TIDMPAT

RNS Number : 3053J

Panthera Resources PLC

16 August 2019

16 September 2019

Panthera Resources Plc

("Panthera" or "the Company")

Audited Financial Results and Management Update for the 12

Months Ended March 31, 2019

Panthera Resources PLC (AIM: PAT), the gold exploration and

development company with assets in India and West Africa, is

pleased to provide a summary of the Company's audited financial

results for the year ended March 31, 2019.

Highlights of the Year

The Bhukia Joint Venture (JV) project in Rajasthan, India is

targeted for a +6.0Moz resource drill-out

-- A high value partnership has been established with Galactic

Gold Mining Pvt Ltd (Galaxy) that is designed to align Indian

capital with the success of the JV and bring increased Indian

business and operational capabilities to advance Panthera's Indian

capabilities.

-- A JORC-Inferred Mineral Resource of 1.74Moz exists, with a

planned exploration programme that targets increasing this to over

6.0Moz.

-- The JV's Prospecting Licence Application (PLA) was rejected

by the Government of Rajasthan ("GoR") in August 2018 on various

spurious grounds, forcing the JV to challenge the rejection order

in court to protect its legal rights and the interests of its

shareholders.

-- The Hon'ble High Court of Rajasthan passed an interim Stay

Order protecting the legal rights of the JV by restraining the GoR

from granting third party rights within the entire area of the PLA.

Court proceedings are ongoing and the JV is confident of getting a

favourable judgment once all pleadings are complete.

-- Following the Rajasthan State and Indian General Elections,

the JV has reopened negotiations with the GoR towards the grant of

the PL over the Bhukia Gold Project.

-- The new National Mineral Policy 2019 declared by the

Government of India, aims to revive the exploration and mining

industry by bringing in necessary reforms to attract private

participation and investments.

High potential West Africa gold exploration portfolio with

drill-ready targets

-- The Company has acquired rights to the Labola gold project in

southern Burkina Faso, West Africa. Historically, combined

resources of over 600,000oz averaging about 1.2g/t Au were

estimated and quoted under JORC and NI43-101 guidelines and

Panthera's priority exploration will focus on confirming and

expanding these known zones of mineralisation.

-- At the Naton JV project in southern Burkina Faso, West Africa

the Company completed its first drill testing programme with

encouraging results which demonstrated ore grade gold

mineralisation on four out of five structures tested. Follow up

geological mapping and geochemical sampling has further refined

existing targets and identified additional high tenor gold

anomalies for drill testing.

-- At the Kalaka JV project in southern Mali, West Africa, a new

(replacement) tenement was granted to Panthera at the end of

December 2018. The new title can be renewed for a period of up to 7

years and will enable systematic exploration of the targets

generated by its technical team, including the potential extension

identified by the Company's geophysical survey of the known

mineralisation at the K1A prospect.

-- Geological mapping and sampling at the Bassala JV has

identified an extensive and highly encouraging gold in soil anomaly

that clearly requires drill testing. Further infill work is

underway to aid drill targeting.

A US$1.25 million funding package was negotiated

-- A strategic alliance and staged financing partnership was

agreed with Galaxy, an Indian company with a strategic objective to

become a premier listed Indian gold mining and investment

company.

-- Tranche one of US$250,000 was drawn down in January 2019 and

tranche two of US$250,000 was received in May 2019. The final

tranche of US$750,000 is due prior to the successful grant of the

Bhukia Gold Project PL.

Operating loss and cash flow reflect ongoing status as an

exploration company

-- The consolidated loss of the Group for the financial period

after providing for income tax and eliminating non-controlling

interests amounted to US$1,553,396 (2018: US$2,479,305).

-- The group incurred a net loss of US$1,580,720 and incurred

operating cash outflows of US$1,443,125.

-- The group had cash of US$188,376 as at 31 March 2019.

Subsequent to this the tranche two payment was received from Galaxy

and most recently the financing package with Republic Investment

Management (RIM) was restructured, such that payment of GBP500,000

was accelerated and due shortly.

-- Management indicate that on current expenditure levels, all

current cash held will be used prior to the 12 months subsequent of

the signing of the financial statements. As with many exploration

companies our auditors have highlighted that the group's ability to

continue as a going concern is dependent upon raising additional

capital. A key factor affecting this is the granting of the PL and

necessary environmental and forestry permits which triggers an

additional US$750,000 from Galaxy and GBP1m from RIM. The Company

will keep the market updated on progress with the PL grant and its

funding requirements.

