John David Sports - Interim Results

21 January 1998 - 6:30PM

UK Regulatory

RNS No 9218k

JOHN DAVID SPORTS PLC

21st January 1998

JOHN DAVID SPORTS PLC

INTERIM RESULTS FOR THE SIX MONTHS TO 30 SEPTEMBER 1997

John David Sports Plc, a leading specialist retailer of fashionable branded

sports and leisure wear today announces its results for the six month period

ended 30 September 1997.

Highlights:-

* Turnover increased by 25.4% to #52.8 million (1996: #42.1 million).

* 14 stores opened and one closed bringing the chain to 91 stores

nationwide at the period end.

* Like for like sales decreased by 8% against extremely strong

comparatives.

* Profit before tax increased 10.4% to #5.52 million compared with #5

million in 1996 (pre exceptional).

* Earnings per ordinary share up 5.3% to 8.19p (1996: 7.78p).

* Store opening programme continued at anticipated rate.

Commenting on the outlook, John Wardle, Chairman, said: "The Company will

benefit from the much improved merchandising and buying controls now in place

and a more focused product offering. I envisage that the material benefits of

this will be gained in the autumn/winter of 1998. We have also greatly

improved the operating effectiveness of the business over the last six months.

To underpin these changes, a number of additional appointments have been made.

The secondary stock problem has now been dealt with and the strengthened

management team is now fully focused on exploiting the Company's position as

the UK's leading fashion sports retailer."

Enquiries: John Wardle (Chairman)/Peter Cowgill (Finance Director)

John David Sports Plc

Telephone: 0171 796 4133 (Hudson Sandler) on 21 January 1998 -

01706 628000 (thereafter)

Andrew Hayes

Hudson Sandler Limited

Telephone: 0171 796 4133

CHAIRMAN'S STATEMENT

Introduction

In my statement accompanying the announcement of the 1997 Preliminary Results

last June, I stated that there was a requirement from Spring 1997 to trade out

a number of slow moving stock lines. This stock disposal programme has taken

place throughout the current financial year and the current stock position is

now much improved. However, as forecast, this action has acted as a brake on

sales and margins over this period and led to some temporary increases in

operating expenses.

Following the stock issues experienced last year, and the associated

performance, management reviewed all aspects of the business. This concluded

that our core range had become too fragmented and not sufficiently fashion

focused. In response to this we have now completed the strengthening of our

merchandising, buying and marketing functions to address this. I am confident

that the combination of the stock clearance programme and these measures will

contribute to an improved future sales performance.

Results

Despite the impact of these stock issues during the six months to 30th

September 1997, total turnover for the six months to 30 September 1997 period

rose by 25.4% from #42.1 million to #52.8 million with pre-tax profits rising

by 10.4% to #5.52 million (1996: #5.0 million prior to exceptional charges.

Earnings per share rose by 5.3% to 8.19p (1996: 7.78p).

The like for like sales decrease of approximately 8% over the period resulted

from the poor stock offering, and the associated clearance programme during

the period together with the fact that the sales were against extremely strong

comparatives. As anticipated, the reduction in operating margin was a

reflection of the clearance programme together with a lower return from new

stores during their early period of trading. This has specifically arisen

from the write off of pre-opening store wages, hardening of rents and the

lower turnover/rent ratio during the early operating periods of new stores.

The considerable majority of new stores are achieving expectations.

The net profit before tax amounted to #5.52 million (1996: #5.0 million).

This reflects an increase in net profitability of 10.4% which has been

achieved despite a relatively disappointing trading period. Adjusted earnings

per share have increased from 7.78p to 8.19p.

Dividend

The Board proposes to pay an interim dividend of 2p per share (1996 : Nil)

which will be paid on 4 March 1998 to shareholders on the register at the

close of business on 6 February 1998.

Trading review

A key objective during the period was to trade out the slow moving stock

highlighted at the time of our 1997 Preliminary Results. The approach was to

trade this out in a planned programme so as to control the impact on sales and

margins. Management reviewed all areas of the business in light of this

issue. This concluded that our core range had become too fragmented and not

sufficiently fashion focused. In response to this we have now completed the

strengthening of our merchandise, buying and marketing functions to address

this. In particular, a number of key appointments have been made in these

areas and procedures and disciplines have been considerably strengthened. We

are confident that the business is now equipped to successfully address the

poor sales performance. Priority was also given to initiatives to improve

operating efficiency throughout the business particularly in wages and central

overhead efficiencies. Progress has been made in these areas.

