TIDMMFX

RNS Number : 4003N

Manx Financial Group PLC

29 September 2021

FOR IMMEDIATE RELEASE 29 September 2021

Manx Financial Group PLC (the 'Company')

Unaudited Interim Results for the 6 months to 30 June 2021

Manx Financial Group PLC (LSE: MFX), the financial services

group which includes Conister Bank Limited, Conister Finance &

Leasing Ltd, Blue Star Business Solutions Limited, Edgewater

Associates Limited and Manx FX Limited, presents the Interim

results for the six months ended 30 June 2021.

Jim Mellon, Executive Chairman, commented: "Each of our business

units is making steady progress. I have great confidence that the

2021 full year will see the Group well on the way to recording the

levels of growth and profitability we experienced prior to the

onset of this awful pandemic."

Copies of the Interim Report will shortly be available on our

website www.mfg.im

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART

OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018.

For further information, please contact:

Manx Financial Group Beaumont Cornish Limited Greentarget Limited

PLC Roland Cornish/James Dafina Grapci-Penney

Denham Eke, Chief Executive Biddle Tel +44 (0) 203 963 1887

Tel +44 (0)1624 694694 Tel +44 (0) 20 7628

3396

Dear Shareholders

I am pleased to present my half-year report for the period ended

30 June 2021.

The effects of COVID-19 on our various businesses continued to

be an issue during the first half of 2021. Against this complex

backdrop, it is encouraging to report that the Group's pre-tax

profit for the first six months of the year was just over GBP1.1

million (2020: GBP1.0 million) - an increase of 13% on the same

period last year. Each of our business units is making steady

progress and, unless there is a resumption of lock-downs and

associated measures - events which I believe to be extremely

unlikely, I have great confidence that the 2021 full year will see

the Group well on the way to recording the levels of growth and

profitability we experienced prior to the onset of this awful

pandemic.

Financial Review

Our operating income showed an increase of 6.2% to GBP9.0

million (2020: GBP8.5 million), including gains in both net

interest income of 9.5% to GBP8.6 million (2020: GBP7.8 million),

and in net trading income of 12.2% to GBP8.9 million (2020: GBP7.9

million). Our interest yield on loans fell slightly to 10.9% (2020:

11.6%), due mainly to our success in promoting the

Government-backed loan schemes and our move away from sub-prime

lending to prime and near prime propositions. Our interest expense

on deposits showed a marginal decrease to 2.2% (2020: 2.4%).

Operating expenses grew by 5.3% to GBP7.8 million (2020: GBP7.5

million), principally as a result of our prudent policy of

recognising further impairments of GBP2.1 million (2020: GBP1.9

million) to protect the integrity of our balance sheet. As a

result, and as already stated, our profit before tax increased to

GBP1.1 million.

Turning to our balance sheet, despite the challenges of the

trading environment, our net loan book has increased by 16.4% to

GBP211.4 million (2020: GBP181.6 million), with impairments falling

to 2.9% (2020: 3.3%) of the gross total. We continue to ensure that

liquidity is maintained to provide a prudent buffer until the

economic situation fully normalises and, as a result, our cash and

debt securities stand at GBP57.2 million (2020: GBP64.0 million) -

a decrease of 10.7%, keeping us in a more advantageous competitive

position with our capacity for increased lending. Our customer

deposits have grown by 6.2% to GBP231.2 million (2020: GBP217.8

million) and are carefully managed by our Treasury function,

especially important at this time.

All of which leads to an 8.8% growth in our total asset base to

GBP283.8 million (2020: GBP260.7 million). Shareholder equity has

increased by 6.0% to GBP23.1 million (2020: GBP21.8 million),

providing net assets per share, adjusted for the post-period script

dividend, of 20.2 pence (2020: 19.1 pence).

Business Review

Conister Bank Limited ("Bank")

In my last Chairman's Statement, I promised to provide an update

on the Bank's second VAT claim of GBP0.6 million. I am pleased to

report that the Bank resolved its claim against the Isle of Man's

Customs and Excise and has been paid in full. A subsequent claim of

statutory interest due on this claim has been lodged with the

first-tier tribunal in the UK, alongside other High Street Banks,

but no value has been recognised in these financial statements for

the claim.

The Bank continues to attract deposits at historically low

market rates which will position it well against any inflationary

pressure. With UK Gilts attracting negative interest rates, our

treasury management strategy increased our cash balance to GBP25.6

million (2020: GBP6.0 million) and reduced our debt securities to

GBP27.6 million (2020: GBP57.0 million).

The Bank continues to be supportive of both the Isle of Man and

UK Governments' business support schemes and has now been

accredited for the UK Government's Recovery Loan Scheme. Along with

this, the Bank has repositioned its distribution to support more

COVID-19 and recession-proof markets. This repositioning, including

moving to a more prime customer base, drove loan book growth to

16.4% (2020: 6.8%), which is encouraging during a period of

short-notice economic lockdowns.

This loan book growth resulted in the net interest income margin

net of commissions increasing by 5.4% (2020: 2.2%) but we expect a

normalised position over the life of these loans due to their prime

nature and the Government guarantees.

