RNS Number:5133Y

John David Group (The) PLC

11 May 2004

11 May 2004

THE JOHN DAVID GROUP PLC

PRELIMINARY RESULTS

FOR THE YEAR ENDED 31 JANUARY 2004

The John David Group Plc (the "Company" or the "Group"), a leading specialist

retailer of fashionable branded sports and leisure wear, today announces its

Preliminary Results for the year ended 31 January 2004.

* Group turnover increased to #458.1 million (10 month period ended 31

January 2003: #370.8 million).

* Group operating profit (before goodwill, exceptional items and loss on

disposal) of #10.5 million (10 month period ended 31 January 2003: #18.0

million).

* Profit before tax (before goodwill, exceptional items and loss on

disposal) of #6.0 million (10 month period ended 31 January 2003: #15.1

million).

* Reported operating profit of #7.7 million (10 month period ended 31

January 2003: #14.1 million).

* Final dividend of 3.64p maintaining the full year dividend at the same

level as last period (total dividend of 6.50p - 10 month period ended 31

January 2003: 6.50p).

* Positive like for like sales in the second half reduced the decline for

the year ended 31 January 2004 to 0.4%.

* Gross margin was 45.6% against 45.5% in the 10 month period ended 31

January 2003.

* Group like for like sales for the thirteen weeks to 1 May 2004 have been

up 0.9% overall against prior year.

* Core Sports Fascias like for like sales growth for the thirteen weeks to

1 May 2004 has been up 2.5%.

* During the same period gross margin has been maintained in line with

management expectations.

Peter Cowgill, Executive Chairman, said: "Our core Sports business continues to

perform strongly without recourse to discounting. Since my return to the Group,

we have been carefully evaluating our operations and procedures with a view to

improving the future prospects of the business. All strategic options remain

under review. "

Enquiries: Tel: 0161 767 1000

The John David Group Plc

Peter Cowgill, Executive Chairman

Barry Bown, Chief Executive

Brian Small, Finance Director

Hogarth Partnership Limited Tel: 020 7357 9477

Andrew Jaques

Tom Leatherbarrow

CHAIRMAN'S STATEMENT

The year to 31 January 2004 proved to be very difficult for the Group. This has

led to a number of management changes including my own return to the Group as

Executive Chairman in March 2004. I am delighted to be back after leaving the

position of Finance Director in 2001 and pleased to report that our core

business proposition, selling Sportswear with style and fashion, is still

clearly an effective consumer offer which differentiates our business from our

competition. However, as Chairman, as a shareholder, and as a key member of the

team which brought this business to and beyond flotation in the first place, it

does not give me any pleasure to report disappointing results for the year.

The results for the last year were adversely impacted by continuing First Sport

integration problems. The integration process is well advanced and all fascias

are now managed by a single management team based at our Bury Head Office.

Optimism in October 2003 about the second half was not justified in the final

result owing to patchy trading in the last quarter in which a strong November

was followed by a weak pre Christmas period which affected many retailers. This

was followed by a comparatively strong sales performance in late December but at

lower margins during the sale period which extended into January. Nevertheless,

there are now grounds for optimism as the core Sports business is performing

well in the new year.

The JD Sports fascia continues to be recognised as a style leader by our target

teenage market and offers a market leading range from our key branded suppliers

(Nike, Adidas, Puma, Lacoste) which includes exclusive product as well as an

improved range of own label (McKenzie, Carbrini) product. Our relationship with

these key suppliers, who recognise our pre-eminence as visual merchandisers of

their products to target consumer groups, is key to our continuing success. This

part of our business will drive the future business performance.

Whilst performance in our Sports Fascias is encouraging, our Fashion Fascias

continue to disappoint. We are actively addressing the key issues in this area

including the continuation of our fascia rationalisation and the development of

stronger brand relationships with fewer Fashion suppliers. Following recent

management changes we are now applying the same successful management principles

employed in the Sports business to the Fashion business. Given that

rationalisation and a strategic review are continuing, it is, in the Board's

opinion, inappropriate to report in detail on the Fashion Fascias separately at

this stage.

The challenges facing the Group have been extensively reported. In difficult

market conditions, however, I have been encouraged by the fact that the core

Sports business, which represents approximately 90% of Group sales, is

increasingly robust.

RESULTS

Total sales increased to #458.1 million during the period in comparison with

#370.8 million for the 10 month period ended January 2003 which incorporated

eight months post acquisition trading from First Sport. Gross margin for the

year rose slightly from 45.5% to 45.6%.

Operating profit before exceptional items, losses on disposals and amortisation

of goodwill was #10.5 million and after interest charges was #6.0 million (10

month period ended 31 January 2003: #18.0 million and #15.1 million after

interest charges).

