TIDMMCON

RNS Number : 5703I

Mincon Group Plc

08 August 2023

Mincon Group plc

("Mincon" or the "Group")

2023 Half Year Financial Results

Mincon Group plc (Euronext:MIO AIM:MCON), the Irish engineering

group specialising in the design, manufacture, sale and servicing

of rock drilling tools and associated products, announces its half

year results for the six months ended 30 June 2023.

H1 2023 Key Financial Highlights:

H1 2023 H1 2022

------------------------------------------------- --------------- ---------------

* Revenue EUR80.6 million EUR85.1 million

* Of which Mincon manufactured product EUR67.2 million EUR70.9 million

* Of which Non-Mincon manufactured product EUR13.4 million EUR14.2 million

* Gross Profit EUR25.6 million EUR27.1 million

* EBITDA EUR11.8 million EUR12.7million

* Operating Profit EUR7.8 million EUR8.8 million

Joe Purcell, Chief Executive Officer, commenting on the results,

said:

"H1 2023 has been a challenging period for Mincon with our

revenue behind the same period in the prior year, primarily due to

a shortfall in our sales to the mining industry and FX headwinds.

This performance in the sector is down to several factors but

mainly due to reduced exploration activity and certain larger

customers taking advantage of improved freight conditions to reduce

inventories. We are, however, working on regaining some of this

revenue with some positive drilling results from customer testing

that we are doing in all our regions, most notably in APAC.

In positive news, it is very pleasing to see that we have

consolidated the gains we made last year in the construction

sector, and more importantly, the revenue mix includes a higher

proportion of smaller projects, which gives a more sustainable

spread to the business. It is notable that there continues to be a

strong pipeline of large projects that we are looking to land in H2

and beyond. Our sales into the water well/geothermal well drilling

market are up, driven by gains in EME and the Americas.

As a result of the lower mining revenues, we have looked closely

at our costs and have taken selective, targeted action to reduce

costs where appropriate. The results of this cost reduction

exercise will be seen in H2, which should help us to recover

margins. In July, we announced the appointment of Tom Purcell to

the role of COO for the Group. Most recently, Tom has been leading

a project to reduce our inventories across the Group and we are

pleased to report that we have started to make good progress in

this area.

I am pleased to report that our sustainability report for 2022

will be published in conjunction with these results. This will show

that we have achieved initial progress on our ambitious goals to

reduce scope 1 and 2 emissions. It also indicates that our biggest

challenge and opportunity to reduce emissions is around the end-use

of our products. This has been well known to us for many years and

is what has driven our ambition and engineering innovations to

focus on the drilling efficiency of our products, whether it be

through increased rate of drilling, longer product life or

reliability.

These attributes are particularly noticeable with some of the

new product develpoment projects that we have been working on, such

as our Greenhammer system. We have engaged with a major rig

manufacturer on a collaboration to prove out the system by

converting one of their rigs and testing it at a location in the

US. This is an attractive location as the largest rig population

suitable for conversion to Greenhammer is in this market. Another

attractive feature of this collaboration is the service footprint

that we both have in this market. We remain heavily focused on

getting the system running in Western Australia and expect the

system to return to operation in the coming month at the gold mine

where we have been carrying out drilling in recent months.

Another project which can deliver positive efficiency gains is

our large hammer and bit project that we have been testing in

Malaysia. We have had excellent performance figures when it has

been run and we have been onsite a number of times to see the

system in action. We see a great opportunity to push this out to

the large diameter drilling market to replace incumbent systems

that have much lower productivity with resulting higher

emissions.

Our Subsea project has been gathering momentum and at our recent

AGM we made a presentation to assembled shareholders and guests in

conjunction with our collaboration partners, Subsea Micropiles. We

had very positive feedback from this event, and we have commenced

the assembly of the subsea rig at our facility in Shannon. We are

working hard to have the subsea testing underway within the next

six months. There remains an enormous opportunity for Mincon with

this exciting project on the successful completion of our

collaboration with Subsea Micropiles and our University

partners.

These transformational product development projects as well as

the continuous improvement initiatives we are engaged in across our

product lines give us confidence about the future of our business.

To ensure we are adequately positioned to capitalise on these

opportunities, we invested a further EUR4.3 million in property,

plant and equipment during the period, which includes a step-change

in efficiency gains with a new heat treatment facility at our

Shannon plant. This will be followed up with the commissioning of a

new manufacturing building at our Shannon site and installing

purpose-built robotic machining cells in the extension to cater for

the growth opportunities we see.

Conclusion

While the first half of 2023 has been challenging, we are

confident that our focus on the efficiency of our production

facilities but, more importantly, the efficient products we have

today as well as those in development, will ensure that we can grow

and thrive in the longer term.

In the short term we expect to deliver revenue growth in H2,

while also realising the benefits of our cost reduction program to

deliver a much improved margin in H2 2023 over H1 2023. We are also

confident that we will continue with the progress we are making on

inventory reduction in H2 2023. I feel privileged to work with the

global Mincon team and look forward to delivering on the platform

that we have created."

Joseph Purcell

Chief Executive Officer

Key financial commentary

Market Industries and Product Mix

Revenue in the first half of 2023 contracted by 5%, due to a

decrease in our mining industry revenue and currency headwinds.

