TIDMKEFI

RNS Number : 6847N

Kefi Gold and Copper PLC

06 June 2022

6 June 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

Results for the year ended 31 December 2021

KEFI (AIM: KEFI), the gold and copper exploration and

development company with projects in the Federal Democratic

Republic of Ethiopia and the Kingdom of Saudi Arabia, is pleased to

announce its audited financial results for the year ended 31

December 2021.

Notice of AGM and Annual Report

The Annual General Meeting will be held at 10.00am on Thursday

30 June 2022 at Marlin Waterloo, Lower Ground Floor, 111

Westminster Bridge Road, Waterloo, SE1 7HR, United Kingdom.

Information on the resolutions to be considered at the AGM can

be found in the Notice of AGM that has been made available to

shareholders of the Company as an electronic communication along

with forms of proxy and direction (the "AGM Materials") as well as

the Annual Report and Accounts for the year ended 31 December 2021

(the "Annual Report"). The AGM Materials and Annual Report are

available on KEFI's website at www.kefi-minerals.com .

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated +44 (0) 20 3470

Adviser) 0470

Jeff Keating, Adam Cowl

+44 (0) 20 7100

Tavira Securities Limited (Lead Broker) 5100

Oliver Stansfield, Jonathan Evans

+ 44 (0) 20 7220

WH Ireland Limited (Joint Broker) 1666

Katy Mitchell, Andrew de Andrade

+44 (0) 20 3934

IFC Advisory Ltd (Financial PR and IR) 6630

Tim Metcalfe, Florence Chandler

Further information can be viewed at www.kefi-minerals.com

EXECUTIVE CHAIRMAN'S REPORT

Due to the improvement in the local working environment in both

Ethiopia (security) and Saudi Arabia (regulatory) since late 2021,

KEFI now has three (not one) advanced projects in two countries.

Combined with the recently reported excellent exploration results

at Hawiah and Al-Godeyer in Saudi Arabia, KEFI now has a

much-improved position as an early-mover in both countries and with

a more balanced portfolio of advancing projects.

We can at last focus on a sequential development path to build a

mid-tier mining company with aggregate annual production of 365,000

ounces of gold and gold equivalent, in which KEFI will have a

beneficial interest of 187,000 ounces of gold and gold

equivalent.

Our reported Mineral Resources provide a solid starting position

for our imminent growth. Since mid-2021, total Mineral Resources

have increased from 3.9 million to 4.7 million gold-equivalent

ounces. KEFI's beneficial interest in the in-situ metal content of

our three projects now totals 2.1 million gold-equivalent ounces.

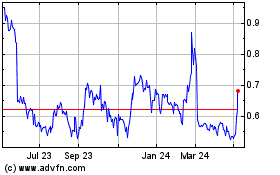

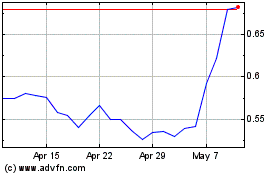

KEFI's current market capitalisation of circa GBP30 million equates

to only $19 per gold-equivalent ounce compares very favourably to

the prevailing gold price range during 2022 of approximately

$1,830-2000/ounce.

The underlying intrinsic value of KEFI's assets has increased

from December 2020 to December 2021 based on the three projects'

NPV (at an 8% discount rate and using 31 December 2021 metal

prices). At that same deck of metal prices, NPV per share has grown

from 3 pence as at mid-2020 to 7 pence as at mid-2021 and 9 pence

as at mid-2022 (calculated on the shares in issue today).

The growth in underlying intrinsic value is due to our progress

in Saudi Arabia in particular - at the Hawiah Copper-Gold Project

and the Jibal Qutman Gold Project. These statistics are merely

illustrative indicators, but the same pattern emerges whether one

assumes prevailing metal prices or analysts' consensus forecast

metal prices.

Our operating alliances are with the following strong

organisations:

-- Partners:

o in Saudi Arabia: Abdul Rahman Saad Al Rashid and Sons

Ltd ("ARTAR")

o in Ethiopia:

-- Federal Government of the Democratic Republic

of Ethiopia

-- Oromia Regional Government

-- Principal contractor for process plants in both Ethiopia

and Saudi Arabia: Lycopodium Ltd ("Lycopodium").

-- Senior project finance lenders for Tulu Kapi:

o East African Trade and Development Bank Ltd ("TDB")

o African Finance Corporation Limited ("AFC")

Ethiopia - Tulu Kapi

Until a few years ago, Ethiopia had been one of the world's top

10 growth countries for nearly 20 years and now, having overcome

its recent security issues, is demonstrating a clear determination

to expedite economic recovery and pursue its economic objectives.

Tulu Kapi will be the country's first large-scale mining project

for some 30 years and is designed to the highest international

standards. It therefore is imposing many demands on a regulatory

system which the Ethiopian Government is upgrading. Under strong

Ministerial leadership, the Government is determined to build a

modern minerals sector.

There is significant potential to increase Tulu Kapi's current

Ore Reserves of 1.05 million ounces of gold and Mineral Resources

of 1.7 million ounces. Economic projections for the Tulu Kapi open

pit indicate the following returns assuming a gold price of

US$1,591/ounce:

-- Average EBITDA of $100 million per annum (KEFI's now planned

c. 70% interest being c. $70 million);

-- All-in Sustaining Costs ("AISC") of $826/ounce, (note that

royalty costs increase with the gold price); and

-- All-in Costs ("AIC") of $1,048/ounce.

The assumptions underlying these projections are detailed in the

Annual Report.

We reactivated Tulu Kapi project launch preparations in early

2022. Ethiopia's Ministry of Mines has recently been formally

advised that progress is on schedule to have secured project

finance by mid-year if the security situation is satisfactory and

if the few remaining regulatory administrative tasks are also

completed punctually.

Saudi Arabia - Jibal Qutman

Jibal Qutman was KEFI's first discovery in Saudi Arabia with

Mineral Resources in excess of 700,000 ounce of gold.

As a result of a new regulatory system and indications from the

Saudi Arabia's Government that the Mining Licence would progress in

2022, development planning studies have recommenced at Jibal

Qutman.

The current gold price is considerably higher than the

$1,200/ounce used in 2015 when the Company lodged its initial

Mining Licence application. Another key change is that several

alternative processing options are likely to have become more

attractive since 2015.

Several consultants have recently been engaged to evaluate

processing options for Jibal Qutman and update elements of the

Mining Licence application. This work includes open-pit design and

scheduling, metallurgy, processing options and updating the

Environmental and Social Impact Assessment.

Saudi Arabia - Hawiah

Hawiah was discovered in September 2019 and now ranks in

the:

-- top three base metal projects in Saudi Arabia; and

-- top 15% VMS projects worldwide.

A three-year 42,000m drilling program has delineated a Mineral

Resource of 24.9 million tonnes at 0.90% copper, 0.85% zinc,

0.62g/t gold and 9.8g/t silver. As a scale-comparison with Tulu

Kapi, Hawiah's recoverable metal is now estimated to be in the

order of 2.2 million gold-equivalent ounces versus Tulu Kapi's 1.2

million ounces of gold.