During the period the Company progressed with its planned store expansion

programme. New store openings amounted to 14 in total with one store closure.

The store openings comprised three out of town/edge of town stores, one JD

footwear store and 10 JD Sports stores. The total number of stores in

operation at the period end was 91 of which 78 were JD Sports stores, 6 were

Athleisure stores, 4 were JD footwear stores and 3 were out of town stores. I

am particularly pleased to report that our out of town format has been well

received. In total the Company operated from 214,000 sq.ft. of retail space

at the period end.

Capital expenditure for the period amounted to #4.0 million. Of this, #3.7

million related to store development.

Balance sheet and financial resources

Shareholders' funds as at the balance sheet date increased to #24.9 million

including a retained profit of #2.9 million for the period. Gross cash

amounted to #6.7 million against structured borrowings of #6.4 million.

Current trading

Since the period end, total sales are 20% ahead of the previous year

reflecting the larger number of stores in operation. However, Christmas

trading was disappointing. As a result, there has been a continued decline in

like for like sales since the period end. Margins continue to be

depressed as the autumn/winter element of the slow moving stock has been

addressed. However, the current stock position is now much healthier and the

Company is in a position to benefit from this during the next financial year.

Outlook

The Company will benefit from the much improved merchandising and buying

controls now in place and a more focused product offering. I envisage that

the material benefits of this will be gained in the autumn/winter of 1998. We

have also greatly improved the operating effectiveness of the business over

the last six months. To underpin these changes, a number of additional

appointments have been made. The secondary stock problem has now been dealt

with and the strengthened management team is now fully focused on exploiting

the Company's position as the UK's leading fashion sports retailer.

John Wardle

Chairman

21 January 1998

John David Sports Plc

Interim results for the 6 months ended 30 September 1997

Profit and loss account

Note Unaudited Unaudited Audited

first half first half year ended

1997 1996 31 March

1997

#000 #000 #000

Turnover - continuing operations 52,804 42,093 88,067

Cost of sales

- ongoing (29,083) (23,268) (48,534)

- exceptional 2 0 (200) (200)

--------- ---------- ---------

Gross profit 23,721 18,625 39,333

Other operating expenses (net) (18,135) (13,630) (29,716)

--------- --------- --------

Operating profit - continuing

operations 5,586 4,995 9,617

Loss on sale of tangible fixed assets

in continuing operations (19) (32) (27)

Other exceptional losses 2 0 (450) (450)

------ ------ ------

5,567 4,513 9,140

Interest receivable and

similar income 213 43 270

Interest payable and similar

charges (263) (208) (444)

------- ------- ------

Profit on ordinary activities

before taxation 5,517 4,348 8,966

Taxation on profit on

ordinary activities 3 (1,710) (1,444) (2,978)

-------- -------- --------

Profit on ordinary activities

after taxation 3,807 2,904 5,988

Dividends paid and proposed 4 (930) 0 (1,674)

------- ------ -------

Retained profit 2,877 2,904 4,314

==== ==== ======

Earnings per ordinary share 8.19p 6.75p 13.45p

==== ==== ====

Adjusted earnings per share (see below) 8.19p 7.78p 14.43p

==== ==== ====

Note:

Adjusted earnings per ordinary share has been calculated on the post tax

earnings for each period before exceptional items in order to allow a better

comparison with the six months ended 30 September 1997.

The adjusted earnings per ordinary share figure for the year ended 31 March

1997 has been restated following finalisation of the tax treatment of the

exceptional item in that year's tax computations. The previous figure stated

was 14.91p.