After charging exceptional items of #2.0 million and goodwill amortisation of

#0.8 million, operating profit before interest charges and loss on disposal of

fixed assets was #7.7 million (10 month period ended 31 January 2003: #14.1

million).

Profit before tax and after exceptional items and goodwill amortisation was #2.1

million (10 month period to 31 January 2003: #10.8 million).

Net interest charges increased to #4.5 million compared with #2.9 million (10

month period) due to the full year's charge on the additional debt taken on to

fund our recent acquisition. Earnings per share, before exceptional items and

goodwill, were 6.21p compared with 21.18p in the previous period.

DIVIDEND

The Board proposes to pay a final dividend of 3.64p per ordinary share (10 month

period ended 31 January 2003: 3.64p) bringing the total dividend paid to 6.50p

per ordinary share (10 month period ended 31 January 2003: 6.50p). The Board is

offering a scrip dividend alternative to shareholders, full details of which

will be included in a circular to be issued with the Annual Report. Irrevocable

undertakings to elect to receive the scrip dividend alternative have been given

by holders of 54% of the ordinary share capital in relation to the beneficial

interest holdings of John Wardle and David Makin, the founding shareholders. The

proposed final dividend will be paid on 2 August 2004 to shareholders on the

register as at 21 May 2004.

As the Group's performance is heavily weighted to the key Christmas trading

period it is likely that future dividend payments will be more weighted towards

the final dividend than they have been in the current year.

OPERATING REVIEW

The year ended 31 January 2004 has been a challenging one for the Group and has

seen a substantial change in the shape of our store portfolio as we sought to

eliminate the old First Sport trading fascias. In the year, over 100 First Sport

stores were converted into JD stores. We also closed 37 loss making stores and

acquired 9 new stores. At 31 January 2004, we had 306 Sports Stores (2003: 337)

and 51 Fashion Stores (2003: 48) trading from a total of 1,236,000 square feet

(2003: 1,264,000 square feet) of which 13% is devoted to Fashion Fascias. Our

focus in the current year will be to continue to eliminate loss making stores

either by disposal or conversion. One new store has been opened so far this year

and six more are committed to. All new stores will only be added to the

portfolio if they meet prudent selection criteria and very few others are likely

to be added this year.

The basic product proposition across the Sports Fascias remains Sportswear with

fashion and style and is now uniform across those fascias. Our objective is to

provide main brand fashionable product, introducing new ranges quickly and

efficiently, including a great number of lines exclusively available at JD. We

supplement the branded ranges with an innovative and exclusive range of both

McKenzie and Carbrini own brand merchandise.

The Fashion business continues to concentrate on fashionable branded leisurewear

but is currently seeking to focus on fewer brands than in the recent past so

that we can more effectively leverage our buying relationships. This is the

approach which has been successfully developed in the Sports business.

Our Group product mix for the year as a whole was broadly 50% Footwear (2003:

50%), 46% Apparel (2003: 46%), and 4% Accessories (2003: 4%). Replica kit

continues to be a minimal part of our turnover.

The main marketing thrust of the current year has been to rationalise our

fascias with JD being the principal Sports fascia and Ath (formerly Ath-Leisure)

being our principal Fashion fascia.

The Group also moved into its new head office facilities in Bury at the start of

the year and the key management is based there. We retain bulk warehousing

facilities in Peterlee as well as Bury. Service to the business from these

facilities continues to improve and was very effective in the key Christmas and

New Year trading period.

BALANCE SHEET & FINANCIAL RESOURCES

Shareholders' funds at the balance sheet date have decreased by 2.5% to #57.3

million from the previous level of #58.8 million at the end of January 2003

after dividend payments of #2.1m (net of irrevocable elections for the scrip

dividend alternative).

Total expenditure on fixed assets during the period amounted to #11.5 million of

which #9.4 million related to stores. Net borrowings at the end of January 2004

were #51.1 million (2003: #55.5 million). A small reduction in gearing is

presently expected by the end of January 2005 and #8 million of our core

borrowings are planned to be repaid during the year in accordance with the

original schedule of repayments. Gearing should fall following reduced capital

expenditure and improving retained earnings in the year to 31 January 2005.

EBITDA interest cover fell to a manageable 4.5 times in the year ended 31

January 2004 and will rise again in the current year.

Stocks at the year end were #65.7 million, lower than last year's level of #69.2

million.

BOARD CHANGES

There have been a number of Board changes in the past twelve months.

The Company's founders and principal shareholders, John Wardle and David Makin,

stepped down from their executive roles in January 2004 and are now

non-executive directors. Their considerable market, product, retail and consumer

knowledge is something the Board will continue to draw on although they are no

longer involved in the day to day management of the business.