The team is progressing at great speed on this exciting project

which is located close to major infrastructure. We are working

towards completing a Preliminary Feasibility Study ("PFS") and an

updated Mineral Resource in late 2022.

Two Exploration Licences ("ELs") located immediately west of the

Hawiah EL were granted in December 2021. Initial exploration of

these Al Godeyer ELs has confirmed similar copper-gold

mineralisation to the Hawiah VMS deposit and indicated good

continuity of the mineralised horizon.

Conclusion

KEFI is preparing to develop the Tulu Kapi Gold Project,

advancing development studies on the Jibal Qutman Gold Project,

progressing the PFS for the Hawiah Copper-Gold Project and testing

exploration targets in Ethiopia and Saudi Arabia.

Simultaneous with the triggering of full development at Tulu

Kapi, we intend to re-commence exploration programs in Ethiopia and

expand our exploration program in Saudi Arabia. In Ethiopia, the

initial focus will be underneath the planned open pit where we

already have established an initial resource for underground mining

at an average grade of 5.7g/t gold. We also intend to follow-up

drilling which indicated good potential for nearby gold deposits in

the Tulu Kapi District. In Saudi Arabia, further drilling is in

progress at Hawiah and the adjacent Al Godeyer prospect.

Along with my fellow Directors, I am very sensitive to the need

to generate returns on investment. It is frustrating and

disappointing that the pandemic and the geopolitics of both

Ethiopia and Saudi Arabia has retarded our progress in recent years

and we have been unable to achieve targeted progress. However, our

operating environment has turned for the better in both countries

and we can now progress on all fronts.

By emphasizing conventional project-level development financing,

we seek to alleviate the past responsibility of KEFI shareholders

to provide all funding and therefore more than 80% of the

development capital is planned to be contributed by our partners

and other syndicate parties. However, exploration and other

pre-development funding will continue to rely exclusively on equity

funding by KEFI and its in-country partners.

The Directors expect that as milestones are achieved, the

Company's share price should naturally narrow the gap between the

Company's market capitalisation and what we believe to be the

significantly higher fundamental valuations of the Company's

projects using conventional measures such as NPV.

We are indeed at an opportune moment, created by our team's hard

work, your support as shareholders and the serendipity of markets

strengthening as we launch our projects. The Directors are deeply

appreciative of all personnel's tenacity and steadfast dedication

and of the support the Company receives from shareholders and other

stakeholders.

Executive Chairman

Harry Anagnostaras-Adams

1 June 2022

FINANCE DIRECTOR'S REVIEW

KEFI is a first-mover within a fast-changing geopolitical

environment and has been financing its activities in the midst of a

global pandemic - a challenging environment indeed. We see the

current global supply chain strains as an aftershock which will

abate but leave a legacy of cost inflation which has already

impacted our projects. We have been adjusting our planning

assumptions since the pandemic began.

Successful implementation will see KEFI emerge in 2024 as a

profitable gold producer of 140,000 ounces per annum. Our growth

plans in Ethiopia and Saudi Arabia are likely to lead to much

higher gold equivalent production within the following few

years.

Subject to the signing of Tulu Kapi's umbrella financing

agreement in June 2022 and its adherence over the following few

months, the Company has been positioned to commence full

construction of the Tulu Kapi mine at the end of the current wet

season. Implementation of this plan provides KEFI with project

ownership levels as follows:

-- c. 70% of the Ethiopian mining development and production

operation, via the shareholding in TKGM;

-- 100% of the Ethiopian exploration projects, via the shareholding

in KEFI Minerals (Ethiopia) Limited ("KME"); and

-- 30% of the Saudi development and exploration projects,

via the shareholding in G&M.

KEFI has funded all of its past activities with approximately

GBP72 million equity capital raised at then prevailing share market

prices. This avoided the superimposing of debt-repayment risk onto

the risks of exploration, permitting and other challenges that

always exist during the early phases of project exploration and

development in frontier markets. We do however avail ourselves of

unsecured advances from time to time as arranged by our Corporate

Broker to provide working capital pending the achievement of a

short-term business milestone.

Overall, the current finance plan is shown below and caters for

all planned development expenditure at TKGM in addition to all

exploration and corporate funding requirements, estimated at c.$356

million (including the mining fleet provided by the contractor of

US$56 million, the original budget of US$240 million and provisions

for cost-inflation US$50 million) which is dependent upon final

procurement price confirmations. These estimates were made in

mid-2022 and took into account cost-inflation in the industry until

then. We are now re-checking pricing for project launch and final

finance planning. The various offers and commitments are made on a

non-binding basis for finalisation as we now move to project launch

. T he financing syndicate has expressed willingness to adjust and

refine amongst itself when final procurement and budget prices,

expected in the coming two months, are set. It will be optimised by

KEFI and the TKGM syndicate which has already conditionally

indicated the following participation as at 31 May 2022:

$

M

56 Mining fleet to be provided by the mining contractor

140 Senior project debt, to be repaid out of operating cash

surpluses

----

196

Equity Risk Capital

38 Government and Local Investors directly into TKGM

122 KEFI-funded component, separate and in addition to historical

investment

----

160 Total TKGM capital requirement, subject to final procurement

clarifications

356 Total of original project budget, plus provision for cost-inflation

plus mining fleet

====

KEFI Component to be funded as follows:

60 Subordinated non-convertible, offtake-linked debt

15 Subordinated debt convertible into KEFI shares at VWAP in

3 years

20 Subordinated convertible at a premium over market in H2-2022

27 Recent issues of KEFI shares and the exercise of the attached

warrants

----

122 Provided by KEFI

====

The following needs to be carried out so as to proceed to

earliest project finance settlement:

-- Field activities to demonstrate readiness to launch from

a security viewpoint;

-- Final construction and mining pricing updates confirmed;

and

-- Definitive individual party documentation to be approved

with relevant Government agencies, including the Ministry

of Mines and the Central Bank of Ethiopia, so that execution

may proceed by all syndicate parties. Early preparatory

works have commenced to give clearance to both banks to

lend on same terms.

Ownership Value and Ownership Dilution

An GBP8.0 million Placing completed in April 2022 will mainly be

used to fund:

-- selected development activities at Tulu Kapi,

-- exploration at Hawiah and the adjacent Al Godeyer prospect;

and

-- development planning at Jibal Qutman.

This paves the way for full construction in Ethiopia from

October 2022 at the end of the local wet season, with the initial

signing at end of June 2022 setting out any residual conditions to

be satisfied.

From an ownership value perspective and measuring the Company's

underlying assets on an NPV basis, compared with the position as at

the time of the last AGM, this plan has resulted in the indicative

value of KEFI's share of its three main assets having more than

tripled from $154 million in June 2020 to c.$471 million (GBP348

million) in May 2022. This is the result of KEFI raising its

planned interest in Tulu Kapi from 45% to c.70%, making a

significant discovery at Hawiah and now, due to progress with

regulatory approvals, the inclusion of Jibal Qutman. The basis for

these estimates is prevailing metal prices and other explanations

provided in the footnotes below.