Foreign exchange movements represented 3% of the reduction in

reported revenue, most notably due to the South African Rand

weakening during Q2 2023.

Industry mix (by revenue)

H1 2023 H1 2022

* Mining 43% 48%

* Construction 39% 37%

* Waterwell / Geothermal 18% 15%

Our revenue from the mining industry contracted by 15% during

the period, with revenues down in three out of our four geographic

regions. The largest contraction in our mining revenue was in the

Europe & Middle East region, down 72% versus the same period in

the prior year. We have received fewer orders from one large

customer in this region due to their inventory reduction strategy.

Since the beginning of the war in Ukraine, emerging mining

opportunities for the Group in Eastern Europe and further East into

Asia, have unfortunately been significantly affected, a

disappointing result given we had been making positive traction in

the mining industry in those areas in recent years.

Our mining revenue in Africa contracted by 11%, however this has

mostly been driven by the weakening in the South African Rand

during the period. Excluding FX impacts, our Africa region business

contracted by 1% in the period due mainly to reduced activity in

the exploration sector. Mining in our APAC region also contracted

in the period and is behind H1 2022 revenue by 22%.

Our revenue in the construction industry was flat during the

period, however this has been on the back of significant growth in

this industry, year on year, since 2019. The Americas region, where

we have seen the largest growth in this industry over the last few

years, contracted by 2% in this period, due to the absence of any

new large construction project and FX headwinds. The focus during

H1 2023 has been on winning smaller projects as they provide the

Group with a steadier income stream and reduced complexity in

controlling working capital. Large construction projects will

remain an important part in our construction growth however, and

there continues to be a healthy pipeline of projects which we will

selectively target.

Our Europe & Middle East region had construction revenue

growth of 8% during the period, this has been due to our expanded

footprint in Northern Europe. Our other regions are continuing to

develop the industry for our products.

Our revenue in the waterwell/geothermal industry grew by 10% in

the period. We experienced positive growth in North America and

Northern Europe where we earn the vast majority of our revenue in

this industry.

Earnings

Our earnings have been impacted due to lower revenue earned in

the period, though our gross margin percentage is consistent with

H1 2022. This is due to price increases that were implemented in H2

2022, and measures taken to protect our margins during this

reported period.

In line with our inventory reduction ambitions, we have

decreased our manufacturing output in H1 2023 versus the same

period in the prior year. However, our margins have been

temporarily impacted as a result.

Decreased revenue together with our inventory reduction program

has had an impact on our gross margin versus the first quarter of

the year due to less manufactured product in our factories. As a

result, our manufacturing plants are not fully utilising their

capacity and manufacturing overheads are spread across less factory

output, thus impacting our consolidated gross margin.

To mitigate this impact on our margin we have implemented a cost

reduction program across our factories and our operations, to

maximise efficiency in manufacturing and to rightsize costs in

subsidiaries to match their revenue. That program has continued

into H2 2023, and we will see the full benefits at the end of this

year and into 2024.

Earnings (continued)

We have also reduced our subcontract manufacturing significantly

in the period and this has given some relief to our factories,

enabling us to increase the volume of Mincon-manufactured product

through our manufacturing plants and thus benefiting our gross

margin.

Our operating employee costs are flat on H1 2022, though we have

reduced our headcount in administration and sales. Total costs

associated with employees exiting the business in H1 2023 was

EUR0.7 million and that cost was recorded within our operating

employee costs. As a result of these actions, we expect to see a

considerable saving in employee costs in H2 2023.

Our finance costs have increased in the period reflecting

increased interest costs on our borrowings as a result of the wider

change in the interest rate environment as central banks take

action to address inflation. The Group has a number of bank loans

and lease liabilities with a mixture of variable and fixed interest

rates.

Balance Sheet and Cash

Our cash generated from operations has increased significantly

over the same period from the prior year although the impact from

movements in debtor balances and the timing of orders in the first

half has resulted in a lower closing cash position at the end of

the period. This is due to where we earned our revenues in the

first half of the year and we expect this debtor position to unwind

in the coming months.

As previously noted in our discussion on new business

development initiatives, we have commissioned EUR4.3 million of

property plant and equipment in the period. This is mostly from

large capex projects over the past eighteen months, including the

new heat treatment facilities in Shannon.

We have implemented a Group-wide inventory reduction program,

with the goal of reducing our overall inventory levels in terms of

months. Targets have been set for each subsidiary in the Group with

timelines attached. We expect to make inroads in our goals on this

important project for the Group by the end of this year.

We borrowed further in the first half of 2023. This is mostly in

relation to our capital equipment program. The borrowings over

capital equipment commissioning are in relation to our Subsea

project. We plan to borrow further in H2 2023 to see out our large

capex projects.

During the period we paid EUR0.4 million for historical

acquisitions. We also paid a final year dividend for 2022 of EUR2.2

million in June 2023. The Board of Mincon has approved the payment

of an interim dividend in the amount of EUR0.0105 (1.05 cent) per

ordinary share, which will be paid to shareholders in December

2023.