Malcolm Blackhurst resigned as Group Finance Director and Company Secretary in

December 2003 and Brian Small was appointed to those positions in January 2004.

Roger Best was replaced as Executive Chairman in March 2004 by me.

Frank Martin, a non-executive director, left the Board in March 2004 and will be

replaced as soon as possible.

CURRENT TRADING

It is pleasing to be able to report that trading since the year end has been in

line with management expectations although the Fashion Fascias will take some

time to recover from some of the buying decisions in the past year. During the

thirteen weeks to 1 May 2004, Group like for like sales have been up 0.9%

against the prior period whilst our core Sports business has been up 2.5%.

During the same period,gross margin has been in line with management

expectations.

PROSPECTS

On my appointment eight weeks ago, I promised to oversee a Board review of all

the strategic options open to the Group. I have concentrated in my opening weeks

on ensuring we have the right management team, the right operating controls and

the right targets so that the Board's expectation of a progressive improvement

in results can be delivered.

The strategic review will take some time to complete and we will announce its

findings and conclusions as soon as it is practicable.

Peter Cowgill

Chairman

11 May 2004

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 January 2004

Note 12 months to 31 10 months to 31

January 2004 January 2003

Continuing Continuing

operations operations

#000 #000

Turnover 458,073 370,804

Cost of sales (249,379) (202,229)

_______ _______

Gross profit 208,694 168,575

Distribution

costs - normal (186,117) (141,145)

Distribution

costs -

exceptional (1,366) (2,933)

Administrative

expenses -

normal (13,503) (10,167)

Administrative

expenses -

exceptional (612) (581)

Other

operating

income 638 333

_______ _______

Operating

profit 7,734 14,082

------------------- ------ --------- -------- ---------- ---------

Before

exceptional

items and

goodwill

amortisation 10,498 18,017

Exceptional

items 1 (1,978) (3,514)

Goodwill 1 (786) (421)

------------------- ------ --------- -------- ---------- ---------

Operating

profit 7,734 14,082

Loss on

disposal of

fixed assets (1,095) (433)

_______ _______

Profit on

ordinary

activities

before

interest 6,639 13,649

Interest

receivable and

similar income 100 212

Interest

payable and

similar

charges (4,634) (3,080)

_______ _______

Profit on

ordinary

activities

before

taxation 2,105 10,781

Taxation on

profit on

ordinary

activities (1,457) (4,024)

_______ _______

Profit on

ordinary

activities

after taxation 648 6,757

Dividends paid

and proposed (3,038) (3,038)

_______ _______

Retained

(loss)/profit (2,390) 3,719

_______ _______

Earnings per

ordinary

share: 2

- Basic 1.39p 14.46p

- Adjusted to

exclude

exceptional

items and

goodwill

amortisation 6.21p 21.18p

- Diluted 1.39p 14.45p

The group has no recognised gains or losses other than the results reported

above.

The results above also represent the historic cost profit.

CONSOLIDATED BALANCE SHEET

As at 31 January 2004

31 January 2004 31 January

2003

#000 #000

Fixed assets

Intangible assets 14,976 11,643

Tangible assets 68,183 74,292

_______ _______

83,159 85,935

_______ _______

Current assets

Stocks 65,727 69,171

Debtors and prepayments 14,452 13,632

Cash at bank and in hand 4,934 3,527

_______ _______

85,113 86,330

Creditors: amounts falling due within one year (55,667) (53,157)

_______ _______

Net current assets 29,446 33,173

_______ _______

Total assets less current liabilities 112,605 119,108

Creditors: amounts falling due after more than

one year (51,555) (56,294)

Provisions for liabilities and charges (3,756) (4,050)

_______ _______

Net assets 57,294 58,764

_______ _______

Capital and reserves

Called up share capital 2,338 2,338

Share premium account 8,917 8,917

Profit and loss account 46,039 47,509

_______ _______

Equity shareholders' funds 57,294 58,764

_______ _______

RECONCILIATION OF MOVEMENTS IN EQUITY SHAREHOLDERS' FUNDS

As at 31 January 2004

31 January 31 January

2004 2003

#000 #000

Profit for the year/period 648 6,757

Dividends paid and

proposed (3,038) (3,038)

_______ _______

Retained (loss)/profit for

the year/period (2,390) 3,719

Proceeds from issue of

ordinary shares - 10

Irrevocable dividend

waiver 920 -

_______ _______

Net movement in equity

shareholders' funds (1,470) 3,729

Opening equity

shareholders' funds 58,764 55,035

_______ _______

Closing equity

shareholders' funds 57,294 58,764

_______ _______

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 January 2004

12 months to 31 10 months to

January 2004 31 January 2003

#000 #000

Net cash inflow from

operating activities 23,600 28,194

Returns on investments and

servicing of finance (4,302) (2,734)