From an ownership dilution perspective, successful completion of

the finance plan will necessarily increase issued capital,

hopefully via the exercise of the recently issued warrants at 1.6

pence per share. But ownership dilution will be minimised because

much of the capital is being raised at the project level and some

of the share issues by KEFI will be at prices two and three years

after project finance completion.

Financial Risk Management

In designing the balance sheet senior debt gearing overall, the

senior debt to equity ratio for TKGM is 47%:53% ($140 million:$160

million) excluding equity funded historical pre-development costs

and 37%:63% ($140 million:$240 million) including equity funded

historical pre-development costs.

And in structuring the TKGM project finance, a number of key

parameters had a driving influence on Company policy:

-- The breakeven gold price after debt service is c.$1,107/ounce

(flat) for 10 years, while over the past 10 years the gold

price was under that price for only 2.4% of the time; and

-- At current analyst consensus gold price of $1,641/ounce,

senior debt could be repaid within 2 years of production

start.

It is important that we now proceed to financial completion in

accordance with the latest plans agreed with the Government.

Indeed, the Government has warned of administrative consequences if

we fail to do so and all of our finance syndicate members have made

it clear that they wish to proceed according to plan subject only

to normal safety and compliance procedures.

We have conditionally assembled all of the development finance,

mostly at the project level from our small, efficient and

economical corporate office in Nicosia, Cyprus. Other than our

Nicosia-based financial control/corporate governance team, all

operational staff are based at the sites for project work. This

approach increases efficiency at a lower cost.

Accounting Policy

KEFI writes off all exploration expenditure in Saudi Arabia.

KEFI's carrying value of the investment in KME, which holds the

Company's share of Tulu Kapi is GBP14.3 million as at 31 December

2021. It is important to note KEFI's planned circa.70% beneficial

interest in the underlying valuation of Tulu Kapi is c.GBP191

million based on project NPV at an assumed gold price of

$1,830/ounce and including the underground mine.

In addition, the balance sheet of TKGM at full closing of all

project funding will reflect all equity subscriptions which are

currently estimated to exceed GBP113 million or $156 million

(Ethiopian Birr equivalent).

John Leach

Finance Director

1 June 2022

Footnotes:

-- Long term analysts' consensus forecast is sourced from

CIBC Global Mining Group Analyst Consensus Long Term

Commodity Price Forecasts 30 April 2022.

-- NPV calculations are based on:

Metal prices as at 31 December 2021 of US$1,830/ounce

for gold, $9,750/tonne for copper, $3,590/tonne for

zinc and $23/ounce for silver; and 8% discount rate

applied against net cash flow to equity, after debt

service and after tax.

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF KEFI GOLD AND COPPER

PLC

Opinion on the financial statements

In our opinion:

-- the financial statements give a true and fair view of

the state of the Group's and of the Parent Company's

affairs as at 31 December 2021 and of the Group's loss

for the year then ended;

-- the Group financial statements have been properly prepared

in accordance with UK adopted international accounting

standards;

-- the Parent Company financial statements have been properly

prepared in accordance with UK adopted international

accounting standards and as applied in accordance with

the provisions of the Companies Act 2006; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

We have audited the financial statements of Kefi Gold and Copper

Plc (the 'Parent Company') and its subsidiaries (the 'Group') for

the year ended 31 December 2021 which comprise the consolidated

statement of comprehensive income, the statements of financial

position, the consolidated statement of changes in equity, the

company statement of changes in equity and the consolidated

statement of cash flow, the company statement of cash flows and

notes to the financial statements, including a summary of

significant accounting policies. The financial reporting framework

that has been applied in their preparation is applicable law and UK

adopted international accounting standards and, as regards the

Parent Company financial statements, as applied in accordance with

the provisions of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Independence

We remain independent of the Group and the Parent Company in

accordance with the ethical requirements that are relevant to our

audit of the financial statements in the UK, including the FRC's

Ethical Standard as applied to listed entities, and we have

fulfilled our other ethical responsibilities in accordance with

these requirements.

Material uncertainty relating to going concern

We draw your attention to note 2 of the financial statements

which explains that the Parent Company and the Group's forecasts

indicate that they will require additional funding in Q3 of 2022 to

meet working capital needs and other obligations and that while

there is potential access to short term funding from shareholders

and other alternatives on offer it is currently not committed.

These conditions, along with other matters set out in note 2,

indicate the existence of a material uncertainty which may cast

significant doubt over the Parent Company's and the Group's ability

to continue as a going concern. Our opinion is not modified in

respect of this matter.

In auditing the financial statements, we have concluded that the

Directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. We have

highlighted going concern as a key audit matter as a result of the

estimates and judgements required by the Directors in their going

concern assessment and the effect on our audit strategy. We

performed the following work in response to this key audit

matter:

-- We obtained the Directors' going concern assessment and

supporting forecasts and performed a detailed review of

the cash flow forecasts, challenging the key assumptions

based on empirical data and comparing of historic actual

monthly expenditure.

-- We discussed with the Directors how they intend to raise

the funds necessary for the Group to continue as a going

concern in the required timeframe and considered their

judgement in light of the Group's previous successful

fundraisings and strategic financing. We reviewed agreements

and term sheets from potential investors in connection

with the planned project financing, and documentation

from the potential sources for financing planned for September

2022.

-- We have agreed any projected fund raises to term sheets

and any funds raised since year end to bank, we ensured

these were reflected in the cash flow forecast.

-- We reviewed the adequacy and completeness of the disclosures

in the financial statements in the context of our understanding

of the Group's operations and plans, and the requirements

of the financial reporting framework.

-- We reviewed correspondence with the Ethiopian Ministry

of Mines and the opinion of Kefi's legal advisors, in

order to assess the mining licence validity.

-- We discussed the impact of Covid-19 with management and

the Audit Committee including their assessment of risks

and uncertainties associated with areas such as the Group's

workforce, supply chain that are relevant to the Group's

business model and operations. We compared this against

our own assessment of risks and uncertainties based on

our understanding of the business and sector information.

Our responsibilities and the responsibilities of the Directors

with respect to going concern are described in the relevant

sections of this report.

Overview

99% (2020: 98%) of Group loss before

Coverage tax

100% (2020: 100%) of Group total assets

2021 2020

Carrying value of exploration P P

assets

Going concern P P

Key audit matters

Group financial statements as a whole

Materiality

GBP430k (2020: GBP400k) based on 1.5%

(2020: 1.5%) of total assets

An overview of the scope of our audit

Our Group audit was scoped by obtaining an understanding of the

Group and its environment, including the Group's system of internal

control, and assessing the risks of material misstatement in the

financial statements. We also addressed the risk of management

override of internal controls, including assessing whether there

was evidence of bias by the Directors that may have represented a

risk of material misstatement.

The Group operates through the Parent Company based in the

United Kingdom whose main function is the incurring of

administrative costs and providing funding to the subsidiaries in

Ethiopia as well as one joint venture company in Saudi Arabia. In

addition to the Parent Company, the two Ethiopian subsidiaries are

considered to be significant components, while the Saudi Arabian

joint venture is not considered a significant component. The

financial statements also include a number of non-trading

subsidiary undertakings, as set out in note 13.1, which were

considered to be not significant components.