For further information, please contact:

Mincon Group plc Tel: +353 (61) 361 099

Joe Purcell CEO

Mark McNamara CFO

Davy Corporate Finance (Nominated Adviser, Euronext Growth Tel:

+353 (1) 679 6363

Listing Sponsor and Joint Broker)

Anthony Farrell

Daragh O'Reilly

Shore Capital (Joint Broker) Tel: +44 (0) 20 7408 4090

Malachy McEntyre

Mark Percy

Daniel Bush

Mincon Group plc

2023 Half Year Financial Results

Condensed consolidated income statement

For the 6 months ended 30 June 2023

Unaudited Unaudited

H1 2023 H1 2022

Notes EUR'000 EUR'000

-------------------------------------- ---------------- ------------ --------------

Continuing operations

Revenue 6 80,585 85,168

Cost of sales 8 (54,940) (58,106)

------------ --------------

Gross profit 25,645 27,062

Operating costs 8 (17,863) (18,238)

------------ --------------

Operating profit 7,782 8,824

Finance income 19 11

Finance cost (1,175) (623)

Foreign exchange gain/(loss) (503) 835

Movement on deferred consideration 4 10

------------ --------------

Profit before tax 6,127 9,057

-------------------------------------- ------------ --------------

Income tax expense (1,228) (2,527)

-------------------------------------- ---------------- ------------ --------------

Profit for the period 4,899 6,530

-------------------------------------- ---------------- ------------ --------------

Earnings per Ordinary Share

Basic earnings per share 12 2.31c 3.07c

Diluted earnings per share 12 2.28c 2.99c

-------------------------------------- ---------------- ------------ --------------

Condensed consolidated statement of comprehensive income

For the 6 months ended 30 June 2023

Unaudited Unaudited

2023 2022

H1 H1

EUR'000 EUR'000

--------------------------------------------------------- --------- ------------

Profit for the period 4,899 6,530

Other comprehensive income:

Items that are or may be reclassified subsequently

to profit or loss:

Foreign currency translation - foreign operations (2,840) 3,814

Other comprehensive (loss)/profit for the period (2,840) 3,814

--------------------------------------------------------- --------- ------------

Total comprehensive income for the period 2,059 10,344

--------------------------------------------------------- --------- ------------

The accompanying notes are an integral part of these financial

statements.

Consolidated statement of financial position

As at 30 June 2023

Unaudited

30 June 31 December

2023 2022

Notes EUR'000 EUR'000

--------------------------------------------- ----- ----------- ------------

Non-Current Assets

Intangible assets and goodwill 14 39,503 40,109

Property, plant and equipment 15 52,777 53,004

Deferred tax asset 10 2,446 2,050

Total Non-Current Assets 94,726 95,163

---------------------------------------------- ----- ----------- ------------

Current Assets

Inventory and capital equipment 16 76,064 76,911

Trade and other receivables 17 30,467 23,872

Prepayments and other current assets 12,717 12,727

Current tax asset 10 314 305

Cash and cash equivalents 12,673 15,939

Total Current Assets 132,235 129,754

---------------------------------------------- ----- ----------- ------------

Total Assets 226,961 224,917

---------------------------------------------- ----- ----------- ------------

Equity

Ordinary share capital 11 2,125 2,125

Share premium 67,647 67,647

Undenominated capital 39 39

Merger reserve (17,393) (17,393)

Share based payment reserve 13 2,669 2,505

Foreign currency translation reserve (8,426) (5,586)

Retained earnings 107,117 104,449

---------------------------------------------- ----- ----------- ------------

Total Equity 153,778 153,786

Non-Current Liabilities

Loans and borrowings 18 28,787 26,971

Deferred tax liability 10 2,091 2,046

Deferred consideration 19 1,498 1,705

Other liabilities 849 833

Total Non-Current Liabilities 33,225 31,555

---------------------------------------------- ----- ----------- ------------

Current Liabilities

Loans and borrowings 18 15,280 14,973

Trade and other payables 14,711 14,420

Accrued and other liabilities 8,537 8,699

Current tax liability 10 1,430 1,484

Total Current Liabilities 39,958 39,576

---------------------------------------------- ----- ----------- ------------

Total Liabilities 73,183 71,131

---------------------------------------------- ----- ----------- ------------

Total Equity and Liabilities 226,961 224,917

---------------------------------------------- ----- ----------- ------------

The accompanying notes are an integral part of these financial

statements.

Condensed consolidated statement of cash flows

For the 6 months ended 30 June 2023

-------------------------------------------------------- -----------------------------------

Unaudited Unaudited

H1 H1

2023 2022

EUR'000 EUR'000

-------------------------------------------------------- ---------------------- -----------

Operating activities:

Profit for the period 4,899 6,530

Adjustments to reconcile profit to net cash provided

by operating activities:

Depreciation 3,974 3,890

Amortisation of internally generated intangible asset 242 -

Amortisation of intellectual property 108 92

Movement on deferred consideration (4) (10)

Finance cost 1,175 623

Finance income (19) (11)

Loss on sale of property, plant & equipment 11 154

Income tax expense 1,228 2,527

Other non-cash movements 510 (831)

-------------------------------------------------------- ---------------------- -----------

12,124 12,964

Changes in trade and other receivables (7,272) (3,396)

Changes in prepayments and other assets (119) (3,333)

Changes in inventory (814) (9,362)

Changes in trade and other payables 650 4,599

-------------------------------------------------------- ---------------------- -----------

Cash provided by operations 4,569 1,472

Interest received 19 11

Interest paid (1,175) (623)

Income taxes paid (1,462) (1,793)

-------------------------------------------------------- ---------------------- -----------