The Annual Report and Accounts for the year ended 31 March 2019,

along with an explanatory note for shareholders, will be available

shortly to view and download from Panthera's website

(www.pantheraresources.com) in accordance with rule 26 of the AIM

Rules for Companies along with a notice of Annual General Meeting

and form of Proxy. The AGM is scheduled to take place at 11:00AM on

13 September 2019 at 2 Duke Street, Manchester Square London W1U

3EH.

Geoff Stanley, CEO Commented:

"I am delighted to be able to report results for our second year

and first whole year since listing on the AIM market in December

2017.

An exciting partnership was negotiated with Galaxy that is

designed to provide strategically timed capital injections to

Panthera while advancing our Bhukia JV Project in India by aligning

Indian capital, technical skills and business capabilities with the

success of the project.

While the GoR spuriously rejected the JV's rightful claim to a

prospecting licence, the Honourable High Court of Rajasthan passed

an interim Stay Order protecting our rights over the entire area of

the PL application. The strength of our case has allowed us to

recommence negotiations with the GoR giving the Company another

avenue to a potential successful outcome in parallel with the Court

process. The next Court hearing is currently scheduled for 18

October 2019.

On the west African front, the Company's management was able to

further leverage its depth and breadth of experience, its network

of connections, and its technical capabilities to significantly

upgrade its portfolio with the addition of the Labola property.

Labola sits on an exciting 9km long gold mineralised structure and

has been the subject of a previously reported 600koz gold resource

which we will be working diligently to confirm and expand. In

addition, targets at the three existing properties were further

upgraded and await drill testing.

Subsequent to the 30 March balance date we successfully

restructured the Republic Investment Management Tranche 3

investment which now allows for a near term capital injection of

GBP500,000 to support the Company in advance of the Bhukia JV

Project PL grant. This financing is an excellent example of the

success that can be achieved with supportive shareholders who share

the Company's vision for value creation"

Chairman's Statement

I am delighted to present the 2018-2019 Annual Report for

Panthera Resources PLC. We have had a good year and have

meaningfully advanced many of our key strategic and corporate

objectives. We remain dedicated to creating a successful

exploration and development Group and consistently enhancing value

for stakeholders.

Strategic Vision

Panthera aims to create a mid-tier mining company by building a

strong portfolio of high quality, low cost gold assets in India and

West Africa.

In light of this vision, the Company has worked tirelessly to

maintain mineral rights for the JV over the highly prospective

Bhukia Gold Project in India together with our JV partner, the

Indian private company Metal Mining India Pvt Ltd (MMI). Together

we are actively pursuing our rights through the Rajasthan High

Court. In addition, the Company has formed a strategic alliance to

advance the project with Galaxy, an Indian company with

international management with over 15 years' experience in the gold

exploration and mining industry in India. Furthermore, Panthera

aims to explore and grow the value of its prospective West African

gold portfolio. In its wider property portfolio, it will nurture

and eventually harvest other non-core exploration and development

assets.

In India, the GoR rejected the JV's PLA over the Bhukia Gold

Project, but Panthera remains extremely confident in its legal

right over the PL area by means of a Court Stay Order. The

partnership with Galaxy has bought Indian capital to support the

development of Bhukia and it also provides key corporate,

bureaucratic, technical and administrative capabilities in India,

which are necessary to advance the project.

The change of Government in the State of Rajasthan (State

Elections, December 2018) and the General Elections (May 2019)

necessitated a hiatus in negotiations with the Government. With

elections behind us and with the support of Galaxy, negotiations

have reopened with the new administration in Rajasthan and we are

optimistic of soon arriving at an agreement that will see the grant

of the PL and allow exploration to recommence.

The long overdue New National Mineral Policy 2019 promises to

address some of the major issues faced by the mining and

exploration industry in India. While auctioning remains the

preferred choice for granting tenements, the policies, if

implemented, aim to attract private investment in exploration by

providing seamless transition between tenements, allowing merger

and acquisitions of mining entities and transfer of tenements.

The Company has also met with considerable success in West

Africa. Work progressed on the three initial projects, these being

the Naton project in southern Burkina Faso and the Kalaka and

Bassala projects in southern Mali. The Company has now expanded its

footprint with the inclusion of the Labola project in southern

Burkina Faso.

Corporate

A successful cooperation and funding agreement negotiated with

Galaxy provides a total investment of US$1.25m, allowing Galaxy to

purchase a 10% stake in Panthera's India focussed subsidiary, Indo

Gold, and to earn additional equity by providing ongoing support

and services to advance the Bhukia Gold Project. An initial tranche

of US$250,000 was received in January 2019, and a second tranche of

US$250,000 was received in May 2019, completing the purchase of

Galaxy's first 5% holding in Indo Gold. The final tranche of

US$750,000 is scheduled for payment prior to the successful grant

of the Bhukia Gold Project PL.

