RNS Number:0484C

John David Sports PLC

7 December 1999

INTERIM RESULTS FOR THE SIX MONTHS TO 30 SEPTEMBER 1999

John David Sports Plc, a leading specialist retailer of fashionable branded

sports and leisure wear, today announces its 1999 Interim Results.

Highlights:-

* Turnover increased by 20.8% to #83.27 million (1998: #68.94 million)

* Like for like sales growth of 5.2% since 30 September 1999

* 3 stores opened during the period with one closure

* Continued focus on store format and product differentiation

* Gross profit margin improved from 45.5% to 46.0%

* Operating profit increased by 18.8% to #7.26 million (1998: #6.11

million)

* Profit before tax up by 13.2% to #6.66 million (1998: #5.88 million)

* Earnings per ordinary share up 13.5% to 9.76p (1998: 8.60p)

* Dividend maintained at 2p

John Wardle, Chairman, said: "Against a difficult retail trading background

I am pleased with the positive progress which the company has made. The

financial results to date fully support the merchandising and retail

strategies which have been successfully implemented and which we are

continuing to develop."

Enquiries: John Wardle (Chairman)/ Peter Cowgill (Finance Director)

John David Sports Plc

Telephone: 0171 796 4133 (Hudson Sandler) on 7 December 1999

Andrew Hayes/James Cracknell

Hudson Sandler Limited

01706 628000 (thereafter)

CHAIRMAN'S STATEMENT

Introduction

In light of the well reported difficult market conditions in clothing

retailing, I am pleased to report that the company has continued its sales

and profit growth. For the six month period ended 30 September 1999 the

company has increased its sales by 20.8% from #68.94m to #83.27m and its pre

tax profit by 13.2% from #5.88m to #6.66m.

The results support my comments in recent announcements that the company has

successfully refined its merchandising and retail strategy and developed its

market position as a brand leader in sports and leisurewear retailing.

Results

Operating profit for the six month period ended 30 September 1999 increased by

18.8% from #6.11m to #7.26m and profit before taxation increased by 13.2% from

#5.88m to #6.66m. Earnings per ordinary share have increased by 13.5% from

8.60p to 9.76p.

The improved net profit has been generated by an increase in turnover of 20.8%

from #68.94m to #83.27m, combined with improved gross profit margin from 45.5%

to 46.0%.

Dividend

The Board proposes to pay an interim dividend of 2p per ordinary share (1998:

2p) which will be paid on 3 March 2000 to shareholders on the register at the

close of business on 14 January 2000.

Trading Review

The six month period under review was one of continued consolidation in the

sportswear retail market. Certain weaker competitors have either been

absorbed or diminished their representation on the high street but market

conditions have remained competitive. In comparative terms the timing of

Easter and the absence of the World Cup or a similar major sporting event

created demanding comparatives and, therefore, the improvement in like for

like sales during the period of 3.4% was encouraging.

The ongoing emphasis upon differentiation in product offerings has benefited

the sales performance of the company. This, together with improved

merchandising controls, has increased the gross profit margin.

As previously announced, the store opening programme has been highly selective

during the current financial year. Three stores were opened during the period

and, following the closure of one clearance outlet, the total number of stores

in operation at the period end was 128 occupying a total of 393,000 retail sq

ft. This total includes 17 out of town/edge of town stores which occupy

113,000 retail sq ft.

Since 30 September 1999 four additional stores have been opened and one

closed, increasing the retail square footage to 404,000 sq ft.

Balance sheet and financial resources

As previously referred, capital expenditure was curtailed during the period to

#2.54m.

Stock levels at 30 September 1999 increased by 1% from #27.44m to #27.73m.

Whilst comparatives have been favoured by the timing of certain deliveries,

the modest uplift in stock compared to the increased levels of turnover is a

consequence of the improved stock and merchandising controls which have been

implemented. The result has been to benefit cash resources and consequently

the period end gearing position.

Net borrowings at the period end amounted to #6.13m (1998: #8.04m) giving

gearing of 18% (1998: 27%). Shareholders' funds as at 30 September 1999

increased to #34.46m.

Year 2000

The majority of systems currently operated by the company have been developed

and reviewed by an external software house who have confirmed that they are

millennium compliant. A steering committee has reviewed all other systems and

hardware operated by the company to ensure millennium compliance will be fully

met. Any costs associated with the exercise are charged to the profit and

loss account as incurred, and are not significant.

Current trading and outlook

Recent announcements by retail clothing companies and continued evidence of

high street discounting confirm that difficult market conditions prevail. We

are therefore encouraged by the continued achievement of positive like for

like sales growth. The cumulative increase in like for like sales for the

financial year to date is 3.8%.

Since 30 September 1999 the growth in like for like sales is 5.2%. We have,

however, achieved this growth partially through higher levels of promotional

expenditure which will continue throughout the second half of the year. The

results for the financial year will also, as ever, be heavily influenced by

sales performance during the Christmas period and in the early months of the

New Year. Sales comparatives are stronger from mid December onwards.

Against a difficult retail trading background I am pleased with the positive

progress which the company has made. The financial results to date fully

support the merchandising and retail strategies which have been successfully

implemented and which we are continuing to develop.