Personnel expenses increased by GBP0.1 million as the Bank's

headcount increased by nine as part of launching a new debt

collection company, Manx Collections Limited, which generated

GBP0.1 million of profitability in the first six months of trading.

Overheads increased by GBP0.2 million, which is primarily due to

the recovery costs on delinquent debts. During these uncertain

times we continue to operate a prudent provisioning policy, with an

allowance of GBP2.1 million (2020: GBP1.9 million). Finally, in

relation to our cost base, depreciation and amortisation increased

by GBP0.1 million to GBP0.4 million (2020: GBP0.3 million), driven

by continued investment in our IT strategy.

Edgewater Associates Limited

Our independent financial advisory business remains the largest

on the Isle of Man and had a difficult half-year with the trading

conditions negatively impacted by COVID-19. Meeting clients became

problematic and many sought to delay investment decisions due to

market turbulence. Despite a UK economic recovery being underway,

the sustained threat of inflation has dampened client confidence

and stifled investment. As a result, profitability has remained

broadly similar year-on-year despite assets under management

increasing by 11.6% to GBP375.0 million (2020: GBP336.0 million)

and renewal income increasing to GBP0.6 million (2020: GBP0.5

million).

Manx FX Limited ("MFX")

Our foreign exchange advisory business has had a remarkable

half-year. Whereas our IFA business suffered from market

volatility, MFX benefitted, demonstrating the importance in having

a diversified financial services group. Turnover remained constant

at GBP0.9 million, particularly trading in Euros and South African

Rand following the wide-ranging impact of BREXIT. The business

continues to have a very liquid balance sheet and declared an

interim dividend to the Group of GBP0.6 million during the

half-year (2020: GBPnil).

Beer Swaps Limited ("BSL")

On 14 June 2021, the Bank acquired further shares in BSL to

increase its ordinary shareholding to 90% for a cash consideration

of GBP0.3 million. For the period under ownership, BSL reported

turnover of GBP0.6 million and a profit before tax of GBP0.2

million with net assets of GBP0.3 million. BSL is now the largest

tank lessor in the UK brewing market.

Blue Star Business Solutions Limited ("BBSL")

BBSL has traded well through difficult economic conditions in

which the economic impact of UK Government support schemes

distorted the credit broker sector. However, and notwithstanding,

BBSL has reported a GBP0.1 million profit (2020: GBP0.0 million).

BBSL brokered GBP6.4 million (2020: GBP3.8 million) of which GBP3.8

million (2020: GBP2.1 million) was referred to the Bank. BBSL

receives no loan interest income for lending placed with the Bank,

but if it did, the imputed profitability for the first half would

have been GBP0.5 million.

Strategic Objectives for 2021

Our strategic priorities for 2021 remain unchanged, and I will

report on these in detail in my next Chairman's Statement. As ever,

we strive to increase shareholder value, both in a prudent yet

progressive manner. I repeat our 2021 key objectives:

-- Treating customers in both as fair and appropriate manner as

possible. Our Treating Customers Fairly ("TCF") regime continues to

be enhanced throughout our businesses and I am pleased to report

that we have a negligible level of complaints, all of which have

been settled to the customers' satisfaction. TCF is the cornerstone

of all our operations as we make every effort to ensure that our

customer service offering is second to none.

-- Adopting a pro-active strategy of managing risk. We have

taken active steps to rebase our loan book away from sub-prime

lending into prime and near-prime advances. In doing so, we

recognise that the gross interest rates may diminish somewhat, but

we anticipate that this erosion will be more than compensated by a

lower incidence of arrears and write-offs. Our new segregated debt

collection subsidiary - Manx Collections Limited - received its FCA

licence in June 2021 and has already made significant progress not

only in recoveries, but also in the early identification of

problems, working with our customers to ensure a better outcome for

the Bank. We continue to make prudential impairments as part of our

policy of strengthening our balance sheet to minimise the risk of

any unforeseen event adversely affecting our profitability.

-- Developing our core businesses by considered acquisitions.

The current economic environment has produced a number of

interesting potential acquisition opportunities. Each of these is

evaluated carefully before commitment. We also recognise that our

recent acquisitions have become significant contributors to our

profitability.

-- Developing and implementing a coherent digital

infrastructure. We recognise the importance of IT to service the

operational requirements of a growing Group and to remain

competitive. We continue with our investment in core systems which

is already minimising the time taken to consider advances, allowing

us to redeploy staff into more productive areas.

-- Managing the liabilities side of our balance sheet. Our new

Treasury management function is working well, ensuring that our

liquidity matches the anticipated growth of our lending. Our

recently launched Isle of Man notice accounts continue to gain

traction and we will continue to develop attractive deposit

products with competitive interest rates for our depositors.

-- Managing our balance sheet to exceed the regulatory

requirements for capital adequacy. We are well capitalised with our

Total Capital Ratio standing at 17.8% (2020: 16.0%). We will

maintain our strategy of converting Group retained earnings into

Tier 1 capital for the Bank to support its lending growth.

