TIDMNESF

RNS Number : 4303W

NextEnergy Solar Fund Limited

27 April 2016

27 April 2016

NextEnergy Solar Fund Limited ("NESF" or the "Company")

2015/16 Year-End Update and Move to Quarterly Dividends

Operating highlights

-- Portfolio installed capacity increased 90% to 414MWp spread

across 33 projects* (2015: 217MWp and 16 projects)

-- Invested capital up 89% to GBP480.1m* (2015: GBP251.6m)

-- Energy generation outperformance of 4.1% versus budget with

irradiation 0.4% above forecasts

Financial highlights

-- Total Financial debt including acquisition commitments of

GBP216.6m (2015: no financial debt)

-- Long-term fully-amortising debt of GBP100.4m and GBP116.2m of

short-term facilities drawn*

-- Final dividend of 3.125p per share expected to be declared in

June 2016; on track for a full year dividend of 6.25p per share

-- Shift to quarterly dividends; first quarterly dividend to be paid in September 2016

NESF, the specialist investment company that invests in

operating solar power plants in the UK, announces an operating

update following the end of its financial year on 31 March 2016 and

a move to a quarterly dividend payment schedule.

The Company will now pay dividends to shareholders on a

quarterly basis, starting from the first quarter of the Company's

current 2016/17 financial year. The first quarterly dividend will

cover the period from April to June 2016, and is expected to be

declared in September 2016. The second quarterly dividend will

cover the period July to September 2016, and is expected to be

declared in December 2016. The subsequent quarterly dividends will

follow accordingly.

For the year ended 31 March 2016, NESF expects to declare a

second and final dividend of 3.125p per share in June 2016. When

added to the first interim dividend of 3.125p, this represents a

total yearly dividend of 6.25p per share. The Company intends to

increase subsequent dividends in line with the Retail Price Index

("RPI") on a yearly basis, which amounts to 1.0% for the 2016/17

dividend.

At year-end, the Company's total portfolio amounted to 33 solar

plants totalling 414MWp with an invested capital of GBP480.1m* (31

March 2015: 16 projects totalling c.217MWp and invested capital of

GBP251.6m). NESF's portfolio of operating solar plants comprised 30

projects totalling 396 MWp with an invested capital of GBP461.2m.

In addition, at year-end the Company had secured three plants via

binding contracts: Ellough Phase 2 (8.0MWp, investment value

GBP8.0m), Hall Farm (5.0MWp, investment value GBP5.0m) and Green

Farm (5.0MWp, investment value GBP5.8m). Post-period end, the

Company completed the Hall Farm acquisition. In addition NESF

expects to complete the Ellough Phase 2 and Green Farm acquisitions

before the end of the first quarter of the current financial

year.

The portfolio has generated electricity significantly above

budget for the 2015/16 financial year. Total energy generated was

4.1% in excess of targets while solar irradiation recorded across

the portfolio was 0.4% above forecasts (2015: 4.8% higher energy

generation and 0.4% lower irradiation versus forecasts across the

portfolio). The continued portfolio outperformance underlines the

investment skills of the Company's Investment Advisor, NextEnergy

Capital, and the asset management capabilities of NESF's long-term

operating asset management service provider, WiseEnergy.

At 31 March 2016, inclusive of the commitments made for

acquisitions, the Company had drawn financial debt totalling

GBP216.6m* (2015: no financial debt). Of the total financial debt,

GBP100.4m was long-term fully amortising debt, while the remainder

of GBP116.2m was drawn under the Company's short-term credit

facilities. NESF expects to increase its credit facilities

marginally in the first quarter of the current financial year and

increase the portion of long-term amortising debt in the portfolio

as it refinances its short-term debt facilities.

The Company expects to publish its annual results for the year

ending 31 March 2016 on or around June 27, 2016.

NESF has been informed by NextEnergy Capital Limited ("NEC"),

the Investment Advisor, that NEC has started acquiring shares in

the Company as per its earlier communication.

Kevin Lyon, Chairman of NESF, commented:

"NESF has made strong progress during the past year, more than

doubling our portfolio of solar plants and increasing installed

capacity by 90%.* We continue to acquire assets below average

market prices, demonstrating our team's capital deployment and

investment abilities.

"We are pleased to continue an unbroken record of operating

outperformance since our IPO . Energy generation outperformed

forecasts by 4.1%, an impressive result given largely stable

irradiation.

"Our stable capital structure has benefitted from the

availability of financial debt to the solar sector and our

attractive, long-term, fully-amortising debt facilities contribute

to improving financial returns and dividend cover going

forward.

"We are looking forward to growing the Company further during

the current year."

Notes:

* Including the Radius acquisition announced on 5 April 2016 and

completed.

For further information:

NextEnergy Capital Limited 020 3239 9054

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Shore Capital 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

Macquarie Capital (Europe)

Limited 020 3037 2000

Ken Fleming

Nick Stamp

MHP Communications 020 3128 8100

Andrew Leach

Jamie Ricketts

Gina Bell

Notes to Editors:

NextEnergy Solar Fund (NESF)

NESF is a specialist investment company that invests in

operating solar power plants in the UK. Its objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of GBP285.4m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities of GBP223.1m in place

(Macquarie: GBP100m, MIDIS: GBP55.0m, Bayersiche Landesbank:

GBP45.4m and NIBC: GBP22.7m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division, providing solar asset management, monitoring and other

services to over 1,200 utility-scale solar power plants with an

installed capacity in excess of 1.5 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDQLFLQZFLBBX

(END) Dow Jones Newswires

April 27, 2016 02:00 ET (06:00 GMT)

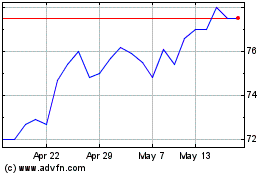

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Jul 2023 to Jul 2024