matthew Wood who beneficially holds

47,844,467 Ordinary Shares, to vote in favour of the Resolution.

Therefore, the Company has received irrevocable undertakings to

vote in favour of the Resolution from Shareholders holding, in

aggregate, 142,355,601 Ordinary Shares, representing 59.99 per

cent. of the Company's existing issued share capital.

The necessary threshold to approve the Resolution (which is

being proposed as an ordinary resolution) is more than 50 per cent.

of the votes validly cast being in favour of the Resolution;

accordingly, it is expected that the Resolution will be approved at

the General Meeting.

Yours faithfully

Brian McMaster

Executive Chairman

SUMMARY OF THE PRINCIPAL TERMS OF THE SHARE PURCHASE

AGREEMENT

THE SHARE PURCHASE AGREEMENT

General

The Share Purchase Agreement was entered into on 16 July 2019

between the Company, the Purchaser and ValOre.

Pursuant to the terms of the Share Purchase Agreement, the

Company has agreed to sell, and the Purchaser has agreed to

purchase, 99.99% of Pedra Branca, the entity that holds the Pedra

Branca Project, to the Purchaser, and the Company has agreed to

procure the transfer of 0.01% of Pedra Branca held by FFA to

ValOre.

ValOre has agreed to guarantee the obligations of the Purchaser

to the Company under the terms of the Share Purchase Agreement.

Conditions

Completion of the Share Purchase Agreement is conditional upon,

inter alia:

1. the passing of Resolution 1 at the General Meeting;

2. ValOre having received shareholder approval in relation to

the creation of a new control person;

3. the TSX Venture Exchange having accepted notice of the Share

Purchase Agreement and issued, listed and posted the Consideration

Shares for trading,

(the "Conditions").

If the Conditions are not satisfied on or before 1 September

2019, Jangada, the Purchaser and ValOre may terminate the Share

Purchase Agreement.

Pre-Completion obligations

The Company has given certain customary covenants to the

Purchaser in relation to the operation of the business in the

period between the signing of the Share Purchase Agreement and

Completion and will not take certain specified actions during such

period without the prior written consent of the Purchaser.

Consideration

The consideration payable by the Purchaser under the terms of

the Share Purchase Agreement is as follows:

1. the issuance and allotment to Jangada of the:

a. Initial Consideration Shares on the date of closing of the Disposal;

b. Post-Closing Consideration Shares in six equal tranches

commencing on the date falling six months after the date of closing

of the Disposal and ending on the date falling thirty-six months

after the date of closing of the Disposal, subject to any

adjustment as further described below; and

2. cash payments to the Company in the aggregate of C$3,000,000, as follows:

a. C$250,000, which has been received by the Company;

b. C$750,000 payable on Completion;

c. C$1,000,000 on, or before, 3 months after Completion; and

d. C$1,000,000 on, or before, 6 months after Completion.

In the event that between Completion and the date on which all

Post-Closing Consideration Shares have been issued to Jangada, a

Governmental Authority determines that there are outstanding taxes

or any associated penalties payable as a result of the Company

entering into advance for a future capital increase ("AFAC")

agreements prior to Completion, the Purchaser/ValOre may reduce the

number of Post-Closing Consideration Shares to be issued to settle

such liability.

Termination

The Share Purchase Agreement and the obligations of the Company,

the Purchaser and ValOre to complete the Disposal may be terminated

on or prior to Completion:

(a) by the mutual written consent of the Company and the Purchaser;

(b) by ValOre or the Purchaser if:

(i) there has been a material breach of any representation,

warranty, covenant or agreement made by the Company and such breach

has not been waived by the Purchaser or cured by the Company

within: (i) 30 days of the Company's receipt of written notice of

such breach from the Purchaser; or (ii) 72 hours of the Company's

receipt of written notice of such breach from the Purchaser where

the Purchaser acquires actual knowledge of the breach within 15

days of Completion; or

(ii) any of the Conditions have not been fulfilled by 1

September 2019 unless such failure is due to the Purchaser's

failure to perform or comply with any of the covenants, agreements

or conditions to be performed or complied with by the Purchaser

before Completion;