Meanwhile, we will continue to maintain a heightened level of cash

liquidity.

-- Increase shareholder value. The discount between Net Asset

Value and market capitalisation is an issue that we are working to

rectify. The strategic aim of returning to being a dividend paying

company has now been achieved and I see no reason to prevent us

returning 10% of profit attributable to shareholders as a dividend

for the foreseeable future. This, together with enhanced investor

relations, should help the market in rerating our shares.

Current trading and outlook

The Isle of Man economy continues to be resilient under the

strain of COVID-19 and our local new business growth shows no signs

of slowing down. The UK also shows signs of a real return to growth

with Gross Domestic Product for Quarter 2 this year increasing by

22.2% over the same quarter last year, and our UK lending growth

reflects this. Taken together, I have every confidence that our

full year will show a significant improvement in profitability

providing the requirement for impairments remain at their current

level.

The Bank's appointments as accredited lenders to the various

Government-backed schemes will help second-half lending growth and

we will continue to strengthen our balance sheet by maintaining

adequate liquidity.

It remains for me, as always, to thank on behalf of the Board,

our staff for their splendid efforts coping with the additional

demands of dealing with the COVID pandemic whilst continuing to

develop the Group in such a successful manner and, finally, to

thank our shareholders for their enduring loyalty.

Jim Mellon

Executive Chairman

27 September 2021

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

For the For the

six months six months For the

ended ended year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Notes (unaudited) (unaudited) (audited)

------------------------------------ ------ --------------- ------------- -------------

Interest income 6 10,979 10,428 20,692

Interest expense (2,424) (2,617) (5,222)

Net interest income 8,555 7,811 15,470

Fee and commission income 2,356 2,157 3,865

Fee and commission expense (1,878) (1,870) (3,481)

Depreciation on leasing assets (173) (203) (406)

Net trading income 8,860 7,895 15,448

Other operating income 129 111 200

Gain on financial instruments - 6 259

Realised (loss) / gain on debt

securities (1) 212 261

Revaluation on acquisition of

subsidiary - 237 237

Operating income 8,988 8,461 16,405

Personnel expenses (3,241) (3,337) (6,823)

Other expenses (2,099) (1,772) (3,707)

Impairment on loans and advances

to customers (2,142) (1,895) (3,950)

Depreciation (323) (222) (490)

Amortisation and impairment of

intangibles (216) (172) (374)

Share of profit / (loss) of equity

accounted investees, net of tax 59 (91) 54

VAT recovery 113 36 906

Profit before tax payable 1,139 1,008 2,021

Income tax expense (122) (16) (53)

Profit for the period / year 1,017 992 1,968

For the For the

six months six months For the

ended ended year ended

30 June 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Notes (unaudited) (unaudited) (audited)

------------------------------------------ ------ --------------- --------------- -----------------

Profit for the period / year 1,017 992 1,968

Other comprehensive income:

Items that will be reclassified

to profit or loss

Unrealised (loss) / gain on debt

securities (9) 102 (51)

Items that will never be reclassified

to profit or loss

Actuarial loss on defined benefit

pension scheme taken to equity - - (241)

Total comprehensive income for

the period / year 1,008 1,094 1,676

Profit attributable to:

Owners of the Company 1,029 997 1,935

Non-controlling interest (12) (5) 33

1,017 992 1,968

Total comprehensive income attributable

to:

Owners of the Company 1,020 1,099 1,643

Non-controlling interest (12) (5) 33

1,008 1,094 1,676

Earnings per share - profit for

the period / year

Basic earnings per share (pence) 8 0.89 0.87 1.65

Diluted earnings per share (pence) 8 0.73 0.71 1.37

Earnings per share - total comprehensive

income

for the period / year

Basic earnings per share (pence) 8 0.88 0.96 1.41

Diluted earnings per share (pence) 8 0.72 0.78 1.19

Condensed Consolidated Statement of Financial Position

30 June 30 June 31 December

2020

2021 2020 GBP'000

GBP'000 GBP'000 (audited)

As at Notes (unaudited) (unaudited)

---------------------------------- ------- ------------- ------------- ------------

Assets

Cash and cash equivalents 29,577 6,991 34,053

Debt securities 9 27,610 57,036 25,532

Trading assets - 4 4

Loans and advances to customers 5,10 211,445 181,581 193,143

Trade and other receivables 11 1,458 2,521 2,170

Property, plant and equipment 6,472 5,793 6,045

Intangible assets 2,329 2,290 2,286

Investment in associate 375 171 316

Other investments 17 68 - -

Goodwill 12 4,412 4,361 4,412

Total assets 283,746 260,748 267,961

Liabilities

Deposits from customers 231,179 217,758 218,285

Creditors and accrued charges 13 4,058 3,148 3,206

Contingent consideration 613 921 672

Loan notes 14 23,722 16,222 22,222

Pension liability 846 688 944

Deferred tax liability 195 141 197

Total liabilities 260,613 238,878 245,526

Equity

Called up share capital 15 19,121 19,121 19,121

Retained earnings 3,984 2,686 3,230

Equity attributable to owners of

the Company 23,105 21,807 22,351

Non-controlling interest 28 63 84

Total equity 23,133 21,870 22,435

Total liabilities and equity 283,746 260,748 267,961

Condensed Consolidated Statement of Changes in Equity

Attributable to owners

of the Company

-----------------------------------

Non-controlling

Share Retained interest Total

capital earnings Total GBP'000 equity

For the six months ended GBP'000 GBP'000 GBP'000 GBP'000

30 June 2021

--------------------------------- ---------- ----------- ---------- ------------------ ----------