John Wardle

Chairman

7 December 1999

PROFIT AND LOSS ACCOUNT

for the half year ended 30 September 1999

Unaudited Unaudited Audited

first half first half year ended

1999 1998 31 March 1999

Note #'000 #'000 #'000

-----------------------------------------------------------------------------

Turnover 83,271 68,939 142,607

Cost of sales (44,957) (37,538) (77,674)

-----------------------------------------------------------------------------

Gross profit 38,314 31,401 64,933

Operating expenses (net) (31,052) (25,290) (54,263)

-----------------------------------------------------------------------------

Operating profit 7,262 6,111 10,670

Loss on sale of tangible

fixed assets (236) - (212)

-----------------------------------------------------------------------------

Profit on ordinary activities

before interest 7,026 6,111 10,458

Interest receivable and

similar income 22 115 164

Interest payable and similar

charges (389) (345) (771)

-----------------------------------------------------------------------------

Profit on ordinary activities

before taxation 6,659 5,881 9,851

Taxation on profit on ordinary

activities 2 (2,120) (1,880) (3,247)

-----------------------------------------------------------------------------

Profit on ordinary activities

after taxation 4,539 4,001 6,604

Dividends paid and proposed 3 (930) (930) (2,605)

-----------------------------------------------------------------------------

Retained profit 3,609 3,071 3,999

-----------------------------------------------------------------------------

Earnings per ordinary share 4 9.76p 8.60p 14.20p

Diluted earnings per ordinary

share 9.76p 8.60p 14.20p

-----------------------------------------------------------------------------

All amounts shown relate to continuing operations

BALANCE SHEET

as at 30 September 1999

Unaudited Unaudited Audited

as at as at as at

30 September 30 September 31 March

1999 1998 1999

#'000 #'000 #'000

-----------------------------------------------------------------------------

Fixed assets

Tangible assets 29,160 26,858 28,796

-----------------------------------------------------------------------------

Current assets

Stocks 27,727 27,439 26,312

Debtors and prepayments 5,042 4,649 4,609

Cash at bank and in hand 2,081 1,556 337

-----------------------------------------------------------------------------

34,850 33,644 31,258

Creditors: amounts falling due

within one year (23,470) (21,548) (21,668)

-----------------------------------------------------------------------------

Net current assets 11,380 12,096 9,590

-----------------------------------------------------------------------------

Total assets less current

liabilities 40,540 38,954 38,386

Creditors:amounts falling due

after more than one year (4,164) (7,574) (5,712)

Provisions for liabilities and

charges (1,917) (1,458) (1,824)

-----------------------------------------------------------------------------

Net assets 34,459 29,922 30,850

-----------------------------------------------------------------------------

Capital and reserves

Called up share capital 2,325 2,325 2,325

Share premium account 8,634 8,634 8,634

Profit and loss account 23,500 18,963 19,891

-----------------------------------------------------------------------------

Equity shareholders' funds 34,459 29,922 30,850

-----------------------------------------------------------------------------

RECONCILIATION OF MOVEMENTS IN EQUITY SHAREHOLDERS' FUNDS

as at 30 September 1999

Unaudited Unaudited Audited

as at as at as at

30 September 30 September 31 March

1999 1998 1999

#'000 #'000 #'000

-----------------------------------------------------------------------------

Retained profit 3,609 3,071 3,999

Opening equity shareholders'

funds 30,850 26,851 26,851

-----------------------------------------------------------------------------

Closing equity shareholders'

funds 34,459 29,922 30,850

-----------------------------------------------------------------------------

CASH FLOW STATEMENT

for the half year ended 30 September 1999

Unaudited Unaudited Audited

first half first half year ended

1999 1998 31 March 1999

#'000 #'000 #'000

-----------------------------------------------------------------------------

Net cash inflow from operating

activities 6,628 3,087 9,652

Returns on investments and

servicing of finance (367) (230) (607)

Taxation paid (233) (231) (2,088)

Capital expenditure (2,538) (5,476) (9,799)

Equity dividends paid - - (1,592)

-----------------------------------------------------------------------------

Net cash inflow/(outflow) before

financing 3,490 (2,850) (4,434)

Financing (1,746) 1,524 1,889

-----------------------------------------------------------------------------

Increase/(decrease) in cash 1,744 (1,326) (2,545)

-----------------------------------------------------------------------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. The unaudited results have been prepared using the same accounting

policies as those used for the financial statements for the year ended 31

March 1999.

2. Taxation has been estimated at the rate expected to be incurred in the

full year.

3. The directors have declared an interim dividend of 2.0p per ordinary

share of 5p, to be paid on 3 March 2000 to shareholders registered on 14

January 2000.

4. Earnings per ordinary share represents the profit for the period of

#4,539,000 (1998: #4,001,000) divided by the weighted average number of

ordinary shares in issue of 46,508,772 (1998: 46,508,772).

5. The financial information set out above does not constitute full

statutory accounts within the meaning of Section 240 of the Companies Act

1985. The amounts shown in respect of the year ended 31 March 1999 have

been extracted from the full statutory accounts, on which the auditors

have made an unqualified report. The statutory accounts have been filed

with the Registrar of Companies.

6. Copies of the interim financial statements will be posted to shareholders

and are available to members of the general public from the company's

registered office: P14 Parklands, Heywood Distribution Park, Pilsworth

Road, Heywood, Lancashire, OL10 2TT.

END

IR CCACDFDDDKBK

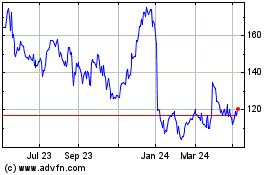

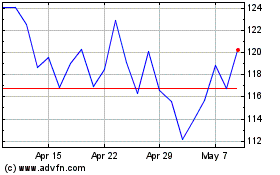

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024