In establishing our overall approach to the group audit, we

determined the type of work that needed to be performed in respect

of each component. A full scope audit of the Ethiopian subsidiaries

were carried out by a locally based component auditor, which was a

BDO network firm. All significant risks were audited by the BDO

Group audit team.

The joint venture company and the non-trading subsidiaries of

the Group were subject to analytical review procedures performed by

the Group audit team.

Our involvement with component auditors

For the work performed by component auditors, we determined the

level of involvement needed in order to be able to conclude whether

sufficient appropriate audit evidence has been obtained as a basis

for our opinion on the Group financial statements as a whole. Our

involvement with component auditors included the following:

-- Detailed Group reporting instructions were sent to the

component auditor, which included the principal areas to

be covered by the audits, and set out the information to

be reported to the Group audit team.

-- The Group audit team was actively involved in the direction

of the audits performed by the component auditor for Group

reporting purposes, along with the consideration of findings

and determination of conclusions drawn.

-- The Group audit team reviewed the component auditor's work

papers remotely, and engaged with the component auditor

by video calls and emails during their planning, fieldwork

and completion phases.

Key audit matters

Key audit matters are those matters that, in our professional

judgement, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) that we identified, including those which had the greatest

effect on: the overall audit strategy, the allocation of resources

in the audit, and directing the efforts of the engagement team.

These matters were addressed in the context of our audit of the

financial statements as a whole, and in forming our opinion

thereon, and we do not provide a separate opinion on these matters.

In addition to the matter described in the Material uncertainty

related to going concern section of our report, we determined the

following matter to be a key audit matter

Key audit matter How the scope of our

audit addressed the

key audit matter

Carrying Value of The exploration and We considered the indicators

Exploration Assets evaluation assets of impairment applicable

(see note 12) of the Group, as disclosed to the Tulu Kapi exploration

in note 12, represent asset, including those

the key assets for indicators identified

the Group. Costs are in IFRS 6 and reviewed

capitalised in accordance the Directors' assessment

with the requirements of these indicators.

set out in IFRS 6: The following work

'Exploration for and was undertaken:

Evaluation of Mineral

Resources' ("IFRS We reviewed the licence

6"). documentation to confirm

that the exploration

The Directors are permits are valid,

required to assess and to check whether

whether there are there is an expectation

potential indicators that these will be

of impairment for renewed in the ordinary

the Tulu Kapi exploration course of business.

asset and whether

an impairment test We have reviewed correspondence

was required to be with the Ethiopian

performed. No indicators Ministry of Mines for

of impairment to the any conditions regarding

asset were identified, the validity of the

and disclosure to licence.

this effect has been

included in the financial We made specific inquires

statements. of the Directors and

reviewed market announcements,

There are a number budgets and plans which

of estimates and judgements confirms the plan to

used by management continue investment

in assessing the exploration in the Tulu Kapi project

and evaluation assets subject to sufficient

for indicators of funding being available,

impairment under IFRS as disclosed in note

6. These estimates 2.

and judgements are

set out in Note 4 Based on our knowledge

of the financial statements of the Group, we considered

and the subjectivity whether there were

of these estimates any other indicators

along with the material of impairment not identified

carrying value of by the Directors.

the assets make this

a key audit area. We have reviewed the

adequacy of disclosures

provided within the

financial statements

in relation to the

impairment assessment

against the requirements

of the accounting standards.

Key observations:

Based on our work performed

we considered the Directors'

assessment and the

disclosures of the

indicators of impairment

review included in

the financial statements

to be appropriate.

------------------------------ ---------------------------------

Our application of materiality

We apply the concept of materiality both in planning and

performing our audit, and in evaluating the effect of

misstatements. We consider materiality to be the magnitude by which

misstatements, including omissions, could influence the economic

decisions of reasonable users that are taken on the basis of the

financial statements.

In order to reduce to an appropriately low level the probability

that any misstatements exceed materiality, we use a lower

materiality level, performance materiality, to determine the extent

of testing needed. Importantly, misstatements below these levels

will not necessarily be evaluated as immaterial as we also take

account of the nature of identified misstatements, and the

particular circumstances of their occurrence, when evaluating their

effect on the financial statements as a whole.

Based on our professional judgement, we determined materiality

for the financial statements as a whole and performance materiality

as follows:

Group financial statements Parent company financial

statements

2021 2020 2021 2020

GBPk GBPk GBPk GBPk

Materiality 430 400 330 230

Basis for determining 1.5% total assets

materiality

Rationale for We consider total assets to be the financial

the benchmark metric of the most interest to shareholders and

applied other users of the financial statements given

the Group and Parent Company's status as a mining

exploration company and therefore consider this

to be an appropriate basis for materiality.

Performance

materiality 320 300 247 172

Basis for determining 75% of materiality for the financial statements

performance materiality as a whole. This is based on our overall assessment

of the control environment and the low level

of expected misstatements.

Component materiality

We set materiality for each significant component of the Group

based on 1.5% total assets (2020: 1.5%), based on the size and our

assessment of the risk of material misstatement of that component.

Component materiality was set at GBP280k (2020: GBP230k). In the

audit of each component, we further applied performance materiality

levels of 75% (2020: 75%) of the component materiality to our

testing to ensure that the risk of errors exceeding component

materiality was appropriately mitigated.

Reporting threshold

We agreed with the Audit Committee that we would report to them

all individual audit differences in excess of GBP21k (2020:

GBP20k). We also agreed to report differences below this threshold

that, in our view, warranted reporting on qualitative grounds.

Other information

The directors are responsible for the other information. The

other information comprises the information included in the annual

report other than the financial statements and our auditor's report

thereon. Our opinion on the financial statements does not cover the

other information and, except to the extent otherwise explicitly

stated in our report, we do not express any form of assurance

conclusion thereon. Our responsibility is to read the other

information and, in doing so, consider whether the other

information is materially inconsistent with the financial

statements or our knowledge obtained in the course of the audit, or

otherwise appears to be materially misstated. If we identify such

material inconsistencies or apparent material misstatements, we are

required to determine whether this gives rise to a material

misstatement in the financial statements themselves. If, based on

the work we have performed, we conclude that there is a material

misstatement of this other information, we are required to report

that fact.

We have nothing to report in this regard.

Other Companies Act 2006 reporting

Based on the responsibilities described below and our work

performed during the course of the audit, we are required by the

Companies Act 2006 and ISAs (UK) to report on certain opinions and

matters as described below.

Strategic In our opinion, based on the work undertaken in the

report and course of the audit:

Directors' * the information given in the Strategic report and the

report Directors' report for the financial year for which

the financial statements are prepared is consistent

with the financial statements; and

* the Strategic report and the Directors' report have

been prepared in accordance with applicable legal

requirements.

* In the light of the knowledge and understanding of

the Group and Parent Company and its environment

obtained in the course of the audit, we have not

identified material misstatements in the strategic

report or the Directors' report.

Matters on We have nothing to report in respect of the following

which we are matters in relation to which the Companies Act 2006

required to requires us to report to you if, in our opinion:

report by * adequate accounting records have not been kept by the

exception Parent Company, or returns adequate for our audit

have not been received from branches not visited by

us; or

* the Parent Company financial statements are not in

agreement with the accounting records and returns; or

* certain disclosures of Directors' remuneration

specified by law are not made; or

* we have not received all the information and

explanations we require for our audit.