Balance at 1 January 2020 20,732 1,587 22,319 - 22,319

Total comprehensive income

for the period:

Profit for the period - 997 997 (5) 992

Other comprehensive income - 102 102 - 102

Total comprehensive income

for the period - 1,099 1,099 (5) 1,094

Transactions with owners:

Purchase of ordinary shares (1,611) - (1,611) - (1,611)

Total transactions with

owners of the Company (1,611) - (1,611) - (1,611)

Changes in ownership interests:

Change in ownership interest

of a subsidiary - - - 68 68

Total changes in ownership

interests - - - 68 68

Balance at 30 June 2020 19,121 2,686 21,807 63 21,870

Balance at 1 July 2020 19,121 2,686 21,807 63 21,870

Total comprehensive income

for the period:

Profit for the period - 938 938 38 976

Other comprehensive income - (394) (394) - (394)

Total comprehensive income

for the period - 544 544 38 582

Changes in ownership interests:

Change in ownership interest

of a subsidiary - - - (17) (17)

Total changes in ownership

interests - - - (17) (17)

Balance at 31 December

2020 19,121 3,230 22,351 84 22,435

Balance at 1 January 2021 19,121 3,230 22,351 84 22,435

Total comprehensive income

for the period:

Profit for the period - 1,029 1,029 (12) 1,017

Other comprehensive income - (9) (9) - (9)

Total comprehensive income

for the period - 1,020 1,020 (12) 1,008

Changes in ownership interests:

Acquisition of subsidiary

with non-controlling interest

(Note 16) - (266) (266) (44) (310)

Total changes in ownership

interests - (266) (266) (44) (310)

Balance at 30 June 2021 19,121 3,984 23,105 28 23,133

Condensed Consolidated Statement of Cash Flows

For the For the For the

six months six months year ended

ended ended 31 December

30 June 30 June 2020

2021 2020 GBP'000

Notes GBP'000 GBP'000 (audited)

(unaudited) (unaudited)

--------------------------------------- -------- ------------- ------------- -------------

RECONCILIATION OF PROFIT BEFORE

TAXATION TO OPERATING CASH FLOWS

Profit before tax 1,139 1,008 2,021

Adjustments for:

Depreciation 496 425 896

Amortisation and impairment

of intangibles 216 172 374

Realised gain on debt securities - (212) (237)

Share of (profit) / loss of

equity accounted investees (59) 91 (54)

Contingent consideration interest

expense 61 58 122

Pension charge included in personnel

costs - - 15

Gain on acquisition of subsidiary - (237) (253)

1,853 1,305 2,884

Changes in:

Trading asset 4 15 15

Trade and other receivables 11 712 73 415

Creditors and accrued charges 13 767 (15) 315

Net cash flow from trading activities 3,336 1,378 3,629

Changes in:

Loans and advances to customers 10 (18,302) (4,461) (16,023)

Deposits from customers 12,894 7,825 8,352

Pension contribution (98) - -

Cash (outflow) / inflow from

operating activities (2,170) 4,742 (4,042)

For the For the For the

six months six months year ended

ended ended 31 December

30 June 30 June 2020

2021 2020 GBP'000

Notes GBP'000 GBP'000 (audited)

(unaudited) (unaudited)

-------------------------------------- -------- ------------- ------------- -------------

CASH FLOW STATEMENT

Cash from operating activities

Cash (outflow) / inflow from

operating activities (2,170) 4,742 (4,042)

Income taxes paid - - (172)

Net cash (outflow) / inflow

from operating activities (2,170) 4,742 (4,214)

Cash flows from investing activities

Purchase of property, plant

and equipment (1,172) (322) (1,187)

Purchase of intangible assets (259) (35) (231)

Sale of property, plant and

equipment 249 - 127

Acquisition of subsidiary or

associate, net of cash acquired 16 (310) (622) (648)

(Purchase) / sale of debt securities

at fair value through other

comprehensive income 9 (3,188) (3,608) 1,101

Sale / (purchase) of debt securities

at amortised cost 9 1,101 (6,322) 20,108

Contingent consideration (120) - (59)

Net cash (outflow) / inflow

from investing activities (3,699) (10,909) 19,211

Cash flows from financing activities

Receipt / (repayment) of loan

notes 14 1,500 (1,360) 4,640

Lease payments (107) (102) (204)

Net cash inflow / (outflow)

from financing activities 1,393 (1,462) 4,436

Net (decrease) / increase in

cash and cash equivalents (4,476) (7,629) 19,433

Cash and cash equivalents -

opening 34,053 14,620 14,620

Cash and cash equivalents -

closing 29,577 6,991 34,053

Included in cash flows are:

Interest received - cash amounts 10,757 10,741 20,274

Interest paid - cash amounts (2,345) (2,669) (5,053)

Notes

For the six months ended 30 June 2021

1. Reporting entity

Manx Financial Group PLC ("Company" or "MFG") is a company

incorporated in the Isle of Man. These condensed consolidated

interim financial statements ("interim financial statements") as at

and for the six months ended 30 June 2021 comprise the Company and

its subsidiaries ("Group").