Taxation (1,287) (5,957)

Capital expenditure (9,229) (18,005)

Acquisitions - (52,201)

Equity dividends paid (4,375) (2,431)

_______ _______

Net cash inflow/(outflow)

before financing 4,407 (53,134)

Financing (3,000) 55,675

_______ _______

Increase in cash 1,407 2,541

_______ _______

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

for the year ended 31 January 2004

12 months to 10 months to

31 January 31 January

2004 2003

#000 #000

Increase in cash in the period 1,407 2,541

Cash outflow/(inflow) from movement in debt and

lease financing 3,000 (55,665)

Reduction/(increase) in net debt in the period 4,407 (53,124)

Net debt at start of period (55,473) (2,349)

Net debt at end of period (51,066) (55,473)

RECONCILIATION OF OPERATING PROFIT TO NET CASH INFLOW FROM OPERATING ACTIVITIES

for the year ended 31 January 2004

12 months to 10 months to

31 January 31 January

2004 2003

#000 #000

Operating profit 7,734 14,082

Depreciation charge 10,060 7,907

Amortisation of goodwill 786 421

Decrease in stocks 1,990 227

Decrease/(increase) in debtors 80 (1,230)

Increase in creditors 2,950 6,787

Net cash inflow from operating activities 23,600 28,194

=== ===

All exceptional items shown within operating profit have resulted in cash flows

in the period.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1 Operating profit and exceptional items

Operating profit is stated after charging goodwill amortisation of #786,000.

Exceptional items comprise mainly of expenditure directly relating to the

integration of the First Sport division of Blacks Leisure Group Plc, acquired in

May 2002, as detailed below.

#000

Redundancy costs 978

Store closure costs 479

Lease and contract exit payments 314

Warehousing, distribution and other reorganisation costs 130

OFT replica kit investigation 77

_____

1,978

_____

2 Earnings per ordinary share

Basic earnings per ordinary share represents the profit for the period of

#648,000 (2003: #6,757,000) divided by the weighted average number of ordinary

shares in issue of 46,748,607 (2003: 46,743,692).

Adjusted basic earnings per ordinary share have been based on the profit on

ordinary activities after taxation for each financial period but excluding

exceptional items and goodwill amortisation.

The diluted earnings per share is based on 46,750,776 (2003: 46,747,348)

ordinary shares, the difference to the basic calculation representing the

additional shares that would be issued on the conversion of all the dilutive

potential ordinary shares. There is no material difference to earnings if all

the dilutive potential ordinary shares are converted.

The earnings used to calculate earnings per ordinary share is given below:

Earnings attributable to ordinary shareholders As at 31 As at 31

January

January 2003

2004

#000 #000

Profit on ordinary activities after taxation 648 6,757

- Exceptional items 1,978 3,514

- Tax relating to exceptional items (509) (791)

- Goodwill amortisation 786 421

_______ _______

Profit after taxation excluding exceptional

items and goodwill amortisation 2,903 9,901

_______ _______

Adjusted basic earnings per ordinary share 6.21p 21.18p

_______ _______

3 Accounts

These figures are abridged versions of the Group's full accounts for the year

ended 31 January 2004 and do not constitute the Group's statutory accounts

within the meaning of Section 240 of the Companies Act 1985. The Group's

auditors have audited the statutory accounts for the Group and have issued an

unqualified audit opinion thereon within the meaning of Section 235 of the

Companies Act 1985 and have not made any statement under Section 237 (2) or (3)

of the Companies Act 1985 for the year ended 31 January 2004. Statutory accounts

for the 10 month period ended 31 January 2003 have been delivered to the

Registrar of Companies. Statutory accounts for the year ended 31 January 2004

will be delivered to the Registrar of Companies following the Annual General

Meeting.

Copies of the full accounts will be sent to shareholders in due course.

Additional copies will be available from The John David Group Plc, Hollinsbrook

Way, Pilsworth, Bury, Lancashire, BL9 8RR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAPSEFLXLEFE

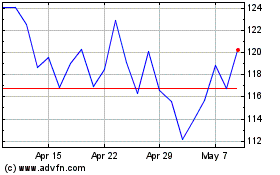

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jun 2024 to Jul 2024

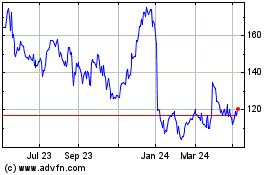

Jd Sports Fashion (LSE:JD.)

Historical Stock Chart

From Jul 2023 to Jul 2024