Responsibilities of Directors

As explained more fully in the Statement of Directors'

Responsibilities, the Directors are responsible for the preparation

of the financial statements and for being satisfied that they give

a true and fair view, and for such internal control as the

Directors determine is necessary to enable the preparation of

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the Directors are

responsible for assessing the Group's and the Parent Company's

ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the going concern basis

of accounting unless the Directors either intend to liquidate the

Group or the Parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Extent to which the audit was capable of detecting

irregularities, including fraud

We obtained an understanding of the legal and regulatory

frameworks that are applicable to the Company. We determined that

the most significant which are directly relevant to specific

assertions in the financial statements are those related to the

reporting framework (UK adopted international accounting standards,

the Companies Act 2006. AIM rules and the QCA Corporate Governance

Code), and terms and requirements included in the Group's

exploration and evaluation licenses. Our procedures included:

-- We understood how the Company is complying with those legal

and regulatory frameworks by making enquiries to the Directors,

and those responsible for legal and compliance procedures.

We corroborated our enquiries through our review of board

minutes and other supporting documentation.

-- We also communicated relevant identified laws and regulations

and potential fraud risks to all engagement team members

and remained alert to any indications of fraud or non-compliance

with laws and regulations throughout the audit.

-- Directing the component auditor to ensure an assessment

is performed on the extent of the components' compliance

with the relevant local and regulatory framework. Reviewing

this work and holding meetings with relevant Directors

to form our own opinion on the extent of Group wide compliance

-- Reviewing minutes from board meetings of those charges

with governance to identify any instances of non-compliance

with laws and regulations

We have considered the potential for material misstatement in

the financial statements, including misstatement arising from fraud

and considered that the areas in which fraud might occur were

management override and missapropriation of cash. Our procedures to

respond to these risks included:

-- We made enquiries of Management and the Board into any

actual or suspected instances of fraud.

-- Testing the appropriateness of journal entries made through

the year by applying specific criteria to detect possible

irregularities and fraud;

-- Performing a detailed review of the Group's year end adjusting

entries and investigating any that appear unusual as to

nature or amount and agreeing to supporting documentation;

-- For significant and unusual transactions, particularly

those occurring at or near year end, obtaining evidence

for the rationale of these transactions and the sources

of financial resources supporting the transactions;

-- Assessed whether the judgements made in accounting estimates

were indicative of a potential bias (refer to key audit

matters above); and

Our audit procedures were designed to respond to risks of

material misstatement in the financial statements, recognising that

the risk of not detecting a material misstatement due to fraud is

higher than the risk of not detecting one resulting from error, as

fraud may involve deliberate concealment by, for example, forgery,

misrepresentations or through collusion. There are inherent

limitations in the audit procedures performed and the further

removed non-compliance with laws and regulations is from the events

and transactions reflected in the financial statements, the less

likely we are to become aware of it.

A further description of our responsibilities is available on

the Financial Reporting Council's website at:

www.frc.org.uk/auditorsresponsibilities . This description forms

part of our auditor's report.

Use of our report

This report is made solely to the Parent Company's members, as a

body, in accordance with Chapter 3 of Part 16 of the Companies Act

2006. Our audit work has been undertaken so that we might state to

the Parent Company's members those matters we are required to state

to them in an auditor's report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Parent Company and the

Parent Company's members as a body, for our audit work, for this

report, or for the opinions we have formed.

Jack Draycott (Senior Statutory Auditor)

For and on behalf of BDO LLP, Statutory Auditor

London, United Kingdom

1 June 2022

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended 31 December 2021

Notes Year Ended Year Ended

31.12.21 31.12.20

GBP'000 GBP'000

Revenue - -

Exploration costs - (25)

Administrative expenses 6 (2,190) (2,365)

Finance transaction costs 8.2 (84) (316)

Share-based payments and warrants-equity settled 18 (810) (51)

Share of loss from jointly controlled entity 20 (1,482) (1,088)

Impairment of jointly controlled entity 20 418 (585)

------------ ------------

Operating loss 6 (4,148) (4,430)

Change in value of financial assets at fair value through profit and loss 14 - (16)

Other (loss)/income (75) 140

Gain on Dilution of Joint Venture 20 428 1,033

Foreign exchange loss (8) (347)

Finance costs 8.1 (1,121) (100)

------------ ------------

Loss before tax (4,924) (3,720)

Tax 9 - -

------------ ------------

Loss for the year (4,924) (3,720)

Loss attributable to:

-Owners of the parent (4,924) (3,720)

Loss for the period (4,924) (3,720)

Other comprehensive expense:

Exchange differences on translating foreign operations - -

Total comprehensive expense for the year (4,924) (3,720)

Total Comprehensive Income to:

------------ ------------

-Owners of the parent (4,924) (3,720)

------------ ------------

Basic diluted loss per share (pence) 10 (0.226) (0.224)

The notes are an integral part of these consolidated financial

statements.

STATEMENTS OF FINANCIAL POSITION

31 December 2021

The The The Restated Restated

The The

Group Company Group Company Company

Notes 2021 2021 2020 2020 1 Jan 2020

--------- --------- --------- --------- -----------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non--current assets

Property, plant

and equipment 11 63 1 35 3 3

Intangible assets 12 28,361 - 24,510 - -

Investment in subsidiaries 13.1 - 14,331 - 13,680 12,575

Investments in jointly 13.2 - - - - -

controlled entities

Receivables from

subsidiaries 15.2 - 7,292 - 6,262 5,813

28,424 21,624 24,545 19,945 18,391

--------- --------- --------- --------- -----------

Current assets

Financial assets

at fair value through

OCI 14 - - 54 - -

Trade and other

receivables 15.1 291 24 448 338 1,154

Cash and cash equivalents 16 394 149 1,315 1,192 65

--------- --------- --------- --------- -----------

685 173 1,817 1,530 1,219

--------- --------- --------- --------- -----------

Total assets 29,109 21,797 26,362 21,475 19,610

--------- --------- --------- --------- -----------

EQUITY AND LIABILITIES

Equity attributable

to owners of the

Company

Share capital 17 2,567 2,567 2,138 2,138 1.149

Deferred Shares 17 23,328 23,328 23,328 23,328 23,328

Share premium 17 35,884 35,884 33,118 33,118 25,452

Share options reserve 18 1,891 1,891 1,273 1,273 1,118

Accumulated losses (42,731) (47,310) (37,824) (40,736) (36,265)

--------- --------- --------- --------- -----------

Attributable to

Owners of parent 20,939 16,360 22,033 19,121 14,782

Non-Controlling

Interest 19 1,379 - 1,204 - -

--------- --------- --------- --------- -----------

Total equity 22,318 16,360 23,237 19,121 14,782

Current liabilities

Trade and other

payables 21 5,556 4,202 3,125 2,354 3,864

Loan and borrowings 23 1,235 1,235 - 964

--------- --------- --------- --------- -----------

Total liabilities 6,791 5,437 3,125 2,354 4,828

--------- --------- --------- --------- -----------

Total equity and

liabilities 29,109 21,797 26,362 21,475 19,610

--------- --------- --------- --------- -----------

The notes are an integral part of these consolidated financial

statements.