2. Basis of accounting

These interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting and should be

read in conjunction with the last annual consolidated financial

statements as at and for the year ended 31 December 2020 ("last

annual financial statements"). They do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual financial statements.

3. Functional and presentation currency

These financial statements are presented in pounds sterling,

which is the Group's functional currency. All amounts have been

rounded to the nearest thousand, unless otherwise indicated. All

subsidiaries of the Group have pounds sterling as their functional

currency.

4. Use of judgements and estimates

In preparing these interim financial statements, management make

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets,

liabilities, income and expenses. Actual results may differ from

these estimates.

The significant judgements made by management in applying the

Group's accounting policies and key sources of estimation

uncertainty were the same as those described in the last annual

financial statements other than those described in Note 17 -

Acquisition of financial instrument.

5. Credit risk

A summary of the Group's current policies and practices for the

management of credit risk is set out in Note 7 - Financial risk

review and Note 37 - Financial risk management on pages 46 and 71

respectively of the Annual Financial Statements 2020.

An explanation of the terms Stage 1, Stage 2 and Stage 3 is

included in Note 39 (G)(vii) on page 80 of the Annual Financial

Statements 2020.

A. Summary of credit risk on loans and advances to customers

2021 2020

Stage Stage Stage Total Stage Stage Stage Total

30 June (unaudited) 1 2 3 GBP'000 1 2 3 GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------- --------- --------- --------- --------- ---------

Grade A 195,141 - - 195,141 164,648 - - 164,648

Grade B - 4,437 7,255 11,692 - 2,252 - 2,252

Grade C 589 50 10,248 10,887 5,558 2,211 13,074 20,843

Gross value 195,730 4,487 17,503 217,720 170,206 4,463 13,074 187,743

Allowance for

ECL (698) (14) (5,563) (6,275) (220) (38) (5,904) (6,162)

Carrying value 195,032 4,473 11,940 211,445 169,986 4,425 7,170 181,581

2020 2019

Stage Stage Stage Total Stage Stage Stage Total

31 December 1 2 3 GBP'000 1 2 3 GBP'000

(audited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- --------- --------- --------- --------- --------- --------- --------- ---------

Grade A 173,673 - - 173,673 168,796 - - 168,796

Grade B - 5,728 7,751 13,479 1,143 1,675 - 2,818

Grade C 335 9 12,771 13,115 - 1,985 10,544 12,529

Gross value 174,008 5,737 20,522 200,267 169,939 3,660 10,544 184,143

Allowance for

ECL (423) (18) (6,683) (7,124) (116) (467) (4,190) (4,773)

Carrying value 173,585 5,719 13,839 193,143 169,823 3,193 6,354 179,370

Loans are graded A to C depending on the level of risk. Grade C

relates to agreements with the highest of risk, Grade B with medium

risk and Grade A relates to agreements with the lowest risk.

B. Summary of overdue status of loans and advances to

customers

2021 2020

Stage Stage Stage Total Stage Stage Stage Total

30 June 2020 (unaudited) 1 2 3 GBP000 1 2 3 GBP000

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------- -------- -------- -------- -------- -------- -------- -------- --------

Current 193,435 - - 193,435 159,467 - - 159,467

Overdue < 30 days 2,293 - - 2,293 5,181 - - 5,181

Overdue > 30 days - 4,488 17,504 21,992 5,558 4,463 13,074 23,095

195,728 4,488 17,504 217,720 170,206 4,463 13,074 187,743

---------------------------- -------- -------- -------- -------- -------- -------- -------- --------

2020 2019

Stage Stage Stage Total Stage Stage Stage Total

31 December (audited) 1 2 3 GBP000 1 2 3 GBP000

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- -------- -------- -------- -------- -------- -------- -------- --------

Current 170,436 - - 170,436 145,373 - - 145,373

Overdue < 30 days 3,572 - - 3,572 24,259 - - 24,259

Overdue > 30 days - 5,737 20,522 26,259 307 3,660 10,544 14,511

174,008 5,737 20,522 200,267 169,939 3,660 10,544 184,143

------------------------- -------- -------- -------- -------- -------- -------- -------- --------

6. Interest income

Interest income represents charges and interest on finance and

leasing agreements attributable to the period or year after

adjusting for early settlements and interest on bank balances,

excluding the Terminal funding portfolio.

7. Operating segments

Segmental information is presented in respect of the Group's

business segments. The Directors consider that the Group currently

operates in one geographic segment comprising of the Isle of Man,

UK and Channel Islands. The primary format, business segments, is

based on the Group's management and internal reporting structure.