Operations

India

The protracted PLA process continues in India. The rejection of

the JV's PLA over the Bhukia Gold Project (August 2018), forced the

JV to seek legal recourses and approached the High Court of

Rajasthan by means of a writ petition. The Hon'ble High Court

passed an interim Stay Order in the JV's favour, preventing the GoR

from granting third party rights over the area applied for by the

JV under the PLA. The indefinite Stay Order reaffirms the legal

right of the Company and we are confident of securing a favourable

judgement once all pleadings in court are complete and the matter

is put up for final hearing.

With the support of Galaxy, we have commenced a parallel path of

negotiations with the newly elected government in Rajasthan. We are

optimistic that the new Government will recognize the duplicitous

stand taken by the previous government in respect to our

application where our Court endorsed legal rights were completely

disregarded. Initial engagement with the new Government has been

encouraging and discussions are ongoing with the objective of

reaching an out of court settlement that will allow the JV to

commence the resource drill-out.

Africa

Activities in West Africa have advanced well over the last year

with the establishment of highly capable technical teams and the

creation of 100% owned subsidiary operating companies in both

Burkina Faso and Mali.

Initial drill testing at the Naton Project (Burkina Faso)

returned positive results with successful upgrading of the Kaga

Vein, Bido Vein and Somika East targets, with these all requiring

additional drill testing to ascertain size potential.

The acquisition of the Labola project (Burkina Faso) gives

Panthera an advanced, drill ready, property with a very large

footprint over a gold system that demonstrates potential for a

large, low grade deposit or series of deposits amenable to open pit

mining. Substantial work is justified to more systematically define

the limits of the system.

In Mali, geophysical work at the Kalaka Project has identified

potential extensions to the known mineralisation at the K1A

prospect. Recognition of similar mineralisation to the K1A style at

the Southern Artisanal Prospect is encouraging. It is now

considered a high priority target with potential for higher grade

mineralisation than K1A, based on the higher tenor chargeability

anomaly and structural considerations.

At the Bassala Project (Mali) first phase mapping and

geochemistry by Panthera has identified lateritic, alluvial,

eluvial and some hard rock artisanal gold workings occurring in a

large, roughly NNE trending zone over about 8km strike. Exploration

work is continuing.

Outlook

The Company's strategic approach of maintaining a vigorous

exploration effort to leverage its exploration expertise is paying

dividends, as our staged, systematic work has upgraded all three

properties and facilitated the acquisition of a fourth advanced

project in West Africa. Delays in India and muted capital market

conditions for mineral exploration companies, necessitates a more

prudent follow-up of the exciting drill targets defined in West

Africa than we might otherwise like. Nevertheless, with additional

financing now secured, increasingly attractive exploration targets

and ore grade intersections to follow up, the Board is confident

that 2020 provides an opportunity for great success.

In India, the Board is confident that the Courts of India, which

have always provided the JV with successful outcomes because of its

rightful and legally sound claims, will again rule favourably and

order the grant of the long overdue PL over the Bhukia Gold

Project. This confidence is strongly supported by the Stay Order

granted by the High Court protecting the JV's rights over the

relevant area.

On behalf of Panthera's executive and management team, I would

like to express our appreciation and gratitude to all of our

employees for their efforts, sacrifices and hard work during the

past year.

On behalf of the Board I would like to extend our immense

gratitude to Chris Rashleigh and Peter Carroll, two Directors who

did not stand for re-election at the Company's AGM. Chris was a

co-founder of the Group and Peter joined in 2005. They served the

Group tirelessly since its inception and their professionalism and

wise counsel will be missed. Succession planning in anticipation of

Chris and Peter's retirement saw the appointment to the Board of

Catherine Apthorpe. Ms Apthorpe, who was previously selected as one

of the Top 100 Global Inspirational Women in Mining, adds important

capabilities, knowledge and independence to Panthera's Board of

Directors.