Net cash provided by/(used in) operating activities 1,951 (933)

-------------------------------------------------------- ---------------------- -----------

Investing activities

Purchase of property, plant and equipment (4,278) (2,327)

Proceeds from the sale of property, plant and equipment 288 605

Investment in intangible assets - (286)

Acquisitions, net of cash required - (1,014)

Payment of deferred consideration (203) (204)

Investment in acquired intangible assets (158) (147)

Net cash provided used in investing activities (4,351) (3,373)

-------------------------------------------------------- ---------------------- -----------

Financing activities

Dividends paid (2,231) (2,231)

Repayment of borrowings (2,569) (1,162)

Repayment of lease liabilities (2,112) (1,349)

Drawdown of loans 6,472 5,159

Net cash provided (used in)/by financing activities (440) 417

-------------------------------------------------------- ---------------------- -----------

Effect of foreign exchange rate changes on cash (426) 171

-------------------------------------------------------- ---------------------- -----------

Net decrease in cash and cash equivalents (3,266) (3,718)

-------------------------------------------------------- ---------------------- -----------

Cash and cash equivalents at the beginning of the

year 15,939 19,049

-------------------------------------------------------- ---------------------- -----------

Cash and cash equivalents at the end of the period 12,673 15,331

-------------------------------------------------------- ---------------------- -----------

The accompanying notes are an integral part of these financial

statements.

Condensed consolidated statement of changes in equity for the 6

months ended 30 June 2023

Foreign

Share based currency Unaudited

Share Share Merger Un-denominated payment translation Retained Total

capital premium reserve capital reserve reserve earnings equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

-------------- -------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Balances at 1

July 2022 2,125 67,647 (17,393) 39 2,959 (1,354) 98,506 152,529

-------------- -------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Comprehensive

income:

Profit for the

period - - - - - - 8,174 8,174

Other

comprehensive

income:

Foreign

currency

translation - - - - - (4,232) - (4,232)

Total

comprehensive

income (4,232) 8,174 3,942

------------ --------- ---------

Transactions

with

Shareholders:

Share-based

payments - - - - (454) - - (454)

Dividend

payment - - - - - - (2,231) (2,231)

-------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Total

transactions

with

Shareholders - - - - (454) - (2,231) (2,685)

-------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Balances at 31

December 2022 2,125 67,647 (17,393) 39 2,505 (5,586) 104,449 153,786

-------------- -------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Comprehensive

income:

Profit for the

period - - - - - - 4,899 4,899

Other

comprehensive

income:

Foreign

currency

translation - - - - - (2,840) - (2,840)

------------ --------- ---------

Total

comprehensive

income (2,840) 4,899 2,059

------------ --------- ---------

Transactions

with

Shareholders:

Share-based

payments - - - - 164 - - 164

Dividend

payment - - ,- - - - (2,231) (2,231)

-------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Total

transactions

with

Shareholders - - - - 164 - (2,231) (2,067)

-------- ------------ ------------ -------------- ------------ ------------ --------- ---------

Balances at 30

June 2023 2,125 67,647 (17,393) 39 2,669 (8,426) 107,117 153,778

-------------- -------- ------------ ------------ -------------- ------------ ------------ --------- ---------

The accompanying notes are an integral part of these financial

statement

Notes to the consolidated interim financial statements

1 Description of business

Mincon Group plc ("the Company") is a company incorporated in

the Republic of Ireland. The unaudited consolidated interim

financial statements of the Company for the six months ended 30

June 2023 (the "Interim Financial Statements") include the Company

and its subsidiaries (together referred to as the "Group"). The

Interim Financial Statements were authorised for issue by the

Directors on 8 August 2023.

2. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, 'Interim Financial Reporting', as adopted

by the EU. The Interim Financial Statements do not include all of

the information required for full annual financial statements and

should be read in conjunction with the Group's consolidated

financial statements for the year ended 31 December 2022 as set out

in the 2022 Annual Report (the "2022 Accounts"). The Interim

Financial Statements do, however, include selected explanatory

notes to explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements.

The Interim Financial Statements do not constitute statutory

financial statements. The statutory financial statements for the

year ended 31 December 2022, extracts from which are included in

these Interim Financial Statements, were prepared under IFRS as

adopted by the EU and will be filed with the Registrar of Companies

together with the Company's 2022 annual return. They are available

from the Company website www.mincon.com and, when filed, from the

registrar of companies. The auditor's report on those statutory

financial statements was unqualified.

The Interim Financial Statements are presented in Euro, rounded

to the nearest thousand, which is the functional currency of the

parent company and also the presentation currency for the Group's

financial reporting.

The financial information contained in the Interim Financial

Statements has been prepared in accordance with the accounting

policies applied in the 2022 Accounts.

3. Use of estimates and judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income, and expenses. The

judgements, estimates and associated assumptions are based on

historical experience and other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about the carrying values of assets

and liabilities that are not readily apparent from other sources.

Actual results may differ materially from these estimates. In

preparing the Interim Financial Statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the 2022 Financial Statements.

4. Changes in significant accounting policies

There have been no changes in significant accounting policies

applied in these interim financial statements, they are the same as

those applied in the last annual audited financial statements.