The Company has taken advantage of the exemption conferred by

section 408 of Companies Act 2006 from presenting its own statement

of comprehensive income. Loss after taxation amounting to GBP6.8

million (2020: GBP5.1 million) has been included in the financial

statements of the parent company.

On the 1 June 2022, the Board of Directors of KEFI Gold and

Copper PLC authorised these financial statements for issue.

Harry Anagnostaras-Adams John Edward Leach

Executive Director- Chairman Finance Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Year ended 31 December 2021

Attributable to the owners of the Company

----------------------------------------------------------------------------------- -------- --------

Share Deferred Share Share Foreign Accum. Owners NCI Total

capital shares premium options exch losses Equity

reserve reserve

---------- ----------- --------- ---------- ------------ ---------- --------- -------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2020 1,149 23,328 25,452 1,118 - (34,640) 16,407 1,075 17,482

Loss for the

year - - - - - (3,720) (3,720) - (3,720)

Total

Comprehensive

Income - - - - - (3,720) (3,720) - (3,720)

Recognition of

share-based

payments - - - 53 - - 53 - 53

Expired warrants - - - (665) - 665 - - -

Issue of share

capital 989 - 8,056 767 - - 9,812 - 9,812

Share issue

costs - - (390) - - - (390) - (390)

Non-controlling

interest - - - - - (129) (129) 129 -

---------- ----------- --------- ---------- ------------ ---------- --------- -------- --------

At 31 December

2020 2,138 23,328 33,118 1,273 - (37,824) 22,033 1,204 23,237

Loss for the

year - - - - - (4,924) (4,924) - (4,924)

Other - - - - - - - - -

comprehensive

income

---------- ----------- --------- ---------- ------------ ---------- --------- -------- --------

Total

Comprehensive

Income - - - - - (4,924) (4,924) - (4,924)

Recognition of

share-based

payments - - - 810 - - 810 - 810

Expired warrants - - - (192) - 192 - - -

Issue of share

capital

and warrants 429 - 2,985 - - - 3,414 - 3,414

Share issue

costs - - (219) - - - (219) - (219)

Non-controlling

interest - - - - - (175) (175) 175 -

At 31 December

2021 2,567 23,328 35,884 1,891 - (42,731) 20,939 1,379 22,318

---------- ----------- --------- ---------- ------------ ---------- --------- -------- --------

The following describes the nature and purpose of each reserve

within owner's equity:

Reserve Description and purpose

Share capital: (Note 17) amount subscribed for ordinary share capital at nominal value

Deferred shares: (Note 17) under the restructuring of share capital, ordinary shares of in the capital

of the Company

were sub-divided into deferred share.

Share premium: (Note 17) amount subscribed for share capital in excess of nominal value, net of

issue costs

Share options reserve (Note 18) reserve for share options and warrants granted but not exercised or lapsed

Foreign exchange reserve cumulative foreign exchange net gains and losses recognized on

consolidation

Accumulated losses Cumulative net gains and losses recognized in the statement of

comprehensive income,

excluding foreign exchange gains within other comprehensive income

NCI (Non-controlling interest): (Note 19) the portion of equity ownership in a subsidiary not attributable to the

parent company

The notes are an integral part of these consolidated financial

statements.

COMPANY STATEMENT OF CHANGES IN EQUITY

Year ended 31 December 2021

Share capital Deferred Share Share Accumulated Total

shares premium options losses

reserve

------------- --------- --------- --------- ------------ ------------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 1,149 23,328 25,452 1,118 (36,265) 14,782

Loss for the year - - - - (5,136) (5,136)

Deferred Shares - - - - - -

Recognition of share-based

payments - - - 53 - 53

Forfeited options - - - - - -

Expired warrants - - - (665) 665 -

Issue of share capital 989 - 8,056 767 - 9,812

Share issue costs - - (390) - - (390)

------------- --------- --------- --------- ------------ ------------------

At 31 December 2020 2,138 23,328 33,118 1,273 (40,736) 19,121

Loss for the year - - - - (6,766) (6,766)

Recognition of share-based

payments - - - 810 - 810

Forfeited options - - - - - -

Expired warrants - - - (192) 192 -

Issue of share capital

and warrants 429 - 2,985 - - 3,414

Share issue costs - - (219) - - (219)

------------- --------- --------- --------- ------------ ------------------

At 31 December 2021 2,567 23,328 35,884 1,891 (47,310) 16,360

------------- --------- --------- --------- ------------ ------------------

The following describes the nature and purpose of each reserve

within owner's equity:

Reserve Description and purpose

Share capital (Note 17) amount subscribed for ordinary share

capital at nominal value

Deferred shares: (Note under the restructuring of share capital,

17) ordinary shares of in the capital of

the Company were sub-divided into deferred

share (Note 17).

Share premium: (Note amount subscribed for share capital

17) in excess of nominal value, net of issue

costs

Share options reserve: reserve for share options and warrants

(Note 18) granted but not exercised or lapsed

Accumulated losses cumulative net gains and losses recognized

in the statement of comprehensive income

The notes are an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

Year ended 31 December 2021

Notes Year Year Ended

Ended 31.12.20

31.12.21 GBP'000

GBP'000

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax (4,924) (3,720)

Adjustments for:

Depreciation of property, plant and equipment 11 17 43

Share based payments 18 - 624

Issue of options 18 810 51

Fair value loss to derivative financial asset 14 - 16

Gain on Dilution of Joint Venture 20.1 (428) (1,033)

Share of loss from jointly controlled entity 20 1,482 1,088

Impairment on jointly controlled entity 20 (418) 585

Exchange difference 159 244

Finance costs 8.1 1,121 100

----------- -------------

(2,181) (2,002)

Changes in working capital:

Trade and other receivables (75) (123)

Trade and other payables 806 (67)

----------- -------------

Cash used in operations (1,450) (2,192)

Interest paid - -

----------- -------------

Net cash used in operating activities (1,450) (2,192)

----------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES

Project exploration and evaluation costs 12 (2,508) (3,029)

Acquisition of property plant and equipment 11 (46) (40)

Proceeds from sale of financial assets at

fair value through OCI 14 54 -

Advances to jointly controlled entity 13.2 (510) (1,320)

----------- -------------

Net cash used in investing activities (3,010) (4,389)

----------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of share capital 17 1,045 7,331

Issue costs 17 (219) (335)

Proceeds from bridge loans 23.1.2 2,713 750

Repayment of convertible notes and bridge 23.1.2 - -

loans

----------- -----------

Net cash from financing activities 3,539 7,746

----------- -----------

Net increase/(decrease) in cash and cash

equivalents (921) 1,165

Cash and cash equivalents:

At beginning of the year 16 1,315 150

----------- -------------

At end of the year 16 394 1,315

----------- -------------

Cash and cash equivalents in the Consolidated Statement of

Financial Position includes restricted cash of GBP20,000 (2020:

GBP20,000).

The notes are an integral part of these consolidated financial

statements.