(c) by the Company if:

(i) there has been a material breach of any representation,

warranty, covenant or agreement made by the Purchaser under this

Agreement and such breach has not been waived by the Company or

cured by the Purchaser within 15 days of the Purchaser's receipt of

written notice of such breach from the Company; or

(ii) any of the Conditions have not been fulfilled by 1

September 2019 unless such failure is due to the Company's failure

to perform or comply with any of the covenants, agreements or

conditions to be performed or complied with by it before

Completion;

(d) by the Company, ValOre or the Purchaser if:

(i) if any governmental authority of competent jurisdiction has

threatened to issue or issued any law, permanent injunction, order,

decree, ruling or other action that prohibits or restrains the

consummation of the transactions contemplated by the Share Purchase

Agreement; or

(ii) Completion has not occurred by 1 September 2019, except

however, the right to terminate the Share Purchase Agreement under

this section will not be available to any party if such party's

failure to fulfil any obligation under the Share Purchase Agreement

causes Completion to not occur prior to 1 September 2019.

Representations, warranties, indemnities and limitations

The Company has agreed to give the Purchaser certain

representations, warranties and indemnities of a nature customarily

given in a sale and purchase agreement in relation to, amongst

other things, financial statements, share capital, compliance with

laws, mineral rights and title to assets, employees and tax. The

representations, warranties and indemnities are given by the

Company on the date of the Share Purchase Agreement and again at

Completion. The representations and warranties are, other than

those warranties relating to 'fundamental' matters, such as

corporate status, company authorization and approval, no

undisclosed indebtedness, title to assets, qualified by certain

general and specific disclosures made in a disclosure letter

delivered to the Purchaser on the date of the Share Purchase

Agreement.

The Company's liability in respect of a breach of the

representations and warranties contained in the Share Purchase

Agreement is subject to certain limitations, including a time limit

of 24 months for all representations and warranties excluding tax

warranties, and the 'fundamental representations and warranties'

which will survive for the maximum period permitted by law.

In addition to customary limitations on liability, the aggregate

liability of the Company for all claims under the Share Purchase

Agreement shall not exceed $3,000,000.

As the Pitombreiras Project has been carved out of the Pedra

Branca Project, the Company has agreed with ValOre that it will

indemnify ValOre in relation to any third party claims arising

which relate to the Pitombreiras Project for a period of five years

from Closing or, if earlier, the date on which ValOre disposes of

Pedra Branca or the Pedra Branca Project.

Governing law

The Share Purchase Agreement is governed by the laws of British

Columbia, Canada.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Publication of the Circular: 17 July 20191

Latest time and date for receipt of 10.00 a.m. on 31 July

Forms of Proxy and CREST voting instructions: 2019

General Meeting: 10.00 a.m. on 2 August

2019

Expected completion of the Disposal Third calendar quarter

by: of 2019

Notes:

1. Each of the above times and/or dates is subject to change at

the absolute discretion of the Company and Strand Hanson. If any of

the above times and/or dates should change, the revised times

and/or dates will be announced through a Regulatory Information

Service.

DEFINITIONS

The following definitions apply throughout this announcement and

the Circular unless the context otherwise requires:

"Act" the Companies Act 2006 (as amended)

"Agreement" the binding letter agreement entered

into between the Company and ValOre,

for the sale, subject to satisfaction

of a number of conditions, of 100%

of Pedra Branca do Brasil Mineração

Ltda., the entity that holds the Pedra

Branca Project, to ValOre

"AIM Rules" the AIM Rules for Companies published

by the London Stock Exchange from

time to time

"AIM" the AIM market operated by the London

Stock Exchange

"certificated form" or an Ordinary Share recorded on a company's

as "in certificated form" share register being held in certificated

form (namely, not in CREST)

"Company" or "Jangada" Jangada Mines plc, a company incorporated

and registered in England and Wales

under the Act with registered number

09663756

"Completion" completion of the Disposal under the

terms of the Share Purchase Agreement

"Consideration Shares" the Initial Consideration Shares and

the Post-Closing Consideration Shares

"CPR" Competent Person's Report

"CREST Regulations" the Uncertificated Securities Regulations

2001 (S.I. 2001 No. 3755)