5. Financial Reporting impact due to the Covid-19 Pandemic:

a. Government Grants

The Group received government grants in certain countries where

the Group operates. These grants differ in structure from country

to country but primarily relate to personnel costs. During the six

months ended 30 June 2023, when the terms attached to the grants

were complied with, the grant was recognised in operating costs in

the consolidated income statement.

b. Expected Credit losses

The Group has not witnessed any trends in its analysis of its

customers that would indicate an adjustment to its trade

receivables as at the 30 June 2023 due to the Covid-19

pandemic.

c. Inventory

The Group has not experienced any material impact on its

valuation of inventory as of 30 June 2023, that can be directly

attributable to the Covid-19 pandemic.

d. Risk Assessment

The Mincon Group's operations are spread globally. This brings

various exposures, such as trading and financial, and strategic

risks. The primary trading risks would encompass operational,

legal, regulatory and compliance. Strategic risks would cover long

term risks effecting the business such as evolving industry trends,

technological advancements, and global economic developments.

Financial risks extend to but are not limited to pricing risks,

currency risks, interest rate volatility and taxation risks. The

risk of managing Covid-19 is encompassed with the abovementioned

risks and therefore the Group considers its management of these

risks as a whole.

6. Revenue

H1 H1

2023 2022

EUR'000 EUR'000

---------------------------- ------- --------

Product revenue:

Sale of Mincon product 67,190 70,906

Sale of third-party product 13,395 14,262

Total revenue 80,585 85,168

---------------------------- ------- --------

7. Operating Segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker

(CODM). Our CODM has been identified as the Board of Directors.

Having assessed the aggregation criteria contained in IFRS 8

operating segments and considering how the Group manages its

business and allocates resources, the Group has determined that it

has one reportable segment. In particular the Group is managed as a

single business unit that sells drilling equipment, primarily

manufactured by Mincon manufacturing sites.

Entity-wide disclosures

The business is managed on a worldwide basis but operates

manufacturing facilities and sales offices in Ireland, Sweden,

Finland, South Africa, UK, Australia, the United States and Canada

and sales offices in other locations including Australia, South

Africa, Finland, Spain, Namibia, France, Sweden, Canada, Chile and

Peru. In presenting information on geography, revenue is based on

the geographical location of customers and non-current assets based

on the location of these assets.

7. Operating Segments (continued)

Revenue by region (by location of customers):

H1 H1

2023 2022

EUR'000 EUR'000

----------------------------------------- ------- --------

Region:

Europe, Middle East, Africa 38,021 42,805

Americas 34,894 33,649

Australasia 7,670 8,714

Total revenue from continuing operations 80,585 85,168

----------------------------------------- ------- --------

Non-current assets by region (location of assets):

30 June 31 December

2023 2022

EUR'000 EUR'000

Region:

Europe, Middle East, Africa 63,646 63,109

Americas 17,265 17,752

Australasia 11,369 12,252

Total non-current assets(1) 92,280 93,113

---------------------------------------------------- ------- -----------

(1) Non-current assets exclude deferred tax assets.

8. Cost of Sales and operating expenses

Included within cost of sales, operating costs were the

following major components:

Cost of sales

H1 H1

2023 2022

EUR'000 EUR'000

------------------------------------- -------- --------

Raw materials 22,364 22,621

Third-party product purchases 10,073 10,886

Employee costs 11,347 11,599

Depreciation 2,643 2,628

In bound costs on purchases 1,744 2,512

Energy costs 1,449 1,562

Maintenance of machinery 832 1,000

Subcontracting 2,612 3,860

Amortisation of product development 242 -

Other 1,634 1,438

------------------------------------- -------- --------

Total cost of sales 54,940 58,106

------------------------------------- -------- --------

Operating costs

H1 H1

2023 2022

EUR'000 EUR'000

------------------------------- --------

Employee costs 10,857 10,835

Depreciation 1,331 1,262

Amortisation of acquired IP 108 91

Travel 889 918

Other 4,678 5,132

-------------------------------- -------- --------

Total other operating costs 17,863 18,238

-------------------------------- -------- --------

The Group recognised EUR32,000 in Government Grants during H1

2023 (H1 2022: EUR194,000). These grants differ in structure from

country to country, they primarily relate to personnel costs.

Employee information

H1 H1

2023 2022

EUR'000 EUR'000

--------------------------------------------- -------- --------

Wages and salaries 19,450 18,817

Social security costs 1,426 2,278

Pension costs of defined contribution plans 1,164 1,075

Share based payments (note 13) 164 264

--------------------------------------------- -------- --------

Total employee costs 22,204 22,434

--------------------------------------------- -------- --------

The average number of employees was as follows:

H1 H1

2023 2022

Number Number

--------------------------------------------------- ------- --------

Sales and distribution 138 135

General and administration 80 80

Manufacturing, service and development 406 416

--------------------------------------------------- ------- --------

Average number of persons employed 624 631

--------------------------------------------------- ------- --------

9. Acquisitions and disposals

Acquisitions

During 2023, Mincon Group Plc made no new acquisitions.