COMPANY STATEMENT OF CASHFLOWS

Year ended 31 December 2021

Notes Year Ended Year Ended

31.12.21 31.12.20

GBP'000 GBP'000

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax (6,763) (5,136)

Adjustments for:

Depreciation of property plant equipment 2 2

Share based payments 18 - 624

Issue of options 18 810 51

Gain on Dilution of Joint Venture 20.1 (428) (1,033)

Share of loss from jointly controlled entity 20 1,482 1,088

Impairment on jointly controlled entity 20 (418) 585

Exchange difference 1,767 1,845

Expected credit loss 43 18

Finance costs 1,121 100

--------------- -----------------

(2,384) (1,856)

Changes in working capital:

Trade and other receivablesss 82 (91)

Trade and other payables 1,562 (174)

--------------- -----------------

Cash used in operations (740) (2,121)

Interest Paid - -

--------------- -----------------

Net cash used in operating activities (740) (2,121)

--------------- -----------------

CASH FLOW FROM INVESTING ACTIVITIES

Acquisition of property plant and equipment - (2)

Investment in subsidiary 13.1 (651) (1,104)

Advances to jointly controlled entity 13.2 (510) (1,320)

Loan to subsidiary 15 (2,684) (2,069)

--------------- -----------------

Net cash used in investing activities (3,845) (4,495)

--------------- -----------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of share capital 17 1,045 7,331

Issue costs 17 (219) (335)

Proceeds from bridge loans 23.1.2 2,713 750

Repayment of convertible notes and bridge loans 23.1.2 - -

--------------- -----------------

Net cash from financing activities 3,539 7,746

--------------- -----------------

Net increase/(decrease) in cash and cash equivalents (1,046) 1,130

Cash and cash equivalents:

At beginning of the year 16 1,195 65

--------------- -----------------

At end of the year 16 149 1,195

--------------- -----------------

Cash and cash equivalents in the Company Statement of Financial

Position includes restricted cash of GBP20,000 (2020:

GBP20,000).

The notes are an integral part of these consolidated financial

statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Year ended 31 December 2021

1. Incorporation and principal activities

Country of incorporation

KEFI Gold and Copper PLC (the "Company") was incorporated in

United Kingdom as a public limited company on 24 October 2006. Its

registered office is at 27/28, Eastcastle Street, London W1W

8DH.The principal place of business is Cyprus.

Principal activities

The principal activities of the Group for the year were:

-- Exploration for mineral deposits of precious and base metals

and other minerals that appear capable of commercial exploitation,

including topographical, geological, geochemical and geophysical

studies and exploratory drilling.

-- Evaluation of mineral deposits determining the technical

feasibility and commercial viability of development, including

the determination of the volume and grade of the deposit,

examination of extraction methods, infrastructure requirements

and market and finance studies.

-- Development of mineral deposits and marketing of the metals

produced.

2. Accounting policies

The principal accounting policies adopted in the preparation of

these financial statements are set out below. These policies have

been consistently applied throughout both periods presented in

these financial statements unless otherwise stated.

Basis of preparation and consolidation

The Company and the consolidated financial statements have been

prepared in accordance with UK adopted international accounting

standardsin conformity with the requirements of the Companies Act

2006. They comprise the accounts of KEFI Gold and Copper PLC and

all its subsidiaries made up to 31 December 2021. The Company and

the consolidated financial statements have been prepared under the

historical cost convention, except for the revaluation of certain

financial instruments.

Business combinations

Business combinations are accounted for using the acquisition

method as at the acquisition date. Subsidiaries are all entities

over which the Group has power to direct relevant activities and an

exposure to variable returns. Subsidiaries are fully consolidated

from the date on which control is transferred to the Group. They

are de-consolidated from the date that control ceases

When the excess is positive, goodwill is recognised in the

statement of financial position, if the excess is negative, a

bargain purchase price is recognised in profit or loss.

Transaction costs, other than those associated with the issue of

debt or equity securities, that the Group incurs in connection with

a business combination are expensed as incurred.

Any contingent consideration payable is measured at fair value

at the acquisition date. If the contingent consideration is

classified as equity, then it is not re-measured and settlement is

accounted for within equity. Otherwise, subsequent changes in the

fair value of the contingent consideration are recognised in profit

or loss.

Subsidiaries

Subsidiaries are entities controlled by the Group. The financial

statements of subsidiaries have been included in the consolidated

financial statements from the date that control commences until the

date that control ceases.

An investor controls an investee if and only if the investor has

all the following:

An investor controls an investee when it is exposed, or has

rights, to variable returns from its involvement with the investee

and has the ability to affect those returns through its power over

the investee.

(a) power over the investee;

(b) exposure, or rights, to variable returns from its

involvement with the investee; and

(c) the ability to use its power over the investee to affect the

amount of the investor's returns.

Transactions eliminated on consolidation

Intra-group balances and transactions, and any income and

expenses arising from intra-group transactions, are eliminated in

preparing the consolidated financial statements.

Going concern

The assessment of the Group's ability to continue as a going

concern involves judgment regarding future funding available for

the development of the Tulu Kapi Gold project, advancement of the

Saudi Arabia exploration properties and for working capital

requirements. As part of this assessment, management have

considered funds on hand at the date of approval of the financial

statements, planned expenditures covering a period of at least 12

months from the date of approving these financial statements and

its suitability in the context of the Group's long term strategic

objectives. The Group also recognises that within the going concern

consideration period it will require funding for its share of the

construction development costs of the Tulu Kapi mine (Further

details on project financing plan are summarised on page 6 of the

Finance Director's Report).

TKGM reactivated Tulu Kapi project launch preparations in early

2022 and funding requirements and project timing could be impacted

by security concerns in Ethiopia. Ethiopia's Ministry of Mines has

been formally advised that the overall project progress is on

schedule and will remain so subject to a satisfactory ongoing

security situation. The Tulu Kapi project financing syndicate's

arrangements are being formalised and definitive agreements are in

preparation. Subject to these agreements and remaining regulatory

and administrative tasks being completed promptly, full

construction can proceed from as early as October 2022, being the

end of the current wet season. Early preparatory works have

commenced, including the regulatory and administrative tasks

include items such as government and central bank approval,

endorsement of historical costs, working rules for the London

clearing account to avoid restrictions of capital controls and

clearance for both banks to lend on same terms. However, such tasks

and approvals are not yet finalised.

At the date of approval of these accounts, the Group has a cash

balance of GBP2.5 million with no debt and all creditors under

normal trading terms. The forecasts show that absent the reduction

of planned expenditure, the Group will require additional funding

in Q3 2022 to meet working capital needs and other obligations.

Should this precede financial close (ie full funding) of the Tulu

Kapi Gold Project, the Company has potential access to short term

funding from shareholders and other alternatives on offer, but

currently not committed, as has been the case in the past.

Accordingly, and as set out above, this indicates the existence

of a material uncertainty which may cast significant doubt over the

Group and Company's ability to continue as a going concern and,

therefore, it may be unable to realise its assets and discharge its

liabilities in the normal course of business. Based on historical

experience and current ongoing proactive discussions with

stakeholders, the Board has a reasonable expectation that

definitive binding agreements will be signed. Accordingly, the

Board has a reasonable expectation that the Group will be able to

continue to raise funds to meet its objectives and obligations.