John David Sports Plc

Interim results for the 6 months ended 30 September 1997

Balance sheet

Unaudited Unaudited Audited

as at as at as at

30 September 30 September 31 March

1997 1996 1997

#000 #000 #000

Fixed assets 18,807 11,246 15,649

===== ===== =====

Stocks 18,400 11,842 16,530

Debtors and prepayments 3,761 2,908 3,208

Cash at bank and in hand 6,670 1,349 7,643

-------- -------- --------

28,831 16,099 27,381

Creditors due within one year (16,321) (9,724) (15,754)

--------- -------- ---------

Net current assets 12,510 6,375 11,627

Creditors due after more

than one year (5,407) (5,425) (4,393)

Provisions (992) (375) (842)

------- ------- ------

Net assets 24,918 11,821 22,041

===== ===== =====

Capital and reserves 24,918 11,821 22,041

===== ===== =====

The net proceeds arising from the company's flotation in October 1996 amounted

to #8.8 million. If the net assets at 30 September 1996 are adjusted to

reflect this amount then the net assets at that date would amount to #20.621

million.

Reconciliation of movement in shareholders' funds

Unaudited Unaudited Audited

as at as at as at

30 September 30 September 31 March

1997 1996 1997

#000 #000 #000

Retained profit 2,877 2,904 4,314

New shares issued 0 6 8,816

------ ------ -------

2,877 2,910 13,130

Opening shareholders' funds 22,041 8,911 8,911

--------- ------- -------

Closing shareholders' funds 24,918 11,821 22,041

===== ===== =====

John David Sports Plc

Interim results for the 6 months ended 30 September 1997

Cashflow statement

Unaudited Unaudited Audited

first half first half year ended

1997 1996 31 March

1997

#000 #000 #000

Net cashflow from operating

activities 2,909 2,598 5,893

Returns on investments and

servicing of finance (50) (165) (174)

Taxation paid 0 (500) (2,020)

Investing activities (3,856) (1,924) (6,475)

Financing 24 (113) 8,966

------- ------- -------

(Decrease)/Increase in cash and

cash equivalents (973) (104) 6,190

==== ==== ====

Notes:

1.The undaudited results have been prepared under the historical cost

accounting rules and in accordance with applicable accounting standards

using the accounting policies set out in the financial statements for the year

ended 31 March 1997.

2.The exceptional item relates to the cost incurred in respect of the

terrorist device that exploded in Manchester on 15 June 1996 affecting the

trading outlets in this city.

3.Taxation has been estimated at the rate expected to be incurred in the

full year.

4.The directors have declared an interim dividend of 2.0p per ordinary

share of 5p, to be paid on 4 March 1998 to shareholders registered on 6

February 1998.

5.The financial information set out above does not constitute full accounts

within the meaning of Section 240 of the Companies Act 1985. The amounts

shown in respect of the year ended 31 March 1997 have been extracted from

the full statutory accounts, on which the auditors have made an unqualified

report. The statutory accounts have been filed with the Registrar of

Companies.

6.Copies of the announcement will be posted to shareholders and are

available to members of the general public from the company's registered

office: John David Sports Plc, Unit P14 Parklands, Heywood Distribution

Park,Pilsworth Road, Heywood, Lancashire OL10 2TT.

Review report by KPMG Audit Plc to John David Sports Plc:

We have reviewed the interim financial information for the six months ended 30

September 1997 set out in pages 2 to 4 which is the responsibility of,

and has been approved by, the directors. Our responsibility is to report on

the results of our review.

Our review was carried out having regard to the Bulletin "Review of Interim

Financial Information", issued by the Auditing Practices Board. This review

consisted principally of applying analytical procedures to the underlying

financial data, assessing whether accounting policies have been consistently

applied, and making enquiries of management responsible for financial and

accounting matters. The review was substantially less in scope than an audit

performed in accordance with Auditing Standards and accordingly we do not

express an audit opinion on the interim financial information.

On the basis of our review:

* In our opinion the interim financial information has been prepared using

accounting policies consistent with those adopted by John David Sports Plc

in its financial statements for the year ended 31 March 1997.

* We are not aware of any material modifications that should be made to the

interim financial information as presented.

KPMG Audit Plc

Chartered Accountants

END

IR FCKCQKDKBKDB

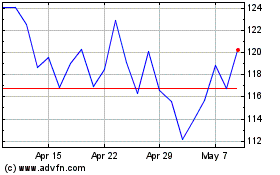

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

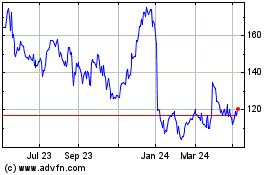

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024