In January 2022, Mincon acquired 100% shareholding in Spartan

Drilling Tools, a manufacturer of drill pipe and related products

based in the USA for a consideration of EUR1,014,000

A. Consideration transferred for acquisitions

Spartan Total

Drilling

Tools

EUR'000 EUR'000

--------------------------------- ---------- --------

Cash 1,014 1,014

Total consideration transferred 1,014 1,014

--------------------------------- ---------- --------

B. Goodwill

Spartan Total

Drilling

Tools

EUR'000 EUR'000

--------------------------------------- ---------- --------

Consideration transferred 1,014 1,014

Fair value of identifiable net assets (815) (815)

Goodwill 199 199

--------------------------------------- ---------- --------

10. Income Tax

The Group's consolidated effective tax rate in respect of

operations for the six months ended 30 June 2023 was 20% (30 June

2022: 28%). The effective rate of tax is forecast at 20% for 2023.

The tax charge for the six months ended 30 June 2023 of EUR1.2

million (30 June 2022: EUR2.5 million) includes deferred tax

relating to movements in provisions, net operating losses forward

and the temporary differences for property, plant and equipment

recognised in the income statement.

The net current tax liability at period-end was as follows:

30 June 31 December

2023 2022

EUR'000 EUR'000

------------------------ ------- ------------

Current tax prepayments 314 305

Current tax payable (1,430) (1,484)

------------------------ ------- ------------

Net current tax (1,116) (1,179)

------------------------ ------- ------------

The net deferred tax liability at period-end was as follows:

30 June 31 December

2023 2022

EUR'000 EUR'000

----------------------- ------- ------------

Deferred tax asset 2,446 2,050

Deferred tax liability (2,091) (2,046)

----------------------- ------- ------------

Net deferred tax 355 4

----------------------- ------- ------------

11. Share capital

Allotted, called- up and fully paid up shares Number EUR000

---------------------------------------------- ----------- ------

01 January 2023 212,472,413 2,125

30 June 2023 212,472,413 2,125

---------------------------------------------- ----------- ------

Share issuances

On 26 November 2013, Mincon Group plc was admitted to trading on the

Enterprise Securities Market (ESM) of the Euronext Dublin and the

Alternative Investment Market (AIM) of the London Stock Exchange.

12. Earnings per share

Basic earnings per share (EPS) is computed by dividing the

profit for the period available to ordinary shareholders by the

weighted average number of Ordinary Shares outstanding during the

period. Diluted earnings per share is computed by dividing the

profit for the period by the weighted average number of Ordinary

Shares outstanding and, when dilutive, adjusted for the effect of

all potentially dilutive shares. The following table sets forth the

computation for basic and diluted net profit per share for the

years ended 30 June:

H1 2023 H1 2022

Numerator (amounts in EUR'000):

Profit attributable to owners of the Parent 4,899 6,530

Denominator (Number):Basic shares outstanding

Restricted share options

Diluted weighted average shares outstanding 212,472,413 212,472,413

----------------------------------------------

2,780,000 5,820,000

215,252,413 218,292,413

---------------------------------------------- ----------- -----------

Earnings per Ordinary Share

Basic earnings per share, EUR 2.31c 3.07c

Diluted earnings per share, EUR 2.28c 2.99c

----------- -----------

13. Share based payment

The vesting conditions of the scheme state that the minimum

growth in EPS shall be CPI plus 5% per annum, compounded annually,

over the relevant three accounting years up to the share award of

100% of the participants basic salary. Where awards have been

granted to a participant in excess of 100% of their basic salary,

the performance condition for the element that is in excess of 100%

of basic salary is that the minimum growth in EPS shall be CPI plus

10% per annum, compounded annually, over the three accounting

years.

Number of

Options in

Reconciliation of outstanding share options thousands

--------------------------------------------- -----------

Outstanding on 1 January 2023 2,030

Forfeited during the period (120)

Exercised during the period -

Granted during the period 715

Outstanding at 30 June 2023 2,625

--------------------------------------------- -----------

Number of

Options in

Reconciliation of outstanding share awards thousands

-------------------------------------------- -----------

Outstanding on 1 January 2023 -

Forfeited during the period -

Exercised during the period -

Granted during the period 155

Outstanding at 30 June 2023 155

-------------------------------------------- -----------

14. Intangible Assets

Internally Goodwill

generated Acquired

intangible intellectual

assets property Total

EUR'000 EUR'000 EUR'000 EUR'000

----------------------------------------- ------------ --------- --------------- -------

Balance at 1 January 2023 7,150 32,328 631 40,109

----------------------------------------- ------------ --------- --------------- -------

Acquired intellectual property - - 158 158

----------------------------------------- ------------ --------- --------------- -------

Amortisation of intellectual property - - (108) (108)

----------------------------------------- ------------ --------- --------------- -------

Amortisation of product development (242) - - (242)

----------------------------------------- ------------ --------- --------------- -------

Foreign currency translation differences - (399) (15) (414)

----------------------------------------- ------------ --------- --------------- -------

Balance at 30 June 2023 6,908 31,929 666 39,503

----------------------------------------- ------------ --------- --------------- -------

15. Property, Plant and Equipment

Capital expenditure in the first half-year amounted to EUR4.3

million (30 June 2022: EUR2.3 million), of which EUR4.1 million was

invested in plant and equipment (30 June 2022: EUR1.9 million) and

EUR800,000 million in ROU assets (30 June 2022: EUR400,000). The

depreciation charge for property, plant and equipment is recognised

in the following line items in the income statement:

H1 H1

2023 2022

EUR'000 EUR'000

-------------------------------------------------- ------- --------

Cost of sales 2,643 2,628

Operating Costs 1,331 1,262

Total depreciation charge for property, plant and

equipment 3,974 3,890

-------------------------------------------------- ------- --------

16. Inventory

30 June 31 December

2023 2022

EUR'000 EUR'000

----------------- ------- ------------

Finished goods 48,244 47,983

Work-in-progress 12,215 12,943

Raw materials 15,605 15,985

----------------- ------- ------------

Total inventory 76,064 76,911

----------------- ------- ------------

The Group recorded an impairment of EUR58,000 against inventory

to take account of net realisable value during the period ended 30

June 2023 (30 June 2022: EUR87,000).

