Petaling Tin Berhd - 1st Quarter Results

30 March 2000 - 9:28PM

UK Regulatory

RNS Number:1173I

Petaling Tin Berhad

29 March 2000

Form Version 1.0

Financial Result Announcement

Reference No PT-000329-35420

Submitting Merchant Bank N/A

(if applicable)

Submitting Secretarial Firm Name N/A

(if applicable)

Company name PETALING TIN BERHAD

Stock name PTG TIN

Stock code 2208

Contact person Mr Lai Gin Nyap

Designation Chief Financial Officer

Financial Year End 10/31/2000

Quarter : *1Qtr 2Qtr 3Qtr 4Qtr Other

Quarterly report on consolidated results for the financial period ended

* 01/31/2000

The figures 0 have been audited * have not been audited.

CONSOLIDATED INCOME STATEMENT

INDIVIDUAL PERIOD CUMULATIVE PERIOD

CURRENT YEAR PRECEDING YEAR CURRENT YEAR PRECEDING YEAR

QUARTER CORRESPONDING TO DATE CORRESPONDING

QUARTER PERIOD

01/31/2000 01/31/99 01/31/2000 01/31/99

(dd/mm/yyyy) (dd/mm/yyyy) (dd/mm/yyyy) (dd/mm/yyyy)

RM'000 RM'000 RM'000 RM'000

1.Turnover 662 0 662 0

(a)

(b)Investment

income 0 0 0 0

(c)Other income

including

interest income 50 0 50 0

2 Operating profit/

(loss) before -348 0 -348 0

interest on

borrowings,

depreciation and

amortisation,

exceptional

items, income tax,

minority

interests and

extraordinary

items

(b)Less interest

on borrowings 246 0 246 0

(c)Less depreciation

and 478 0 478 0

amortisation

(d)Exceptional

items 0 0 0 0

(e)Operating profit/ -1,072 0 -1,072 0

(loss) after

interest on

borrowings,

depreciation and

amortisation and

exceptional items

but before income

tax, minority

interests and

extraordinary items

(f)Share in the results 0 0 0 0

of associated

companies

(g)Profit/(loss) -1,072 0 -1,072 0

before taxation,

minority interests

and extraordinary

items

(h)Taxation -16 0 -16 0

(i)Profit/(loss) after -1,088 0 -1,088 0

taxation

(i)before deducting

minority interests

(ii)Less minority

interests 0 0 0 0

(i) Profit (loss) after

taxation -1,088 0 -1,088 0

attributable to

members of the

company

(k)Extraordinary items 0 0 0 0

(i)

(ii)Less minority

interests 0 0 0 0

(iii)Extraordinary

items attributable

to members of the

company 0 0 0 0

(i) Profit/ (loss)

after taxation

and extraordinary

items attributable

to members of the

company -1,088 0 -1,088 0

3 Earnings per share

(a) based on 2(j) above

after deducting any

provision for

preference dividends,

if any :

(i)Basic (based on ordinary

shares - sen) -5.39 0.00 -5.39 0.00

(ii)Fully diluted

(based on ordinary

shares - sen) -5.39 0.00 -5.39 0.00

4. Net tangible

assets per share(RM) 0.3500 0.0000

Dividend per share (sen) 0.00 0.00

(b)Dividend Description 0

PETALING TIN BERHAD

CONSOLIDATED BALANCE SHEET

Registered Office :

Level 19, Menara PanGlobal

No, 8 Lorong P. Ramlec

50250 Kuala Lumpur.

Tel 03-201 2377

Fax 03-201 2327

(UNAUDITED) (AUDITED)

AS AT END OF AS AT

CURRENT PRECEDING

QUARTER FINANCIAL YEAR

31/01/2000 END

31/10/1999

RM'OOO RM'OOO

1 Fixed Assets 18,064 18,542

2 Investment in Associated

Companies - -

3 Long Term Investments 183,000 183,000

4 Intangible Assets - -

5 Current Assets

Development properties

and expenditure 81,343 79,648

Stocks 12 12

Trade debtors 5,641 6,127

Short term investments 508 508

Other debtors, deposits

and prepayments 3,424 2,909

Fixed deposits with

financial institutions 489 489

Cash and bank balances 343 976

91,760 90,669

6 Current Liabilities

Trade creditors 3,730 2,929

Other creditors

and accrued liabilities 229,185 228,658

Hire purchase creditors 186 193

Bank overdraft 1,295 1,057

Term loan 10,201 9,708

Taxation 2,806 2,768

247,403 245,313

7 Net Current Liabilities (155,643) (154,644)

Expenditure Carried Forward 21 20

45,442 46,918

8 Shareholders' funds

Share Capital 20,168 20,168

Reserves

Share Premium 11,171 11,171

Capital Reserve 2,584 2,584

Retained Loss (26,857) (25,770)

7,066 8,153

9 Deferred Taxation 35,324 35,347

10 Long Term Loan 2,912 3,271

11 Hire Purchase Creditors 140 147

45,442 46,918

12 Net Tangible

Assets Per Share (RM) 0.35 0.40

Petaling TIN BERHAD

QUARTERLY REPORT ENDED 31/01/2000

Notes

1. Accounting Policies

The accounts of the Group are prepared using the same accounting policies,

method of computation and basis of consolidation as those used in the

preparation of the latest audited annual financial statements.