Michael Higgins

Non-Executive Chairman

16 August 2019

Group statement of comprehensive income for the year ended 31

March 2019

2019 2018

Notes $ USD $ USD

---------------------- ------ -------------------------- ------------- ----------------------------

Continuing operations

Revenue - -

---------------------- ------ -------------------------- ------------- ----------------------------

Gross profit - -

Other Income 4 29,768 -

Exploration costs

expensed (675,810) (608,836)

Administrative

expenses (934,720) (1,094,570)

Share option expenses - (311,666)

Impairment expense - -

AIM Listing and

acquisition related

costs - (513,285)

---------------------- ------ -------------------------- ------------- ----------------------------

Loss from operations (1,580,762) (2,528,357)

Investment revenues 4 8,454 15,264

Loss on sale of

investments (8,412) -

---------------------- ------ -------------------------- -------------- ---------------------------

Loss before taxation (1,580,720) (2,513,093)

Taxation 9 - -

Other comprehensive

income

Items that may be

reclassified

to profit or loss:

Changes in the fair

value of

available-for-sale

financial assets 49,602 146,988

Gain on sale to

non-controlling

interest 500,040 -

---------------------- ------ -------------------------- -------------- ---------------------------

Exchange differences (35,521) 732,943

---------------------- ------ -------------------------- -------------- ---------------------------

Loss and total

comprehensive income

for the year (1,066,329) (1,633,162)

---------------------- ------ -------------------------- ------------- ----------------------------

Total loss for the year attributable

to:

* Owners of the parent Company (1,553,396) (2,479,305)

* Non-controlling interest (27,324) (33,788)

--------------------------------------------- -------------------------- ---------------------------

(1,580,720) (2,513,093)

--------------------------------------------- -------------------------- ---------------------------

Total comprehensive income for the

year attributable to:

* Owners of the parent Company (1,039,005) (1,599,374)

* Non-controlling interest (27,324) (33,788)

--------------------------------------------- -------------------------- ---------------------------

(1,066,329) (1,633,162)

--------------------------------------------- -------------------------- ---------------------------

Loss per share attributable to the

owners of the parent

Continuing operations

(undiluted/diluted) 10 (0.02) (0.04)

---------------------- --------------------- -------------------------- ---------------------------

Group statement of financial position for the year ended 31

March 2019

2019 2018

Notes $ USD $ USD

------------------------------- ----- ------------ -------------

Non-current assets

Property, plant and equipment 11 3,526 10,530

Investments 12 21,769 16,003

Available for sale financial

asset 13 1,918,257 1,341,362

------------------------------- ----- ------------ -------------

1,943,552 1,367,895

Current assets

Trade and other receivables 14 343,057 80,332

Cash and cash equivalents 188,376 1,571,578

531,433 1,651,910

-------------------------------------- ------------ -------------

Total assets 2,474,985 3,019,805

Non-current liabilities

Provisions 15 38,489 40,528

------------------------------- ----- ------------ -------------

38,489 40,528

Current liabilities

Provisions 15 5,646 1,624

Trade and other payables 16 299,519 161,520

------------------------------- ----- ------------ -------------

Total liabilities 343,654 203,672

-------------------------------------- ------------ -------------

Net assets 2,131,331 2,816,133

------------------------------- ----- ------------ -------------

Equity

Share capital 17 913,588 913,588

Share premium 17 17,373,601 17,373,601

Capital reorganisation reserve 18 537,757 537,757

Other reserves 25 (115,997) (497,524)

Retained earnings (16,352,292) (15,313,287)

------------------------------- ----- ------------ -------------

Total equity attributable

to owners of the

parent 2,356,657 3,014,135

Non-controlling interest (225,326) (198,002)

------------------------------- ----- ------------ -------------

Total equity 2,131,331 2,816,133

------------------------------- ----- ------------ -------------

Group statement of changes of equity for the year ended 31 March

2019

Share Share Capital Other Retained Total Non-controlling Total

capital premium re-organisation reserves earnings equity interest

account reserve

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

----------------- ------------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 1

April 2017 16,210,761 - - (1,855,148) (12,833,982) 1,521,631 (164,214) 1,357,417

Loss for the

year - - - - (2,479,305) (2,479,305) (33,788) (2,513,093)

Movements in

unrealised gain

reserve - - - - 146,988 - 146,988 146,988

Foreign exchange

movement

on capital

re-organisation 657,819 657,819 - - 657,819

Foreign exchange

differences

on translation

of currency - - - 75,124 - 75,124 - 75,124

----------------- ------------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

comprehensive

income

for the year - - - 879,931 (2,479,305) (1,599,374) (33,788) (1,633,162)

Issue of share

capital in

Indo Gold prior

to acquisition 1,712,183 - - - - 1,712,183 - 1,712,183

Options issued

in lieu of

fees - - 142,399 - 142,399 - 142,399

Capital

re-organisation

on

reverse

acquisition (17,086,577) 15,891,001 537,757 - - (657,819) - (657,819)

Share issue

costs - (81,802) - - - (81,802) - (81,802)