17. Trade and other receivables

30 June 31 December

2023 2022

EUR'000 EUR'000

--------------------------------------------------- -------- ----------------

Gross receivable 31,750 24,975

Provision for impairment (1,283) (1,103)

Net trade and other receivables 30,467 23,872

--------------------------------------------------- -------- ----------------

Provision

for impairment

EUR'000

------------------------------------------------------------- ------------------

Balance at 1 January 2023 (1,103)

Additions (180)

Balance at 30 June 2023 (1,283)

------------------------------------------------------------- ------------------

The following table provides the information about the exposure

to credit risk and ECL's for trade receivables as at 30 June

2023.

Weighted Gross Loss

average carrying allowance

loss rate amount EUR'000

% EUR'000

Current (not past due) 1.2% 23,318 280

1-30 days past due 6.2% 4,293 266

31-60 days past due 12% 2,289 271

61 to 90 days 14.5% 1,618 235

More than 90 days past due 100% 232 231

-------------------------------- ---------- -----------

Net trade and other receivables 31,750 1,283

-------------------------------- ---------- -----------

The following table provides the information about the exposure

to credit risk and ECL's for trade receivables as at 31 December

2022.

Weighted Gross Loss

average carrying allowance

loss rate amount EUR'000

% EUR'000

Current (not past due) 1% 17,929 179

1-30 days past due 5% 4,245 211

31-60 days past due 13% 1,459 189

61 to 90 days 21% 1,034 216

More than 90 days past due 100% 308 308

-------------------------------- ---------- -----------

Net trade and other receivables 24,975 1,103

-------------------------------- ---------- -----------

18. Loans, borrowings and lease liabilities

30 June 31 December

2023 2022

Maturity EUR'000 EUR'000

--------------------------------------------------------- ------- ------------

Loans and borrowings 2023-2037 34,531 30,848

Lease liabilities 2023-2032 9,536 11,096

Total Loans, borrowings and lease liabilities 44,067 41,944

------- ------------

Current 15,280 14,973

------- ------------

Non-current 28,787 26,971

------- ------------

The Group has a number of bank loans and lease liabilities with

a mixture of variable and fixed interest rates. The Group has not

been in default on any of these debt agreements during any of the

periods presented. The loans are secured against the assets for

which they have been drawn down for.

19. Financial Risk Management

The Group is exposed to various financial risks arising in the

normal course of business. Our financial risk exposures are

predominantly related to changes in foreign currency exchange rates

as well as the creditworthiness of our financial asset

counterparties.

The half-year financial statements do not include all financial

risk management information and disclosures required in the annual

financial statements and should be read in conjunction with the

2022 Annual Report. There have been no changes in our risk

management policies since year-end and no material changes in our

interest rate risk.

a) Liquidity and Capital

The Group defines liquid resources as the total of its cash,

cash equivalents and short term deposits. Capital is defined as the

Group's shareholders' equity and borrowings.

The Group's objectives when managing its liquid resources are:

* To maintain adequate liquid resources to fund its

ongoing operations and safeguard its ability to

continue as a going concern, so that it can continue

to create value for investors;

* To have available the necessary financial resources

to allow it to invest in areas that may create value

for shareholders; and

-- To maintain sufficient financial resources to mitigate against

risks and unforeseen events.

Liquid and capital resources are monitored on the basis of the

total amount of such resources available and the Group's

anticipated requirements for the foreseeable future. The Group's

liquid resources and shareholders' equity at 30 June 2023 and 31

December 2022 were as follows:

30 June 31 December

2023 2022

EUR'000 EUR'000

-------------------------- -------- -----------

Cash and cash equivalents 12,673 15,939

Loans and borrowings 44,067 41,944

Shareholders' equity 153,778 153,786

-------------------------- -------- -----------

19. Financial Risk Management (continued)

b) Foreign currency risk

The Group is a multinational business operating in a number of

countries and the euro is the presentation currency. The Group,

however, does have revenues, costs, assets and liabilities

denominated in currencies other than euro. Transactions in foreign

currencies are recorded at the exchange rate prevailing at the date

of the transaction. The resulting monetary assets and liabilities

are translated into the appropriate functional currency at exchange

rates prevailing at the reporting date and the resulting gains and

losses are recognised in the income statement. The Group manages

some of its transaction exposure by matching cash inflows and

outflows of the same currencies. The Group does not engage in

hedging transactions and therefore any movements in the primary

transactional currencies will impact profitability. The Group

continues to monitor appropriateness of this policy.

The Group's global operations create a translation exposure on

the Group's net assets since the financial statements of entities

with non-euro functional currencies are translated to euro when

preparing the consolidated financial statements. The Group does not

use derivative instruments to hedge these net investments.