2. Exceptional items

There were no exceptional items for the financial quarter under review

3. Extraordinary items

There were no extraordinary items for the fiscal quarter under review.

4. Taxation

Taxation comprises of the follows:

Individual Quarter Cumulative Quarter

Current Year To Date Current Year Quarter

31.01.2000 31.01.2000

RM'000 RM'000

Current taxation 38 38

Deferred taxation (22) (22)

____ ____

16 16

5. Pre-acquisition Profit

There were no pre-acquisition profit or losses for the current financial year to

date.

6. Profit on sales of Investments and/or Properties

There were no profits on sales of investments and/or properties for

the current financial year to date

7. Quoted securities

a) There were no purchases nor disposals of quoted securities for the

current financial year to date.

b) Total investments in quoted securities as at 31 January 2000 are as

follows.

RM'000

At cost 1,158

Provision for diminution in value (650)

_______

At book value 508

Market value 504

=====

8. Changes in the Composition of the Group

There were no changes in the composition of the Group during the

current financial year to date.

9. Status of Corporate Proposals

All the Rescue Proposals duly approved by the shareholders at an

Extraordinary General Meeting held on 20 August 1999 has been completed,

save and except for the proposed cash settlement (RM53,235,000 to the

vendors of the Ulu Kelang Project which is currently in progress.

Included in other creditors and accrued liabilities as at 31

January 2000 is an amount (RM185,000,000 in respect of the purchase

consideration for the 100% entire equity interest in Golden Domain

Holdings Sdn Bhd which has subsequently been satisfied via the issue of 10-

year zero coupon Irredeemable Convertible Loan Stocks on 2 February

2000.

10. Seasonal or Cyclical Factors

The business operations of the Group are generally affected by the major

festive seasons, i.e.Christmas, New Year Eve and Hari Raya Puasa

celebrations. The group turnover for the current quarter was affected

especially in the month of December and January due to slower work program

at site and lower sales.

11. There were no issuance or repayment of debt and equity

securities, share buy-backs, share cancellations, shares held as

treasury shares and resale of treasury shares for the current

financial year to date.

12. Group Borrowings and Debt Securities

Total group borrowings as at 31 January 2000 are as follows:

Secured RM'000

Long Term Loans

Total outstanding balances 13,113

Repayment due within the next 12 months (10,201)

Total 2,912

Short Term Loans

Bank overdraft 1,295

Current portion of term loan 10,201

Total 11,496

13. Contingent Liabilities (secured)

The Company has a contingent liability in respect of certain of

its leasehold land which has been charged to a bank for credit

facilities extended to a subsidiary company up to a limit of

RM3,000,000 as at the date of this report.

14. Off Balance Sheet Financial Instruments

The Group does not have any financial instruments with off balance

sheet risk as at the date of this report.

15. Material Litigation

The Group is not engaged in any material litigation as at the

date of this report.

16. Segmental Reporting for the current financial year to date

Profit/(loss) before

taxation, minority interest Assets

Turnover and extraordinary items Employed

RM'000 RM'000 RM'000

Investment holding (422) 2,509

Manufacturing - (692) 17,969

Property and investment

holding 662 42 272,346

____ _______ _______

662 (1,072) 292,824

___ _______ _______

17. Material Changes in the Quarterly Results compared to the results of

the Preceding Quarter.

The Group's turnover for current quarter of RM662,000 is generated mainly

from the sales of properties from projects acquired under the Rescue

Proposals. In comparison, the preceding quarter's turnover of RM220,000 was

derived from the sales of bricks.

The increase of Group's loss before taxation of RM259,000 is mainly due to

the additional maintenance overheads of the dredge.

18. Review of Performance of the Company and its Principal Subsidiaries

The Group has ceased its tin mining operations during the year

ended 31 October 1997. The Group has also not recommenced operations of its

brick factory and the Group's activities is now mainly focused on property

investment and development.

19. Prospects for the Current Financial Year

The completion of the Rescue Proposals has transformed the Group into a

significant player in property development with ongoing projects for mixed

developments as well as prime landbank for future development located both

in Peninsular and East Malaysia. The Group also expects to benefit

from its involvement in low and medium-cost housing projects in view of the

Government's effort to ensure that the lower and medium income groups are

given adequate opportunities to buy affordable shelter.

Furthermore, the existing projects of the newly acquired Golden

Domain Group are also expected to enjoy encouraging support as

these are situated in key areas of growth and activity with

established market bases. Therefore barring any unforeseen

circumstances, the Board of Directors expects the Group to

achieve satisfactory results.

20. Variance of Actual Profit from Forecast Profit

Not applicable for the financial quarter under review.

21. Dividend

There was no dividend proposed for the current financial year to

date.

By Order of The Board

PETALING TIN BERHAD

Lai Gin Nyap

Chief Financial Officer

Kuala Lumpur

Date: 29 March 2000

END

QRFDGGZFMLMGGZM

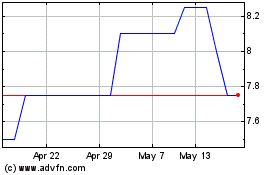

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

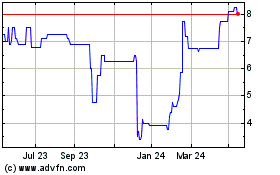

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024