Share options

cancelled and

re-issued in

Panthera - - - 318,860 - 318,860 - 318,860

Issue of share

capital in

Panthera 77,221 1,564,402 - - - 1,641,623 - 1,641,623

Options issued

to management - - - 16,434 - 16,434 - 16,434

----------------- ------------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Total

transactions in

the

year,

recognised

directly

in equity (15,297,173) 17,373,601 537,757 477,693 - 3,091,878 - 3,091,878

----------------- ------------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Balance at 31

March 2018 913,588 17,373,601 537,757 (497,524) (15,313,287) 3,014,135 (198,002) 2,816,133

----------------- ------------- ----------- ---------------- ------------ ------------- ------------ ---------------- ------------

Group statement of changes of equity for the year ended 31 March

2019 (continued)

Share Share Capital Other Retained Total Non-controlling Total

capital premium re-organisation reserves earnings equity interest

account reserve

$ USD $ USD $ USD $ USD $ USD $ USD $ USD $ USD

-------------------- -------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at 1 April

2018 913,588 17,373,601 537,757 (497,524) (15,313,287) 3,014,135 (198,002) 2,816,133

Year ended 31 March

2019:

Loss for the year - - - - (1,553,396) (1,553,396) (27,324) (1,580,720)

Changes in the fair

value

of

available-for-sale

financial

assets 49,602 49,602 49,602

Gain on sale to non

controlling

interest 500,040 500,040 500,040

Foreign exchange

differences - - - - (35,251) (35,251)) - (35,251)

-------------------- -------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Total comprehensive

income

for the year - - - - (1,039,005) (1,039,005) (27,324) (1,066,329)

Foreign exchange

differences

on translation of

currency - - - (394,595) - (394,595) - (394,595)

Gain on fair value

of investment

assets - - - 776,122 - 776,122 - 776,122

-------------------- -------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Total transactions

with owners,

recognised

directly in equity - - 381,527 - 381,527 - 381,527

-------------------- -------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Balance at 31 March

2019 913,588 17,373,601 537,757 (115,997) (16,352,292) 2,356,657 (225,326) 2,131,331

-------------------- -------- ----------- ---------------- ---------- ------------- ------------ ---------------- ------------

Group statement of cash flows for the year ended 31 March

2019

2019 2018

Notes $ USD $ USD

-------------------------------- --------------------------------- --------- --------------- ----------------

Cash flows from operating

activities

Cash used in operations 29 (1,443,125) (1,869,249)

Income taxes paid - -

-------------------------------- --------------------------------- --------- --------------- ----------------

Net cash outflow from

operating activities (1,443,125) (1,869,249)

Investing activities - -

Purchase of intangible assets

Sale of property, plant and

equipment (3,485) (11,954)

Sale/(Purchase) proceeds

for investments 242,914 (77,317)

Proceeds from other investments - -

and loans

------------------------------------------------------------------- --------- --------------- ----------------

Net cash generated /(used)

in investing activities 239,429 (89,271)

Financing activities

Proceeds from issue of

shares - 3,353,806

Share Issue costs - (81,804)

Proceeds from share

applications - 24,636

Loans repaid from other

companies - 24,636

Loans advanced to other - -

companies

Effect of exchange rate

on cash (179,506) (31,286)

-------------------------------- --------------------------------- --------- --------------- ----------------

Net cash generated from

financing activities 70,494 3,265,352

Net decrease in cash and

cash equivalents (1,383,202) 1,306,832

Cash and cash equivalents

at beginning of year 1,571,578 264,746

Cash and cash equivalents

at end of year 188,376 1,571,578

-------------------------------- -------------------------------------------- --------------- ----------------

Enquiries

Panthera Resources PLC

Geoff Stanley (CEO) +1 (917) 941 7704

Nominated Advisor and Broker

RFC Ambrian +44 (0) 20 3440 6800

Rob Adamson

Bhavesh Patel

Charlie Cryer

Technical Information

The technical information contained in this disclosure has been

read and approved by Antony Truelove (BSc (Hon), MAusIMM, MAIG),

who is a qualified geologist and acts as the Competent Person under

the AIM Rules - Note for Mining and Oil & Gas Companies. Antony

Truelove has visited the Naton Project site and reviewed the

drilling and sampling protocols and procedures. Antony Truelove is

the COO of Panthera Resources PLC.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSGLGDIUDBBGCL

(END) Dow Jones Newswires

August 16, 2019 02:30 ET (06:30 GMT)

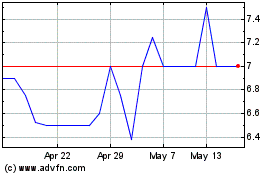

Panthera Resources (LSE:PAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Panthera Resources (LSE:PAT)

Historical Stock Chart

From Jul 2023 to Jul 2024