The financial statements therefore do not include the

adjustments that would result if the Group was unable to continue

as a going concern.

Presentational changes and prior period adjustment

Identified a prior period adjustment in relation to the

reclassification of part of an intercompany receivable from current

to non-current. As per IAS 1, part of the intercompany receivable

should have been classified as non-current as it was not expected

to be recovered in the next 12 months. This will have an impact on

the total non-current assets and current assets figure on the

company accounts but has no impact on the group statement of

financial position. In addition, this adjustment has no impact on

overall net assets or profit of the Company and the Group. The

impact on the Company's financial position as at 1 January 2020 and

31 December 2020 is as follows:

Company Statement of Adjustment to recognise Restated

Financial Position. reclassification

of intercompany receivable

31.12.2020 31.12.2020

GBP'000 GBP'000 GBP'000

----------- ---------------------------- -----------

Impact of Adjustment

on Company Non-Current

Assets and Current Assets

----------- ---------------------------- -----------

Company Non-current

assets

Receivables from subsidiaries - 6,262 6,262

----------- ---------------------------- -----------

Company Current assets

Trade and other receivables 6,600 (6,262) 338

----------- ---------------------------- -----------

01.01.2020 01.01.2020

----------- ---------------------------- -----------

Company Non-current

assets- Receivables from

subsidiaries - 5,813 5,813

----------- ---------------------------- -----------

Company Current assets

Trade and other receivables 6,967 (5,813) 1,154

----------- ---------------------------- -----------

Functional and presentation currency

The individual financial statements of each Group entity are

measured and presented in the currency of the primary economic

environment in which the entity operates. The consolidated

financial statements of the Group and the statement of financial

position and equity of the Company are in British Pounds ("GBP")

which is the functional currency of the Company and the

presentation currency for the consolidated financial statements.

Functional currency is also determined for each of the Company's

subsidiaries, and items included in the financial statements of the

subsidiary are measured using that functional currency. GBP is the

functional currency of all subsidiaries.

(1). Foreign currency translation

Foreign currency transactions are translated into the

presentational currency using the exchange rates prevailing at the

date of the transactions. Gains and losses resulting from the

settlement of such transactions and from the translation of

monetary assets and liabilities denominated in foreign currencies

are recognized in profit or loss in the statement of comprehensive

income.

(2). Foreign operations

On consolidation, the assets and liabilities of the consolidated

entity's foreign operations are translated at exchange rates

prevailing at the reporting date. Income and expense items are

translated at the average exchange rates for the period unless

exchange rates fluctuate significantly in which case they are

recorded at the actual rate. Exchange differences arising, if any,

are recognized in the foreign currency translation reserve and as a

component of other comprehensive income, and recognized in profit

or loss on disposal of the foreign operation.

Revenue recognition

The Group had no sales or revenue during the year ended 31

December 2021 (2020: Nil).

Property plant and equipment

Property plant and equipment are stated at their cost of

acquisition at the date of acquisition, being the fair value of the

consideration provided plus incidental costs directly attributable

to the acquisition less depreciation.

Depreciation is calculated using the straight-line method to

write off the cost of each asset to their residual values over

their estimated useful life.

Property plant and equipment

The annual depreciation rates

used are as follows:

Furniture, fixtures and office

equipment 25%

Motor vehicles 25%

Plant and equipment 25%

Intangible Assets

Cost of licenses to mines are capitalised as intangible assets

which relate to projects that are at the pre-development stage. No

amortisation charge is recognised in respect of these intangible

assets. Once the Group starts production these intangible assets

relating to license to mine will be depreciated over life of

mine.

Interest in jointly controlled entities

The group is a party to a joint arrangement when there is a

contractual arrangement that confers joint control over the

relevant activities of the arrangement to the group and at least

one other party. Joint control exists where unanimous consent is

required over relevant decisions.

The group classifies its interests in joint arrangements as

either:

- Joint ventures: where the group has rights to only the

net assets of the joint arrangement

- Joint operations: where the group has both the rights

to assets and obligations for the liabilities of the joint

arrangement.

In assessing the classification of interests in joint

arrangements, the Group considers:

-- The structure of the joint arrangement

-- The legal form of joint arrangements structured through

a separate vehicle

-- The contractual terms of the joint arrangement agreement

-- Any other facts and circumstances (including any other

contractual arrangements).

The Group accounts for its interests in joint ventures using the

equity method. The Group accounts for its interests in joint

operations by recognising its share of assets, liabilities, and

expenses in accordance with its contractually conferred rights and

obligations.

Finance costs

Interest expense and other borrowing costs are charged to the

statement of comprehensive income as incurred and is recognised

using the effective interest method.

Tax

The tax payable is based on taxable profit for the period.

Taxable profit differs from net profit as reported in the statement

of comprehensive income because it excludes items of income or

expense that are taxable or deductible in other years and it

further excludes items that are never taxable or deductible. Tax is

payable in the relevant jurisdiction at the rates described in note

9.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit and is accounted for using the

statement of financial position liability method. Deferred tax

liabilities are generally recognized for all taxable differences

and deferred tax assets are recognized to the extent that taxable

profits will be available against which deductible temporary

differences can be utilized. The amount of deferred tax is based on

the expected manner of realisation or settlement of the carrying

amounts of assets and liabilities, using tax rates that have been

enacted or substantively enacted at the reporting date.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off deferred tax assets against

deferred tax liabilities and when the deferred taxes relate to the

same fiscal authority.

Investments

Investments in subsidiary companies are stated at cost less

provision for impairment in value, which is recognized as an

expense in the period in which the impairment is identified, in the

Company accounts.

Exploration costs

The Group has adopted the provisions of IFRS 6 "Exploration for

and Evaluation of Mineral Resources". The company still applies

IFRS 6 until the project financing is secured. Once financing is

secured the project moves to the development stage.

Exploration and evaluation expenditure, including acquisition

costs of licences, in respect of each identifiable area of interest

is expensed to the statement of comprehensive income as incurred,

until the point at which development of a mineral deposit is

considered economically viable and the formal definitive

feasibility study is completed. At this point costs incurred are

capitalised under IFRS 6 because these costs are necessary to bring

the resource to commercial production.

Exploration expenditures typically include costs associated with

prospecting, sampling, mapping, diamond drilling and other work

involved in searching for ore. Evaluation expenditures are the

costs incurred to establish the technical and commercial viability

of developing mineral deposits identified through exploration

activities. Evaluation expenditures include the cost of directly

attributable employee costs and economic evaluations to determine

whether development of the mineralized material is commercially

justified, including definitive feasibility and final feasibility

studies.

Impairment reviews for deferred exploration and evaluation

expenditure are carried out on a project by project basis, with

each project representing a potential single cash generating unit.

An impairment review is undertaken when indicators of impairment

arise such as: (i) unexpected geological occurrences that render

the resource uneconomic; (ii) title to the asset is compromised;

(iii) variations in mineral prices that render the project

uneconomic; (iv) substantive expenditure on further exploration and

evaluation of mineral resources is neither budgeted nor planned;

and (v) the period for which the Group has the right to explore has