The Directors consider that the Group operates in three (2020:

three) product orientated segments in addition to its investing

activities: Asset and Personal Finance (including provision of HP

contracts, finance leases, personal loans, commercial loans, block

discounting, vehicle stocking plans and wholesale funding

agreements); EAL and MFX.

Asset

and Investing

For the 6 months ended Personal EAL MFX Activities Total

30 June 2021 (unaudited) Finance GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

Net interest income / (expense) 9,201 - - (646) 8,555

Fee and commission income 469 1,031 856 - 2,356

Operating income / (expense) 6,456 1,031 852 649 8,988

Profit / (loss) before tax payable 759 (12) 717 (325) 1,139

Capital expenditure 1,384 - 24 23 1,431

Total assets 274,832 2,150 615 6,259 283,856

Total liabilities 243,136 545 8 17,034 260,723

Asset

and Investing

For the 6 months ended Personal EAL MFX Activities Total

30 June 2020 (unaudited) Finance GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

Net interest income / (expense) 8,287 - - (476) 7,811

Fee and commission income 207 1,075 875 - 2,157

Operating income / (expense) 6,932 1,075 872 (215) 8,664

Profit / (loss) before tax payable 843 6 785 (626) 1,008

Capital expenditure 357 - - - 357

Total assets 257,310 2,292 321 825 260,748

Total liabilities 228,416 633 7 9,822 238,878

Asset

and Investing

For the year ended Personal EAL MFX Activities Total

31 December 2020 (audited) Finance GBP000 GBP000 GBP000 GBP000

GBP000

Net interest income 15,470 - - - 15,470

Fee and commission income 430 2,103 1,332 - 3,865

Operating income 13,206 2,103 1,096 - 16,405

Profit / (loss) before tax payable 1,316 (94) 1,096 (297) 2,021

Capital expenditure 1,138 46 2 1 1,187

Total assets 260,155 2,638 536 4,632 267,961

Total liabilities 230,001 660 12 14,853 245,526

------------------------------------ ---------- --------- --------- ------------- ---------

8. Earnings per share

For the

For the For the

6 months 6 months

ended ended year ended

30 June 30 June 31 Dec

2021 2020 2020

(unaudited) (unaudited) (audited)

Profit for the period / year GBP1,017,000 GBP992,000 GBP1,968,000

Weighted average number of ordinary

shares in issue (basic) 114,130,077 114,130,077 118,964,270

Basic earnings per share (pence) 0.89 0.87 1.65

Diluted earnings per share (pence) 0.73 0.71 1.37

Total comprehensive income for the period GBP1,008,000 GBP1,094,000 GBP1,676,000

/ year

Weighted average number of ordinary

shares in issue (basic) 114,130,077 114,130,077 118,964,270

Basic earnings per share (pence) 0.88 0.96 1.41

Diluted earnings per share (pence) 0.72 0.78 1.19

The basic earnings per share calculation is based upon the

profit for the period / year after taxation and the weighted

average of the number of shares in issue throughout the period /

year.

30 June 30 June 31 Dec

2021 2020 2020

As at (unaudited) (unaudited) (audited)

Reconciliation of weighted average number

of ordinary shares in issue between

basic and diluted

Weighted average number of ordinary

shares (basic) 114,130,077 114,130,077 118,964,270

Number of shares issued if all convertible

loan notes were exchanged for equity 36,555,556 36,555,556 36,555,556

Dilutive element of share options if - - -

exercised

Weighted average number of ordinary

shares (diluted) 150,685,633 150,685,633 155,519,826

Reconciliation of profit for the period

/ year between basic and diluted

Profit for the period / year (basic) GBP1,017,000 GBP992,000 GBP1,968,000

Interest expense saved if all convertible GBP83,125 GBP83,125 GBP166,250

loan notes were exchanged for equity

Profit for the period / year (diluted) GBP1,100,125 GBP1,075,125 GBP2,134,250

The diluted earnings per share calculation assumes that all

convertible loan notes and share options have been converted /

exercised at the beginning of the period where they are

dilutive.

30 June 30 June 31 Dec

2021 2020 2020

As at (unaudited) (unaudited) (audited)

Reconciliation of total comprehensive

income for the period / year between

basic and diluted

Total comprehensive income for the period GBP1,008,000 GBP1,094,000 GBP1,676,000

/ year (basic)

Interest expense saved if all convertible GBP83,125 GBP83,125 GBP166,250

loan notes were exchanged for equity

Total comprehensive income for the period GBP1,091,125 GBP1,177,125 GBP1,842,250

/ year (diluted)

9. Debt securities

30 June 30 June 31 Dec

2021 2020 2020

GBP'000 GBP'000 GBP'000

As at (unaudited) (unaudited) (audited)

Financial assets at fair value through

other comprehensive income:

UK Government treasury bills 27,610 48,612 24,431

Financial assets at amortised cost:

UK Certificates of Deposit - 8,424 1,101

27,610 57,036 25,532

UK Government Treasury Bills are stated at fair value and

unrealised changes in the fair value are reflected in other

comprehensive income. There were realised losses of GBP1,000 (30

June 2020: realised gains of GBP212,000 and 31 December 2020:

realised gains of GBP261,000) and unrealised losses of GBP9,000 (30

June 2020: unrealised gains of GBP102,000 and 31 December 2020:

unrealised losses of GBP51,000) for the period.