"CREST" the relevant system (as defined in

the CREST Regulations) in respect

of which Euroclear is the operator

(as defined in those regulations)

"Directors" or "Board" the directors of the Company whose

names are set out on page 7 of the

Circular, or any duly authorised committee

thereof

"Disposal" the proposed disposal by the Company

of its interest in Pedra Branca pursuant

to the Share Purchase Agreement

"Euroclear" Euroclear UK & Ireland Limited, the

operator of CREST

"FCA" the UK Financial Conduct Authority

"Form of Proxy" the form of proxy for use in connection

with the General Meeting which accompanies

the Circular

"FSMA" the Financial Services and Markets

Act 2000 (as amended)

"General Meeting" the General Meeting of the Company

to be held at 10.00 a.m. on Friday,

2 August 2019, notice of which is

set out at the end of the Circular

"Group" the Company and its subsidiary undertakings

"Initial Consideration 22,000,000 common shares in the authorised

Shares" share capital of ValOre

"London Stock Exchange" London Stock Exchange plc

"Notice of General Meeting" the notice convening the General Meeting

or "Notice" which is set out at the end of the

Circular

"Ordinary Shares" ordinary shares of GBP0.0004 each

in the capital of the Company

"Pedra Branca" Pedra Branca do Brasil Mineração

Ltda., the entity that holds the Pedra

Branca Project

"Pedra Branca Project" the Company's palladium, platinum

and nickel project located in north-eastern

Brazil, with a JORC (2012) Compliant

Resource of 1.52 million oz of PGM+Au,

180 Mlb of nickel, 34 Mlb of copper

and 9.2 Mlb of cobalt

"PGM" platinum group metals, being platinum,

osmium, iridium, ruthenium, rhodium

and palladium

"Pitombreiras" the Company's Pitombreiras West Vanadium

Project which is being retained by

the Company following the Disposal

"Post-Closing Consideration 3,000,000 common shares in the authorised

Shares" share capital of ValOre

"Prospectus Rules" the prospectus rules made by the FCA

pursuant to section 73A of the FSMA

"Purchaser" PBBM Holdings Ltd., a wholly-owned

subsidiary of ValOre

"Registrar" Computershare Investor Services plc,

the Company's registrar

"Regulatory Information a service approved by the FCA for

Service" the distribution to the public of

regulatory announcements and included

within the list maintained on the

FCA's website

"Resolution" the resolution set out in the Notice

of General Meeting

"Share Purchase Agreement" the conditional share purchase agreement

dated 16 July 2019 and made between

the Company, the Purchaser and ValOre

"Shareholders" and each holders of Ordinary Shares

a "Shareholder"

"Strand Hanson" Strand Hanson, the Company's nominated

& financial adviser

"TSX-V" the TSX Venture Exchange

"UK" the United Kingdom of Great Britain

and Northern Ireland

"uncertificated" or "in an Ordinary Share recorded on a company's

uncertificated form" share register as being held in uncertificated

form in CREST and title to which,

by virtue of the CREST Regulations,

may be transferred by means of CREST

"US" or "United States" the United States of America, each

State thereof, its territories and

possessions (including the District

of Columbia) and all other areas subject

to its jurisdiction

"ValOre" ValOre Metals Corp. (TSX-V: VO), a

TSX-V listed entity with a portfolio

of uranium and precious metal exploration

projects in Canada

"ValOre Board" the board of directors of ValOre

"VO Equity Raise" the equity fundraising of at least

C$3 million by ValOre as announced

by ValOre on 6 June 2019

"VTF" VTF Mineracao Ltda.

*ENDS*

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLFFSVDRIRLIA

(END) Dow Jones Newswires

July 17, 2019 02:00 ET (06:00 GMT)

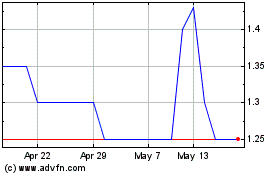

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jul 2023 to Jul 2024