UK Commercial Property Lenders Return But Lack Of Good Buildings

16 March 2010 - 11:30AM

Dow Jones News

Banks have increased their appetite to lend to U.K.'s commercial

property sector but they are constrained by the lack of good

quality buildings they can invest in, real estate advisor Savills

PLC (SVS.LN) said Tuesday.

The company said that 21 lenders are willing to provide more

than GBP30 million for a transaction of U.K. commercial property

but that scarcity of good quality lending opportunities is holding

back lenders from realizing their ambitions.

Over the past year, fewer commercial investment properties have

come to the market and in many cases the better quality investments

have been purchased by cash buyers, often from overseas at premium

prices, sparking a rise in the value of commercial property in the

U.K.

"One consequence of this is that for better quality property

investments, loan to values have increased and interest rate

margins have decreased as lenders compete with each other for

business," said Savills.

Savills has increased its definition of biggerticket lending to

GBP30 million from GBP20 million it reported in October and said

that 60% of current lenders are German.

The company also said that the provision of development finance

has re-emerged into the market with Barclays PLC (BARC.LN) and

Barclays Wealth, Close Brothers Group PLC (CBG.LN), Eurohypo AG

(EHY-XE), HSBC Holdings PLC (HSBA.LN) and HSBC Private Bank,

Investec Holdings Ltd. (OD-INH), Lloyds Banking Group (LLOY.LN),

Royal Bank of Scotland Group PLC (RBS), National Westminster Bank

PLC (NWBD.LN), Coutts Holdings PLC (CTH.LN), willing to provide

site acquisition finance and in some cases construction

finance.

Savills U.K. head of valuation William Newsom said "I am very

pleasantly surprised by the number of lenders who are prepared to

provide development finance, mostly for residential schemes."

"In the late 1990s the development finance markets were closed

for half a dozen years. In this cycle we have seen the markets

reopen again after only two years albeit on cautious terms."

The 21 lenders comprise of Aareal Bank AG (ARL.XE), Aviva PLC

(AV.LN), Bank of London and Middle East, Barclays, Bayerische

Landesbank, Canada Life, Deka Bank, Deutsche Bank AG (DB), Deutsche

Pfandbriefbank, Deutsche Postbank AG (DPB.XE), Deutsche

Genossenschafts Hypothekenbank AG (GD-DGH), Eurohypo AG, Helaba,

ING Real Estate Finance, Landesbank Baden-Wurttemberg, Landesbank

Berlin Holding AG (BEB2.XE), Lloyds Banking Group, Nord LB,

Deutsche Hypothekenbank, RBS, Santander Bancorp (SBP), Westdeutsche

Immobilienbank.

-By Anita Likus, Dow Jones Newswires; +44 20 7842 9407;

anita.likus@dowjones.com

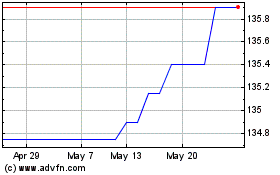

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From Jan 2025 to Feb 2025

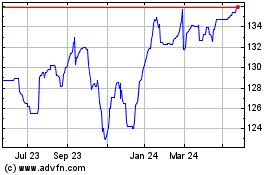

Nat.west 9%pf (LSE:NWBD)

Historical Stock Chart

From Feb 2024 to Feb 2025