10. Loans and advances to customers

30 June 30 June 31 Dec

2021 2020 2020

Carrying Carrying Carrying

Gross Impairment Value Value Value

Allowance

Amount GBP'000 GBP'000 GBP'000 GBP'000

As at GBP'000 (unaudited) (unaudited) (audited)

HP 69,747 (2,115) 67,632 70,168 71,151

Finance lease 32,775 (3,237) 29,538 35,841 31,132

Wholesale funding arrangements 16,890 16,890 18,832 17,272

Block discounting 13,488 - 13,488 14,911 13,430

Unsecured personal loans 32,040 (432) 31,608 24,788 27,398

Secured commercial loans 10,170 (469) 9,701 12,237 9,091

Secured personal loans 1,746 - 1,746 3,182 2,152

Vehicle stocking plans 1,520 - 1,520 1,622 1,807

Government backed loans 39,344 (22) 39,322 - 19,710

217,720 (6,275) 211,445 181,581 193,143

11. Trade and other receivables

30 June 30 June 31 Dec

2021 2020 2020

GBP'000 GBP'000 GBP'000

As at (unaudited) (unaudited) (audited)

VAT claim - 871 586

Prepayments 360 309 482

Other debtors 1,098 1,341 1,102

1,458 2,521 2,170

The VAT claim was settled in full and the Bank received

GBP699,000 during the period. An additional recovery of GBP113,000

over and above the carrying amount recognised at year end has been

recognised in profit and loss.

12. Goodwill

30 June 30 June 31 Dec

2021 2020 2020

GBP'000 GBP'000 GBP'000

As at (unaudited) (unaudited) (audited)

EAL 1,849 1,849 1,849

BBSL 1,390 1,390 1,390

BSL 678 627 678

ECF Asset Finance PLC ("ECF") 454 454 454

Three Spires Insurance Services Limited

("Three Spires") 41 41 41

4,412 4,361 4,412

13. Creditors and accrued charges

30 June 30 June 31 Dec

2021 2020 2020

GBP'000 GBP'000 GBP'000

As at (unaudited) (unaudited) (audited)

Commission creditors 2,345 1,110 1,748

Other creditors and accruals 999 1,089 822

Lease liability 396 605 503

Taxation creditors 254 344 133

Deferred interest (Note 17) 64 - -

4,058 3,148 3,206

14. Loan notes

30 June 30 June 31 Dec

2021 2020 2020

GBP'000 GBP'000 GBP'000

As at Notes (unaudited) (unaudited) (audited)

Related parties

J Mellon JM 1,750 1,750 1,750

Burnbrae Limited BL 3,200 2,200 3,200

4,950 3,950 4,950

Unrelated parties UP 18,772 12,272 17,272

23,722 16,222 22,222

JM - Two loans, one of GBP1,250,000 maturing on 26 February 2025

with interest payable of 5.4% per annum, and one of GBP500,000

maturing on 31 July 2022, paying interest of 5.0% per annum. Both

loans are convertible to ordinary shares of the Company at the rate

of 7.5 pence and 9 pence respectively.

BL - Three loans, one of GBP1,200,000 maturing on 31 July 2022,

paying interest of 5.0% per annum, one of GBP1,000,000 maturing on

25 February 2025, paying interest of 5.4% per annum, and one of

GBP1,000,000 maturing on 28 February 2025 paying interest of 6% per

annum. Jim Mellon is the beneficial owner of BL and Denham Eke is

also a director. The GBP1,200,000 loan is convertible to ordinary

shares of the Company at a rate of 7.5 pence.

UP - Thirty-six loans consisting of an average GBP521,447 with

an average interest payable of 5.7% per annum. The earliest

maturity date is 4 May 2022 and the latest maturity is 30 March

2026.

With respect to the convertible loans, the interest rate applied

was deemed by the Directors to be equivalent to the market rate at

the time with no conversion option.

15. Called up share capital

Ordinary Shares of no-par value available for Number

issue

----------------------------------------------- ------------

At 30 June 2021, 31 December 2020 and 30 June

2020 200,200,000

----------------------------------------------- ------------

Issued and fully paid ordinary Shares of no Number GBP'000

par value

--------------------------------------------- ------------ --------

At 31 December 2020 and 30 June 2020 114,130,077 19,121

At 30 June 2021 114,130,077 19,121

--------------------------------------------- ------------ --------

There are three convertible loans totalling GBP2,950,000 (30

June and 31 December 2020: three convertible loans totalling

GBP2,950,000). On 23 June 2014, 1,750,000 share options were issued

to Executive Directors and senior management within the Group at an

exercise price of 14 pence per share.