The principal foreign currency risks to which the Group is

exposed relate to movements in the exchange rate of the euro

against US dollar, South African rand, Australian dollar, Swedish

krona, British Pound and Canadian dollar.

The Group has material subsidiaries with a functional currency

other than the euro, such as US dollar, Australian dollar, South

African rand, Canadian dollar, British pound and Swedish krona.

In 2023, 56% (2022: 58%) of Mincon's revenue EUR81 million (30

June 2022: EUR85 million) was generated in AUD, SEK and USD. The

majority of the Group's manufacturing base has a Euro, US dollar or

Swedish krona cost base. While Group management makes every effort

to reduce the impact of this currency volatility, it is impossible

to eliminate or significantly reduce given the fact that the

highest grades of our key raw materials are either not available or

not denominated in these markets and currencies. Additionally, the

ability to increase prices for our products in these jurisdictions

is limited by the current market factors.

Currency also has a significant transactional impact on the

Group as outstanding balances in foreign currencies are

retranslated at closing rates at each period end. The changes in

the South African Rand, Australian Dollar, Swedish Krona and

British Pound have either weakened or strengthened, resulting in a

foreign exchange loss being recognised in other comprehensive

income and a significant movement in foreign currency translation

reserve.

Average and closing exchange rates for the Group's primary

currency exposures were as disclosed in the table below for the

period presented.

30 June 31 December

2023 H1 2023 2022 H1 2022

Euro exchange rates Closing Average Closing Average

-------------------- ------- -------- ------------ --------

US Dollar 1.09 1.08 1.07 1.05

Australian Dollar 1.64 1.60 1.57 1.52

Canadian Dollar 1.44 1.46 1.45 1.37

Great British Pound 0.86 0.88 0.88 0.85

South African Rand 20.50 19.67 18.18 17.19

Swedish Krona 11.79 11.33 11.15 10.63

-------------------- ------- -------- ------------ --------

There has been no material change in the Group's currency

exposure since 31 December 2022. Such exposure comprises the

monetary assets and monetary liabilities that are not denominated

in the functional currency of the operating unit involved.

19. Financial Risk Management (continued)

c) Fair values

Financial instruments carried at fair value

The deferred consideration payable represents management's best

estimate of the fair value of the amounts that will be payable,

discounted as appropriate using a market interest rate. The fair

value was estimated by assigning probabilities, based on

management's current expectations, to the potential pay-out

scenarios. The fair value of deferred consideration is not

dependent on the future performance of the acquired businesses

against predetermined targets and on management's current

expectations thereof.

Movements in the year in respect of Level 3 financial

instruments carried at fair value

The movements in respect of the financial assets and liabilities

carried at fair value in the period ended to 30 June 2023 are as

follows:

Deferred

consideration

EUR'000

-------------------------- --------------

Balance at 1 January 2023 1,705

-------------------------- --------------

Cash payment (203)

-------------------------- --------------

Fair value movement (4)

-------------------------- --------------

Balance at 30 June 2023 1,498

-------------------------- --------------

20. Commitments

The following capital commitments for the purchase of property,

plant and equipment had been authorised by the directors at 30 June

2023:

Total

EUR'000

------------------- --------

Contracted for 2,104

Not contracted for 28

------------------- --------

Total 2,132

------------------- --------

21. Litigation

The Group is not involved in legal proceedings that could have a

material adverse effect on its results or financial position.

22. Related Parties

The Group has relationships with its subsidiaries, directors and

senior key management personnel. All transactions with subsidiaries

eliminate on consolidation and are not disclosed.

As at 30 June 2023, the share capital of Mincon Group plc was

56.32% owned by Kingbell Company (31 December 2022 56.32%), this

company is ultimately controlled by Patrick Purcell and members of

the Purcell family. Patrick Purcell is also a director of the

Company. The Group paid the final dividend for 2022 in June 2023,

Kingbell Company receive EUR1.3 million.

There were no other related party transactions in the half year

ended 30 June 2023 that affected the financial position or the

performance of the Company during that period and there were no

changes in the related party transactions described in the 2022

Annual Report that could have a material effect on the financial

position or performance of the Company in the same period.

23. Events after the reporting date

Dividend

On 3 August 2023, the Board of Mincon Group plc approved the

payment of an interim dividend in the amount of EUR0.0105 (1.05

cent) per ordinary share. This amounts to a dividend payment of

EUR2.2 million which will be paid on 08 December 2023 to

shareholders on the register at the close of business on 17

November 2023.

24. Approval of financial statements

The Board of Directors approved the interim condensed

consolidated financial statements for the six months ended 30 June

2023 on 08 August 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFATRIDIIV

(END) Dow Jones Newswires

August 08, 2023 02:00 ET (06:00 GMT)

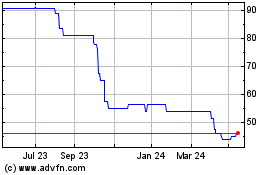

Mincon (LSE:MCON)

Historical Stock Chart

From Apr 2024 to May 2024

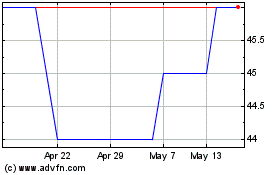

Mincon (LSE:MCON)

Historical Stock Chart

From May 2023 to May 2024