The options vest over three years with a charge based on the

fair value of 8 pence per option at the date of grant. The period

of grant is for 10 years less 1 day ending 22 June 2024.

Of the 1,750,000 share options issued, 1,050,000 (30 June and 31

December 2020:1,050,000) remain outstanding.

16. Acquisition of non-controlling interest

On 14 June 2021, the Group increased its shareholding in Beer

Swaps Limited ("BSL"), trading as Ninkasi Rentals and Finance, to

90% (30 June and 31 December 2020: 75%) for a cash consideration of

GBP310,000.

The carrying value of non-controlling interest acquired at the

date of acquisition was GBP44,000. The consideration in excess of

the carrying amount of GBP266,000 has been charged directly to the

profit and loss account.

17. Acquisition of financial instrument

On 9 June 2021 the Group acquired 10% of the issued share

capital of RFG for nil consideration. The receipt of the issued

share capital is considered to be a commitment fee receivable by

the Group in order to originate loan facilities in aggregate not

exceeding GBP6,250,000 to RFG. The commitment fee is an integral

part of the effective interest rate of the associated loan

facilities issued to RFG.

The Group is not considered to have a significant influence over

RFG as it holds less than a 20% shareholding and is not considered

to participate in the policy making decisions of the entity. The

10% shareholding has thus been classified as a financial

instrument.

The Group continues to obtain information necessary to measure

the fair value of the shares obtained. The fair value of the

financial instrument received has been provisionally determined as

GBP68,000 at initial recognition based on the proportionate share

of the net asset value of RFG.

As part of the transaction, the Group has been granted two

warrants to acquire further shares. The first warrant is for 5% of

the share capital and the second warrant is for a further 5% of the

share capital.

The two warrants are exercisable dependent upon the Group's

banking subsidiary, the Bank, contracting with RFG, for a larger

facility. The fair value of the two warrants has been determined to

be nil due to the significant uncertainty that exists at

acquisition date and the period end in issuing a further debt

facility.

18. Regulators

Certain Group subsidiaries are regulated by the FSA and the FCA

as detailed below.

The Bank and EAL are regulated by the FSA under a Class 1(1) -

Deposit Taking licence and Class 2 - Investment Business licence

respectively. The Bank and CFL are regulated by the FCA to provide

regulated products and services.

19. Contingent liabilities

The Bank is required to be a member of the Isle of Man

Government Depositors' Compensation Scheme which was introduced by

the Isle of Man Government under the Banking Business (Compensation

of Depositors) Regulations 1991 and creates a liability on the Bank

to participate in the compensation of depositors should it be

activated.

20. Subsequent events

On 7 July 2021, the Company announced a dividend of 0.1724 pence

per Ordinary Share for the period from 1 January 2020 to 31

December 2020, calculated as being 10% of the profit after tax

available to Shareholders. The dividend was paid on 10th August

2021 to holders of Ordinary Shares recorded on the register on 16

July 2021. MFG also offered a Script Dividend Scheme under which

Shareholders could elect to receive New Ordinary Shares in lieu of

the cash dividend.

There were no other significant subsequent events identified

after 30 June 2021.

21. Approval of interim financial statements

The interim financial statements were approved by the Board on

27 September 2021. The interim report will be available from that

date at the Group's website - www.mfg.im and at the Registered

Office: Clarendon House, Victoria Street, Douglas, Isle of Man, IM1

2LN. The Group's nominated adviser and broker is Beaumont Cornish

Limited, Building 3, 566 Chiswick High Road, London W4 5YA. The

interim and annual financial statements along with other

supplementary information of interest to shareholders, are included

on the Group's website. The website includes investor relations

information, including corporate governance observance and contact

details.

Appendix - Glossary of terms

BBSL Blue Star Business Solutions Limited

BL Burnbrae Limited

BSL Beer Swaps Limited

Bank Conister Bank Limited

CFL Conister Finance & Leasing Ltd

Company Manx Financial Group PLC

EAL Edgewater Associates Limited

ECF ECF Asset finance PLC

FCA UK Financial Conduct Authority

FSA Isle of Man Financial Services Authority

Group Comprise the Company and its subsidiaries

HP Hire Purchase

IFA Independent Financial Advisors

Interim financial Condensed consolidated interim financial statements

statements

JM Jim Mellon

LSE London Stock Exchange

MFG Manx Financial Group PLC

MFX Manx FX Limited

MFX.L Manx Financial Group PLC ticker symbol on the LSE

RFG Rivers Finance Group Plc

Subsidiaries MFG's subsidiaries being EAL, MFX, BBSL, BSL, Bank,

CFL, ECF, Three Spires

UK United Kingdom

UP Unrelated parties

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKCBNKBKDFCB

(END) Dow Jones Newswires

September 29, 2021 06:59 ET (10:59 GMT)

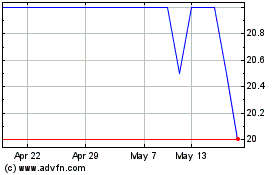

Manx Financial (LSE:MFX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Manx Financial (LSE:MFX)

Historical Stock Chart

From Jul 2023 to Jul 2024